2013

Analyst Meeting New York Stock Exchange

March 6, 2013

Exhibit 99.2 |

2013

Analyst Meeting New York Stock Exchange

March 6, 2013

Exhibit 99.2 |

Cautionary Statement

Forward-Looking

Statements.

Outlooks,

projections,

estimates,

targets,

business

plans,

and

other

statements

of

future

events

or

conditions in this presentation or the subsequent discussion period are

forward-looking statements. Actual future results, including

financial

and

operating

performance;

demand

growth

and

mix;

ExxonMobil’s

production

growth

and

mix;

the

amount

and mix of capital expenditures; future distributions; resource additions and

recoveries; finding and development costs; project plans, timing, costs, and

capacities; efficiency gains; cost efficiencies; integration benefits; product sales and mix; and the impact

of technology could differ materially due to a number of factors. These include

changes in oil or gas prices or other market conditions affecting the oil,

gas, and petrochemical industries; reservoir performance; timely completion of

development projects; war and other political or security disturbances;

changes in law or government regulation; the outcome of commercial

negotiations; the actions of competitors and customers; unexpected technological

developments; the occurrence and duration of economic recessions; unforeseen

technical difficulties; and other factors discussed here and under the heading "Factors

Affecting

Future

Results"

in

the

Investors

section

of

our

Web

site

at

exxonmobil.com.

See

also

Item

1A

of

ExxonMobil’s

2012

Form 10-K. Forward-looking statements are based on management’s

knowledge and reasonable expectations on the date hereof, and we assume no

duty to update these statements as of any future date. Frequently Used

Terms. References to resources, resource base, recoverable resources,

and

similar

terms

include

quantities

of

oil and gas that are not yet classified as proved reserves but that we believe will

likely be moved into the proved reserves category and produced in the

future. “Proved reserves" in this presentation are presented using the SEC pricing basis in effect

for the year presented, except for the calculation of 19 straight years of at least

100-percent replacement; oil sands and equity company reserves are

included for all periods. For definitions of, and information regarding, reserves, return on average capital

employed, cash flow from operations and asset sales, free cash flow, and other terms

used in this presentation, including information required by SEC Regulation G,

see the "Frequently Used Terms" posted on the Investors

section of our Web site.

The Financial and Operating Review on our Web site also shows ExxonMobil's net

interest in specific projects. The

term

“project”

as

used

in

this

presentation

does

not

necessarily

have

the

same

meaning

as

under

SEC

Rule

13q-1

relating

to

government payment reporting.

For example, a single project for purposes of the rule may encompass numerous

properties, agreements, investments, developments, phases, work efforts,

activities and components, each of which we may also informally describe

herein as a “project.” 2 |

Agenda

9 AM

Welcome

Corporate Overview

Business Overview

Strategic Overview

Upstream

Downstream and Chemical

Break

Summary

11 AM

Q&A

12 PM

Meeting Concludes

Rex Tillerson, Chairman and CEO

Mike Dolan, Senior Vice President

David Rosenthal, Vice President, Investor Relations

Rex Tillerson, Chairman and CEO

3 |

Chairman and CEO

Rex Tillerson

Corporate Overview

4 |

Key

Messages Risk management is fundamental to our business

Continued strong financial and operating results

Major project start-ups drive volume growth for 2013 –

2017

Portfolio of opportunities for long-term profitable growth

ExxonMobil strategy delivers superior returns over the long term

5 |

2012

Results Strong industry safety performance

Rigorous environmental management

Superior financial / operating results

Disciplined capex

$39.8B

Unmatched shareholder

distributions*

$30.1B

Reserves replacement**

115%

Strong results across key financial and non-financial parameters

*

Includes dividends and share purchases to reduce shares outstanding.

**

Includes asset sales.

6

Earnings

$44.9B

ROCE

25.4%

Cash flow from operations

and assets sales

$63.8B |

Risk

Management Management accountability

High standards

Employee and contractor training

Operations Integrity Management

Systems (OIMS)

Risk management is fundamental to our business

7

Well-developed and clearly-

defined policies and procedures

Rigorously applied systems |

Safety

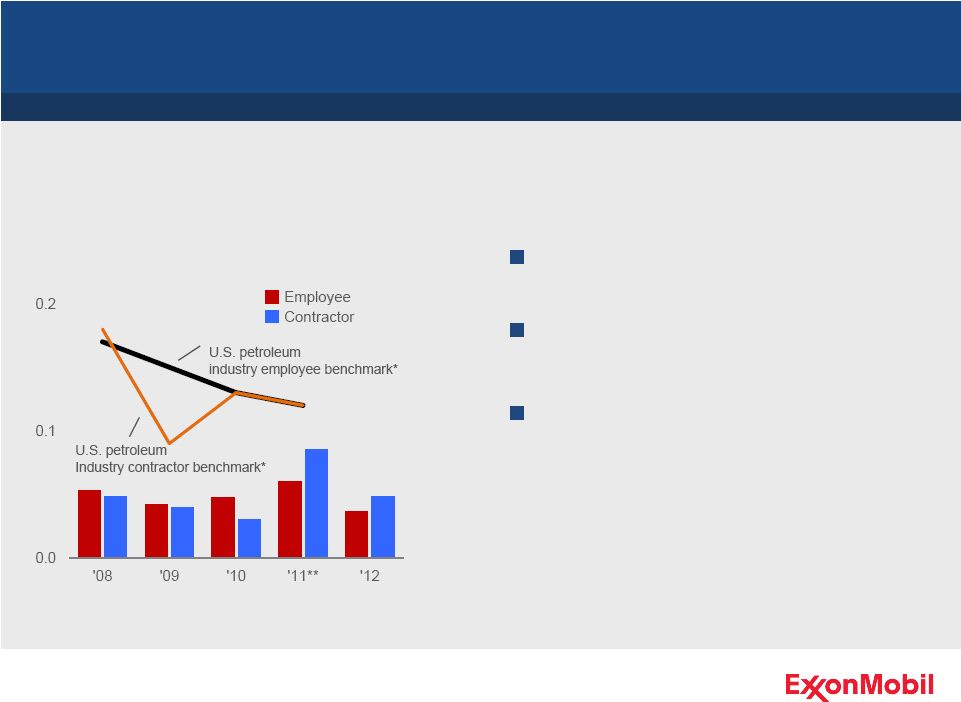

Our vision: Nobody Gets Hurt

Emphasis on personnel and process

safety risk

Committed to continuously improving

safety performance

Lost Time Incident Rate

Incidents per 200K hours

Safety performance improved versus 2011

*

2012 industry data not available.

**

XTO included beginning in 2011.

8 |

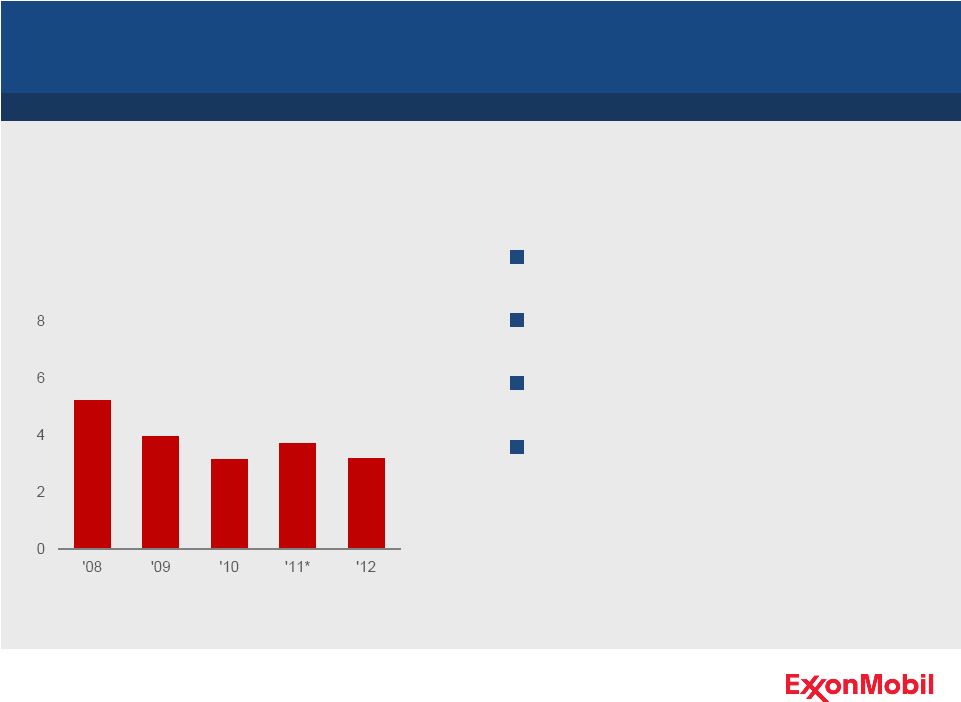

Environmental Performance

Strong environmental management

Improving energy efficiency

Reducing flaring, emissions, releases

Protect Tomorrow. Today.

Hydrocarbon Flaring from

Upstream Oil & Gas Production

Million metric tons

Committed to reducing environmental impact

*

XTO included beginning in 2011.

9 |

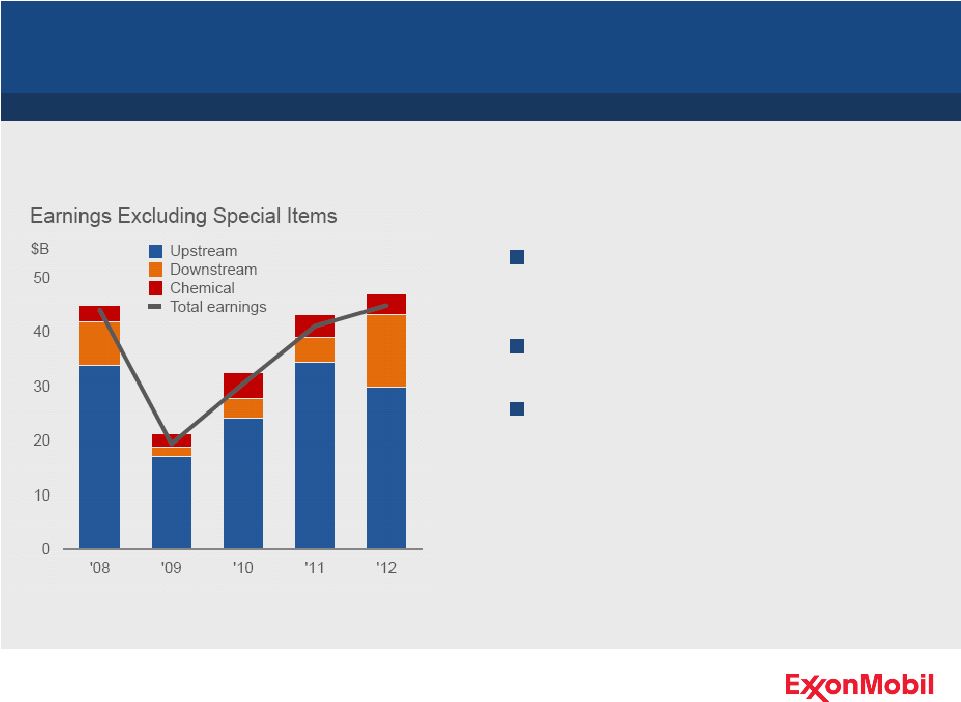

Earnings

Earnings of $44.9B in 2012, an increase of 9% over 2011

Strong performance across all

business lines

Leveraging integration advantages

Maximizing value of asset base

10 |

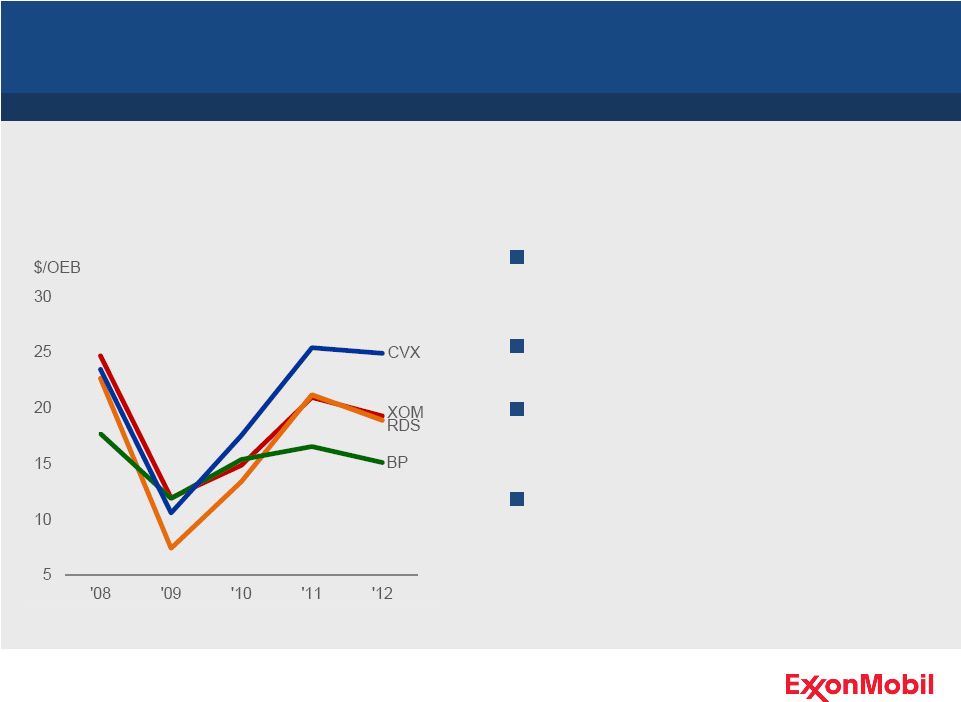

Upstream Earnings per Barrel

Managing the Upstream portfolio to improve earnings per barrel

Current asset mix impacting results

in the short term

Plans in place to maximize value

Disciplined and consistent approach

over the long term

Ongoing portfolio management

Earnings per OEB*

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information.

11 |

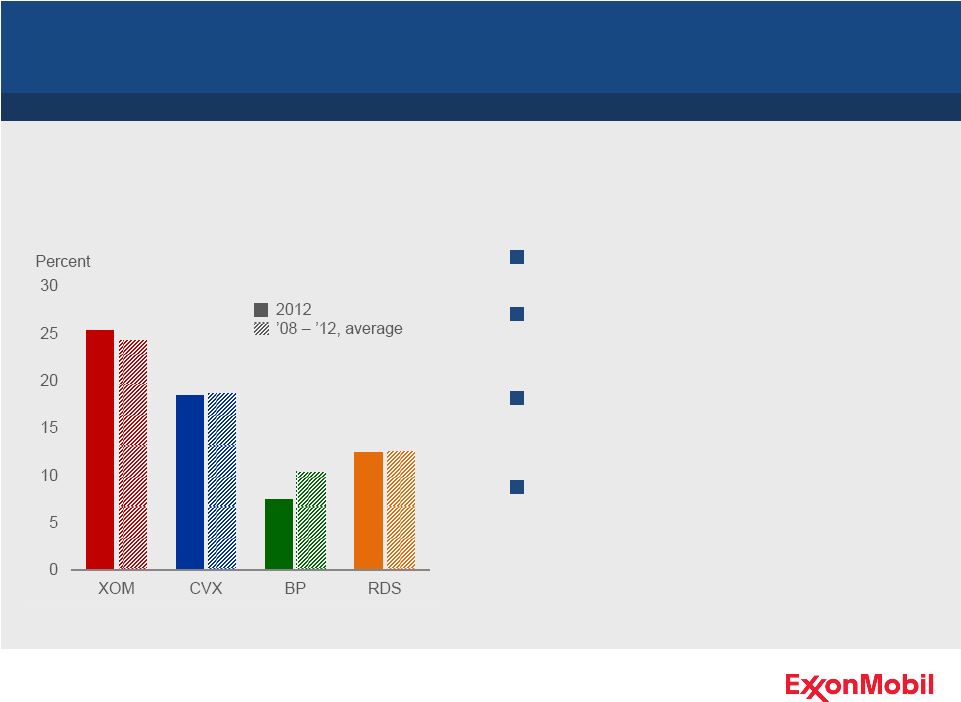

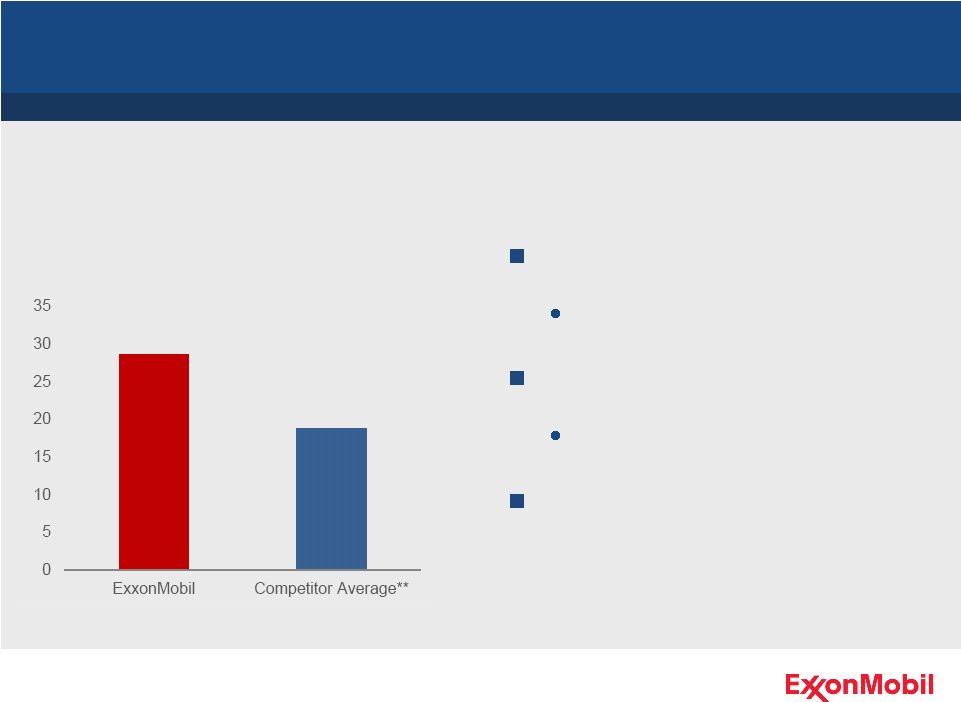

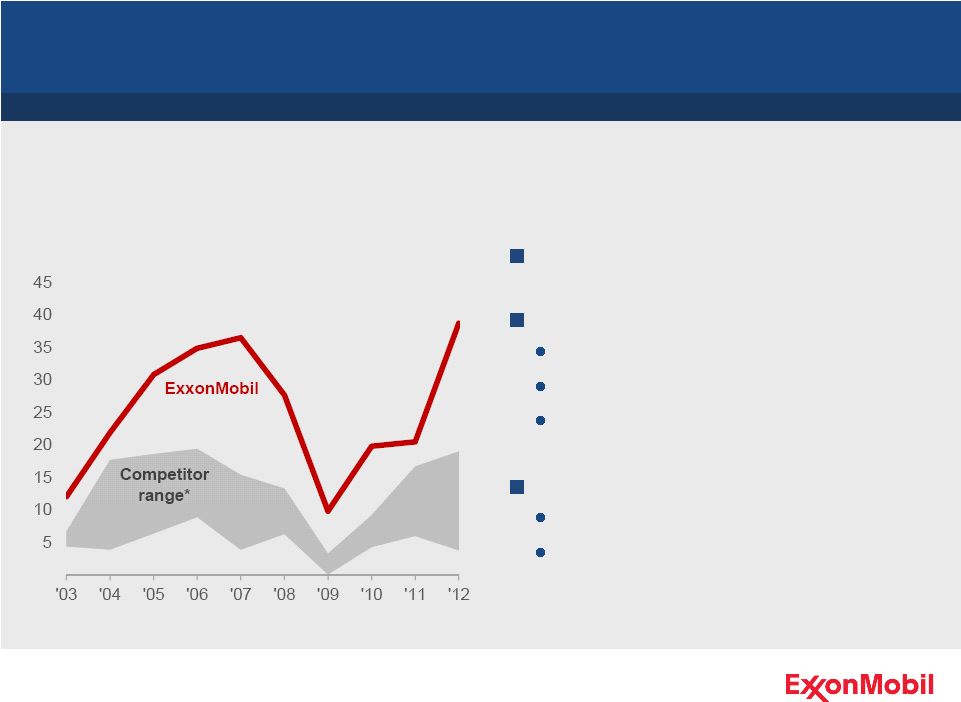

Return on Capital Employed

ROCE of 25.4% in 2012

Investments position long-term

performance

Disciplined investment through the

business cycle

Strength of integrated portfolio,

project management, and

technology application

Return on Average Capital Employed*

Proven business model continues to deliver ROCE leadership

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information.

12 |

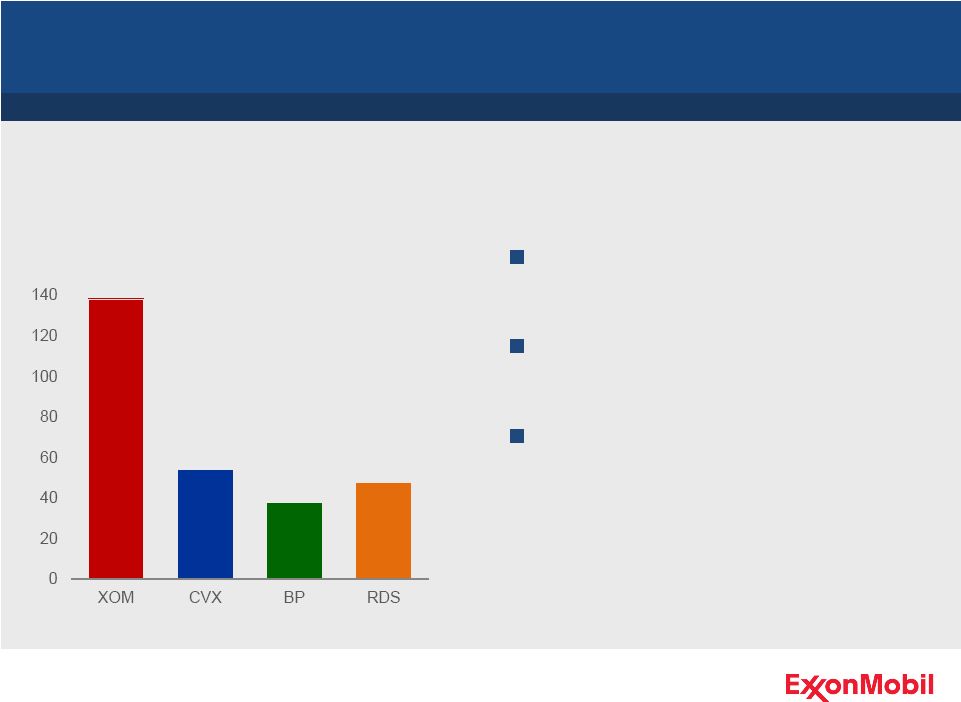

Free Cash Flow

Funded attractive investment

opportunities

Generated free cash flow of $138B

since beginning of 2008

Provides capacity for unmatched

shareholder distributions

Total Free Cash Flow*

$B, cumulative ‘08 –

‘12

Superior cash flow provides investment and distribution flexibility

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information.

13 |

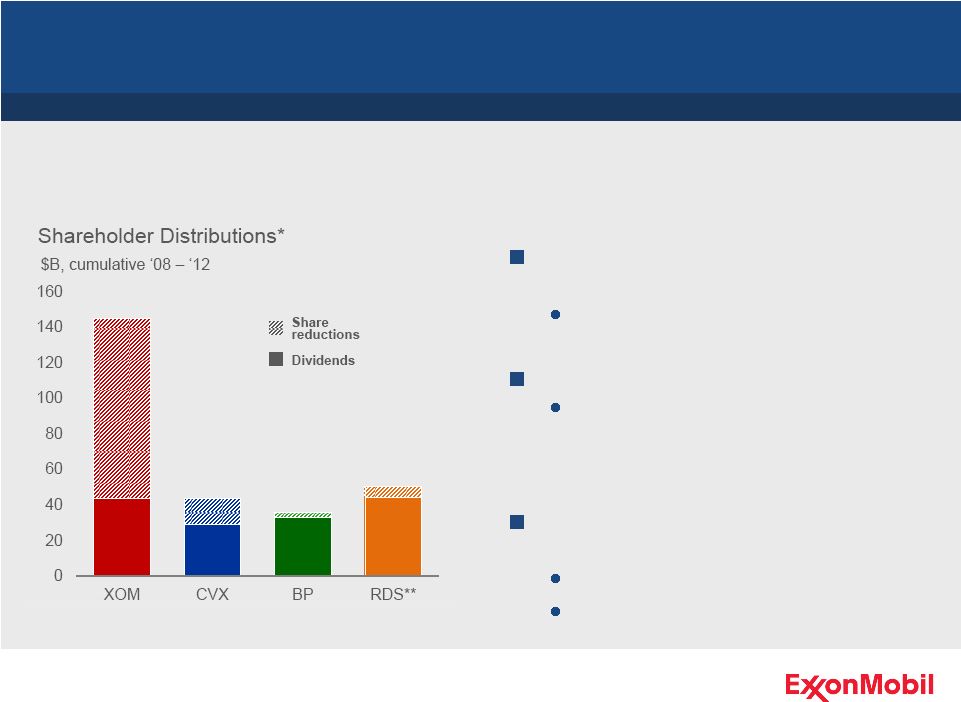

Total shareholder distributions of

$145 billion

Higher than competitors combined

4.5 billion shares outstanding

Reduced from 7.0 billion post

Exxon-Mobil merger and 5.1 billion

post XTO acquisition

Dividends per share increased 59%

since beginning of 2008

21% per-share increase in 2Q ‘12

30 years of consecutive per-share

dividend increases

Unmatched Shareholder Distributions

Industry-leading shareholder distributions

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information.

**

Includes share repurchases related to Scrip Dividend Programme.

14 |

Distribution Yield

Industry-leading shareholder distributions

Total distribution yield of 29%

since beginning of 2008

Nearest competitor at 23%

Average annual distribution yield

of 7.2%

Competitor average of 4.7%

Maintained strong financial

position

Distribution Yield*

Percent, dividends and share repurchases, ‘08 –

‘12

*

Yield based on 2007 year-end market capitalization.

**

RDS, BP, and CVX. Competitor data estimated on a consistent

basis with ExxonMobil and based on

public information. 15 |

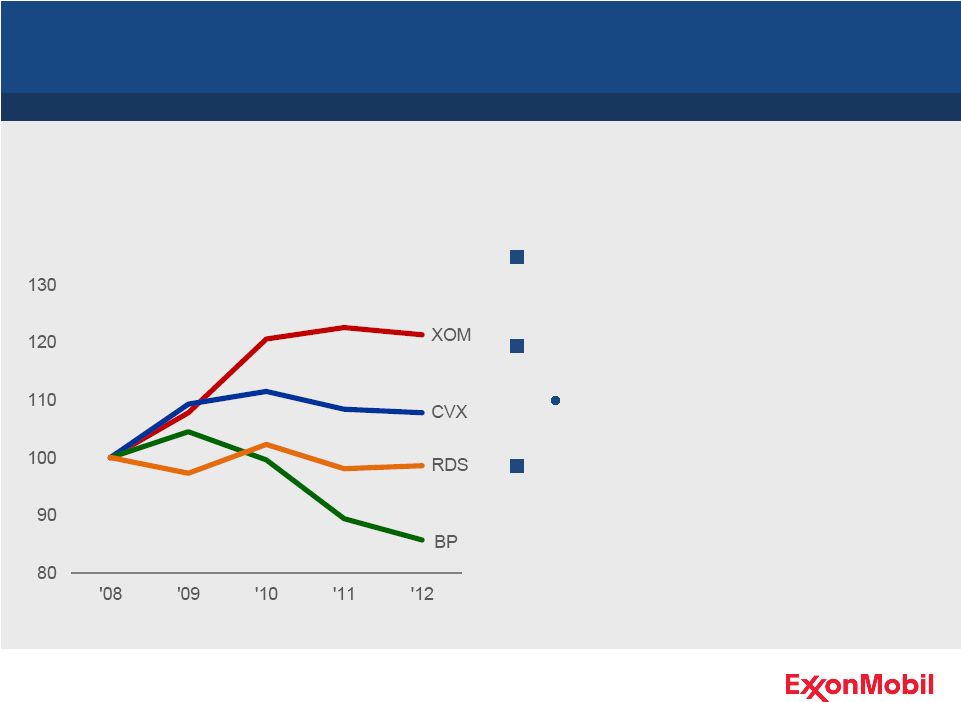

Production Growth per Share*

Indexed growth, ‘08 –

‘12

Each share has an interest in 21%

more production volumes

Annualized production growth per

share of 5%

Nearest competitor at about 2%

Reflects benefit of share purchases

Increasing Ownership

Enhanced per-share interest in ExxonMobil production

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information.

16 |

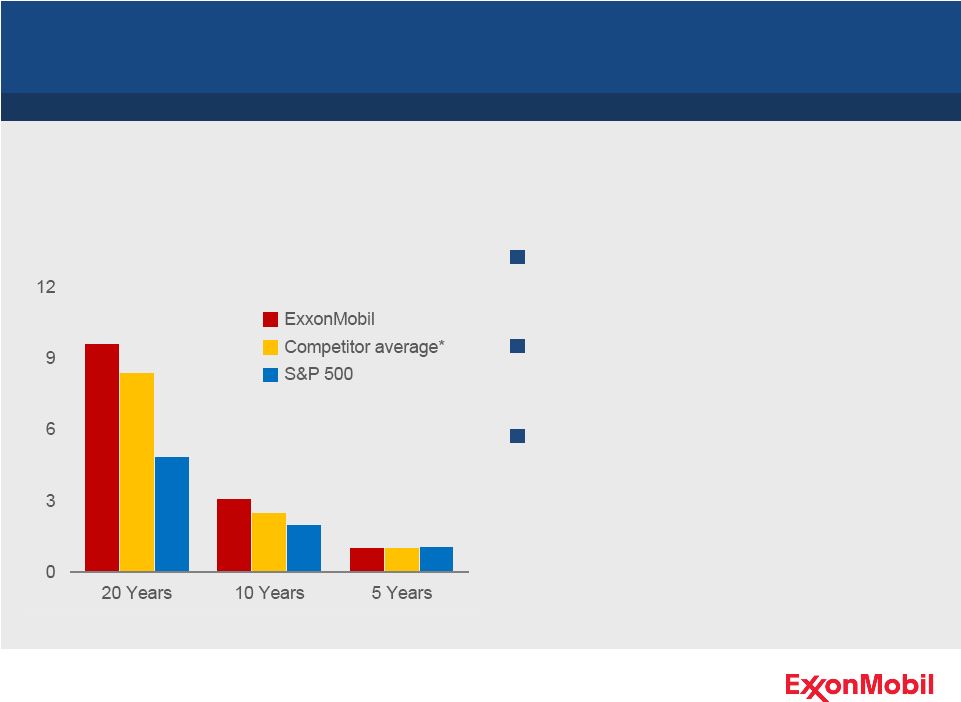

Financial results and stock market

returns best viewed over long term

Reflects strong financial and

operating performance

Competitive advantages maximize

shareholder value

Shareholder Returns

$K, value of $1,000 invested (as of YE 2012)

Share Performance

Long-term performance exceeds competitor average and S&P 500

*

RDS, BP, and CVX. Competitor data estimated on a consistent

basis with ExxonMobil and based on

public information.

17 |

Chairman and CEO

Rex Tillerson

Business Overview

18 |

Business Environment

Global environment offers a broad mix of challenges and opportunities

Near-term economic growth remains sluggish with risks persisting in the

OECD Developing economies show signs of stabilizing after slowdown in

2012

Significant regulatory initiatives continue while climate policies remain

uncertain Long-term outlook for energy and petrochemical demand remains

robust 19 |

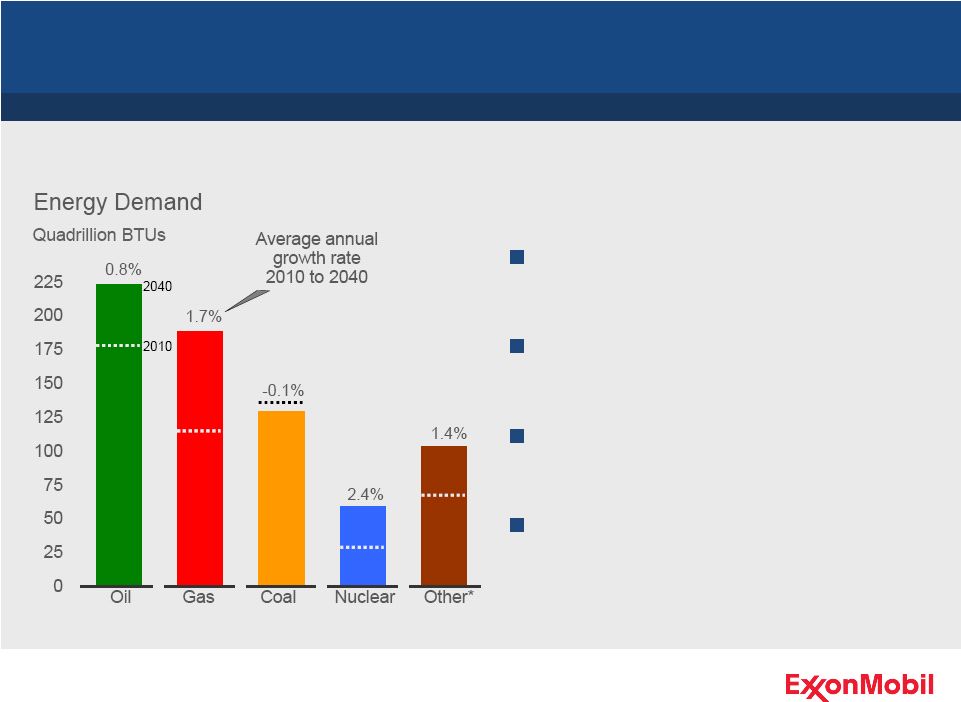

Energy Demand to 2040

Source: ExxonMobil 2013 Outlook for Energy

* Other includes hydro, geothermal, biomass, wind, solar, and biofuels.

Mix gradually shifts with oil and

natural gas remaining prominent

Higher oil demand driven by

expanding transportation needs

Strong growth in natural gas led by

power generation needs

Pace of demand growth

moderated by efficiency gains

across the world

Global energy demand expected to grow about 35% by 2040

20 |

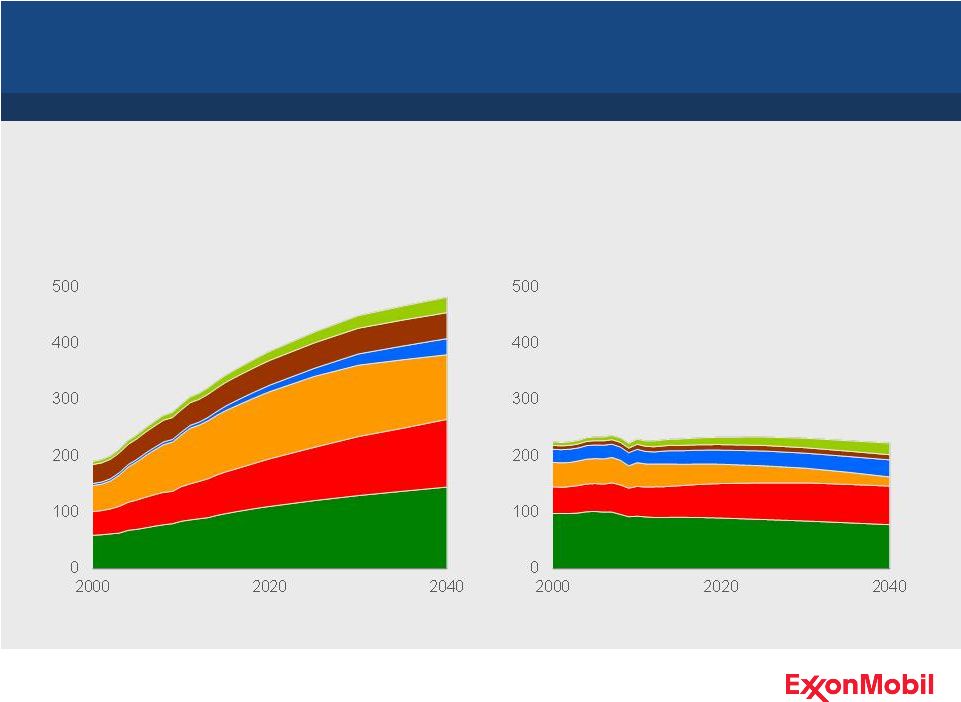

Developing Economies Lead Growth

Source: ExxonMobil 2013 Outlook for Energy

* OECD: Organization for Economic Co-operation and Development

Asia Pacific demand accounts for close to 60% of global increase

21

Non-OECD Countries*

Quadrillion BTUs

Biomass

Other

Oil

Nuclear

OECD Countries

Coal

Gas

Quadrillion BTUs |

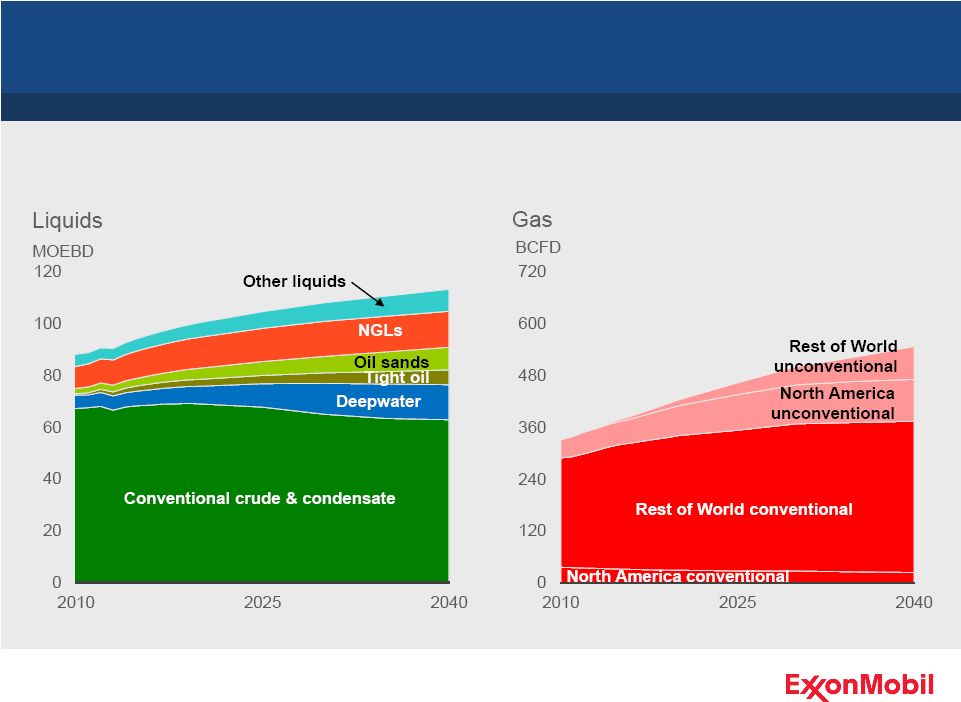

Liquids and Gas Supplies Expand and Diversify

Source: ExxonMobil 2013 Outlook for Energy

Advances in technology enable growth from unconventional resources

22 |

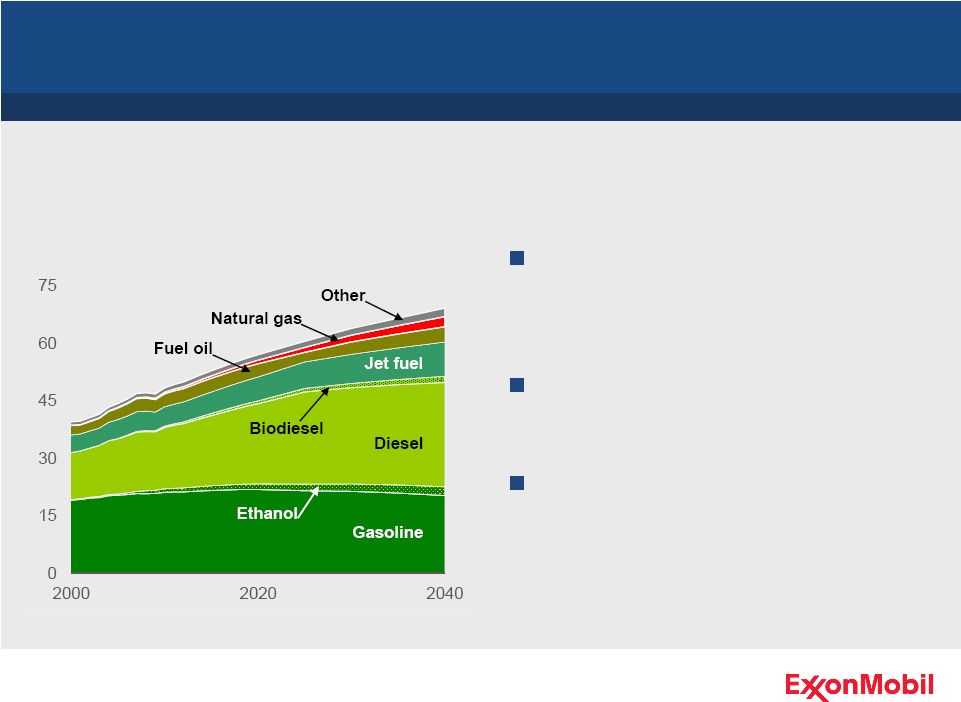

Transportation Product Demand

Transportation product mix will

shift as demand rises more than

40%

Demand for diesel driven by

expanding commercial activity

Gasoline demand will be relatively

flat, reflecting fuel economy gains

Diesel will surpass gasoline as the number one transportation fuel

MOEBD

Global Demand

Source: ExxonMobil 2013 Outlook for Energy

23 |

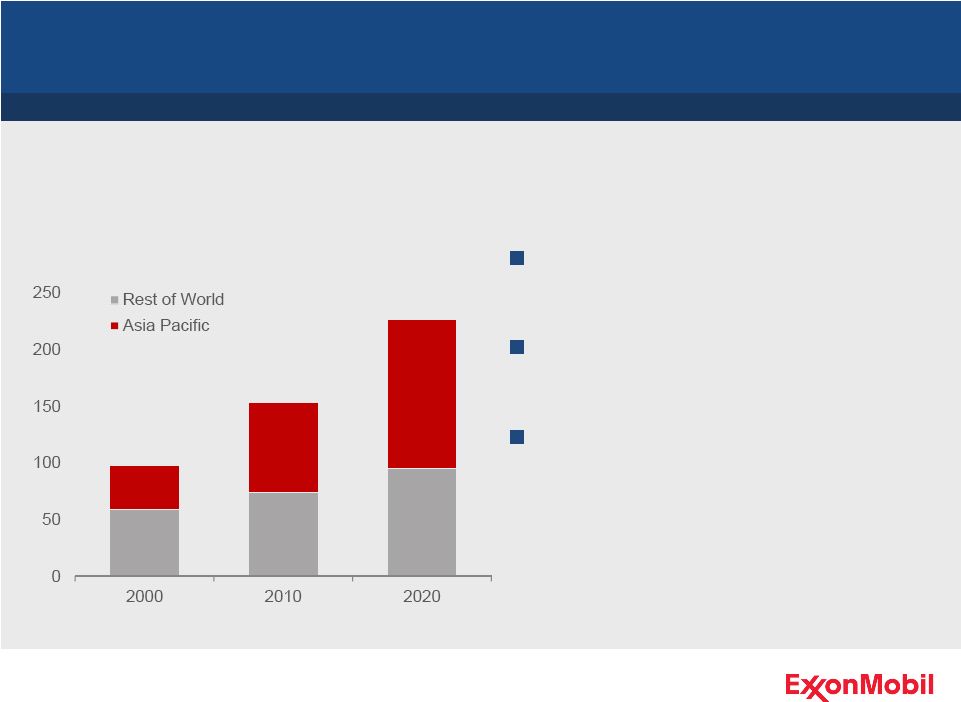

Global Chemical Demand

Demand growth above GDP’s as

standards of living improve

Two-thirds of growth in Asia

Pacific

Chemicals provide cost and

material attribute advantages

Sources: IHS Chemical and ExxonMobil estimates

* Chemical demand shown is polyethylene, polypropylene, and paraxylene.

Global Chemical Demand*

Million metric tons

Chemical demand growth driven by Asia Pacific

24 |

The

Energy Challenge Meeting the world’s growing energy needs safely and

responsibly Requires an abundance of diverse, reliable, and affordable

supplies Demands a commitment to innovation and technology

Requires access to high-quality resources

Calls for unprecedented levels of investment and expanding trade

Requires sound, stable government policies

Demands effective risk management and operational excellence

25 |

Strategic Overview

Chairman and CEO

Rex Tillerson

26 |

Key

Elements of ExxonMobil Strategy Best-in-class Upstream, Downstream, and

Chemical businesses Effective risk management, safety, and operational

excellence Integrated business model

Disciplined processes

World-class assets across all business lines

Focus on profitability and returns

Long-term approach

27 |

Upstream

Chairman and CEO

Rex Tillerson

28 |

Leading Upstream Business

Consistent execution of strategy delivers long-term value

Industry-leading capabilities

Successful track record of

developing best-in-class resources

Positioned for sustained growth

Intense focus on profitability and

differentiation from competition

29 |

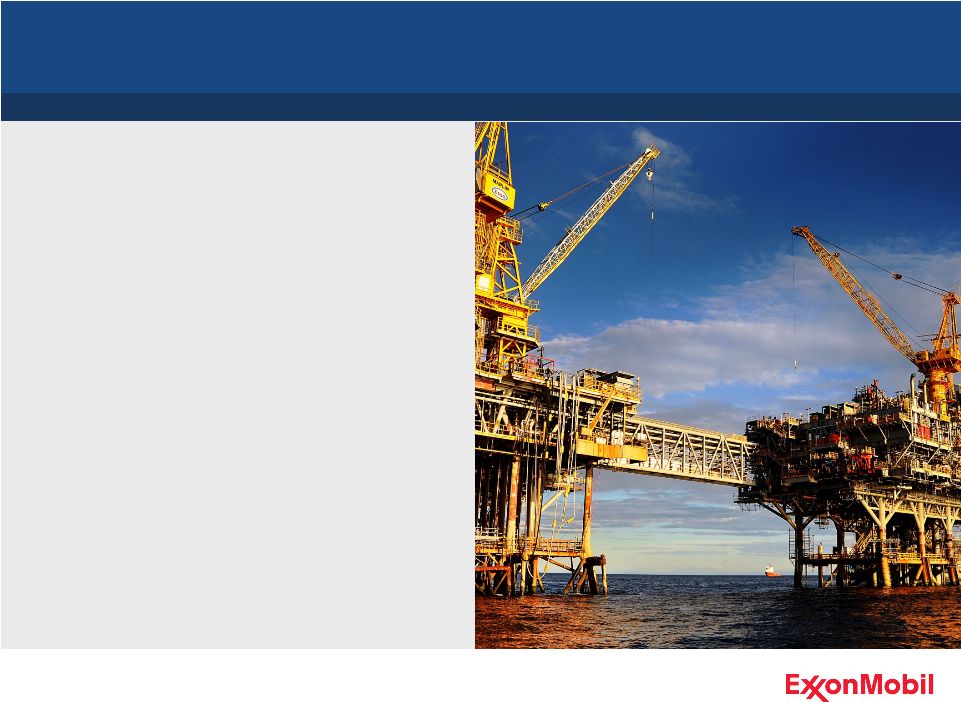

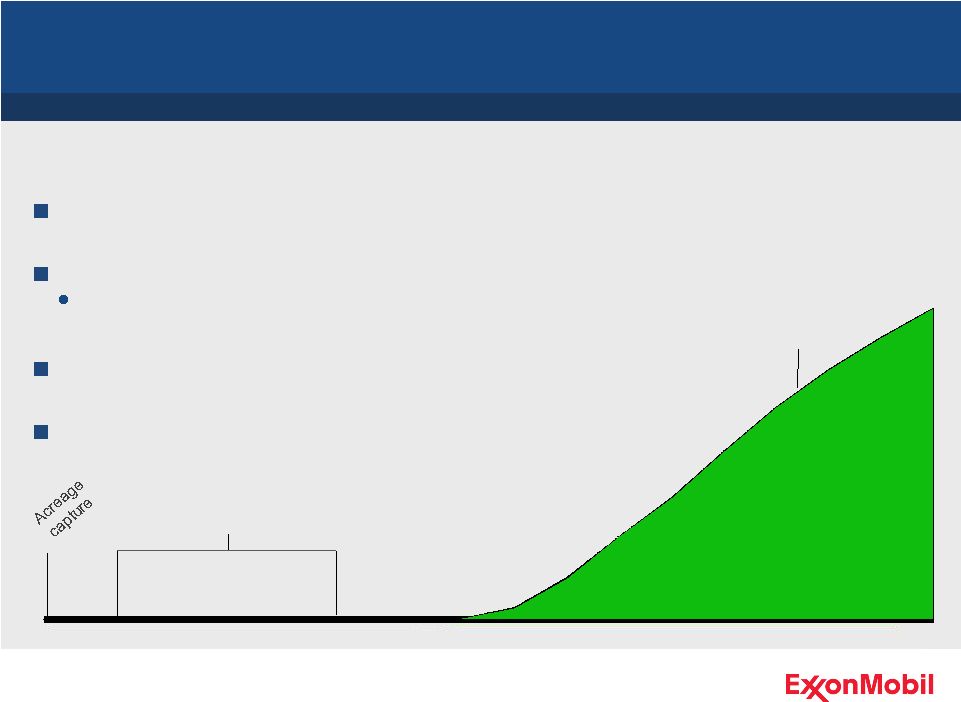

Leading Deepwater Capability

Identified and captured high-quality acreage

Cost-effective hub and satellite development

Operations practices delivering industry leading reliability

Developing and applying high-impact technologies

Transformed frontier acreage to large-scale production

30

Angola-operated

gross cumulative

production

Major exploration

discoveries

Design one, build multiple

1995

2000

2005

2010 |

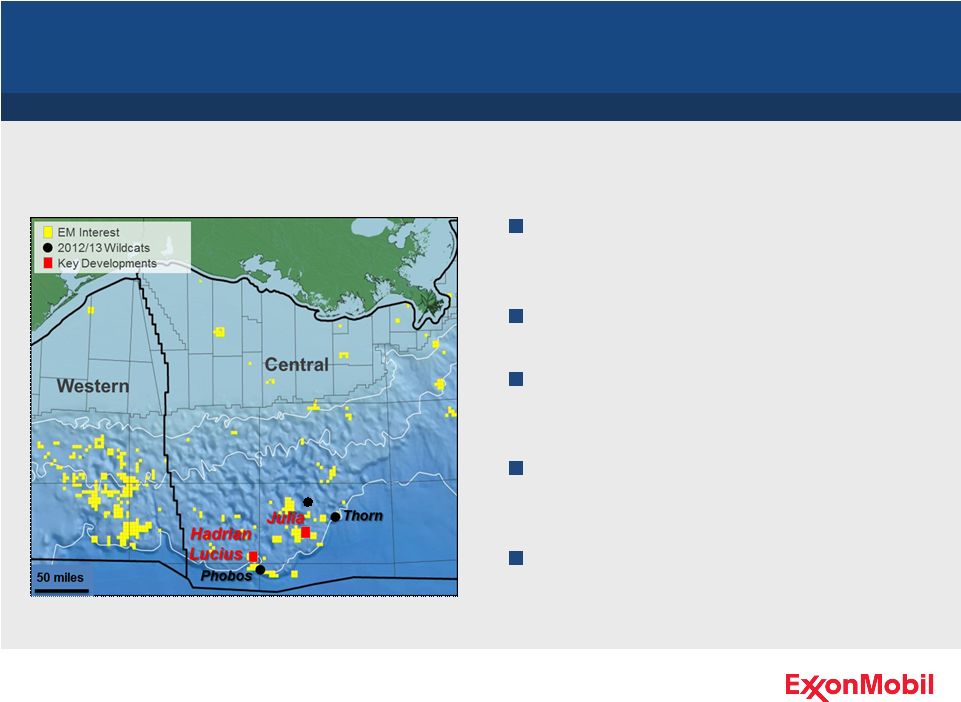

New

Developments - Gulf of Mexico

Leading Deepwater Capability

Lucius and Hadrian South projects

progressing toward 2014 start-up

Hadrian North appraisal drilling

Julia project long-lead items on

order; engineering underway

Exploration drilling and seismic

activity ongoing

Marine Well Containment System

delivery in 2013

Applying expertise to 1.7 million acres in the Gulf of Mexico

Maui

Maui

31 |

1995

2000

2005

2010

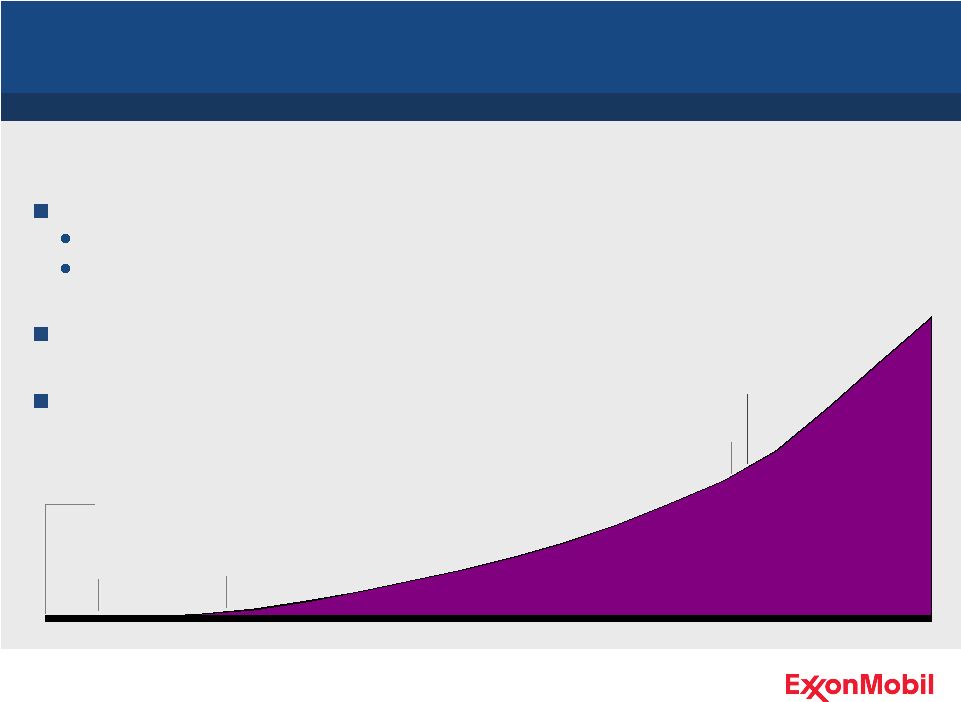

Leading LNG Capability

Qatar joint ventures

gross cumulative

production

Developing and applying high-impact technologies

Developing emerging LNG markets

Extending LNG operating experience and project

execution capabilities globally

1st

LNG cargo

Ras Laffan

JV established

Train 1

Ras Gas

Commercialized world’s largest gas field via LNG with Qatar Petroleum

> 5 BOEB

produced

Train 4

Qatargas II

32

Multiple industry “firsts”

Economies of scale across value chain |

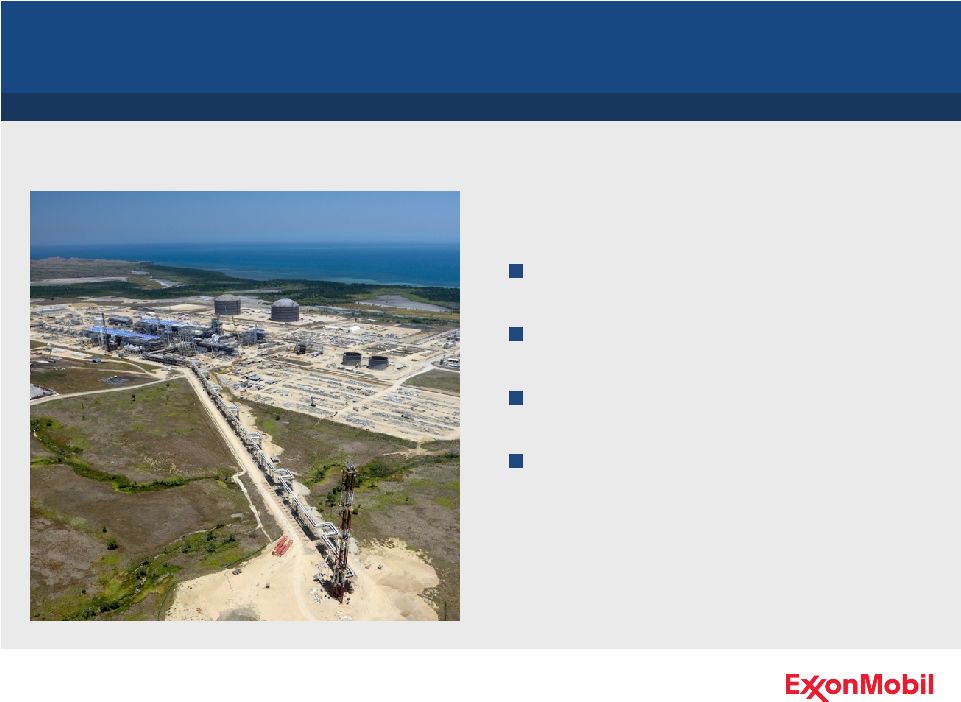

New

Developments - Papua New Guinea

Leading LNG Capability

High-quality 9 TCF resource

Two-train 6.9 MTA LNG plant

On schedule for start-up in 2014

Adding resource for a potential third

train

Applying global LNG experience and project execution capabilities

33 |

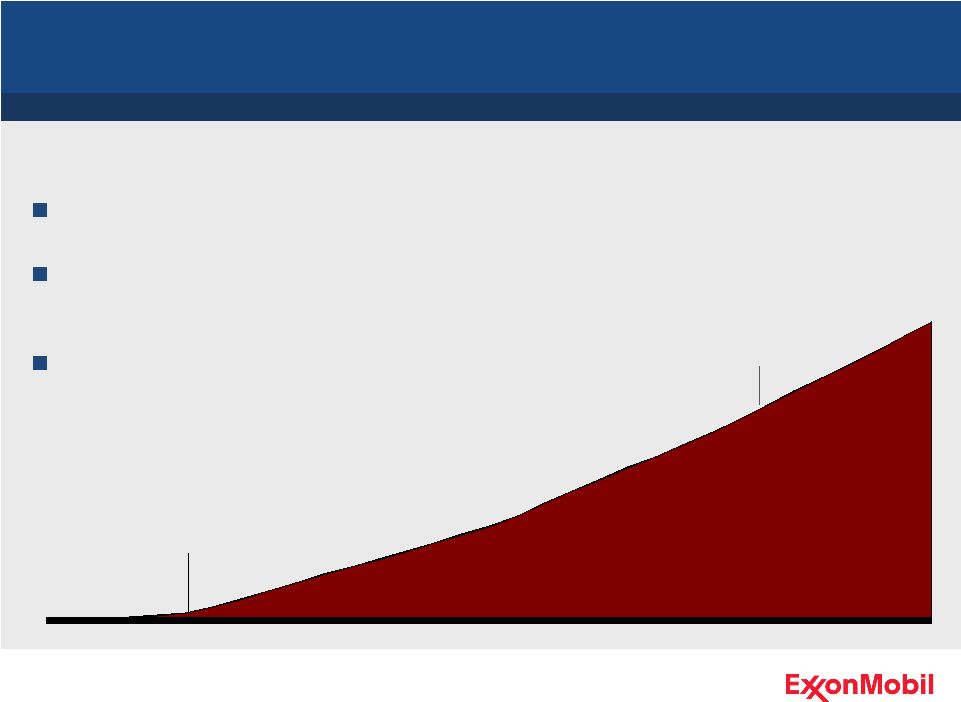

1980

1985

1990

1995

2000

2005

2010

Leading Oil Sands / Heavy Oil Capability

Premier portfolio of long-plateau volumes

Enabling technologies improve recoveries and

reduce environmental impact

Developing projects with strong earnings

Cold Lake

gross cumulative

production

High-quality resources and enabling technologies deliver long-term

value > 1 BOEB

produced

Commercial development

34 |

Facility start-up 1Q 2013

Proprietary technology

Long-term plateau production

Expansion project execution in

progress ~30% complete

New Developments -

Kearl

Leading Oil Sands Capability

Long-life resource begins production

35 |

Leading Arctic Capability

ExxonMobil interest & field

program experience

Arctic-like conditions

Over 90 years of technology innovation in the Arctic

1920

1970s

2002

2012

1969

1997

2005

36

1984 |

New

Developments - Sakhalin and Hebron

Leading Arctic Capability

Sakhalin

Arkutun-Dagi

Chayvo Onshore Expansion start-up

Hebron

Project sanctioned

Develops 700 MBO

Execution under way

Applying proven arctic capabilities to progress additional developments

37

Gravity-based structure complete

Topsides fabrication in progress

On schedule for 2014 start-up |

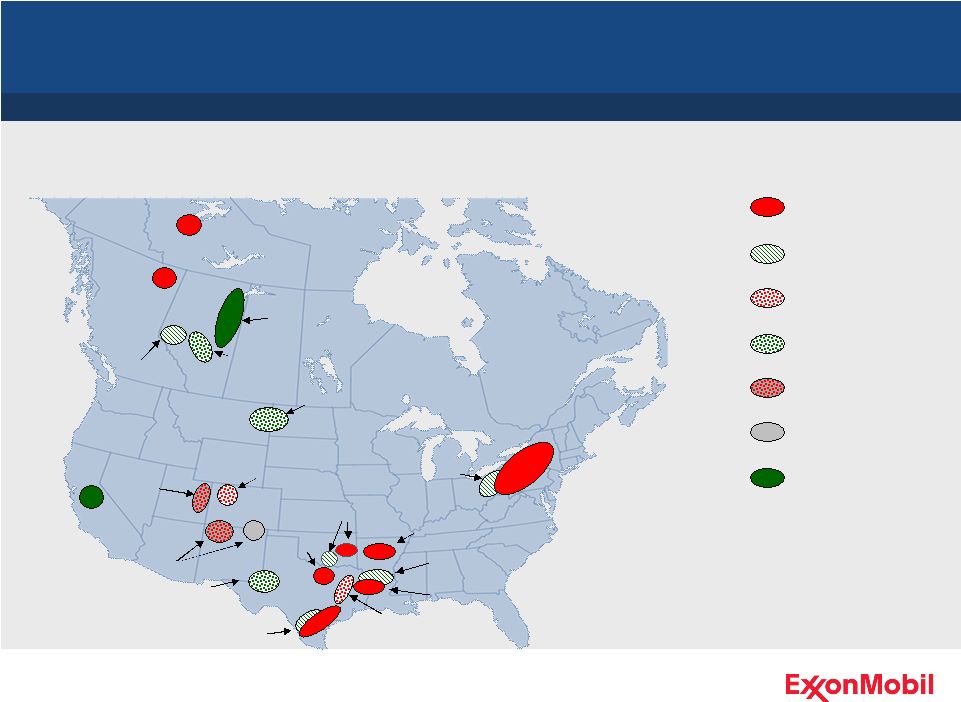

Leading Unconventional Capability

Unmatched position in unconventional plays in North America

Shale gas

Tight oil

Tight gas

CBM

Tight gas / CBM

Heavy oil /

Oil sands

Shale oil

(incl. liquids rich)

Fayetteville

505K

Woodford

385K

Bakken

585K

San Juan / Raton

445K

Uinta

260K

Piceance

320K

Barnett

230K

Haynesville / Bossier

240K

Horn River

340K

Marcellus / Utica

625K

Cardium

235K

San Joaquin

Valley

150K

Utica

90K

Permian

400K

Eagle Ford

90K

Freestone

320K

Athabasca

720K

Summit Creek

445K

Smackover

215K

Montney / Duvernay

650K

38 |

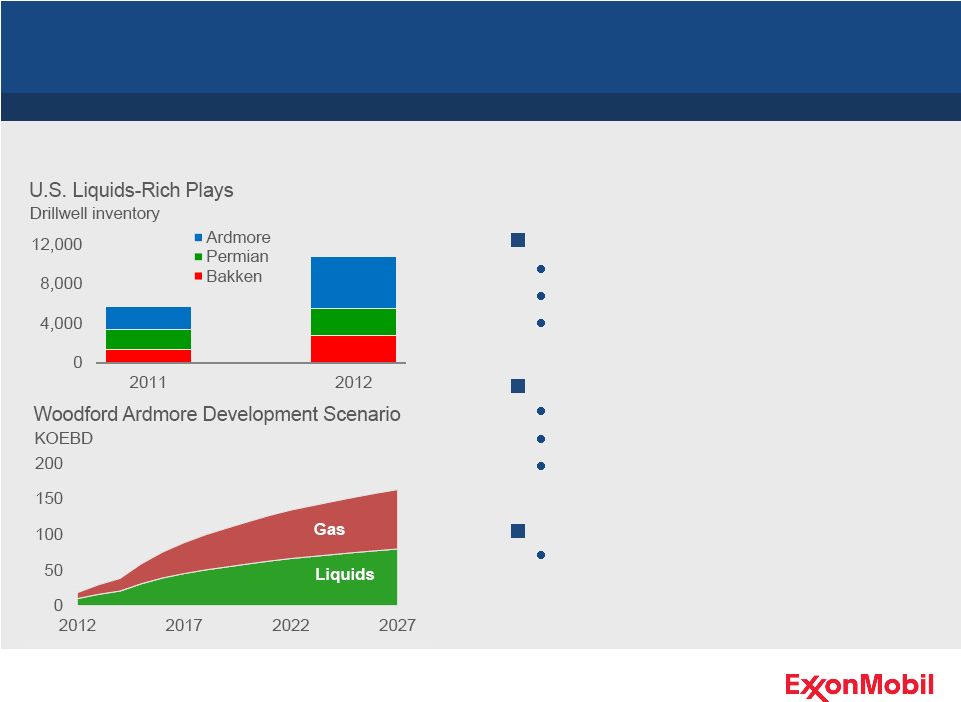

Woodford Ardmore

Bakken

Permian

Expanding Liquids-Rich Position

Leading Unconventional Capability

Leading position in major plays drives significant liquids growth

39

> 1.5 BOEB resource potential

Most active unconventional play

Infrastructure build-out progressing

Growing core liquids position

0.9 BOEB resource

Strategic bolt-on acquisition

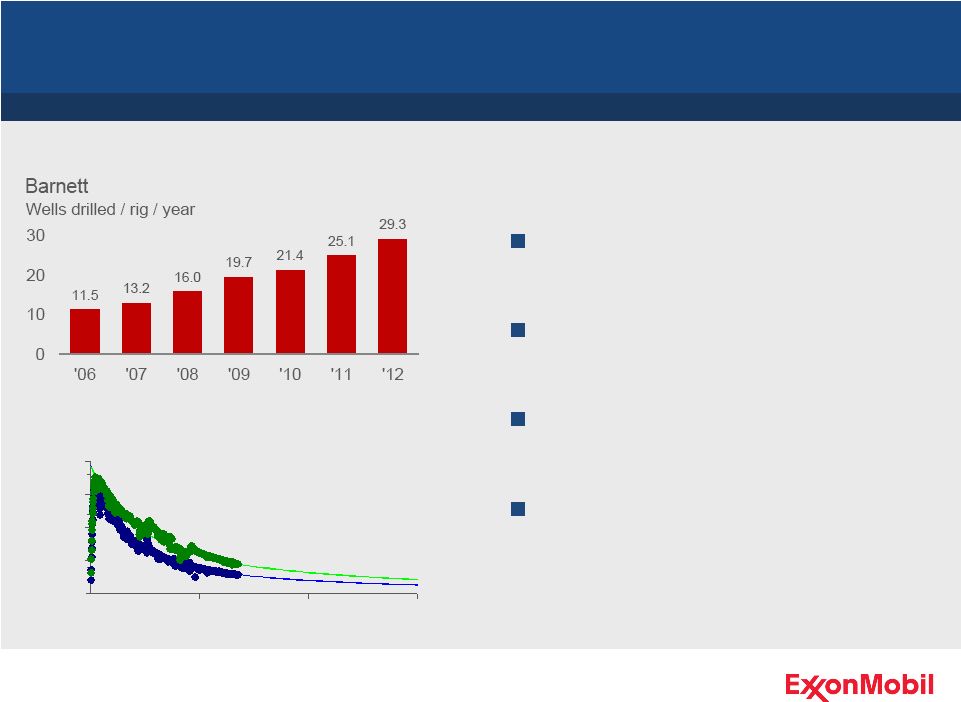

Leading producer and acreage holder |

0

500

1,000

1,500

2,000

0

500

1,000

1,500

Consistent increase in wells per rig

year yields reduction in drilling costs

Continuing to extract value even with

increasing well complexity

Optimized completions yield higher

recoveries

Approach applied to global portfolio

Operational Excellence

Leading Unconventional Capability

Driving down costs and increasing recovery

Completion Optimization -

Haynesville

Rate, MCF per 1,000 feet

Time (days on production)

Optimized

Traditional

40 |

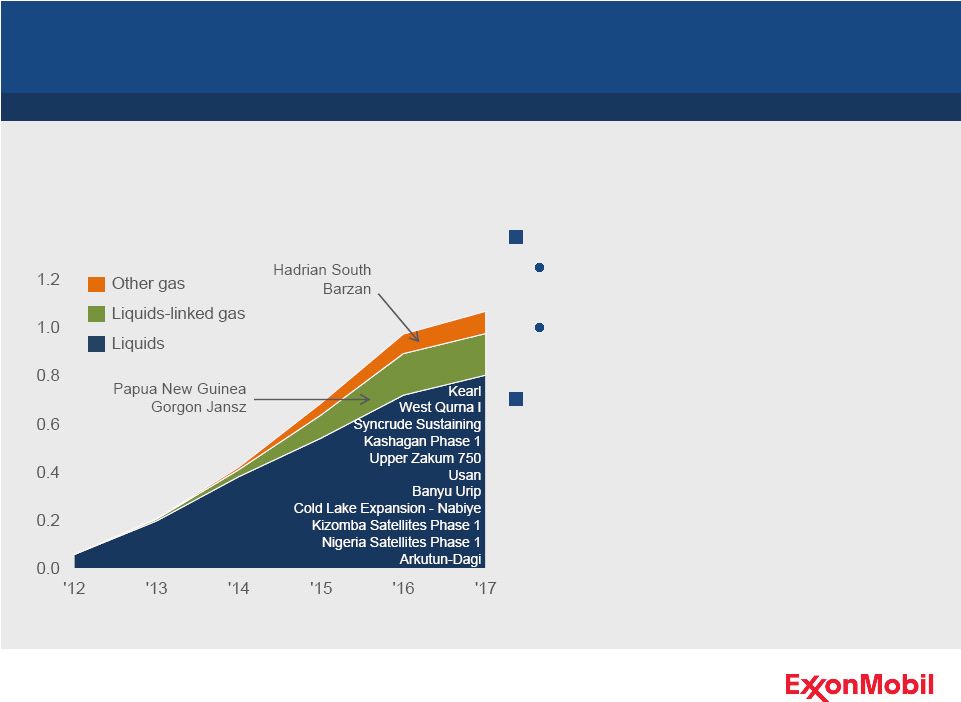

2013 –

2017 Production growth

Major project start-ups deliver significant volume growth

Continued development of resource

base

Adding 1 MOEBD net by 2017

Significant growth in liquids and

liquids-linked gas

41 |

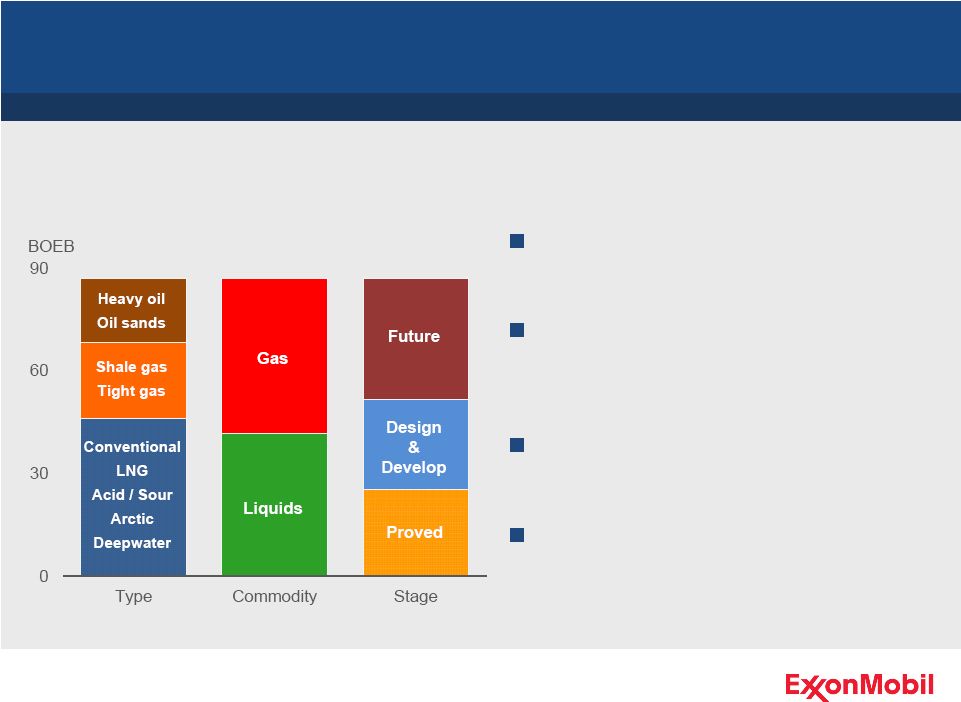

Resource Base

87 BOEB –

delivering today, positioning for tomorrow

Large, diverse, and well-balanced

portfolio of assets

25 BOEB proved reserves –

current

operations and projects in

construction

27 BOEB –

in design and

development stages

35 BOEB –

future development

2013 –

2017 Production Growth

Resource Base

42 |

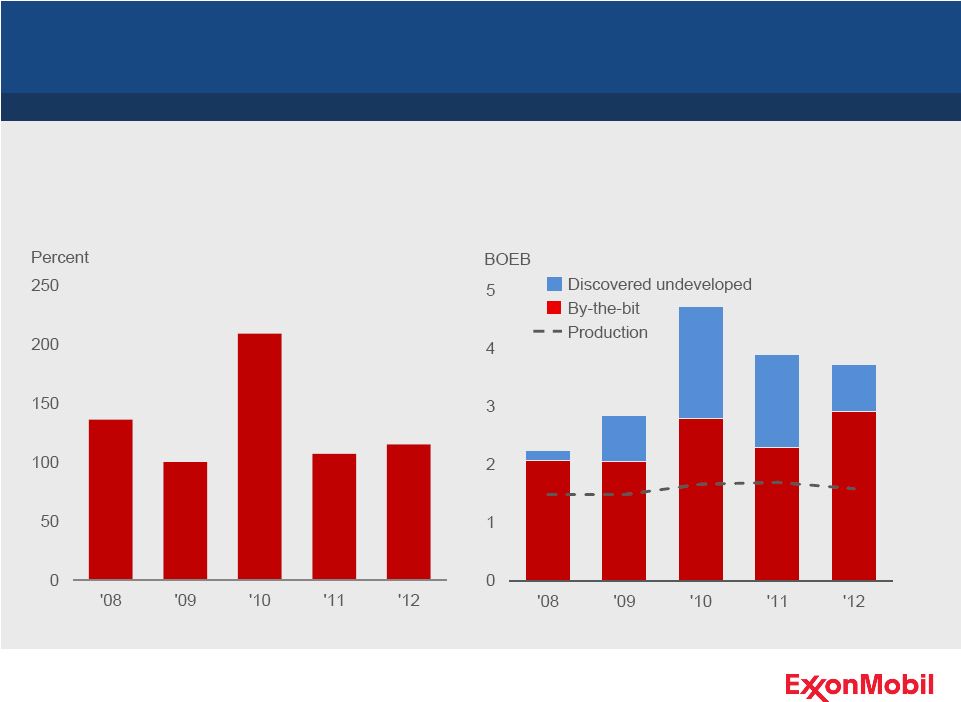

Reserves Replacement & Resource Additions

Proved Reserves Replacement*

Annual Resource Additions**

Consistently replacing reserves and adding quality resources

2013 –

2017 Production Growth

*

Reserves replacement based on SEC pricing bases and including asset sales, except

as noted in the Cautionary Statement.

**

Excludes XTO acquisition and the proved portion of discovered undeveloped

additions. 43 |

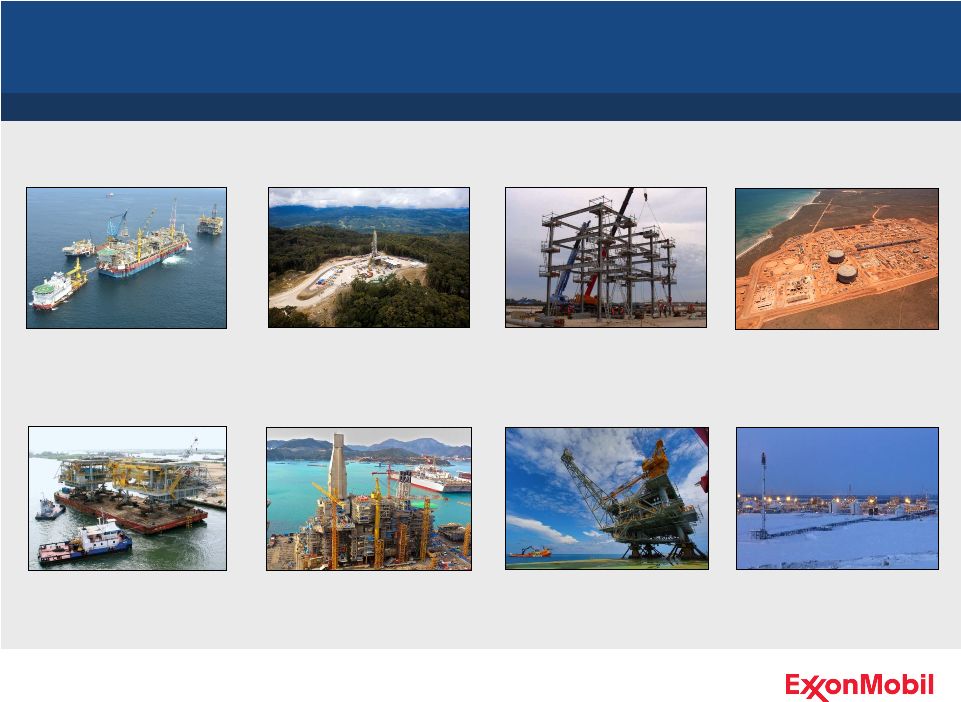

Projects Delivering Volume Growth

2013 –

2017 Production Growth

Oil Sands

Kearl

Conventional

Nigeria Satellites

Arctic

Arkutun-Dagi

Deepwater

Angola Satellites

LNG

Papua New Guinea

Conventional

Banyu Urip

LNG

Gorgon Jansz

31 major project start-ups between 2012 and 2017

Conventional

Telok

44 |

Major Project Production Outlook

2013 –

2017 Production Growth

Major Project Production Outlook*

Over 1 MOEBD net added by 2017

Portfolio supports long-term growth

MOEBD

Major projects deliver liquids and liquids-linked volume growth

*

Excludes impact of future divestments and OPEC quota effects.

Projections based on 2012 average prices ($112/B Brent)

45

> 90% liquids + liquids-linked

volumes

Two-thirds long-plateau volumes |

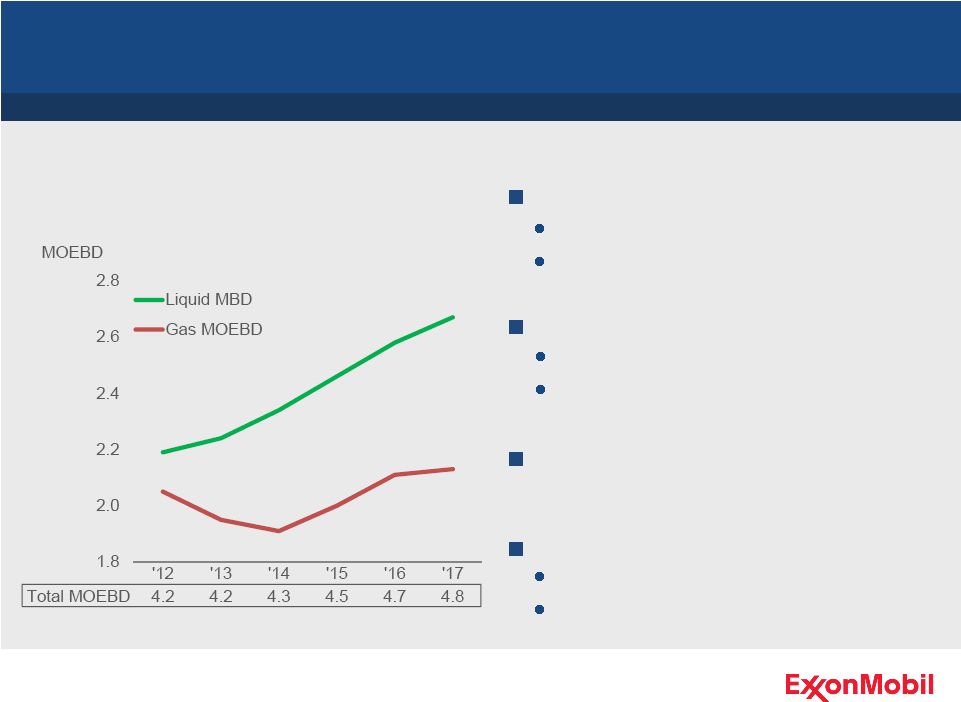

Total Production Outlook*

Upstream Production Outlook

Liquids outlook

Gas outlook

Liquids + liquids-linked outlook:

up 3 –

4% per year

Total production outlook

2013 –

2017 Production Growth

2 –

3% growth per year through 2017 –

strong contribution from liquids

*

Excludes impact of future divestments and OPEC quota effects.

Projections based on 2012 average prices ($112/B Brent)

46

2013: up ~2%

2013 –

2017: up ~4% per year

2013: down ~5%

2013 –

2017: up ~1% per year

2013: down ~1%

2013 –

2017: up 2 –

3% per year |

Long-Term Growth Opportunities

Well positioned for sustained long-term growth

Successful exploration results

Deep and robust inventory

Adding quality acreage in proven and

emerging plays

47 |

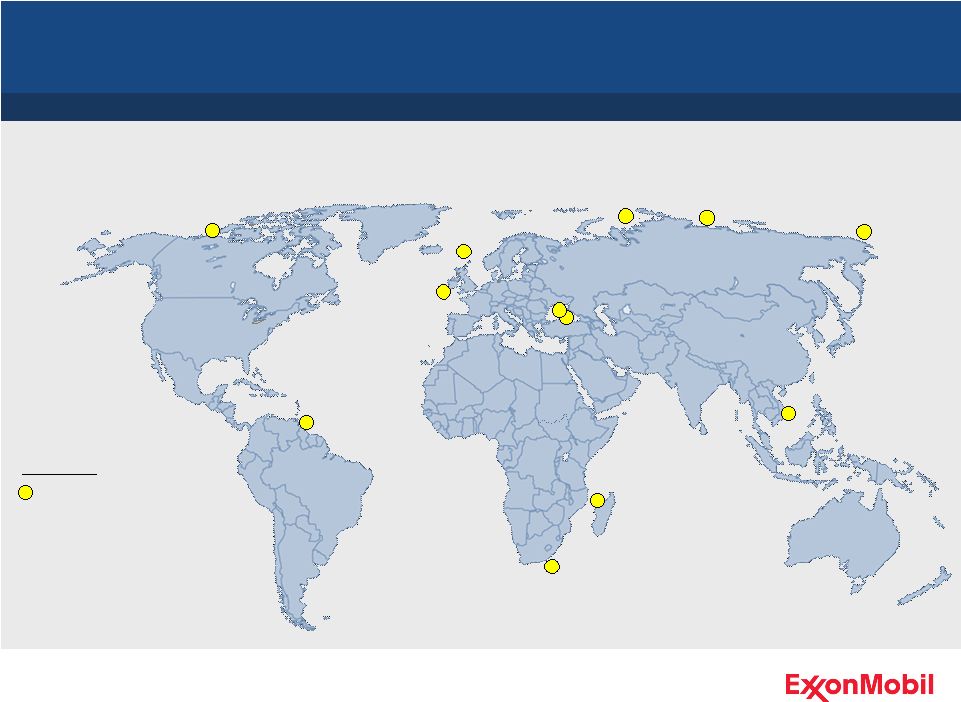

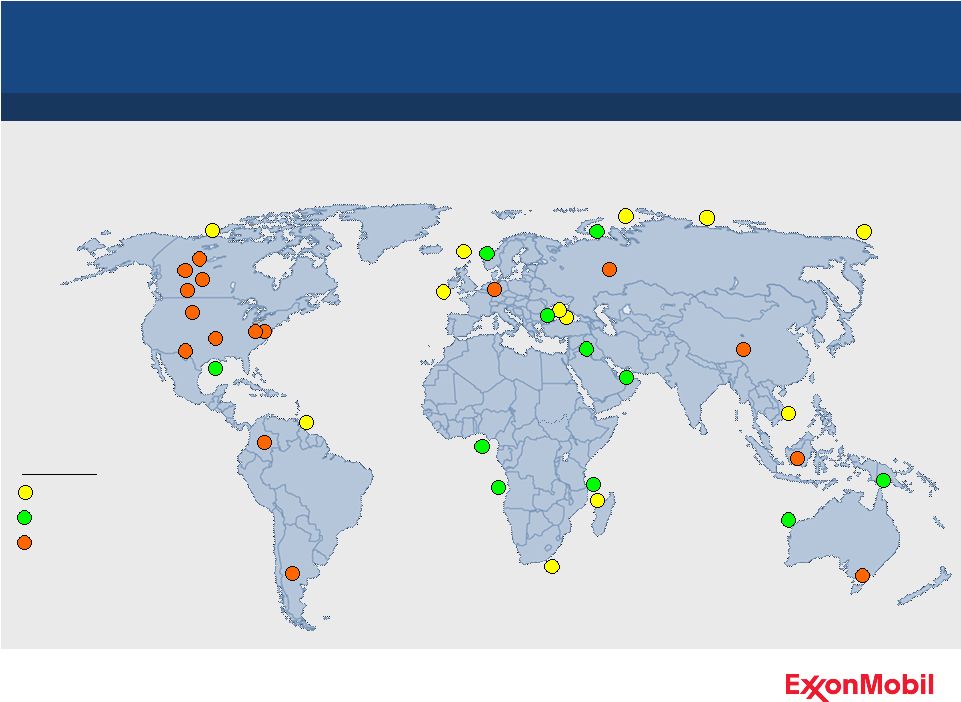

New

Opportunity Growth Growth Opportunities

Vietnam

Beaufort

Faroe Islands

Madagascar

Guyana

Ireland

New play tests

Play Type

Kara Sea

Russian Black Sea

Ukraine

Growing global portfolio of high-quality resource opportunities

South Africa

Chukchi Sea

Laptev Sea

48 |

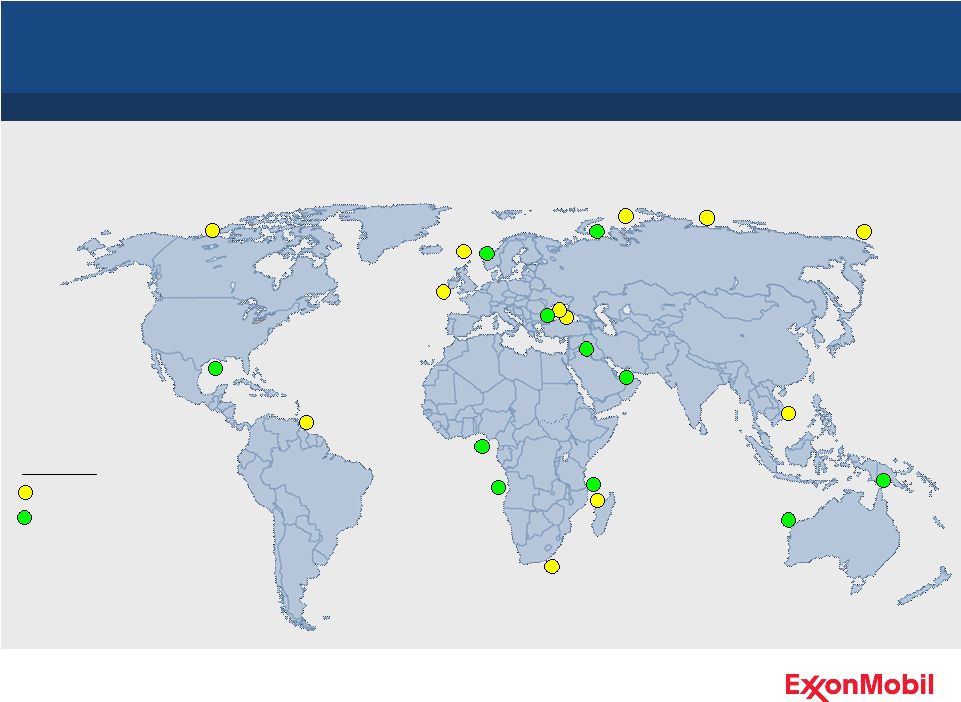

New

Opportunity Growth Growth Opportunities

Vietnam

Norway

Abu Dhabi

Beaufort

Romania

Iraq

Tanzania

Nigeria

PNG

Gulf of Mexico

Australia

Angola

Faroe Islands

Madagascar

Guyana

Ireland

New play tests

Play Type

Proven conventional plays

Kara Sea

Russian Black Sea

Ukraine

Growing global portfolio of high-quality resource opportunities

South Africa

Chukchi Sea

Laptev Sea

49 |

Vietnam

Indonesia

Norway

Abu Dhabi

Horn River

Alberta tight oil

Athabasca

Beaufort

Summit Creek

Romania

Iraq

Tanzania

Nigeria

PNG

Gulf of Mexico

Australia

Angola

Faroe Islands

Madagascar

Guyana

Ireland

Permian Basin

Woodford

Utica

Argentina

Colombia

New play tests

Unconventional

Play Type

Proven conventional plays

Marcellus

Germany

New Opportunity Growth

Kara Sea

West Siberia

Russian Black Sea

Bakken

China

Ukraine

Growth Opportunities

Growing global portfolio of high-quality resource opportunities

South Africa

Chukchi Sea

Laptev Sea

50 |

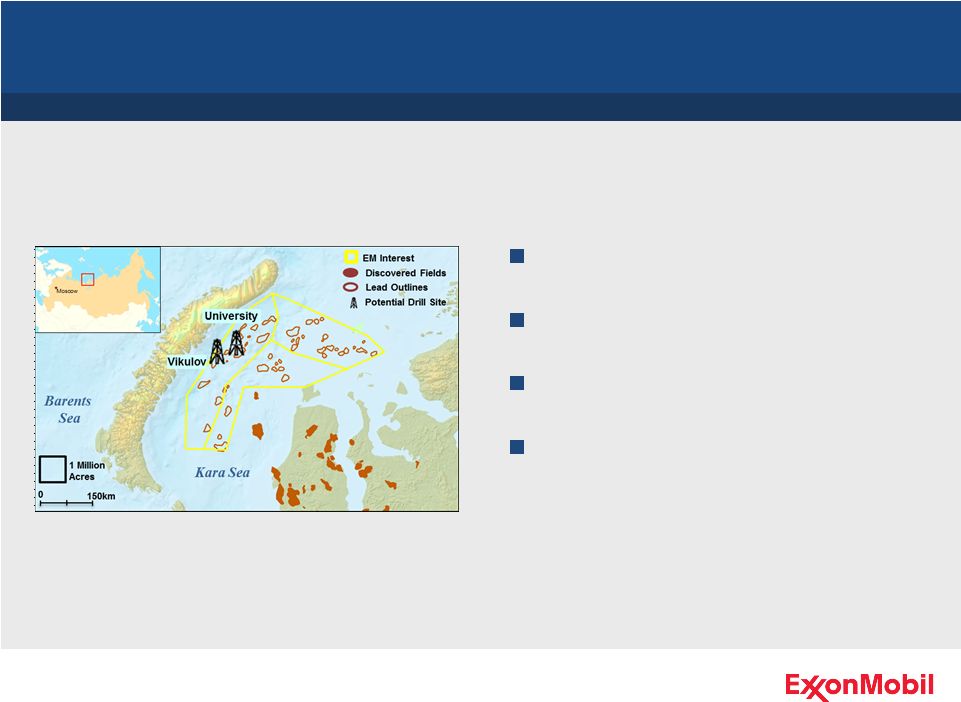

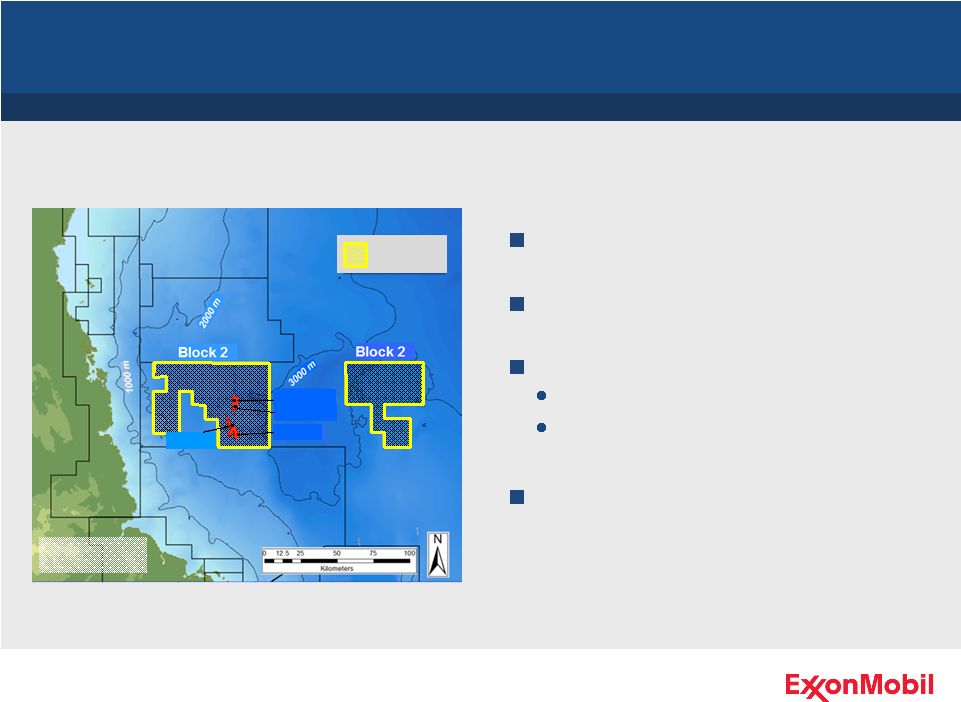

Kara Sea

Growth Opportunities

31 million acres in Kara Sea

Completed large field program

Completed definitive agreements

Expect to start drilling in 2014

Significant new exploration position in prospective Arctic

51 |

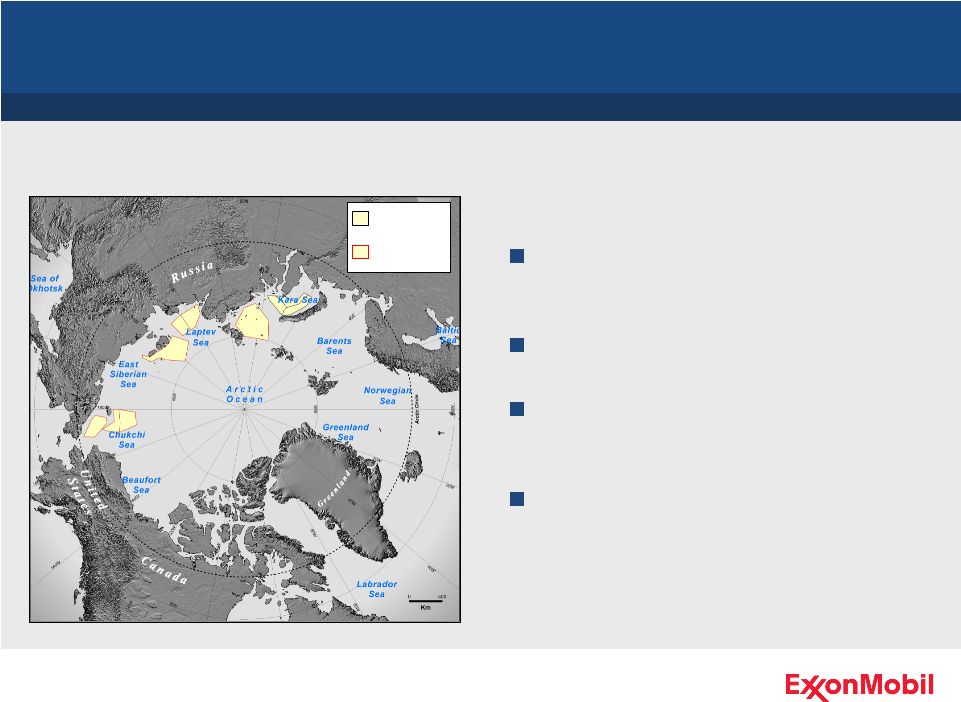

Russian Arctic

Growth Opportunities

Expanding strong partnership between ExxonMobil and Rosneft

SCA licenses

Expanded

SCA licenses

Expansion of Strategic Cooperation

Agreement

Additional 150 million acres

Blocks among most promising

offshore areas globally

Leverages strengths of ExxonMobil

and Rosneft

52 |

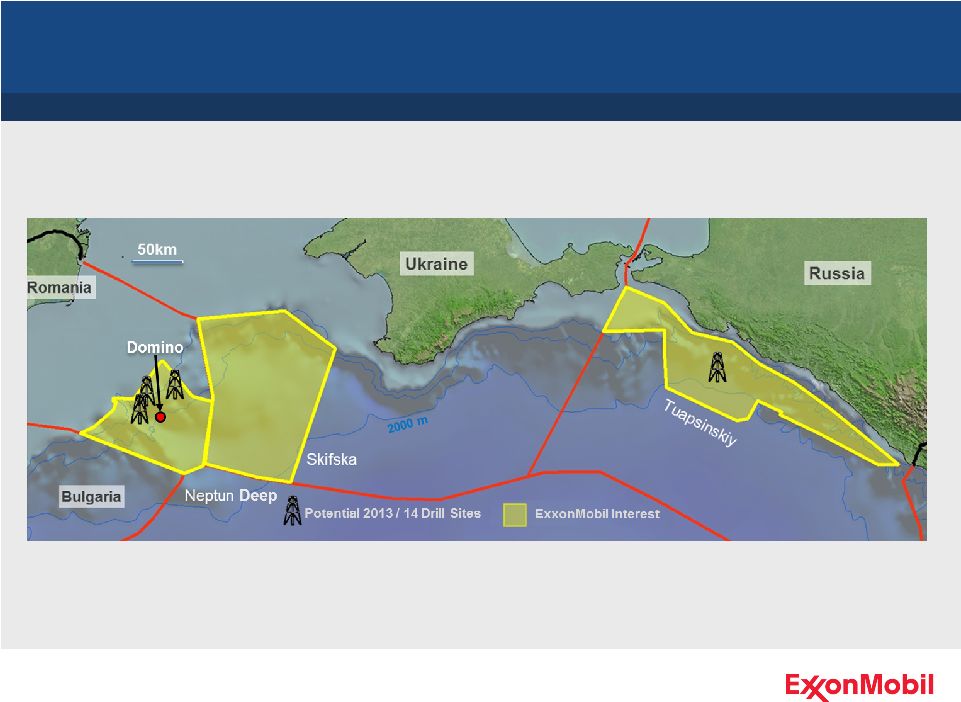

Black Sea

Growth Opportunities

Established strong position in emerging new hydrocarbon province

53 |

Zafarani-1

Lavani-1

Lavani-2

Zafarani-2

Tanzania

ExxonMobil

interest

Tanzania

Growth Opportunities

Drilled three successful wells in 2012

Appraising Zafarani and Lavani

Continuing exploration activities

Discovered fields in initial

development planning

Bringing industry-leading capability to a new frontier basin

54

Seismic acquisition

Prospect maturation and drilling |

Upstream Summary

Successful track record of

developing best-in-class resources

and projects

Near-term project start-ups deliver

significant volume growth

Continuing to expand differentiating

capabilities

Strong portfolio of opportunities

Intense focus on profitability and

differentiation from competition

Upstream business is well positioned for sustained growth

55 |

Senior Vice President

Mike Dolan

Downstream and Chemical

56 |

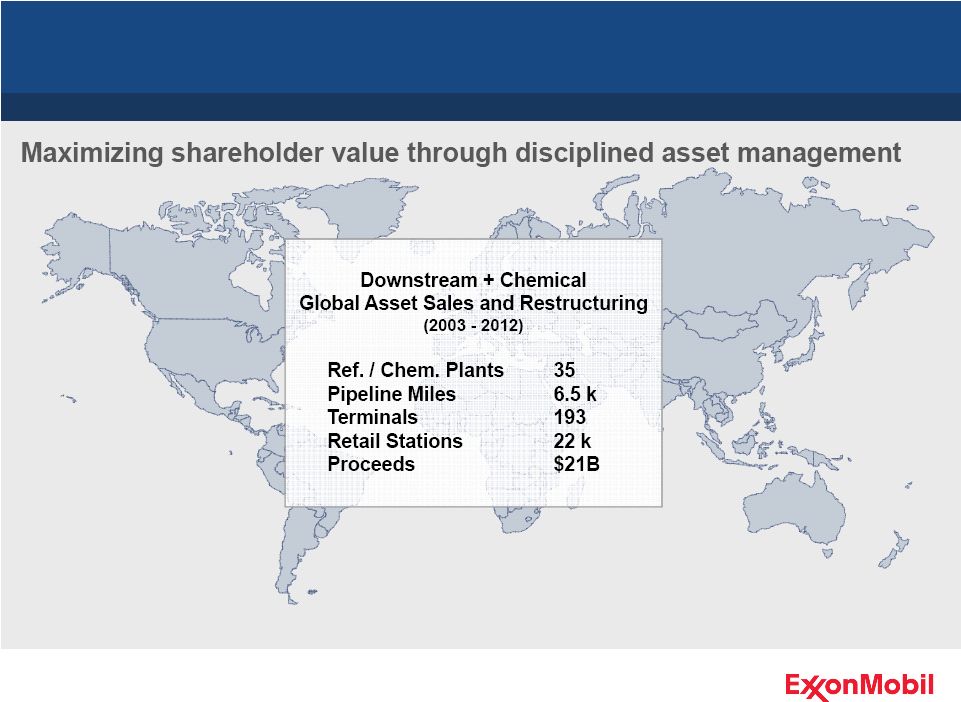

Premier Downstream and Chemical Businesses

57 |

Premier Downstream and Chemical Businesses

58 |

Premier Downstream and Chemical Businesses

Operational excellence

Industry-leading portfolio

Superior financial performance

59

Best-in-class operations

Operating flexibility and optimization tools

Technology-enabled, high-value product growth

Balanced suite of pacesetter sites

Disciplined portfolio management and highgrading

Robust pipeline of quality investments

Best-in-class returns

Strong cash generation |

Operational Excellence

Strong reliability

Advantaged cost position

Technology leadership

Operational metrics favorable versus competitors

60

Steam cracker utilizations 1 –

2%

above average

Refining unit costs 10% lower than

average

Aromatics unit energy consumption

20% lower than average |

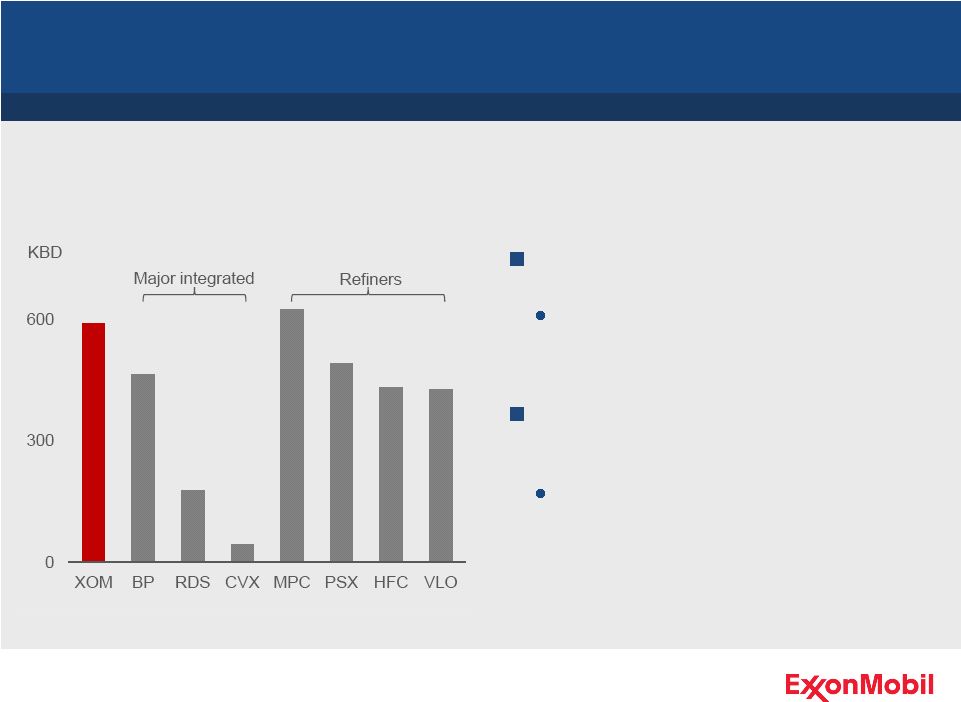

A

leader in mid-continent refining capacity

ExxonMobil mid-continent refineries

processing ~100% advantaged

crudes

North America Mid-Continent Advantage

Maximizing value via integrated and flexible refining circuit

Mid-Continent* Equity Refining Capacity

Source: PIRA data, 3Q12

* United States and Canada

61

Benefiting from North America

unconventional crude growth

Seven-fold earnings increase

since 2010 |

U.S. Gulf Coast Refining Optimization

Flexible integrated circuit capturing

heavy and light crude opportunities

Increasing advantaged crude runs

Well positioned to benefit from

industry logistics enhancements

Advantaged Crude Processing

Maximizing value via integrated and flexible refining circuit

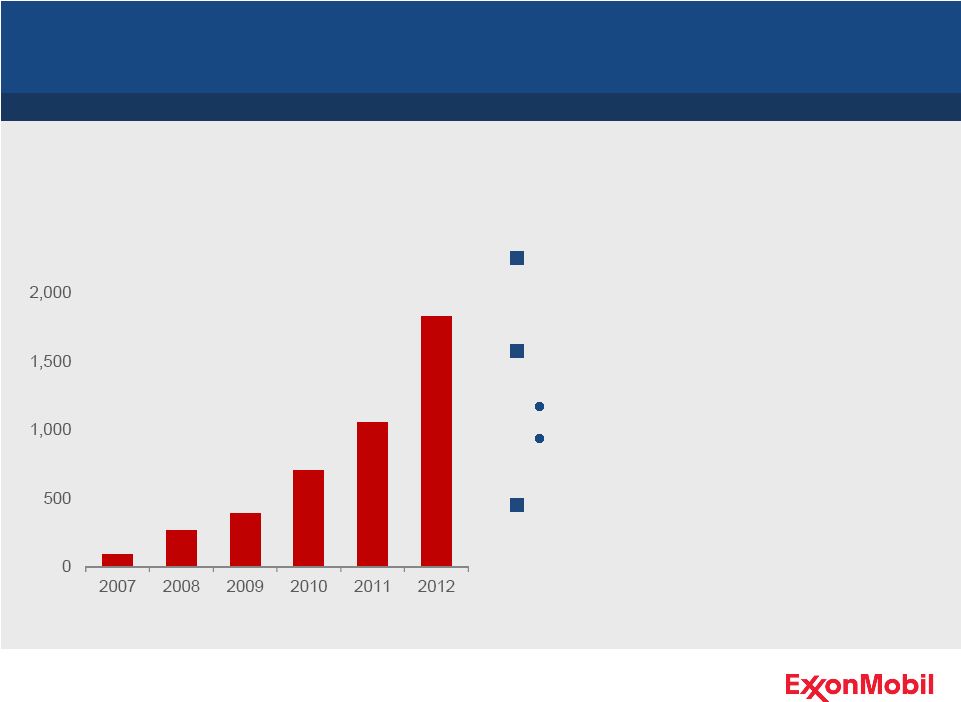

62 |

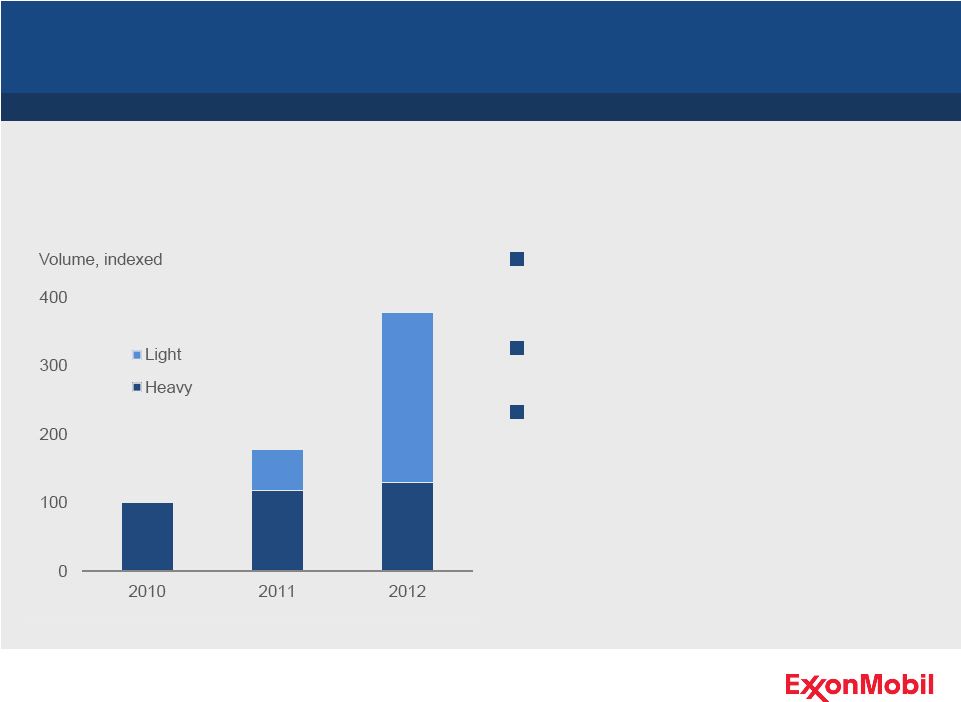

Chemical Optimization –

Ethane

17-fold increase in earnings

contribution since 2007

Unmatched capacity to feed U.S.

ethane

Robust capability over wide range

of feed price environments

Feedstock flexibility capitalizes on changing price environment

ExxonMobil U.S. Ethane Earnings Contribution

Earnings, indexed

63

Proprietary technology

Integration |

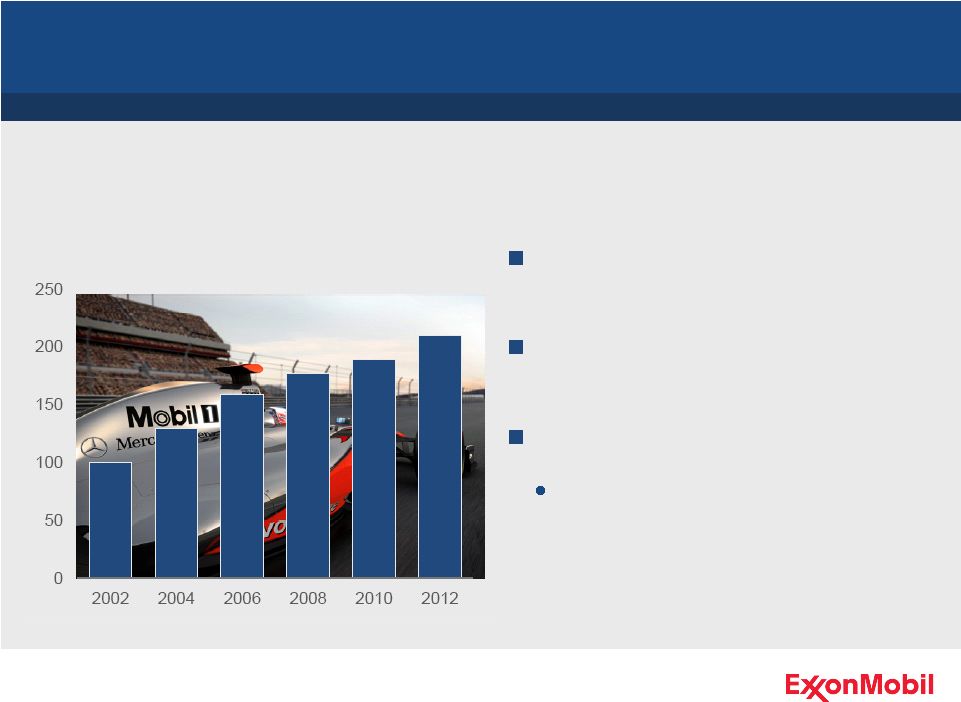

Industry leader in basestocks and

synthetic lubricants

Pioneered synthetic lubricant

technology with premier Mobil 1

Doubled high-value synthetic lubes

sales in the last decade

High-Value Product Growth

Continual pursuit of high-value growth

Mobil 1 Sales

Volume, indexed

64

Faster than industry growth rate |

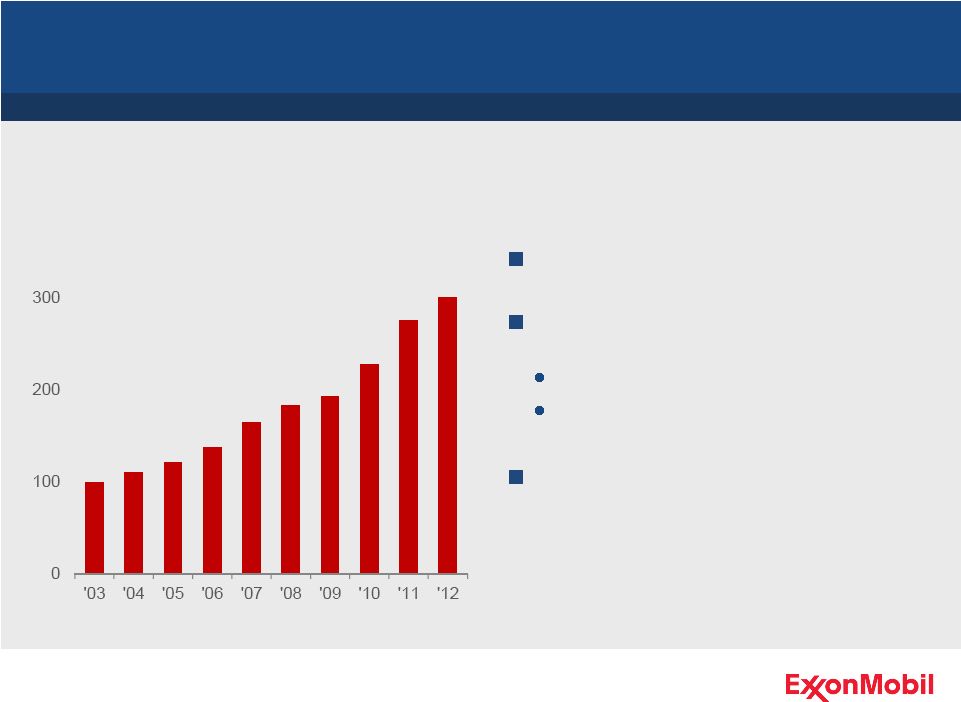

Premium Chemical Products

Maximizing high-value specialties

Differentiating commodities

through technology

Tripled earnings over the last

decade

High-value product portfolio drives earnings

Premium Product Earnings

3-year moving average, indexed

65

Premium margins

Faster growth than industry |

Poised to Capture Growth

66 |

Strengthening the Portfolio

67 |

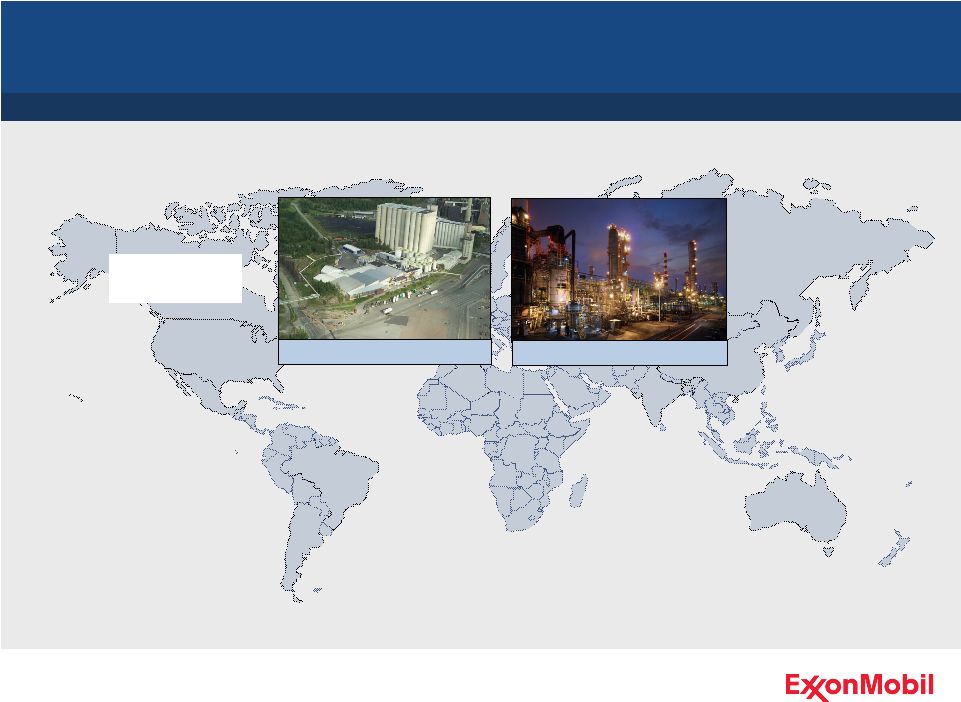

Investing for Growth

Finland Lube Blending

Downstream

Manufacturing

Singapore Hydrotreater

68 |

Investing for Growth

Finland Lube Blending

Downstream

Manufacturing

Singapore Parallel Train

Saudi Elastomers

Baytown Cracker

Chemical

Manufacturing

Singapore Hydrotreater

69 |

Industry-Leading Returns

Downstream and Chemical businesses outperform across the cycle

Industry-leading financial performance

Operational excellence

Capital discipline

Downstream and Chemical Combined ROCE

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information.

Competitors include BP, RDS, and CVX.

Percent

70

Best-in-class operations

Flexibility, optimization

High-value product growth

World-class assets

Continual portfolio highgrading |

Break

2013 Analyst Meeting

71 |

Chairman and CEO

Rex Tillerson

Summary

72 |

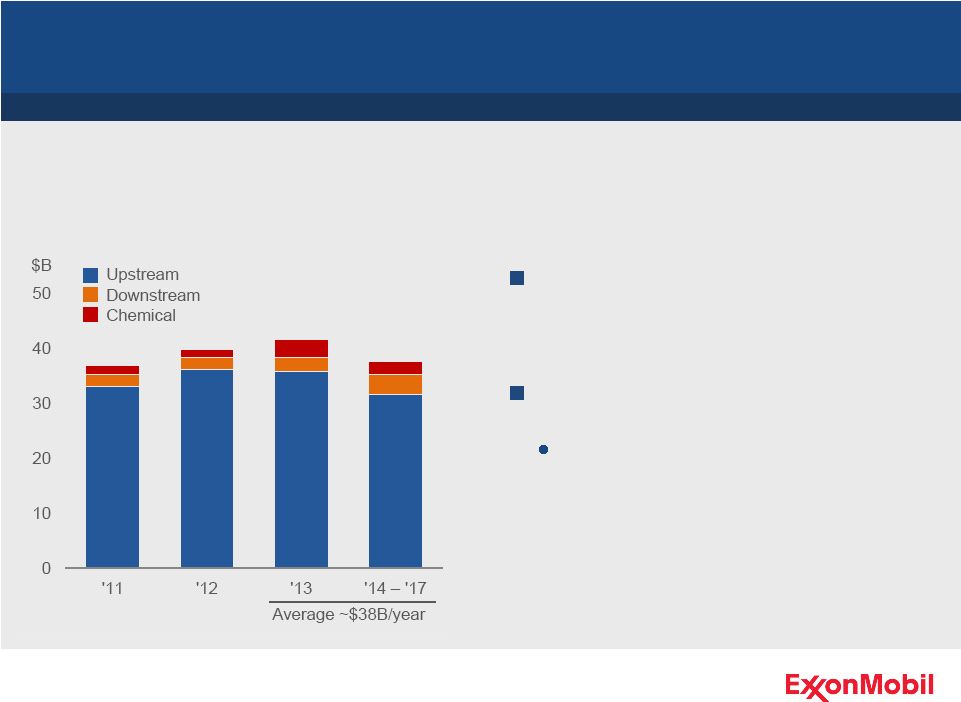

Investment Plan

Capex by Business Line

Expect to spend average of

about $38 billion per year from

2013 to 2017

Plan to invest approximately

$41 billion in 2013

Committed to investing through the business cycle

73

Includes $3.1 billion for

Celtic acquisition |

ExxonMobil Strengths

Relentless focus on maximizing long-term shareholder value

Strong financial and operating performance

Balanced portfolio

Disciplined investing

High-impact technologies

Operational excellence

Global integration

74 |

Key

Messages Risk management is fundamental to our business

Continued strong financial and operating results

Major project start-ups drive volume growth for 2013 –

2017

Portfolio of opportunities for long-term profitable growth

ExxonMobil strategy delivers superior returns over the long term

75 |

Q&A

2013 Analyst Meeting

76 |