Exhibit 99.2

| Exhibit 99.2

|

2017

Analyst meeting

New York Stock Exchange

March 1, 2017

ExxonMobil

|

|

Cautionary statement

Forward-looking statements

Outlooks, projections, estimates, targets, business plans, and other statements of future events or conditions in this presentation or the subsequent discussion period are forward-looking statements. Actual future results, including financial and operating performance; demand growth and energy mix; ExxonMobil’s production growth and mix; the amount and mix of capital expenditures; future distributions; reserve and resource additions and recoveries; project plans, timing, costs, and capacities; efficiency gains; cost savings; integration benefits; product sales and mix; production rates; and the impact of technology could differ materially due to a number of factors. These include changes in oil or gas prices or other market conditions affecting the oil, gas, and petrochemical industries; reservoir performance; timely completion of development projects; war and other political or security disturbances; changes in law or government regulation, including environmental regulations and political sanctions; the outcome of commercial negotiations; the actions of competitors and customers; unexpected technological developments; general economic conditions, including the occurrence and duration of economic recessions; unforeseen technical difficulties; and other factors discussed here and under the heading “Factors Affecting Future Results” in the Investors section of our website at exxonmobil.com.

See also Item 1A of ExxonMobil’s 2016 Form 10-K. Forward-looking statements are based on management’s knowledge and reasonable expectations on the date hereof, and we assume no duty to update these statements as of any future date.

Frequently used terms

References to resources, resource base, recoverable resources, and similar terms include quantities of oil and gas that are not yet classified as proved reserves but that we believe will likely be moved into the proved reserves category and produced in the future. “Proved reserves” in this presentation are presented using the SEC pricing basis in effect for the year presented, except that for years prior to 2009, proved reserves were determined using the price and cost assumptions we used in managing the business, not historical prices used in SEC definitions; oil sands and equity company reserves are included for all periods. For definitions of, and information regarding, reserves, return on average capital employed, cash flow from operations and asset sales, free cash flow, and other terms used in this presentation, including information required by SEC Regulation G, see the “Reference materials” included with this presentation and “Frequently Used Terms” posted on the Investors section of our website. The Financial and Operating Review on our website also shows ExxonMobil’s net interest in specific projects. As used in this presentation, “rate of return”, “cash flow returns”, and “return(s)” (unless referring to ROCE) mean discounted cash flow returns based on current company estimates.

The term “project” as used in this presentation can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

2 Welcome

|

|

9:45 Welcome

ExxonMobil investment case

Investment plans

Upstream: Maximizing portfolio value

Downstream & Chemical: Building on strength

Closing

11:00 Break

11:30 Q&A

12:30 Meeting concludes

Agenda

|

|

ExxonMobil investment case

|

|

Positioned for success in any environment

Robust strategy in a dynamic market

Today’s market long on supply

Growing demand

Dynamic markets, expect continued volatility

Plans robust for any price environment

Brent

$/Barrel

150

100

50

0

‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17

Source: Bloomberg.

5 ExxonMobil investment case

|

|

Three world-class business

Competitively advantaged in the fundamentals

Demonstrated operational excellence

Disciplined investment

Application of high-impact technology

Exceptional project execution

Sustained industry-leading performance

6 ExxonMobil investment case

|

|

Competitively positioned across the value chain

Unique industry advantage

Mitigates sector risk

Flexibility to capture new opportunities

Integration adds synergies and optionality

Maximizes value in dynamic markets

Strategic investments guided by insights

Upstream

Research & Technology Exploration & Development Production

Downstream

Research & Technology Refining Fuels, Lubricants, & Specialties

Chemical

Research & Technology Liquids Polymers

7 ExxonMobil investment case

|

|

Capturing the value of integration

Significant opportunities from wellhead to customer

Growing U.S. unconventional production

Investing in advantaged logistics and manufacturing

Advantaged feedstock, high-value sales

Optionality to maximize value

Europe

Asia South America

8 ExxonMobil investment case

|

|

Capturing the value of integration

Significant opportunities from wellhead to customer

Growing U.S. unconventional production

Investing in advantaged logistics and manufacturing

Advantaged feedstock, high-value sales

Optionality to maximize value

9 ExxonMobil investment case

|

|

Capturing synergies and shared capabilities

Sharing skills, knowledge, and experience across segments

Leveraging capabilities throughout businesses

Value-driven deployment of people

Organizational efficiency driving substantial productivity gains

Effective cost management, $13B reduction since 20111

Workforce Consolidated company cash opex1

Thousands $B

110 70

90

50

70 27% 23%

Reduction compared to YE2011

Reduction compared to YE2011

50 30

‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16

1 Reconciliation in reference material.

10 ExxonMobil investment case

|

|

Improving profitability with technology

Developing and applying unique technology to create value

cMIST in-line gas separation

Relative weight

1

0

Conventional cMIST

Patented compact, in-line gas separation

For use in remote onshore, offshore, and subsea gas developments

Up to 25% cost savings on gas treating

High manganese steels

Relative service life

4

2

0

X70 steel High Manganese Steel

Family of steels with increased erosion resistance

Broad potential applications

Significant savings for slurry pipelines at Kearl

11 ExxonMobil investment case

|

|

Addressing the risks of climate change

Responsibly managing our business and contributing to solutions

Invested nearly $7B since 2000 on initiatives to reduce emissions

Mitigating impact from our operations; reduced over 8M metric tons of GHG emissions1

Developing products to help consumers reduce their emissions

Leader in carbon capture and storage

Progressing lower-carbon technologies

Constructively engaging on policy

1 Since 2011; net equity CO2-equivalent emissions from flare and vent reduction, energy efficiency, and co-generation.

12 ExxonMobil investment case

|

|

Unparalleled financial strength

Capacity to execute business strategies, invest through the cycle

Strong balance sheet provides unique capacity

2016 cash from operations of $22B

Continuing focus on portfolio management delivers value

Flexible capex program in low-price environment

Only integrated major with positive free cash flow

1 Moody’s and Standard & Poor’s credit ratings as of 01/31/17, financial data as of 12/31/2016. Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

- Total Capitalization is defined as: “Net Debt + Market Capitalization”

- Leverage is defined as: “Net Debt / (Net Debt + Market Capitalization)”

Total capitalization, leverage, and credit rating1

$B

Total Capitalization

500

ExxonMobil

Aaa / AA+

400

300

Shell

Aa2 / A

Chevron

Aa2 / AA-

200

Total

Aa3 / A+

BP

A2 / A-

100

5% 10% 15% 20% 25% 30%

Leverage

13 ExxonMobil investment case

|

|

Unparalleled financial strength

Capacity to execute business strategies, invest through the cycle

Strong balance sheet provides unique capacity

2016 cash from operations of $22B

Continuing focus on portfolio management delivers value

Flexible capex program in low-price environment

Only integrated major with positive free cash flow

1 Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

2016 cash flow1

$B

50

40

30

20

10

0

XOM

CVX

RDS

TOT

BP

$B Free cash flow:

9.7

(4.5)

(10.6)

(1.1)

(4.1)

Cash flow from operations

PPE adds / investments and advances

Asset sales

Shareholder distributions

Other

Other

14 ExxonMobil investment case

|

|

Disciplined investments in advantaged assets

Long-term focus on rigorous capital allocation

Focused on development of advantaged projects

Investments robust to range of market dynamics

Consistently outperform peers over long-term

| Return on average capital employed1 |

||

| Percent |

||

| 25 |

‘07 to ‘16, average | |

| ‘12 to ‘16, average | ||

| 20 |

2016 | |

| 15 |

||

| 10 |

||

| 5 |

||

| 0 |

||

| -5 |

||

| XOM CVX RDS TOT BP |

1 Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

15 ExxonMobil investment case

|

|

Sharing success with shareholders

34 consecutive years of per-share dividend growth

Annual dividend up 8.8% per year over the last 10 years

2016 dividends $2.98 per share, up 3.5%

Flexible share purchase program

Nearly $370B returned to shareholders since the merger of Exxon and Mobil1

| Annual dividend growth rate |

||

| Percent |

||

| 12 |

‘07 to‘16 | |

| ‘12 to‘16 | ||

| 2016 | ||

| 8 |

||

| 4 |

||

| 0 |

0 0 0 | |

| S&P |

XOM CVX RDS TOT2 BP |

1 Includes dividends and share purchases to reduce shares outstanding.

2 TOT’s growth rates based on dividends in Euros; 2015 Dividend adjusted for timing impacts from implementation of scrip dividend program.

Source: Bloomberg.

16 ExxonMobil investment case

|

|

Investment plans

Growing value through strategic choices

|

|

Capital discipline focused on creating value

Broad portfolio of opportunities

Managed 2016 capex to $19B

Flexible 2017 capex plan of $22B

Selectively advancing investment program

Continued emphasis on project execution and capital efficiency

| Capex by business line1 |

||

| $B |

||

| Chemical | ||

| Downstream | ||

| 30 |

Upstream | |

| 20 |

||

| 10 |

||

| 0 |

||

| ‘15 |

‘16 ‘17 ‘18 - ‘20 | |

| Average |

1 Capex does not include equity issued as part of acquisitions.

18 Investment plans

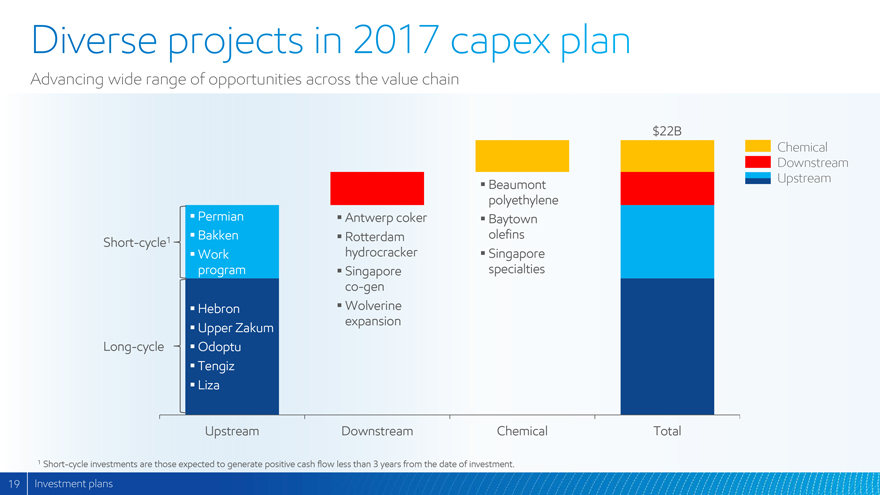

Diverse projects in 2017 capex plan

Advancing wide range of opportunities across the value chain

Short-cycle1

Permian

Bakken

Work program

Long-cycle

Hebron

Upper Zakum

Odoptu

Tengiz

Liza

Upstream

Antwerp coker

Rotterdam hydrocracker

Singapore co-gen

Wolverine expansion

Downstream

Beaumont polyethylene

Baytown olefins

Singapore specialties

Chemical

$22B

Total

Chemical

Downstream

Upstream

1 Short-cycle investments are those expected to generate positive cash flow less than 3 years from the date of investment.

19 Investment plans

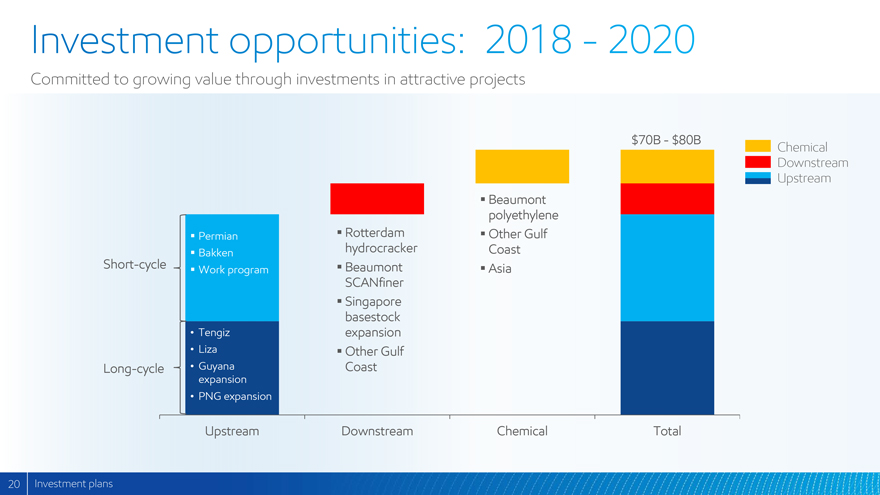

Investment opportunities: 2018 – 2020

Committed to growing value through investments in attractive projects

Short-cycle

Permian

Bakken

Work program

Long-cycle

Tengiz

Liza

Guyana expansion

PNG expansion

Upstream

Rotterdam hydrocracker

Beaumont SCANfiner

Singapore basestock expansion

Other Gulf Coast

Downstream

Beaumont polyethylene

Other Gulf Coast

Asia

Chemical

$70B - $80B

Total

Chemical

Downstream

Upstream

20 Investment plans

|

|

Enhancing the portfolio

Pursuing value opportunities

Executing accretive acquisitions to grow value

Permian Delaware Basin

Papua New Guinea InterOil

Capturing high-potential exploration acreage

Capitalizing on opportunistic asset divestments

Focusing on highest value opportunities

| 7.5 BOEB |

2012-2016 | |

| Discovered undeveloped resources acquired |

||

| 84 million |

||

| Net exploration acres captured |

||

| $21 billion |

||

| Proceeds from asset sales |

21 Investment plans

|

|

Emphasis on cash generation

Major projects and short-cycle investments generating future cash flow

Growing cash flow through the end of the decade

Flexible investment program

Maintain capability to pursue attractive opportunities

Capacity to grow shareholder distributions

| Cash flow |

| Cash Flow from Operations & Asset Sales (CFOAS), actual |

| CFOAS, $40 - $100 flat real Brent1 |

| CFOAS, $57 flat real Brent1 |

| Shareholder Distributions2 |

| Net Investments3 |

| ‘15 ‘16 ‘17 ‘18 - ‘20 |

| Average |

1 Asset sale proceeds based on long-term average. 2/1/2017 prices, $57 Brent and $3 Henry Hub.

2 Shareholder distributions include dividends and share purchases to reduce shares outstanding.

3 Net investments include PP&E adds, investments and advances, and other uses including share purchases to offset shares or units settled in shares issued in conjunction with company benefit plans and programs.

22 Investment plans

|

|

Creating long-term value

Managing the business to achieve industry-leading returns throughout the commodity price cycle

| ROCE |

Maintain long-term industry-leading returns | |

| Integration |

Capture maximum value chain benefit, leverage capabilities | |

| Capital discipline |

Selectively invest in and respond to attractive opportunities | |

| Upstream volumes |

Produce 4.0 to 4.4 MOEBD through 20201 | |

| Cash flow |

Grow cash flow from investments and capital efficiency | |

| Shareholder distributions |

Maintain reliable and growing dividend, flexible share purchase program |

1 Production outlook excludes impact from future divestments. Based on $40 to $100 Brent.

23 Investment plans

|

|

Upstream

Maximizing portfolio value

|

|

Competitive Upstream business

Leading long-term returns on capital employed

Demonstrated operational excellence

Disciplined investment

Application of high-impact technology

Exceptional project execution

Culture of continuous improvement

Sustained industry-leading performance

Upstream ROCE and Volumes1

ROCE ‘07 to ‘16 Average

Percent

30

25

20 Chevron ExxonMobil

15 BP

Total Shell

10

5

2.0 2.5 3.0 3.5 4.0 4.5

2016 Volumes (MOEBD)

1 Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

25 Upstream: Maximizing portfolio value

|

|

Diverse production base delivers value growth

More than 4 MOEB of daily production provides cash flow for new investments

2.4 MBD 10.1 BCFD

Liquids production Gas production

Over 70%

Liquids and liquids-linked production

Over 40%

Production from long-plateau assets

North Slope

Norman Wells

Kearl/Syncrude North Sea

Montney/Duvernay Cold Lake South Hook Germany

Bakken Hibernia Netherlands Kazakhstan Sakhalin

LaBarge Sable Adriatic Azerbaijan

Aera Haynesville Utica/Marcellus

Santa Ynez Iraq

Golden Pass

Permian Gulf of Mexico Qatar UAE

Chad Yemen Thailand

Nigeria Malaysia

EG

Angola Indonesia PNG

Gorgon Jansz

Vaca Muerta

Conventional Bass Strait

Unconventional

Heavy Oil

LNG

LNG infrastructure

26 Upstream: Maximizing portfolio value

|

|

Maximizing value from base production

Improving unit profitability

Added ~750 KOEBD incremental volumes over the last five years

Improving reliability

Maximizing facility capacity

Optimizing resource development

Lowering operating costs

Capturing economies of scale at Kearl

Reducing costs in unconventional gas plays

50% unit cash opex1 reduction via mine and plant optimization

20% unit cash opex1 reduction since 2014 in key U.S. gas plays

1 Consolidated company cash opex.

27 Upstream: Maximizing portfolio value

|

|

Improving value in any price environment

Attractive portfolio of short-cycle and long-cycle opportunities

Ongoing focused effort to enhance commercial potential of portfolio

Improving resource definition / recovery

Development optimization / synergies

Optimizing market variables

Selectively investing in accretive opportunities

Relative Size of resource

Short-cycle opportunities

Major projects PNG

New opportunities

25 BOEB

Opportunities at current prices1

3 – 4 BOEB

Potential reserve additions

2017 - 2018

Increasing cash flow returns

Current Average Unit Profitability

‘14

‘93

Increasing unit profitability

1 >10% rate of return at 2/1/2017 prices, $57 Brent and $3 Henry Hub.

28 Upstream: Maximizing portfolio value

|

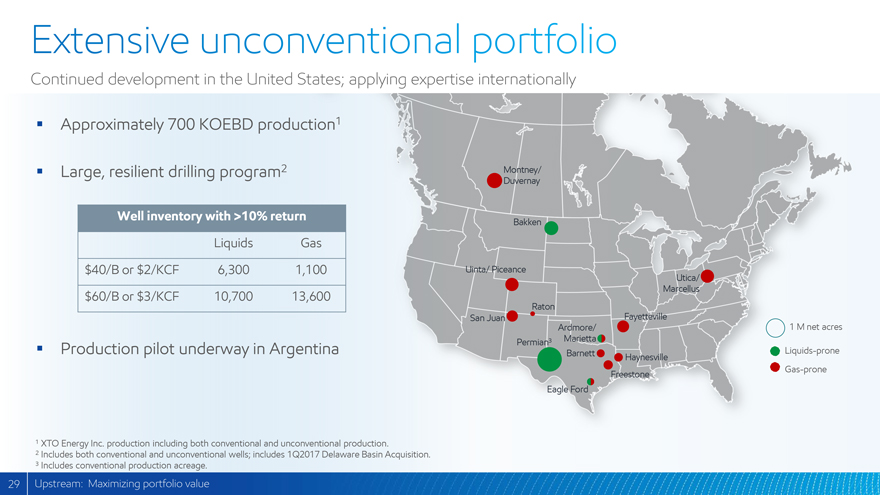

Extensive unconventional portfolio

Continued development in the United States; applying expertise internationally

Approximately 700 KOEBD production1

Large, resilient drilling program2

Well inventory with >10% return

Liquids Gas

$40/B or $2/KCF 6,300 1,100

$60/B or $3/KCF 10,700 13,600

Production pilot underway in Argentina

Montney/ Duvernay

Bakken

Uinta/ Piceance

Utica/ Marcellus

Raton

San Juan

Fayetteville

Ardmore/Marietta

1 M net acres

Permian3

Barnett

Haynesville

Liquids-prone

Freestone

Gas-prone

Eagle Ford

1 XTO Energy Inc. production including both conventional and unconventional production.

2 Includes both conventional and unconventional wells; includes 1Q2017 Delaware Basin Acquisition.

3 Includes conventional production acreage.

29 Upstream: Maximizing portfolio value

|

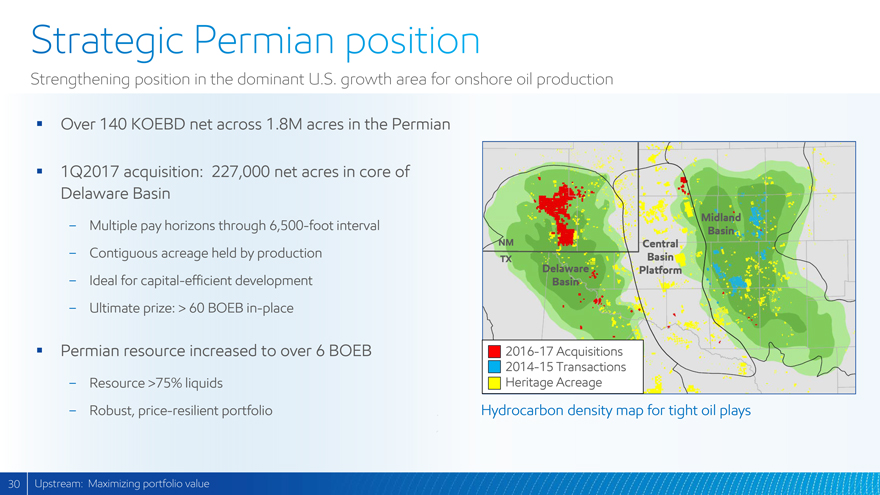

Strategic Permian position

Strengthening position in the dominant U.S. growth area for onshore oil production

Over 140 KOEBD net across 1.8M acres in the Permian

1Q2017 acquisition: 227,000 net acres in core of Delaware Basin

Multiple pay horizons through 6,500-foot interval

Contiguous acreage held by production

Ideal for capital-efficient development

Ultimate prize: > 60 BOEB in-place

Permian resource increased to over 6 BOEB

Resource >75% liquids

Robust, price-resilient portfolio

Midland

Basin

Central

Basin

Platform

NM

TX

Delaware

Basin

2016-17 Acquisitions

2014-15 Transactions

Heritage Acreage

Hydrocarbon density map for tight oil plays

30 Upstream: Maximizing portfolio value

|

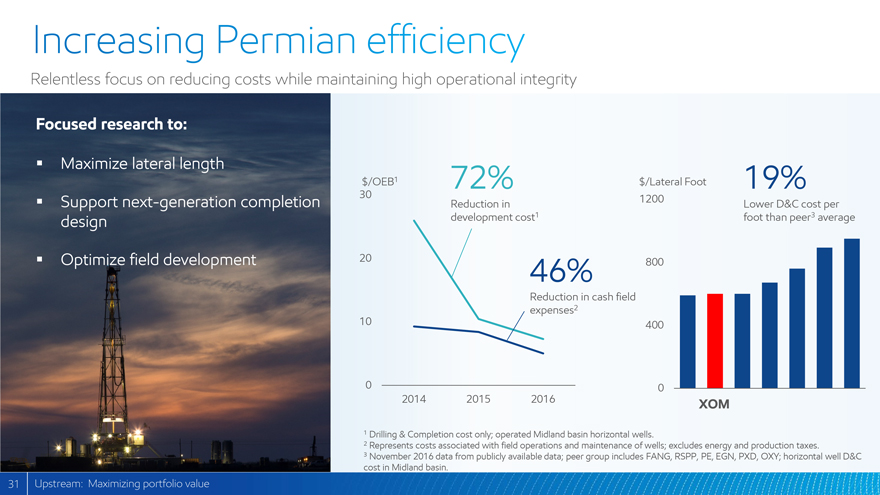

Increasing Permian efficiency

Relentless focus on reducing costs while maintaining high operational integrity

Focused research to:

Maximize lateral length

Support next-generation completion design

Optimize field development

$/OEB1 30

72% Reduction in development cost1

$/Lateral Foot 1200

19% Lower D&C cost per foot than peer3 average

20 10

46% Reduction in cash field expenses2

800 400

0

2014 2015 2016 0 XOM

1 Drilling & Completion cost only; operated Midland basin horizontal wells.

2 Represents costs associated with field operations and maintenance of wells; excludes energy and production taxes.

3 November 2016 data from publicly available data; peer group includes FANG, RSPP, PE, EGN, PXD, OXY; horizontal well D&C cost in Midland basin.

31 Upstream: Maximizing portfolio value

|

Significant unconventional growth

Growing inventory of profitable opportunities in the Permian and Bakken

Inventory1 for Delaware & Midland Basins and Bakken

Wells

7,500 10-30% Return >30% Return

5,000

2,500

0

$40/B $60/B $40/B $60/B

2016 Delaware acquisition 2017

Net production Delaware, Midland, and Bakken

KOEBD

800 600 ~20% High-side flexibility Delaware acquisition

Compound annual growth rate

400 Heritage Delaware/Midland

200

0 Bakken

‘15 ‘17 ‘19 ‘21 ‘23 ‘25

1 Horizontal drillwell inventory with rate of return at flat real WTI prices.

32 Upstream: Maximizing portfolio value

|

|

Major projects portfolio

Investment flexibility to respond to changing business environment

Nearly 100

projects in development

850 KOEBD

working interest capacity with

returns >10% at current prices1

30% reduction

near-term project costs

1 Based on 2/1/2017 prices, $57 Brent and $3 Henry Hub.

Aspen Hebron Liza Neptun Deep Bonga SW Owowo UZ 750 Kashagan compression Tengiz expansion Odoptu Stage 2 PNG expansion

Conventional

Heavy Oil

LNG

ExxonMobil is supporting the State of Alaska as it progresses Alaska LNG.

33 Upstream: Maximizing portfolio value

|

|

Excellence in project execution

Proven advantage in project management; industry-leading capital efficiency

Applying innovative techniques and technologies

Effectively managing contractor interfaces

“Project Essentials” approach lowers development cost

Concept design

Cost control

Execution

Superior global integration of expertise and technology

Superior execution of challenging, complex projects Major Project Start-ups 2001-2016 Development Cost per OEB Arctic Deepwater LNG Schedule (Full Funding to Startup) Arctic Deepwater LNG 0% 25% 50% 75% Competitor Average by Type 100%

Source: ExxonMobil / WoodMackenzie.

34 Upstream: Maximizing portfolio value

|

|

Guyana: Rapid development of Liza

Phase 1 start-up by 2020, less than 5 years after discovery

Greater than 1 BOEB recoverable resource

– Liza-4 will test 1.4 BOEB high-side

Multi-FPSO, ExxonMobil-operated development

– Phase 1: 100 -120 KBD; attractive return at $40/B flat real

–FEED under way; Phase 1 FID expected in 2017

KBD Gross 300 150 0 Liza Phase 1 Liza Phase 2 Future potential

Sea floor view

35 Upstream: Maximizing portfolio value

|

|

Guyana: World-class exploration potential

High-potential exploration program on over 11 million gross acres

Payara discovery in December 2016

Successful well test confirmed reservoir quality comparable to Liza

Payara-2 appraisal later this year

Snoek prospect currently drilling

Additional wildcats planned in 2017

Multiple plays to test in near future

0

Kilometers 15 30

US GOM OCS Block Size 60 Discoveries Potential 2017-2019 opportunities XOM interest

3000m Stabroek

Kaieteur Canje Payara Liza Snoek

36 Upstream: Maximizing portfolio value

|

|

Papua New Guinea: Development synergies

Significant advantages; attractive growth opportunities

20% PNG LNG plant capacity increase

Capital-efficient multiple train expansion of foundation PNG LNG site

Discovered resources at P’nyang field

InterOil acquisition with Elk-Antelope field

Significant Muruk discovery in 4Q2016

Highly competitive cost of supply

Growth in net exploration acreage to more than 9 million acres

Active exploration program and acreage pursuit in 2017-2018

P’nyang XOM interest InterOil acquisition 0 PNG LNG pipeline Gas fields 100 Muruk 200 Kilometers Hides Gulf of Papua N Elk-Antelope PNG LNG plant Port Moresby

37 Upstream: Maximizing portfolio value

|

|

Industry-leading resource opportunities

Enhancing the portfolio with new acreage captures and focused exploration program

16 BOEB

Resource additions1 since 2012

$1.27/OEB

Finding cost (5-year average1)

>60,000 km2

seismic data in 2016

1 2012 - 2016

Exploration acreage

2015 – 2017 resource additions 2015 – 2017 exploration awards2

ExxonMobil continues to comply with all sanctions applicable to its affiliates’ investments in the Russian Federation.

2 Pending final contract negotiations in some countries.

38 Upstream: Maximizing portfolio value

|

|

Maximizing portfolio value

Well positioned to generate value through the cycle

Large and diverse portfolio provides investment flexibility and optionality

Pursuing accretive new opportunities

Investment discipline

Applying high-impact technologies

World-class operational excellence

39 Upstream: Maximizing portfolio value

|

|

Downstream & Chemical

Building on strength

|

|

Delivering highest returns in the industry

Premier integrated Downstream and Chemical businesses

Demonstrated operational excellence

Application of high-impact technology

Disciplined investment

Sustained industry-leading performance

1 Competitor data estimated on a consistent basis with ExxonMobil and based on public information. RDS 2008-2012 capital employed restated in 2013.

2016 Chemical sales not included: ExxonMobil 24.9 MT; Shell 17.3 MT; BP 14.2 MT

Downstream & Chemical ROCE and Petroleum Product Sales1 ROCE ‘07 to ‘16 Average Percent 30 25 20 15 10 5 2.0 Chevron 3.0 2016 Petroleum Product Sales (MBD) ExxonMobil Total 4.0 5.0 BP 6.0 Shell 7.0

41 Downstream & Chemical: Building on strength

|

|

Integrated manufacturing platforms

Advantaged asset base supports fuels, lubricants, and chemicals value chains

4.9 MBD

Refining capacity

34.9 MTA

Chemical capacity

126 KBD

Lube basestock refining

Refining

Major chemical

Major refining & chemical

42 Downstream & Chemical: Building on strength

|

|

Efficient operations and feedstock flexibility

First quartile refining unit cash costs

Industry-leading operating efficiency

$1.5B annual cost savings versus industry average

Expanding midstream access to secure advantage

Source: Solomon Associates; fuels and lubes refining data available for even years only.

1 Constant foreign exchange rates, energy prices, and 2016 year-end portfolio.

Refinery unit cash operating expenses

2006 – 2014 Average unit cost, indexed1

100

90

80

70

Industry

ExxonMobil

43 Downstream & Chemical: Building on strength

|

|

Increasing higher-value refining products

Growing production of premium distillates, lube basestocks, and chemical feedstocks

Technology delivers step-change yield improvements

Doubled premium distillate production since 2006

Expanded high-performance lube basestocks

Providing advantaged chemical feedstocks

Further 8% increase in higher-value products

Higher-value products growth1

Global product yield, indexed

Planned investments

180

160

140

120

100

‘06

‘08

‘10

‘12

‘14

‘16

Future

1 High-value products include premium distillates, lube basestocks / specialties, and chemical feedstocks.

44 Downstream & Chemical: Building on strength

|

|

Growing premium sales

Creating value for our customers

Access to higher-value channels for refining production

Expanding retail network and continued roll-out of

Synergy-branded fuels program

Synthetic lubricants sales growth

Volume, indexed

250

200

150

100

‘06

‘08

‘10

‘12

‘14

‘16

More than doubled high-value synthetic product sales

Largest producer of lube basestocks with broadest product group offering

45 Downstream & Chemical: Building on strength

|

|

Maximizing feedstock advantage

Processing 30% more advantaged feed than industry average

Capturing liquids and gas cracking benefits

Expanding specialty manufacturing by leveraging commodity base

Delivering value through integrated model

U.S. ethylene production from ethane1

Percent

ExxonMobil

Industry

90

80

70

60

50

40

‘06

‘08

‘10

‘12

‘14

‘16

Source: Jacobs Consultancy The Hodson Report.

1 Includes ethane and ethane equivalents.

46 Downstream & Chemical: Building on strength

|

|

Growing differentiated product portfolio

Increasing premium and specialty product sales

Supplying diverse market segments growing above GDP

Leveraging global supply chain, product technology, and commercial capabilities

Positioned to serve growth regions

Metallocene products sales growth

Volume, indexed

300

ExxonMobil metallocene products sales 1

Global chemical growth 2

Global GDP growth

250

200

150

100

‘06

‘08

‘10

‘12

‘14

‘16

1 Metallocene-based polyethylene, polypropylene, specialty elastomers, and synthetic basestocks.

2 Sources: IHS Chemical and ExxonMobil estimates. Includes polyethylene, polypropylene, and paraxylene.

47 Downstream & Chemical: Building on strength

|

|

Major projects portfolio

Investment driving growth across the value chains

30% uplift

Cash generation from major projects1

200 KBD

Refining volume improvement

4.1 MTA

Chemical capacity additions

Increasing feedstock and logistics flexibility Upgrading molecule value

Increasing higher-value products

1 Incremental 2020 cash flow from operations of 17 projects with 2016-2019 start-up (estimated based on corporate plan price assumption and trendline estimates), versus 2016 cash flow from operations (base business).

48 Downstream & Chemical: Building on strength

|

|

Building on strength

Focus on business fundamentals delivering superior results

Driving operational efficiency

Capturing advantaged feeds

Growing high-value products

Selectively investing across value chains

Generating cash flow from diverse portfolio

49 Downstream & Chemical: Building on strength

|

|

ExxonMobil investment case

|

|

Enduring value proposition

Targeted investments to maximize profitability, returns, and cash flow

Focused on value growth

Disciplined investment for financial leadership

Improving resilience of portfolio

Positioned to excel in any price environment

51 ExxonMobil investment case

|

|

Break

|

|

Q&A

|

|

Reference material

|

|

Enduring value proposition

World-class workforce delivering distinct competitive advantages

Value chain integration Financial strength Efficient cost structure Technology leadership Operational excellence Portfolio of opportunities

Optionality allows capture of the highest value for each molecule Balance sheet supports leading financial flexibility Relentless focus on costs and capital efficiency Enhancing profitability through innovation Superior reliability and execution through effective risk management High-quality assets; large inventory of accretive investments

55 Reference material

|

|

Energy Outlook guides business strategy

Long-term view of supply and demand informs investment plans

Non-OECD nations drive growth in GDP and energy demand

Middle class more than doubling to reach almost 5 billion people

Non-OECD energy use per person remains well below OECD

Efficiency gains keep OECD demand flat

Without efficiency gains, global demand growth could be four times projected amount

Source: ExxonMobil 2017 The Outlook for Energy: A View to 2040.

Global energy demand

Quadrillion BTUs

750

0.9% 2040 Average Growth/Year

2015 to 2040

2015

500 1.4%

250 -0.1%

0

Total Non-OECD OECD

56 Reference material

|

|

Energy Outlook guides business strategy

All forms of energy are required to meet global energy demand

Oil and natural gas lead growth as energy mix evolves

Higher oil demand driven by transportation and chemicals

Strong growth in natural gas led by power generation and industrial demand

Global LNG trade reaches more than 2.5 times 2015 level by 2040

Energy-related CO2 outlook consistent with aggregation of Paris agreement Nationally Determined Contributions

Source: ExxonMobil 2017 The Outlook for Energy: A View to 2040.

Global energy demand

Quadrillion BTUs

250

0.7% Average Growth/Year

2040 2015 to 2040

200

2015 1.5%

150 -0.1%

100 0.6%

50 2.6%

5.8%

0

Oil Gas Coal Other Nuclear Solar &

Renewable1Wind

1 Other Renewable includes hydro, geothermal, biofuels, and biomass.

57 Reference material

|

|

Committed to operational integrity

Risk management maintains license to operate and creates value across the business

Ensuring personnel and process safety

Effectively managing security and geopolitical risks

Minimizing environmental impact

Maintaining excellence in operations and project execution

Safety Security

Leadership & people

Monitoring & improving

Policies, standards & practices

Operations

Integrity

Management

System

Risk assessment & mitigation

Accountability & expectation

Hazard

identification

Environment

Health

58 Reference material

|

|

2016 results

Demonstrates strength of integrated business

Best-ever safety performance

Earnings $7.8B

ROCE 3.9%

Cash flow from operations and asset sales $26.4B

Capex $19.3B

Dividends paid to shareholders $12.5B

Workforce Lost-Time Incident Rate1

Employee and Contractor Incidents per 200K hours

0.2

0.1 Industry

ExxonMobil

0.0

‘12 ‘13 ‘14 ‘15 ‘16

1 Source: American Petroleum Institute. 2016 Industry data not available.

59 Reference material

|

|

Generating free cash flow

Capital discipline yields cash flow to support distributions and investments

2016 free cash flow of $9.7B

Strong long-term free cash flow outpacing competitors

Provides flexibility to invest in attractive business opportunities

Supports reliable and growing dividend

1 Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

Free cash flow1

$B

‘07 to ‘16

20 ‘12 to ‘16

2016

10

0

-10

-20

XOM CVX RDS TOT BP

Proceeds from

‘16 Asset Sales 4.3 2.8 3.6 1.9 2.6

60 Reference material

|

|

Maximizing learning curve benefits

Global application of industry-leading expertise in complex drilling environments

Industry leader with 8 of 10 longest-reach wells drilled

Applying more than 10 years of experience to Hebron and Odoptu Stage 2

0

5000

Vertical Depth (ft) 10,000

15,000

20,000

EM Sakhalin Wells

Industry Wells

25,000

0 5000 10,000 15,000 20,000 25,000 30,000 35,000 40,000

Horizontal Reach (ft)

Hebron topsides

61 Reference material

|

|

Consolidated Company Cash Opex

Reconciliation for data referenced on charts 10 and 27

Consolidated Company Cash Opex 2016 2015 2014 2013 2012 2011

(millions of dollars)

Reconciliation of Consolidated Company Cash Opex

From EM Consolidated Statement of Income

Total costs and other deductions 218,125 246,916 360,309 380,544 401,955 413,172

less:

Crude oil and product purchases 104,171 130,003 225,972 244,156 263,535 266,534

Depreciation and depletion 22,308 18,048 17,297 17,182 15,888 15,583

Interest expense 453 311 286 9 327 247

Sales-based taxes 21,090 22,678 29,342 30,589 32,409 33,503

Other taxes and duties 25,910 27,265 32,286 33,230 35,558 39,973

Total Consolidated Company cash opex 44,193 48,611 55,126 55,378 54,238 57,332

Components of Consolidated Company Cash Opex

From EM Consolidated Statement of Income

Production and manufacturing expenses 31,927 35,587 40,859 40,525 38,521 40,268

Selling, general and administrative expenses 10,799 11,501 12,598 12,877 13,877 14,983

Exploration expenses, including dry holes 1,467 1,523 1,669 1,976 1,840 2,081

Total Consolidated Company cash opex 44,193 48,611 55,126 55,378 54,238 57,332

62 Reference material