UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ Preliminary

Proxy Statement |

|

¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

| x Definitive Proxy Statement |

|

|

|

| ¨ Definitive

Additional Materials |

|

|

|

|

| ¨ Soliciting

Material Pursuant to §240.14a-12 |

|

|

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

| NOTICE OF 2015 |

|

|

| ANNUAL MEETING |

|

|

| AND PROXY STATEMENT |

|

|

|

|

|

|

|

|

|

April 14, 2015 |

Dear Shareholder:

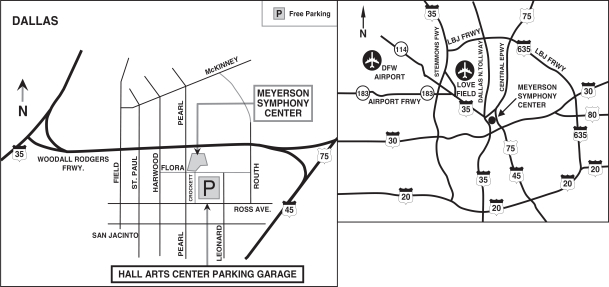

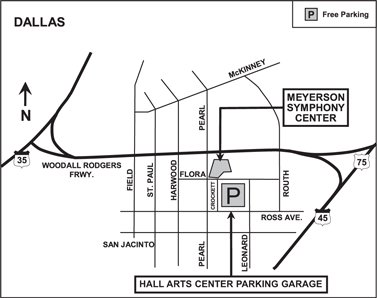

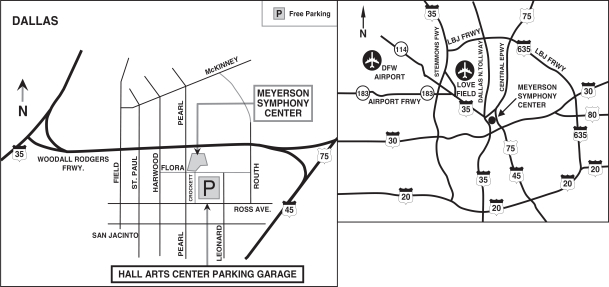

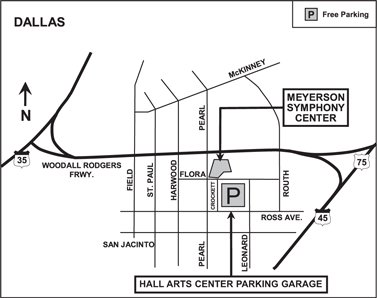

We invite you

to attend the annual meeting of shareholders on Wednesday, May 27, 2015, at the Morton H. Meyerson Symphony Center, 2301 Flora Street, Dallas, Texas 75201. The meeting will begin promptly at 9:30 a.m., Central Time. At the meeting, you will

hear a report on our business and vote on the following items:

| Ÿ |

|

Ratification of PricewaterhouseCoopers LLP as independent auditors; |

| Ÿ |

|

Advisory vote to approve executive compensation as required by law; |

| Ÿ |

|

Eight shareholder proposals contained in this proxy statement; and |

| Ÿ |

|

Other matters if properly raised. |

Only

shareholders of record on April 7, 2015, or their proxy holders may vote at the meeting. Attendance at the meeting is limited to shareholders or their proxy holders and ExxonMobil guests. Only shareholders or their valid proxy holders may

address the meeting.

This booklet includes the formal notice of the meeting and proxy statement. The proxy statement tells you about the agenda,

procedures, and rules of conduct for the meeting. It also describes how the Board operates, gives information about our director candidates, and provides information about the other items of business to be conducted at the meeting.

Financial information is provided separately in the booklet, 2014 Financial Statements and Supplemental Information, enclosed with proxy materials available to all

shareholders.

Even if you own only a few shares, we want your shares to be represented at the meeting. You can vote your shares by Internet, toll-free

telephone call, or proxy card.

To attend the meeting in person, please follow the instructions on page 3. An audio webcast with slide presentation and

a report on the meeting will be available on our website at exxonmobil.com.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

| Jeffrey J. Woodbury |

|

|

|

Rex W. Tillerson |

| Secretary |

|

|

|

Chairman of the Board |

GENERAL INFORMATION

Who May Vote

Shareholders of ExxonMobil, as recorded in our stock register on April 7, 2015, may vote at

the meeting.

How to Vote

You may vote in person

at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 27, 2015

| Ÿ |

|

The 2015 Proxy Statement, 2014 Summary Annual Report, and 2014 Financial Statements are available at

www.edocumentview.com/xom. |

Electronic Delivery of Proxy Statement and Annual Report

Documents

Instead of receiving future copies of these documents by mail, shareholders can elect to receive an e-mail that will provide electronic

links to the proxy materials. Opting to receive your proxy materials online will save the Company the cost of producing and mailing documents to your home or business, and will also give you an electronic link to the proxy voting site.

| Ÿ |

|

Shareholders of Record: If you vote on the Internet at www.investorvote.com/exxonmobil, simply follow the prompts for enrolling in the electronic

proxy delivery service. You may enroll in the electronic proxy delivery service at any time in the future by going directly to www.computershare.com/exxonmobil. You may also revoke an electronic delivery election at this site at any time.

|

| Ÿ |

|

Beneficial Shareholders: If you hold your shares in a brokerage account, you may also have the opportunity to receive copies of the proxy materials

electronically. Please check the information provided in the proxy materials mailed to you by your bank or broker regarding the availability of this service. |

How Proxies Work

ExxonMobil’s Board of Directors is asking for your proxy. Giving us your proxy means you

authorize us to vote your shares at the meeting in the manner you direct.

If your shares are held in your name, you can vote by proxy in one of three

convenient ways:

| Ÿ |

|

Via Internet: Go to www.investorvote.com/exxonmobil and follow the instructions. You will need to have your proxy card or electronic notice in

hand. At this website, you can elect to access future proxy statements and annual reports via the Internet. |

| Ÿ |

|

By Telephone: Call toll-free 1-800-652-8683 or 1-781-575-2300 (outside the United States, Canada, and Puerto Rico), and follow the instructions. You will

need to have your proxy card in hand. |

| Ÿ |

|

In Writing: Complete, sign, date, and return your proxy card in the enclosed envelope. |

Your proxy card covers all shares registered in your name and shares held in your Computershare Investment Plan account. If you own shares in the ExxonMobil

Savings Plan for employees and retirees, your proxy card also covers those shares.

If you give us your signed proxy but do not specify how to vote, we

will vote your shares as follows:

| Ÿ |

|

FOR the election of our director candidates; |

| Ÿ |

|

FOR ratification of the appointment of independent auditors; |

| Ÿ |

|

FOR approval of the compensation of the Named Executive Officers; and |

| Ÿ |

|

AGAINST the shareholder proposals. |

1

If you hold shares through someone else, such as a stockbroker, you will receive material from that firm asking

how you want to vote. Check the voting form used by that firm to see if it offers Internet or telephone voting.

Voting Shares in the ExxonMobil

Savings Plan

The Trustee of the ExxonMobil Savings Plan will vote Plan shares as participants direct. To the extent participants do not give

instructions, the Trustee will vote shares as it thinks best. The proxy card serves to give voting instructions to the Trustee.

Revoking a Proxy

You may revoke your proxy before it is voted at the meeting by:

| Ÿ |

|

Submitting a new proxy with a later date via a proxy card, the Internet, or by telephone; |

| Ÿ |

|

Notifying ExxonMobil’s Secretary in writing before the meeting; or |

| Ÿ |

|

Voting in person at the meeting. |

Confidential Voting

Independent inspectors count the votes.

Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy card will be sent to us if you write comments on the card.

Quorum

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority

of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person. Treasury shares, which are shares owned by ExxonMobil itself, are not voted and do not count for this purpose.

Votes Required

| Ÿ |

|

Election of Directors Proposal: A plurality of the votes cast is required for the election of directors. This means that the director nominee with the

most votes for a particular seat is elected for that seat. Only votes FOR or WITHHELD count. Abstentions and broker non-votes are not counted for purposes of the election of directors. A broker non-vote occurs when a bank, broker, or other holder of

record that is holding shares for a beneficial owner does not vote on a particular proposal because the record holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

If you own shares through a broker, you must give the broker instructions to vote your shares in the election of directors. Otherwise, your shares will not be voted. |

Our Corporate Governance Guidelines, which can be found in the Corporate Governance section of our website at exxonmobil.com/guidelines,

state that all directors will stand for election at the annual meeting of shareholders. In any non-contested election of directors, any director nominee who receives a greater number of votes WITHHELD from his or her election than votes FOR such

election shall tender his or her resignation. Within 90 days after certification of the election results, the Board of Directors will decide, through a process managed by the Board Affairs Committee and excluding the nominee in question, whether to

accept the resignation. Absent a compelling reason for the director to remain on the Board, the Board shall accept the resignation. The Board will promptly disclose its decision and, if applicable, the reasons for rejecting the tendered resignation

on Form 8-K filed with the Securities and Exchange Commission (SEC).

| Ÿ |

|

Other Proposals: Approval of the ratification of the appointment of independent auditors, the advisory vote to approve executive compensation, and the

shareholder proposals requires the favorable vote of a majority of votes cast. Only votes FOR or AGAINST these proposals count. |

2

Abstentions count for quorum purposes, but not for voting. Broker non-votes count as votes FOR the ratification

of the appointment of independent auditors but do not count for voting on any of the other proposals.

Annual Meeting Admission

Only shareholders or their proxy holders and ExxonMobil guests may attend the meeting. For safety and security reasons, cameras, smartphones, recording

equipment, electronic devices, computers, large bags, briefcases, or packages will not be permitted in the building. In addition, each shareholder and ExxonMobil guest will be asked to present valid government-issued picture identification, such

as a driver’s license, before being admitted to the meeting.

For registered shareholders, an admission ticket is attached to your proxy card.

Please detach and bring the admission ticket with you to the meeting.

If your shares are held in the name of your broker, bank, or other nominee, you

must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 7, 2015, the record date for voting. You may receive an admission ticket in advance by sending a written

request with proof of ownership to the address listed below under Contact Information.

Shareholders who do not present admission tickets at the meeting

will be admitted only upon verification of ownership at the admission counter.

Audio Webcast of the Annual Meeting

You are invited to visit our website at exxonmobil.com to hear the audio webcast with slide presentation at 9:30 a.m., Central Time, on Wednesday,

May 27, 2015. An archived copy of this audio webcast will be available on our website for one year.

Conduct of the Meeting

The Chairman has broad responsibility and legal authority to conduct the annual meeting in an orderly and timely manner. This authority includes establishing rules

for shareholders who wish to address the meeting. Only shareholders or their valid proxy holders may address the meeting. Copies of these rules will be available at the meeting. The Chairman may also exercise broad discretion in recognizing

shareholders who wish to speak and in determining the extent of discussion on each item of business. In light of the number of business items on this year’s agenda and the need to conclude the meeting within a reasonable period of time, we

cannot ensure that every shareholder who wishes to speak on an item of business will be able to do so.

Dialogue can usually be better accomplished with

interested parties outside the meeting and, for this purpose, we have provided a method on our website at exxonmobil.com/directors for raising issues and contacting the non-employee directors either in writing or electronically. The Chairman

may also rely on applicable law regarding disruptions or disorderly conduct to ensure that the meeting is conducted in a manner that is fair to all shareholders. Shareholders making comments during the meeting must do so in English so that the

majority of shareholders present can understand what is being said.

Contact Information

If you have questions or need more information about the annual meeting, write to Mr. Jeffrey J. Woodbury, Secretary, Exxon Mobil Corporation, 5959 Las Colinas Boulevard, Irving, TX 75039-2298. Or call us

at 1-972-444-1157 or send a fax to 1-972-444-1505.

For information about shares registered in your name or your Computershare Investment Plan account,

call ExxonMobil Shareholder Services at 1-800-252-1800 or 1-781-575-2058 (outside the United States, Canada, and Puerto Rico), or access your account via the website at www.computershare.com/exxonmobil. We also invite you to visit

ExxonMobil’s website at exxonmobil.com. Investor information can be found at exxonmobil.com/investor. Website materials are not part of this proxy solicitation.

3

BOARD OF DIRECTORS

CORPORATE GOVERNANCE

Overview

The Board of Directors and its committees perform a number of functions for ExxonMobil and its shareholders, including:

| Ÿ |

|

Overseeing the management of the Company on your behalf, including oversight of risk management; |

| Ÿ |

|

Reviewing ExxonMobil’s long-term strategic plans; |

| Ÿ |

|

Exercising direct decision-making authority in key areas, such as declaring dividends; |

| Ÿ |

|

Selecting the CEO and evaluating the CEO’s performance; and |

| Ÿ |

|

Reviewing development and succession plans for ExxonMobil’s top executives. |

The Board has adopted Corporate Governance Guidelines that govern the structure and functioning of the Board and set out the Board’s position on a number of governance issues. A copy of our current Corporate

Governance Guidelines is posted on our website at exxonmobil.com/guidelines.

All ExxonMobil directors stand for election at the annual meeting.

Non-employee directors cannot stand for election after they have reached age 72, unless the Board makes an exception on a case-by-case basis. Employee directors resign from the Board when they are no longer employed by ExxonMobil.

Risk Oversight

Risk oversight is the responsibility of the

full Board of Directors. The Board throughout the year participates in reviews with management on the Company’s business, including identified risk factors. As a whole, the Board reviews include litigation and other legal matters; political

contributions, budget, and policy; developments in climate science and policy; the Energy Outlook, which projects world supply and demand to 2040; stewardship of business performance; and long-term strategic plans.

The Board and/or the Public Issues and Contributions Committee visit an ExxonMobil operation each year. These visits allow the directors to better understand local

issues and to discuss safety, environmental performance, technology, products, industry and corporate standards, and community involvement associated with the Company’s business.

In addition, existing committees help the Board carry out its responsibility for risk oversight by focusing on specific key areas of risk:

| Ÿ |

|

The Audit Committee oversees risks associated with financial and accounting matters, including compliance with legal and regulatory requirements, and the

Company’s financial reporting and internal control systems; |

| Ÿ |

|

The Board Affairs Committee oversees risks associated with corporate governance, including board structure and succession planning; |

| Ÿ |

|

The Compensation Committee helps ensure that the Company’s compensation policies and practices encourage long-term focus, support the retention and

development of executive talent, and discourages excessive risk taking; |

| Ÿ |

|

The Public Issues and Contributions Committee oversees operational risks such as those relating to employee and community safety, health, environmental, and

security matters; and |

| Ÿ |

|

The Finance Committee oversees risk associated with financial instruments, financial policies and strategies, and capital structure.

|

The Board receives regular updates from the committees, and believes this structure is best for overseeing risk.

4

Board Leadership Structure

The Board believes that the decision as to who should serve as Chairman and/or CEO is the proper responsibility of the Board. The Board retains authority to amend the By-Laws to separate the positions of Chairman

and CEO at any time and will carefully consider the pros and cons of such separation or combination. At the present time, the Board believes the interests of all shareholders are best served through a leadership model with a combined Chairman/CEO

position and an independent Presiding Director.

The current CEO possesses an in-depth knowledge of the Company; its integrated, multinational

operations; the evolving energy industry supply and demand; and the array of challenges to be faced. This knowledge was gained through more than 39 years of successful experience in progressively more senior positions, including domestic and

international responsibilities.

The Board believes that these experiences and other insights put the CEO in the best position to provide broad

leadership for the Board as it considers strategy and as it exercises its fiduciary responsibilities to shareholders. Further, the Board has demonstrated its commitment and ability to provide independent oversight of management.

The Board is comprised entirely of independent directors except the CEO, and 100 percent of the Audit, Compensation, Board Affairs, and Public Issues and

Contributions Committee members are independent. Each independent director has access to the CEO and other Company executives on request; may call meetings of the independent directors; and may request agenda topics to be added or dealt with in more

detail at meetings of the full Board or an appropriate Board committee.

In addition, after considering evolving governance practices and shareholder

input regarding Board independence, the Board established the role of Presiding Director. The Board believes the Presiding Director can provide effective independent Board leadership. J.S. Fishman serves as Presiding Director and is expected to

remain in the position at least through the annual meeting of shareholders. In accordance with the specific duties prescribed in the Corporate Governance Guidelines, the Presiding Director chairs executive sessions of the independent directors,

which are held several times per year, normally coincident with meetings of the Board and without the CEO or other management present; chairs meetings of the Board in the absence of the Chairman; and works closely with the Chairman in developing

Board agendas, topics, schedules, and in reviewing materials provided to the directors.

Director Qualifications

The Board has adopted guidelines outlining the qualifications sought when considering non-employee director candidates. These guidelines are published on our

website at exxonmobil.com/directorguidelines.

In part, the guidelines describe the necessary experiences and skills expected of director

candidates as follows:

“Candidates for non-employee director of Exxon Mobil Corporation should be individuals who have achieved prominence in

their fields, with experience and demonstrated expertise in managing large, relatively complex organizations, and/or, in a professional or scientific capacity, be accustomed to dealing with complex situations, preferably those with worldwide

scope.”

The key qualifications the Board seeks across its membership to achieve a balance of diversity and experiences important to the

Corporation include: financial expertise; experience as the CEO of a significant company or organization or as a next-level executive with responsibilities for global operations; experience managing large, complex organizations; experience on one or

more boards of significant public or non-profit organizations; and expertise resulting from significant academic, scientific, or research activities. The Board also seeks diversity of life experiences and backgrounds, as well as gender and ethnic

diversity.

5

The table below describes the particular experience, qualifications, attributes, and skills of each director

nominee that led the Board to conclude that such person should serve as a director of the Company.

|

|

|

|

|

| |

|

|

| M.J. Boskin |

|

Ÿ |

|

Public finance, tax, budget, and macroeconomic policy experience as Senior Fellow at the Hoover Institution and the T.M. Friedman

Professor of Economics at Stanford University |

| |

Ÿ |

|

Financial expertise |

| |

Ÿ |

|

Government/research experience as Chairman of the President’s Council of Economic Advisors and an Associate at the National

Bureau of Economic Research |

| |

Ÿ |

|

Experience advising the federal government, heads of state, finance ministries, and central banks around the world |

| |

Ÿ |

|

Board experience as a Director of Oracle, and as former Director of Shinsei Bank and Vodafone Group

(both prior to 2010) |

| |

|

|

| P. Brabeck-Letmathe |

|

Ÿ |

|

Global leadership position as Chairman of Nestlé |

| |

Ÿ |

|

Board experience at Nestlé and L’Oréal, and as former Director of Alcon (prior to 2010), Roche Holding, and Credit

Suisse Group |

| |

Ÿ |

|

Experience with worldwide leadership of strategic business groups |

| |

Ÿ |

|

Financial expertise |

| |

Ÿ |

|

Affiliation with leading business associations (Hong Kong/Europe Business Council and Foundation Board of the World Economic

Forum) |

| |

Ÿ |

|

Recipient of awards, including “La Orden Mexicana del Aguila Azteca,” the Schumpeter Prize

for outstanding contribution in economics, and the Austrian Cross of Honour for service to the Republic of Austria |

| |

|

|

| U.M. Burns |

|

Ÿ |

|

Global leadership position as Chairman and Chief Executive Officer of Xerox Corporation |

| |

Ÿ |

|

Board experience at Xerox, American Express, and as former Director of Boston Scientific (prior to 2010) |

| |

Ÿ |

|

Financial expertise |

| |

Ÿ |

|

Leadership positions as Vice Chair of the President’s Export Council and as founding Board Director of Change the Equation to

improve education in the United States in science, technology, engineering, and math |

| |

Ÿ |

|

Affiliation with numerous community, educational, and non-profit organizations including FIRST (For

Inspiration and Recognition of Science and Technology), National Academy Foundation, MIT, and the U.S. Olympic Committee |

| |

|

|

| L.R. Faulkner |

|

Ÿ |

|

Leadership experience as President Emeritus of The University of Texas at Austin and former President of Houston

Endowment |

| |

Ÿ |

|

Financial expertise |

| |

Ÿ |

|

Academic/administration experience at major universities including the University of Illinois and Harvard University |

| |

Ÿ |

|

Expertise in chemistry, electrochemistry, and materials |

| |

Ÿ |

|

Board experience as a former Director of Guaranty Financial Group (prior to 2010) and Temple-Inland |

| |

Ÿ |

|

Recognition by the American Academy of Arts and Sciences and leadership of the National Mathematics

Advisory Panel |

6

|

|

|

|

|

| |

|

|

| J.S. Fishman |

|

Ÿ |

|

Global leadership position as Chairman and Chief Executive Officer of The Travelers Companies |

| |

Ÿ |

|

Board experience at The Travelers Companies and The Carlyle Group, and as former Director of Nuveen Investments and Platinum

Underwriters Holdings Ltd. (both prior to 2010) |

| |

Ÿ |

|

Affiliation with a leading academic institution as a member of the Board of Trustees of the University of

Pennsylvania |

| |

Ÿ |

|

Affiliation with leading business associations (the Business Council and the American Insurance

Association) |

| |

|

|

| H.H. Fore |

|

Ÿ |

|

Global leadership position as Chairman and Chief Executive Officer of Holsman International |

| |

Ÿ |

|

Government service (former Administrator of the U.S. Agency for International Development and Director of U.S. Foreign Assistance;

former Under Secretary of State for Management, the Chief Operating Officer for the Department of State; and former Director of the U.S. Mint) |

| |

Ÿ |

|

Board experience at Theravance Biopharma and General Mills, and as former Director of Dexter Corporation and HSB Group (both prior to

2010) |

| |

Ÿ |

|

Leadership positions as global Co-Chair of Asia Society and global Co-Chair of WomenCorporateDirectors, and as Trustee of the Aspen

Institute and the Center for Strategic and International Studies |

| |

Ÿ |

|

Affiliation as a Director with leading humanitarian associations (the Committee Encouraging

Corporate Philanthropy and the Center for Global Development) |

| |

|

|

| K.C. Frazier |

|

Ÿ |

|

Global leadership position as Chairman, President, and Chief Executive Officer of Merck |

| |

Ÿ |

|

Board experience at Merck and at non-profit organizations |

| |

Ÿ |

|

Affiliation with leading legal, business, and public policy associations (the President’s Export Council, the American Law

Institute, the Business Council, and Pharmaceutical Research and Manufacturers of America) |

| |

Ÿ |

|

Recipient of award for extraordinary achievement in pro bono and public service |

| |

|

|

| D.R. Oberhelman |

|

Ÿ |

|

Global leadership experience as Chairman and Chief Executive Officer of Caterpillar |

| |

Ÿ |

|

Financial experience as former CFO of Caterpillar |

| |

Ÿ |

|

Board Experience at Caterpillar, and as a former Director of Eli Lilly and Company and Ameren Corporation |

| |

Ÿ |

|

Affiliation with leading business associations (Vice Chairman of the Business Council, Executive

Committee member of the Business Roundtable, the Nature Conservancy’s Latin America Conservation Council, Wetlands America Trust, Board of Trustees for the Easter Seals Foundation of Central Illinois, and Chairman of the National Association of

Manufacturers) |

| |

|

|

| S.J. Palmisano |

|

Ÿ |

|

Global business experience as former Chairman, President, and Chief Executive Officer of IBM |

| |

Ÿ |

|

Board experience as a Director of American Express, and as former Director of Gannett Co. (prior to 2010) and IBM |

| |

Ÿ |

|

Affiliation with leading business and public policy associations (the Business Roundtable and the Executive Committee of the Council

on Competitiveness) |

| |

Ÿ |

|

Awarded honorary fellowship from the London Business School, Honorary Degree of Doctor of Humane

Letters from Johns Hopkins University and Rensselaer Polytechnic Institute, and the French Legion of Honor |

7

|

|

|

|

|

| |

|

|

| S.S Reinemund |

|

Ÿ |

|

Global business experience as former Chairman, President, and Chief Executive Officer of PepsiCo |

| |

Ÿ |

|

Leadership position as Executive in Residence and former Dean of Business at Wake Forest University |

| |

Ÿ |

|

Academic experience as Professor of Leadership and Strategy at Wake Forest University |

| |

Ÿ |

|

Board experience as a Director of American Express, Marriott, and Walmart, and as former Director of Johnson & Johnson and

PepsiCo (both prior to 2010) |

| |

Ÿ |

|

Affiliation with leading charitable and business associations (U.S. Naval Academy Foundation,

National Minority Supplier Development Council, and National Advisory Board of the Salvation Army) |

| |

|

|

| R.W. Tillerson |

|

Ÿ |

|

Global business position as Chairman and Chief Executive Officer of ExxonMobil since January 2006 with demonstrated leadership skills

resulting from a career of more than 39 years involving positions of increasing responsibility with the Company’s domestic and international business operations |

| |

Ÿ |

|

Affiliation with leading business and public policy associations (the Executive Committee of the American Petroleum Institute, the

Center for Strategic and International Studies, the National Petroleum Council, the Business Council, the Business Roundtable, the Business Council for International Understanding, and the Emergency Committee for American Trade) |

| |

Ÿ |

|

Leadership as a former President of the Boy Scouts of America, Vice Chairman of the Ford’s

Theatre Society, and a former Director of the United Negro College Fund |

| |

|

|

| W.C. Weldon |

|

Ÿ |

|

Global business experience as former Chairman and CEO of Johnson & Johnson |

| |

Ÿ |

|

Board experience as a Director of JPMorgan Chase, Chubb, CVS Caremark, and as former Chairman of Johnson &

Johnson |

| |

Ÿ |

|

Leadership positions as Director of US–China Business Council and Trustee of Quinnipiac University |

| |

Ÿ |

|

Affiliation with leading business associations (past Vice Chairman of the Business Council, the

Business Roundtable, past Chairman of the CEO Roundtable on Cancer, Healthcare Leadership Council, and past Chairman of Pharmaceutical Research and Manufacturers of America) |

Director Independence

Our

Corporate Governance Guidelines require that a substantial majority of the Board consist of independent directors. In general, the Guidelines require that an independent director must have no material relationship with ExxonMobil, directly or

indirectly, except as a director. The Board determines independence on the basis of the standards specified by the New York Stock Exchange (NYSE), the additional standards referenced in our Corporate Governance Guidelines, and other facts and

circumstances the Board considers relevant.

Under ExxonMobil’s Corporate Governance Guidelines, a director will not be independent if a reportable

“related person transaction” exists with respect to that director or a member of the director’s family for the current or most recently completed fiscal year. See the Guidelines for Review of Related Person Transactions posted on the

Corporate Governance section of our website and described in more detail under Related Person Transactions and Procedures on pages 15 to 16.

The Board

has reviewed relevant relationships between ExxonMobil and each non-employee director and director nominee to determine compliance with the NYSE standards and ExxonMobil’s additional standards. The Board has also evaluated whether there are any

other facts or circumstances that might impair a director’s independence. Based on that review, the Board has determined that all ExxonMobil non-employee directors and nominees are independent. The Board has also determined that each member of

the Audit, Board Affairs, Compensation, and Public Issues and Contributions Committees (see membership table on page 9) is independent.

8

In recommending that each director and nominee be found independent, the Board Affairs Committee reviewed the

following transactions, relationships, or arrangements. All matters described below fall within the NYSE and ExxonMobil independence standards.

|

|

|

| Name |

|

Matters Considered |

| P. Brabeck-Letmathe |

|

Ordinary course business with Nestlé (purchases of food and nutrition products; sales of

fuels and lubricants) |

| U.M. Burns |

|

Ordinary course business with Xerox (purchases of business process, IT, and document and benefit

plan services) |

| J.S. Fishman |

|

Ordinary course business with Travelers (purchases of insurance products; sales of ExxonMobil

commercial paper) |

| K.C. Frazier |

|

Ordinary course business with Merck (purchases of pharmaceuticals; sales of chemicals and

oils) |

| D.R. Oberhelman |

|

Ordinary course business with Caterpillar (purchases of license rights and equipment; sales of

lubricants) |

Board Meetings and Committees; Annual Meeting Attendance

The Board met 10 times in 2014. ExxonMobil’s incumbent directors, on average, attended approximately 95 percent of Board and committee meetings during 2014. No director attended less than 75 percent of such

meetings. ExxonMobil’s non-employee directors held five executive sessions in 2014.

As specified in our Corporate Governance Guidelines, it is

ExxonMobil’s policy that directors should make every effort to attend the annual meeting of shareholders. All incumbent directors attended last year’s meeting.

The Board appoints committees to help carry out its duties. Board committees work on key issues in greater detail than would be possible at full Board meetings. Only non-employee directors may serve on the Audit,

Compensation, Board Affairs, and Public Issues and Contributions Committees. Each committee has a written charter. The charters are posted on the Corporate Governance section of our website at exxonmobil.com/governance.

The table below shows the current membership of each Board committee and the number of meetings each committee held in 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director |

|

Audit |

|

Compensation |

|

Board

Affairs |

|

Finance |

|

Public

Issues and Contributions |

|

Executive(1) |

| M.J. Boskin |

|

|

|

Ÿ |

|

|

|

|

|

Ÿ |

|

Ÿ |

| P. Brabeck-Letmathe |

|

Ÿ |

|

|

|

|

|

Ÿ |

|

|

|

|

| U.M. Burns |

|

Ÿ |

|

|

|

|

|

Ÿ |

|

|

|

|

| L.R. Faulkner |

|

C |

|

|

|

|

|

Ÿ |

|

|

|

|

| J.S. Fishman |

|

|

|

Ÿ |

|

|

|

|

|

Ÿ |

|

|

| H.H. Fore |

|

|

|

|

|

Ÿ |

|

|

|

Ÿ |

|

|

| K.C. Frazier |

|

|

|

|

|

C |

|

|

|

Ÿ |

|

|

| W.W. George |

|

Ÿ |

|

|

|

|

|

Ÿ |

|

|

|

Ÿ |

| S.J. Palmisano |

|

|

|

C |

|

Ÿ |

|

|

|

|

|

Ÿ |

| S.S Reinemund |

|

|

|

|

|

Ÿ |

|

|

|

C |

|

Ÿ |

| R.W. Tillerson |

|

|

|

|

|

|

|

C |

|

|

|

C |

| W.C. Weldon |

|

|

|

Ÿ |

|

Ÿ |

|

|

|

|

|

|

| 2014 Meetings |

|

11 |

|

8 |

|

6 |

|

2 |

|

5 |

|

0 |

C =

Chair Ÿ = Member (1) Other directors serve as alternate members on a rotational

basis.

9

Below is additional information about each Board committee.

Board Affairs Committee

The Board Affairs Committee serves

as ExxonMobil’s nominating and corporate governance committee. The Committee recommends director candidates, reviews non-employee director compensation, and reviews other corporate governance practices, including the Corporate Governance

Guidelines. The Committee also reviews any issue involving an executive officer or director under ExxonMobil’s Code of Ethics and Business Conduct and administers ExxonMobil’s Related Person Transaction Guidelines.

The Committee has adopted Guidelines for the Selection of Non-Employee Directors that describe the qualifications the Committee looks for in director candidates.

These Selection Guidelines, as well as the Committee’s charter, are posted on the Corporate Governance section of our website, and are described in more detail below and in the section titled Director Qualifications on pages 5 to 8.

A substantial majority of the Board must meet the independence standards described in the Corporate Governance Guidelines, and all candidates must be free from any

relationship with management or the Corporation that would interfere with the exercise of independent judgment. Candidates should be committed to representing the interests of all shareholders and not any particular constituency. The Board must

include members with the particular experience required for service on key Board committees, as described in the committee charters.

The Guidelines for

the Selection of Non-Employee Directors state:

“ExxonMobil recognizes the strength and effectiveness of the Board reflect the balance, experience,

and diversity of the individual directors; their commitment; and importantly, the ability of directors to work effectively as a group in carrying out their responsibilities. ExxonMobil seeks candidates with diverse backgrounds who possess knowledge

and skills in areas of importance to the Corporation.”

In addition to seeking a diverse set of business or academic experiences, the Committee

seeks a mix of nominees whose perspectives reflect diverse life experiences and backgrounds, as well as gender and ethnic diversity. The Committee does not use quotas but considers diversity along with the other requirements of the Selection

Guidelines when evaluating potential new directors. The Committee has also instructed its executive search firm to include diversity as part of the candidate search criteria.

The Committee identifies director candidates primarily through recommendations made by the non-employee directors. These recommendations are developed based on the directors’ own knowledge and experience in a

variety of fields, and research conducted by ExxonMobil staff at the Committee’s direction. The Committee has also engaged an executive search firm to help the Committee identify new director candidates. The firm identifies potential director

candidates for the Committee to consider and helps research candidates identified by the Committee. Additionally, the Committee considers recommendations made by employee directors, shareholders, and others. All recommendations, regardless of the

source, are evaluated on the same basis against the criteria contained in the Selection Guidelines.

The recommendation of Mr. Oberhelman was made by

incumbent directors and the executive search firm.

Shareholders may send recommendations for director candidates to the Secretary at the address given

under Contact Information on page 3. A submission recommending a candidate should include:

| Ÿ |

|

Sufficient biographical information to allow the Committee to evaluate the candidate in light of the Selection Guidelines; |

| Ÿ |

|

Information concerning any relationship between the candidate and the shareholder recommending the candidate; and |

| Ÿ |

|

Material indicating the willingness of the candidate to serve if nominated and elected. |

The procedures by which shareholders may recommend nominees have not changed materially since last year’s proxy statement.

10

The Committee also administers provisions of the Corporate Governance Guidelines that require a director to

tender a resignation when there is a substantial change in the director’s circumstances. The Committee reviews the relevant facts to determine whether the director’s continued service would be appropriate and makes a recommendation to the

Board.

Another responsibility of the Committee is to review and make recommendations to the Board regarding the compensation of the non-employee

directors. The Committee uses an independent consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the

Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

Audit Committee

The Audit Committee oversees accounting and internal control matters. Its responsibilities include oversight of:

| Ÿ |

|

Management’s conduct of the Corporation’s financial reporting process; |

| Ÿ |

|

The integrity of the financial statements and other financial information provided by the Corporation to the SEC and the public; |

| Ÿ |

|

The Corporation’s system of internal accounting and financial controls; |

| Ÿ |

|

The Corporation’s compliance with legal and regulatory requirements; |

| Ÿ |

|

The performance of the Corporation’s internal audit function; |

| Ÿ |

|

The independent auditors’ qualifications, performance, and independence; and |

| Ÿ |

|

The annual independent audit of the Corporation’s financial statements. |

The Committee has direct authority and responsibility to appoint (subject to shareholder ratification), compensate, retain, and oversee the independent auditors.

The Committee also prepares the report that SEC rules require be included in the Corporation’s annual proxy statement. This report is on pages 59 to 60.

The Audit Committee has adopted specific policies and procedures for pre-approving fees paid to the independent auditors. Under the Audit

Committee’s approach, an annual program of work is approved each October for the following categories of services: Audit, Audit-Related, and Tax. Additional engagements may be brought forward from time to time for pre-approval by the Audit

Committee. Pre-approvals apply to engagements within a category of service, and cannot be transferred between categories. If fees might otherwise exceed pre-approved amounts for any category of permissible services, the incremental amounts must be

reviewed and pre-approved prior to commitment. The complete text of the Audit Committee’s pre-approval policies and procedures is posted on the Corporate Governance section of ExxonMobil’s website.

The Board has determined that all members of the Committee are financially literate within the meaning of the NYSE standards, and that Mr. Brabeck-Letmathe,

Ms. Burns, Dr. Faulkner, and Mr. George are “audit committee financial experts” as defined in the SEC rules.

Compensation

Committee

The Compensation Committee oversees compensation for ExxonMobil’s senior executives, including salary, bonus, and incentive awards.

They also oversee succession planning for key executive positions. The Committee’s charter is available on the Corporate Governance section of our website.

During 2014, the Committee established the ceiling for the 2014 short term and long term incentive award programs, approved the salary program for 2015, reviewed the individual performance and contributions of each

senior executive including the CEO, granted individual incentive awards and set salaries for the senior executives, and reviewed progress on executive development and succession planning for senior positions.

11

The Compensation Committee’s report is on page 23.

The Committee does not delegate its responsibilities with respect to ExxonMobil’s executive officers and other senior executives (currently 27 positions). For other employees, the Committee delegates authority

to determine individual salaries and incentive awards to a committee consisting of the Chairman and the Senior Vice Presidents of the Corporation. That committee’s actions are subject to a salary budget and aggregate annual ceilings on cash and

equity incentive awards established by the Compensation Committee.

The Committee utilizes the expertise of an external independent consultant, Pearl

Meyer & Partners. The Committee is solely and directly responsible for the appointment, compensation, and oversight of the consultant. The Committee considers factors that could affect Pearl Meyer & Partners’ independence,

including that the consultant provides no other services for ExxonMobil other than its engagement by the Committee and the Board Affairs Committee as described below. Based on this review, the Committee has determined the consultant’s work for

the Committee to be free from conflicts of interest.

At the direction of the Committee, the consultant provides the following services:

| Ÿ |

|

Attends Compensation Committee meetings; |

| Ÿ |

|

Informs the Compensation Committee regarding general trends in executive compensation across industries, particularly trends that reflect a change in

compensation practices, and prepares the analysis of comparator company compensation used by the Compensation Committee; and |

| Ÿ |

|

Participates in the Committee’s deliberations regarding compensation for Named Executive Officers that include items such as: |

| |

– |

|

Whether changes in trends in compensation practices are relevant to ExxonMobil’s compensation programs, as well as a perspective on the structure and

competitive standing of ExxonMobil’s compensation program for senior executives; |

| |

– |

|

Whether the ExxonMobil compensation strategy continues to support the business model, including how the Committee should emphasize or weigh one compensation

element versus another to address the long-term nature of the business and long investment lead times of the Company’s capital program; |

| |

– |

|

How the compensation strategy impacts executive succession planning; |

| |

– |

|

The interpretation of issues involving executive compensation raised by shareholders and the appropriate responses from management; |

| |

– |

|

How to determine the appropriate level of compensation and each compensation element for the Named Executive Officers considering similar positions across

industries, their career experience, and length of experience in their positions, as well as general performance of the Company within the industry; and |

| |

– |

|

Input on the pace at which compensation levels should be adjusted over future years and how to weigh or consider the impact of a compensation change today on

future retirement income. |

The independent consultant’s input is given serious consideration as part of the Committee’s

decision-making process but is not assigned a weight versus the other matters considered by the Committee as described in the Compensation Discussion and Analysis beginning on page 24.

In addition, at the direction of the Chair of the Board Affairs Committee, Pearl Meyer & Partners provides an annual survey of non-employee director compensation for use by that Committee.

The Compensation Committee meets with ExxonMobil’s CEO and other senior executives during the year to review the Corporation’s business results and

progress on strategic plans. The Committee uses this input to help determine the aggregate annual ceilings to be set for the Corporation’s cash and stock-based incentive award programs. The CEO also provides input to the Committee regarding

performance assessments for ExxonMobil’s other senior executives and makes recommendations to the Committee with respect to salary and incentive awards for these executives and succession planning for senior positions. The CEO does not,

however, participate in or provide input on decisions regarding his own compensation.

12

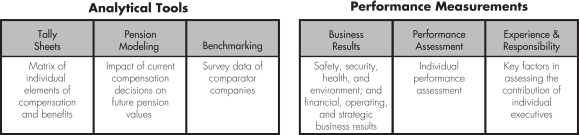

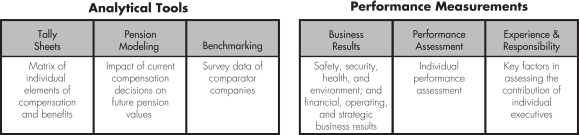

The Committee uses tally sheets to assess total compensation for the Corporation’s senior executives. The

tally sheets value all elements of cash compensation; incentive awards, including stock-based grants; the annual change in pension value; and other benefits and perquisites. The tally sheets also display the value of outstanding stock-based awards

and lump sum pension estimates.

Additional information on tally sheets and other analytical tools used by the Committee to facilitate compensation

decisions is on page 43.

The Compensation Committee determines whether ExxonMobil’s compensation program could result in inappropriate risk

taking. The assessment process includes examining each element of the Company’s compensation policies and practices to determine whether they encourage or reward excessive risk taking. Based on its assessment, the Committee does not believe

that ExxonMobil’s compensation policies and practices create any material adverse risks for the Company.

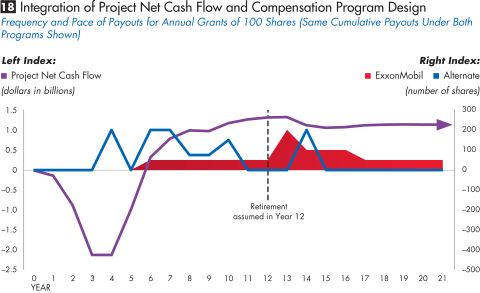

The key design features of our

compensation program that discourage inappropriate risk taking are summarized below. These elements are also described in more detail in the Compensation Discussion and Analysis section of this proxy statement.

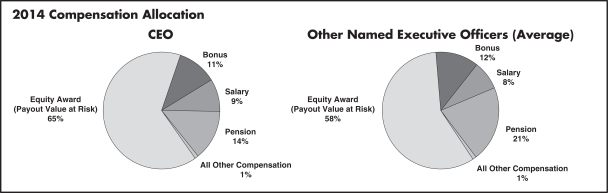

| Ÿ |

|

Allocation of Compensation Elements |

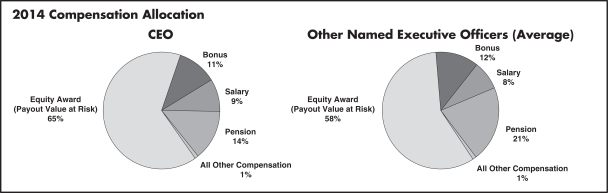

The objective of the Compensation Committee is to grant more than 50 percent of compensation in the form of equity awards with long restriction periods and 10 to 20 percent as an annual bonus. Salary comprises 10

percent or less of pay granted annually. The allocation of these compensation elements for the Named Executive Officers for 2014 is shown on pages 38 and 46. In the judgment of the Committee, this mix of short and long term incentives strikes an

appropriate balance in aligning the interests of senior executives with the business priorities of the Company and sustainable growth in long-term shareholder value.

Long Restriction Periods. As noted above, senior executives are granted a substantial portion of annual compensation in the form of

restricted stock or restricted stock units and these equity awards are restricted from sale for extended periods of time. Specifically, half of the annual equity award may not be sold for 10 years from grant date or until retirement, whichever is

later. The other half is restricted for five years.

Risk of Forfeiture. During these long restriction periods, the equity

award is at risk of forfeiture for resignation or detrimental activity. The long vesting periods on equity awards and the risk of forfeiture together support an appropriate risk/reward profile that reinforces the long-term orientation expected of

senior executives.

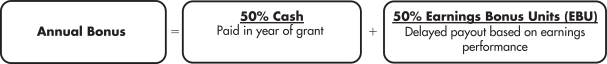

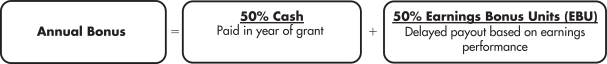

Delayed Payout. Payout of half of the annual bonus is delayed. This is a unique feature of our compensation program relative to many

comparator companies and further discourages inappropriate risk taking; the timing of the delayed payout is determined by earnings performance.

Risk of Forfeiture. Similar to equity awards, the delayed portion of the bonus is subject to risk of forfeiture for resignation or detrimental activity.

Recoupment. The entire annual bonus is subject to recoupment (“claw-back”) in the event of material negative restatement of

the Corporation’s reported financial or operating results. The recoupment provision reinforces the importance of the Company’s financial controls and compliance programs.

The CEO

and the other Named Executive Officers do not have employment contracts, severance agreements, or change-in-control arrangements with the Company. The Committee believes that inappropriate risk taking is discouraged by the fact that senior

executives are “at-will” employees of the Company.

All of

ExxonMobil’s U.S. executives (more than 1,000), including the Named Executive Officers, are eligible for the same salary, incentive, and retirement programs, which are reviewed by the Compensation Committee. We do not have special programs

specifically for the CEO or other Named Executive Officers. Inappropriate risk taking is discouraged at all levels of the Company through similar compensation design features and allocation of awards.

13

For more information on the Committee’s approach to executive compensation and the decisions made by the

Committee for 2014, refer to the Compensation Discussion and Analysis beginning on page 24.

Finance Committee

The Finance Committee reviews ExxonMobil’s financial policies and strategies, including our capital structure, dividends, and share purchase program. The

Committee authorizes the issuance of corporate debt subject to limits set by the Board. The Committee’s charter is available on the Corporate Governance section of our website.

Public Issues and Contributions Committee

The Public Issues and Contributions Committee reviews the

effectiveness of the Corporation’s policies, programs, and practices with respect to safety, security, health, the environment, and social issues. The Committee hears reports from operating units on safety and environmental activities, and also

visits operating sites to observe and comment on current operating practices. In addition, the Committee reviews the level of ExxonMobil’s support for education and other public service programs, including the Company’s contributions to

the ExxonMobil Foundation. The Foundation works to improve the quality of education in the United States at all levels, with special emphasis on math and science. The Foundation also supports the Company’s other cultural and public service

giving. The Committee’s charter is available on the Corporate Governance section of our website.

Executive Committee

The Executive Committee has broad power to act on behalf of the Board. In practice, the Committee meets only when it is impractical to call a meeting of the full

Board.

Shareholder Communications

The Board

Affairs Committee has approved and implemented procedures for shareholders and other interested persons to send written or electronic communications to individual directors, including the Presiding Director, Board committees, or the non-employee

directors as a group.

| Ÿ |

|

Written Communications: Written correspondence should be addressed to the director or directors in care of the Secretary at the address given under

Contact Information on page 3. |

| Ÿ |

|

Electronic Communications: You may send e-mail to individual non-employee directors, Board committees, or the non-employee directors as a group by using

the form provided for that purpose on our website at exxonmobil.com/directors. |

Additional instructions and procedures for

communicating with the directors are posted on the Corporate Governance section of our website at exxonmobil.com/proceduresdircom.

Code of

Ethics and Business Conduct

The Board maintains policies and procedures (which we refer to in this proxy statement as the “Code”) that

represent both the code of ethics for the principal executive officer, principal financial officer, and principal accounting officer under SEC rules, and the code of business conduct and ethics for directors, officers, and employees under NYSE

listing standards. The Code applies to all directors, officers, and employees. The Code includes a Conflicts of Interest Policy under which directors, officers, and employees are expected to avoid any actual or apparent conflict between their own

personal interests and the interests of the Corporation.

The Code is posted on the ExxonMobil website at exxonmobil.com/code. The Code is also

included as an exhibit to our Annual Report on Form 10-K. Any amendment of the Code will be posted promptly on our website.

The Corporation

maintains procedures for administering and reviewing potential issues under the Code, including procedures that allow employees to make complaints without identifying themselves. The Corporation also conducts periodic mandatory business practice

training sessions, and requires regular employees and non-employee directors to make annual compliance certifications.

14

The Board Affairs Committee will initially review any suspected violation of the Code involving an executive

officer or director and will report its findings to the Board. The Board does not envision that any waiver of the Code will be granted. Should such a waiver occur, it will be promptly disclosed on our website.

Related Person Transactions and Procedures

In accordance

with SEC rules, ExxonMobil maintains Guidelines for Review of Related Person Transactions. These Guidelines are available on the Corporate Governance section of our website.

In accordance with the Related Person Transaction Guidelines, all executive officers, directors, and director nominees are required to identify, to the best of their knowledge after reasonable inquiry, business and

financial affiliations involving themselves or their immediate family members that could reasonably be expected to give rise to a reportable related person transaction. Covered persons must also advise the Secretary of the Corporation promptly of

any change in the information provided, and will be asked periodically to review and reaffirm their information.

For the above purposes,

“immediate family member” includes a person’s spouse, parents, siblings, children, in-laws, and step-relatives.

Based on this

information, we review the Company’s own records and make follow-up inquiries as may be necessary to identify potentially reportable transactions. A report summarizing such transactions and including a reasonable level of detail is then

provided to the Board Affairs Committee. The Committee oversees the Related Person Transaction Guidelines generally and reviews specific items to assess materiality.

In assessing materiality for this purpose, information will be considered material if, in light of all circumstances, there is a substantial likelihood a reasonable investor would consider the information important

in deciding whether to buy or sell ExxonMobil stock or in deciding how to vote shares of ExxonMobil stock. A director will abstain from the decision on any transactions involving that director or his or her immediate family members.

Under SEC rules, certain transactions are deemed not to involve a material interest (including transactions in which the amount involved in any 12-month period is

less than $120,000 and transactions with entities where a related person’s interest is limited to service as a non-employee director). In addition, based on a consideration of ExxonMobil’s facts and circumstances, the Committee will

presume that the following transactions do not involve a material interest for purposes of reporting under SEC rules:

| Ÿ |

|

Transactions in the ordinary course of business with an entity for which a related person serves as an executive officer, provided: (1) the affected

director or executive officer did not participate in the decision on the part of ExxonMobil to enter into such transactions; and (2) the amount involved in any related category of transactions in a 12-month period is less than 1 percent of the

entity’s gross revenues. |

| Ÿ |

|

Grants or membership payments in the ordinary course of business to non-profit organizations, provided: (1) the affected director or executive

officer did not participate in the decision on the part of ExxonMobil to make such payments; and (2) the amount of general purpose grants in a 12-month period is less than 1 percent of the recipient’s gross revenues.

|

| Ÿ |

|

Payments under ExxonMobil plans and arrangements that are available generally to U.S. salaried employees (including contributions under the ExxonMobil

Foundation’s Educational and Cultural Matching Gift Programs and payments to providers under ExxonMobil health care plans). |

| Ÿ |

|

Employment by ExxonMobil of a family member of an executive officer, provided the executive officer does not participate in decisions regarding the

hiring, performance evaluation, or compensation of the family member. |

Transactions or relationships not covered by the above

standards will be assessed by the Committee on the basis of the specific facts and circumstances.

The following disclosures are made as of

February 25, 2015, the date of the most recent Board Affairs Committee review of potential related person transactions.

15

ExxonMobil and its affiliates have about 75,000 regular employees around the world and employees related by birth

or marriage may be found at all levels of the organization. ExxonMobil employees do not receive preferential treatment by reason of being related to an executive officer, and executive officers do not participate in hiring, performance evaluation,

or compensation decisions for family members. ExxonMobil’s employment guidelines state, “Relatives of Company employees may be employed on a non-preferential basis. However, an employee should not be employed by or assigned to work under

the direct supervision of a relative, or to report to a supervisor who in turn reports to a relative of the employee.”

Several current ExxonMobil

executive officers have family members also employed by the Corporation or its affiliates: M.W. Albers (Senior Vice President) has a daughter employed by ExxonMobil Development Company; R.N. Schleckser (Vice President and Treasurer) has a brother

employed by ExxonMobil Refining & Supply Company; S.M. Greenlee (Vice President) has a son employed by ExxonMobil Development Company; and J.J. Woodbury (Vice President – Investor Relations and Secretary) has a son employed by XTO

Energy, Inc. In each case, the total value of the family member’s current annualized compensation (including benefits) exceeds the SEC threshold for disclosure. However, consistent with ExxonMobil’s Related Person Transaction Guidelines,

we do not consider any of the relationships noted above to be material within the meaning of the related person transaction disclosure rules.

The Board

Affairs Committee also reviewed ExxonMobil’s ordinary course business with companies for which non-employee directors or their immediate family members serve as executive officers. The Committee determined that, in accordance with the

categorical standards described above, none of those matters represent reportable related person transactions. See Director Independence on page 8.

The

Committee also determined that no related person transactions occurred during the year involving any of the investors who have reported ownership of 5 percent or more of ExxonMobil’s outstanding common stock. See “Certain Beneficial

Owners” on page 22.

We are not aware of any related person transactions required to be reported under applicable SEC rules since the beginning of

the last fiscal year where our policies and procedures did not require review, or where such policies and procedures were not followed.

The

Corporation’s Related Person Transaction Guidelines are intended to assist the Corporation in complying with its disclosure obligations under SEC rules. These procedures are in addition to, not in lieu of, the Corporation’s Code of Ethics

and Business Conduct.

16

ITEM 1 – ELECTION OF DIRECTORS

The Board of Directors has nominated the director candidates named on the following pages. Personal information on each of our nominees, including public company

directorships during the past five years, is provided. All of our nominees currently serve as ExxonMobil directors except for Mr. Oberhelman, who has been nominated by the Board for first election as a director at the annual meeting.

All director nominees have stated they are willing to serve if elected. If a nominee becomes unavailable before the election, your proxy authorizes the people

named as proxies to vote for a replacement nominee if the Board names one. Alternatively, the Board may reduce its size to equal the number of remaining nominees.

The Board recommends you vote FOR each of the following candidates:

|

|

|

| |

| Michael J. Boskin

Age 69 Director since

1996 |

|

Principal Occupation: T.M. Friedman Professor of Economics and Senior Fellow, Hoover Institution, Stanford University

Business Experience: Dr. Boskin is also a Research Associate, National Bureau of

Economic Research. He is Chief Executive Officer and President of Boskin & Co., an economic consulting company. Current Public Company Directorships: Oracle (April 1994–Present) Past Public Company Directorships: None |

|

| |

| Peter Brabeck-Letmathe

Age 70 Director since

2010 |

|

Principal Occupation: Chairman of the Board, Nestlé

Business Experience: Mr. Brabeck-Letmathe was elected Chairman of Nestlé in 2005, Chief Executive Officer in 1997, and relinquished the role of CEO in

2008. He also served as Vice Chairman, Executive Vice President, and Senior Vice President of Nestlé. Current Public Company Directorships: Nestlé (June 1997–Present); L’Oréal (June 1997–Present)

Past Public Company Directorships: Roche Holding (April 2000–March 2010); Credit Suisse Group (May 1997–May 2014) |

|

| |

| Ursula M. Burns

Age 56 Director since 2012 |

|

Principal Occupation: Chairman of the Board and Chief Executive Officer, Xerox Corporation

Business Experience: Ms. Burns was elected Chairman of Xerox in 2010, Chief Executive

Officer in 2009, and President in 2007. She also served as Senior Vice President, Corporate Strategic Services; and Senior Vice President and President, Document Systems and Solutions Group, and Business Group Operations, at Xerox.

Current Public Company Directorships: Xerox (April 2007–Present); American Express

(January 2004–Present) Past Public Company Directorships:

None |

|

| |

17

|

|

|

|

| |

| Larry R. Faulkner

Age 70 Director since

2008 |

|

Principal Occupation: President Emeritus, The University of Texas at Austin

Business Experience: Dr. Faulkner served as President of Houston Endowment from 2006 to

2012 and as President of The University of Texas at Austin from 1998 to 2006. He served on the chemistry faculties of The University of Texas, the University of Illinois, and Harvard University. At the University of Illinois, he also held a number

of positions in academic administration including Provost and Vice Chancellor for Academic Affairs. Current Public Company Directorships: None

Past Public Company Directorships: Temple-Inland (August 2005–February 2012) |

|

| |

| Jay S. Fishman

Age 62 Director since 2010 Presiding Director since 2013 |

|

Principal Occupation: Chairman of the Board and Chief Executive Officer, The Travelers Companies

Business Experience: Mr. Fishman was elected Chairman of The Travelers Companies in

2005, and Chief Executive Officer in 2004 upon the merger of The St. Paul Companies and Travelers Property Casualty Corporation. From 2001 to 2004, he was Chairman, Chief Executive Officer, and President of The St. Paul Companies.

Current Public Company Directorships: Travelers (October 2001–Present); The

Carlyle Group (May 2012–Present) Past Public Company Directorships:

None |

|

| |

| Henrietta H. Fore

Age 66 Director since

2012 |

|

Principal Occupation: Chairman of the Board and Chief Executive Officer, Holsman International

Business Experience: Ms. Fore has served as Chairman and Chief Executive Officer of

Holsman International since 2009. She served as the Administrator of the U.S. Agency for International Development and Director of U.S. Foreign Assistance from 2007 to 2009. She also served as Under Secretary of State for Management, the Chief

Operating Officer for the Department of State, from 2005 to 2007. Current Public

Company Directorships: General Mills (June 2014–Present); Theravance Biopharma (June 2014–Present) Past Public Company Directorships: Theravance (October 2010–May 2014) |

|

| |

18

|

|

|

| |

| Kenneth C. Frazier

Age 60 Director since

2009 |

|

Principal Occupation: Chairman of the Board, President, and Chief Executive Officer, Merck & Co.

Business Experience: Mr. Frazier was elected Chairman and Chief Executive Officer of

Merck in 2011, and President in 2010. He was elected Executive Vice President and President, Global Human Health, at Merck in 2007; and Executive Vice President and General Counsel in 2006. He served as Senior Vice President and General Counsel at

Merck from 1999 to 2006. Current Public Company Directorships: Merck

(January 2011–Present) Past Public Company Directorships:

None |

| |

| Douglas R. Oberhelman

Age 62 Director

nominee |

|

Principal Occupation: Chairman and Chief Executive Officer, Caterpillar Inc.

Business Experience: Mr. Oberhelman was elected Chairman and Chief Executive Officer of

Caterpillar in 2010. He was elected Group President of Caterpillar in 2002; and Vice President, Engine Products Division in 1998. He also served as Vice President and Chief Financial Officer of Caterpillar from 1995 to 1998.

Current Public Company Directorships: Caterpillar (July 2010–Present)

Past Public Company Directorships: Eli Lilly and Company (December 2008–February

2015) and Ameren Corporation (April 2003–April 2010) |

| |

| Samuel J. Palmisano

Age 63 Director since

2006 |

|

Principal Occupation: Former Chairman of the Board, IBM

Business Experience: Mr. Palmisano was elected Chairman, President, and Chief Executive Officer of IBM in 2003; and relinquished the roles of President and

CEO in January 2012 and Chairman in September 2012. Mr. Palmisano also served as President, Senior Vice President, and Group Executive for IBM’s Enterprise Systems Group, IBM Global Services, and IBM’s Personal Systems

Group. Current Public Company Directorships: American Express (March

2013–Present) Past Public Company Directorships: IBM (July

2000–September 2012) |

| |

| Steven S Reinemund

Age 67 Director since

2007 |

|

Principal Occupation: Executive in Residence, Wake Forest University

Business Experience: Mr. Reinemund served as Dean of Business, Wake Forest University

2008 to 2014; Executive Chairman of the Board of PepsiCo from 2006 to 2007, and retired in 2007; was elected Chief Executive Officer and Chairman of the Board in 2001; President and Chief Operating Officer in 1999; and Director in 1996. He was also

elected President and CEO of Frito-Lay in 1992 and Pizza Hut in 1986. Current

Public Company Directorships: American Express (April 2007–Present); Marriott (April 2007–Present); Walmart (June 2010–Present)

Past Public Company Directorships: None |

| |

19

|

|

|

|

| |

| Rex W. Tillerson

Age 63 Chairman and CEO

since 2006 Director since 2004 |

|

Principal Occupation: Chairman of the Board and Chief Executive Officer, Exxon Mobil Corporation

Business Experience: Mr. Tillerson was elected Chairman and Chief Executive Officer of

ExxonMobil in 2006; President and Director in 2004; and Senior Vice President in 2001. Mr. Tillerson has held a variety of management positions in domestic and foreign operations since joining the Exxon organization in 1975, including President,

Exxon Yemen Inc. and Esso Exploration and Production Khorat Inc.; Vice President, Exxon Ventures (CIS) Inc.; President, Exxon Neftegas Limited; and Executive Vice President, ExxonMobil Development Company.

Current Public Company Directorships: None

Past Public Company Directorships: None |

|

| |

| William C. Weldon

Age 66 Director since

2013 |

|

Principal Occupation: Former Chairman of the Board, Johnson & Johnson

Business Experience: Mr. Weldon was elected Chairman and Chief Executive Officer of

Johnson & Johnson in 2002, and relinquished the roles of CEO in April 2012 and Chairman in December 2012. He also served as Vice Chairman from 2001 to 2002 and as Worldwide Chairman, Pharmaceuticals Group, from 1998 to 2001.

Current Public Company Directorships: Chubb (May 2013–Present); CVS Caremark

(March 2013–Present); JPMorgan Chase (March 2005–Present) Past Public

Company Directorships: Johnson & Johnson (February 2001–December 2012) |

|

| |

DIRECTOR COMPENSATION

Director compensation elements are designed to:

| Ÿ |

|

Ensure alignment with long-term shareholder interests; |

| Ÿ |

|

Ensure the Company can attract and retain outstanding director candidates who meet the selection criteria outlined in the Guidelines for Selection of

Non-Employee Directors, which can be found on the Corporate Governance section of our website; |

| Ÿ |

|

Recognize the substantial time commitments necessary to oversee the affairs of the Corporation; and |

| Ÿ |

|

Support the independence of thought and action expected of directors. |

Non-employee director compensation levels are reviewed by the Board Affairs Committee each year, and resulting recommendations are presented to the full Board for approval. The Committee uses an independent

consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive

compensation, but performs no other work for ExxonMobil.

ExxonMobil employees receive no additional pay for serving as directors.

20

Non-employee directors receive compensation consisting of cash and equity in the form of restricted stock.

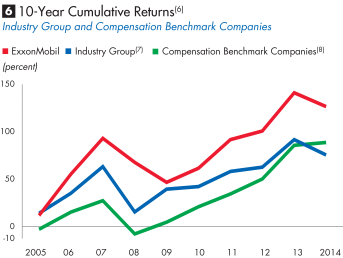

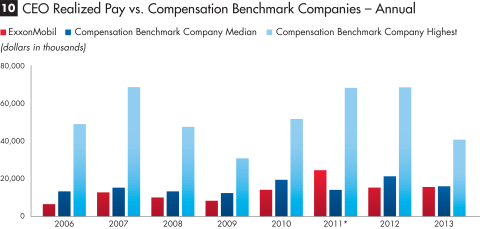

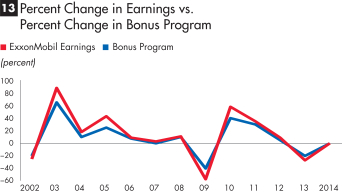

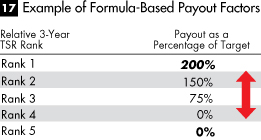

Non-employee directors are also reimbursed for reasonable expenses incurred to attend Board meetings or other functions relating to their responsibilities as a director of Exxon Mobil Corporation.