| Notice of 2024 Annual Meeting and Proxy Statement |

| |||

| April 11, 2024 | ||||

Dear Shareholder:

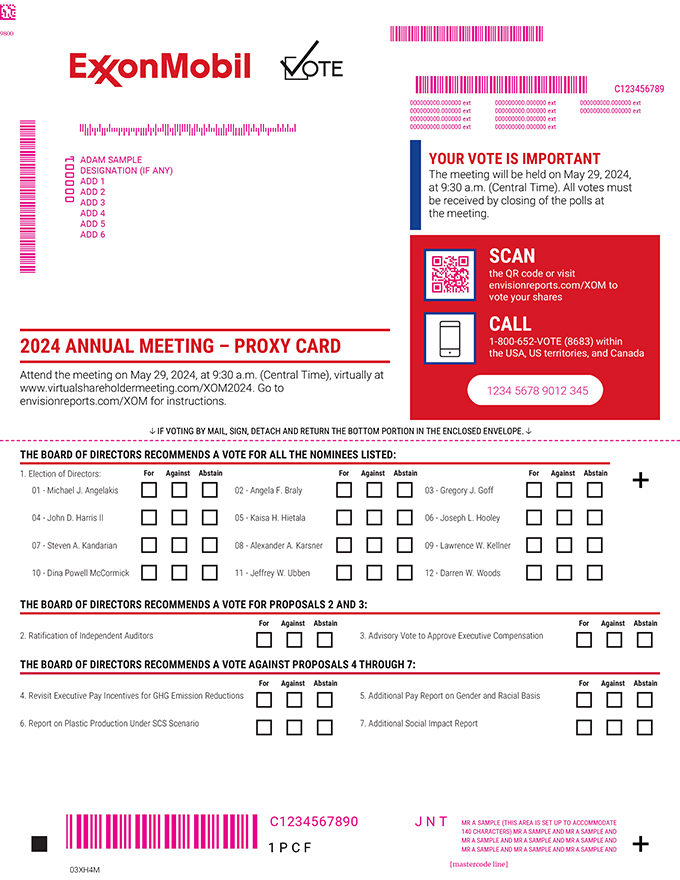

We invite you to attend the annual meeting of shareholders on Wednesday, May 29, 2024, beginning promptly at 9:30 a.m. Central Time. The annual meeting of shareholders will be a virtual meeting. This format will help provide for a safe experience for our shareholders, employees, and other members of the community, and provide broader access and participation in the meeting versus an in-person meeting. Shareholders will be able to attend, vote, and submit questions during the annual meeting from any remote location that has Internet connectivity. We believe this approach provides for equitable participation and enhances accessibility to the meeting. Online access will be available approximately 15 minutes prior to the annual meeting start time at www.virtualshareholdermeeting.com/XOM2024. Please see page 5 for detailed instructions for attending and participating in the annual meeting.

At the meeting, you will hear a report on our business and vote on the following items:

| • | Election of directors; |

| • | Ratification of PricewaterhouseCoopers LLP as independent auditors; |

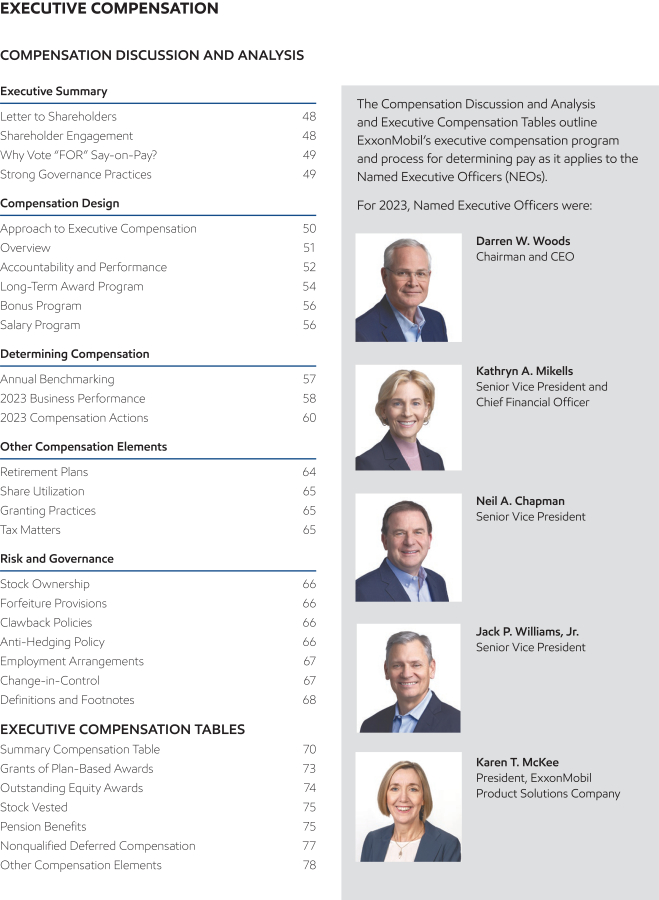

| • | Advisory vote to approve executive compensation; |

| • | Four shareholder proposals contained in this proxy statement; and |

| • | Other matters if properly raised. |

Only shareholders of record on April 3, 2024, or their valid proxy holders may vote at the meeting. We are first mailing these proxy materials to shareholders of record on or about April 11, 2024.

This booklet includes the formal notice of the meeting and proxy statement. The proxy statement tells you about the agenda, procedures, and rules of conduct for the meeting. It also describes how the Board operates, gives information about our director candidates, and provides information about the other items of business to be conducted at the meeting.

Financial information is provided separately in the 2023 Annual Report that accompanies or precedes the proxy materials or is made available online to all shareholders.

Your vote is important. Even if you own only a few shares, we want your voice to be represented at the meeting. You can vote your shares by Internet, toll-free telephone call, or proxy card. A preliminary summary of 2024 Proxy Voting Results will be available at exxonmobil.com after the annual meeting of shareholders and will be filed on a Form 8-K within four business days of the meeting.

Sincerely,

|

|

| |||

|

Craig S. Morford Secretary |

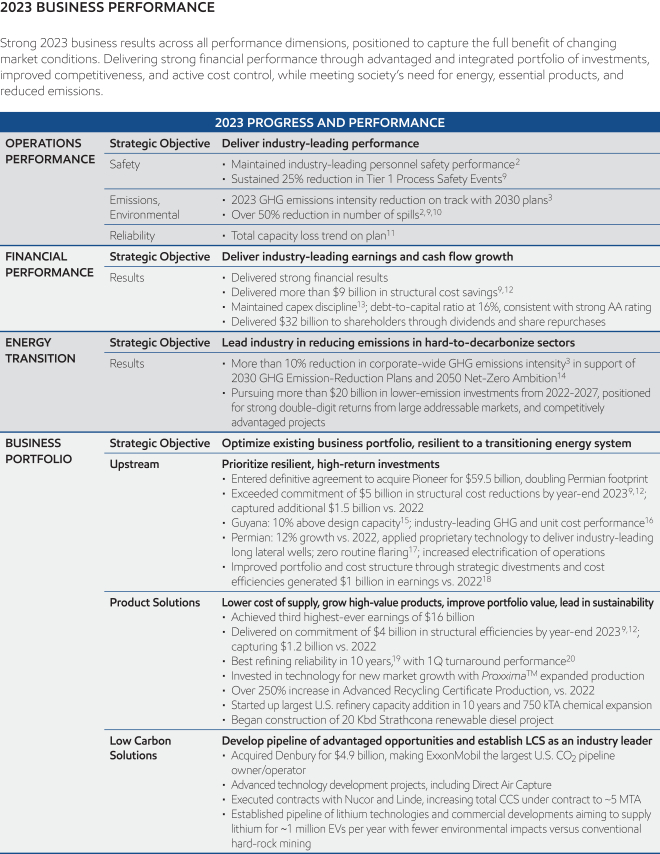

Darren W. Woods Chairman of the Board |