UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Meeting the world’s energy needs and reducing emissions ESG summary for shareholder engagements ExxonMobil Research Center April 2023 Clinton, New Jersey

Cautionary statement Outlooks; projections; plans; ambitions; estimates; and descriptions of strategic plans and objectives are forward-looking statements. Similarly, emission-reduction roadmaps are dependent on future market factors, such as continued technological progress and policy support, and also represent forward-looking statements. Actual future results from our capital plans, lower-emissions spending and structural cost reductions efforts; ambitions to reach Scope 1 and Scope 2 net zero from operated assets by 2050, to reach Scope 1 and 2 net zero in Upstream Permian Basin unconventional operated assets by 2030, to eliminate routine flaring in-line with World Bank Zero Routine Flaring, to reduce methane emissions, to meet ExxonMobil’s emission reduction plans, divestment and start-up plans, and associated project plans as well as technology efforts; success in or development of future business markets like carbon capture, hydrogen or biofuels could differ materially due to a number of factors. These include the evolution of the energy market compared to our investments in current and future potential markets; the ability to bring new technologies to commercial scale on a cost-competitive basis, including carbon capture projects, biofuel projects and hydrogen projects; policy and consumer support for lower-emissions products and technologies in different jurisdictions; regulatory actions to implement the Inflation Reduction Act; changes in law, taxes, regulation, or policies, including environmental regulations, political sanctions, and international treaties; the timely granting or freeze, suspension or revocation of government permits; regional differences in product concentration and demand; the severity, length and ultimate impact of future pandemics and government responses on people and economies; war, trade agreements, shipping blockades or harassment and other political or security concerns; feasibility and timing for regulatory approval of potential investments or divestments; the capture of efficiencies between business lines; unexpected technological developments; general economic conditions, including the occurrence and duration of economic recessions; unforeseen technical or operating difficulties; and other factors discussed here, in Item 1A. Risk Factors in our Form 10-K for the year ended December 31, 2022 and under the heading Factors Affecting Future Results on the Investors page of our website at www.exxonmobil.com under the heading News & Resources. The forward-looking statements and dates used in this presentation are based on management’s good faith plans and objectives as of the date of this presentation, unless otherwise stated. We assume no duty to update these statements as of any future date and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of these figures as of any future date. Any future update of these figures will be provided only through a public disclosure indicating that fact. This presentation includes a number of third-party scenarios such as the IPCC 74 Lower 2°C scenarios, made available through the IPCC SR 1.5 scenario explorer data, and the International Energy Agency’s (IEA) Net Zero Emissions by 2050 Scenario. These third-party scenarios reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use and inclusion herein is not an endorsement by ExxonMobil of their likelihood or probability. The analysis done by ExxonMobil on the IPCC Lower 2°C scenarios and the IEA NZE 2050 scenario and the representation thereof aims to reflect the average or trends across a wide range of pathways. Where data was not or insufficiently available, we conducted further analysis to enable a more granular view on trends within these scenarios. Actions needed to advance the Company’s 2030 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which we update annually. The reference case for planning beyond 2030 is based on the Company’s Energy Outlook research and publication, which contains the Company’s demand and supply projection based on its assessment of current trends in technology, government policies, consumer preferences, geopolitics, and economic development. Reflective of the existing global policy environment, the Energy Outlook does not project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the Outlook, and the Company’s business plans will be updated accordingly. ExxonMobil reported emissions, including reductions and avoidance performance data, are based on a combination of measured and estimated data using reasonable efforts and collection methods. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. The uncertainty associated with the emissions, reductions and avoidance performance data depends on variation in the processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Changes to the performance data may be reported as updated data and/or emission methodologies become available. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and methodologies, including measurements and estimates. 2 EXXONMOBIL

LAW (D. Kern) TO BE UPDATED Table of contents 04 2022 highlights 05 Create sustainable solutions that improve quality of life and meet society’s evolving needs 06 Supporting a lower-emissions future for society 07 Uniquely positioned to meet the world’s energy needs and reduce emissions 08 Positioning for a lower-emissions future 09 Resilient through the energy transition; IEA NZE scenario analysis 10 High-performance plastics and advanced recycling 11 Constructive policy critical for lower emissions 12 Political contributions and lobbying 13 Independent and diverse board 14 Executive compensation 15 Investing in people 16 2022 accomplishments 17 2022 industry-leading financial results 18 Response to 2022 passing shareholder proposal on scenario analysis 19-24 2023 proxy items 25 Climate Action 100+ Net Zero Company Benchmark 27-33 Supplemental information 3

2022 highlights 2022 financial performance It’s an “and” equation: meeting the world’s needs and reducing emissions & o $56 billion in earnings Upstream production growth despite significant divestments and o 87% total shareholder return 25 Koebd Sakhalin-1 expropriation in Russia o 25% return on capital employed Production growth in Guyana and Permian Basin >30 % o $77 billion of cash flow from operations 1 o $7 billion in structural cost savings Baton Rouge polypropylene unit started up in 4Q22 450 Kta o $30 billion of shareholder distributions, including $15 billion of dividends U.S. refining capacity expansion mechanically completed; o 40 consecutive years of annual growth in dividend 250 Kbd largest U.S. addition since 2012 GHG emission-reduction plans 6 Elimination of routine flaring in Permian Basin operations 100 % o Net-zero ambition by 2050 is backed by a comprehensive approach centered on detailed emission-reduction roadmaps for our major operated 7 Reduction in methane intensity since 2016 2 assets, which were completed in 2022 . >50 % 3 o Continued progress toward our 2030 emission-reduction plans consistent Metric tons of third-party CO per year expected to be captured 2 4 with Paris Agreement pathways 8 2 million and permanently stored in Louisiana by 2025 o Continued progress toward our plans for net-zero emissions in our Permian Pounds of annual advanced recycling capacity started up in 5 Basin unconventional operations by 2030 Baytown, Texas 80 million o Plans to invest approximately $17 billion on lower-emission investments from 2022 through 2027 4 See Supplemental Information for footnotes and definitions See the Investor Relations website for more information on our Quarterly Earnings

Create sustainable solutions that improve quality of life and meet society’s evolving needs Strategic priorities Leading performance Industry leader in operating and financial performance Essential partner Value through win-win solutions for our customers, partners, and broader stakeholders Advantaged portfolio Portfolio of assets and products outperform competition and grow value in a lower-emissions future New products, technologies, and approaches to accelerate large-scale deployment of solutions Innovative solutions essential to modern life and lower emissions Diverse and engaged organization with unrivaled opportunities for personal and Meaningful development professional growth 5

Supporting a lower-emissions future for society 1 3 2030 Emission-reduction plans Emission-reduction roadmaps o 20-30% reduction in corporate-wide GHG intensity o Roadmaps for major operated assets were completed in 2022; we’ll update them as needed to reflect technology, market, policy and other developments. o 40-50% reduction in upstream GHG intensity o These roadmaps provide investment options for over 800 potential projects. o 70-80% reduction in corporate-wide methane intensity o In the absence of market incentives to initiate and support these opportunities, we o 60-70% reduction in corporate-wide flaring intensity advocate for clear and consistent government policies. 2 1 o Net-zero GHG emissions in our Permian Basin unconventional operations o Potential GHG abatement options supporting 2030 emission-reduction plans include: o Energy efficiency o Flare and methane minimization 2 2050 Net-zero ambition o Operations / reconfigurations o With advances in technology and the support of clear and consistent government policies, we aim to achieve net-zero operated Scope 1 and 2 GHG emissions by 2050. o Electrification, renewable power purchase agreements, and high-quality offsets o CCS, hydrogen, and/or future technology advancements o One example of our roadmap approach is our Permian Basin unconventional operations, where we announced industry-leading plans to reach net-zero Scope 1 and 2 emissions by 2030. 6 See Supplemental Information for footnotes and definitions See the Advancing Climate Solutions 2023 Progress Report (‘23 ACS) for more information

Uniquely positioned to meet the world’s energy needs and reduce emissions Life cycle approach (LCA) Helping customers reduce their emissions o To evaluate impact on society’s overall GHG emissions, it is critical to consider: o Innovative solutions to improve modern life 6 o Society’s evolving needs o Plastic packaging has 54% lower life-cycle GHG emissions impact vs. alternatives TM 7 o Available alternatives o Exceed XP enables up to 30% thinner plastic packaging vs. conventional plastics 8 o Emissions created or avoided throughout the full value chain o Certified circular polymers with equivalent performance of virgin plastics o Utilizing a life-cycle approach (LCA) and applying it to ExxonMobil’s business plans through 2030, we expect a 6% reduction in full life-cycle emissions intensity, the o Total vehicle product solutions to improve transportation efficiency result of which is expected to be an estimated 18% reduction in full life-cycle 1 absolute emissions (vs. 2016) . 9 o Plastics enable lighter vehicles, 6-8% fuel efficiency per 10% reduction in weight 10 Potential GHG benefits of ExxonMobil products o Mobil 1 ESP X2 0W-20 engine oil helps improve fuel economy by up to 4% 11 o Renewable diesel can reduce GHG emissions by up to 70% vs. conventional diesel o 120 MTA of GHG emissions avoided if all of ExxonMobil’s projected 2030 LNG 2 supply to the market substitutes unabated coal in power generation . TM o Marine bio fuel, BMF.5 , can reduce GHG emissions by up to 30% vs. conventional 12 marine fuel o 25 MTA of GHG emissions avoided if all of ExxonMobil’s projected 2030 renewable 3 fuel production displaces conventional fuel refined from crude oil . o 13 MTA of life-cycle GHG emissions avoided if all of ExxonMobil’s projected 2030 o Reliable solutions for industrial efficiency 4 volumes into U.S. plastic packaging displaces alternatives . 13 o Mobil DTE 10 Excel Series improves hydraulic pump efficiency by up to 6% o 4 MTA of GHG emissions avoided if all of ExxonMobil Baytown’s expected 2030 5 TM 14 blue hydrogen production displaces natural gas use in industrial applications . o Mobil SHC 600 Series provides up to 3.6% energy efficiency gain TM 15 o Mobil SHC Gear WT helps reduce oil consumption and maintenance costs 7 See Supplemental Information for footnotes and definitions See the Advancing Climate Solutions 2023 Progress Report (‘23 ACS) for more information

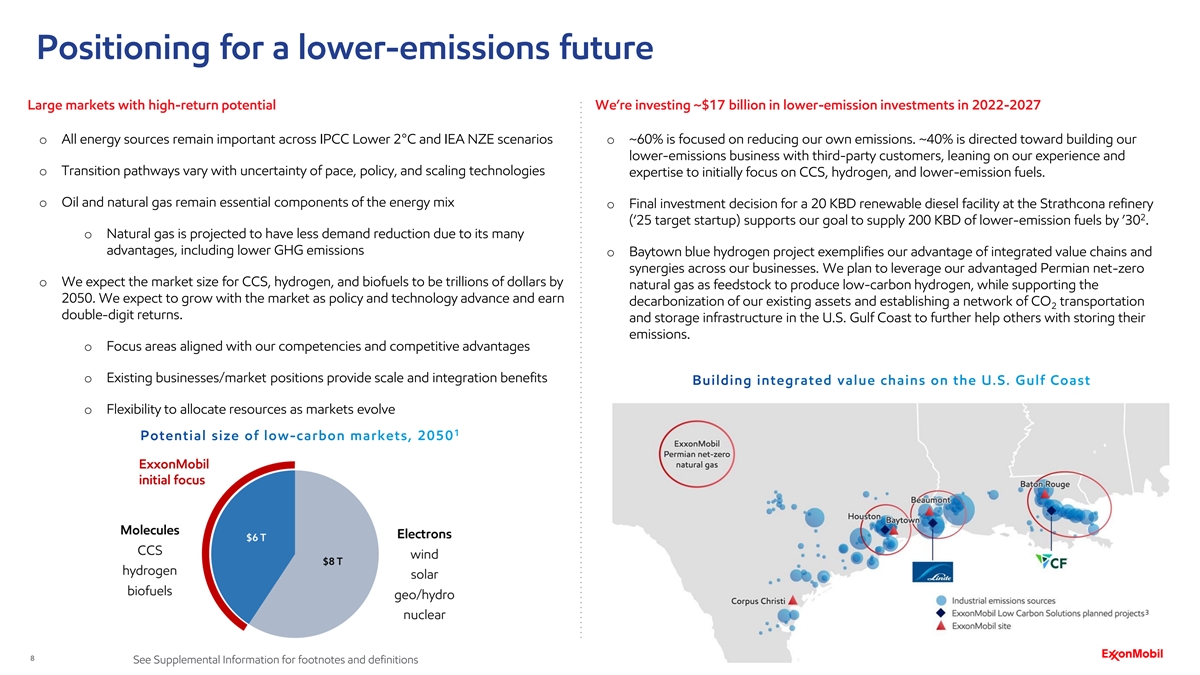

Positioning for a lower-emissions future Large markets with high-return potential We’re investing ~$17 billion in lower-emission investments in 2022-2027 o All energy sources remain important across IPCC Lower 2°C and IEA NZE scenarios o ~60% is focused on reducing our own emissions. ~40% is directed toward building our lower-emissions business with third-party customers, leaning on our experience and o Transition pathways vary with uncertainty of pace, policy, and scaling technologies expertise to initially focus on CCS, hydrogen, and lower-emission fuels. o Oil and natural gas remain essential components of the energy mix o Final investment decision for a 20 KBD renewable diesel facility at the Strathcona refinery 2 (‘25 target startup) supports our goal to supply 200 KBD of lower-emission fuels by ’30 . o Natural gas is projected to have less demand reduction due to its many advantages, including lower GHG emissions o Baytown blue hydrogen project exemplifies our advantage of integrated value chains and synergies across our businesses. We plan to leverage our advantaged Permian net-zero o We expect the market size for CCS, hydrogen, and biofuels to be trillions of dollars by natural gas as feedstock to produce low-carbon hydrogen, while supporting the 2050. We expect to grow with the market as policy and technology advance and earn decarbonization of our existing assets and establishing a network of CO transportation 2 double-digit returns. and storage infrastructure in the U.S. Gulf Coast to further help others with storing their emissions. o Focus areas aligned with our competencies and competitive advantages o Existing businesses/market positions provide scale and integration benefits o Flexibility to allocate resources as markets evolve 3 8 See Supplemental Information for footnotes and definitions

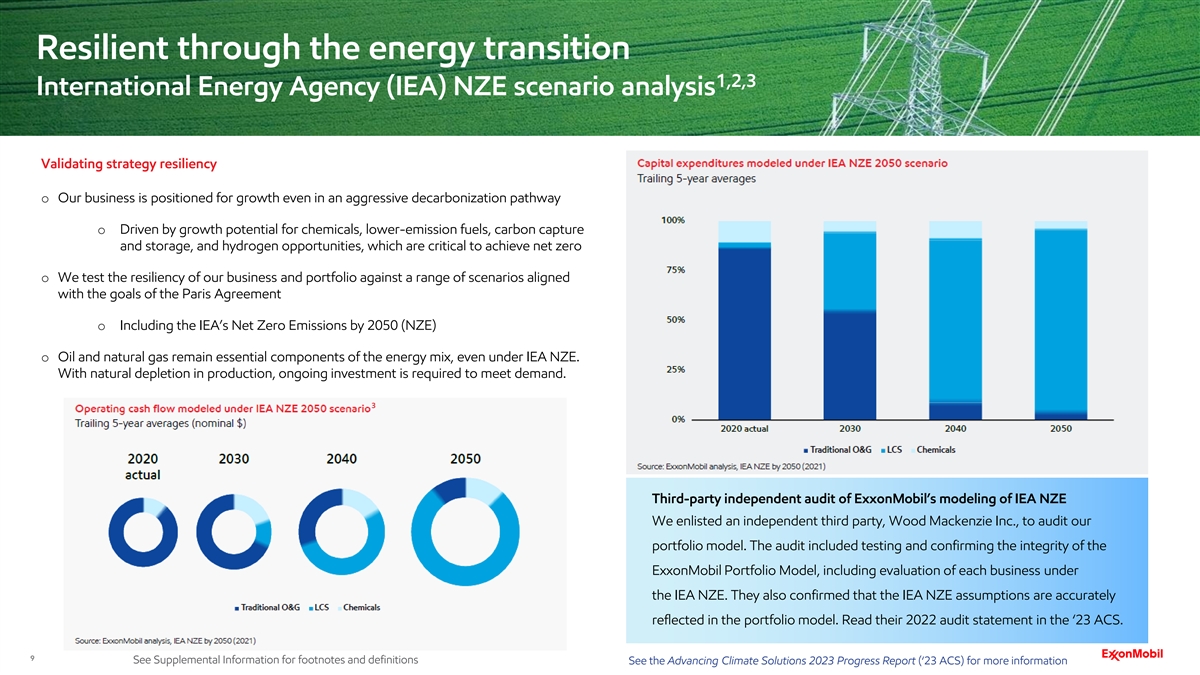

Resilient through the energy transition 1,2,3 International Energy Agency (IEA) NZE scenario analysis Validating strategy resiliency o Our business is positioned for growth even in an aggressive decarbonization pathway o Driven by growth potential for chemicals, lower-emission fuels, carbon capture and storage, and hydrogen opportunities, which are critical to achieve net zero o We test the resiliency of our business and portfolio against a range of scenarios aligned with the goals of the Paris Agreement o Including the IEA’s Net Zero Emissions by 2050 (NZE) o Oil and natural gas remain essential components of the energy mix, even under IEA NZE. With natural depletion in production, ongoing investment is required to meet demand. 3 Third-party independent audit of ExxonMobil’s modeling of IEA NZE We enlisted an independent third party, Wood Mackenzie Inc., to audit our portfolio model. The audit included testing and confirming the integrity of the ExxonMobil Portfolio Model, including evaluation of each business under the IEA NZE. They also confirmed that the IEA NZE assumptions are accurately reflected in the portfolio model. Read their 2022 audit statement in the ‘23 ACS. 9 See Supplemental Information for footnotes and definitions See the Advancing Climate Solutions 2023 Progress Report (‘23 ACS) for more information

High-performance plastics and advanced recycling Addressing plastic waste Plastic waste advanced recycling plans o Founding member of the Houston Recycling Collaboration to increase o Plan to build ~1 billion pounds of annual advanced recycling capacity globally by year- access to plastic recycling end 2026 o Founding member of the Alliance to End Plastic Waste, helping address o Every ton of waste plastic processed using our technology results in at least 19% 6 plastic waste in the environment lower GHG emissions vs. processing the same amount of crude-based feedstocks o Offering innovative products that enable downgauging and increased o Started up Baytown advanced recycling facility with a capacity to process 80 million recycling (i.e., using less plastic for the same function) pounds per year of plastic waste - one of the largest facilities in North America. In TM 2022, we processed >10 million pounds of plastic waste with our Exxtend technology Plastics enable modern life o Announced first commercial sale of certified circular polymers in February 2022 o Superior performance and sustainability benefits such as lifecycle GHG 1 benefits versus alternative materials o Assessing future deployment of our technology at our sites in Belgium, the Netherlands, Canada, and the United States 2 o Provide for life-enhancing products used in our daily lives in support of good health, food preservation, and clean drinking water o Collaborating with third parties on advanced recycling opportunities in France, Malaysia, Indonesia, and Singapore o Enable new lower-emission technologies, including electric vehicles, solar panels, wind turbine blades, and high-performance building insulation Strategic collaborations o Plastic packaging has 54% lower life-cycle GHG emissions impact versus o Cyclyx, a joint venture with Agilyx, to develop solutions for sourcing large volumes of 3 alternatives as a group plastic waste to fill the missing link between waste companies and plastic recyclers o Even under the IEA NZE scenario, demand for chemicals grows 30% from o Operation Clean Sweep-Blue (OCS-Blue) member, encouraging industry use of best 4 2020 to 2050 – plastics make up approximately half of that volume practices to reduce plastic pellet loss in our own operations o If applied globally, our plastics could enable approximately 40 million o Collaborating with several value chain partners -- including Ten Cate Grass, Sealed 5 metric tons per year of avoided emissions Air, Ahold Delhaize, Berry Global and Amcor -- to demonstrate circularity at scale 10 See Supplemental Information for footnotes and definitions

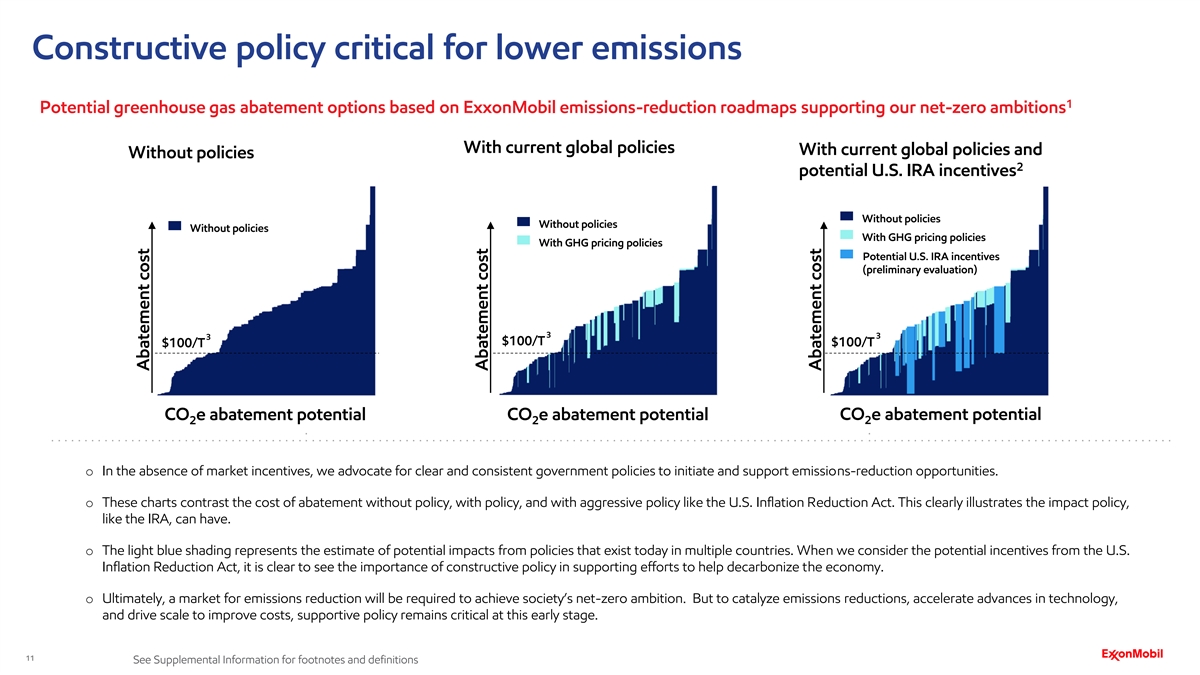

Constructive policy critical for lower emissions 1 Potential greenhouse gas abatement options based on ExxonMobil emissions-reduction roadmaps supporting our net-zero ambitions With current global policies With current global policies and Without policies 2 potential U.S. IRA incentives Without policies Without policies Without policies With GHG pricing policies With GHG pricing policies Potential U.S. IRA incentives (preliminary evaluation) 3 3 3 $100/T $100/T $100/T CO e abatement potential CO e abatement potential CO e abatement potential 2 2 2 o In the absence of market incentives, we advocate for clear and consistent government policies to initiate and support emissions-reduction opportunities. o These charts contrast the cost of abatement without policy, with policy, and with aggressive policy like the U.S. Inflation Reduction Act. This clearly illustrates the impact policy, like the IRA, can have. o The light blue shading represents the estimate of potential impacts from policies that exist today in multiple countries. When we consider the potential incentives from the U.S. Inflation Reduction Act, it is clear to see the importance of constructive policy in supporting efforts to help decarbonize the economy. o Ultimately, a market for emissions reduction will be required to achieve society’s net-zero ambition. But to catalyze emissions reductions, accelerate advances in technology, and drive scale to improve costs, supportive policy remains critical at this early stage. 11 See Supplemental Information for footnotes and definitions Abatement cost Abatement cost Abatement cost

Political contributions and lobbying Lobbying and advocacy Climate lobbying o We engage in lobbying in the United States at the federal and state levels to o Recognizing that sound government policies are required and can act as an accelerator for advocate our positions on issues that affect our Corporation and the energy lower-emission alternatives, ExxonMobil actively participates in climate-related policy industry. discussions around the world. o Each year, the Company’s political contributions, lobbying activities, and lobbying o Our policy principles and associated lobbying are consistent with helping society achieve its expenditures are reviewed by the Board. ambition for a net-zero future. o ExxonMobil’s 2021 Lobbying Report provides additional detail of our direct and o Our 2021 Report on Climate Lobbying provides a global assessment of our climate lobbying indirect lobbying activities at the federal, state and local level, as well as our activities. grassroots lobbying communications. Political contributions Lobbying and political engagement stewardship Lobbying and political engagement are included as part of the Board’s stewardship of the o The Board authorizes the Company to make political contributions in the United States and Canada, and annually reviews those contributions. Company’s enterprise-risk framework. Each year, the Vice President for Public and Government Affairs presents the Company’s political contributions, lobbying activities and o The Company’s support of candidates and political organizations reflects corporate interests and not those of any individual employee, officer, or director. lobbying expenditures to the full Board, along with the Board’s Environment, Safety and Public Policy Committee, which is comprised entirely of independent directors. The o View our 2022 corporate political contributions on the ExxonMobil website. directors review the efforts and associated expenditures. In addition, in-depth reviews of the Company’s priority issues are conducted by the Management Committee several times a year as part of the process. 12 See the 2021 Lobbying Report and the 2021 Climate Lobbying Report for more information

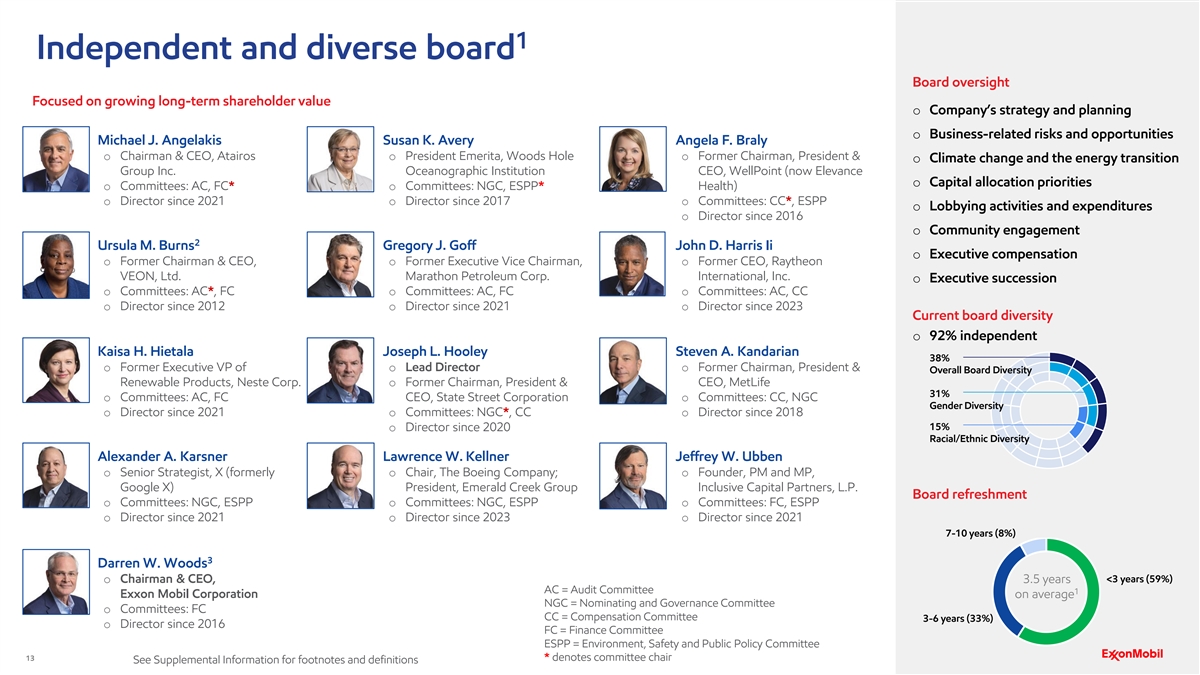

1 Independent and diverse board Board oversight Focused on growing long-term shareholder value o Company’s strategy and planning o Business-related risks and opportunities Michael J. Angelakis Susan K. Avery Angela F. Braly o Chairman & CEO, Atairos o President Emerita, Woods Hole o Former Chairman, President & o Climate change and the energy transition Group Inc. Oceanographic Institution CEO, WellPoint (now Elevance o Capital allocation priorities o Committees: AC, FC* o Committees: NGC, ESPP* Health) o Director since 2021 o Director since 2017 o Committees: CC*, ESPP o Lobbying activities and expenditures o Director since 2016 o Community engagement 2 Ursula M. Burns Gregory J. Goff John D. Harris Ii o Executive compensation o Former Chairman & CEO, o Former Executive Vice Chairman, o Former CEO, Raytheon VEON, Ltd. Marathon Petroleum Corp. International, Inc. o Executive succession o Committees: AC*, FC o Committees: AC, FC o Committees: AC, CC o Director since 2012 o Director since 2021 o Director since 2023 Current board diversity o 92% independent Kaisa H. Hietala Joseph L. Hooley Steven A. Kandarian 38% o Former Executive VP of o Lead Director o Former Chairman, President & Overall Board Diversity Renewable Products, Neste Corp. o Former Chairman, President & CEO, MetLife 31% o Committees: AC, FC CEO, State Street Corporation o Committees: CC, NGC Gender Diversity o Director since 2021 o Committees: NGC*, CC o Director since 2018 15% o Director since 2020 Racial/Ethnic Diversity Alexander A. Karsner Lawrence W. Kellner Jeffrey W. Ubben o Senior Strategist, X (formerly o Chair, The Boeing Company; o Founder, PM and MP, Google X) President, Emerald Creek Group Inclusive Capital Partners, L.P. Board refreshment o Committees: NGC, ESPP o Committees: NGC, ESPP o Committees: FC, ESPP o Director since 2021 o Director since 2023 o Director since 2021 7-10 years (8%) 3 Darren W. Woods o Chairman & CEO, <3 years (59%) 3.5 years AC = Audit Committee 1 Exxon Mobil Corporation on average NGC = Nominating and Governance Committee o Committees: FC CC = Compensation Committee 3-6 years (33%) o Director since 2016 FC = Finance Committee ESPP = Environment, Safety and Public Policy Committee 13 * denotes committee chair See Supplemental Information for footnotes and definitions

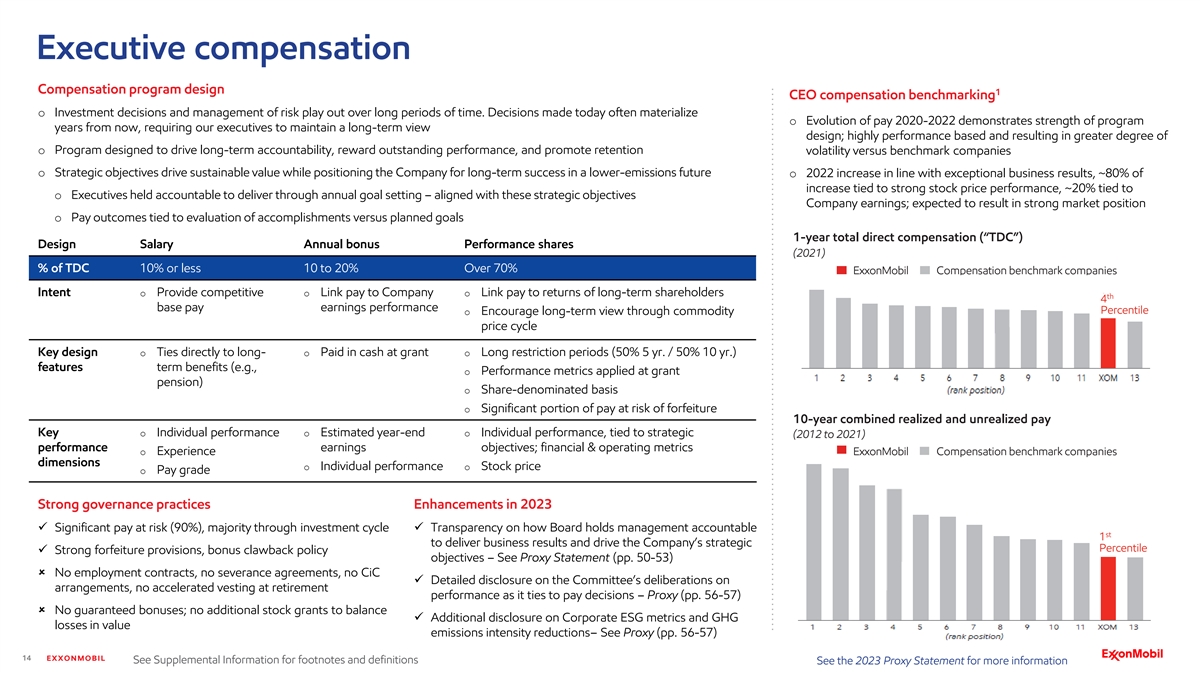

Executive compensation Compensation program design 1 CEO compensation benchmarking o Investment decisions and management of risk play out over long periods of time. Decisions made today often materialize o Evolution of pay 2020-2022 demonstrates strength of program years from now, requiring our executives to maintain a long-term view design; highly performance based and resulting in greater degree of o Program designed to drive long-term accountability, reward outstanding performance, and promote retention volatility versus benchmark companies o Strategic objectives drive sustainable value while positioning the Company for long-term success in a lower-emissions future o 2022 increase in line with exceptional business results, ~80% of increase tied to strong stock price performance, ~20% tied to o Executives held accountable to deliver through annual goal setting – aligned with these strategic objectives Company earnings; expected to result in strong market position o Pay outcomes tied to evaluation of accomplishments versus planned goals 1-year total direct compensation (“TDC”) Design Salary Annual bonus Performance shares (2021) % of TDC 10% or less 10 to 20% Over 70% ExxonMobil Compensation benchmark companies Intent o Provide competitive o Link pay to Company o Link pay to returns of long-term shareholders th 4 base pay earnings performance Percentile o Encourage long-term view through commodity price cycle Key design o Ties directly to long- o Paid in cash at grant o Long restriction periods (50% 5 yr. / 50% 10 yr.) features term benefits (e.g., o Performance metrics applied at grant pension) o Share-denominated basis o Significant portion of pay at risk of forfeiture 10-year combined realized and unrealized pay Key o Individual performance o Estimated year-end o Individual performance, tied to strategic (2012 to 2021) performance earnings objectives; financial & operating metrics o Experience ExxonMobil Compensation benchmark companies dimensions o Individual performance o Stock price o Pay grade Strong governance practices Enhancements in 2023 ✓ Significant pay at risk (90%), majority through investment cycle✓ Transparency on how Board holds management accountable st 1 to deliver business results and drive the Company’s strategic Percentile ✓ Strong forfeiture provisions, bonus clawback policy objectives – See Proxy Statement (pp. 50-53) û No employment contracts, no severance agreements, no CiC ✓ Detailed disclosure on the Committee’s deliberations on arrangements, no accelerated vesting at retirement performance as it ties to pay decisions – Proxy (pp. 56-57) û No guaranteed bonuses; no additional stock grants to balance ✓ Additional disclosure on Corporate ESG metrics and GHG losses in value emissions intensity reductions– See Proxy (pp. 56-57) 14 EXXONMOBIL See Supplemental Information for footnotes and definitions See the 2023 Proxy Statement for more information

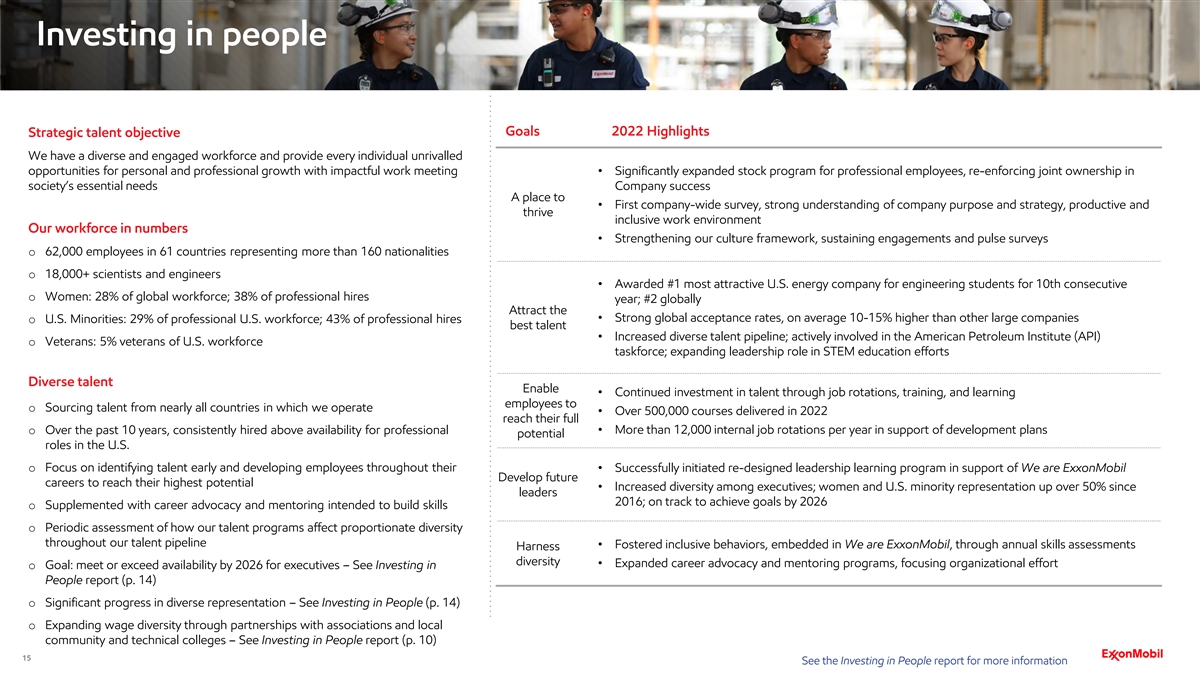

Investing in people Goals 2022 Highlights Strategic talent objective We have a diverse and engaged workforce and provide every individual unrivalled opportunities for personal and professional growth with impactful work meeting • Significantly expanded stock program for professional employees, re-enforcing joint ownership in society’s essential needs Company success A place to • First company-wide survey, strong understanding of company purpose and strategy, productive and thrive inclusive work environment Our workforce in numbers • Strengthening our culture framework, sustaining engagements and pulse surveys o 62,000 employees in 61 countries representing more than 160 nationalities o 18,000+ scientists and engineers • Awarded #1 most attractive U.S. energy company for engineering students for 10th consecutive o Women: 28% of global workforce; 38% of professional hires year; #2 globally Attract the • Strong global acceptance rates, on average 10-15% higher than other large companies o U.S. Minorities: 29% of professional U.S. workforce; 43% of professional hires best talent • Increased diverse talent pipeline; actively involved in the American Petroleum Institute (API) o Veterans: 5% veterans of U.S. workforce taskforce; expanding leadership role in STEM education efforts Diverse talent Enable • Continued investment in talent through job rotations, training, and learning employees to o Sourcing talent from nearly all countries in which we operate • Over 500,000 courses delivered in 2022 reach their full o Over the past 10 years, consistently hired above availability for professional • More than 12,000 internal job rotations per year in support of development plans potential roles in the U.S. o Focus on identifying talent early and developing employees throughout their • Successfully initiated re-designed leadership learning program in support of We are ExxonMobil Develop future careers to reach their highest potential • Increased diversity among executives; women and U.S. minority representation up over 50% since leaders 2016; on track to achieve goals by 2026 o Supplemented with career advocacy and mentoring intended to build skills o Periodic assessment of how our talent programs affect proportionate diversity throughout our talent pipeline • Fostered inclusive behaviors, embedded in We are ExxonMobil, through annual skills assessments Harness diversity • Expanded career advocacy and mentoring programs, focusing organizational effort o Goal: meet or exceed availability by 2026 for executives – See Investing in People report (p. 14) o Significant progress in diverse representation – See Investing in People (p. 14) o Expanding wage diversity through partnerships with associations and local community and technical colleges – See Investing in People report (p. 10) 15 See the Investing in People report for more information

2022 accomplishments Execution of our strategy drove strong results Leading performance | Essential partner | Advantaged portfolio | Innovative solutions | Meaningful development 1 • Industry-leading 2022 financial performance driven by strong operating results • Grew production to meet global needs for energy and products • Formed Product Solutions, creating the world’s largest fuels, chemicals, and lubricants business • Expanded Low Carbon Solutions opportunities; signed ground-breaking CCS agreements • Enhanced portfolio, investing $22.7 billion of Capex in advantaged projects and selling ~$5 billion of non-core assets • Further enhanced disclosures and increased transparency, including content regarding our IEA NZE scenario analysis published in response to investor input. See 2023 Proxy Statement (pp. 29-31) for full details regarding our response to the 2022 shareholder vote. 16 See Supplemental Information for footnotes and definitions See the Investor Relations website for more information on our Quarterly Earnings

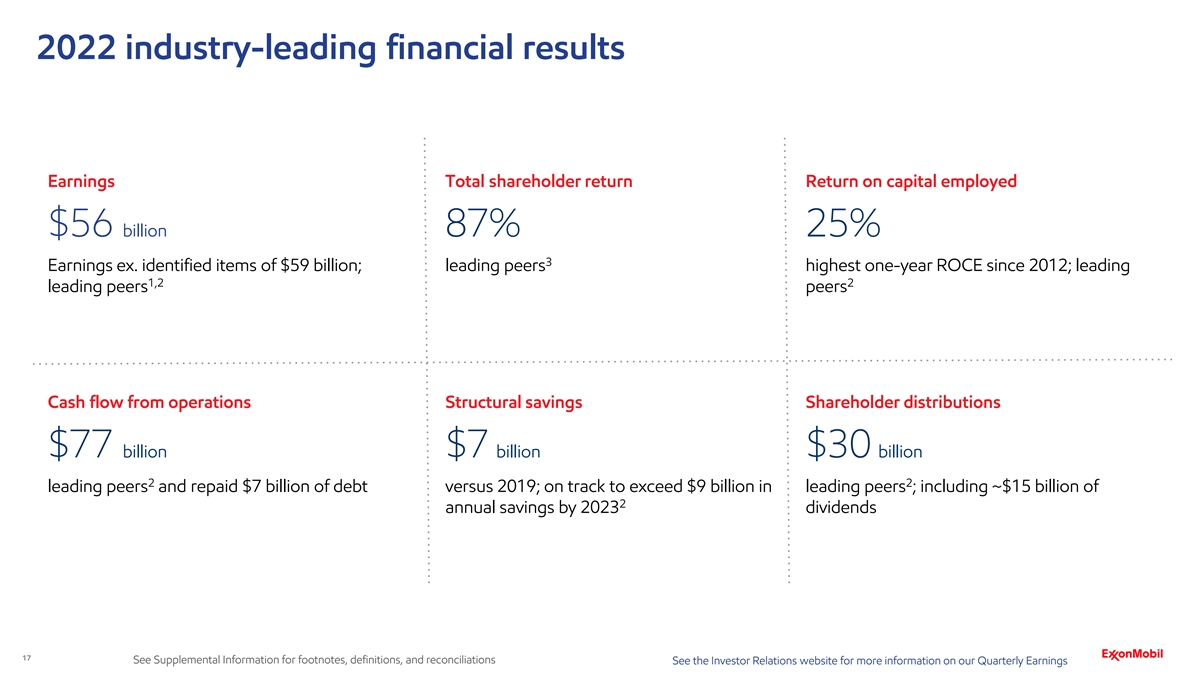

2022 industry-leading financial results Earnings Total shareholder return Return on capital employed $56 billion 87% 25% 3 Earnings ex. identified items of $59 billion; leading peers highest one-year ROCE since 2012; leading 1,2 2 leading peers peers Cash flow from operations Structural savings Shareholder distributions $77 billion $7 billion $30 billion 2 2 leading peers and repaid $7 billion of debt versus 2019; on track to exceed $9 billion in leading peers ; including ~$15 billion of 2 annual savings by 2023 dividends 17 See Supplemental Information for footnotes, definitions, and reconciliations See the Investor Relations website for more information on our Quarterly Earnings

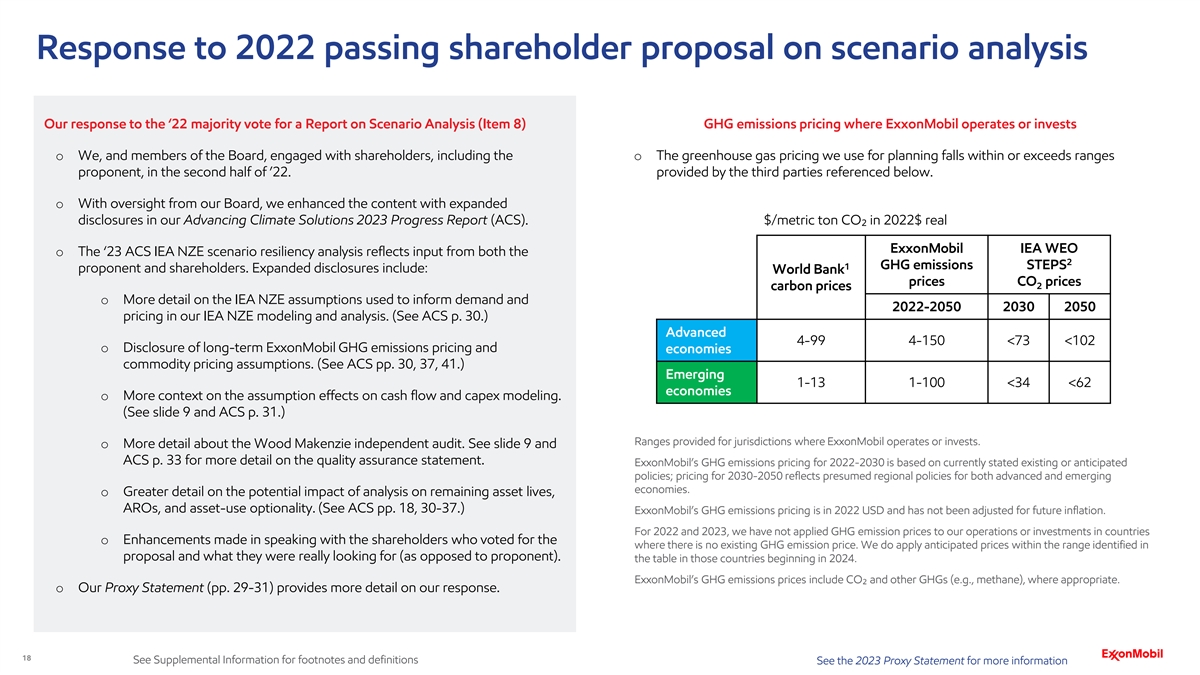

Response to 2022 passing shareholder proposal on scenario analysis Our response to the ‘22 majority vote for a Report on Scenario Analysis (Item 8) GHG emissions pricing where ExxonMobil operates or invests o We, and members of the Board, engaged with shareholders, including the o The greenhouse gas pricing we use for planning falls within or exceeds ranges proponent, in the second half of ’22. provided by the third parties referenced below. o With oversight from our Board, we enhanced the content with expanded disclosures in our Advancing Climate Solutions 2023 Progress Report (ACS). $/metric ton CO₂ in 2022$ real ExxonMobil IEA WEO o The ‘23 ACS IEA NZE scenario resiliency analysis reflects input from both the 2 1 GHG emissions STEPS proponent and shareholders. Expanded disclosures include: World Bank prices CO prices 2 carbon prices o More detail on the IEA NZE assumptions used to inform demand and 2022-2050 2030 2050 pricing in our IEA NZE modeling and analysis. (See ACS p. 30.) Advanced 4-99 4-150 <73 <102 o Disclosure of long-term ExxonMobil GHG emissions pricing and economies commodity pricing assumptions. (See ACS pp. 30, 37, 41.) Emerging 1-13 1-100 <34 <62 economies o More context on the assumption effects on cash flow and capex modeling. (See slide 9 and ACS p. 31.) Ranges provided for jurisdictions where ExxonMobil operates or invests. o More detail about the Wood Makenzie independent audit. See slide 9 and ACS p. 33 for more detail on the quality assurance statement. ExxonMobil’s GHG emissions pricing for 2022-2030 is based on currently stated existing or anticipated policies; pricing for 2030-2050 reflects presumed regional policies for both advanced and emerging economies. o Greater detail on the potential impact of analysis on remaining asset lives, AROs, and asset-use optionality. (See ACS pp. 18, 30-37.) ExxonMobil’s GHG emissions pricing is in 2022 USD and has not been adjusted for future inflation. For 2022 and 2023, we have not applied GHG emission prices to our operations or investments in countries o Enhancements made in speaking with the shareholders who voted for the where there is no existing GHG emission price. We do apply anticipated prices within the range identified in proposal and what they were really looking for (as opposed to proponent). the table in those countries beginning in 2024. ExxonMobil’s GHG emissions prices include CO₂ and other GHGs (e.g., methane), where appropriate. o Our Proxy Statement (pp. 29-31) provides more detail on our response. 18 See Supplemental Information for footnotes and definitions See the 2023 Proxy Statement for more information

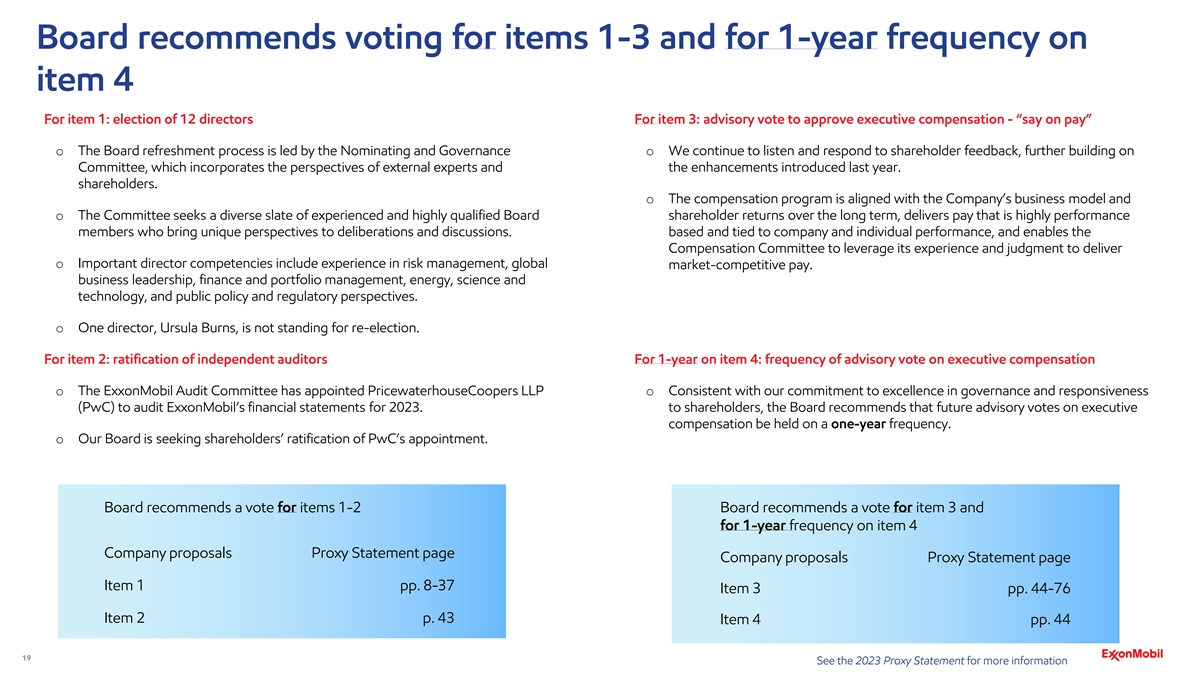

Board recommends voting for items 1-3 and for 1-year frequency on item 4 For item 1: election of 12 directors For item 3: advisory vote to approve executive compensation - “say on pay” o The Board refreshment process is led by the Nominating and Governance o We continue to listen and respond to shareholder feedback, further building on Committee, which incorporates the perspectives of external experts and the enhancements introduced last year. shareholders. o The compensation program is aligned with the Company’s business model and o The Committee seeks a diverse slate of experienced and highly qualified Board shareholder returns over the long term, delivers pay that is highly performance members who bring unique perspectives to deliberations and discussions. based and tied to company and individual performance, and enables the Compensation Committee to leverage its experience and judgment to deliver o Important director competencies include experience in risk management, global market-competitive pay. business leadership, finance and portfolio management, energy, science and technology, and public policy and regulatory perspectives. o One director, Ursula Burns, is not standing for re-election. For item 2: ratification of independent auditors For 1-year on item 4: frequency of advisory vote on executive compensation o The ExxonMobil Audit Committee has appointed PricewaterhouseCoopers LLP o Consistent with our commitment to excellence in governance and responsiveness (PwC) to audit ExxonMobil’s financial statements for 2023. to shareholders, the Board recommends that future advisory votes on executive compensation be held on a one-year frequency. o Our Board is seeking shareholders’ ratification of PwC’s appointment. Board recommends a vote for items 1-2 Board recommends a vote for item 3 and for 1-year frequency on item 4 Company proposals Proxy Statement page Company proposals Proxy Statement page Item 1 pp. 8-37 Item 3 pp. 44-76 Item 2 p. 43 Item 4 pp. 44 19 See the 2023 Proxy Statement for more information

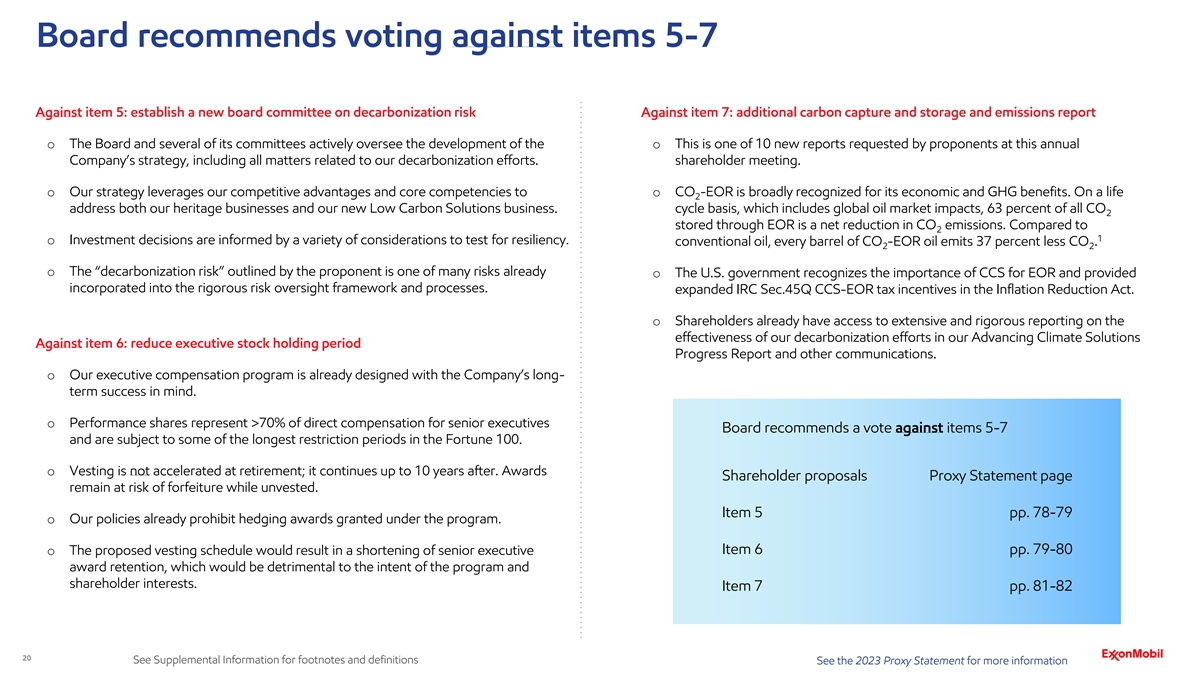

Board recommends voting against items 5-7 Against item 5: establish a new board committee on decarbonization risk Against item 7: additional carbon capture and storage and emissions report o The Board and several of its committees actively oversee the development of the o This is one of 10 new reports requested by proponents at this annual Company’s strategy, including all matters related to our decarbonization efforts. shareholder meeting. o Our strategy leverages our competitive advantages and core competencies to o CO -EOR is broadly recognized for its economic and GHG benefits. On a life 2 address both our heritage businesses and our new Low Carbon Solutions business. cycle basis, which includes global oil market impacts, 63 percent of all CO 2 stored through EOR is a net reduction in CO emissions. Compared to 2 1 o Investment decisions are informed by a variety of considerations to test for resiliency. conventional oil, every barrel of CO -EOR oil emits 37 percent less CO . 2 2 o The “decarbonization risk” outlined by the proponent is one of many risks already o The U.S. government recognizes the importance of CCS for EOR and provided incorporated into the rigorous risk oversight framework and processes. expanded IRC Sec.45Q CCS-EOR tax incentives in the Inflation Reduction Act. o Shareholders already have access to extensive and rigorous reporting on the effectiveness of our decarbonization efforts in our Advancing Climate Solutions Against item 6: reduce executive stock holding period Progress Report and other communications. o Our executive compensation program is already designed with the Company’s long- term success in mind. o Performance shares represent >70% of direct compensation for senior executives Board recommends a vote against items 5-7 and are subject to some of the longest restriction periods in the Fortune 100. o Vesting is not accelerated at retirement; it continues up to 10 years after. Awards Shareholder proposals Proxy Statement page remain at risk of forfeiture while unvested. Item 5 pp. 78-79 o Our policies already prohibit hedging awards granted under the program. Item 6 pp. 79-80 o The proposed vesting schedule would result in a shortening of senior executive award retention, which would be detrimental to the intent of the program and shareholder interests. Item 7 pp. 81-82 2 20 See Supplemental Information for footnotes and definitions See the 2023 Proxy Statement for more information

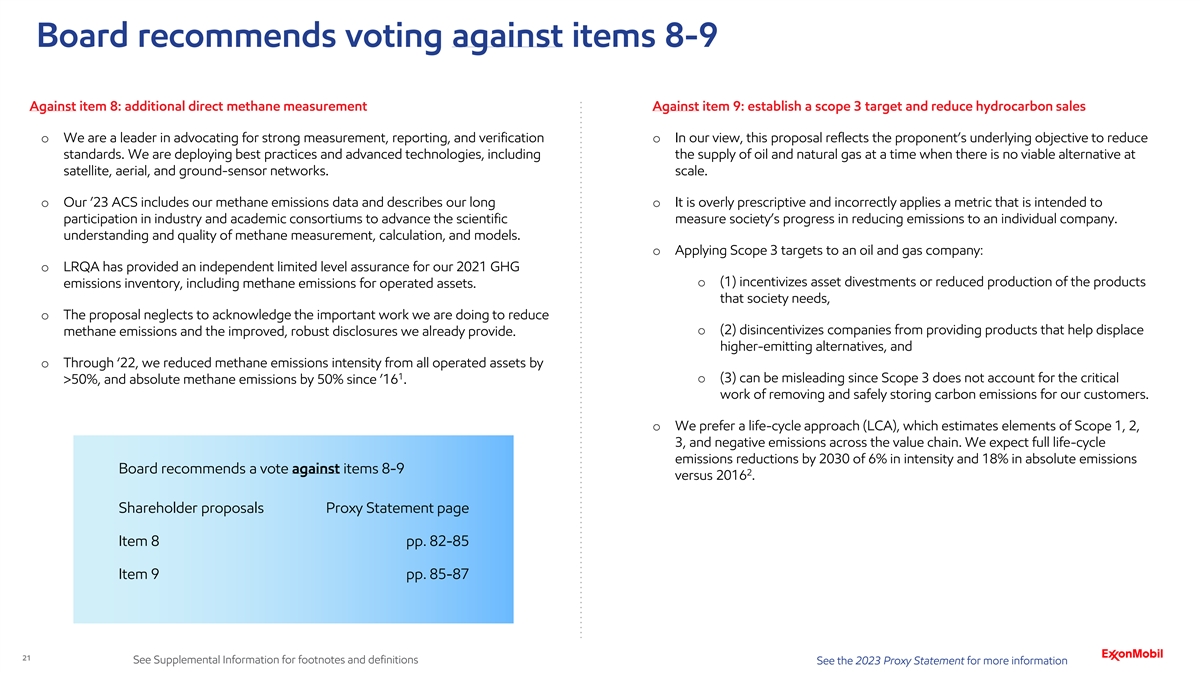

Board recommends voting against items 8-9 Against item 8: additional direct methane measurement Against item 9: establish a scope 3 target and reduce hydrocarbon sales o We are a leader in advocating for strong measurement, reporting, and verification o In our view, this proposal reflects the proponent’s underlying objective to reduce standards. We are deploying best practices and advanced technologies, including the supply of oil and natural gas at a time when there is no viable alternative at satellite, aerial, and ground-sensor networks. scale. o Our ’23 ACS includes our methane emissions data and describes our long o It is overly prescriptive and incorrectly applies a metric that is intended to participation in industry and academic consortiums to advance the scientific measure society’s progress in reducing emissions to an individual company. understanding and quality of methane measurement, calculation, and models. o Applying Scope 3 targets to an oil and gas company: o LRQA has provided an independent limited level assurance for our 2021 GHG o (1) incentivizes asset divestments or reduced production of the products emissions inventory, including methane emissions for operated assets. that society needs, o The proposal neglects to acknowledge the important work we are doing to reduce o (2) disincentivizes companies from providing products that help displace methane emissions and the improved, robust disclosures we already provide. higher-emitting alternatives, and o Through ‘22, we reduced methane emissions intensity from all operated assets by 1 o (3) can be misleading since Scope 3 does not account for the critical >50%, and absolute methane emissions by 50% since ’16 . work of removing and safely storing carbon emissions for our customers. o We prefer a life-cycle approach (LCA), which estimates elements of Scope 1, 2, 3, and negative emissions across the value chain. We expect full life-cycle emissions reductions by 2030 of 6% in intensity and 18% in absolute emissions Board recommends a vote against items 8-9 2 versus 2016 . Shareholder proposals Proxy Statement page Item 8 pp. 82-85 Item 9 pp. 85-87 21 See Supplemental Information for footnotes and definitions See the 2023 Proxy Statement for more information

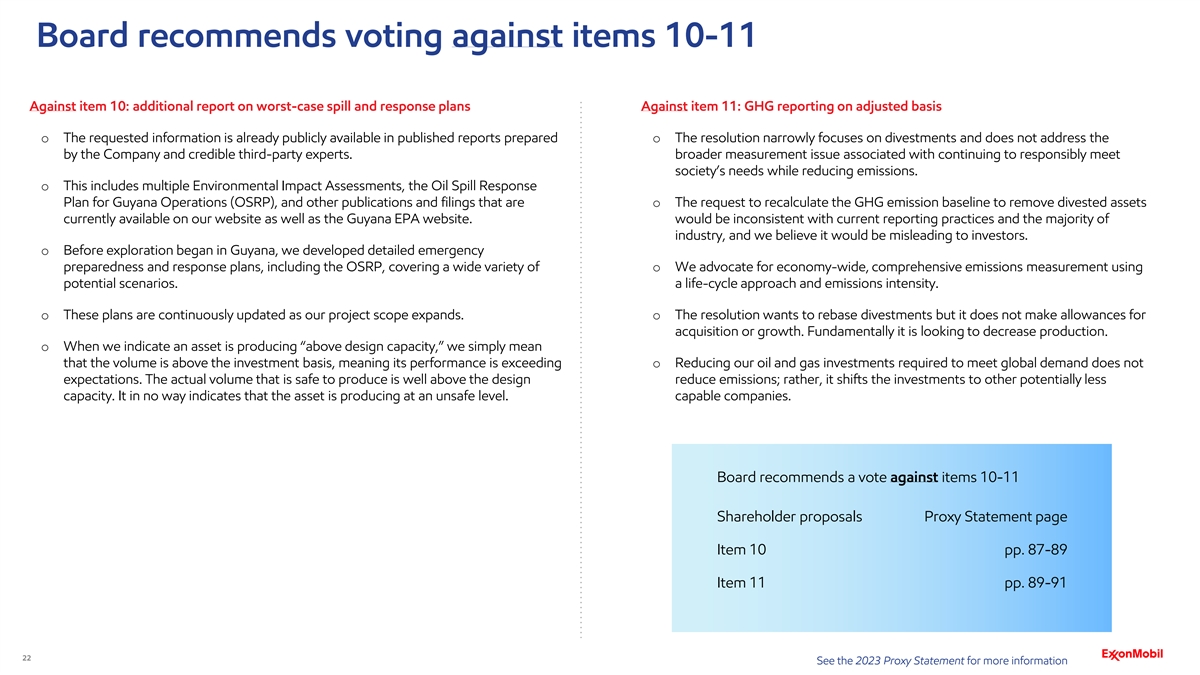

Board recommends voting against items 10-11 Against item 10: additional report on worst-case spill and response plans Against item 11: GHG reporting on adjusted basis o The requested information is already publicly available in published reports prepared o The resolution narrowly focuses on divestments and does not address the by the Company and credible third-party experts. broader measurement issue associated with continuing to responsibly meet society’s needs while reducing emissions. o This includes multiple Environmental Impact Assessments, the Oil Spill Response Plan for Guyana Operations (OSRP), and other publications and filings that are o The request to recalculate the GHG emission baseline to remove divested assets currently available on our website as well as the Guyana EPA website. would be inconsistent with current reporting practices and the majority of industry, and we believe it would be misleading to investors. o Before exploration began in Guyana, we developed detailed emergency preparedness and response plans, including the OSRP, covering a wide variety of o We advocate for economy-wide, comprehensive emissions measurement using potential scenarios. a life-cycle approach and emissions intensity. o These plans are continuously updated as our project scope expands. o The resolution wants to rebase divestments but it does not make allowances for acquisition or growth. Fundamentally it is looking to decrease production. o When we indicate an asset is producing “above design capacity,” we simply mean that the volume is above the investment basis, meaning its performance is exceeding o Reducing our oil and gas investments required to meet global demand does not expectations. The actual volume that is safe to produce is well above the design reduce emissions; rather, it shifts the investments to other potentially less capacity. It in no way indicates that the asset is producing at an unsafe level. capable companies. Board recommends a vote against items 10-11 Shareholder proposals Proxy Statement page Item 10 pp. 87-89 Item 11 pp. 89-91 22 See the 2023 Proxy Statement for more information

Board recommends voting against items 12-13 Against item 13: report on plastics under SCS scenario Against item 12: report on asset retirement obligations (AROs) under IEA NZE scenario o Through responsible manufacturing, advanced recycling solutions, and collaboration o The ‘23 ACS provides enhanced detail on the IEA NZE resiliency modeling in direct to increase plastic recycling, we are: response to shareholder feedback. See Proxy Statement (pp. 29-31) and slide 18. o Developing products that society can more easily recycle, o This analysis makes clear that our business model is resilient, and assets with a low o Expanding advanced recycling capacity that broadens the range of plastics that cost of supply would continue to attract capital and generate competitive returns can be recycled, under a multitude of scenarios, including the IEA NZE scenario. o Supporting improvements in plastic waste recovery, and o Minimizing plastic pellet loss from our operations. o The analysis also demonstrates we have flexibility to change the product mix in our o Proposed plastic bans are not expected to have a material impact on EM. Single-use integrated, petrochemical assets to extend their useful lives as the energy transition applications currently targeted by bans make up a small portion of total plastics. evolves. As demand for conventional road transport fuels declines, select assets can be repurposed to manufacture high-value products like chemicals, lubricants, and o The proposal is based on a very narrow, singular hypothetical scenario that we do not lower-emission fuels (e.g., Strathcona renewable diesel, Baytown blue hydrogen). view as a credible as it incorrectly assumes a plastic demand well below industry and even IEA NZE scenario projections. o The future value and flexibility of individual assets in our portfolio vary based on characteristics that respond differently to many variables. As a result, the lifespan of o We already publish our guidelines, measures, and practices to assess and mitigate risk many of our assets are indeterminate and, by design, provide greater optionality and factors related to plastics, and we include detailed information about plastic waste lend themselves to the possibility of other use. solutions in our Sustainability Report and ’23 ACS report. o >75% of our refining and chemical manufacturing capacity is co-located in large, o Creating another report does not provide decision-useful information to our integrated sites, providing flexibility to shift product yield to best meet society’s shareholders and comes at a cost to shareholders. needs. o Less advantaged, non-integrated refineries could be potentially be converted to terminals or sold. Disclosing which ones we might sell would be a competitive Board recommends a vote against items 12-13 disadvantage, reduce the value of these assets, and is not in the best interest of our shareholders. Shareholder proposals Proxy Statement page o It is unreasonable and prescriptive to require us to arbitrarily establish AROs for Item 12 pp. 91-93 assets with indeterminate lives, contrary to our IEA NZE by 2050 scenario analysis. Item 13 pp. 93-96 o An additional report based on a hypothetical, remote scenario would be misleading and would not provide decision-useful information to investors. 23 See the 2023 Proxy Statement for more information

Board recommends voting against items 14-16 Against item 14: litigation disclosure beyond legal and accounting requirements Against item 16: energy transition social impact report o We already disclose material litigation risks and account for financial contingencies o The requested report is unnecessary because our existing disclosures provide this related to litigation in accordance with SEC & GAAP rules. information. o Providing information beyond what is required by legal and accounting practices o Our approach to managing potential impacts to employees and the community is could result in proprietary or confidential information being revealed, jeopardizing already communicated in our Sustainability Report. Our approach also addresses our ability to defend the Company in current and future litigation. considerations associated with lower-emission projects at existing sites. o The resolution does not enhance shareholder value and only helps those looking to o The capabilities and skills of today’s workforce are the same critical skills required to sue us by having more information on how we view and will approach litigation, lead an energy transition. which is absolutely against shareholders’ interests. o The energy transition is expected to result in direct, ongoing employment o The proponent is a director of As You Sow, whose general counsel was named as a opportunities, community investment programs, and indirect economic growth. witness against ExxonMobil by the New York Attorney General and deposed in the o Our Investing in People report (see page 15 of this ESG Summary) highlights that lead-up to the 2019 trial in which the court ultimately ruled in our favor on all claims. people are our biggest competitive advantage. Against item 15: tax reporting beyond legal requirements o We conduct business in >100 countries, subject to some of the highest tax rates in the world. For tax years ‘19-‘21, our effective income tax rate, excluding equity companies, was the third highest of Fortune 10 companies, according to Bloomberg. Board recommends a vote against items 14-16 In ‘21 our effective tax rate was 31% and in ’22 it increased to 33%. Shareholder proposals Proxy Statement page o Contrary to Oxfam’s claim, tax penalties over the last five years have been negligible. Item 14 pp. 96-97 o Several new reporting requirements intended to enhance tax transparency for our industry take effect in the immediate future. Item 15 pp. 98-99 o Implementing new disclosures beyond what is currently and soon to be required by Item 16 pp. 100-101 law, and beyond the practices of our U.S.-based peers with extensive international operations, risks putting us at a competitive disadvantage. 24 See the 2023 Proxy Statement for more information

Climate Action 100+ Net Zero Company Benchmark 1 CA100+ assessment for ExxonMobil (October ‘22) should not be relied upon Our view on why ExxonMobil and CA100+ are misaligned o The CA100+ benchmark was cited in ISS’s 2022 Proxy Analysis & Benchmark o Our ’23 ACS report (page 94) highlights that the current CA100+ Net Zero Policy Voting Recommendations as the primary source for its peer analysis of Company Benchmark for ExxonMobil does not recognize the work we have global upstream oil and gas development companies. done, particularly in meeting Indicator 3 (Medium-term Reduction Targets) and Indicator 5 (Decarbonization Strategy). The CA100+ Appendix in our ’23 ACS o This peer analysis served as the foundation for ISS’s recommendation to report (p. 94) provides our view on how we meet the criteria for these indicators. vote “for” the ‘22 shareholder proposal submitted to ExxonMobil requesting a GHG reduction goal (Scope 3). o We believe we should receive a partial score for Indicators 3 and 5, which would be aligned with our peers. o We have significant concerns if this approach is continued, because through October ’23 the currently-published CA100+ Net Zero Company Benchmark for o Indicator 3: In March ‘22, CA100+ recognized EM’s 2030 emission-reduction ExxonMobil will be based on outdated disclosures, such as our Advancing plans as meeting Indicator 3, but CA100+ downgraded their October ‘22 Climate Solutions 2022 Progress Report (January ‘22). assessment despite our continued progress. o It does not account for our latest disclosures, such as the Advancing Climate o We believe our 2030 emission-reduction plans meet Indicator 3 by covering Solutions 2023 Progress Report (’23 ACS) report that was published in more than 95% of our total operated Scope 1 and 2 emissions. Our ‘30 plans December ’22 and our ‘23 ACS Supplement that was published in April ‘23. apply to all of our operated assets, corporate-wide. The actions needed to advance our 2030 GHG emission-reduction plans are incorporated into our o We have similar concerns with ISS’s coverage of any repeat in ‘23 of a “vote no” medium-term business plans, which are updated annually, demonstrating our campaign by Majority Action. Per ISS’s benchmark report (p. 18), in ‘22 Majority commitment to reducing emissions. See ‘23 ACS (pp. 6, 10-20, 87-88) for more Action filed an exempt solicitation advocating for votes against ExxonMobil information. directors. The CA100+ benchmark is listed throughout that exempt solicitation repeatedly as a “key data source.” o Indicator 5: We have established a specific set of actions to achieve our 2030 emission-reduction plans, which support our net-zero by 2050 ambition. The o ISS’s benchmark report recommended a cautionary vote “for” Directors actions to reduce our GHG emissions intensity are provided in our ’23 ACS Woods and Hooley because of the ‘22 Majority Action “vote no” report and are more than sufficient to meet the requirements of this indicator. campaign. See ‘23 ACS (pp. 8-20, 57-77) for more information. o Separately, other Indicators, such as a requirement to set Scope 3 targets, are 1 Based on ExxonMobil’s Advancing Climate Solutions 2022 Progress Report published in January 2022, too narrow of an approach to evaluate a company’s efforts and contributions to assessed under the CA100+ Net Zero Company Benchmark v1.2: October 2022 helping reduce global GHG emissions (see ‘23 ACS p. 94). 25 See the Advancing Climate Solutions 2023 Progress Report (‘23 ACS) for more information

26 EXXONMOBIL 26

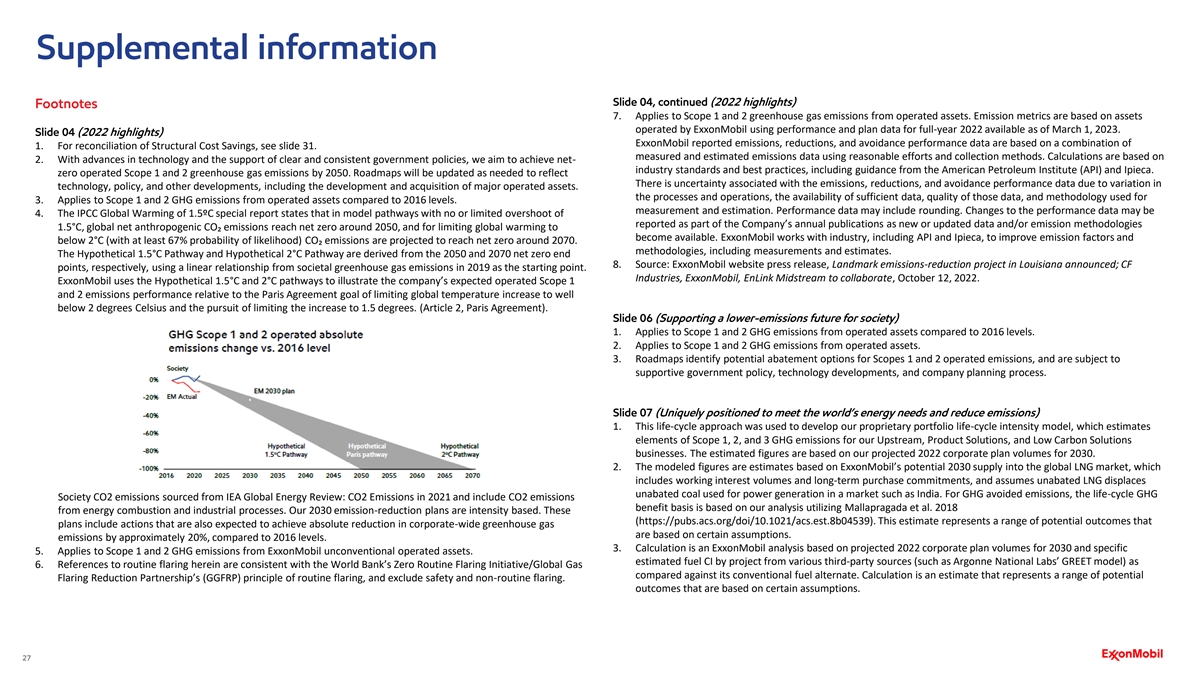

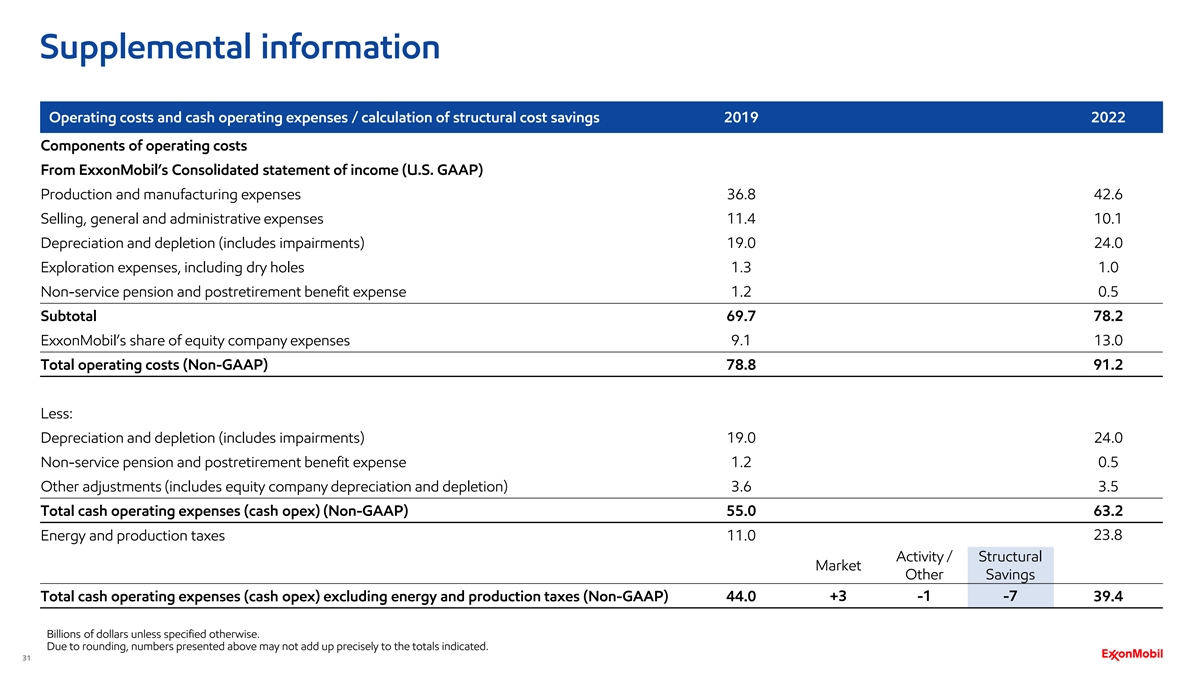

Supplemental information Slide 04, continued (2022 highlights) Footnotes 7. Applies to Scope 1 and 2 greenhouse gas emissions from operated assets. Emission metrics are based on assets operated by ExxonMobil using performance and plan data for full-year 2022 available as of March 1, 2023. Slide 04 (2022 highlights) ExxonMobil reported emissions, reductions, and avoidance performance data are based on a combination of 1. For reconciliation of Structural Cost Savings, see slide 31. measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based on 2. With advances in technology and the support of clear and consistent government policies, we aim to achieve net- industry standards and best practices, including guidance from the American Petroleum Institute (API) and Ipieca. zero operated Scope 1 and 2 greenhouse gas emissions by 2050. Roadmaps will be updated as needed to reflect There is uncertainty associated with the emissions, reductions, and avoidance performance data due to variation in technology, policy, and other developments, including the development and acquisition of major operated assets. the processes and operations, the availability of sufficient data, quality of those data, and methodology used for 3. Applies to Scope 1 and 2 GHG emissions from operated assets compared to 2016 levels. measurement and estimation. Performance data may include rounding. Changes to the performance data may be 4. The IPCC Global Warming of 1.5ºC special report states that in model pathways with no or limited overshoot of reported as part of the Company’s annual publications as new or updated data and/or emission methodologies 1.5°C, global net anthropogenic CO₂ emissions reach net zero around 2050, and for limiting global warming to become available. ExxonMobil works with industry, including API and Ipieca, to improve emission factors and below 2°C (with at least 67% probability of likelihood) CO₂ emissions are projected to reach net zero around 2070. methodologies, including measurements and estimates. The Hypothetical 1.5°C Pathway and Hypothetical 2°C Pathway are derived from the 2050 and 2070 net zero end 8. Source: ExxonMobil website press release, Landmark emissions-reduction project in Louisiana announced; CF points, respectively, using a linear relationship from societal greenhouse gas emissions in 2019 as the starting point. Industries, ExxonMobil, EnLink Midstream to collaborate, October 12, 2022. ExxonMobil uses the Hypothetical 1.5°C and 2°C pathways to illustrate the company’s expected operated Scope 1 and 2 emissions performance relative to the Paris Agreement goal of limiting global temperature increase to well below 2 degrees Celsius and the pursuit of limiting the increase to 1.5 degrees. (Article 2, Paris Agreement). Slide 06 (Supporting a lower-emissions future for society) 1. Applies to Scope 1 and 2 GHG emissions from operated assets compared to 2016 levels. 2. Applies to Scope 1 and 2 GHG emissions from operated assets. 3. Roadmaps identify potential abatement options for Scopes 1 and 2 operated emissions, and are subject to supportive government policy, technology developments, and company planning process. Slide 07 (Uniquely positioned to meet the world’s energy needs and reduce emissions) 1. This life-cycle approach was used to develop our proprietary portfolio life-cycle intensity model, which estimates elements of Scope 1, 2, and 3 GHG emissions for our Upstream, Product Solutions, and Low Carbon Solutions businesses. The estimated figures are based on our projected 2022 corporate plan volumes for 2030. 2. The modeled figures are estimates based on ExxonMobil’s potential 2030 supply into the global LNG market, which includes working interest volumes and long-term purchase commitments, and assumes unabated LNG displaces unabated coal used for power generation in a market such as India. For GHG avoided emissions, the life-cycle GHG Society CO2 emissions sourced from IEA Global Energy Review: CO2 Emissions in 2021 and include CO2 emissions benefit basis is based on our analysis utilizing Mallapragada et al. 2018 from energy combustion and industrial processes. Our 2030 emission-reduction plans are intensity based. These (https://pubs.acs.org/doi/10.1021/acs.est.8b04539). This estimate represents a range of potential outcomes that plans include actions that are also expected to achieve absolute reduction in corporate-wide greenhouse gas are based on certain assumptions. emissions by approximately 20%, compared to 2016 levels. 3. Calculation is an ExxonMobil analysis based on projected 2022 corporate plan volumes for 2030 and specific 5. Applies to Scope 1 and 2 GHG emissions from ExxonMobil unconventional operated assets. estimated fuel CI by project from various third-party sources (such as Argonne National Labs’ GREET model) as 6. References to routine flaring herein are consistent with the World Bank’s Zero Routine Flaring Initiative/Global Gas compared against its conventional fuel alternate. Calculation is an estimate that represents a range of potential Flaring Reduction Partnership’s (GGFRP) principle of routine flaring, and exclude safety and non-routine flaring. outcomes that are based on certain assumptions. 27

Supplemental information Slide 08 (Positioning for a lower-emissions future) Footnotes 1. Total addressable market based on ExxonMobil analysis of the IPCC’s Sixth Assessment Report Scenarios Database hosted by IIASA for carbon capture and storage, wind, solar, hydrogen, nuclear, biofuels, geothermal and Slide 07, continued (Uniquely positioned to meet the world’s energy needs and reduce emissions) hydropower. Secondary energy demand and prices in 2050 in the Lower 2°C scenarios (Category C3) were used, 4. Calculation of 13 million metric tons is estimated based on: April 2018 Franklin Associates Report, 4.7 metric tons where available, to calculate an estimate of potential market revenue. Carbon capture and storage estimate of enabled avoided emissions per metric ton of resin used in plastic packaging derived from April 2018 Franklin includes both CCS and Direct Air Capture and used price of carbon for pricing estimate. Biofuels estimate used Associates Report (Table 2-2 and Table 4-14), ExxonMobil’s sales volumes into U.S. packaging applications, and liquids pricing for pricing estimate. 2020 dollars. U.S. growth of plastic packaging to 2030 using third-party forecast for polyethylene (IHS Markit report, 2022 2. Source: ExxonMobil website press release, ExxonMobil moves forward with largest renewable diesel facility in Edition: Fall 2022 update, U.S., 2019- 2030) as a proxy. Reference: April 2018 report of Franklin Associates on Life Canada, January 26, 2023. Cycle Impacts of Plastic Packaging Compared to Substitutes; alternatives include steel, aluminum, glass, paper- 3. References in this slide to “ExxonMobil Permian net zero natural gas” means natural gas expected to be produced based packaging, fiber-based textiles, and wood (Table 4-14). Source: with net zero Scope 1 and 2 GHG emissions from ExxonMobil operated unconventional facilities in the Permian https://www.americanchemistry.com/content/download/7885/file/Life-Cycle-Impacts-of-Plastic-Packaging- Basin, and used at ExxonMobil’s facilities in the U.S. Gulf Coast. Slide reflects potential opportunities as of March Compared-to-Substitutes-in-the-United-Statesand-Canada.pdf. 28, 2023. May not reflect all potential opportunities or final investment decisions made by the company. 5. The modeled figures are estimates based on our potential 2030 Baytown complex blue hydrogen production Individual opportunities may advance based on a number of factors, including availability of supportive policy, volumes, assuming all the blue hydrogen displaces natural gas on an equivalent amount of energy basis, for technology for cost-effective abatement, and alignment with our partners and other stakeholders. Project example in industrial fuel switching. For GHG avoided emissions, the life-cycle GHG comparison basis is based on viability and returns may vary. The company may refer to these opportunities as projects in this presentation or our analysis utilizing Bauer et al., 2022, On the climate impacts of blue hydrogen production. Sustainable external disclosures at various stages throughout their progression. Energy & Fuels 6.1 (2022): 66-75, estimated from Fig. 1. Our hydrogen project at our Baytown manufacturing facility remains subject to final investment decision. This estimate represents a range of potential outcomes that are based on certain assumptions. Slide 09 (Resilient through the energy transition; IEA NZE scenario analysis) 6. Per April 2018 report of Franklin Associates; U.S.; Max Decomp.; Figure 4-1; Impacts as defined in Chapter 4.7: 1. The Use of Scenario Analysis in Disclosure of Climate related Risks and Opportunities - TCFD Knowledge Global Warming Potential (GWP) results, and indexed to the alternatives as a group (including steel; aluminum; https://www.tcfdhub.org/scenario-analysis/. glass; paper-based packaging; fiber-based textiles; and wood). Source: https://www.americanchemistry.com/ 2. The statements and figures contained in this section are hypothetical in nature, do not constitute a forecast of content/download/7885/file/Life-Cycle-Impacts-of-Plastic-Packaging-Compared-to-Substitutes-in-the-United- future company performance and are based on assumptions from International Energy Agency (2021), Net Zero States-and-Canada.pdf. by 2050, IEA, Paris. 7. Based on performance of specific ExxonMobil Exceed™ XP grades versus conventional polyethylene in flexible 3. Slide 9 mentions modeled operating cash flow in comparing different businesses over time in a future scenario. packaging applications. Historic operating cash flow is defined as net income, plus depreciation, depletion and amortization for 8. Certifications through the International Sustainability and Carbon Certification PLUS (ISCC PLUS) process. consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus 9. Department of Energy statements at https://www.energy.gov/eere/vehicles/lightweight-materials-cars-and- proceeds from asset sales. The Company’s long-term portfolio modeling estimates operating cash flow as revenue trucks. or margins less cash expenses, taxes and abandonment expenditures plus proceeds from asset sales before 10. Based on ExxonMobil analysis when compared to conventional mineral oils. portfolio capital expenditures. The Company believes this measure can be helpful in assessing the resiliency of 11. ExxonMobil analysis using Argonne National Labs’ GREET tools and published fuel carbon intensity from California the business to generate cash from different potential future markets. The performance data presented in this LCFS regulations. publication, including on emissions, is not financial data and is not GAAP data. The statements and figures 12. Based on ExxonMobil analysis versus conventional fuel oil. contained in this slide are hypothetical in nature, and do not constitute a forecast of future company 13. Based on ExxonMobil analysis. performance. 14. Based on ExxonMobil analysis. TM 15. Mobil SHC Gear WT helps reduce oil consumption and maintenance costs through extended oil life and drain intervals. Based on ExxonMobil analysis. 28

Supplemental information Slide 11 (Constructive policy critical for lower emissions) Footnotes 1. With advances in technology and the support of clear and consistent government policies, we aim to achieve net- zero operated Scope 1 and 2 greenhouse gas emissions by 2050. We have also set a goal to be net zero in Scope 1 Slide 10 (High-performance plastics and advanced recycling) and 2 greenhouse gas emissions by 2030 for our Permian Basin unconventional operated assets. 1. Adapted from April 2018 report of Franklin Associates for ACC; US; Max Decomp.; Figure 4-1; Impacts as defined in Chapter 4.7: Global Warming Potential (GWP) results, and Indexed to the alternatives as a group (including Charts illustrate potential GHG abatement options for Scope 1 and 2 greenhouse gas emissions, based on current steel; aluminum; glass; paper-based packaging; fiber-based textiles; and wood). Source: roadmaps for major operated assets and ExxonMobil analysis. These options are not all-inclusive, may not reflect https://plastics.americanchemistry.com/Reports-and-Publications/LCA-of-Plastic-Packaging-Compared-to- investment decisions made by the company, and are subject to change as a result of a number of factors, including Substitutes.pdf abatement reduction magnitude, implementation timing, abatement cost, portfolio changes, policy developments, 2. The benefits of plastics are compelling and help make modern life possible. In any emergency room, kitchen, technology advancement, alignment with our partners and other stakeholders, and as annual company plans are daycare center, shopping center, data center, or mode of transportation, there are abundant examples of life- updated. enhancing plastic products. Medical equipment, hygienic products, building materials, mobile phones, computers, 2. Based on preliminary ExxonMobil analysis of U.S. IRA provisions. All assumptions and interpretations of U.S. IRA monitors, appliances, packaging, clothes, protective sporting gear, and many other applications provide countless incentives are subject to change. IRS has yet to publish guidance and regulations to implement the U.S. IRA 45V. benefits. Plastics even played a vital role in the pandemic response. For example, vaccines are delivered in 3. The $100/T line is meant as a reference point to indicate the size of the challenge, especially without supportive disposable plastic syringes and ventilators and other medical equipment are made of plastic. Health care workers policy, and it does not reflect investment decisions made by the company. also depend on personal protective equipment made from hygienic, durable, and reliable plastics. 3. Per April 2018 report of Franklin Associates; U.S. packaging market; Max Decomp.; Figure 4-1; Impacts as defined in Chapter 4.7: Global Warming Potential (GWP) results, and indexed to the alternatives as a group (including Slide 13 (Independent and diverse board) steel; aluminum; glass; paper-based packaging; fiber-based textiles; and wood). Source: 1. Independent Director tenure / average tenure as of April 1, 2023. https://www.americanchemistry.com/content/download/7885/file/Life-CycleImpacts-of-Plastic-Packaging- 2. Not standing for re-election at ‘23 Annual Shareholder Meeting. Comparedto-Substitutes-in-the-United-States-andCanada.pdf. 3. Not an independent director. 4. IEA Net Zero by 2050: A Roadmap for the Global Energy Sector (2021), https://www.iea.org/reports/net- zero-by-2050. 5. Calculation of 40 million metric tons is estimated based on: April 2018 Franklin Associates Report, 4.7 metric Slide 14 (Executive compensation) tons of enabled avoided emissions per metric ton of resin used in plastic packaging derived from April 2018 1. Total Direct Compensation, Realized Pay, and Unrealized Pay are defined in the Frequently Used Terms on page Franklin Associates Report (Table 2-2 and Table 4-14), ExxonMobil’s sales volumes into packaging 66 of the ExxonMobil 2023 Proxy Statement. The Frequently Used Terms also identify the compensation applications globally, and global growth of plastic packaging to 2030 using third-party forecast for benchmark companies. Benchmark company data for 2022 not available at time of proxy statement publication. polyethylene (IHS Markit report, 2022 Edition: Fall 2022 update, global) as a proxy. Actual market conditions vary by region and over time. Reference: April 2018 report of Franklin Associates on Life Cycle Impacts of Plastic Packaging Compared to Substitutes; alternatives include steel, aluminum, glass, paper-based Slide 16 (2022 accomplishments) packaging, fiber-based textiles, and wood (Table 4-14). Source: 1. Industry leading based on comparison to IOC peers: BP, Chevron, Shell, and Total Energies. https://www.americanchemistry.com/content/download/7885/file/Life-Cycle-Impacts-of-Plastic- Packaging-Compared-to-Substitutes-in-the-United-States-and-Canada.pdf. 6. Source: ExxonMobil website, ExxonMobil shares carbon footprint assessment of proprietary advanced recycling technology. 29

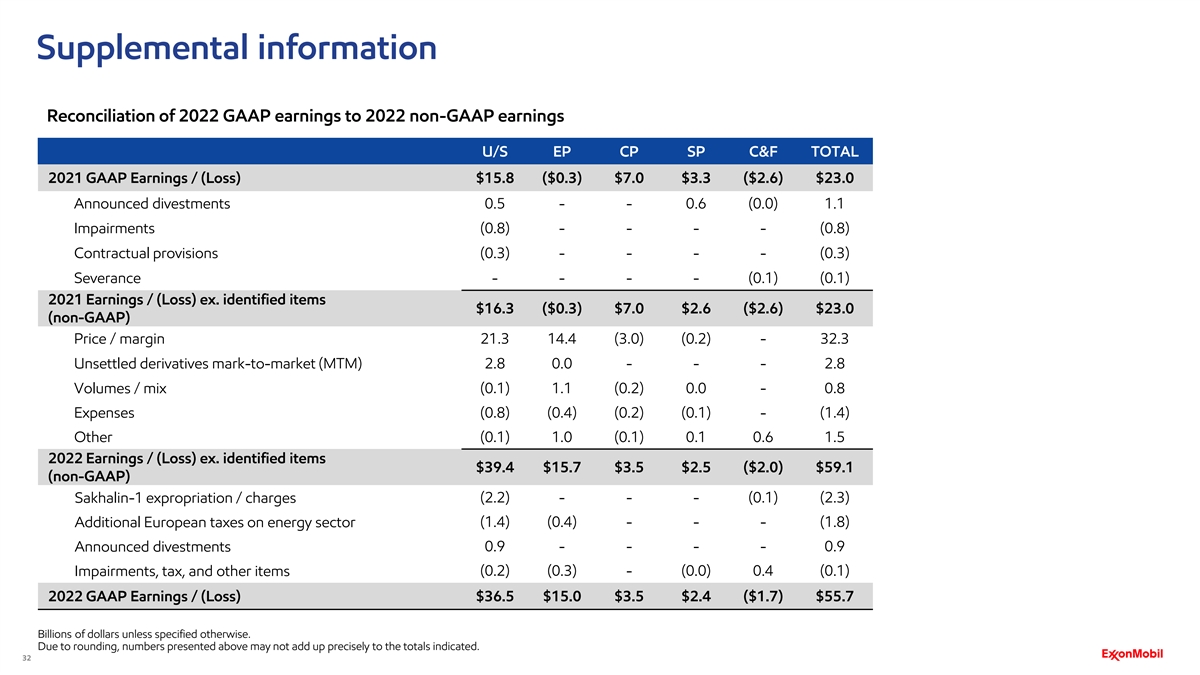

Supplemental information Slide 21, (Board recommends voting against items 8-9) Footnotes 1. Applies to Scope 1 and 2 greenhouse gas emissions from operated assets. Emission metrics are based on assets operated by ExxonMobil using performance and plan data for full-year 2022 available as of March 1, 2023. Slide 17 (2022 industry-leading financial results) ExxonMobil reported emissions, reductions, and avoidance performance data are based on a combination of 1. Reconciliation to U.S. GAAP of $55.7 billion on slide 32. measured and estimated emissions data using reasonable efforts and collection methods. Calculations are based 2. One-year (2022) results with industry peer group estimated using nine month 2022 annualized figures or on industry standards and best practices, including guidance from the American Petroleum Institute (API) and announced programs (shareholder distributions); industry peer group includes BP, Chevron, Shell, and Total Ipieca. There is uncertainty associated with the emissions, reductions, and avoidance performance data due to Energies. Reconciliation on slide 32. variation in the processes and operations, the availability of sufficient data, quality of those data, and methodology 3. One-year total shareholder return (TSR); industry peer group includes BP, Chevron, Shell, and Total Energies used for measurement and estimation. Performance data may include rounding. Changes to the performance data may be reported as part of the Company’s annual publications as new or updated data and/or emission methodologies become available. ExxonMobil works with industry, including API and Ipieca, to improve emission Slide 18 (Response to 2022 passing shareholder proposal on scenario analysis) factors and methodologies, including measurements and estimates. 1. World Bank: State and Trends of Carbon Pricing 2022, 2. This life-cycle approach was used to develop our proprietary portfolio life-cycle intensity model, which estimates https://openknowledge.worldbank.org/handle/10986/37455. Reference World Bank ranges are consistent with elements of Scope 1, 2, and 3 GHG emissions for our Upstream, Product Solutions, and Low Carbon Solutions existing carbon pricing for those jurisdictions as of April 1, 2022. businesses. The estimated figures are based on our projected 2022 corporate plan volumes for 2030. 2. IEA World Energy Outlook 2021. Slide 20 (Board recommends voting against items 5-7) 1. “CO EOR represents a win-win strategy for beneficial use of industrially-sourced CO . From an economic 2 2 standpoint,CO EOR is a highly effective tool for re-invigorating oil production from mature fields that might 2 otherwise be abandoned. From an environmental standpoint, it represents a practical way to recycle and utilize CO while reducing overall atmospheric CO emissions.” 2 2 https://cdn.catf.us/wp-content/uploads/2019/06/21093723/CATF_EOR_LCA_Factsheet_2019.pdf https://netl.doe.gov/research/coal/energy-systems/gasification/gasifipedia/eor See also https://iea.blob.core.windows.net/assets/bf99f0f1-f4e2-43d8-b123- 309c1af66555/Storing_CO2_through_Enhanced_Oil_Recovery.pdf; Global CCS capacity: Global CCS Institute, Global Status of CCS 2021, p. 14. ExxonMobil CCS capacity: ExxonMobil estimates. 30

Supplemental information Operating costs and cash operating expenses / calculation of structural cost savings 2019 2022 Components of operating costs From ExxonMobil’s Consolidated statement of income (U.S. GAAP) Production and manufacturing expenses 36.8 42.6 Selling, general and administrative expenses 11.4 10.1 Depreciation and depletion (includes impairments) 19.0 24.0 Exploration expenses, including dry holes 1.3 1.0 Non-service pension and postretirement benefit expense 1.2 0.5 Subtotal 69.7 78.2 ExxonMobil’s share of equity company expenses 9.1 13.0 Total operating costs (Non-GAAP) 78.8 91.2 Less: Depreciation and depletion (includes impairments) 19.0 24.0 Non-service pension and postretirement benefit expense 1.2 0.5 Other adjustments (includes equity company depreciation and depletion) 3.6 3.5 Total cash operating expenses (cash opex) (Non-GAAP) 55.0 63.2 23.8 Energy and production taxes 11.0 Activity / Structural Market Other Savings Total cash operating expenses (cash opex) excluding energy and production taxes (Non-GAAP) 44.0 +3 -1 -7 39.4 Billions of dollars unless specified otherwise. Due to rounding, numbers presented above may not add up precisely to the totals indicated. 31

Supplemental information Reconciliation of 2022 GAAP earnings to 2022 non-GAAP earnings U/S EP CP SP C&F TOTAL 2021 GAAP Earnings / (Loss) $15.8 ($0.3) $7.0 $3.3 ($2.6) $23.0 Announced divestments 0.5 - - 0.6 (0.0) 1.1 Impairments (0.8) - - - - (0.8) Contractual provisions (0.3) - - - - (0.3) Severance - - - - (0.1) (0.1) 2021 Earnings / (Loss) ex. identified items $16.3 ($0.3) $7.0 $2.6 ($2.6) $23.0 (non-GAAP) Price / margin 21.3 14.4 (3.0) (0.2) - 32.3 Unsettled derivatives mark-to-market (MTM) 2.8 0.0 - - - 2.8 Volumes / mix (0.1) 1.1 (0.2) 0.0 - 0.8 Expenses (0.8) (0.4) (0.2) (0.1) - (1.4) Other (0.1) 1.0 (0.1) 0.1 0.6 1.5 2022 Earnings / (Loss) ex. identified items $39.4 $15.7 $3.5 $2.5 ($2.0) $59.1 (non-GAAP) Sakhalin-1 expropriation / charges (2.2) - - - (0.1) (2.3) Additional European taxes on energy sector (1.4) (0.4) - - - (1.8) Announced divestments 0.9 - - - - 0.9 Impairments, tax, and other items (0.2) (0.3) - (0.0) 0.4 (0.1) 2022 GAAP Earnings / (Loss) $36.5 $15.0 $3.5 $2.4 ($1.7) $55.7 Billions of dollars unless specified otherwise. Due to rounding, numbers presented above may not add up precisely to the totals indicated. 32