| 1 | ||||||

| 3 | ||||||

| 14 | ||||||

| 16 | ||||||

| 58 | ||||||

| 72 | ||||||

| 82 | ||||||

| 90 | ||||||

| 94 | ||||||

| 95 | ||||||

COVER PHOTO: Liquefied natural gas (LNG) produced at our joint ventures with Qatar Petroleum is transported to global markets at constant temperature and pressure by dedicated carriers designed and built to meet the most rigorous safety standards.

Statements of future events or conditions in this report, including projections, targets, expectations, estimates, and business plans, are forward-looking statements. Actual future results, including demand growth and energy mix; capacity growth; the impact of new technologies; capital expenditures; project plans, dates, costs, and capacities; resource additions, production rates, and resource recoveries; efficiency gains; cost savings; product sales; and financial results could differ materially due to, for example, changes in oil and gas prices or other market conditions affecting the oil and gas industry; reservoir performance; timely completion of development projects; war and other political or security disturbances; changes in law or government regulation; the actions of competitors and customers; unexpected technological developments; general economic conditions, including the occurrence and duration of economic recessions; the outcome of commercial negotiations; unforeseen technical difficulties; unanticipated operational disruptions; and other factors discussed in this report and in Item 1A of ExxonMobil’s most recent Form 10-K.

Definitions of certain financial and operating measures and other terms used in this report are contained in the section titled “Frequently Used Terms” on pages 90 through 93. In the case of financial measures, the definitions also include information required by SEC Regulation G.

“Factors Affecting Future Results” and “Frequently Used Terms” are also available on the “investors” section of our website.

Prior years’ data have been reclassified in certain cases to conform to the 2013 presentation basis.

The term “project” as used in this publication can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

2013: Financial & Operating Summary

We achieved strong financial and operating results in 2013, highlighted by our continued ability to generate strong cash flows that enable industry-leading shareholder distributions. We maintain a long-term perspective on our business with a relentless focus on operational excellence and disciplined investing through the business cycle. We continue to progress a unique and balanced set of profitable growth opportunities, which position us well to deliver long-term shareholder value.

FINANCIAL HIGHLIGHTS

| (millions of dollars, unless noted) |

|

Earnings After Income Taxes |

|

|

Average Capital Employed |

(1) |

|

Return on Average Capital Employed (%) |

(1) |

|

Capital and Exploration Expenditures |

(1) | ||||

| Upstream |

26,841 | 152,969 | 17.5 | 38,231 | ||||||||||||

| Downstream |

3,449 | 24,430 | 14.1 | 2,413 | ||||||||||||

| Chemical |

3,828 | 20,665 | 18.5 | 1,832 | ||||||||||||

| Corporate and Financing |

(1,538 | ) | (6,489 | ) | N.A. | 13 | ||||||||||

| Total |

32,580 | 191,575 | 17.2 | 42,489 | ||||||||||||

OPERATING HIGHLIGHTS

| Liquids production (net, thousands of barrels per day) |

2,202 | |||

| Natural gas production available for sale (net, millions of cubic feet per day) |

11,836 | |||

| Oil-equivalent production(2) (net, thousands of oil-equivalent barrels per day) |

4,175 | |||

| Refinery throughput (thousands of barrels per day) |

4,585 | |||

| Petroleum product sales (thousands of barrels per day) |

5,887 | |||

| Chemical prime product sales(1) (thousands of tonnes) |

24,063 | |||

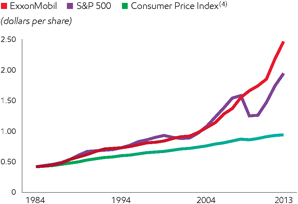

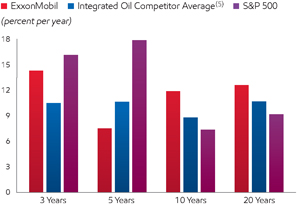

| Dividend Growth Since 1984(3) | Total Shareholder Returns(1) | |

|

| |

(1) See Frequently Used Terms on pages 90 through 93.

(2) Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels.

(3) S&P and CPI indexed to 1984 Exxon dividend.

(4) CPI based on historical yearly average from Bureau of Labor Statistics.

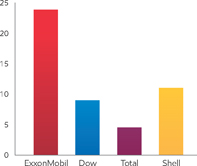

(5) Royal Dutch Shell, BP, Chevron, and Total values are on a consistent basis with ExxonMobil, based on public information.

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

|

|

RESULTS & HIGHLIGHTS

| • | Strong safety, environmental, and operations performance supported by effective risk management |

| • | Earnings of $32.6 billion and an industry-leading return on average capital employed(1) of 17 percent |

| • | Total shareholder distributions(1) of $25.9 billion |

| • | Dividends per share increased 11 percent in the second quarter of 2013, the 31st consecutive year of dividend-per-share increases |

| • | Proved oil and gas reserves(1) additions of 1.6 billion oil-equivalent barrels, replacing more than 100 percent of production for the 20th consecutive year |

| • | Started up six major Upstream projects with gross facility capacity of more than 930 thousand oil-equivalent barrels per day, highlighted by the Kearl Initial Development project |

| • | Started up the Singapore Chemical Expansion project, more than doubling steam-cracking capacity at the site and significantly increasing premium and specialties capacity |

| • | Advanced construction and began commissioning activities at the Papua New Guinea Liquefied Natural Gas project |

| • | Progressed and expanded the Strategic Cooperation Agreement with Rosneft to include seven additional licenses of exploration acreage in the Russian Arctic |

| • | Commissioned a new diesel hydrotreater in Singapore to increase ultra-low sulfur diesel production capacity |

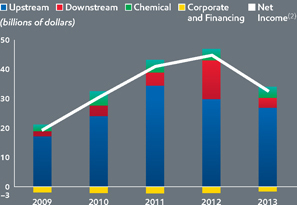

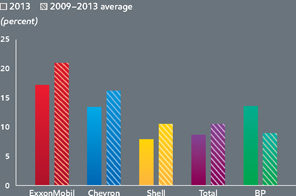

| Functional Earnings and Net Income | Return on Average Capital Employed(1)(3) | |

|

| |

(1) See Frequently Used Terms on pages 90 through 93.

(2) Net income attributable to ExxonMobil.

(3) Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

|

| ||

ExxonMobil is positioned to deliver profitable growth as we start up our major projects and develop our unconventional portfolio in the Upstream and selectively invest in high-value opportunities in Downstream and Chemical. We continue to strategically position the company to deliver shareholder value over the long term, while maintaining our relentless focus on operational excellence.

Operational Excellence Sustaining operational excellence is critical to our ability to deliver profitable growth. We rigorously deploy proven management systems to all of our facilities around the world and incorporate these standard systems into our daily operations to improve safety performance, increase reliability, and lower operating cost.

Upstream We are bringing several major projects online between 2012 and 2017, which are expected to deliver 1 million net oil-equivalent barrels per day of production by 2017, highlighted by the Kearl Initial Development in 2013, Papua New Guinea Liquefied Natural Gas (LNG) in 2014, and the Kearl Expansion project in 2015. We also continue to grow liquids production in our North American unconventional plays. This new production positions us to achieve profitable growth as our percentage of liquids and liquids-linked gas volumes are expected to increase to nearly 70 percent of total production in 2017.

Downstream We are making selective investments to strengthen our world-class Downstream business, which has been significantly improved through our continuous and disciplined portfolio management process. These investments will increase the production of high-value products, such as ultra-low sulfur diesel, jet fuel, and lubricants, to meet growing demand. Other investments will increase feedstock flexibility and operating efficiency at our advantaged manufacturing sites.

Chemical We are developing projects that capture advantaged feedstocks, deploy lower-cost processes, and increase premium product sales. Key examples include our recently completed Singapore expansion, where we more than doubled our steam-cracking capacity, and the specialty elastomers plant we are constructing in Saudi Arabia. Both of these projects will produce high-value premium products to serve growth markets. In the United States, we continue to progress a world-scale ethane cracker and associated premium polymer capacity at our Gulf Coast facilities to capture the value of advantaged feedstock from natural gas liquids.

We continue to evaluate and progress longer-term opportunities. Our deep portfolio includes additional LNG projects, global unconventional resources, and Russian Arctic developments with the potential to create long-term shareholder value. As we have demonstrated throughout our history, we maintain capital discipline by being selective and progressing only the opportunities with the greatest value.

Rex W. Tillerson, Chairman and CEO

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

DELIVERING PROFITABLE GROWTH

Operational Excellence

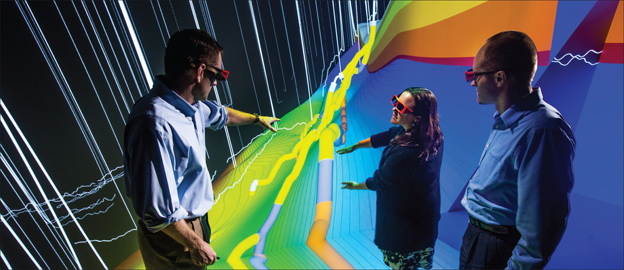

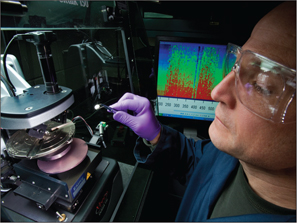

| Operational excellence underpins everything we do at ExxonMobil and is critical to delivering profitable growth. Driven by our talented and committed workforce, proven management systems are rigorously employed at ExxonMobil facilities across the globe and are incorporated into daily operations. These systems enable continuous improvement in safety performance, increased reliability, and lower operating costs.

CULTURE OF EXCELLENCE

Operational excellence begins with exceptional employees. Backed by comprehensive management systems, the men and women of ExxonMobil form the foundation for strong operational performance. We are proud of the culture of excellence reflected in the daily accomplishments of our employees around the world. It is a culture built by decades of past and current employees’ dedication to doing the right things, the right way, and not accepting compromises to our values.

Maintaining our culture of excellence begins the day a new employee starts working for ExxonMobil. In addition to having access to the depth and breadth of experiences of employees in similar positions around the world, new employees receive intensive training that is designed to incorporate proven best practices.

|

Comprehensive management systems are consistently applied around the globe, including at the Joliet Refinery (above and on opposite page). | |

| Employees also receive diverse experiences and assignments enabled by our global functional organization, which encourage the sharing of information and talent. Our goal is to retain employees for a long-term career so they can continue to grow | ||

| professionally, contribute to our strong experience base, and develop into our next generation of leaders. This philosophy applies equally to local workforce development, where we hire and train people of the developing countries in which we operate. | ||

| Refining Energy Intensity(1)(2)

(1) Solomon Associates fuels refining data available for even years only. (2) 2013 data estimated by ExxonMobil. (3) Constant year-end 2013 portfolio. |

RELIABILITY AND EFFICIENCY

Operational excellence also involves a steadfast commitment to continuously improve the reliability and efficiency of our assets, which leads to improved profitability. We deploy rigorous reliability and maintenance systems that improve operating performance and preserve equipment integrity. Our Upstream reliability performance over the last five years demonstrates the effectiveness of our approach, with improved uptime more than 3 percentage points higher at ExxonMobil-operated assets compared to assets in our portfolio operated by others. This improvement equates to approximately 39 thousand net oil-equivalent barrels per day of additional production.

Another way that our commitment to operational excellence improves profitability is demonstrated by the efficiency of our Downstream assets. Cash operating costs at ExxonMobil refineries have been well below the |

|

| ||

| industry average, driven in large part by energy efficiency improvements. With energy representing as much as 60 percent of the operating cost of a refinery, every incremental improvement in energy efficiency results in increased margins and profitability. Since 2002, we have improved refinery energy efficiency by 10 percent, enabled by the application of our Global Energy Management System and strategic investments.

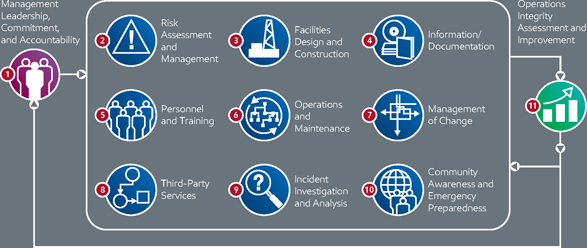

OPERATIONS INTEGRITY MANAGEMENT SYSTEM

Management systems are deployed throughout our global operations to ensure the consistent application of high operating standards. The Operations Integrity Management System (OIMS) forms the cornerstone of our commitment to operational excellence and provides a solid framework to achieve safe and reliable operations.

OIMS establishes the framework for managing the safety, security, health, and environmental risks in our business, and provides the structure to help us meet or exceed applicable regulations. We continually assess the framework and its effectiveness and incorporate learnings to further improve performance. OIMS is implemented consistently around the world in all business lines, and compliance is tested on a regular basis. |

|

SYSTEMATIC APPROACH

ExxonMobil’s Operations Integrity Management System (OIMS) contributes to maintaining high standards across all operations. Each of the 11 elements of OIMS contains an underlying principle and a set of expectations that apply to all ExxonMobil operations worldwide. Management is responsible for having robust systems in place to satisfy these expectations and testing for compliance on a regular basis.

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

DELIVERING PROFITABLE GROWTH

Upstream: Developing Advantaged Resources

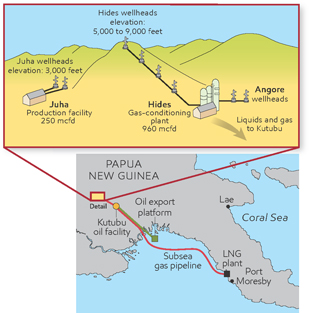

ExxonMobil’s unique combination of experience and expertise operating in difficult environments sets the stage for project execution success in emerging countries such as Papua New Guinea (PNG). In PNG, this knowledge has enabled ExxonMobil and its partners to surmount a myriad of challenges as they approach start-up of the PNG Liquefied Natural Gas (PNG LNG) project in 2014.

| The $19 billion development in PNG will produce 6.9 million tonnes per annum (MTA) of LNG for shipment to international markets as well as domestic sales. It is designed to tap world-class reserves from eight separate fields spread across approximately 120 miles. The project includes the construction of a 960-million-cubic-foot- per-day gas conditioning plant in the mountainous Southern Highlands, a liquefaction plant near Port Moresby, and 434 miles of pipeline (253 miles subsea) connecting the two. Successful project development, start-up, and future operations rely on strong relationships with host governments, local communities, and partners, as well as thoughtful planning and proper employment of project management fundamentals. |

A vessel is transported to the Hides gas plant site through the unique PNG terrain. |

WORLD-CLASS EXECUTION

Through a disciplined approach to project management, the project is well positioned to start up in 2014 despite difficult local conditions. The challenges included zero to low visibility, minimal pre-existing infrastructure, incredibly steep slopes (up to 50-percent grade), as well as geotechnical constraints such as volcanic soil and fault lines. The onshore pipeline, for instance, crosses five faults, which required strain-based-designed pipe and specialized installation procedures. An airfield was constructed in the Highlands to airlift facility modules to build the gas conditioning plant. During the airfield’s construction, more than 9 million cubic meters of earth were moved, and the area experienced enough rainfall to cover the site with 31 feet of water. In addition to technical challenges, a project of this magnitude required global experience to successfully manage a workforce of approximately 20,000 people (speaking more than 40 different languages). Papua New Guinean nationals comprised more than 40 percent of the workforce at its peak.

The project team is preparing for production as construction activities near completion.

|

| ||

COST COMPETITIVENESS

Global LNG projects must be cost-competitive to deliver superior returns. Based on our world-class project execution capabilities and ability to complete projects on schedule, PNG LNG will be at the low end of the cost curve relative to other projects being developed. Even by incorporating the more expensive cost component of the construction in the mountainous Highlands, the cost per MTA for the PNG LNG project will be among the lowest of projects being built in the region.

CAPTURING GROWING ASIAN LNG DEMAND

PNG LNG project revenues and profitability are underpinned by long-term LNG sales contracts covering more than 95 percent of the plant’s capacity. The project is optimally located to serve growing Asian markets where LNG demand is expected to grow by approximately 165 percent between 2010 and 2025, to 370 million tonnes per year. ExxonMobil’s LNG marketing experience and successful track record of developing large LNG projects were instrumental in securing sales with customers in China, Japan, and Taiwan.

EFFECTIVE RELATIONSHIPS WITH THE

GOVERNMENT AND LOCAL COMMUNITIES

Throughout construction, the project team, with our co-venture partners and positive relationship with the PNG government, has been able to draw on specific industry, socioeconomic, and cultural expertise that has helped position the project for success.

In 2011, we began training approximately 140 talented Papua New Guinean nationals for the production workforce that will operate the facilities for more than 30 years. Our Papua New Guinean employees developed into a team that respects and understands the importance of business fundamentals by maintaining excellence in safety, health and environment, and in ensuring accountability, integrity, and the highest standards of performance.

We created programs to improve maternal health and reduce child mortality rates as well as initiatives designed to promote sustainable business growth. For example, we developed the Enterprise Centre, which has already assisted more than 16,000 Papua New Guinean entrepreneurs. To care for the local environment, the project has adopted international best practices in its approach to biodiversity management, waste management and recycling, and invasive weed and pest control programs.

LEADING LNG CAPABILITIES

The PNG LNG project exemplifies ExxonMobil’s leadership in project execution, advanced technologies, and marketing capabilities. We will continue to enhance our reputation and leading LNG capabilities as we start delivering LNG cargoes from PNG in 2014. Our demonstrated expertise enables effective working relationships with customers, partners, and governments around the world as we progress other LNG opportunities in our portfolio, including expansion opportunities in PNG, to meet growing global demand.

PNG LNG underscores our ability to complete a complex project and develop a world-class resource in a challenging environment on schedule and at a competitive cost. This project will deliver reliable, affordable energy to our customers and create long-term economic value for the people of Papua New Guinea, our partners, and shareholders.

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

DELIVERING PROFITABLE GROWTH

Upstream: Developing Advantaged Resources

ExxonMobil has captured a significant position in one of the United States’ premier tight oil plays, the Bakken of North Dakota and Montana. By applying our unconventional expertise to leasehold covering nearly 570,000 acres and leveraging our world-class research organization, we are expanding the resource base and delivering strong, high-margin production growth.

| STRONG, HIGH-MARGIN GROWTH | ||

|

Driven by a record 110 wells brought to sales, improving well performance, and an opportunistic acquisition, Bakken gross-operated production increased 81 percent in 2013 to more than 59 thousand oil-equivalent barrels per day. Peak 30-day production rates on new Bakken wells also increased 22 percent in 2013 and have risen 46 percent in the last two years. Since XTO Energy entered the play in 2008, operated production is up fivefold, and our Bakken resource now exceeds more than 900 million net oil-equivalent barrels.

After several years of delineation drilling and optimizing drilling and completion practices, rapidly increasing production reflects our entry into the development stage of the play. We are now completing multiple pad-based wells in geological sweet spots and have significantly increased the number of stimulation stages in the horizontal laterals. In order to optimize productivity, the Bakken |

Bakken Production Growth Gross-Operated Production

|

completion “recipe” is being continuously adjusted based on several

factors, including the number of stages, varying stage length, the sand volume used in each stimulation, the liquid volume and rate, and the proppant type.

The late 2012 Bakken acquisition of more than 190,000 acres is another principal factor contributing to resource and production growth. In addition to increasing our production and acreage by roughly 50 percent, the quality of the acreage and location close to our core operations enabled us to highgrade the drilling inventory and seamlessly integrate the acquired properties. Moreover, we were able to add the properties at an attractive price since part of the transaction involved trading non-core legacy ExxonMobil properties to the seller. This provides a prime example of how the integration of XTO and ExxonMobil enhances shareholder value, and of our disciplined investment approach.

OPERATIONAL EXCELLENCE

We continue to demonstrate operational excellence through relentless efforts to increase drilling, completion, and operations

| efficiencies, and through our enduring commitment to safety and environmental performance, | all of which are critical to maximizing value. | |

| Bakken Stages

|

For example, after entering the Bakken development phase, highlighted by standardized drilling and completion practices and pad drilling, we have seen our drilling days per well decline 28 percent to 22 days since 2011. Coupled with a 39-percent reduction in completion costs per stimulation stage, these efficiencies have contributed to a 25-percent decrease in total drilling and completion costs in the last two years. |

Source: ExxonMobil estimates based on IHS and North Dakota Industrial Commission data.

|

| ||

| We also are progressing development of Bakken infrastructure to match production growth. In 2013, we completed a major upgrade to our gas gathering facilities in the Nesson area, increasing our ability to capture value from liquids-rich gas, and reducing downtime and gas flaring. Other transportation and gathering initiatives are under way in the Little Missouri and Fort Berthold areas.

INTEGRATING HIGH-IMPACT TECHNOLOGY

XTO and ExxonMobil’s Upstream Research Company are collaborating to increase Bakken recovery and enhance drilling, completion, and operational efficiencies. The unique combination of ExxonMobil’s research capability and XTO’s strong acreage position and operational expertise provides numerous opportunities to test new technologies in the field and deliver proven technologies for immediate benefit.

This partnership forms an important part of the future development strategy of the Middle Bakken and Three Forks reservoirs in the Williston Basin. Ultimately, integrated geoscience and engineering |

ExxonMobil is applying its Bakken expertise and technology in areas such as the Vaca Muerta in Argentina and West Siberia in Russia. |

teams will rapidly incorporate the results of regional geologic analyses and local stratigraphic trends, fracturing research, and data analytics into planning and completing the highest-impact wells in the most productive areas.

Initial field studies are already under way, with drilling and completion of pilot wells evaluating the optimum spacing of laterals in a drilling unit, and analyzing the potential from the lower benches of the Three Forks formation. Both of these could have a significant impact on our resource and production upside in the Bakken.

In addition, we have begun testing our next generation of completion technology, called XFrac. The Bakken industry standard for hydraulic fracturing completions requires setting dozens of “plugs” in the well to achieve the most effective completion. The plugs must then be drilled out and removed in order to produce the wells. Both of these steps require significant time at a substantial cost. Our proprietary XFrac technology is designed to eliminate the need for plugs, making it possible to complete the well at a lower cost and produce the well sooner, compared to the industry’s current methods.

When combined with XTO’s operational expertise, our proprietary technology provides unique opportunities to optimize Bakken development.

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

DELIVERING PROFITABLE GROWTH

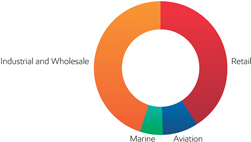

Downstream: Strengthening the Portfolio

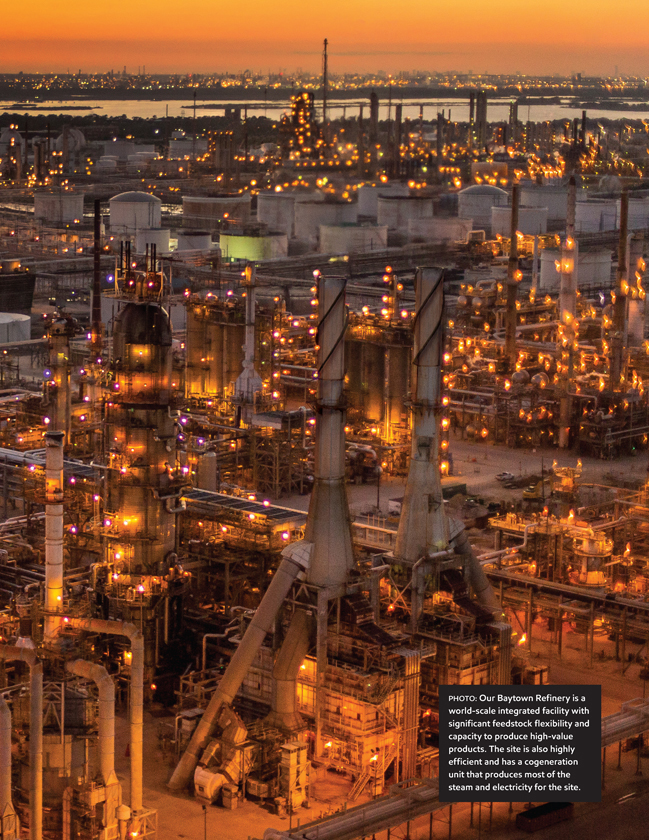

ExxonMobil’s Downstream investments continue to strengthen our advantaged manufacturing assets by leveraging proprietary technology to increase the yield of high-value products, improve feedstock flexibility, and increase operating efficiency. We carefully evaluate investment opportunities across a range of potential market conditions and advance only those projects likely to provide long-term shareholder value. The success of our disciplined investment approach is demonstrated by our industry-leading Downstream return on capital employed.

| Since 2005, we have reduced our refining capacity by more than 1 million barrels per day by divesting smaller, less-competitive facilities. The refineries that remain in our portfolio are generally larger, more efficient, and integrated with chemical and lubricant manufacturing facilities. Going forward, we will continue to strengthen our portfolio by investing in attractive return projects at our advantaged sites. These projects will capitalize on ExxonMobil’s technology, scale, and integration.

INCREASING HIGH-VALUE PRODUCT YIELDS

A key focus area for our Downstream investments is increasing the production of high-value products at our advantaged sites. While the demand for some petroleum products, such as gasoline and fuel oil, is expected to decline, demand for high-value products, such as ultra-low sulfur diesel, jet fuel, chemical feedstocks, and lubricants, is expected to continue to grow. Our investments will increase the production of these high-value products to meet future demand and improve profitability. Our fully integrated marketing and sales teams generate consumer demand for these products and help us maximize the value of every molecule that we produce. |

Downstream Return on Average Capital Employed(1)

(1) See Frequently Used Terms on pages 90 through 93. (2) Royal Dutch Shell, BP, Chevron, and Total values are estimated on a consistent basis with ExxonMobil, based on public information. |

A recent highlight was the commissioning of a new diesel hydrotreater at our Singapore Refinery, which resulted in a significant increase in our ultra-low sulfur diesel production capacity. To build on this success, we are evaluating the construction of a 50-thousand-barrel-per-day delayed coker at our integrated refinery in Antwerp, Belgium. If approved, the new facility will efficiently upgrade low-value fuel oil currently produced at our refineries in northern Europe into higher-value products, including ultra-low sulfur diesel.

Recent investments such as our new hydrotreater in Singapore are contributing to growing production of high-value products. Commissioned in December 2013, the new facility has a capacity of 62 thousand barrels per day.

|

| ||

| We continue to expand our high-value lubricants business. Sales of our industry-leading products, Mobil 1, Mobil SHC, and Mobil Delvac 1, have almost doubled in the last 10 years and are growing at a faster rate than industry. To further capture profitable growth, we are increasing our capacity to produce high-performance lube basestocks at our facilities in Texas, Louisiana, and Singapore. We are also expanding our lube oil blending capacities in the United States, Finland, and China, supporting the growing demand for finished lubricants in key markets.

REDUCING RAW MATERIAL COST

Downstream investments will also continue to expand refinery feedstock flexibility in order to lower raw material costs and increase margins. Our major focus will remain in North America, where increased crude oil production is creating attractive downstream investment opportunities. ExxonMobil has |

ExxonMobil U.S. Gulf Coast Advantaged Crude Refining

|

the largest combined mid-continent and Gulf Coast refining capacity, and refineries in these regions are benefiting from the growing North American crude oil supply. Our investments in these facilities will further expand our capability to process both light and heavy crude oil.

|

EXPANDING LOGISTICS CAPABILITY

We are investing to strengthen our crude oil and product logistics capabilities, particularly in North America. For example, in 2013, we acquired a controlling interest in the Wolverine Pipeline system to improve our U.S. mid-continent product logistics. We also recently began construction of a new crude oil rail export terminal in Edmonton to provide cost-advantaged logistics for the growing supply of Western Canadian crude oil. The new terminal will begin operating in 2015 with a capacity of up to 250 thousand barrels per day. Additional investments will expand product export capabilities at our large U.S. Gulf Coast refineries.

WORLD-CLASS OPERATING EFFICIENCY

Underpinned by disciplined investments, worldwide cash operating cost for our portfolio of refineries has been well below the industry average and consistently outperforms competition. Future investments will strengthen our cost advantage. For example, building on our leadership position in cogeneration, we recently started up a new project at our refinery in Augusta, Italy, and are progressing plans for the next project at our refinery in Singapore.

Future downstream investments are expected to increase high-value product yields, reduce raw material cost, and improve operating efficiency at advantaged sites, such as our Baytown Refinery. |

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

DELIVERING PROFITABLE GROWTH

Chemical: Strategic Investments

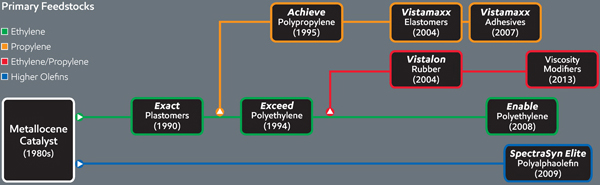

We capture market opportunities in our Chemical business by developing world-scale projects that process advantaged feedstocks, deploy lower-cost processes, and increase premium product sales, particularly targeting growth markets. Our strategic and disciplined investment approach delivers superior returns throughout the business cycle and across a variety of market conditions.

| Our major projects in Singapore, the United States, and Saudi Arabia are all based on the proven combination of advantaged feedstocks, lower-cost processes, and premium products. These projects leverage proprietary technologies to efficiently serve expanding markets and deliver profitable growth.

SINGAPORE

Our recent Singapore expansion illustrates how we identify and approach new capital investments. The project doubled our steam-cracking capacity at the site and significantly increased capacity for premium and specialty products to serve the rapidly growing markets in Asia and beyond.

Enabled by dozens of new proprietary technologies, the world-scale steam cracker can process an unprecedented range of feedstocks, from light gases to heavy liquids, including crude oil. Converting crude oil directly into chemicals provides a cost advantage over naphtha feedstock, the industry standard in Asia. This technology also saves energy and reduces emissions by eliminating the refining steps required to produce naphtha. This crude-cracking approach is an industry first. It is also another step in our ongoing search for advantaged chemical feedstock and demonstrates our ability to innovate and extend our competitive advantage. |

An industry-standard steam cracker in Asia receives naphtha feedstock from a refinery. Our Singapore expansion steam cracker is able to process crude directly, bypassing the refinery steps. |

Crude cracking produces a wider range of valuable by-products that can be further upgraded to additional specialty products, making this a platform for growth. We are developing plans for additional specialty product lines, including halobutyl rubber to supply the growing tire market, as well as premium resins for adhesive applications. These facilities are planned to start up in 2017.

UNITED STATES

As the largest U.S. chemical manufacturer and natural gas producer, we are progressing a unique project that builds on our proven integration model. In addition to capitalizing on the abundance of low-cost ethane feedstock, it will be enhanced by advantages in integration, scale, and premium products.

The project includes a new world-scale ethane cracker at our site in Baytown, Texas, already the country’s largest integrated refining and chemical manufacturing site. Feedstock and energy supplies will be coordinated with ExxonMobil’s Upstream business. Two world-scale polyethylene lines, the largest in industry, will be added at the nearby Mont Belvieu Plastics Plant to produce a mixed slate of polyolefin products, including metallocene polyethylene.

|

Based on sustainability and performance advantages, metallocene polyethylene demand grows faster than commodity polyethylene and commands a market premium. As the world’s largest producer of metallocene polyethylene, with manufacturing locations in all major regions, we will leverage our existing global supply chain and market-facing resources to further penetrate growth markets around the world.

Based on our competitive advantages, we believe the Baytown expansion project, with start-up planned for 2017, is well positioned to outperform other announced projects in North America.

Enable and Exceed metallocene polyethylene resins provide stronger, lighter, and lower-cost packaging solutions with reduced environmental impact. |

|

| ||

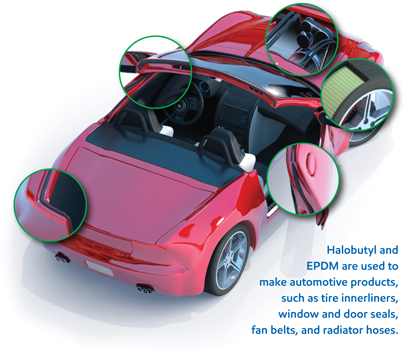

SAUDI ARABIA

In Saudi Arabia, we are working with our joint venture partner, Saudi Basic Industries Corporation, to build a world-scale specialty elastomers facility. This will produce a broad range of synthetic rubber and related products to help meet the growing demand for rubber-based automotive products created by the significant expansion of road networks and vehicle ownership in the Middle East and Asia. We are integrating proprietary ExxonMobil technologies for premium halobutyl and ethylene propylene diene monomer (EPDM) rubbers into our existing operations at Jubail Industrial City with start-up planned for 2015.

These ExxonMobil processes enable lower-cost production versus competition. For example, our halobutyl technology saves energy and capital investment per tonne of capacity through our proprietary configuration and equipment design. Similarly, our metallocene EPDM technology utilizes fewer process steps and consumes less energy, while

significantly reducing emissions.

This project builds on our world-scale commodity assets at the site, which

are based on low-cost feedstocks, to provide specialty products needed

to develop the automotive industry in Saudi Arabia and beyond.

DELIVERING SUPERIOR FINANCIAL PERFORMANCE

Our investments are guided by rigorous analysis of growth

opportunities that leverage integration and capture advantages

in feedstock, lower-cost processes, and premium products,

where we can bring benefits to our customers while

generating industry-leading returns for our shareholders.

The success of this approach is evidenced by our ability

to deliver superior returns on capital employed relative

to competitors throughout the business cycle.

Our recently completed investments, combined with

those under development, will continue to support our

industry-leading position.

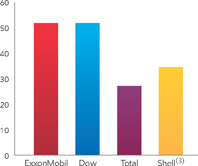

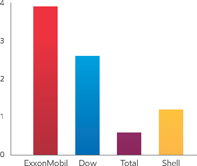

| Chemical: Industry-Leading Returns(1) (10-year average, 2004–2013)

|

||||

| Revenue

|

Earnings

|

ROCE (2)

| ||

| (billions of dollars) | (billions of dollars) | (percent) | ||

|

|

| ||

(1) Competitor values are estimated on a consistent basis with ExxonMobil and are based on public information. Chemical segments only: Royal Dutch Shell and Total (Total data only available through 2011). Dow Chemical shown on a corporate total basis.

(2) See Frequently Used Terms on pages 90 through 93.

(3) Royal Dutch Shell revenue data only available through 2012.

|

| ||

|

| ||

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

|

Upstream

| ||||||||||||||||

| The disciplined execution of ExxonMobil’s Upstream strategies, underpinned by a relentless focus on operational excellence, drives delivery of our competitive advantages and superior results.

RESULTS & HIGHLIGHTS

• Strong safety and environmental performance

• Industry-leading earnings of $26.8 billion

• Proved oil and natural gas reserve additions of 1.6 billion oil-equivalent barrels, replacing more than 100 percent of production for the 20th consecutive year

|

STRATEGIES

• Apply effective risk management, safety,

• Identify and

selectively capture the

• Exercise a disciplined approach to investing

• Develop and apply high-impact technologies

• Maximize profitability of existing oil and gas

• Capitalize on

growing natural gas and power

| |||||||||||||||

| • Added 6.6 billion oil-equivalent barrels of new

resource, increasing the overall resource base to

• Exploration discoveries totaling 1.5 billion oil-equivalent barrels in several

countries, including

• Six major project start-ups including the 110-thousand-barrel-per-day Kearl Initial

Development

• Advanced construction and began commissioning activities at the Papua New Guinea

Liquefied

• Signed expansion of the 2011 Strategic Cooperation Agreement with Rosneft to include seven

• Advanced preparation to drill first Kara Sea exploration well in 2014

• Progressed three North America liquefied natural gas opportunities in Alaska,

Western Canada,

| ||||||||||||||||

|

UPSTREAM STATISTICAL RECAP

|

2013

|

2012

|

2011

|

2010

|

2009

|

| ||||||||||

| Earnings (millions of dollars) |

26,841 | 29,895 | 34,439 | 24,097 | 17,107 | |||||||||||

| Liquids production (net, thousands of barrels per day) |

2,202 | 2,185 | 2,312 | 2,422 | 2,387 | |||||||||||

| Natural gas production available for sale |

11,836 | 12,322 | 13,162 | 12,148 | 9,273 | |||||||||||

| Oil-equivalent production(1) (net, thousands of barrels per day) |

4,175 | 4,239 | 4,506 | 4,447 | 3,932 | |||||||||||

| Proved reserves replacement ratio(2)(3) (percent) |

106 | 124 | 116 | 211 | 100 | |||||||||||

| Resource additions(2) (millions of oil-equivalent barrels) |

6,595 | 4,012 | 4,086 | 14,580 | 2,860 | |||||||||||

| Average capital employed(2) (millions of dollars) |

152,969 | 139,442 | 129,807 | 103,287 | 73,201 | |||||||||||

| Return on average capital employed(2) (percent) |

17.5 | 21.4 | 26.5 | 23.3 | 23.4 | |||||||||||

| Capital and exploration expenditures(2) (millions of dollars) |

38,231 | 36,084 | 33,091 | 27,319 | 20,704 | |||||||||||

|

(1) Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels. (2) See Frequently Used Terms on pages 90 through 93. (3) Proved reserves exclude asset sales. Includes non-consolidated interests and Canadian oil sands. Note: Unless otherwise stated, production rates, project capacities, and acreage values referred to on pages 16 through 47 are gross.

| ||||||||||||||||

|

| ||

BUSINESS OVERVIEW

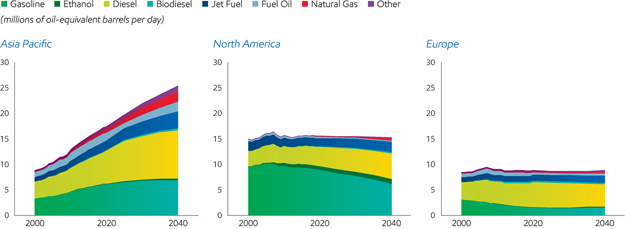

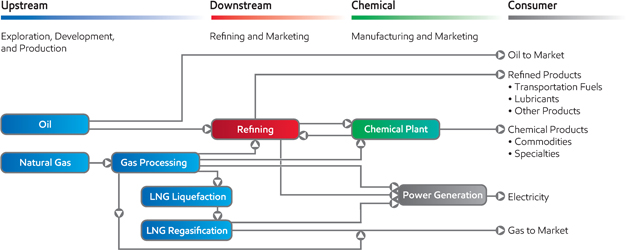

Oil and natural gas are expected to continue to play a leading role in meeting the world’s growing demand for energy. In fact, oil and natural gas are projected to be the world’s top two energy sources accounting for approximately 60 percent of global demand by 2040, up slightly from today.

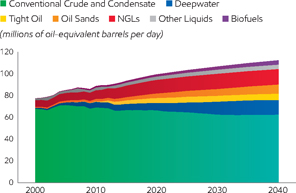

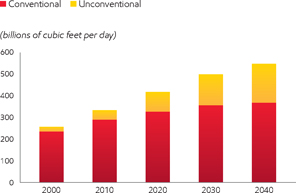

Demand for oil and other liquid fuels is forecast to increase by about 25 percent from 2010 to 2040. Meeting this demand will require replacing normal conventional resource decline while also increasing production from deepwater, tight oil, oil sands, and natural gas liquids. Global demand for natural gas is likely to increase by about 65 percent by 2040. About 65 percent of the growth in natural gas supplies through 2040 is expected to be from unconventional sources, which will account for one-third of global production by 2040. Meanwhile, liquefied natural gas (LNG) volume is expected to triple by 2040, contributing approximately 15 percent of global gas supply. Meeting the world’s growing demand for energy presents a tremendous challenge that will require a long-term view, significant investment, and continuing innovation to develop conventional and unconventional resources.

ExxonMobil is well positioned to meet this challenge while delivering sustained, long-term value for our shareholders through the disciplined execution of our Upstream strategies across exploration, development, production, natural gas and power marketing, and research activities. We begin by identifying and selectively capturing the highest-quality resources, testing for technical and commercial quality as well as materiality. We then apply a disciplined approach to investing and cost management. Proven project management systems incorporate best practices developed from our extensive worldwide experience to rigorously manage our global project portfolio from initial discovery to start-up.

We have a steadfast commitment to develop and apply high-impact technologies in areas such as subsurface imaging, reservoir modeling, and well completions. This enhances our ability to find, efficiently develop, and produce new resources from some of the most challenging reservoirs. These technologies also enable us to improve the economic performance of our existing assets.

We apply robust operating and risk management systems to maximize the profitability of our existing oil and gas production. Over the last five years, our operated-facility downtime has been close to 25-percent better than fields operated by others in which we hold an interest, which equates to approximately 39 thousand net oil-equivalent barrels per day.

With our detailed knowledge of global energy markets, we are also able to capitalize on growing natural gas and power markets. In 2013, we sold more than 14 billion net cubic feet per day of gas across 35 countries including participating in LNG operations that delivered more than 62 million tonnes to global markets. Our industry leadership in the application of cogeneration technology enables the capture of additional value by increasing efficiency and reducing emissions.

Our Upstream strategies, supported by a relentless focus on effective risk management, safety, and operational excellence, are designed to deliver superior results through the long term.

| Global Liquids Supply by Type | Global Natural Gas Production by Type | |

|

| |

| Source: ExxonMobil, 2014 The Outlook for Energy: A View to 2040 | Source: ExxonMobil, 2014 The Outlook for Energy: A View to 2040 | |

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

Opportunity Capture

Integration of technical expertise, extensive global databases, and industry-leading research capabilities enables ExxonMobil to identify and selectively capture the highest-quality resources across all resource types and environments. The depth and breadth of our worldwide experience as explorers, developers, producers, and technology innovators position us favorably as a partner of choice for resource owners and other organizations.

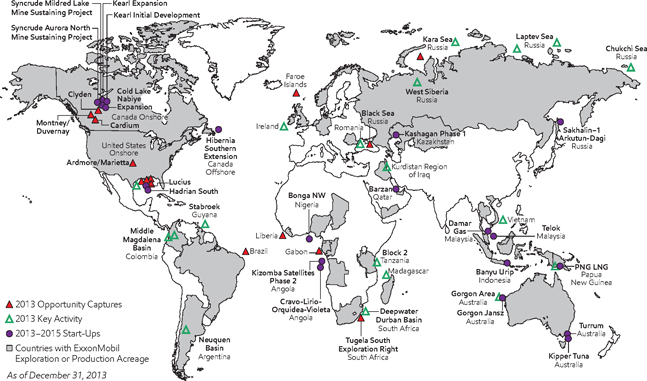

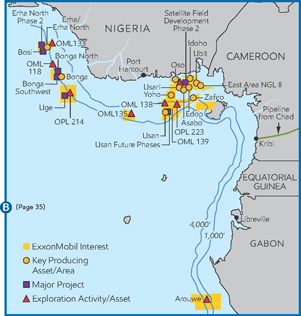

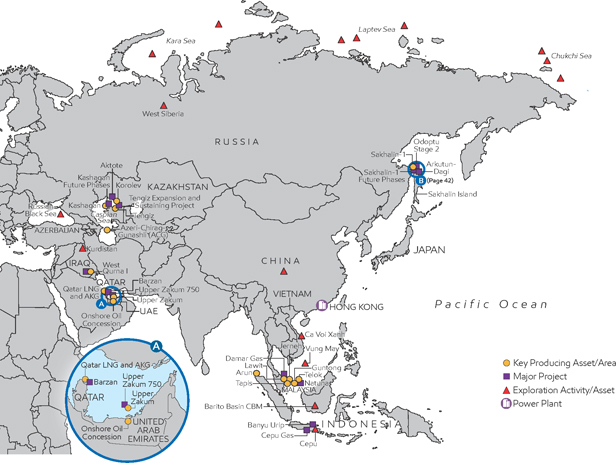

2013 OPPORTUNITY CAPTURES

In 2013, we captured 15 new opportunities spanning conventional and unconventional plays to build on our industry-leading resource base. At year-end 2013, our exploration acreage totaled more than 61 million net acres in 32 countries. Some of the new acreage positions that were established are in Russia, Brazil, Gabon, Liberia, South Africa, and the Faroe Islands.

Brazil • We participated in the Brazil Tender Round 11 in 2013 and successfully acquired two blocks in the Potiguar and Ceara basins for a combined 190,000 net acres. ExxonMobil will operate these blocks.

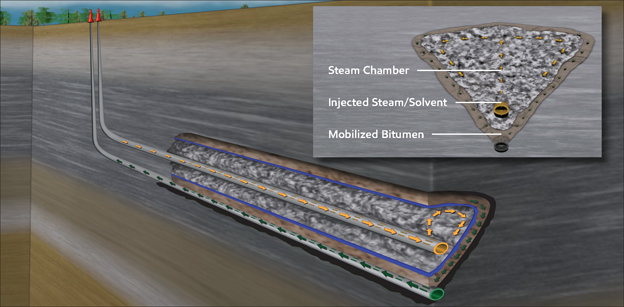

Canada • In February 2013, we completed the acquisition of Celtic Exploration Ltd., expanding our presence in Western Canada through the addition of roughly 545,000 net acres in the liquids-rich Montney Shale and 104,000 net acres in the Duvernay Shale unconventional plays. In addition, ExxonMobil acquired an interest in the in situ Steam-Assisted Gravity Drainage Clyden oil sands lease adding 226,000 net acres of high-quality oil resource.

Faroe Islands • ExxonMobil expanded its position in 2013 and acquired a 26-percent interest in license L016 in the Faroe Islands, covering 249,000 net acres.

Gabon • ExxonMobil entered Gabon by acquiring a 30-percent stake in the deepwater Arouwe Block encompassing 327,000 net acres.

Liberia • ExxonMobil entered Liberia by acquiring an 83-percent interest in Liberia Block 13, adding approximately 520,000 net acres in a deepwater play.

GLOBAL UPSTREAM PORTFOLIO

|

| ||

| Russia • ExxonMobil is working with Rosneft on the exploration potential in the Kara Sea (10.35 million net acres) and the Black Sea Tuapinskiy (990,000 net acres), as part of the original Strategic Cooperation Agreement (SCA). Additionally, agreements were signed to increase the scope of the SCA, including seven new blocks in the Russian Arctic.

South Africa • ExxonMobil acquired a 75-percent interest and 2.1 million net acres in the Tugela South deepwater block offshore South Africa, representing another new country entry in 2013.

U.S. Offshore • We expanded our position in the Gulf of Mexico by a combined 75,000 net acres. We were awarded 11 Offshore Continental Shelf (OCS) blocks in Sale 229 and Sale 227 and concluded a six-block farm-in agreement.

U.S. Onshore • In April, we acquired 12,000 net acres of additional Woodford Shale acreage in southern Oklahoma, bringing our total acreage position to more than 270,000 net acres in the liquids-rich Ardmore/Marietta area. |

|

RESOURCES

In 2013, we continued to build our diverse global portfolio of resources and reserves by adding 6.6 billion oil-equivalent barrels. After adjusting for production, asset sales, and revisions to existing fields, the resource base totals more than 90 billion oil-equivalent barrels. Proved reserves comprise approximately 28 percent of the resource base, or 25.2 billion oil-equivalent barrels.

The addition of an average of 4.8 billion oil-equivalent barrels to our resource base per year over the last decade demonstrates the success of our global strategy to identify, evaluate, pursue, and capture high-quality opportunities. Today, ExxonMobil holds the largest global resource base among international oil companies. The size and diversity of our resource base afford further advantage by supporting global risk management and offering unequaled investment flexibility.

We continue to increase and expand the quality of our resources through successful exploration drilling, capture of undeveloped resources, strategic acquisitions, and increased recovery from existing fields. In 2013, resources were added in Argentina, Australia, Canada, Nigeria, Norway, Tanzania, the United Arab Emirates, and the United States.

Our exploration drilling program added 1.5 billion oil-equivalent barrels in 2013, with additions from multiple resource types around the world. Additions from exploration drilling averaged approximately 2 billion oil-equivalent barrels per year over the last decade.

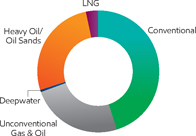

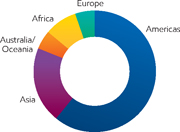

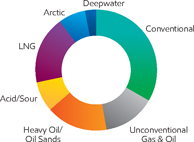

| Resource Additions/Acquisitions(1) | Resource Base Distribution(1) | Resource Base Distribution(1) | ||

| By Resource Type | By Region | By Resource Type | ||

| (percent, oil-equivalent barrels added) | (percent, oil-equivalent barrels) | (percent, oil-equivalent barrels) | ||

|

|

| ||

(1) See Frequently Used Terms on pages 90 through 93.

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

Opportunity Capture, continued

|

Our resource base is assessed annually to include new

The largest components of ExxonMobil’s resource base |

RESOURCE BASE CHANGES (1) | |||||||||

| (billions of oil-equivalent barrels) | 2013 | 5-Year Average |

||||||||

| Resource additions/acquisitions |

6.6 | 6.4 | ||||||||

| Revisions to existing fields |

(0.2 | ) | (0.6 | ) | ||||||

| Production |

(1.6 | ) | (1.6 | ) | ||||||

| Sales |

(1.2 | ) | (0.6 | ) | ||||||

|

|

||||||||||

| Net change versus year-end 2012 |

3.6 | 3.6 | ||||||||

|

Proved Reserves Replacement Ratio(1)(2)

(percent of annual production replaced with proved reserves additions)

|

| |||||||||

PROVED RESERVES

ExxonMobil’s resource base includes 25.2 billion oil-equivalent barrels of proved oil and gas reserves, equating to 16 years of reserves life at current production rates. These reserves represent a diverse global portfolio distributed across all geographic regions and resource types, with a higher proportion of liquids.

In 2013, we replaced 103 percent of the reserves we produced, including the impact of asset sales. We added 1.6 billion oil-equivalent barrels to proved reserves (76 percent liquids) while producing 1.6 billion oil-equivalent barrels. Excluding asset sales, our proved reserves replacement ratio was 106 percent. Key proved reserve additions resulted from the funding of the Abu Dhabi Upper Zakum 750 project and the associated license extension, and North America unconventional activities.

ExxonMobil added 10.3 billion oil-equivalent barrels to proved reserves over the last five years, more than replacing production over that time period. The development of new fields and extensions of existing fields have resulted in the addition of an average of 1.1 billion oil-equivalent barrels per year to proved reserves.

Revisions to proved reserves have averaged about 0.4 billion oil-equivalent barrels per year over the last five years, driven by effective reservoir management and the application of new technologies. We have more than replaced our production for 20 consecutive years. Proved reserve estimates are managed by a team of experienced reserve experts and are the result of a rigorous and structured management review process.

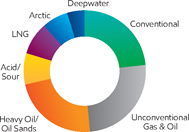

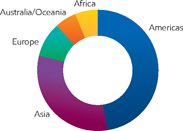

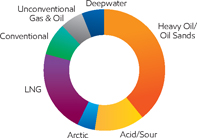

| Proved Reserves Distribution(1) |

Proved Reserves Distribution(1) | Proved Reserves Distribution(1) | ||

| By Region | By Resource Type | By Hydrocarbon Type | ||

| (percent, oil-equivalent barrels) | (percent, oil-equivalent barrels) | (percent, oil-equivalent barrels) | ||

|

|

| ||

(1) See Frequently Used Terms on pages 90 through 93.

(2) Includes asset sales.

|

| ||

Global Upstream Portfolio

Our disciplined investment approach combines systematic project assessment with technical and commercial expertise. We advance opportunities that will provide the most attractive returns across a broad range of potential market conditions, while maintaining a focus on the efficient use of capital. We apply this approach across the asset life cycle from initial resource capture and project execution through production operations. Our primary focus is to deliver superior investment returns over the long term.

| PRODUCTION VOLUMES

Net liquids production was up 17 thousand barrels per day versus 2012 as start-up of the Kearl Initial Development project, ramp-up of recent West Africa projects, increasing U.S. unconventional liquids production, and improved uptime performance more than offset field decline. Net natural gas production was down 4 percent as expected lower U.S. production and field decline were partially offset by lower facility downtime, higher weather-related demand, and project start-ups. Net oil-equivalent production of 4.2 million barrels per day decreased 1.5 percent versus 2012 consistent with our projections.

Near-term activity will focus on starting up 14 projects in 2014 and 2015, highlighted by the Papua New Guinea Liquefied Natural Gas, Sakhalin-1 Arkutun-Dagi, Banyu Urip, and Kearl Expansion projects. We will continue to develop our significant, liquids-rich North American unconventional resources. We will also continue to pursue attractive opportunities to increase volumes from existing assets through new drill wells, workovers of existing wells, and secondary and tertiary recovery programs. |

FOCUS ON PROFITABILITY

We have focused efforts to improve long-term unit profitability and have made strategic choices to meet this objective. We have a portfolio of production volumes across a range of profitability. We first maximize the production of our high-profit volumes by running our facilities at the highest uptime possible. Application of technologies to reduce costs and improve recovery is another key enabler to producing high-profit volumes. In some instances, improved fiscal or contractual terms are needed to improve profitability. In these cases, we engage the resource owners to develop mutually beneficial solutions, as we have done with the Upper Zakum concession in the United Arab Emirates. Another example of improving long-term profitability is our decision to continue shifting capital from dry gas to liquids-rich plays in North America, which reduces total oil-equivalent production but improves the profitability mix as we increase the production of higher-margin liquids.

|

Excluding the impact of the United Arab Emirates onshore concession expiry and the Iraq West Qurna I partial divestment, liquids production is anticipated to grow by 2 percent in 2014 and by 4 percent per year on average from 2015 through 2017. Natural gas production is anticipated to decline by 2 percent in 2014 and to grow by 1 percent per year on average from 2015 through 2017.

|

The forward-looking projections of production volumes in this document reflect our best assumptions regarding technical, commercial, and regulatory aspects of existing operations and new projects. Factors that could impact actual volumes include project start-up timing, regulatory changes, quotas, changes in market conditions, asset sales, and entitlement volume effects under certain production sharing contracts and royalty agreements.

The production we are bringing online from our major projects and other activities positions us to achieve profitable growth as our liquids and liquids-linked gas volumes as a percentage of total volumes are projected to increase to nearly 70 percent in 2017. |

Production Outlook(1)

(millions of oil-equivalent barrels per day, net)

|

| Total (millions of oil-equivalent barrels per day, net) |

4.0 | (1) | 4.0 | 4.1 | 4.2 | 4.3 | ||||||||||||||

(1) 2013 production excludes the impact of United Arab Emirates onshore concession expiry and Iraq West Qurna I partial divestment. Production based on 2013 average price ($109 Brent).

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

Global Upstream Portfolio, continued

| 2013 MAJOR DEVELOPMENT PROJECTS

ExxonMobil participated in six major start-ups in 2013 and we plan to bring 21 more major projects online by 2017. These projects, along with our 2012 start-ups, are expected to deliver 1 million net oil-equivalent barrels per day to our production volumes by 2017.

Kearl Initial Development • (Combined ExxonMobil and Imperial Oil interest, 100 percent) Kearl Initial Development started up in April 2013. It is anticipated to produce 110 thousand barrels of bitumen per day and employs a number of technology innovations, including a proprietary froth treatment process that eliminates the need to build an upgrader. Ongoing expansion and planned future debottlenecking have the potential to increase production up to 345 thousand barrels per day.

Kashagan Phase 1 • (ExxonMobil interest, 17 percent) Phase 1 of the Kashagan Development started up in September 2013 and reached a maximum gross production level of approximately 80 thousand barrels per day. Following a brief period of production, the field was shut-in due to a leak in the main gas pipeline. Work is progressing on the repair options and production reinstatement. |

Major Project Production Outlook Production by Start-Up Year(1)

(1) Excludes impact of future divestments and OPEC quota effect. Production based on 2013 average price ($109 Brent). |

Syncrude Aurora North Mine Sustaining Project • (Imperial Oil interest, 25 percent) Aurora North oil sands ore processing plant relocations and tailings management facility start-ups were completed in October 2013. These projects enable sustained production rates of approximately 215 thousand barrels of bitumen per day.

Telok • (ExxonMobil interest, 50 percent) Located offshore Malaysia, Telok first gas was achieved in March 2013 ahead of plan. Eight wells have been successfully drilled, and seven completions tied in and flowing full well stream gas to the host platform Guntong E at an estimated combined rate of 275 million cubic feet per day.

| Kipper Tuna and Turrum • (ExxonMobil interest, Tuna and Turrum 50 percent; Kipper 32.5 percent) The Kipper Tuna and Turrum projects started up in 2013 with initial production from the Tuna and Turrum fields. Located in the Gippsland Basin in Australia, the projects include a new offshore platform and subsea tieback. Peak production will be achieved following the completion of development drilling at Turrum and start-up of onshore gas conditioning facilities. | PROJECT EXECUTION PERFORMANCE – EXXONMOBIL PROJECTS |

|||||||||

| (percent of plan, 2009-2013 average) | Cost | Schedule | ||||||||

| ExxonMobil Operated |

102 | 106 | ||||||||

| Operated by Others

|

|

133

|

|

|

139

|

| ||||

|

|

||||||||||

| Upstream Projects |

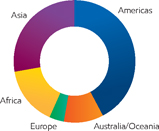

Upstream Projects | Upstream Projects | ||

| By Geographic Region | By Resource Type | By Hydrocarbon Type | ||

| (percent, number of projects) | (percent, oil-equivalent barrels) | (percent, oil-equivalent barrels) | ||

|

|

| ||

|

| ||

| MAJOR PROJECT START-UPS(1) | ||||||||||||||||||||||||||||||||||||||

| Facility Capacity (Gross) |

ExxonMobil | Facility Capacity (Gross) |

ExxonMobil | |||||||||||||||||||||||||||||||||||

| Liquids (KBD) |

Gas (MCFD) |

Working Interest (%) |

Liquids (KBD) |

Gas (MCFD) |

Working Interest (%) | |||||||||||||||||||||||||||||||||

| 2012-2013 (Actual) |

|

2017+ (Projected) | ||||||||||||||||||||||||||||||||||||

| Angola |

Kizomba Satellites Phase 1 | 100 | – | 40 | n | Angola | AB32 Kaombo Split Hub | 250 | – | 15 | l | |||||||||||||||||||||||||||

| Australia |

Kipper Tuna | 15 | 175 | 40 | n | Australia | Gorgon Area Expansion | 10 | 915 | 25 | l | |||||||||||||||||||||||||||

| Turrum | 20 | 200 | 50 | n | Scarborough | – | 1,030 | 50 | n | |||||||||||||||||||||||||||||

| Canada |

Kearl Initial Development | 110 | – | 100 | n | Canada | Aspen | 90 | – | 100 | n | |||||||||||||||||||||||||||

|

Syncrude Aurora North Mine |

215 | – | 25 | p | Cold Lake Grand Rapids | 40 | – | 100 | n | |||||||||||||||||||||||||||||

| Sustaining Project | ||||||||||||||||||||||||||||||||||||||

|

Kazakhstan |

Kashagan Phase 1 |

|

370 |

|

|

450 |

|

|

17 |

|

l |

Firebag | 380 | – | 70 | n | ||||||||||||||||||||||

|

Malaysia |

Telok |

|

– |

|

|

430 |

|

|

50 |

|

n |

Hebron | 150 | – | 36 | n | ||||||||||||||||||||||

|

Nigeria |

Satellite Field Development |

|

70 |

|

|

– |

|

|

40 |

|

n |

Kearl Debottleneck | 125 | – | 100 | n | ||||||||||||||||||||||

| Phase 1 | Mackenzie Gas Project | 10 | 830 | 56 | n | |||||||||||||||||||||||||||||||||

|

Usan

|

|

180 |

|

|

– |

|

|

30 |

|

l |

Syncrude Aurora South | 210 | – | 25 | p | |||||||||||||||||||||||

|

2014-2016 (Projected) |

Phases 1 and 2 | |||||||||||||||||||||||||||||||||||||

| Angola

|

Cravo-Lirio-Orquidea-Violeta (CLOV) |

160 | – | 20 | l | Syncrude Mildred Lake Extension |

210 | – | 25 | p | ||||||||||||||||||||||||||||

|

Indonesia |

Cepu Gas |

5 | 220 | 41 | p | |||||||||||||||||||||||||||||||||

| Kizomba Satellites Phase 2 | 85 | – | 40 | n |

Natuna |

– | 1,100 | ** | n | |||||||||||||||||||||||||||||

|

Australia |

Gorgon Jansz |

|

20 |

|

|

2,765 |

|

|

25 |

|

l |

Iraq |

West Qurna I |

1,600 | – | 25 | p | |||||||||||||||||||||

| Canada |

Cold Lake Nabiye Expansion | 50 | – | 100 | n | Kazakhstan | Aktote | 50 | 850 | 17 | l | |||||||||||||||||||||||||||

| Hibernia Southern Extension | 55 | – | 27 | n | Kashagan Future Phases | 1,260 | – | 17 | l | |||||||||||||||||||||||||||||

| Kearl Expansion | 110 | – | 100 |

n |

Tengiz Expansion | 260 | – | 25 | l | |||||||||||||||||||||||||||||

|

Syncrude Mildred Lake Mine Sustaining Project |

180 | – | 25 | p | Tengiz Sustaining Project | 395 | – | 25 | l | |||||||||||||||||||||||||||||

|

Indonesia |

Banyu Urip |

165 | 15 | 45 | n |

Nigeria |

Bonga North |

100 | 60 | 20 | l | |||||||||||||||||||||||||||

| Malaysia |

Damar Gas | 5 | 200 | 50 | n | Bonga Southwest | 225 | 15 | 16 | l | ||||||||||||||||||||||||||||

| Nigeria |

Erha North Phase 2 | 60 | – | 56 | n | Bosi | 140 | 260 | 56 | n | ||||||||||||||||||||||||||||

|

Norway

|

Aasgard Subsea Compression

|

|

40

|

|

|

415

|

|

|

14

|

|

l |

Satellite Field Development Phase 2 |

80 | – | 40 | n | ||||||||||||||||||||||

| Papua |

PNG LNG | 30 | 1,000 | 33 | n | Uge | 110 | 20 | 20 | n | ||||||||||||||||||||||||||||

| New Guinea |

||||||||||||||||||||||||||||||||||||||

|

Qatar |

Barzan |

90 | 1,400 | 7 | p |

Usan Future Phases |

50 | – | 30 | n | ||||||||||||||||||||||||||||

| Russia |

Sakhalin-1 Arkutun-Dagi | 90 | – | 30 | n | Romania | Domino | – | 630 | 50 | n | |||||||||||||||||||||||||||

| U.S. |

Hadrian South | 5 | 300 | 47 | n | Russia | Sakhalin-1 Future Phases | – | 800 | 30 | n | |||||||||||||||||||||||||||

| Heidelberg | 80 | 80 | 9 | l | Sakhalin-1 Odoptu Stage 2 | 55 | – | 30 | n | |||||||||||||||||||||||||||||

| Julia Phase 1 | 30 | – | 50 | n | Tanzania | Tanzania Block 2 | – | 1,000 | 35 | l | ||||||||||||||||||||||||||||

| Lucius | 100 | 150 | 15 | l |

United Arab Emirates |

Upper Zakum 750 | 750 | – | 28 | p | ||||||||||||||||||||||||||||

| Point Thomson Initial Production System

|

10 | 200 | 37 | n | U.S. | Alaska LNG | 60 | 3,500 | 36 | l | ||||||||||||||||||||||||||||

| KBD = Thousand barrels per day MCFD = Million cubic feet per day

| ||||||||||||||||||||||||||||||||||||||

|

n ExxonMobil Operated l Co-Venturer Operated D Joint Operations ** Pending Final Agreements | ||||||||||||||||||||||

| (1) | The term “project” as used in this publication can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports. |

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

Worldwide Upstream Operations

| ExxonMobil has an interest in exploration

and

THE AMERICAS

Our Americas portfolio includes conventional onshore

fields, |

AMERICAS HIGHLIGHTS | 2013 | 2012 | 2011 | ||||||||||

| Earnings (billions of dollars) |

5.6 | 5.5 | 7.8 | |||||||||||

| Proved Reserves (BOEB) |

12.0 | 11.8 | 10.8 | |||||||||||

| Acreage (gross acres, million) |

46.2 | 47.0 | 50.2 | |||||||||||

| Net Liquids Production (MBD) |

0.7 | 0.7 | 0.7 | |||||||||||

| Net Gas Available for Sale (BCFD) |

3.9 | 4.2 | 4.3 | |||||||||||

|

|

||||||||||||||

|

Americas Production

(millions of oil-equivalent barrels per day, net)

|

| |||||||||||||

|

| ||

UNITED STATES

ExxonMobil is a leading reserves holder and producer of oil and natural gas in the United States. We maintain a significant position in all major producing regions, including offshore

Gulf of Mexico, the

Gulf Coast, the

Rockies, the

mid-continent,

California, Alaska,

and

Appalachia.

Our U.S.

portfolio includes

mature conventional assets,

emerging unconventional

developments, and new

deepwater developments. With a

focus on technological improvements,

operational efficiency, and high-quality

drilling programs, we are extending the

lives of our base producing fields, some

of which have been onstream for decades.

Our portfolio is further augmented by

activity in unconventional plays,

eight of which are estimated to

contain recoverable resources of

greater than 1 billion oil-equivalent

barrels. Future developments are

also planned from ExxonMobil’s

extensive deepwater Gulf

of Mexico acreage position.

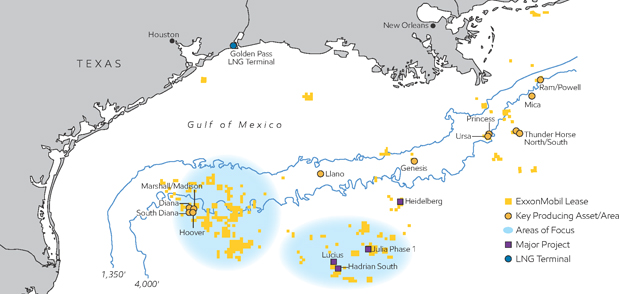

Gulf of Mexico/Gulf Coast

2013 average net production in the Gulf of

Mexico was 43 thousand barrels of liquids

per day and 159 million cubic feet of gas.

Deepwater • In the deepwater

Gulf of Mexico, we operate the

Hoover platform that is located in more

than 4,800 feet of water and produces

oil and gas from the Hoover field and several

subsea tiebacks. In addition, we are a partner in six

deepwater fields, including the co-venturer-operated Thunder Horse field (ExxonMobil interest, 25 percent) where active drilling is ongoing.

Activity continues in the Keathley Canyon (KC) area. We are developing the Hadrian-5 discovery under a unitization agreement

as part of the Anadarko-operated Lucius development (ExxonMobil interest, 15 percent).

|

| ||

The Hadrian South project (ExxonMobil interest, 47 percent), which is situated in KC-963 and KC-964, is being developed as a subsea tieback to the Lucius platform. Start-up for both developments is planned for 2014.

ExxonMobil and its co-venturers continue to incorporate appraisal drilling results into concept selection for development of the Hadrian North oil discovery (ExxonMobil interest, 50 percent), which is situated on blocks KC-918 and KC-919.

The Julia Phase 1 project (ExxonMobil interest, 50 percent) in the Walker Ridge (WR) area was fully funded in 2013, as a subsea tieback to the Chevron-operated Jack-St. Malo host facility on WR-718. First oil production is planned for 2016.

ExxonMobil is also participating in the Anadarko-operated Heidelberg project (ExxonMobil interest, 9 percent), which was fully funded in 2013. The project develops resources located in a five-block unit in Green Canyon and is planned to start up in 2016.

We continue to expand and evaluate our substantial exploration portfolio of 1.5 million net acres in the deepwater Gulf of Mexico with investments in advanced seismic data to further enhance understanding of the subsurface. ExxonMobil was the high bidder on four Offshore Continental Shelf (OCS) blocks in Sale 229 and seven OCS blocks in Sale 227.

Conventional • The Mobile Bay development offshore Alabama contributed net production of 121 million cubic feet of gas per day during 2013. We continue to realize the cost efficiency and environmental benefits associated with the consolidation of our sour gas plants in late 2010.

| LNG • Golden Pass Products, LLC, a partnership of ExxonMobil and Qatar Petroleum International, progressed federal permitting to add up to 15.6 million tonnes per annum of proposed export capacity to the existing Golden Pass LNG terminal, a liquefied natural gas (LNG) import terminal at Sabine Pass, Texas. This project affords this world-class LNG terminal the opportunity to import or export natural gas in response to market conditions. The project received approval to export to countries with Free Trade Agreements (FTA) with the United States in 2012 and is awaiting approval to export to non-FTA countries. In 2013, the Federal Energy Regulatory Commission (FERC) Pre-Filing Environmental Review Process was initiated. |

| |

|

The Golden Pass LNG terminal in Sabine Pass, Texas, progressed federal permitting to add up to 15.6 million tonnes per annum of proposed LNG export capacity. |

|

|

EXXONMOBIL 2013 FINANCIAL & OPERATING REVIEW | |

Worldwide Upstream Operations, continued

U.S. Onshore Texas and Louisiana

ExxonMobil is a leading producer in Louisiana and Texas with a strong position in multiple unconventional gas plays and the Permian Basin. In 2013, onshore net production in Texas and Louisiana averaged 102 thousand barrels of liquids per day and 1.8 billion cubic feet of gas per day.

Conventional • ExxonMobil is a leading leaseholder and producer in the Permian Basin. After ramping up activity to eight drilling rigs in 2013, we completed more than 130 wells across multiple fields, primarily Russell, Goldsmith, Fullerton, Cornell, and Mahoney. More than 65 workover rigs are also active in the Permian, increasing production by opening up additional zones with fracture stimulation treatments, most significantly in the Fullerton and Robertson areas. We are also optimizing development and expanding infrastructure in our carbon dioxide projects in the Central Basin Platform area and in East Texas, and continue to evaluate the results of the Means Residual Oil Zone project that started up in late 2011.

Unconventional • ExxonMobil holds 224,000 net acres in the Haynesville/Bossier Shale of East Texas and Louisiana, where we continued to realize the benefits of our drilling and completion improvements. We also continued well spacing tests in both the Haynesville and overlying Bossier Shale reservoir with encouraging early results.

In the Barnett Shale play in North Texas, we completed 95 wells in 2013 across our leasehold of 218,000 net acres, primarily focusing on the liquids-rich gas areas. In the Freestone tight gas trend, ExxonMobil holds 319,000 net acres. We brought 11 wells online in 2013 and completed upgrades to both sweet and sour gas infrastructure in the Beargrass area to handle high-volume horizontal completions.

In the Permian, we continue to evaluate unconventional potential across our acreage, highlighted by the Wolfcamp, Wolfbone, Wolfberry, and Bone Springs reservoirs. In 2013, we completed nine Bone Springs wells that had average 30-day rates of approximately 600 oil-equivalent barrels per day.

Mid-Continent and Appalachia

ExxonMobil produces oil and gas throughout the mid-continent states, including Wyoming, Utah, North Dakota, Montana, Colorado, Kansas, Oklahoma, Arkansas, and New Mexico, as well as the Appalachian states of Pennsylvania and West Virginia. Average net production from these areas in 2013 was 88 thousand barrels of liquids per day and more than 1.5 billion cubic feet of gas per day.

Conventional • The LaBarge development (ExxonMobil interest, 100 percent) in Wyoming comprises the Madison, Tip Top, and Hogsback fields and the Shute Creek gas processing plant. It includes one of the world’s largest helium recovery and physical solvent gas sweetening plants. Implementation of a project to improve environmental performance of the Shute Creek plant’s compressor engines started up in early 2012, and record carbon dioxide sales of more than 340 million cubic feet per day were reached in late 2013. The LaBarge facilities processed an average of 629 million cubic feet of inlet gas per day in 2013.

ExxonMobil’s proprietary Controlled Freeze Zone (CFZ) technology underwent rigorous testing from 2012 to 2013 at the Shute Creek commercial demonstration plant. CFZ is a single-step cryogenic separation process with the potential to make carbon capture and storage more affordable and significantly reduce carbon dioxide and hydrogen sulfide content in the natural gas stream while meeting or exceeding product purity specifications. The testing also demonstrated the ability to reinject the acid gas product stream, a key differentiating attribute of this technology.

Unconventional • The Bakken Shale remained one of our most active unconventional programs in 2013 with well completions and production volumes reaching all-time highs. ExxonMobil currently holds 570,000 net acres of high-quality resource in this play. Through the deployment of 10 rigs and the acquisition of more than 190,000 acres from Denbury Resources, gross-operated production in the Bakken increased 81 percent from 2012 to 59 thousand barrels of oil per day in 2013.

The liquids-rich Woodford Shale in the Ardmore Basin of southern Oklahoma was another one of our active areas in 2013. We operated 12 rigs across our more than 270,000 net acres of leasehold and continue to successfully delineate the Woodford and Caney reservoirs across our core Ardmore and Marietta areas. We are also progressing infrastructure projects to optimize the liquids-rich production from this area.

In the Fayetteville Shale, pad drilling, optimized well spacing, and improved drilling processes are increasing efficiencies as development proceeds across our 490,000 net acres.

|

| ||

ExxonMobil holds a material acreage position in the Marcellus Shale of 589,000 acres across Pennsylvania and West Virginia and 84,000 acres in the promising Utica Shale in Ohio. We continue to be encouraged by early drilling results. In 2013, we commissioned and started up a 125-million-cubic-foot-per-day cryogenic gas plant in Butler County, which will increase our returns in the Marcellus area through the capture of additional natural gas liquids. In Utah, Colorado, and New Mexico, development of the more than 1 million net acres in the Uinta, Piceance, Raton, and San Juan has continued.

California

Net production from fields both onshore and offshore California averaged 91 thousand barrels of liquids per day and 23 million cubic feet of gas per day during 2013. The Santa Ynez Unit (SYU) development (ExxonMobil interest, 100 percent) consists of three platforms located 5 miles offshore Santa Barbara and a processing plant in Las Flores Canyon. We continue to successfully employ world-class extended-reach drilling from these platforms to increase recovery. In 2013, development drilling was resumed at the SYU Harmony drilling rig following several upgrades that resulted in a 70-percent increase in the rig’s reach capacity. Onshore California, we are progressing plans to commence further development drilling in 2014.

ExxonMobil also has a 48-percent equity share in Aera Energy LLC’s operations, comprising eight fields and about 11,000 wells that produce 61 thousand net oil-equivalent barrels per day of a mixture of heavy and conventional oil with associated natural gas.

Alaska

Average net production in Alaska was 106 thousand barrels of liquids per day in 2013. ExxonMobil is the largest holder of discovered natural gas resources on the North Slope of Alaska. The initial development phase of the Point Thomson project is progressing with site preparation and an air strip completed, permanent housing camp occupied, and large processing module fabrication in progress. Together with the State of Alaska and its co-venturers, ExxonMobil is continuing to progress the Alaska LNG project to commercialize Alaskan gas resources.

CANADA

ExxonMobil is one of the leading oil and gas producers in Canada through our wholly owned affiliate, ExxonMobil Canada, and majority-owned affiliate Imperial Oil (ExxonMobil interest, 69.6 percent). Through these entities, we have one of the largest resource positions in Canada and possess a significant portfolio of major projects, both onshore and offshore.

Offshore Canada Operations

The Hibernia field (ExxonMobil interest, 33 percent) offshore Newfoundland is operated by Hibernia Management and Development Company Ltd., utilizing ExxonMobil personnel and processes. Hibernia’s net production averaged 29 thousand barrels of oil per day in 2013. Progress continued on the Hibernia Southern Extension project (ExxonMobil interest, 27 percent), which consists of a subsea tieback to the existing Hibernia platform and will access recoverable resources of approximately 170 million gross oil-equivalent barrels. Subsea equipment installation was completed and subsea drilling commenced. Start-up is expected in 2014.