UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

S T R E N G T H E N I N G O U R I N D U S T R Y L E A D E R S H I P S H A R E H O L D E R E N G A G E M E N T April 2022

LAW (D. Kern) TO BE UPDATED TABLE OF CONTENTS 03 Highlights 23 - 28 Supplemental Information 04 Create Sustainable Solutions that Improve Quality of Life and meet Society’s Evolving Needs 05 Driving Toward a Net-Zero Future 06 Reducing GHG Emissions while Meeting Society’s Essential Needs 07 Positioning for a Lower-Emissions Future 08 Resilient Under Net-Zero Pathways; IEA NZE Scenario Analysis 09 Plastics and the Circular Economy 10 Advocating for Sound Policies 11 Political Contributions and Lobbying 12 Independent and Diverse Board 13 Executive Compensation 14 Investing in People 15 2021 Accomplishments 16 2021 Financial Performance 17 - 21 2022 Proxy Items Important Additional Information Regarding Proxy Solicitation This document provides disclosure on future emission-reduction plans and ambitions, resiliency modeling of our business using third-party scenarios and other forward-looking statements. See the Cautionary Statement on Page 28 for a discussion of these forward-looking statements and supplemental information to the slides. 2 EXXONMOBIL

HIGHLIGHTS A D V A N C I N G C L I M A T E S O L U T I O N S 2 0 2 1 F I N A N C I A L P E R F O R M A N C E o Established ExxonMobil Low Carbon Solutions business in February 2021 o Earnings of $23 billion o Expanded our global CCS of potential opportunities, spanning across U.S., o Cash flow from operations increased to $48 billion Canada, Scotland, France, Belgium, Netherlands, Qatar, Malaysia, Singapore, o Captured additional $2 billion in 2021 in structural cost reductions, Indonesia and Australia totaling ~$5 billion since 2019 o Planning our first world-scale low-carbon hydrogen plant for up to 1 billion CFD o ~$9 billion annually by 2023 vs 2019 production in Baytown, Texas o Capex discipline with investment of $17 billion o Collaborated to deploy advanced methane detection technology at a global scale 3 o Breakeven lowered to $41 /bbl o Signed agreement to begin a certification process for natural gas produced at our Permian Basin facilities o Debt reduced by $20 billion o Progressed plastic waste advanced recycling facilities; planning ~500kmt o Dividend annual growth for 39 consecutive years capacity by 2026 4 o Share repurchase program announced $10 billion o Announced plans for 40kbd of lower-emission fuels (LEF) by 2025 with a goal of 200kbd by 2030 G H G E M I S S I O N - R E D U C T I O N P L A N S 1 o Net-zero ambition by 2050 o Achieved 2025 emission-reduction plans four years early o New 2030 emission-reduction plans consistent with Paris Agreement pathways 2 o Plans for net-zero emissions in our Permian Basin operations by 2030 o Plans to invest $15 billion on lower-emission initiatives through 2027 3 EXXONMOBIL See Supplemental Information for footnotes and definitions

CREATE SUSTAINABLE SOLUTIONS THAT IMPROVE QUALITY OF LIFE AND MEET SOCIETY’S EVOLVING NEEDS S T R A T E G I C P R I O R I T I E S Leading performance Industry leader in operating and financial performance Value through win-win solutions for our customers, partners, and broader stakeholders Essential partner Advantaged portfolio Portfolio of assets and products outperform competition and grow value in a lower-emissions future New products, technologies, and approaches to accelerate large-scale deployment of solutions Innovative solutions essential to modern life and lower emissions Diverse and engaged organization with unrivaled opportunities for personal and Meaningful development professional growth 4 EXXONMOBIL

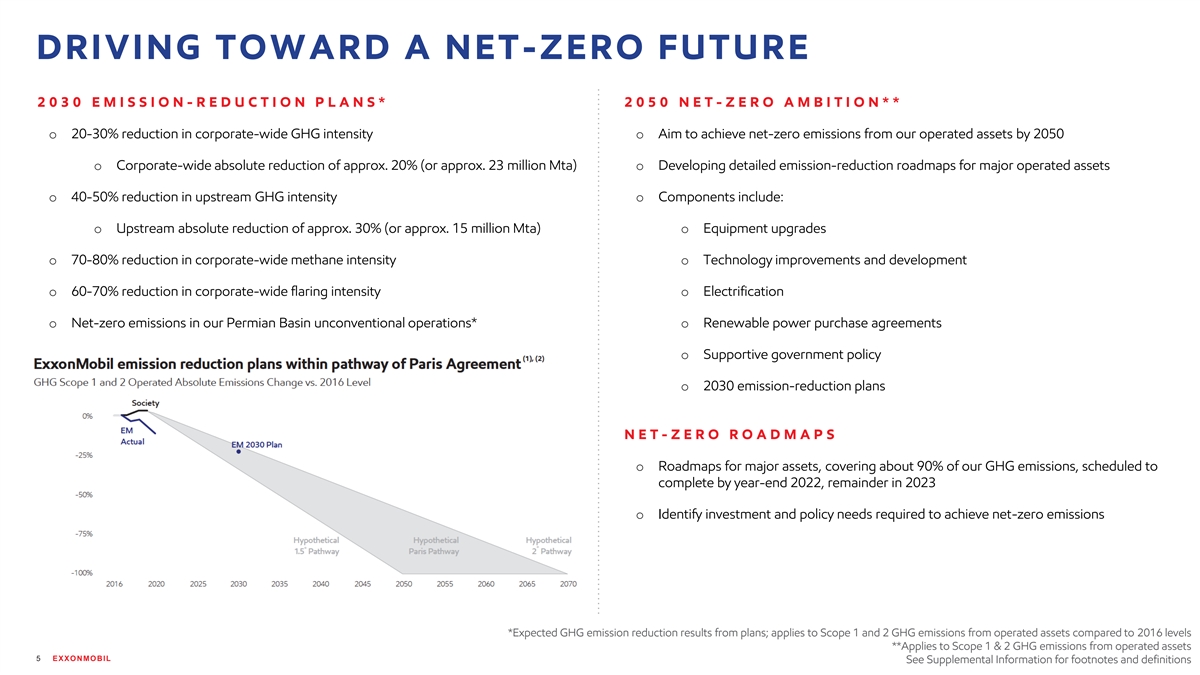

DRIVING TOWARD A NET -ZERO FUTURE 2 0 3 0 E M I S S I O N - R E D U C T I O N P L A N S * 2 0 5 0 N E T - Z E R O A M B I T I O N * * o 20-30% reduction in corporate-wide GHG intensity o Aim to achieve net-zero emissions from our operated assets by 2050 o Corporate-wide absolute reduction of approx. 20% (or approx. 23 million Mta) o Developing detailed emission-reduction roadmaps for major operated assets o 40-50% reduction in upstream GHG intensity o Components include: o Upstream absolute reduction of approx. 30% (or approx. 15 million Mta) o Equipment upgrades o 70-80% reduction in corporate-wide methane intensity o Technology improvements and development o 60-70% reduction in corporate-wide flaring intensity o Electrification o Net-zero emissions in our Permian Basin unconventional operations* o Renewable power purchase agreements o Supportive government policy o 2030 emission-reduction plans N E T - Z E R O R O A D M A P S o Roadmaps for major assets, covering about 90% of our GHG emissions, scheduled to complete by year-end 2022, remainder in 2023 o Identify investment and policy needs required to achieve net-zero emissions *Expected GHG emission reduction results from plans; applies to Scope 1 and 2 GHG emissions from operated assets compared to 2016 levels **Applies to Scope 1 & 2 GHG emissions from operated assets 5 EXXONMOBIL See Supplemental Information for footnotes and definitions

REDUCING GHG EMISSIONS WHILE MEETING SOCIETY’S ESSENTIAL NEEDS L I F E C Y C L E A S S E S S M E N T ( L C A ) P R O D U C T S T O H E L P C U S T O M E R S R E D U C E T H E I R E M I S S I O N S o To evaluate impact on society’s overall GHG emissions, it is critical to consider: o Sustainable solutions to improve modern life 8 o Society’s essential needs o Plastic packaging has 54% lower life-cycle GHG emissions impact vs alternatives TM 9 o Available alternatives o Exceed XP enables up to 30% thinner plastic packaging vs conventional plastics 10 o Emissions created or avoided throughout a product’s life cycle o Certified circular polymers with equivalent performance of virgin plastics o We used an LCA to analyze the change in overall emissions associated with the o Total vehicle product solutions to improve transportation efficiency 1,2 Company’s business plans 11 o Plastics enable lighter vehicles, 6-8% fuel efficiency per 10% reduction in weight o ExxonMobil’s full life-cycle absolute greenhouse gas emissions for its oil, natural 12 o Mobil 1 ESP X2 0W-20 engine oil helps improve fuel economy by up to 4% gas, fuels (including biofuels), chemicals, and lubricants portfolio could decrease 3 by about 12% in 2030 relative to 2016 levels 13 o Renewable diesel can reduce GHG emissions by up to 70% vs conventional diesel o Similarly, ExxonMobil’s portfolio life-cycle emissions intensity (g CO₂e/MJ) TM o Marine bio fuel, BMF.5 , can reduce GHG emissions by up to 30% vs conventional 3 could decrease by about 4% in 2030 relative to 2016 14 marine fuel B E N E F I T S O F E X X O N M O B I L P R O D U C T S o Reliable solutions for industrial efficiency 15 o Mobil DTE 10 Excel Series improves hydraulic pump efficiency by up to 6% o If our projected 2030 LNG production displaced coal in power generation, 100 million 4 Mta of GHG emissions could be avoided TM 16 o Mobil SHC 600 Series provides up to 3.6% energy efficiency gain o In U.S., fuel switching from coal to natural gas led to a 14% reduction in GHG emissions TM 17 o Mobil SHC Gear WT helps reduce oil consumption and maintenance costs 5 from 1995 to 2020 o If our projected 2030 renewable fuel production displaced conventional fuel refined 6 from crude oil, more than 25 million Mta of GHG emissions could be avoided o If our projected 2030 chemical volumes used for plastic packaging displaced 7 alternatives as a group, ~40 million Mta of GHG emissions would be avoided 6 EXXONMOBIL See Supplemental Information for footnotes and definitions

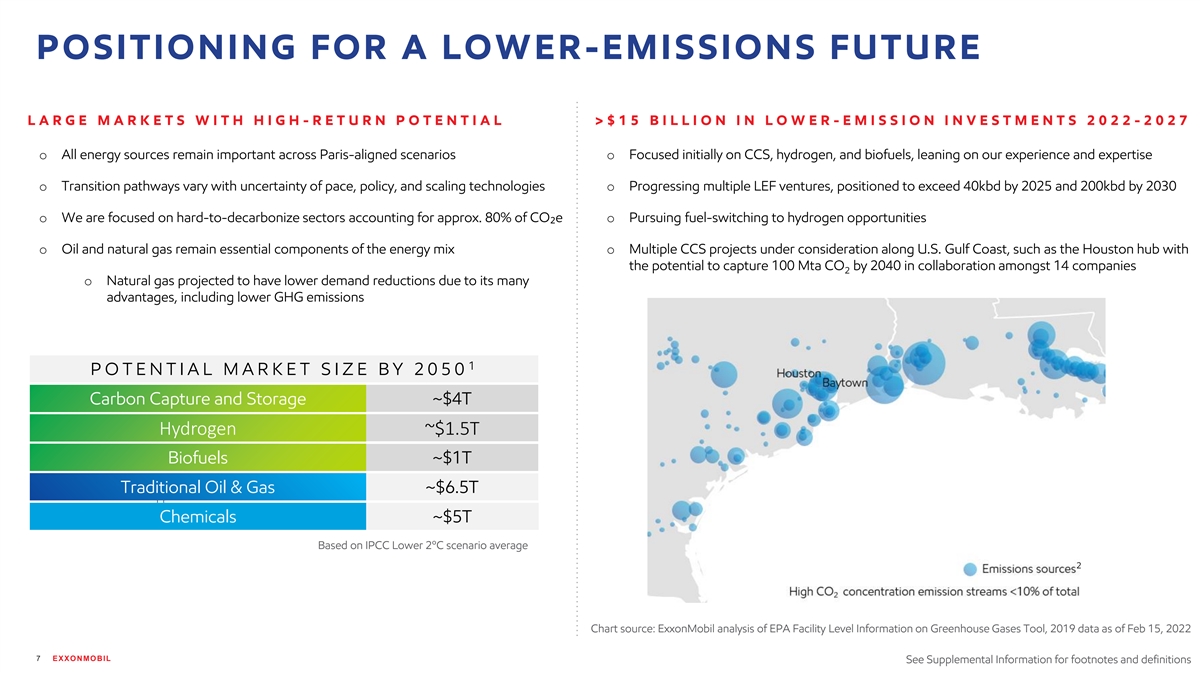

POSITIONING FOR A LOWER -EMISSIONS FUTURE L A R G E M A R K E T S W I T H H I G H - R E T U R N P O T E N T I A L > $ 1 5 B I L L I O N I N L O W E R - E M I S S I O N I N V E S T M E N T S 2 0 2 2 - 2027 o All energy sources remain important across Paris-aligned scenarios o Focused initially on CCS, hydrogen, and biofuels, leaning on our experience and expertise o Transition pathways vary with uncertainty of pace, policy, and scaling technologies o Progressing multiple LEF ventures, positioned to exceed 40kbd by 2025 and 200kbd by 2030 o We are focused on hard-to-decarbonize sectors accounting for approx. 80% of CO₂e o Pursuing fuel-switching to hydrogen opportunities o Oil and natural gas remain essential components of the energy mix o Multiple CCS projects under consideration along U.S. Gulf Coast, such as the Houston hub with the potential to capture 100 Mta CO by 2040 in collaboration amongst 14 companies 2 o Natural gas projected to have lower demand reductions due to its many advantages, including lower GHG emissions 1 P O T E N T I A L M A R K E T S I Z E B Y 2 0 5 0 Carbon Capture and Storage ~$4T Hydrogen ~$1.5T Biofuels ~$1T Traditional Oil & Gas ~$6.5T See Supplemental Information for footnotes and definitions Chemicals ~$5T Based on IPCC Lower 2ºC scenario average 2 Chart source: ExxonMobil analysis of EPA Facility Level Information on Greenhouse Gases Tool, 2019 data as of Feb 15, 2022 7 EXXONMOBIL See Supplemental Information for footnotes and definitions

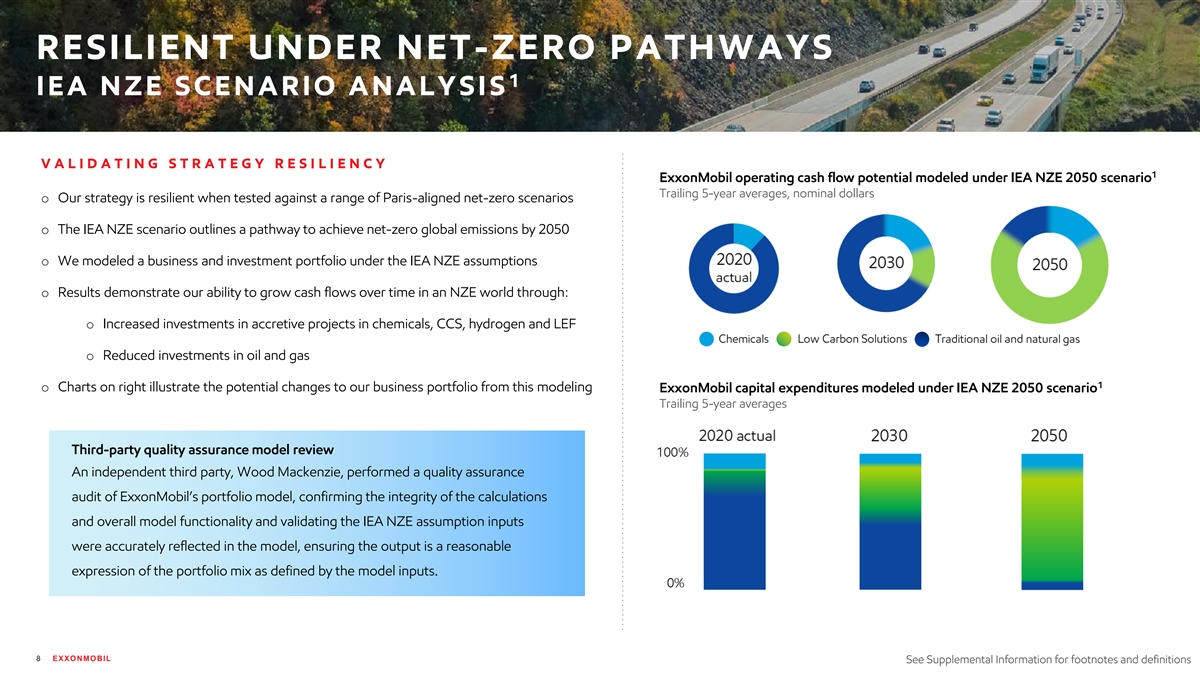

RESILIENT UNDER NET -ZERO PATHWAYS 1 I E A N Z E S C E N A R I O A N A L Y S I S V A L I D A T I N G S T R A T E G Y R E S I L I E N C Y 1 ExxonMobil operating cash flow potential modeled under IEA NZE 2050 scenario Trailing 5-year averages, nominal dollars o Our strategy is resilient when tested against a range of Paris-aligned net-zero scenarios o The IEA NZE scenario outlines a pathway to achieve net-zero global emissions by 2050 o We modeled a business and investment portfolio under the IEA NZE assumptions o Results demonstrate our ability to grow cash flows over time in an NZE world through: o Increased investments in accretive projects in chemicals, CCS, hydrogen and LEF o Reduced investments in oil and gas 1 o Charts on right illustrate the potential changes to our business portfolio from this modeling ExxonMobil capital expenditures modeled under IEA NZE 2050 scenario Trailing 5-year averages Third-party quality assurance model review An independent third party, Wood Mackenzie, performed a quality assurance audit of ExxonMobil’s portfolio model, confirming the integrity of the calculations and overall model functionality and validating the IEA NZE assumption inputs were accurately reflected in the model, ensuring the output is a reasonable expression of the portfolio mix as defined by the model inputs. 8 EXXONMOBIL See Supplemental Information for footnotes and definitions

PLASTICS AND THE CIRCULAR ECONOMY P L A S T I C S E N A B L E M O D E R N L I F E P L A S T I C W A S T E A D V A N C E D R E C Y C L I N G P L A N S o Superior performance and life cycle sustainability benefits o Plan to build capacity for approx. 500kmt per year by end of 2026 o Support good health, food preservation, and clean drinking water o Baytown operation to be among North America’s largest advanced plastic waste recycling facilities o Enable new lower-emission technologies, including: o Began operations in 2021, have processed more than 2kmt of plastic waste o Electric vehicles, solar panels, wind turbine blades, and high- performance building insulation o Announced first commercial sale of certified circular polymers in Feb 2022 o Plastic packaging has 54% lower life-cycle GHG emissions impact o Complete expansion by end of 2022; planned capacity of 30kmt per year 1 versus alternatives o Collaborating on an advanced recycling plant in France, start-up expected in 2023 o Even in IEA NZE scenario, demand for chemicals grows 30% vs 2020, o Initial planned capacity of 25kmt per year plastics make up approx. half that volume 2 o Assessing opportunities in the Netherlands, US Gulf Coast, Canada, Singapore o Provide for life-enhancing products used in our daily lives A D D R E S S I N G P L A S T I C W A S T E S T R A T E G I C C O L L A B O R A T I O N S o All waste products need to be properly managed and requires o Founding member of the Alliance to End Plastic Waste, helping address plastic waste investment in waste management infrastructure in the environment o Offering innovative products that enable increased recycling o Joint venture to develop innovative solutions for aggregating and pre-processing large volumes of plastic waste for recycling o Supporting improvements in plastic waste recovery o Fills “missing link” between waste companies and plastic recyclers o Operation Clean Sweep-Blue (OCS-Blue) member, encouraging industry use of best practices to reduce plastic pellet loss 9 EXXONMOBIL See Supplemental Information for footnotes and definitions

ADVOCATING FOR SOUND POLICIES D U R A B L E A N D P R E D I C T A B L E P O L I C I E S C A N : o Accelerate deployment of critical lower-emissions technologies at the pace and scale required to support a net-zero future o Help achieve the Paris Agreement’s goals at the lowest cost to society o Provide direct investment and incentives for technologies like CCS, hydrogen and LEF, similar to the supportive policies that have accelerated growth for wind, solar and electric vehicles O U R A P P R O A C H : Advocating for an economy-wide price on carbon Supporting policy solutions to help address hardest-to-decarbonize sectors: o In absence of economy-wide carbon pricing, we support a comprehensive policy agenda to address key sectors accounting for nearly 80% of emissions across the U.S. economy o Establish market incentives o Cost-effectively lower carbon intensity Transportation: holistic low carbon transportation policy linking a carbon o Deliver meaningful emission reductions intensity based fuel standard with a life-cycle vehicle CO₂ emission standard Leading on regulations to reduce methane emissions Manufacturing: policy and regulatory frameworks to enable critical lower- carbon technologies, including CCS and hydrogen o Published methane regulatory model framework o Advocating for methane reduction policies globally Power generation: technology-neutral clean energy standard that sets carbon intensity targets and incentivizes lower-emission options o Supporting U.S. and EU actions on methane 10 EXXONMOBIL See Supplemental Information for definitions

POLITICAL CONTRIBUTIONS AND LOBBYING L O B B Y I N G A N D A D V O C A C Y C L I M A T E L O B B Y I N G o We engage in lobbying in the United States at the federal and state levels to advocate o Recognizing that sound government policies are required and can act as an accelerator for our positions on issues that affect our Corporation and the energy industry lower-emission alternatives, ExxonMobil actively participates in climate-related policy discussions around the world o Each year, the Company’s political contributions, lobbying activities, and lobbying expenditures are reviewed by the Board o ExxonMobil’s climate lobbying activities are aligned with limiting average global warming to well below 2 degrees Celsius, and include strong support for policies that will incentivize o ExxonMobil’s Lobbying Report, provides additional detail of our direct and indirect emission reductions climate-related lobbying activities at the federal, state and local level, as well as our grassroots lobbying communications o Our 2021 Report on Climate Lobbying provides a global assessment of our climate lobbying activities P O L I T I C A L C O N T R I B U T I O N S Lobbying and Political Engagement Stewardship o The Board authorizes the Company to make political contributions in the United States Lobbying and political engagement are included as part of the Board’s stewardship of the and Canada, and annually reviews those contributions Company’s enterprise-risk framework. Each year, the Vice President for Public and Government o The Company’s support of candidates and political organizations reflects corporate Affairs presents the Company’s political contributions, lobbying activities and lobbying interests and not those of any individual employee, officer, or director expenditures to the full Board, along with the Board’s Public Issues and Contributions Committee, which is comprised entirely of independent directors. The directors review the efforts and associated expenditures. In addition, in-depth reviews of the Company’s priority issues are conducted by the Management Committee several times a year as part of the process. 11 EXXONMOBIL

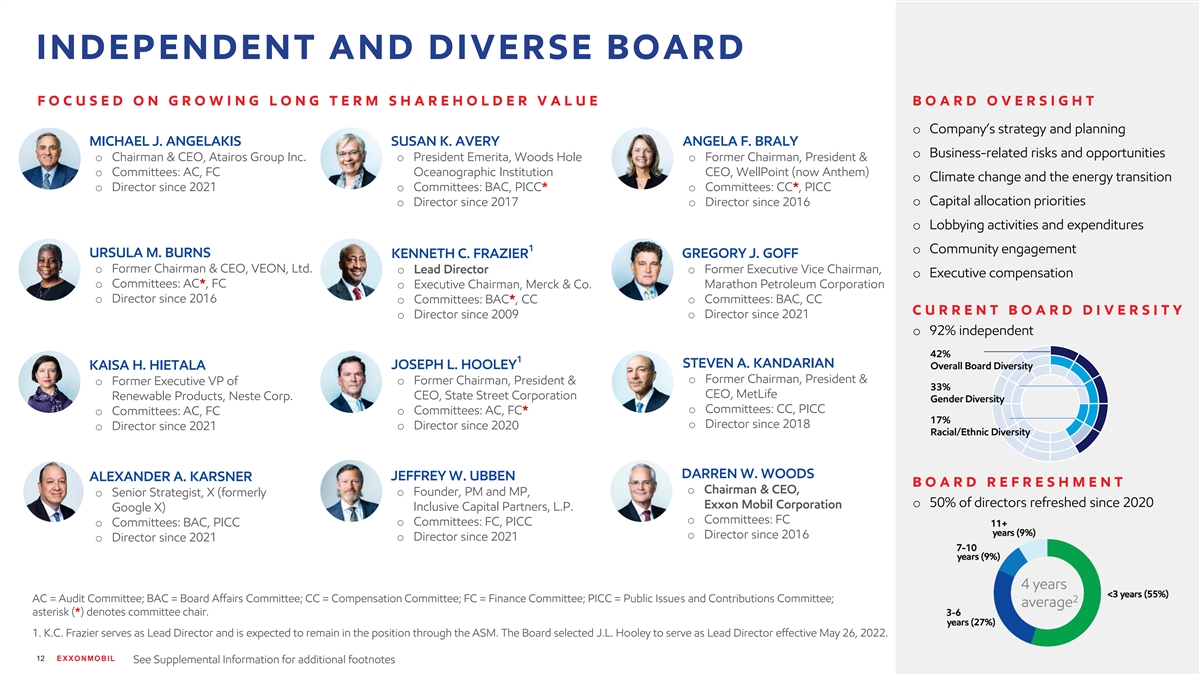

INDEPENDENT AND DIVERSE BOARD F O C U S E D O N G R O W I N G L O N G T E R M S H A R E H O L D E R V A L U E B O A R D O V E R S I G H T o Company’s strategy and planning MICHAEL J. ANGELAKIS SUSAN K. AVERY ANGELA F. BRALY o Business-related risks and opportunities o Chairman & CEO, Atairos Group Inc. o President Emerita, Woods Hole o Former Chairman, President & o Committees: AC, FC Oceanographic Institution CEO, WellPoint (now Anthem) o Climate change and the energy transition o Director since 2021 o Committees: BAC, PICC* o Committees: CC*, PICC o Capital allocation priorities o Director since 2017 o Director since 2016 o Lobbying activities and expenditures 1 o Community engagement URSULA M. BURNS GREGORY J. GOFF KENNETH C. FRAZIER o Former Chairman & CEO, VEON, Ltd. o Lead Director o Former Executive Vice Chairman, o Executive compensation o Committees: AC*, FC o Executive Chairman, Merck & Co. Marathon Petroleum Corporation o Director since 2016 o Committees: BAC*, CC o Committees: BAC, CC C U R R E N T B O A R D D I V E R S I T Y o Director since 2009 o Director since 2021 o 92% independent 42% 1 STEVEN A. KANDARIAN JOSEPH L. HOOLEY KAISA H. HIETALA Overall Board Diversity o Former Chairman, President & o Former Executive VP of o Former Chairman, President & 33% CEO, MetLife Renewable Products, Neste Corp. CEO, State Street Corporation Gender Diversity o Committees: CC, PICC o Committees: AC, FC o Committees: AC, FC* 17% o Director since 2018 o Director since 2021 o Director since 2020 Racial/Ethnic Diversity DARREN W. WOODS JEFFREY W. UBBEN ALEXANDER A. KARSNER B O A R D R E F R E S H M E N T o Chairman & CEO, o Senior Strategist, X (formerly o Founder, PM and MP, o 50% of directors refreshed since 2020 Exxon Mobil Corporation Google X) Inclusive Capital Partners, L.P. o Committees: FC o Committees: BAC, PICC o Committees: FC, PICC o Director since 2016 o Director since 2021 o Director since 2021 4 years AC = Audit Committee; BAC = Board Affairs Committee; CC = Compensation Committee; FC = Finance Committee; PICC = Public Issues and Contributions Committee; 2 average asterisk (*) denotes committee chair. 1. K.C. Frazier serves as Lead Director and is expected to remain in the position through the ASM. The Board selected J.L. Hooley to serve as Lead Director effective May 26, 2022. 12 EXXONMOBIL See Supplemental Information for additional footnotes

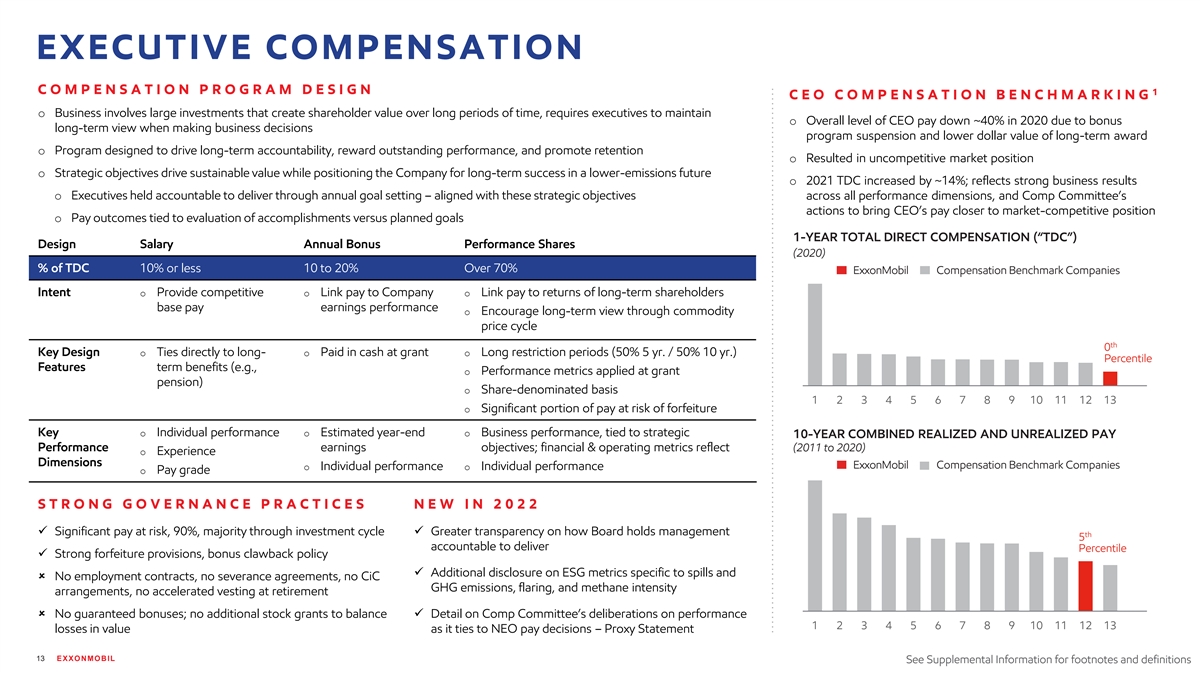

EXECUTIVE COMPENSATION C O M P E N S A T I O N P R O G R A M D E S I G N 1 C E O C O M P E N S A T I O N B E N C H M A R K I N G o Business involves large investments that create shareholder value over long periods of time, requires executives to maintain o Overall level of CEO pay down ~40% in 2020 due to bonus long-term view when making business decisions program suspension and lower dollar value of long-term award o Program designed to drive long-term accountability, reward outstanding performance, and promote retention o Resulted in uncompetitive market position o Strategic objectives drive sustainable value while positioning the Company for long-term success in a lower-emissions future o 2021 TDC increased by ~14%; reflects strong business results o Executives held accountable to deliver through annual goal setting – aligned with these strategic objectives across all performance dimensions, and Comp Committee’s actions to bring CEO’s pay closer to market-competitive position o Pay outcomes tied to evaluation of accomplishments versus planned goals 1-YEAR TOTAL DIRECT COMPENSATION (“TDC”) Design Salary Annual Bonus Performance Shares 100 (2020) % of TDC 10% or less 10 to 20% Over 70% ExxonMobil Compensation Benchmark Companies Intent o Provide competitive o Link pay to Company o Link pay to returns of long-term shareholders base pay earnings performance o Encourage long-term view through commodity price cycle th 0 Key Design o Ties directly to long- o Paid in cash at grant o Long restriction periods (50% 5 yr. / 50% 10 yr.) Percentile Features term benefits (e.g., o Performance metrics applied at grant pension) 0 o Share-denominated basis 1 2 3 4 5 6 7 8 9 10 11 12 13 o Significant portion of pay at risk of forfeiture Key o Individual performance o Estimated year-end o Business performance, tied to strategic 10-YEAR COMBINED REALIZED AND UNREALIZED PAY Performance earnings objectives; financial & operating metrics reflect (2011 to 2020) o Experience Dimensions ExxonMobil Compensation Benchmark Companies o Individual performance o Individual performance o Pay grade 500 S T R O N G G O V E R N A N C E P R A C T I C E S N E W I N 2 0 2 2 400 ü Significant pay at risk, 90%, majority through investment cycleü Greater transparency on how Board holds management 300 th 5 accountable to deliver Percentile ü Strong forfeiture provisions, bonus clawback policy 200 ü Additional disclosure on ESG metrics specific to spills and û No employment contracts, no severance agreements, no CiC 100 GHG emissions, flaring, and methane intensity arrangements, no accelerated vesting at retirement 0 û No guaranteed bonuses; no additional stock grants to balance ü Detail on Comp Committee’s deliberations on performance 1 2 3 4 5 6 7 8 9 10 11 12 13 losses in value as it ties to NEO pay decisions – Proxy Statement 13 EXXONMOBIL See Supplemental Information for footnotes and definitions

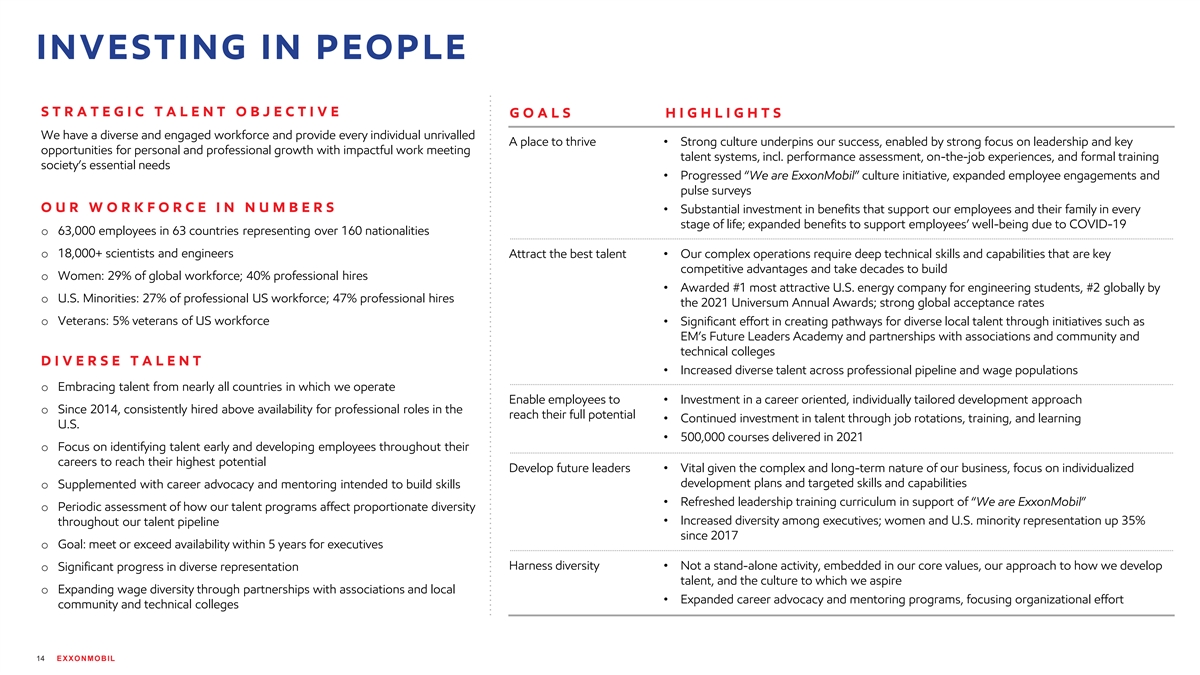

INVESTING IN PEOPLE S T R A T E G I C T A L E N T O B J E C T I V E G O A L S H I G H L I G H T S We have a diverse and engaged workforce and provide every individual unrivalled A place to thrive• Strong culture underpins our success, enabled by strong focus on leadership and key opportunities for personal and professional growth with impactful work meeting talent systems, incl. performance assessment, on-the-job experiences, and formal training society’s essential needs • Progressed “We are ExxonMobil” culture initiative, expanded employee engagements and pulse surveys O U R W O R K F O R C E I N N U M B E R S • Substantial investment in benefits that support our employees and their family in every stage of life; expanded benefits to support employees’ well-being due to COVID-19 o 63,000 employees in 63 countries representing over 160 nationalities o 18,000+ scientists and engineers Attract the best talent• Our complex operations require deep technical skills and capabilities that are key competitive advantages and take decades to build o Women: 29% of global workforce; 40% professional hires • Awarded #1 most attractive U.S. energy company for engineering students, #2 globally by o U.S. Minorities: 27% of professional US workforce; 47% professional hires the 2021 Universum Annual Awards; strong global acceptance rates o Veterans: 5% veterans of US workforce • Significant effort in creating pathways for diverse local talent through initiatives such as EM’s Future Leaders Academy and partnerships with associations and community and technical colleges D I V E R S E T A L E N T • Increased diverse talent across professional pipeline and wage populations o Embracing talent from nearly all countries in which we operate Enable employees to • Investment in a career oriented, individually tailored development approach o Since 2014, consistently hired above availability for professional roles in the reach their full potential • Continued investment in talent through job rotations, training, and learning U.S. • 500,000 courses delivered in 2021 o Focus on identifying talent early and developing employees throughout their careers to reach their highest potential Develop future leaders• Vital given the complex and long-term nature of our business, focus on individualized development plans and targeted skills and capabilities o Supplemented with career advocacy and mentoring intended to build skills • Refreshed leadership training curriculum in support of “We are ExxonMobil” o Periodic assessment of how our talent programs affect proportionate diversity • Increased diversity among executives; women and U.S. minority representation up 35% throughout our talent pipeline since 2017 o Goal: meet or exceed availability within 5 years for executives Harness diversity• Not a stand-alone activity, embedded in our core values, our approach to how we develop o Significant progress in diverse representation talent, and the culture to which we aspire o Expanding wage diversity through partnerships with associations and local • Expanded career advocacy and mentoring programs, focusing organizational effort community and technical colleges 14 EXXONMOBIL

2021 ACCOMPLISHMENTS Sustained best-ever workforce safety and reliability performance 1 Achieved 2025 GHG emission–reduction plans in 2021 and established more aggressive plans for 2030 Established LCS business to commercialize portfolio of CCS, hydrogen, and biofuels opportunities Maintained capital discipline, progressed advantaged projects, and increased earnings capacity Completed key operational milestones in Guyana, Permian, and Corpus Christi Chemical Complex Grew high-value product sales of Chemical performance products and lubricants 15 EXXONMOBIL See Supplemental Information for footnotes and definitions

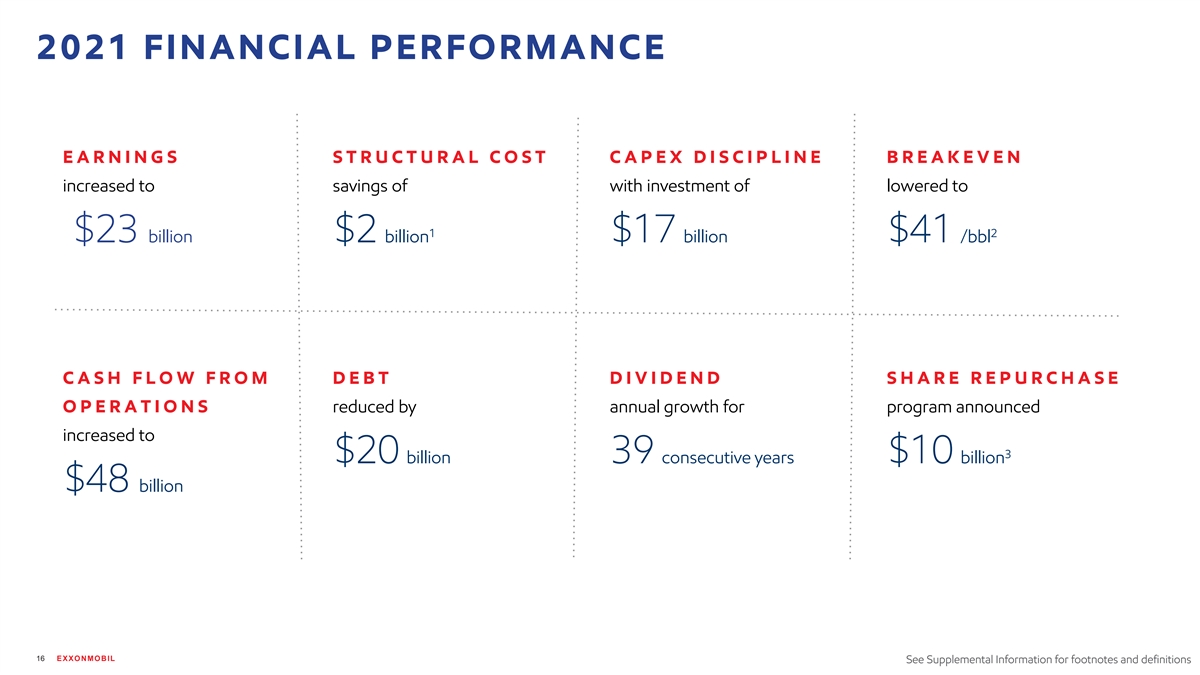

2021 FINANCIAL PERFORMANCE E A R N I N G S S T R U C T U R A L C O S T C A P E X D I S C I P L I N E B R E A K E V E N increased to savings of with investment of lowered to 1 2 $23 billion $2 billion $17 billion $41 /bbl C A S H F L O W F R O M D E B T D I V I D E N D S H A R E R E P U R C H A S E O P E R A T I O N S reduced by annual growth for program announced increased to 3 $20 billion 39 consecutive years $10 billion $48 billion 16 EXXONMOBIL See Supplemental Information for footnotes and definitions

BOARD RECOMMENDS VOTING FOR ITEMS 1-3 F O R I T E M 1 : E L E C T I O N O F 1 1 D I R E C T O R S o The Board refreshment process is led by the Board Affairs Committee, which incorporates the perspectives of external experts and shareholders. o The Committee seeks a diverse slate of experienced and highly qualified Board members who bring unique perspectives to deliberations and discussions. BOARD RECOMMENDS A VOTE FOR ITEMS 1-3 o Important director competencies include experience in risk management, global business leadership, finance, energy, industrial operations, science, technology, and research. Company proposals Proxy Statement page numbers F O R I T E M 2 : R A T I F I C A T I O N O F I N D E P E N D E N T A U D I T O R S o The ExxonMobil Audit Committee has appointed PricewaterhouseCoopers LLP (PwC) to Item 1 – Election of Directors pp. 9 - 33 audit ExxonMobil’s financial statements for 2022. o Our Board is seeking shareholders’ ratification of PwC’s appointment. Item 2 – Ratification of Independent Auditors pp. 35 F O R I T E M 3 : A D V I S O R Y “ S A Y O N P A Y ” V O T E Item 3 – Advisory vote to approve executive compensation pp. 36 - 68 o The compensation program is aligned with the Company’s business model and shareholder returns over the long term; o Delivers pay that is highly performance based and tied to company and individual performance; and o Enables the Compensation Committee to leverage its experience and judgment to deliver market competitive pay. 17 EXXONMOBIL

BOARD RECOMMENDS VOTING AGAINST ITEMS 4-10 A G A I N S T I T E M 4 : R E M O V E E X E C U T I V E P E R Q U I S I T E S o Executives participate in the same programs as other U.S. employees. o Our compensation and benefits programs are designed to support the Company’s core principles and business strategies and are market competitive for all employees. o The Company provides security for its employees, as appropriate, based on a risk BOARD RECOMMENDS A VOTE AGAINST ITEMS 4-10 assessment that includes consideration of the employee’s position and work location. o The Company does not consider security costs to be personal benefits since these costs arise from the nature of the employee’s occupation with the Company. Shareholder proposals Proxy Statement page numbers A G A I N S T I T E M 5 : L I M I T S H A R E H O L D E R R I G H T S F O R Item 4 – Remove Executive Perquisites pp. 69 - 70 P R O P O S A L S U B M I S S I O N o The Board respects the rights of shareholders to have their perspectives heard. Item 5 – Limit Shareholder Rights for Proposal Submission pp. 70 - 71 o The Board values input from shareholders and considers this input as it fulfills its commitment to thorough oversight of the Company’s plans to grow long-term shareholder value. o The Board provides several alternatives, including written correspondence and a portal for electronic communication at exxonmobil.com/directors, through which shareholders can communicate with the directors. 18 EXXONMOBIL

BOARD RECOMMENDS VOTING AGAINST ITEMS 4-10 A G A I N S T I T E M 6 : R E D U C E C O M P A N Y E M I S S I O N S A N D H Y D R O C A R B O N S A L E S o The Board supports the Company’s approach towards net-zero: 1. Measuring, monitoring, and managing reductions of the Company’s emissions. 2. Providing lower emissions-intensive products as the energy transition progresses that help our customers increasingly reduce their own emissions. BOARD RECOMMENDS A VOTE AGAINST ITEMS 4-10 3. Advancing commercialization of emissions-reduction, and emissions- sequestration technologies. o This is a more effective response to addressing the risks of climate change. Shareholder proposals Proxy Statement page numbers o Decreasing production today, without reductions in demand, would result in customers simply choosing other suppliers, which could have unintended consequences. Item 6 – Reduce Company Emissions and Hydrocarbon Sales pp. 71 - 73 o More details can be found on page 5 and page 6. Item 7 – Report on Low Carbon Business Planning pp. 73 - 75 A G A I N S T I T E M 7 : R E P O R T O N L O W C A R B O N B U S I N E S S P L A N N I N G o The information requested by the proposal is included in the ACS. o ExxonMobil’s strategy uses its advantages in scale, integration, technology, and talent to build globally competitive businesses that lead industry in earnings and cash flow growth across a broad range of scenarios. o The analysis disclosed in the ACS, which was reviewed by a respected third party, confirms that our strategy is resilient when tested against a range of Paris-aligned net- zero scenarios, including the IEA NZE scenario. o More details can be found on page 8. 19 EXXONMOBIL See Supplemental Information for definitions

BOARD RECOMMENDS VOTING AGAINST ITEMS 4-10 A G A I N S T I T E M 8 : R E P O R T O N S C E N A R I O A N A L Y S I S o The information requested by the proposal is included in the recently published Advancing Climate Solutions report that contains an analysis of the Company’s business and investment portfolio under the IEA NZE scenario. o Wood Mackenzie performed an independent quality assurance audit of ExxonMobil’s portfolio model. BOARD RECOMMENDS A VOTE AGAINST ITEMS 4-10 o More details can be found on page 8. Shareholder proposals Proxy Statement page numbers A G A I N S T I T E M 9 : R E P O R T O N P L A S T I C P R O D U C T I O N o The Company already provides information and disclosures on the Company’s Item 8 – Report on Scenario Analysis pp. 75 - 77 approach to plastics and plastic waste. o Plastics have superior performance and life cycle sustainability benefits vs. alternatives. Item 9 – Report on Plastic Production pp. 78 - 80 o We are taking action in response to plastic waste by enabling products that society can more easily recycle, advancing recycling technology for use in a broader array of products, and also supporting improvements in plastic waste recovery. o The Company also employs a comprehensive approach and established systems to manage the manufacture of plastics in an environmentally responsible way. o More details can be found on page 9. 20 EXXONMOBIL See Supplemental Information for definitions

BOARD RECOMMENDS VOTING AGAINST ITEMS 4-10 A G A I N S T I T E M 1 0 : R E P O R T O N P O L I T I C A L C O N T R I B U T I O N S o ExxonMobil is committed to full compliance with relevant laws and regulations, and publicly shares its policy on corporate political spending and its direct contributions to candidates, parties, and committees. o The Company believes disclosure requirements outlined by federal and state laws are BOARD RECOMMENDS A VOTE AGAINST ITEMS 4-10 both adequate and equitable, in that they require the same level of disclosure from all participants in the political process. o The political contributions of the Corporation, and the contributions of the political Shareholder proposals Proxy Statement page numbers action committees established by the Corporation, are reviewed with the Public Issues and Contributions Committee, and the Board, on multiple occasions annually. Item 10 – Report on Political Contributions pp. 80 - 81 o Requests for further disclosure requirements would be most appropriately addressed to the U.S. Congress, the Executive Branch, and state and local governments. 21 EXXONMOBIL

SUPPLEMENTAL INFORMATION D E F I N I T I O N S approx.: approximately MOU: memorandum of understanding ACS: Advancing Climate Solutions – 2022 Progress Report Mta: metric tonnes per annum ASM: annual shareholders meeting NEO: Named Executive Officers CCS: carbon capture and storage TDC: total direct compensation CFD: cubic feet per day WBZRF: World Bank Zero Routine Flaring by 2030 CO₂e: carbon dioxide equivalent ESG: Environmental, Social, Governance EV: electric vehicle GHG: greenhouse gas IEA: International Energy Agency IEA NZE: International Energy Agency Net Zero Emissions by 2050 kmt: thousand metric tons LEF: lower-emission fuels LCS: Low Carbon Solutions LCA: Life Cycle Assessment 23 EXXONMOBIL

SUPPLEMENTAL INFORMATION F O O T N O T E S Page 06 (REDUCING GHG EMISSIONS WHILE MEETING SOCIETY’S ESSENTIAL NEEDS) Page 03 (HIGHLIGHTS) 1. ExxonMobil’s proprietary portfolio life-cycle model estimates elements of Scope 1, 2, and 3 GHG emissions for 1. Scope 1 and 2 GHG emissions from ExxonMobil operated assets. ExxonMobil’s Upstream, Downstream, and Chemicals businesses. The estimated figures are based on projected 2021 2. Applies to Scope 1 and 2 GHG emissions from ExxonMobil unconventional operated assets. plan volumes for 2030. 3. 2021 Breakeven based on cash flow from operations and asset sales, excluding working capital, with actual 2021 2. See ExxonMobil’s Advancing Climate Solutions 2022 Progress Report, page 9 Downstream and Chemical margins and gas prices adjusted to average levels. Dividends to shareholders and 3. The decrease in absolute emissions and emissions intensity is a result of continued improvement in greenhouse gas additions to PP&E, net investments and advances, and other financing items are subtracted. The PP&E / I&A performance of existing operations, optimization of the asset portfolio and product mix, with a growth in LNG, chemical factor includes changes in non-controlling interests and dividends to minority interests. The remainder is divided products, lubricants, and lower-emissions fuels that help customers reduce their emissions. by an assumption of a $475 million change in after-tax earnings for every $1/bbl change in oil price and (note 5.1 below) 4. The Company modeled the greenhouse gas benefit of substituting unabated LNG for unabated coal for subtracted from 2021 Brent price to estimate the 2021 breakeven. Average Downstream and Chemical margins generating power in a market such as India. The analysis concluded that more than 100 million metric tons of greenhouse reflect annual historical averages for the 10-year period from 2010—2019. We assume $3/mmbtu Henry Hub gas gas emissions per year could be avoided if all of ExxonMobil’s projected 2030 LNG production displaced coal in power prices for adjustment. generation. Similar benefits can also be expected in other industry sectors utilizing coal. 4. To be executed over 12—24 months beginning in 2022. 4.1 The modeled figures are estimates and assume that 100% EM LNG volumes displace unabated coal for power generation. For GHG avoided emissions, the life-cycle GHG benefit basis from Mallapragada et al. 2018 (https:// pubs.acs.org/doi/10.1021/acs.est.8b04539) was used. Page 05 (DRIVING TOWARD A NET-ZERO FUTURE) 5. Carbon Dioxide Emissions from Energy Consumption by Source (from EIA Monthly Energy Review Section 11) https:// 1. The IPCC Global Warming of 1.5ºC special report states that in model pathways with no or limited overshoot of www.eia.gov/totalenergy/data/browser/index.php?tbl=T11.01#/?f=A&start=1973&end=2020&charted=14. 1.5°C, global net anthropogenic CO₂ emissions reach net zero around 2050, and for limiting global warming to 6. Calculation based on projected 2021 plan volumes for 2030 and specific estimated fuel CI by project from Argonne below 2°C (with at least 66% probability of likelihood) CO₂ emissions are projected to reach net zero around 2070. National Labs’ GREET model analysis as compared against its conventional fuel alternate. The Hypothetical 1.5°C Pathway and Hypothetical 2°C Pathway are derived from the 2050 and 2070 net zero end points, respectively, using a linear relationship from societal greenhouse gas emissions in 2019 as the starting point. 2. ExxonMobil uses the Hypothetical 1.5°C and 2°C pathways to illustrate the Company’s expected operated Scope 1 and 2 emissions performance relative to the Paris Agreement goal of “limiting global temperature increase to well below 2 degrees Celsius and the pursuit of limiting the increase to 1.5 degrees. (Article 2, Paris Agreement). Global CO₂ emissions used to calculate society’s relative emissions to 2016 are taken from the Global Carbon Budget 2020 (Friedlingstein et al (2020), https://doi.org/10.5194/essd-12-3269-2020, and include energy-related and cement processing CO₂ emissions. ExxonMobil’s plans regarding expected GHG emissions reductions by 2030 can be found at https://corporate.exxonmobil.com/News/Newsroom/News-releases/2021/1201_ExxonMobil- announces-plans-to-2027-doubling-earnings-and-cash-flow-potentialreducing-emissions. 24 EXXONMOBIL

SUPPLEMENTAL INFORMATION F O O T N O T E S Page 06, continued (REDUCING GHG EMISSIONS WHILE MEETING SOCIETY’S ESSENTIAL NEEDS) (note 8.1 below) 12. Based on ExxonMobil analysis when compared to conventional mineral oils. 7. In the chemical sector, a study concluded that plastic packaging in the United States helped society 13. ExxonMobil analysis using Argonne National Labs’ GREET tools and published fuel carbon intensity from California LCFS avoid life-cycle greenhouse gas emissions versus turning to alternatives as a group. In terms of 2030 ExxonMobil (note 8.2 below) regulations. volumes into U.S. plastic packaging, that calculation would equate to approximately 13 million metric 14. Based on ExxonMobil analysis versus conventional fuel oil. tons per year of U.S. enabled avoided emissions. If applied globally, our plastics could enable approximately 40 (note 8.3 below) 15. Based on ExxonMobil analysis; performance profile at https://www.mobil.com/en-us/industrial/pds/gl-xx-mobil-dte-10- million metric tons per year of avoided emissions . excel-series. 7.1 April 2018 report of Franklin Associates on Life Cycle Impacts of Plastic Packaging Compared to 16. Based on ExxonMobil analysis; performance profile at https://www.mobil.com/en-us/industrial/pds/gl-xx-mobil-shc- Substitutes (April 2018 Franklin Associates Report); alternatives include steel, aluminum, glass, paper-based 600-series. packaging, fiber-based textiles, and wood (Table 4-14). Source: 17. Mobil SHCTM Gear WT helps reduce oil consumption and maintenance costs through extended oil life and drain https://www.americanchemistry.com/content/download/7885/file/Life-Cycle-Impacts-of-Plastic-Packaging- intervals. Based on ExxonMobil analysis; performance profile at https://www.mobil.com/en-us/industrial/pds/gl-xx- Compared-to-Substitutes-in-the-United-States-and-Canada.pdf. mobil-shc-gear-320-wt. 7.2 Calculation of 13 million metric tons based on: April 2018 Franklin Associates Report, 4.7 metric tons of enabled avoided emissions per metric ton of resin used in plastic packaging derived from April 2018 Franklin Associates Report (Table 2-2 and Table 4-14), ExxonMobil’s sales volumes into U.S. packaging applications, Page 07 (POSITIONING FOR A LOWER-EMISSIONS FUTURE) and U.S. growth of plastic packaging to 2030 using third-party forecast for polyethylene (IHS Markit report, 1. Potential market size figures: ExxonMobil analysis of Integrated Assessment Modeling Consortium (IAMC) 1.5 scenario 2022 Edition: Fall 2021 update, U.S., 2019- 2030) as a proxy. explorer and data on Lower 2°C scenarios for CO2, wind, solar, H2, nuclear, biofuels, and fuels. Volumes and prices in 7.3 Calculation of 40 million metric tons based on: April 2018 Franklin Associates Report, 4.7 metric tons of 2050 in the Lower 2°C scenarios were used, where available, to calculate an estimate of the market revenue. For CCS, enabled avoided emissions per metric ton of resin used in plastic packaging derived from April 2018 Franklin estimate assumes capture from fossil sources only (~80%). For H2, the highest and lowest outliers for market revenue in Associates Report (Table 2-2 and Table 4-14), ExxonMobil’s sales volumes into packaging applications the Lower 2°C scenarios were excluded. For Chemicals, ExxonMobil analysis of current market data from Statista 2020 globally, and global growth of plastic packaging to 2030 using third-party forecast for polyethylene (IHS Report on Chemical Industry Worldwide, and the IEA Sustainable Development Scenario data for petrochemical Markit report, 2022 Edition: Fall 2021 update, global) as a proxy. Actual market conditions vary by region and feedstock growth to 2050. over time. 2. ExxonMobil analysis of EPA Facility Level Information on Greenhouse Gases Tool, 2019 data as of Feb 15, 2022. High 8. Per April 2018 report of Franklin Associates; U.S.; Max Decomp.; Figure 4-1; Impacts as defined in Chapter 4.7: concentration includes natural gas processing, ammonia manufacturing, and ethanol production. Global Warming Potential (GWP) results, and indexed to the alternatives as a group (including steel; aluminum; glass; paper-based packaging; fiber-based textiles; and wood). Source: https://www.americanchemistry.com/ content/download/7885/file/Life-Cycle-Impacts-of-Plastic-Packaging-Compared-to-Substitutes-in-the-United- States-and-Canada.pdf. 9. Based on performance of specific ExxonMobil Exceed™ XP grades versus conventional polyethylene in flexible packaging applications. 10. Certifications through the International Sustainability and Carbon Certification PLUS (ISCC PLUS) process. 11. Department of Energy statements at https://www.energy.gov/eere/vehicles/lightweight-materials-cars-and- trucks. 25 EXXONMOBIL

SUPPLEMENTAL INFORMATION F O O T N O T E S Page 12 (INDEPENDENT AND DIVERSE BOARD) Page 08 (RESILIENT UNDER NET-ZERO PATHWAYS; IEA NZE SCENARIO ANALYSIS) 1. K.C. Frazier serves as Lead Director and is expected to remain in the position through the ASM. The Board 1. Modeling assumptions include: (1) current prices for Brent and Henry Hub decline to conform with IEA NZE published prices selected J.L. Hooley to serve as Lead Director effective May 26, 2022. by 2025 and the price path is linear between IEA NZE published prices by decade thereafter, (2) chemicals margins decline 2. Independent Director tenure / average tenure as of April 1, 2022. over time partially offset by inflation, (3) refining margins decline consistent with the change in oil demand under IEA NZE, (4) Low Carbon Solutions investments attract reasonable returns based on historical Company averages for similar business lines and products, (5) market position as a percentage of demand under IEA NZE for current business (Upstream, F&L, Page 13 (EXECUTIVE COMPENSATION) Chemicals) and new products (biofuels, hydrogen, and carbon capture and storage) is in line with the Company’s current 1. Total Direct Compensation, Realized Pay, and Unrealized Pay are defined in the Frequently Used Terms on market positions in existing businesses, (6) investment to abate estimated GHG emissions from remaining Upstream, F&L, page 58 of the 2022 Proxy Statement. The Frequently Used Terms also identify the compensation benchmark and Chemicals businesses by 2050, (7) annual inflation of 2.5%, (8) total capital expenditures held approximately constant companies. For consistency, CEO compensation versus compensation benchmark companies as discussed on near 2020 trailing 5-year average through 2050. The statements and figures contained in this section are hypothetical in pages 39 and 51 of the 2022 Proxy Statement is based on compensation as disclosed in the Summary nature, and do not constitute a forecast of future Company performance. Compensation Table of the proxy statements as of July 31, 2021. Benchmark company data for 2021 not available at time of publication. Page 15 (2021 ACCOMPLISHMENTS) 1. 2025 emissions reductions plans announced in December 2020 included a 15 to 20 percent reduction in greenhouse gas intensity for upstream operations compared to 2016 levels. This was supported by a 40 to 50 percent reduction in corporate methane intensity, and a 35-45 percent reduction in corporate flaring intensity. Plans covered Scope 1 and Scope 2 emissions for assets operated by the company. Emission reduction plans announced in December 2021 include a 20 to 30 percent reduction in corporate greenhouse gas intensity by 2030 compared to 2016 levels. This will be supported by a 40 to 50 percent reduction in upstream greenhouse gas intensity, a 70 to 80 percent reduction in methane intensity, and a 60 to 70 percent reduction in flaring intensity compared to 2016. The 2030 emission reduction plans are expected to reduce absolute greenhouse gas emissions of the Corporation by approximately 20 percent. Plans cover Scope 1 and Scope 2 emissions for asset operated by the company, consistent with approved corporate plans. Page 09 (PLASTICS AND THE CIRCULAR ECONOMY) Page 16 (2021 FINANCIAL PERFORMANCE) 1. Per April 2018 report of Franklin Associates; U.S.; Max Decomp.; Figure 4-1; Impacts as defined in Chapter 4.7: Global 1. Versus 2020. Warming Potential (GWP) results, and indexed to the alternatives as a group (including steel; aluminum; glass; paper-based 2. 2021 Breakeven based on cash flow from operations and asset sales, excluding working capital, with actual packaging; fiber-based textiles; and wood). Source: https://www.americanchemistry.com/content/download/7885/ 2021 Downstream and Chemical margins and gas prices adjusted to average levels. Dividends to shareholders file/Life-CycleImpacts-of-Plastic-Packaging-Comparedto-Substitutes-in-the-United-States-andCanada.pdf. and additions to PP&E, net investments and advances, and other financing items are subtracted. The PP&E / 2. The benefits of plastics are compelling and help make modern life possible. In any emergency room, kitchen, daycare I&A factor includes changes in non-controlling interests and dividends to minority interests. The remainder is center, shopping center, data center, or mode of transportation, there are abundant examples of life-enhancing plastic divided by an assumption of a $475 million change in after-tax earnings for every $1/bbl change in oil price products. Medical equipment, hygienic products, building materials, mobile phones, computers, monitors, appliances, and subtracted from 2021 Brent price to estimate the 2021 breakeven. Average Downstream and Chemical packaging, clothes, protective sporting gear, and many other applications provide countless benefits. Plastics even played a margins reflect annual historical averages for the 10-year period from 2010—2019. We assume $3/mmbtu vital role in the pandemic response. For example, vaccines are delivered in disposable plastic syringes and ventilators and Henry Hub gas prices for adjustment. other medical equipment are made of plastic. Health care workers also depend on personal protective equipment made 3. To be executed over 12—24 months beginning in 2022. from hygienic, durable, and reliable plastics. 26 EXXONMOBIL

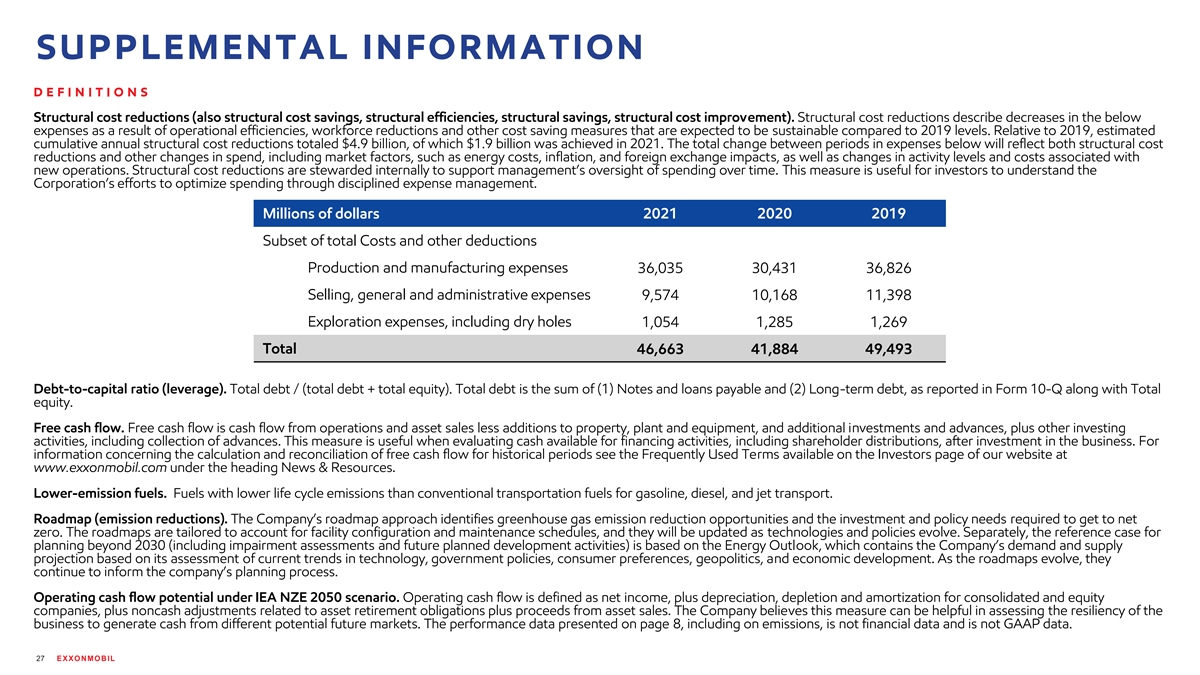

SUPPLEMENTAL INFORMATION D E F I N I T I O N S Structural cost reductions (also structural cost savings, structural efficiencies, structural savings, structural cost improvement). Structural cost reductions describe decreases in the below expenses as a result of operational efficiencies, workforce reductions and other cost saving measures that are expected to be sustainable compared to 2019 levels. Relative to 2019, estimated cumulative annual structural cost reductions totaled $4.9 billion, of which $1.9 billion was achieved in 2021. The total change between periods in expenses below will reflect both structural cost reductions and other changes in spend, including market factors, such as energy costs, inflation, and foreign exchange impacts, as well as changes in activity levels and costs associated with new operations. Structural cost reductions are stewarded internally to support management’s oversight of spending over time. This measure is useful for investors to understand the Corporation’s efforts to optimize spending through disciplined expense management. Millions of dollars 2021 2020 2019 Subset of total Costs and other deductions Production and manufacturing expenses 36,035 30,431 36,826 Selling, general and administrative expenses 9,574 10,168 11,398 Exploration expenses, including dry holes 1,054 1,285 1,269 Total 46,663 41,884 49,493 Debt-to-capital ratio (leverage). Total debt / (total debt + total equity). Total debt is the sum of (1) Notes and loans payable and (2) Long-term debt, as reported in Form 10-Q along with Total equity. Free cash flow. Free cash flow is cash flow from operations and asset sales less additions to property, plant and equipment, and additional investments and advances, plus other investing activities, including collection of advances. This measure is useful when evaluating cash available for financing activities, including shareholder distributions, after investment in the business. For information concerning the calculation and reconciliation of free cash flow for historical periods see the Frequently Used Terms available on the Investors page of our website at www.exxonmobil.com under the heading News & Resources. Lower-emission fuels. Fuels with lower life cycle emissions than conventional transportation fuels for gasoline, diesel, and jet transport. Roadmap (emission reductions). The Company’s roadmap approach identifies greenhouse gas emission reduction opportunities and the investment and policy needs required to get to net zero. The roadmaps are tailored to account for facility configuration and maintenance schedules, and they will be updated as technologies and policies evolve. Separately, the reference case for planning beyond 2030 (including impairment assessments and future planned development activities) is based on the Energy Outlook, which contains the Company’s demand and supply projection based on its assessment of current trends in technology, government policies, consumer preferences, geopolitics, and economic development. As the roadmaps evolve, they continue to inform the company’s planning process. Operating cash flow potential under IEA NZE 2050 scenario. Operating cash flow is defined as net income, plus depreciation, depletion and amortization for consolidated and equity companies, plus noncash adjustments related to asset retirement obligations plus proceeds from asset sales. The Company believes this measure can be helpful in assessing the resiliency of the business to generate cash from different potential future markets. The performance data presented on page 8, including on emissions, is not financial data and is not GAAP data. 27 EXXONMOBIL

SUPPLEMENTAL INFORMATION C A U T I O N A R Y S T A T E M E N T Outlooks; projections; plans; ambitions; estimates; and descriptions of strategic plans and objectives are forward-looking statements. Similarly, emission-reduction roadmaps are dependent on future market factors, such as continued technological progress and policy support, and also represent forward-looking statements. Actual future results from our capital plans, lower-emissions spending and structural cost reductions efforts; ambitions to reach Scope 1 and Scope 2 net zero from operated assets by 2050, to reach Scope 1 and 2 net zero in Upstream Permian Basin operated assets by 2030, to eliminate routine flaring in-line with World Bank Zero Routine Flaring, to reduce methane emissions, to meet ExxonMobil’s emission reduction plans, divestment and start-up plans, and associated project plans as well as technology efforts; success in or development of future business markets like carbon capture, hydrogen or biofuels could differ materially due to a number of factors. These include the evolution of the energy market compared to our investments in current and future potential markets; the ability to bring new technologies to commercial scale on a cost-competitive basis, including carbon capture projects, biofuel projects and hydrogen projects; policy and consumer support for lower-emissions products and technologies in different jurisdictions; regulatory actions targeting public companies in the oil and gas industry; changes in law, taxes, regulation, or policies, including environmental regulations, political sanctions, and international treaties; the timely granting or freeze, suspension or revocation of government permits; regional differences in product concentration and demand; the severity, length and ultimate impact of future pandemics and government responses on people and economies; war, trade agreements, shipping blockades or harassment and other political or security concerns; feasibility and timing for regulatory approval of potential investments or divestments; the capture of efficiencies between business lines; unexpected technological developments; general economic conditions, including the occurrence and duration of economic recessions; unforeseen technical or operating difficulties; and other factors discussed here, in Item 1A. Risk Factors in our Form 10-K for the year ended December 31, 2021 and under the heading Factors Affecting Future Results on the Investors page of our website at www.exxonmobil.com under the heading News & Resources. The forward-looking statements and dates used in this presentation are based on management’s good faith plans and objectives as of the date of this presentation, unless otherwise stated. We assume no duty to update these statements as of any future date and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of these figures as of any future date. Any future update of these figures will be provided only through a public disclosure indicating that fact. This presentation includes a number of third party scenarios such as the IPCC 74 Lower 2°C scenarios, made available through the IPCC SR 1.5 scenario explorer data, and the IEA’s Net Zero Emissions by 2050 Scenario. These third party scenarios reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use and inclusion herein is not an endorsement by ExxonMobil of their likelihood or probability. The analysis done by ExxonMobil on the IPCC Lower 2°C scenarios and the IEA NZE 2050 scenario and the representation thereof aims to reflect the average or trends across a wide range of pathways. Where data was not or insufficiently available, further analysis was done to enable a more granular view on trends within these scenarios. Forward-looking statements contained in this presentation regarding the potential for future earnings and cash flows, emission reduction efforts, dividends, and volumes, including statements regarding future cash flow potential and returns under third-party net-zero scenarios, are not forecasts of actual future results. The statements and analysis in this presentation under third-party net-zero scenarios represent a good faith effort by the Company to address these hypotheticals despite significant unknown variables and, at times, inconsistent market and government policy signals. Energy demand modeling aims to replicate system dynamics of the global energy system, requiring simplifications. The reference to any scenario, including any potential net zero scenario, does not imply ExxonMobil views any particular scenario as likely to occur. In addition, energy demand scenarios require assumptions on a variety of parameters. As such, the outcome of any given scenario using an energy demand model comes with a high degree of uncertainty. For example, the IEA describes its NZE scenario as extremely challenging, requiring unprecedented innovation, unprecedented international cooperation and sustained support and participation from consumers. Third-party scenarios discussed in this presentation reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use or inclusion herein is not an endorsement by ExxonMobil of their underlying assumptions, likelihood or probability. Investment decisions are made on the basis of ExxonMobil’s separate planning process, but may be secondarily tested for robustness or resiliency against different assumptions, including against various scenarios. Any use of the modeling of a third-party organization within this document does not constitute or imply an endorsement by ExxonMobil of any or all of the positions or activities of such organization. Actions needed to advance the Company’s 2030 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually. The reference case for planning beyond 2030 is based on the Company’s Energy Outlook research and publication, which contains the Company’s demand and supply projection based on its assessment of current trends in technology, government policies, consumer preferences, geopolitics, and economic development. Reflective of the existing global policy environment, the Energy Outlook does not project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the Outlook, and the Company’s business plans will be updated accordingly. ExxonMobil reported emissions, including reductions and avoidance performance data, are based on a combination of measured and estimated data. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and IPIECA. The uncertainty associated with the emissions, reductions and avoidance performance data depends on variation in the processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Changes to the performance data may be reported as updated data and/or emission methodologies become available. ExxonMobil works with industry, including API and IPIECA, to improve emission factors and methodologies, including measurements and estimates. 28 EXXONMOBIL