United

States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE

OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: Exxon Mobil Corporation

Name of persons relying on exemption: Christian Brothers Investment Services, Inc.

Address of persons relying on exemption: 125 S. Wacker Drive, Suite 2400, Chicago, IL 60606

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934.

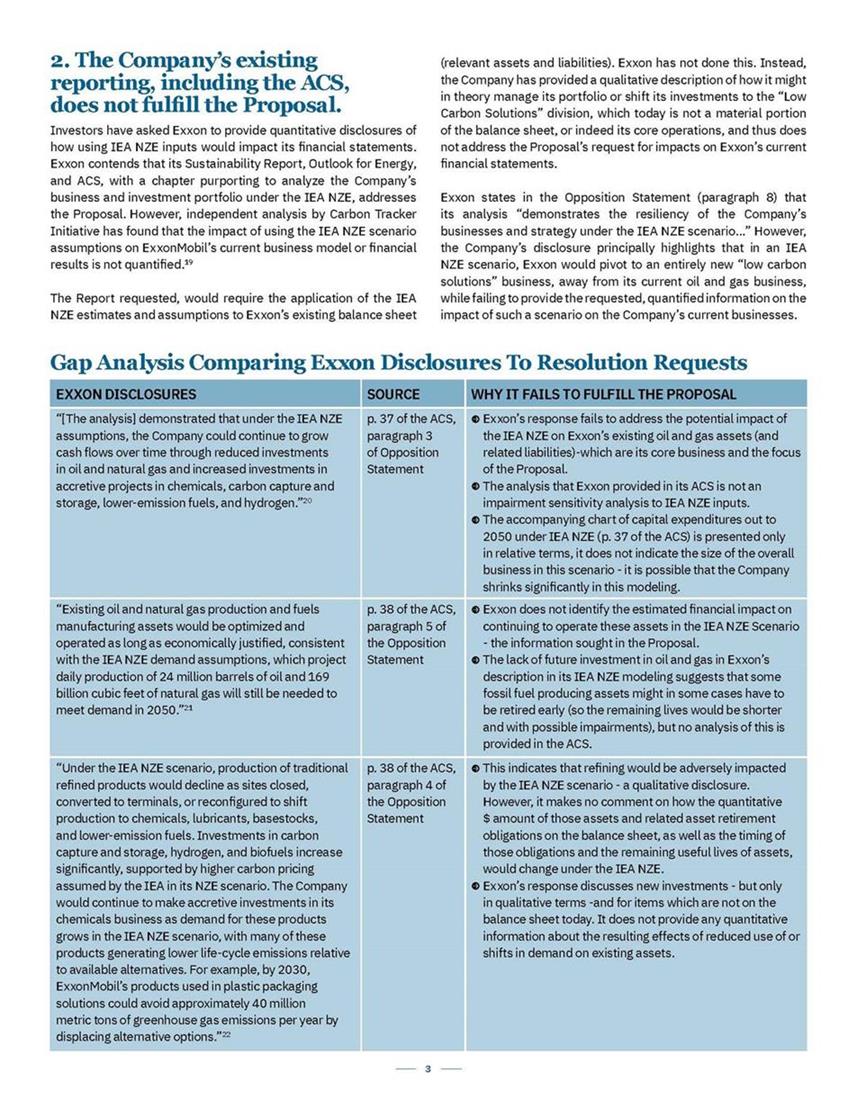

1 Christian Brothers Investment Services, Inc., as lead proponent of a filing group1, seeks your support for Shareholder Proposal Item 8, Report on Scenario Analysis, going to a vote at the 2022 ExxonMobil (Exxon or the Company) shareholder meeting. It requests the Company issue an audited report assessing the impact of the IEA’s Net Zero 2050 Scenario (the IEA NZE) on the assumptions, costs, estimates, and valuations underlying its financial statements (the Proposal). A similar proposal in 2021 received 49.4% support from Exxon shareholders.2 Despite publishing its Advancing Climate Solutions 2022 Progress Report (ACS)3, Outlook for Energy4, Opposition Statement5, and Sustainability Report6, in the opinion of the Proponent, the Company’s disclosures still do not fulfill the requests of the Proposal. The Proposal “RESOLVED: Shareholders request that ExxonMobil’s Board of Directors seek an audited report assessing how applying the assumptions of the International Energy Agency’s Net Zero by 2050 pathway would affect the assumptions, costs, estimates, and valuations underlying its financial statements, including those related to long-term commodity and carbon prices, remaining asset lives, future asset retirement obligations, capital expenditures and impairments. The Board should obtain and ensure publication of the report by February 2023, at reasonable cost and omitting proprietary information.” Reasons to support Item 8: 1. BUSINESS MODEL RISK: Exxon’s business strategy is built on continuing growth in demand for hydrocarbons for the next several decades. By contrast, The IEA NZE, reflecting global adoption of net zero commitments, anticipates a steep reduction in oil and gas demand (and therefore prices).7 The requested information concerning how the IEA NZE would alter the assumptions and estimates that Exxon uses to prepare its financial statements is therefore crucial to enabling shareholders to factor climaterelated information into their decision-making processes. 2. INADEQUATE DISCLOSURE: While Exxon argues that it provides extensive relevant information, its existing reporting does not fulfill the Proposal by making visible how using IEA NZE inputs would impact its financial statements (see Table: Gap Analysis Comparing Exxon Disclosures To Resolution Requests). Independent analysis by Carbon Tracker Initiative has confirmed that the impact of using the scenario’s assumptions on Exxon’s current business model or financial results is not quantified.8 Instead, Exxon offers a qualitative description of how it might in theory manage its assets or shift its existing business to various low carbon solutions, including investing in new assets not yet included in current financial statements. In addition, the request for “reasonable assurance” from an independent auditor has not been met. 3. GROUNDSWELL FROM INVESTORS: The Proposal is in line with investor calls for rigorous, audited disclosures on climate transition impacts in companies’ financial statements and evidence of consideration of these issues by their auditors. Major investor groups representing assets worth over $103 trillion have called on companies and auditors to fully disclose the financial impacts of climate change.9 Additionally, the U.S. Securities and Exchange Commission’s (SEC) proposed climate change risk disclosure rule10, if adopted, could require certain related information in audited financial statements, and three of the four relevant standard-setters, including the Financial Accounting Standards Board (FASB)11, have clarified the requirements to consider material climate-related matters in financial statements and in audits. 4. LAGGING BEHIND PEERS: Implementation of the Proposal would bring the Company closer to energy sector peers (including Shell, bp, TotalEnergies, Devon Energy, ConocoPhillips and Occidental Petroleum) that have provided more transparent disclosures in their audited financial statements articulating consideration of various financial impacts of climate change-related risks (and relevant targets). After consideration of the 2021 proposal it became apparent that specificity of the types of disclosures needed to fulfill the proposal would improve its clarity. Notably, the Company has not filed a no action challenge of the proposal on any basis. The clarified disclosures sought by this year’s proposal are appropriate as they relate to the types of assessments commonly included in financial statements. APRIL 2022 Proxy Exempt Solicitation and Investor Brief VOTE FOR Item 8 – Report on Scenario Analysis ExxonMobil Corporation (XOM) Annual Meeting: May 25, 2022 Contact: Julie Tanner, Managing Director, jtanner@cbisonline.com +1 (212) 503-1947 2 1. The information requested is crucial to investor decision-making The Proposal requests an audited report from Exxon indicating the estimated effects on specific financial statement items based on inputs from the IEA NZE, including long-term commodity and carbon prices, and changes to expected demand. These are important because they can impact the remaining lives and values of existing productive assets (including potential impairments), and the timing of current and future AROs. It also asks for information on how existing capital expenditures might change in the face of IEA NZE. In effect, the Proposal seeks information on the how using IEA NZE inputs would impact the Company’s current financial statements. Although the proposal requests a “report”, the proponent believes that the Company could fulfill this request either within or outside of its SEC-submitted annual report. On March 21, 2022, the SEC proposed rules on climate disclosure. If enacted, the rules may require the company to include some elements of this report in its financial statement or Reg S-K filings. Many items in the financial statements are based on estimates of future cash flows. Therefore, whether a company’s business plan is based on a high or low carbon future (and higher or lower demand and so commodity prices, respectively), can materially impact the accounts. For instance, the switch to renewable energy for power, regulations to limit emissions, and the phase out of internal combustion engines may result in reduced demand for oil and gas, which can directly and significantly affect financial statement results.12 They can change the assumptions used to determine expected future cash flows for impairment testing, resulting in impairments and altering the reported amounts of assets and liabilities. They can shorten the estimated useful lives of productive assets and accelerate the timing of asset retirement obligations. These can lead to increased costs, reduced revenues and profits and lower returns on capital. It is also important for investors to understand how management and the board are viewing the energy transition in order to effectively gauge corporate governance and engagement practices, and to make voting decisions on management and shareholder proposals. Asking companies to provide a sensitivity analysis of how changes to key assumptions and estimates in a low carbon scenario would impact the current accounts can help to verify company claims that financial impacts and therefore risks are minimal even in such a low carbon scenario. In effect, this is the request to Exxon. By contrast, the IEA NZE entails a significant drop in liquid fuel demand -from 99 mb/d in 2019 to an estimated 78 mb/d in 2030 and 31 mb/d in 2050.13 Notably, under the IEA NZE the share of oil in these totals declines as more demand is met by biofuels and ammonia. The share of oil decreases from 98% in 2019 to 90% in 2030 and 65% in 2050. Under the IEA NZE, oil prices fall to $36/barrel (bbl) in 2030 and $24/bbl in 2050.14 Given growing global political and business commitments to accelerating the decarbonization of the economy15, it is reasonable to ask that Exxon examine the IEA NZE and report to shareholders how that would change Exxon’s current financial statements. This differs sharply from Exxon’s 2021 business strategy which assumes continuing growth i n d emand f or h ydrocarbons f or the next several decades, with liquid fuel demand reaching 114 million barrels [of oil equivalent] per day (mb/d) in 2040.16 The company believes that conventional sources of oil will continue to be important to this growth in demand. In the opinion of the proponent, the Company’s core planning case, the Outlook for Energy, is not aligned with the goals of the Paris agreement. It projects a 2050 future where fossil fuels still provide over 70% of primary energy, with absolute demand growth for oil and natural gas vs. 2019.17 Recent oil and gas price rises do not reduce the immediate pressure to consider the longer-term impacts of decarbonization. Many companies, including Exxon18, indicate that they consider long-term prices for impairment tests rather than short-term volatility. Further, as major economies accelerate plans to transition away from fossil fuels, including for reasons of national security, it is vital that investors understand the financial risks and implications associated with the Company’s business plan which is inconsistent with a 1.5C pathway. Reasons to support the Proposal “Asking companies to provide a sensitivity analysis of how changes to key assumptions and estimates in a low carbon scenario would impact the current accounts can help to verify company claims that financial impacts and therefore risks are minimal even in such a low carbon scenario. In effect, this is the request to Exxon.” 3 2. The Company’s existing reporting, including the ACS, does not fulfill the Proposal. Investors have asked Exxon to provide quantitative disclosures of how using IEA NZE inputs would impact its financial statements. Exxon contends that its Sustainability Report, Outlook for Energy, and ACS, with a chapter purporting to analyze the Company’s business and investment portfolio under the IEA NZE, addresses the Proposal. However, independent analysis by Carbon Tracker Initiative has found that the impact of using the IEA NZE scenario assumptions on ExxonMobil’s current business model or financial results is not quantified.19 The Report requested, would require the application of the IEA NZE estimates and assumptions to Exxon’s existing balance sheet (relevant assets and liabilities). Exxon has not done this. Instead, the Company has provided a qualitative description of how it might in theory manage its portfolio or shift its investments to the “Low Carbon Solutions” division, which today is not a material portion of the balance sheet, or indeed its core operations, and thus does not address the Proposal’s request for impacts on Exxon’s current financial statements. Exxon states in the Opposition Statement (paragraph 8) that its analysis “demonstrates the resiliency of the Company’s businesses and strategy under the IEA NZE scenario…” However, the Company’s disclosure principally highlights that in an IEA NZE scenario, Exxon would pivot to an entirely new “low carbon solutions” business, away from its current oil and gas business, while failing to provide the requested, quantified information on the impact of such a scenario on the Company’s current businesses. EXXON DISCLOSURES SOURCE WHY IT FAILS TO FULFILL THE PROPOSAL “[The analysis] demonstrated that under the IEA NZE assumptions, the Company could continue to grow cash flows over time through reduced investments in oil and natural gas and increased investments in accretive projects in chemicals, carbon capture and storage, lower-emission fuels, and hydrogen.”20 p. 37 of the ACS, paragraph 3 of Opposition Statement P Exxon’s response fails to address the potential impact of the IEA NZE on Exxon’s existing oil and gas assets (and related liabilities)-which are its core business and the focus of the Proposal. P The analysis that Exxon provided in its ACS is not an impairment sensitivity analysis to IEA NZE inputs. P The accompanying chart of capital expenditures out to 2050 under IEA NZE (p. 37 of the ACS) is presented only in relative terms, it does not indicate the size of the overall business in this scenario - it is possible that the Company shrinks significantly in this modeling. “Existing oil and natural gas production and fuels manufacturing assets would be optimized and operated as long as economically justified, consistent with the IEA NZE demand assumptions, which project daily production of 24 million barrels of oil and 169 billion cubic feet of natural gas will still be needed to meet demand in 2050.”21 p. 38 of the ACS, paragraph 5 of the Opposition Statement P Exxon does not identify the estimated financial impact on continuing to operate these assets in the IEA NZE Scenario - the information sought in the Proposal. P The lack of future investment in oil and gas in Exxon’s description in its IEA NZE modeling suggests that some fossil fuel producing assets might in some cases have to be retired early (so the remaining lives would be shorter and with possible impairments), but no analysis of this is provided in the ACS. “Under the IEA NZE scenario, production of traditional refined products would decline as sites closed, converted to terminals, or reconfigured to shift production to chemicals, lubricants, basestocks, and lower-emission fuels. Investments in carbon capture and storage, hydrogen, and biofuels increase significantly, supported by higher carbon pricing assumed by the IEA in its NZE scenario. The Company would continue to make accretive investments in its chemicals business as demand for these products grows in the IEA NZE scenario, with many of these products generating lower life-cycle emissions relative to available alternatives. For example, by 2030, ExxonMobil’s products used in plastic packaging solutions could avoid approximately 40 million metric tons of greenhouse gas emissions per year by displacing alternative options.”22 p. 38 of the ACS, paragraph 4 of the Opposition Statement P This indicates that refining would be adversely impacted by the IEA NZE scenario - a qualitative disclosure. However, it makes no comment on how the quantitative $ amount of those assets and related asset retirement obligations on the balance sheet, as well as the timing of those obligations and the remaining useful lives of assets, would change under the IEA NZE. P Exxon’s response discusses new investments - but only in qualitative terms -and for items which are not on the balance sheet today. It does not provide any quantitative information about the resulting effects of reduced use of or shifts in demand on existing assets. Gap Analysis Comparing Exxon Disclosures To Resolution Requests 4 Further, the Proposal recommends the requested report be supported with reasonable assurance from an independent auditor. Reasonable Assurance is sought in order to have confidence that quantitative effects of using IEA NZE on key costs, estimates, and assumptions used in the financial statements is fairly assessed. The assurance provided does not meet the requested standard for several reasons: P Lack of reasonable assurance: Exxon has not provided an audited report with reasonable assurance. Instead, Exxon obtained what it labels a “quality assurance audit,” which differs from the reasonable assurance requested by the Proponents; P Use of “independent third party” rather than an auditor: In performing audits, auditors are tasked with obtaining reasonable assurance - a high level of assurance - that, in the auditor›s opinion, is satisfactorily free from material misstatement. This is typically provided by an audit firm. Instead, Exxon has looked not to an auditor but “an independent third party,” Wood Mackenzie, a research and consultancy firm, not an accounting or assurance firm. Further, according to the ACS, what was performed was a “model review” and does not render an opinion that the ACS is satisfactorily free of material misstatement; and P The ACS does not address the financial statement impact on core fossil fuel segments: Since the ACS fails to address the financial statement impact on the company’s core fossil fuel segments, their assurance falls short of the Proponent’s request. 3. The need for rigorous, audited disclosure of climate change impacts on financial statements is demanded by the global investment community In late 2020, the Principles for Responsible Investment (PRI), the UN Environment Programme Finance Initiative (UNEP FI), the UNconvened Net-Zero Asset Owner Alliance initiative, the Institutional Investors Group on Climate Change (IIGCC), and other investor groups representing more than $100 trillion in global assets under management, called on companies and their auditors to follow relevant requirements to consider climate change risks in the 2020 audited financial statements and audit reports, respectively, and to use assumptions and estimates compatible with the goals of the Paris Agreement.23 This was further emphasized with engagements from leading global investors to carbon intensive companies through the Institutional Investors Group on Climate Change (IIGCC).24 To address the lack of corporate disclosure, Climate Action 100+ (CA100+), a group of 615 investors with $68 trillion in assets under management, released in March 2022 a provisional Climate Accounting Alignment Assessment to complement the CA100+ Disclosure Framework.25 It assesses if corporate accounting practices and related disclosures, and corresponding auditor’s report, reflect the effects of climate risk and the global move towards a 2050 (or sooner) net zero emissions pathway and the Paris goal to limit global warming to no more than 1.5°C.26 According to the Climate Accounting and Audit (Overall Score), Exxon did not meet any of the criteria identified.27 To challenge boards to address climate-related financial risk in financial statements and audits, investors are also using the proxy ballot. A resolution at Chevron on this topic received a vote in favor of 47.8% last year.28 The 2022 shareholder season also saw a similar shareholder resolution filed at Valero29 and Marathon Oil.30 Shareholders withdrew their proposals after an agreement was reached with the companies, with Marathon Oil agreeing to provide a quantitative analysis of the IEA Net Zero by 2050 pathway and its impact on select indicators requested in the proposal. In Europe, some investors have taken to declaring their vote intentions on company financial statements, appointment of the auditor, and Audit Committee members to hold boards to account for Parisaligned financial statements.31 Additionally, accounting and auditing standard-setters and security market regulators have clarified the requirements to consider material climate-related matters in financial statements and in audits, including The European Securities and Markets Authority (ESMA)32, and FRC.33 Other examples include The International Auditing and Assurance Standards Board (IAASB)34 and the International Accounting Standards Board (IASB)35, which have each clarified that material climate-related matters should be considered in preparing and auditing financial statements. Moreover, US Generally Accepted Accounting Standards (US GAAP), established by the FASB36, are required to be followed by US public companies. Notably, the SEC proposed climate change risk disclosure rule37, if adopted, could require certain related information in audited financial statements, reflecting the importance of companies’ disclosure of the potential financial impact of climate change on their businesses and strategies. The 2021 shareholder proposal on this topic at Exxon received 49.4% of the vote, including support from BlackRock and State Street, and received recommendations FOR the Proposal from ISS and Glass Lewis reflecting widespread investor and advisor support for the company to produce the requested information. “The 2021 shareholder proposal on this topic at Exxon received 49.4% of the vote, including support from BlackRock and State Street, and received recommendations FOR the Proposal from ISS and Glass Lewis reflecting widespread investor and advisor support for the company to produce the requested information.” 5 4. Exxon lags peers on accounting disclosures Exxon lags its peers in failing to disclose many of the actual inputs underpinning its financial statements. In contrast oil majors Shell, bp, Equinor and TotalEnergies all disclose assumed oil and gas prices which provides investors with actionable information regarding their divergence from those in the IEA NZE. In 2020 each of bp, Royal Dutch Shell (Shell), and TotalEnergies (Total) altered and disclosed their future commodity price assumptions for oil and natural gas. bp noted that its approximately $24bn in write-downs was largely due to revised price assumptions driven in part by the energy transition and provided an indication of remaining useful lives of upstream and downstream assets.38 Shell reduced refining margins by 30% triggering a $6.5bn impairment to its manufacturing, supply and distribution assets (to a revised carrying value of $50bn), and recognized nearly $1.0bn in decommissioning and restoration provisions for shorterlived facilities in its Oil Products segment as a result of the energy transition.39 Total’s nearly $7.0bn impairment of its oil sands assets partly related to its new Climate Ambition. Some peers provided disclosures for other types of inputs that they used. Repsol S.A. disclosed the near and long-term CO2 prices that it used in its 2020 asset impairment tests.40 Eni S.p.A. provided a range of discount rates, total estimated time period and a break-down of the timing of estimated undiscounted future costs of decommissioning obligations.41 In 2021, Shell increased near term commodity prices but held oil and gas prices from 2023 steady. In its financial statements it included property, plant and equipment sensitivities to different climate scenarios and an impairment sensitivity to changes in commodity price assumptions.42 bp increased the short-term but decreased long-term oil prices as “bp’s management expects an acceleration of the pace of transition to a lower carbon economy”.43 As bp’s auditor, in 2020 Deloitte compared the company’s revised price assumptions against third-party forecasts including Paris 2 degree Celsius scenarios. Deloitte commented that the assumptions were broadly consistent with achieving the goals of the Paris Agreement.44 Shell’s auditors identified in its 2020 report that the energy transition would impact the estimation of future refining margins to evaluate the recoverability of refineries.45 In 2021 Ernst & Young compared Shell’s oil and gas prices to those included in the IEA NZE.46 U.S. companies have also made progress. For example, Devon Energy Corporation47 d isclosed i nformation o n t he o il a nd g as price assumptions that it used in its 2020 impairment testing. Occidental Petroleum48 and ConocoPhillips49 also include commodity price information they used for impairment testing in their quarterly report. In addition, Marathon Oil recently agreed to provide shareholders with a quantitative analysis of the IEA Net Zero by 2050 pathway and its impact on the company’s financial position and underlying assumptions in exchange for a withdrawal of a shareholder proposal.50 The number of companies disclosing data in line with the Proposal demonstrates that meaningful and actionable information is available, reasonable, and not onerous to obtain or expect. In fact, Exxon argues in its Opposition Statement51 that the information requested by the Proponent has already been published, not that it is impractical or unachievable. Conclusion Last year, this topic received 49.4% support from Exxon shareholders.52 Given the Company’s inadequate disclosures in response, it is vital shareholders support this year’s Proposal to encourage Exxon to provide the requested information. Reasons to vote in favor of ITEM 8: P Given the divergence between Exxon’s current business strategy and the IEA NZE the Proposal requests information crucial for investors trying to assess the financial impacts of climate related risks facing the Company. P Exxon’s existing disclosures do not fulfill the Proposal’s request. The Company’s response fails to address the potential financial impact of the IEA NZE on Exxon’s existing oil and gas assets (and related liabilities) — which are its core business and the focus of the Proposal. P The Proposal is reasonable as it is in line with requests being made by global investors, guidance statements provided by regulators and international standard setters, and disclosures being made by other oil and gas companies. 6 WHEREAS: Many policymakers, investors and companies have converged on goals including the need to limit global temperature increase to 1.5°C and to reach net zero global greenhouse gas (GHG) emissions by 2050, if not sooner.53 The International Energy Agency’s Net Zero 2050 Roadmap (NZE) describes an energy sector path for net-zero GHG emissions. According to the IEA, no investment in new fossil supply projects is needed in a net zero scenario and the IEA anticipates oil prices dropping as low as $36/barrel in 2030 and $24/barrel in 2050, projecting a negative trend for a fundamental input in developing ExxonMobil’s cash flow projections for oil and gas production assets.54 Yet ExxonMobil continues development of new fossil fuel resources, even while acknowledging55 that climate change scenarios pose uncertainties that may lead to impairments. Investors are concerned that the continued development of new fossil fuel resources increases the risk of such future impairments. ExxonMobil’s existing, audited annual disclosures do not provide investors with sufficient insight into stranded asset risk related to the energy transition. ’If climate change impacts the entity, the auditor needs to consider whether the financial statements appropriately reflect this,’ according to the International Auditing and Assurance Standards Board. An independent analysis56 in September 2021 concluded that the financial statements of ExxonMobil lack the requisite transparency about climate-related assumptions and estimates, and company disclosures do not appear to use Paris-aligned assumptions and estimates. In February 2022, independent analysis57 again determined that the impact to ExxonMobil’s current business model of NZE is not quantified. In contrast, peers (Royal Dutch Shell, bp, TotalEnergies) released more transparent disclosures in their audited financial statements, articulating the extent of consideration of climate change contingencies and risks.58 RESOLVED: Shareholders request that ExxonMobil’s Board of Directors seek an audited report assessing how applying the assumptions of the International Energy Agency’s Net Zero by 2050 pathway would affect the assumptions, costs, estimates, and valuations underlying its financial statements, including those related to long-term commodity and carbon prices, remaining asset lives, future asset retirement obligations, capital expenditures and impairments. The Board should obtain and ensure publication of the report by February 2023, at reasonable cost and omitting proprietary information. Supporting Statement The proponent recommends the requested report be supported with reasonable assurance from an independent auditor. Investors with $103 trillion in assets under management have already called for companies and their auditors to rigorously disclose climate risks in financial reporting, or risk overstatement by failing to integrate impacts on profits and financial positions.59 Last year, this topic received 49.4% support of ExxonMobil investors. In light of ExxonMobil’s disclosures regarding potential impairments from uncertain climate scenarios depressing product demand, it is urgent for investors to vote in favor. This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card; Christian Brothers Investment Services is not able to vote your proxies, nor does this communication contemplate such an event. CBIS urges shareholders to vote for Item No. 8 following the instructions provided on management’s proxy mailing. The views expressed are those of Christian Brothers Investment Services, Inc. as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast of future events or a guarantee of future results. These views may not be relied upon as investment advice. The securities identified and described do not represent all the securities purchased, sold or recommended for the CRI Funds, CBIS Global Funds and separate managed accounts. The information provided in this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. Appendix: The Proposal FINANCIAL STATEMENT ASSUMPTIONS AND CLIMATE CHANGE 7 1 Co-filers of the Proposal include: Adrian Dominican Sisters; As You Sow Foundation; Congregation des Soeurs des Saints Noms de Jesus et de Marie; Congregation of Benedictine Sisters of Boerne, Texas; Benedictine Sisters of Mount St. Scholastica; Benedictine Sisters of Virginia; Bon Secours Mercy Health; CommonSpirit Health; Congregation of St. Joseph, OH; Daughters of Charity, Province of St Louise; Dominican Sisters of Hope; M&G Investments; Maryknoll Sisters; Mercy Investment Services; Monasterio Pan de Vida; Presbyterian Church USA; Providence St. Joseph Health; Province of St. Joseph of the Capuchin Order (Midwest Capuchins); School Sisters of Notre Dame, Atlantic Midwest Province; School Sisters of Notre Dame, Central Pacific Province; School Sisters of Notre Dame Cooperative Investment Fund; Sisters of the Holy Names of Jesus and Mary, US Ontario Province; Sisters of St. Dominic of Caldwell, NJ. 2 Exxon Mobil, Form 8-K, May 26, 2021. https://ir.exxonmobil.com/node/32811/ html. Data based on SEC rule Rule 14a-8(i)(12) vote counting formula, counting votes for and against. See https://www.sec.gov/interps/legal/cfslb14.htm 3 ExxonMobil, Advancing Climate Solutions, 2022 Progress Report, January 2022 https://corporate.exxonmobil.com/-/media/Global/Files/Advancing-Climate- Solutions-Progress-Report/2022/ExxonMobil-Advancing-Climate-Solutions- 2022-Progress-Report. pdf?la=en&hash=AFC42B15F21ADB081F9A35AA685385A3287F48E5 4 ExxonMobil, Outlook For Energy, December 2021. https://corporate.exxonmobil. com/Energy-and-innovation/Outlook-for-Energy 5 U.S. SEC Schedule 14A Proxy Statement, ExxonMobil Corporation, Notice of 2022 Annual Meeting and Proxy Statement, Opposition Statement, April 7, 2022, pg 77. https://ir.exxonmobil.com/node/34026/html#toc280259_21 6 ExxonMobil Sustainability Report, January 2021. https://corporate.exxonmobil. com/-/media/Global/Files/sustainability-report/publication/Sustainability- Report.pdf 7 International Energy Agency (IEA), World Energy Outlook, October 2021, p. 101. https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae- 789a4e14a23c/WorldEnergyOutlook2021.pdf 8 Coffin, M. “Exxon is planning on climate failure despite ‘Advancing Climate Solutions,’” February 8, 2022. Carbon Tracker. https://carbontracker.org/ exxonmobil-is-planning-on-climate-failure-despite-advancing-climatesolutions/#_ ftn2 9 Principles for Responsible Investment, “Investor groups call on companies to reflect climate-related risks in financial reporting,” September 16, 2020.https:// www.unpri.org/accounting-for-climate-change/investor-groups-call-oncompanies- to-reflect-climate-related-risks-in-financial-reporting/6432.article 10 U.S. Securities And Exchange Commission, 17 CFR 210, 229, 232, 239, and 249 [Release Nos. 33-11042; 34-94478; File No. S7-10-22] RIN 3235-AM87 “The Enhancement and Standardization of Climate-Related Disclosures for Investors,” March 21, 2022. https://www.sec.gov/rules/proposed/2022/33-11042.pdf 11 The U.S. Financial Accounting Standards Board, FASB Staff Educational Paper, “Intersection of Environmental, Social, and Governance Matters with Financial Accounting Standards,” March 19, 2021, p. 3. https://www.fasb.org/page/ ShowPdf?path=FASB_Staff_ESG_Educational_Paper_FINAL. pdf&title=FASB%20Staff%20Educational%20Paper-Intersection%20of%20 Environmental 12 Carbon Tracker and The Climate Accounting Project, “Flying blind: The glaring absence of climate risks in financial reporting,” September 2021. https:// carbontracker.org/reports/flying-blind-the-glaring-absence-of-climate-risks-infinancial- reporting/ 13 Estimates of total liquid fuel demand were converted from IEA NZE supply amounts (in exajoules or EJ) using a fixed 0.52 EJ to mb/d conversion factor. See IEA World Energy Outlook 2021, October 2021, p. 309. https://iea.blob.core. windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/ WorldEnergyOutlook2021.pdf For purposes of this discussion, supply is considered equivalent to demand. 14 IEA, World Energy Outlook, October 2021, p. 101. https://iea.blob.core.windows. net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/ WorldEnergyOutlook2021.pdf 15 On January 27, 2021, the US joined eight of the 10 highest-emitting nations that have committed to seeking net zero greenhouse gas (GHG) emissions in line with many corporate and financial leaders. See for example the Glasgow Financial Alliance for Net Zero, with over $130 trillion in assets under management “Committed to accelerating the decarbonization of the economy.” https://www. gfanzero.com 16 Exxon Mobil, Form 10-K, January 2022, p. 44. https://ir.exxonmobil.com/ static-files/73aca83c-e65f-42ec-9a13-a7b04a302b7f 17 Coffin, M. “Exxon is planning on climate failure despite ‘Advancing Climate Solutions,’” February 8, 2022. Carbon Tracker Initiative. https://carbontracker. org/exxonmobil-is-planning-on-climate-failure-despite-advancing-climatesolutions/#_ ftn2 18 ExxonMobil, 2020 Form 10-K, p. 64 https://sec.report/ Document/0000034088-21-000012/ 19 Coffin, M. “Exxon is planning on climate failure despite ‘Advancing Climate Solutions’. February 8, 2022. Carbon Tracker. https://carbontracker.org/ exxonmobil-is-planning-on-climate-failure-despite-advancing-climatesolutions/#_ ftn2 20 ExxonMobil, Advancing Climate Solutions, 2022 Progress Report, January 2022, p. 37. https://corporate.exxonmobil.com/-/media/Global/Files/Advancing- Climate-Solutions-Progress-Report/2022/ExxonMobil-Advancing-Climate- Solutions-2022-Progress-Report. pdf?la=en&hash=AFC42B15F21ADB081F9A35AA685385A3287F48E5 21 ExxonMobil, Advancing Climate Solutions, 2022 Progress Report, January 2022. p. 38 https://corporate.exxonmobil.com/-/media/Global/Files/Advancing- Climate-Solutions-Progress-Report /2022/ExxonMobil-Advancing-Climate- Solutions-2022-Progress-Report. pdf?la=en&hash=AFC42B15F21ADB081F9A35AA6853 85A3287F48E5 22 ExxonMobil, Advancing Climate Solutions, 2022 Progress Report, January 2022. p. 38 https://corporate.exxonmobil.com/-/media/Global/Files/Advancing- Climate-Solutions-Progress-Report/2022/ExxonMobil-Advancing-Climate- Solutions-2022-Progress-Report. pdf?la=en&hash=AFC42B15F21ADB081F9A35AA685385A3287F48E5 23 Principles For Responsible Investment (PRI), “Investor groups call on companies to reflect climate-related risks in financial reporting,” September 16, 2020. https://www.unpri.org/accounting-for-climate-change/investor-groups-call-oncompanies- to-reflect-climate-related-risks-in-financial-reporting/6432.article 24 Institutional Investors Group on Climate (IIGCC), “Leading investors call on Europe’s largest companies to address missing climate change costs in financial accounts,” November 16, 2020 https://www.iigcc.org/news/leading-investorscall- on-europes-largest-companies-to-address-missing-climate-change-costsin- financial-accounts/; https://www.iigcc.org/download/iigcc-letter-to-europeancompanies- on-paris-aligned-accounts/?wpdmdl=4006&masterkey=5fabc9c5af 24f 25 Climate Action 100+ Net Zero Company Benchmark Summary of company assessments, Climate Accounting and Audit, p. 53, March 2022. https://www. climateaction100.org/wp-content/uploads/2022/04/March-2022_Benchmarkassessments_ public-summary_Final.pdf 26 Climate Action 100+ Net-Zero Company Benchmark, Structure And Methodologies, March 2022. https://www.climateaction100.org/net-zerocompany- benchmark/methodology/ 27 Climate Action 100+, Climate Accounting and Audit (Provisional Assessment), Carbon Tracker Initiative and the Climate Accounting and Audit Project, March 2022.https://www.climateaction100.org/company/exxon-mobil-corporation/ 28 Chevron, Form 8-K, May 26, 2021. https://www.chevron.com/-/media/chevron/ stories/documents/chevron-2021-shareholder-proposal-voting-results.pdf. Data based on SEC rule Rule 14a-8(i)(12) vote counting formula, counting votes for and against. See https://www.sec.gov/interps/legal/cfslb14.htm 29 “Valero Energy Corp: Net Zero Scenario analysis or disclose critical climate financial assumptions,” As You Sow. November 25, 2021. https://www.asyousow. org/resolutions/2021/11/16-valero-net-zero-scenario-analysis 30 “Marathon Oil Corp: Net Zero Scenario analysis or disclose critical climate financial assumptions.” As You Sow. December 17, 2021. https://www.asyousow. org/resolutions/2021/12/15-marathon-oil-net-zero-scenario-analysis 31 “Public Statement on Shell and BP Votes, Sarasin & Partners, April 28, 2021. https://sarasinandpartners.com/stewardship-post/public-statement-on-shelland- bp-votes/ 32 The European Securities and Markets Authority (ESMA), “Public Statement, European common enforcement priorities for 2021 annual financial reports,” ESMA32-63-1186. October 2021. https://www.esma.europa.eu/sites/default/ files/library/esma32-63-1186_public_statement_on_the_european_common_ enforcement_priorities_2021.pdf Endnotes 8 33 Financial Reporting Council (FRC), “Key matters for 2021/2022 reports and accounts,” October 2021. https://www.frc.org.uk/getattachment/ecd6d6b2- 7f4d-4a70-bf60-32b07143ece1/FRC-CRR-Year-End-Key-Matters_ October-2021.pdf 34 The International Auditing and Assurance Standards Board (IAASB), “The Consideration Of Climate-Related Risks In An Audit Of Financial Statement,” Staff Audit Practice Alert, Oct 01, 2020. https://www.iaasb.org/publications/ consideration-climate-related-risks-audit-financial-statement 35 The IFRS Foundation, “Effects of climate related matters on financial statements,” November 2020, p.1. https://www.ifrs.org/content/dam/ifrs/supportingimplementation/ documents/effects-of-climate-related-matters-on-financialstatements. pdf 36 FASB Staff Educational Paper – Intersection of Environmental, Social, and Governance Matters with Financial Accounting Standards, March 2021, p. 3. https://fasb.org/jsp/FASB/Document_C/DocumentPage&cid=1176176379917 37 U.S. Securities and Exchange Commission 17 CFR 210, 229, 232, 239, and 249 [Release Nos. 33-11042; 34-94478; File No. S7-10-22] RIN 3235-AM87, “The Enhancement and Standardization of Climate-Related Disclosures for Investors,” March 2022. https://www.sec.gov/rules/proposed/2022/33-11042.pdf 38 Includes $12.9bn related to Upstream assets, $0.8bn related to Downstream assets and $9.9bn related to Exploration and Appraisal expenditure. bp Annual Report and Form 20-F 2020, pp. 160, 166,179, 191, 261-261. https://www. bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/investors/ bp-annual-report-and-form-20f-2020.pdf 39 Shell, Form 20-F 2021, March 11, 2022, p. 223. https://sec.report/ Document/0001306965-21-000025/ 40 Repsol, S.A., Annual Financial Report 2020-Financial Statements 2020, p. 52.https://www.repsol.com/content/dam/repsol-corporate/es/accionistas-einversores/ pdf/hr18022021-repsol-sa-consolidated-annual-financial-report.pdf 41 Eni SpA, Annual Report 2020, March 18, 2021, pp. 241, 262. https://www.eni. com/assets/documents/eng/reports/2020/Annual-Report-2020.pdf 42 Shell, Form 20-F 2021, March 11, 2022, pp. 219-221. https://sec.report/Document/0001306965-21-000025/ 43 bp’s fourth quarter and full year 2021 results - 31.12.2021 BP SEA (Q4) (unaudited), p. 20. bp’s audited 2021 financial statements and additional information for TotalEnergies 2021 financial statements, were not yet available at the time of this briefing. 44 Bp, Annual Report and Form 20-F 2020, filed March 3, 2020. https://sec.report/ Document/313807/000162828020003753/a31122019bp20fdoc.htm 45 Shell, Annual Report and Form 20-F 2020, filed March 12, 2020. https://sec. report/ix?doc=/Document/1306965/000130696520000014/ royaldutchshell20-f2019.htm 46 Shell, Annual Report and Accounts 2021, March 2022, p. 220. https://reports. shell.com/annual-report/2021/ 47 Devon Energy Corporation Form 10-K for the year ended December 31, 2021, p. 68. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001090012/a8a62679-53ed- 494e-8149-2ce227a4fac0.pdf 48 Occidental Petroleum Corporation, Form 10-Q 2020, Note 7, filed August 10, 2020, p.21. https://www.sec.gov/ix?doc=/Archives/edgar/ data/797468/000079746820000027/oxy-20200630.htm 49 ConocoPhillips, Form 10-Q 2020, Note 14, filed May 5, 2020, p. 19. https://www. conocophillips.com/investor-relations/sec-filings/ 50 “Marathon Oil Corp: Net Zero Scenario analysis or disclose critical climate financial assumptions,” As You Sow. December 17, 2021. https://www.asyousow. org/resolutions /2021/12/15-marathon-oil-net-zero-scenario-analysis 51 U.S. SEC Schedule 14A Proxy Statement, ExxonMobil Corporation, Notice of 2022 Annual Meeting and Proxy Statement, Opposition Statement, April 7, 2022, pg 77. https://ir.exxonmobil.com/node/34026/html#toc280259_21 52 Exxon Mobil, Form 8-K, May 26, 2021. https://ir.exxonmobil.com/node/32811/ html. Data based on SEC rule Rule 14a-8(i)(12) vote counting formula, counting votes for and against. See https://www.sec.gov/interps/legal/cfslb14.htmp 53 See, for instance, Glasgow Financial Alliance for Net Zero, with over $130 trillion in assets under management. https://www.gfanzero.com/press/amount-of-financecommitted- to-achieving-1-5c-now-at-scale-needed-to-deliver-thetransition/#:~: text=Roadmaps-,Amount%20of%20finance%20committed%20 to%20achieving%201.5%C2%B0C%20now,needed%20to%20deliver%20 the%20transition&text=Today%2C%20through%20the%20Glasgow%20 Financial,the%20economy%20for%20net%20zero 54 IEA, World Energy Outlook, October 2021, p. 101. https://iea.blob.core.windows. net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/ WorldEnergyOutlook2021.pdf 55 E.g., MD&A: https://www.sec.gov/ix?doc=/Archives/edgar/ data/34088/000003408821000064/xom-20210930.htm 56 Carbon Tracker and The Climate Accounting Project, Flying Blind: the glaring absence of climate risks in financial reporting, September 2021, Table 2, p. 24, https://carbontracker.org/flying-blind-pr/ 57 Coffin, M. “Exxon is planning on climate failure despite ‘Advancing Climate Solutions,’ February 8, 2022. Carbon Tracker. https://carbontracker.org/ exxonmobil-is-planning-on-climate-failure-despite-advancing-climatesolutions/#_ ftn2 58 https://www.sec.gov/Archives/edgar/data/34088/000121465921004380/ cg421210px14a6g.htm 59 Principles for Responsible Investment, “Investor groups call on companies to reflect climate-related risks in financial reporting,” September 16, 2020. https:// www.unpri.org/accounting-for-climate-change/investor-groups-call-oncompanies- to-reflect-climate-related-risks-in-financial-reporting/6432.article Filed By: CHRISTIAN BROTHERS INVESTMENT SERVICES, INC. Registrant: ExxonMobil Corporation (XOM) Shareholder Proposal: VOTE FOR Item 8 – Report on Scenario Analysis Annual Meeting: May 25, 2022 Contact: Julie Tanner, Managing Director jtanner@cbisonline.com +1 (212) 503-1947