Frequently Used Terms

Please also

read the footnotes on page 36 for additional definitions of terms we use and other important information.

Performance Share Program is the terminology used to

describe our equity program to better reflect the strong connection between performance and pay.

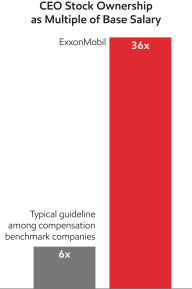

Compensation Benchmark Companies consist of AT&T, Boeing,

Chevron, Ford, General Electric, General Motors, IBM, Johnson & Johnson, Pfizer, Procter & Gamble, United Technologies, and Verizon. For consistency, CEO compensation on page 33, in charts 3 and 4, is based on compensation as disclosed in

the Summary Compensation Table of the proxy statements as of July 31, 2017.

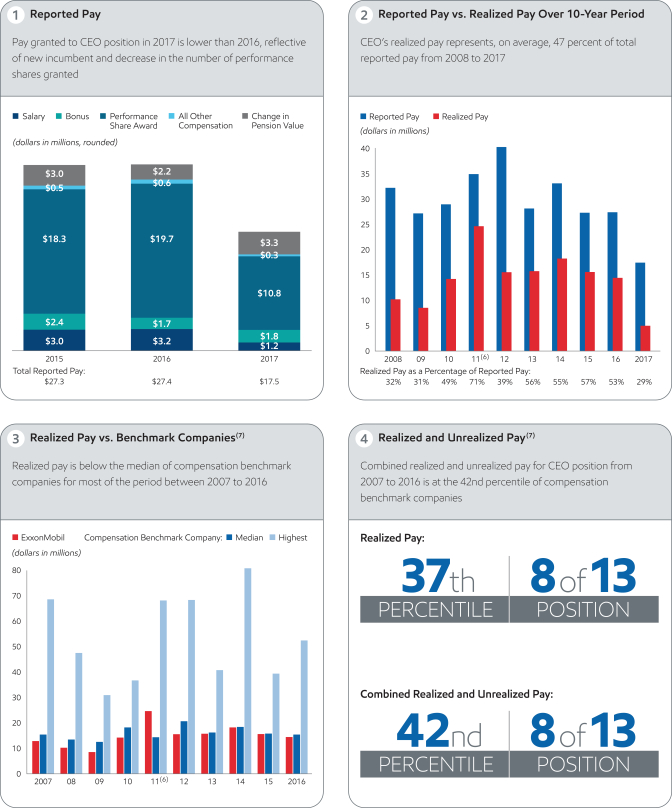

Reported Pay is Total Compensation reported in the Summary Compensation Table,

except for 2008, where the grant date value of restricted stock as provided under current SEC rules is used to put all years of compensation on the same basis.

Realized Pay is compensation actually received by the CEO during the year, including salary, current bonus, payouts of previously granted earnings bonus units

(EBUs), net spread on stock option exercises, market value at vesting of previously granted stock-based awards, and All Other Compensation amounts realized during the year. It excludes unvested grants, change in pension value, and other amounts that

will not actually be received until a future date. Amounts for compensation benchmark companies include salary, bonus, payouts of non-equity incentive plan compensation, and All Other Compensation as reported in the Summary Compensation Table, plus

value realized on option exercise or stock vesting as reported in the Option Exercises and Stock Vested table. It excludes unvested grants, change in pension value, and other amounts that will not actually be received until a future date, as well as

any retirement-related payouts from pension or nonqualified compensation plans.

Unrealized Pay is calculated on a different basis than the grant date fair

value of awards used in the Summary Compensation Table. Unrealized Pay includes the value based on each compensation benchmark company’s closing stock price at fiscal year-end 2016 of unvested restricted stock awards; unvested long-term share-

and cash performance awards, valued at target levels; and the “in the money” value of unexercised stock options (both vested and unvested). If a CEO retired during the period, outstanding equity is included assuming that unvested awards,

as of the retirement date, continued to vest pursuant to the original terms of the award.

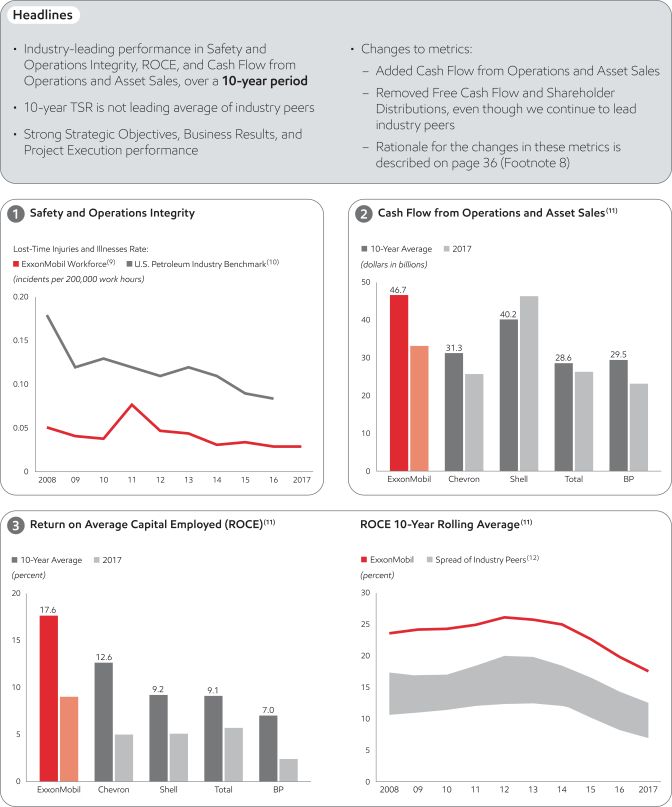

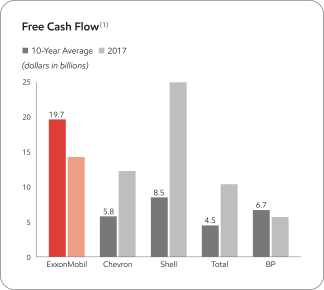

Cash Flow from Operations and Asset Sales is the sum of the net cash

provided by operating activities and proceeds associated with sales of subsidiaries, property, plant and equipment, and sales and returns of investments from the Summary Statement of Cash Flows. For additional information, see page 37 of the

Summary Annual Report included with the Corporation’s 2018 Proxy Statement.

Return on Average Capital Employed (ROCE) for the Corporation is net

income attributable to ExxonMobil excluding the after-tax cost of financing, divided by total corporate average capital employed. For this purpose, capital employed means the Corporation’s net share of property, plant and equipment, and other

assets less liabilities, excluding both short-term and long-term debt. For additional information, see pages 36 and 37 of the Summary Annual Report included with the Corporation’s 2018 Proxy Statement.

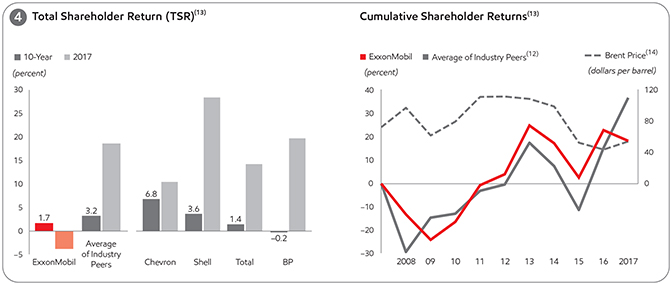

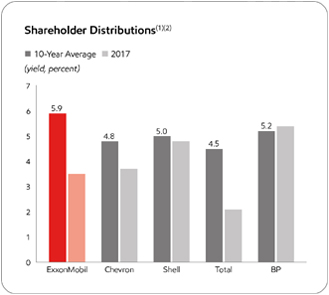

Total Shareholder Return (TSR) measures the change in value of an investment in stock over a specified period of time, assuming dividend reinvestment. TSR is

subject to many different variables, including factors beyond the control of management. For additional information, see page 36 of the Summary Annual Report included with the Corporation’s 2018 Proxy Statement.

Statements regarding future events or conditions are forward-looking statements. Actual future results, including project plans, schedules, and results,

as well as the impact of compensation incentives, could differ materially due to changes in oil and gas prices and other factors affecting our industry, technical or operating conditions, and other factors described in Item 1A Risk Factors in our

most recent Form 10-K. References to oil-equivalent barrels and other quantities of oil and gas herein include amounts not yet classified as proved reserves under SEC rules, but which are expected to be ultimately moved into the proved category and

produced in the future.

The term “project” can refer to a variety of different activities and does not necessarily have the same meaning as in any

government payment transparency reports.

|

|

|

|

|

|

|

| 2018 Proxy Statement |

|

|

|

37 |

|

|

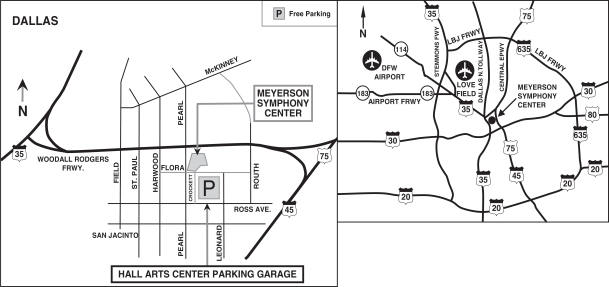

Audio Webcast of the Annual Meeting

Audio Webcast of the Annual Meeting