United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: ExxonMobil Corporation

Name of persons relying on exemption: Mercy Investment Services, Inc.

Address of persons relying on exemption:

2039 North Geyer Road, Saint Louis, MO 63131

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration of these important issues.

ExxonMobil Corporation

Vote FOR: Proxy Ballot Item #10

Report on Worst-case Spill for Exxon’s Guyana Offshore Drilling Operations

Annual Meeting: May 31, 2023

CONTACT: Mary Minette, Mercy Investment Services | mminette@Mercyinvestments.org

The proposal states:

Shareholders request that the Company issue a report evaluating the economic, human, and environmental impacts of a worst-case oil spill from its operations offshore of Guyana. The report should be prepared at reasonable expense, omit proprietary or privileged information, and clarify the extent of the Company’s cleanup response commitments given the potential for severe impact on Caribbean economies.

In its supporting statement, it adds that:

A ‘worst-case’ should use adverse assumptions such as an extended duration of an uncontrolled release similar to the BP spill, severe weather conditions, increased flow including risks from operating beyond the production thresholds in the EIA, and potential harm to marine ecosystems and public health.

| 1 |

As long-term investors in ExxonMobil Corporation (“Exxon” or “the Company”), we are concerned that the Company’s existing disclosures fail to address worst-case spill vulnerabilities in its Guyana operations. As evidenced by the BP Deepwater Horizon disaster, the Company operates in an industry particularly vulnerable to reputational, legal and financial risks associated with offshore drilling operations.

Why investors should vote FOR this proposal:

| 1) | A large spill of long-duration as could happen during climate change induced hurricanes can expose the Company to significant financial, legal and reputational risks |

| 2) | Company operations have been operating above safe production levels in its Liza Phase I project, increasing the risk of a worst-case spill |

| 3) | Exxon’s existing reports do not include the information requested by the Proposal |

| 1) | A worst-case spill exposes the Company to significant financial, legal and reputational risks |

As investors are acutely aware, the BP Macondo oil spill (also referred to as “Deepwater Horizon”) is widely recognized as one of the worst environmental disasters in U.S. history and exemplifies the potential reputational and financial damage our own company could be exposed to in the event of a similar disaster. BP’s share price lost 54 percent on the NYSE between the date the spill began, April 20, 2010, and June 25, 2010.1

Further, estimates suggest the BP Macondo oil spill has cost BP and its drilling partners at least $71 billion to mitigate the disaster’s effects.2 Even this astronomical figure may continue to increase over time, as the company’s settlement with individuals who filed medical claims immediately after the accident could cost BP well into the future, with more recent lawsuits filed by hundreds of individuals with late-occurring health effects still pending.3

_____________________________

1 https://investingnews.com/daily/resource-investing/energy-investing/oil-and-gas-investing/bp-oil-stock-price-before-spill/

2 https://www.nola.com/news/business/bp-and-its-partners-have-spent-71-billion-over-10-years-on-deepwater-horizon-disaster/article_

ca773cc0-80f4-11ea-8fbe-ffa77e5297bd.html#:~:text=BP%20and%20its%20partners%20have,%7C%20Business%20News%20%7C%20nola.com

3 https://www.nola.com/news/business/bp-and-its-partners-have-spent-71-billion-over-10-years-on-deepwater-horizon-disaster/article_

ca773cc0-80f4-11ea-8fbe-ffa77e5297bd.html#:~:text=BP%20and%20its%20partners%20have,%7C%20Business%20News%20%7C%20nola.com;

See also,

https://www.fox10tv.com/2022/07/08/12-years-later-bp-still-fighting-hundreds-lawsuits-over-deepwater-horizon-spill/

| 2 |

| 2) | The Company’s explanation of design capacity obfuscates the fact that it is operating above safe production levels in its Liza Phase I project |

The Company is already reported to be operating above its safe production threshold for its Liza Phase I project. In its Opposition Statement, the Company states “the actual volume that is safe to produce is well above the design capacity. It in no way indicates that the asset is producing at an unsafe level.” Yet, the Company’s actual operations not only exceed design capacity, but also reportedly exceed their disclosed safety threshold.4

As listed in their Environmental Impact Assessment, the Company’s design capacity for Liza Destiny is 100,000 bpd, an entirely different figure than the peak safety figure the Proposal and Proponent Response Letter discuss.5 At no point in the Proposal do we provide the figures for the Company’s design capacity. As the Company explained, exceeding design capacity does not necessarily indicate operations are at an unsafe level. Thus, exceeding design capacity would not be an “adverse assumption” useful in assessing impact of a worst-case spill.

|

Production Thresholds

Design Capacity, Safety Thresholds and Recent Operations at Liza I

Reported recent operations 150,000 bbl/day Safety threshold 120,000 bbl/day Design capacity 100,000 bbl/day |

The Company’s Liza Phase I Environmental Impact Statement notes the facility has “the potential to safely operate at sustained peaks of oil production up to approximately 120,000 bpd.”6 This threshold is 20,000 bbl/day greater in volume than the design capacity, while the Company’s own operations are reportedly 50,000 bbl/day greater in volume than the design capacity (See chart above).7

To be clear, the Company is both operating above design capacity and exceeding its safety threshold for Liza Phase I, the potential impact and risk of which has not been assessed by its existing disclosures. Therefore, the opposition statement obfuscates rather than clarifies the concerns flagged by the Proposal, deflecting from known exceedances of “safety thresholds,” which clearly do implicate an adverse assumption — information relevant to assessing the scale and probability of worst-case scenarios.

_____________________________

4

In its Liza Phase I Environmental Impact Assessment, the Company states the facility has “the potential to safely

operate at sustained peaks of oil

production up to approximately 120,000 bpd.” However, data produced by Guyana’s Ministry of Natural Resources shows production for the Liza

Destiny in September was at 150,000 barrels per day (bpd), clearly above this listed peak threshold; See, Liza Phase I EIA, p. viii; See also,

https://www.kaieteurnewsonline.com/2022/11/01/exxonmobil-ruthlessly-taking-advantage-of-slack-govt-abysmal-epa-by-violating-safe-production-limits-dr-adams/

5 Liza Phase I EIA, p. viii

6 Liza Phase I EIA, p. viii

7 https://www.kaieteurnewsonline.com/2022/11/01/exxonmobil-ruthlessly-taking-advantage-of-slack-govt-abysmal-epa-by-violating-safe-production-limits-dr-adams/

| 3 |

| 3) | Exxon’s existing reports do not adequately assess the potential impacts of a worst-case spill |

While the Company asserts in its opposition statement that the Proposal is “redundant and unnecessary,” its published assessment and disclosures do not account for the adverse assumptions requested by the Proposal:

| · | an extended duration of a discharge similar to the BP oil spill which lasted for three months; |

| · | severe weather conditions; |

| · | marine or human health impacts of such a worst-case spill; |

| · | economic impacts on Caribbean countries of a worst-case spill. |

In fact, the Company attempted to exclude the proposal at the Securities and Exchange Commission through a no action asserting that the proposal was substantially implemented by its existing disclosures. After evaluating the evidence, the SEC staff concluded,8 “We are unable to concur in your view that the Company may exclude the Proposal … Based on the information you have presented, it appears that the Company’s public disclosures do not substantially implement the Proposal.”

| a) | Extended duration |

The Proposal requests that a ‘worst-case’ should use adverse assumptions such as an extended duration of an uncontrolled release similar to the BP Macondo spill. This is due to the fact that the Company’s most severe spill scenario only accounts for a well release lasting 30 days. For comparison, the BP Macondo well released oil for 87 days. Thus, the Company’s existing disclosures do not adequately delineate the impact of a well release of a similar duration.

| b) | Severe weather conditions |

The proposal requests that the company’s spill assessment consider severe weather conditions. The Company’s existing reporting uses historical weather data; however, as the impacts of climate change are manifesting worldwide, scientists estimate that by just 2050, intense hurricanes and typhoons could more than double in nearly all regions of the world.9 This timeline is well within that of the Company’s Guyana operations, with the Payara development project operating through at least 2053.10 Thus, the Proponent believes the Company’s disclosures should account for the projected increased frequency/severity of natural disasters in the Caribbean region resulting from climate change to adequately assess the potential impact of a spill. Hurricanes cause about 25% of offshore platform-related spills; thus, an increased prevalence of storm activity could present a greater risk of spill to the company via infrastructure damage.

_____________________________

8 https://www.sec.gov/divisions/corpfin/cf-noaction/14a-8/2023/mercyexxon032423-14a8.pdf

9 https://www.cnn.com/2022/04/27/weather/intense-tropical-cyclones-could-double-climate/index.html

10 Payara EIA Volume I, p. EIS-13, stating “initial production by early 2023, with operations continuing for at least 20 years.”

| 4 |

Severe weather could result in delayed cleanup response, increased spill length and oil sweeping area, infrastructure damage, and/or multiple well failures. Increased frequency of severe weather could heighten the risk and impact of a spill in the Company’s Guyana operations in several ways. Severe weather could delay a cleanup response, as many spill response operations cannot be conducted during hazardous weather conditions. Such delays, in turn, may delay the ability to cap a well and increase the duration and the range of dispersion of the spill. For example, the Coast Guard halted BP Macondo disaster response due to safety concerns posed by Tropical Storm Bonnie nearing the Gulf of Mexico.13 Thus, because of severe weather concerns, spill length may be interconnected with a delayed cleanup response.

The Company also uses ocean current data from 2005-2014 in its oil spill scenario mapping.11 Increased hurricane frequency not only poses a greater risk of the duration of oil spills as discussed above, but also a potentially larger oil sweeping area due to faster currents. Hurricanes bring intense wind speed, which causes ocean waves and surface currents to increase speed. This action may cause surface oil to spread faster, potentially devastating nearby coastlines. Hurricanes also cause faster under-surface currents, which can extend as far as 300 feet below the surface.12 Thus, oil under the surface may also spread quickly through marine ecosystems, wreaking deadly havoc on marine life.

Severe weather could result in multiple well failures. The Company’s Guyana operations consist of multiple development projects in a 6.6 million acre area called the Stabroek Block, with estimated potential daily oil production reaching up to 820,000 barrels per day by 2025.13 Given the proximity between the Stabroek Block’s developments, a spill scenario caused by an extreme weather event could involve releases from multiple wells. Such a scenario could cause a far greater amount of oil to be released into the Caribbean than the limited single well release scenario published by the Company. The cost to respond to, contain, and remediate multiple well releases would materially increase the financial risk to Company and its investors.

The Company’s existing disclosures do not consider the potential impact or response for a scenario of simultaneous well failures.

| c) | Harm to ecosystems and public health |

The Company’s existing disclosures assess the impact of a potential, less severe spill on some aspects of public health and marine ecosystems. The proposed worst-case oil spill assessment would entail a release for a significantly longer duration with potentially much broader dispersion of oil with greater human and marine impacts.

_____________________________

11 “The time series data set defines

three-dimensional currents at a 3-hour interval for the 10 years between 2005 and 2014. The data from the SAT-OCEAN

current model were

calibrated by current data measured at a location offshore Guyana (8.08°N, 56.95°W) during 2015.” Payara EIA Volume

I, p. EIS-30

12 https://oceanservice.noaa.gov/facts/hurricanes-sea-life.html

13 https://corporate.exxonmobil.com/news/news-releases/2022/0426_exxonmobil-makes-three-new-discoveries-offshore-guyana-increases-stabroek-

resource-estimate#:~:text=IRVING%2C%20Texas%20%E2%80%93%20ExxonMobil%20has%20made,11%20billion%20oil%2Dequivalent%20barrels.

| 5 |

The Company determines in its existing spill assessments that a spill is “unlikely” and relies on this determination to characterize risk in several aspects as “minor.”14 However, the relative likelihood and magnitude of a potential spill may well be elevated by the concerns described above.

| d) | Impact on Caribbean economies |

The proposal requests the Company clarify its cleanup response commitments given the potential for the severe impact a spill could have on Caribbean economies. As mentioned in the background of the Proposal, President of Esso Exploration and Guyana Limited Alistair Routledge has stated “there is no limit” to what ExxonMobil would do in response to an oil spill. This should raise questions for investors concerning the extent of the Company’s financial commitment, as well as how such a cleanup would be funded.

Beyond the Company’s financial responsibility to Guyana to clean a worst-case spill, the Company has a financial responsibility to countries surrounding Guyana under international law.15

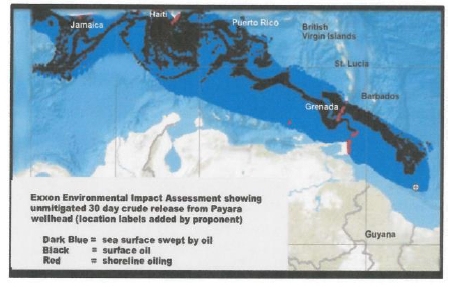

The above map, included in the Proposal, was derived from the Company’s Environmental Impact Assessment for its Payara development project.16 The map depicts the most severe discharge scenario assessed by the Company. However, the map depicts a release of crude oil lasting for only 30 days. This limited scenario already shows oil reaching numerous Caribbean countries, yet as discussed above, a true worst-case scenario could have an extended duration release, with the potential for an even greater oil sweeping area.

_____________________________

14 See, for example, Payara EIA, p. 9-137 - 9-138, “...In combination with a likelihood rating of Unlikely for a marine oil spill, the residual risk to marine mammals from a mitigated marine oil spill would be Minor.”

15 The Company’s Environmental Permit

for Liza Phase I states: “the Permit Holder shall comply with any directions which the Agency gives from time to time,

including

but not limited to, those directions given in furtherance of the implementation of any international or other obligation under any treaty

or International Law

related to the environmental protection of Guyana and surrounding regions likely to be affected (including neighbouring

South American Coast and Caribbean Sea).”

Liza Phase I Environmental Permit, § 1.2, p. 2, The Company may, then, be

liable under International Law to neighboring countries.

16 Payara EIA, p. 9-47

| 6 |

This is particularly concerning as many Caribbean countries rely on fishing and ecotourism to support their economies. For example, statistics indicate that the tourism industry in the British Virgin Islands generates an estimated 45% of the national income.17 Given this liability, the potential costs owed to surrounding countries to clean up a worst-case spill should be clarified for investors.

Conclusion

Our company operates in an industry exposed to significant financial, legal and reputational risks. In the opinion of the Proponent, the Company’s existing reporting is insufficient as it fails to address scientifically recognized worst-case spill vulnerabilities in its Guyana operations, such as risks from more frequent and intense severe weather events and an extended duration well release. Further, the Company has not assessed the potential heightened risk from operating above its listed peak safety threshold.

Investors should also be aware of the Company’s cleanup response commitments, given the potential for a spill to impact multiple nations throughout the Caribbean. It is in the investors’ best financial interests that the Company assess and disclose these potential risks associated with a worst-case spill scenario in its Guyana operations.

Vote “FOR” on this Shareholder Proposal

--

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. PROXY CARDS WILL NOT BE ACCEPTED BY MERCY INVESTMENT SERVICES. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON THE COMPANY’S PROXY CARD.

_____________________________

17 https://www.nationmaster.com/country-info/profiles/British-Virgin-Islands/Economy

7