March 9, 2011

New York Stock Exchange

2011 Analyst Meeting

Exhibit 99.2 |

March 9, 2011

New York Stock Exchange

2011 Analyst Meeting

Exhibit 99.2 |

Cautionary Statement

2 |

9

AM Welcome

David Rosenthal

Vice President, Investor Relations

Business Overview

Rex Tillerson

Chairman and CEO

Financial and Operating Results

Competitive Advantages

Global Exploration &

Mark Albers

Upstream Projects

Senior Vice President

Unconventional Portfolio

Andy Swiger

Senior Vice President

Summary

Rex Tillerson

Chairman and CEO

Break

Q&A

12 PM

Meeting Concludes

Agenda

Agenda

3 |

Rex

Tillerson Chairman and CEO

Business Overview |

5

Business Environment

Stabilizing global economy with modest growth in the U.S. and Europe

Stronger economic growth in developing world, especially Asia Pacific region

Increasing regulation and oversight; climate change policies uncertain

Some competitors re-evaluating business model and plans

Long-term forecasts for energy and petrochemical demand remain robust

ExxonMobil is well-positioned for the challenges and opportunities in the

global business environment. |

6

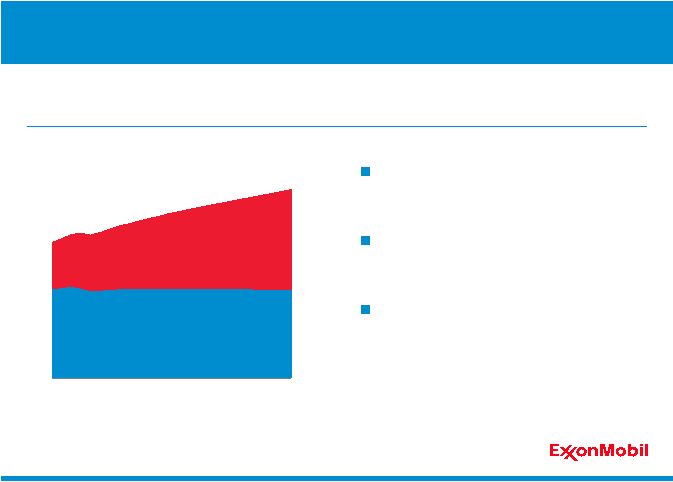

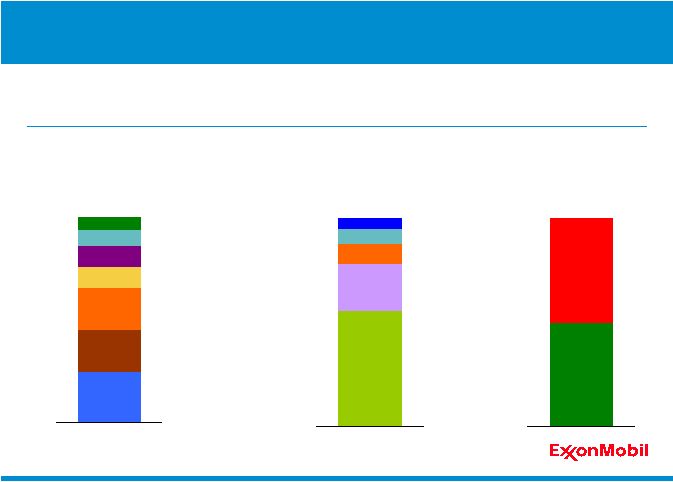

Energy Demand

Quadrillion BTUs

0

50

100

150

200

250

300

Oil

Gas

Coal

Other*

'05–'30

'30

Average Annual Growth

2005 --

2030

2.0%

0.7%

1.2%

1.8%

* Other includes nuclear, hydro, geothermal, biomass, wind, solar, and biofuels.

'30

'05

'30

'05

'30

'05

'30

'05

'30

'05

'30

'05

'30

'05

'30

'05

Total

Energy

Growth

Annual

Energy

Savings

0.7%

Global Energy Demand to 2030

Oil, gas, and coal continue to provide

about 80 percent of world energy

Strong growth in natural gas

•

Driven by power generation

Energy savings in 2030 about twice

the growth in projected energy use

Energy

demand

is

expected

to

grow

about

35

percent

by

2030

–

led

by

economic

progress

in

developing

nations

–

even

with

large

efficiency

gains. |

7

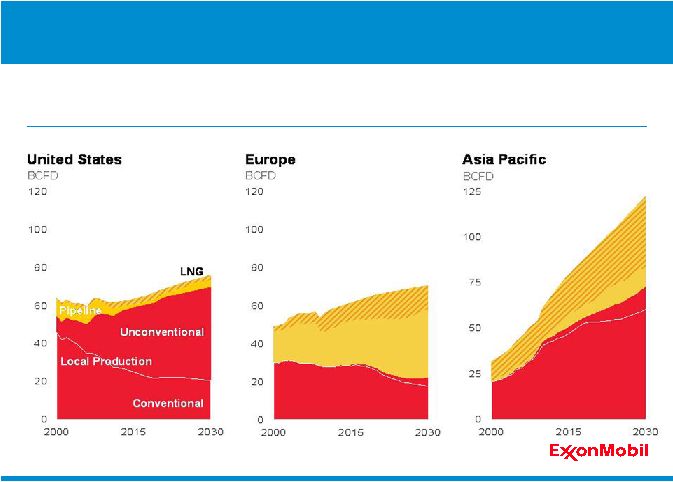

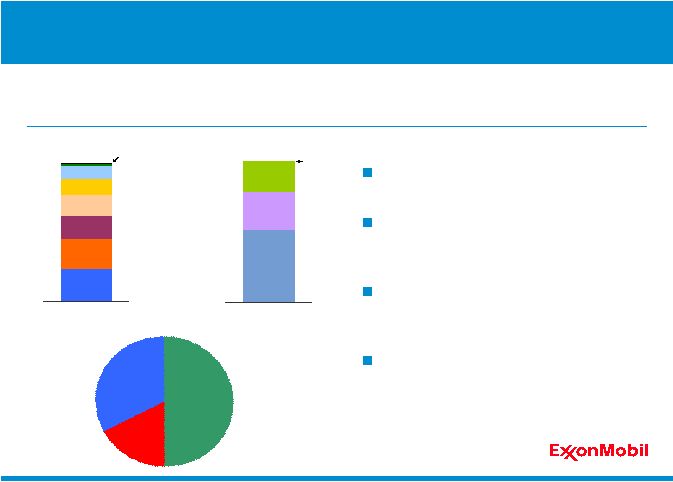

Regional Gas Supply and Demand

Strong

growth

in

global

gas

demand

led

by

Asia

Pacific,

met

with

expanding

supplies of LNG and unconventional gas. |

8

0

10

20

30

40

50

60

'05

'10

'15

'20

'25

'30

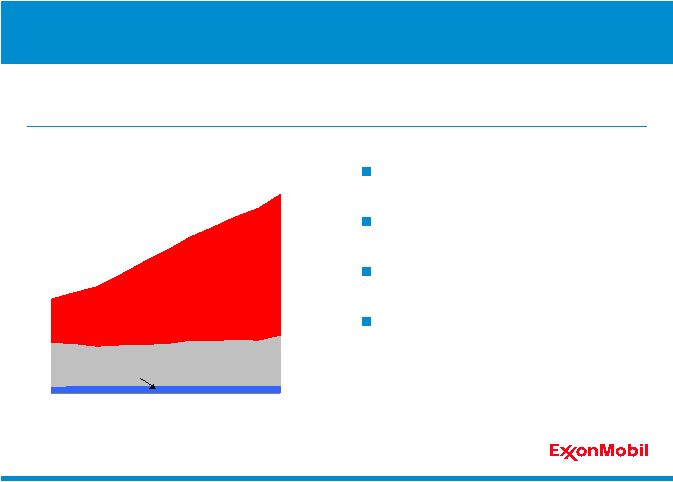

Transportation Energy Demand

MOEBD

OECD*

Non-OECD

Global Downstream Demand

Long-term transportation energy demand likely to increase almost 40 percent

between 2005 and 2030.

Long-term growth driven by doubling

of demand in developing countries

New capacity impacting supply /

demand balances

Significant regulatory pressures

continue

* OECD –

Organization for Economic Co-operation and Development.

|

9

-3

0

3

6

9

12

'95

'00

'05

'10

'15

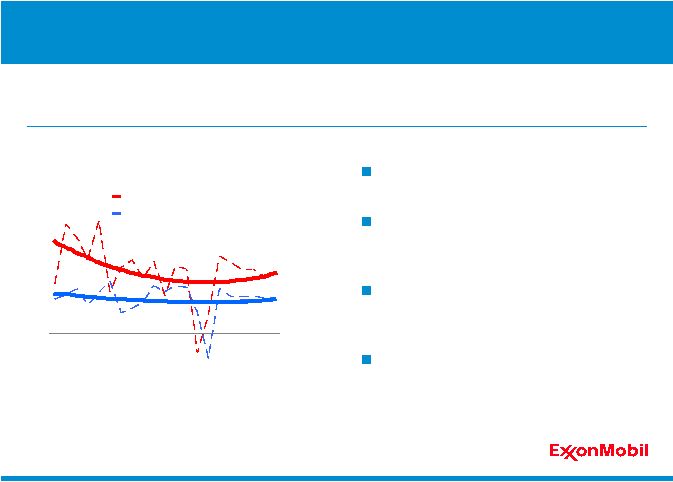

Commodities Demand and Global GDP*

Year-on-Year Percent Change

* ExxonMobil estimates; Chemical commodity demand includes

Polyethylene, Polypropylene, and Paraxylene.

Chemical Commodity Demand

Global GDP

Global Chemical Demand

Global demand growth above GDP

Penetration into new markets and

material substitution

Asia Pacific 60 percent of future

growth

Higher growth potential in specialties

Global demand for commodity chemicals poised to resume growth.

|

10

The Energy Challenge

The scale of the challenge is enormous –

and growing

Requires an integrated set of solutions and pursuit of all economic options

Demands a commitment to innovation and technology

Calls for unprecedented levels of investment

Requires sound, stable government policies

Involves effective risk management and a relentless focus on operational

excellence

The energy industry must meet the world’s growing energy needs safely while

minimizing the impact on the environment. |

11

Industry Risks

The energy industry faces multiple uncertainties and risks. Well-developed

processes, procedures, and people are required to manage risks.

Risk

Management

Financial &

Economic

Geopolitical

Technical

Climate

Change

Safety &

Security

Health &

Environment |

12

Risk Management Approach

ExxonMobil has established common worldwide expectations for

addressing risks inherent in our business.

Capable, committed workforce with clear accountability

Well-developed and clearly-defined policies and procedures

High standards of design to reduce or eliminate risk

Employee and contractor training

Systematic approach to performance metrics and continuous improvement

Rigorously applied management systems |

13

ExxonMobil employs multiple frameworks to lower risk profiles across the

business, forming the foundation for strong financial and operating results.

Multiple Risks –

Multiple Frameworks

Operations Integrity Management System (OIMS)

Facility Integrity Management Systems

Controls Integrity Management System (CIMS)

ExxonMobil Capital Project Management System (EMCAPS)

Operated-by-Others Management System |

Rex Tillerson

Chairman and CEO

Financial and Operating Results |

15

2010 Financial and Operating Results

Industry-Leading Safety Performance

Superior Financial and Operating Results

Unmatched Shareholder Distributions

Disciplined Investments Focused on Long-Term Value

ExxonMobil delivered strong results across all key measures and all

business lines. |

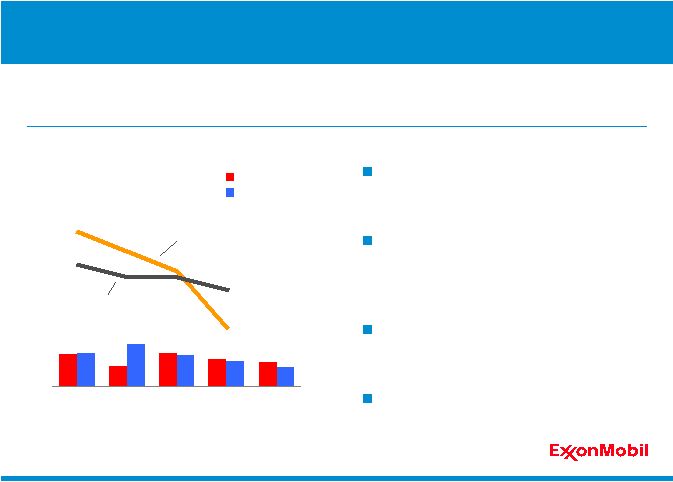

16

0.0

0.1

0.2

0.3

'06

'07

'08

'09

'10**

Lost Time Incident Rate

U.S. petroleum industry

contractor benchmark*

U.S. petroleum industry

employee benchmark*

Employee

Contractor

Incidents per 200K hours

* 2010 industry data not available.

** Excludes XTO Energy Inc. data.

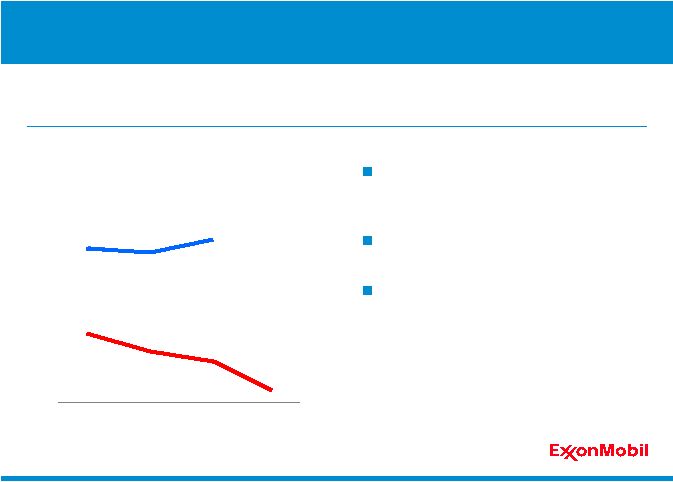

Safety

Safety performance

continues to lead the industry

Achieved best-ever lost time incident

rates for combined employee and

contractor workforce

Effective risk management and focus

on operational excellence

Committed to maintaining and

improving strong performance

ExxonMobil’s

vision

of

Nobody

Gets

Hurt

is

internalized

in

the

Company’s

culture,

positively

influencing

the

behavior

of

each

employee

and

contractor.

Industry-Leading Safety Performance |

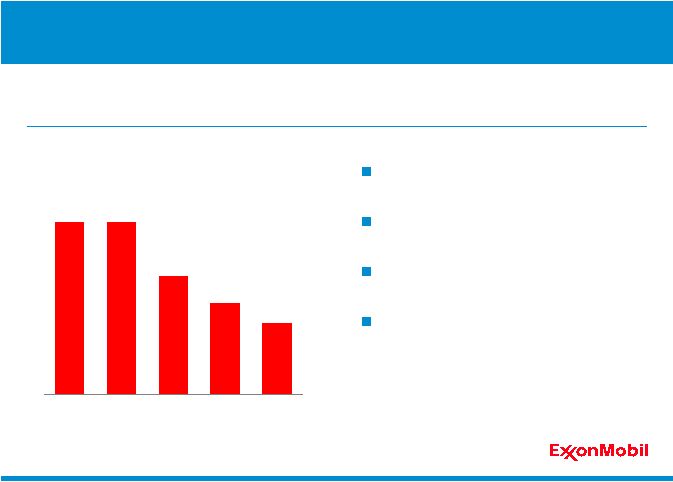

17

0

2

4

6

8

'06

'07

'08

'09

'10*

Hydrocarbon Flaring from

Upstream Oil and Gas Production

Million Metric Tons

* Excludes XTO Energy Inc. data.

Strong environmental management

Improving energy efficiency

Reducing flaring, spills, and releases

Protect Tomorrow. Today.

Environmental Performance

ExxonMobil

is

committed

to

reducing

the

impact

on

the

environment

while

expanding

energy

supplies

needed

to

fuel

economic

growth.

Industry-Leading Safety Performance |

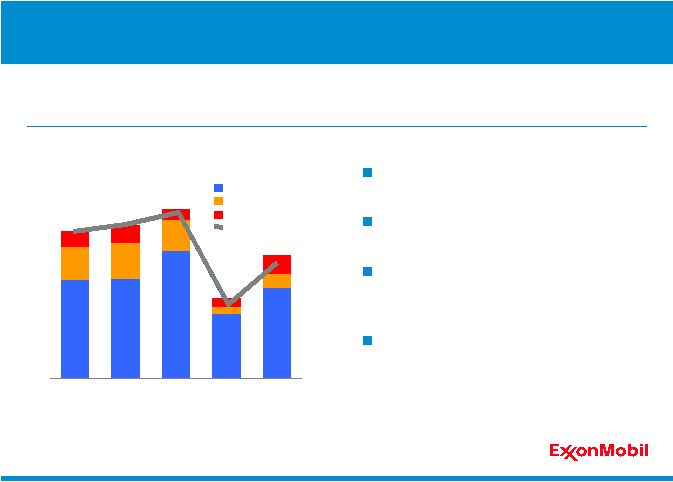

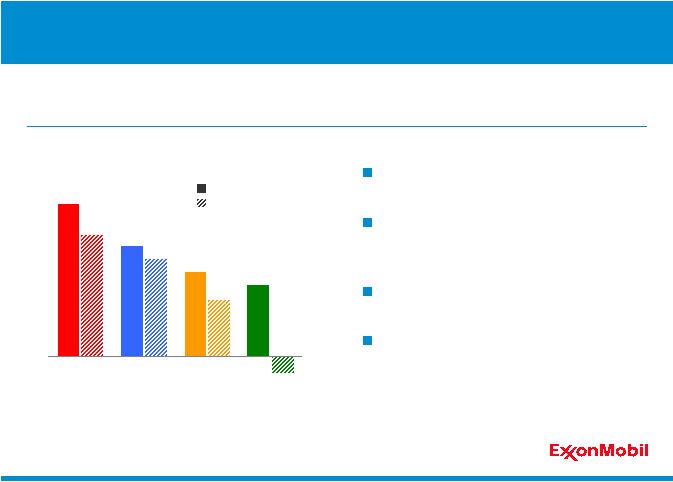

18

0

10

20

30

40

50

'06

'07

'08

'09

'10

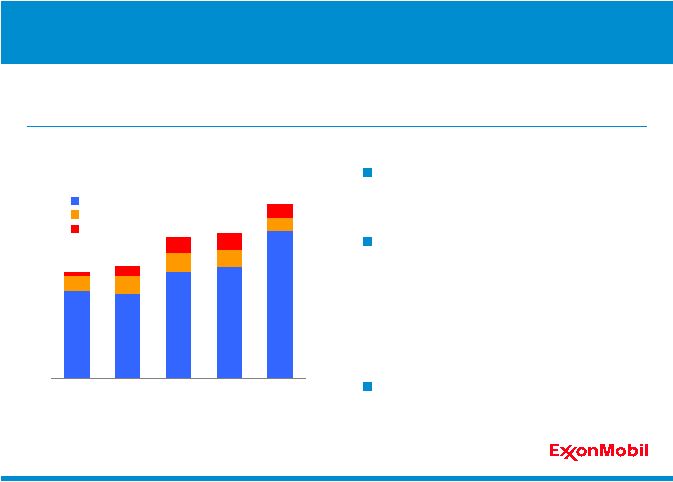

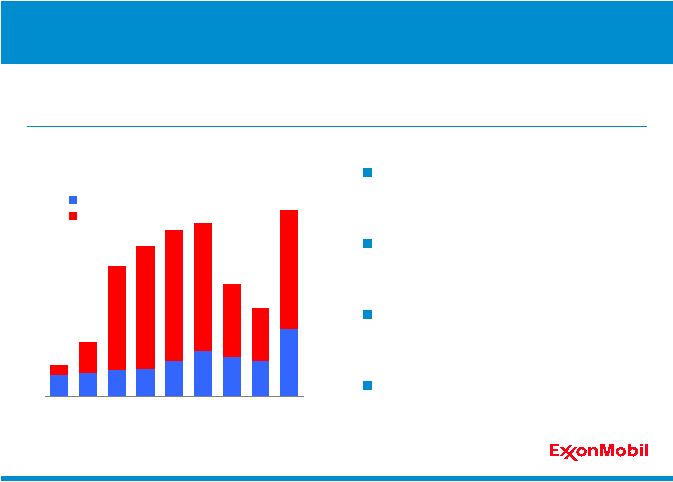

Earnings Excluding Special Items

$B

Upstream

Downstream

Chemical

Earnings

Upstream

Downstream

Chemical

Earnings

Earnings

57 percent increase over 2009

Industry-leading results

Record earnings for Chemical

business

Maximizing value of asset base

ExxonMobil earned $30.5 billion in 2010 supported by project start-ups and

strong operational performance across all business lines.

Superior Financial and Operating Results |

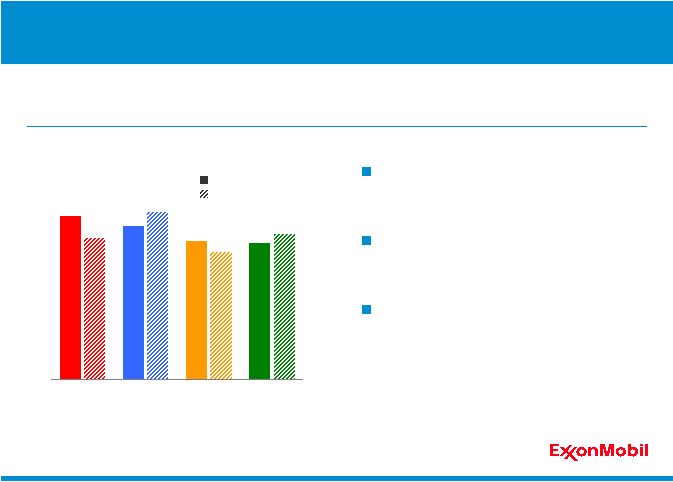

19

0

5

10

15

20

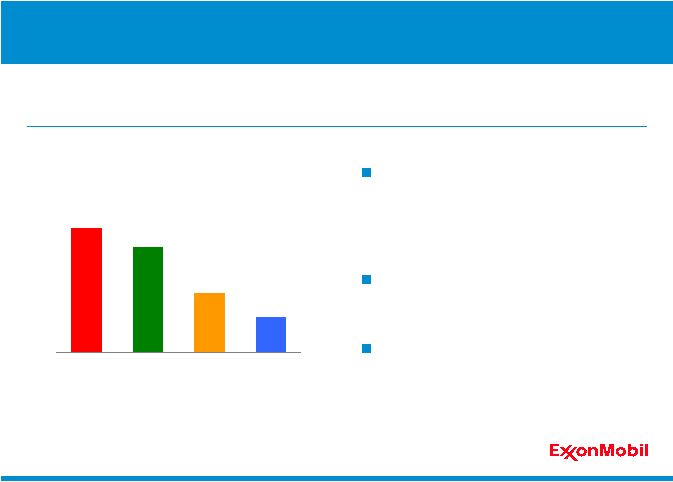

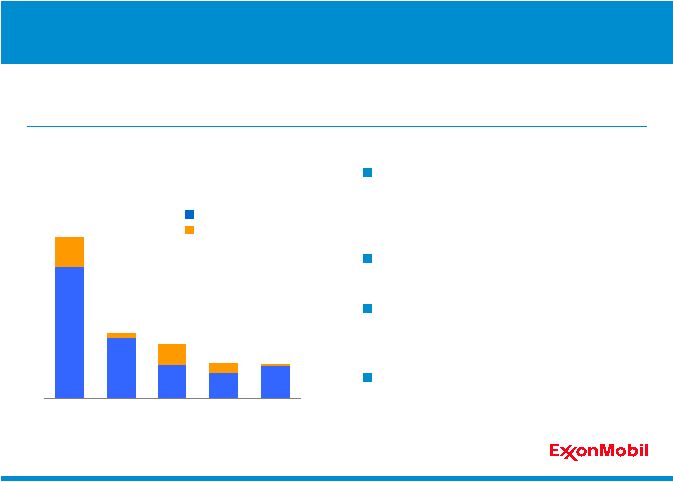

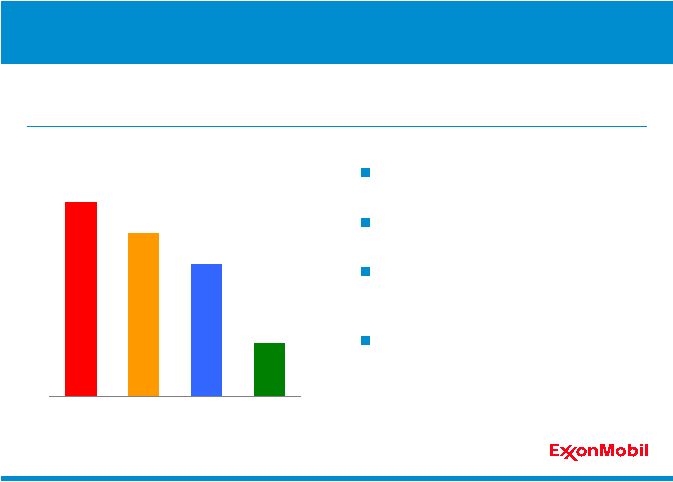

XOM

CVX

RDS

BP

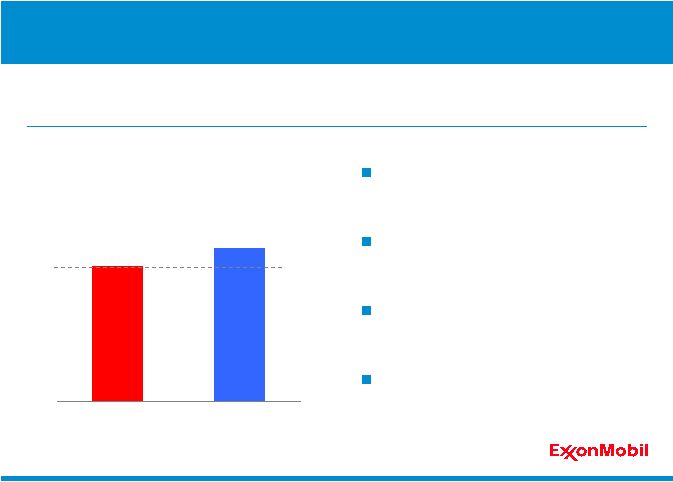

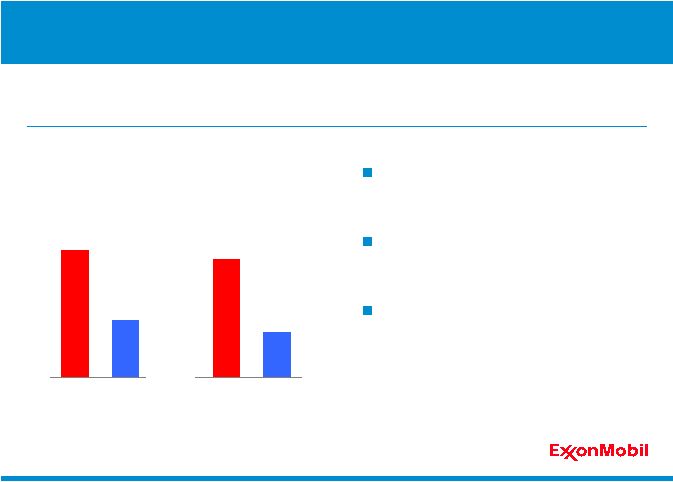

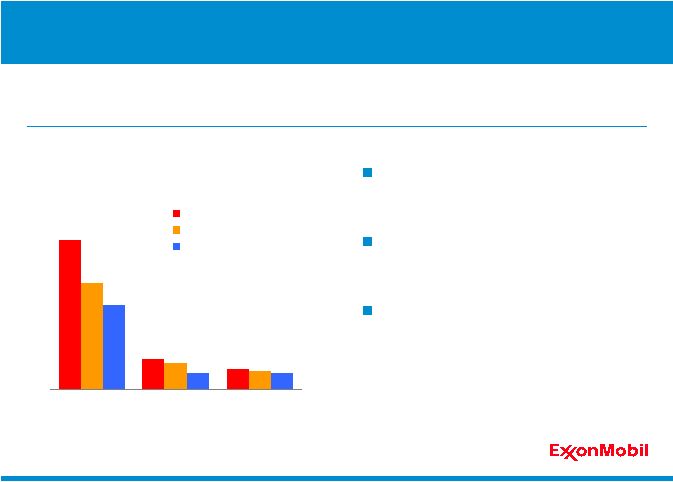

Earnings per Barrel*

$ per OEB

2010

'06 -‘10, average

* Competitor data estimated on a consistent basis with ExxonMobil and based on

public information. Profitability ahead of competition

over 5-year period

Benefit of disciplined approach to

cost management

Result of relentless focus on

maximizing value of each asset

Upstream Earnings per Barrel

High-quality Upstream portfolio continues to deliver strong earnings per

barrel.

Superior Financial and Operating Results |

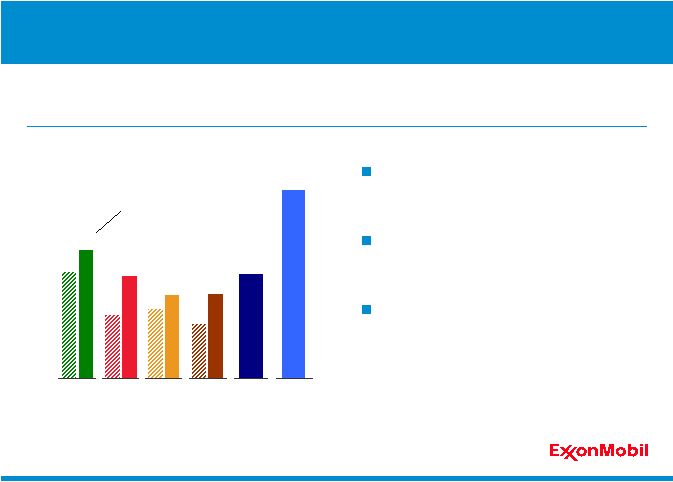

20

-5

0

5

10

15

XOM

RDS

CVX

2010 Volume Growth

Percent

XTO

BP

Upstream Volumes Growth

Largest independent producer of oil

and gas: 4.45 MOEBD

Most significant annual increase

among competitor group

•

Peer average increase: one percent

Supported by effective risk

management and operational

excellence

Ongoing successful integration of XTO

Upstream volumes grew 13 percent in 2010 driven by project start-ups, the

addition of XTO, and strong operational performance.

Superior Financial and Operating Results |

21

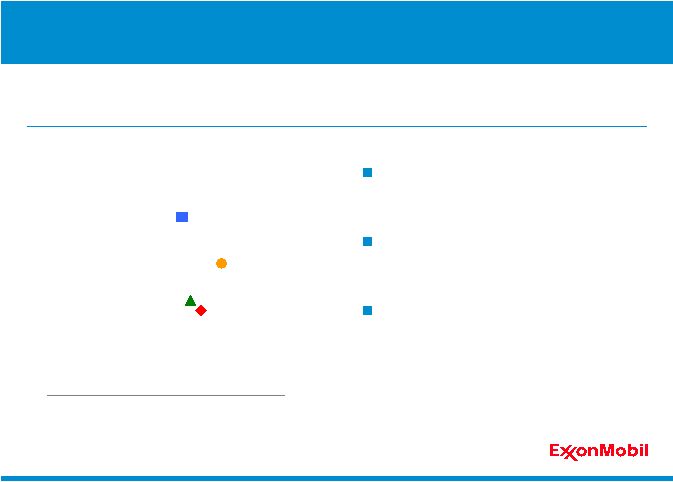

0

6

12

18

0%

50%

100%

150%

200%

Proved Reserves Replacement

Percent

* vs. Costs**

(‘05 –

‘09 average)

CVX

RDS

BP

XOM

$ per OEB

*

Reserves

replacement

based

on

SEC

pricing

bases,

excluding

asset

sales.

**

Costs incurred in property acquisition & exploration plus development

activities, divided by proved oil-equivalent reserves additions,

including purchases. Competitor data estimated on a consistent basis with ExxonMobil and

based on public information.

ExxonMobil

consistently

replaces

more

reserves

than

it

produces,

at

a

lower

unit cost than competitors.

Reserves Replacement

Replaced 211 percent of reserves

produced in 2010

Additions exceeded production for

the

17

th

consecutive

year

Proved reserves increased by 8

percent from 2009 to 24.8 BOEB

Superior Financial and Operating Results |

22

Return on Average Capital Employed*

Percent

-5

0

5

10

15

20

25

30

XOM

CVX

RDS

BP

2010

'06 -‘10, average

Return on Capital Employed

ROCE of 22 percent in 2010

Consistent execution of

business model

Strength of integrated portfolio

Disciplined investment through

the business cycle

* Competitor data estimated on a consistent basis with ExxonMobil and based on

public information. ROCE continues to lead industry.

Superior Financial and Operating Results |

23

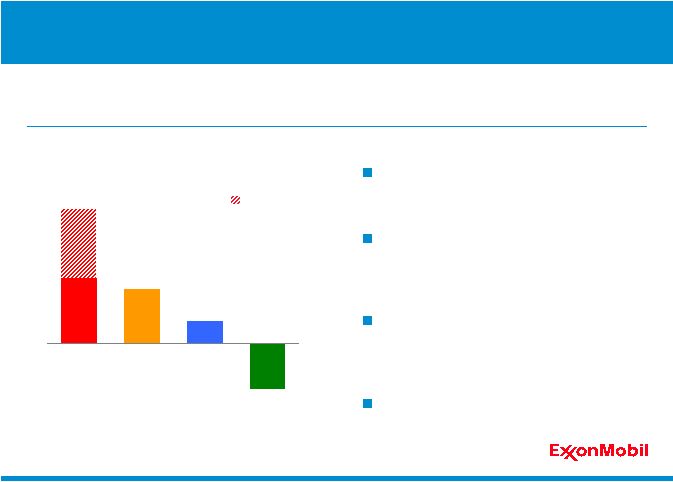

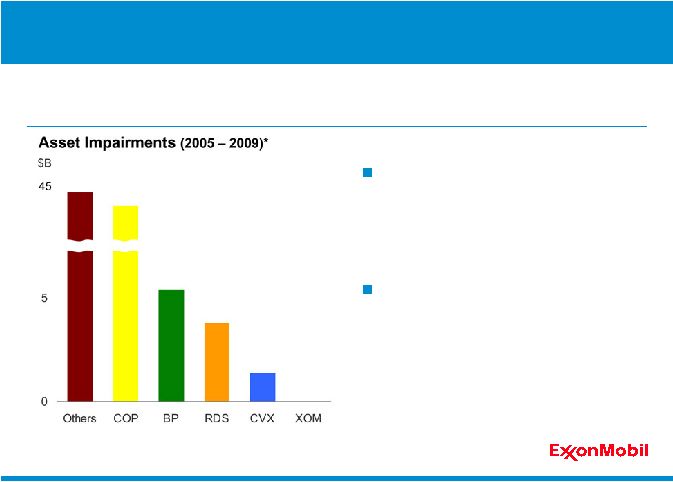

Asset Impairments

Industry

•

Asset impairments totaled $96B

from 2005 -

2009

•

Erosion of shareholder value

•

Distortion of returns

ExxonMobil

•

No material impairments

•

Supported by disciplined

investment decision processes

•

Demonstrates strength and

quality of portfolio

•

Highlights ability to generate

value from each dollar invested

ExxonMobil’s industry-leading returns are supported by superior

investment discipline and the efficient use of capital.

Superior Financial and Operating Results

*

Represents

publicly

reported

asset

impairments

on

a

before

tax

basis. |

24

0

20

40

60

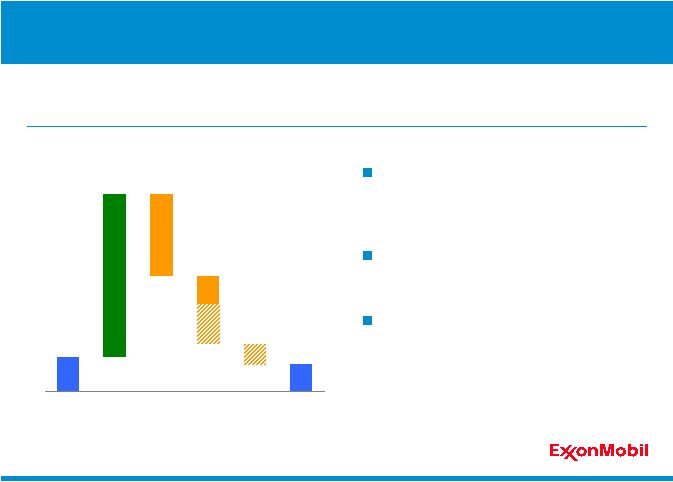

2010 Cash Flow

$B

Share Purchases

Dividends

11

52

27

21

7

8

YE’09

Cash

Cash

Flow*

Adds

to

PP&E**

Share-

holder

Distributions

Financing/

Other

YE’10

Cash

2010 Cash Flow

Cash flow up over 70 percent from

2009; year-end cash balance of over

$8B

Funded all attractive investment

opportunities and growing dividend

Cash flow of $16B available after

investments and dividends

•

Returned cash to shareholders

with flexible share purchases

•

Reduced debt by more than 25

percent since XTO merger

Superior cash generation provides ability to fund profitable projects, return

cash to shareholders, and maintain financial flexibility.

Superior Financial and Operating Results

* Represents cash flow from operations and asset sales of $51.7 billion, including

$3.3 billion from asset sales. ** PP&E –

Property, Plant, and Equipment. |

25

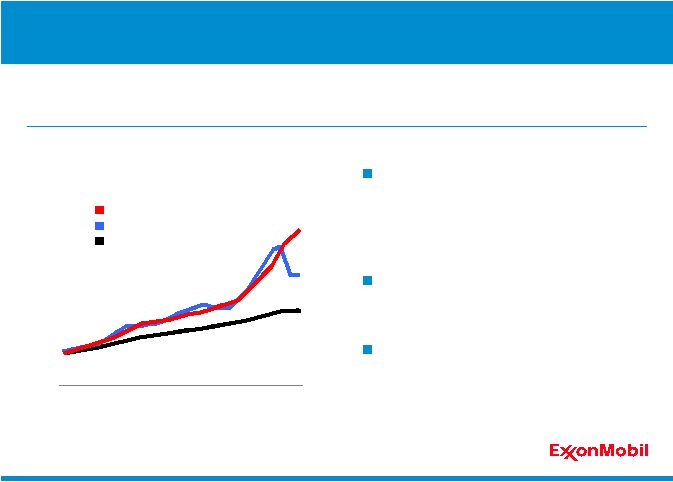

Dividend Growth since 1983*

0.00

0.50

1.00

1.50

2.00

'83

$ per share

XOM

S&P 500

CPI**

‘10

‘00

‘90

Dividends

Almost $40B distributed to

shareholders over past five years

•

Per-share dividends increased 53

percent

Dividend has grown every year since

1983

Annualized growth rate of 5.7

percent

•

Almost twice inflation

* S&P and CPI indexed to 1983 Exxon dividend.

Unmatched Shareholder Distributions

ExxonMobil delivers reliable and growing dividends. In 2010, $8.5 billion was

distributed to shareholders.

** CPI based on historical yearly average from Bureau of Labor Statistics.

|

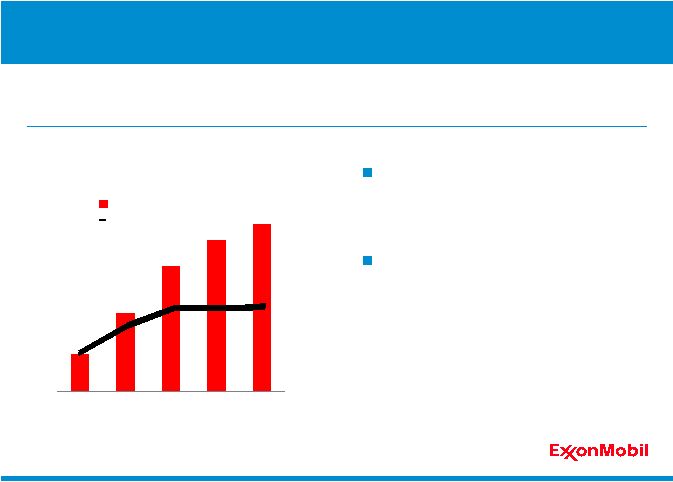

26

Cumulative Purchases to

Reduce Shares Outstanding

0

40

80

120

'06

'07

'08

'09

'10

$B

XOM

Competitors*

Share Purchases

$114B distributed over the last five

years

•

More than twice competitor total

Average annual yield of 5.6 percent

since beginning of 2006

In 2010, ExxonMobil distributed $11.2 billion to shareholders through share

purchases.

* Combined total for RDS, BP, and CVX.

Unmatched Shareholder Distributions |

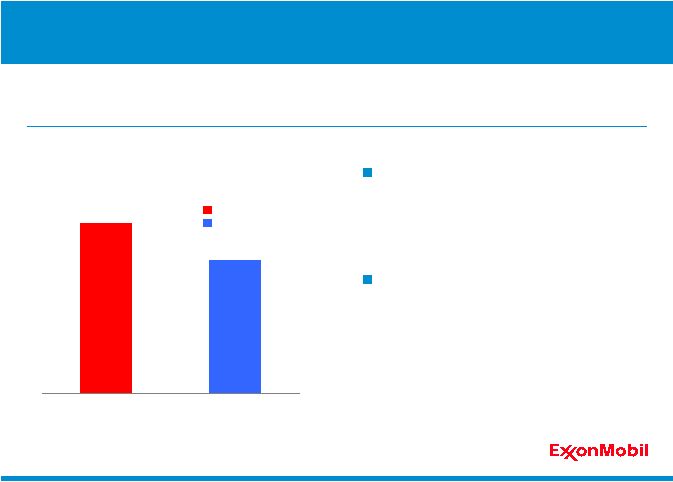

27

Average Annual Distribution Yield*

Dividends & Share Repurchases

0

2

4

6

8

ExxonMobil

Competitors

Percent

XOM

Competitors**

Annual Distribution Yield

Average total distribution yield of 7.6

percent since beginning of 2006

•

Competitors averaged 6 percent

over same period

Consistent, strong payout over time

ExxonMobil shareholder distributions are unmatched in the industry.

* Yield based on previous year-end market capitalization (2006-2010).

** RDS, BP, and CVX.

Unmatched Shareholder Distributions |

28

0

7

14

21

28

35

'06

'07

'08

'09

'10

Capex by Business Line

$B

Upstream

Downstream

Chemical

Capex

Continued selective investments to enhance long-term value of the asset

base.

Invested over $126B

during the past five years

Completed three major Upstream

projects with 2011 forecasted

production of 120 KOEBD

•

RasGas Train 7

•

Golden Pass Terminal

•

Sakhalin-1 Odoptu

Maintained capital efficiency and

discipline

Disciplined Investments Focused on Long-Term Value |

29

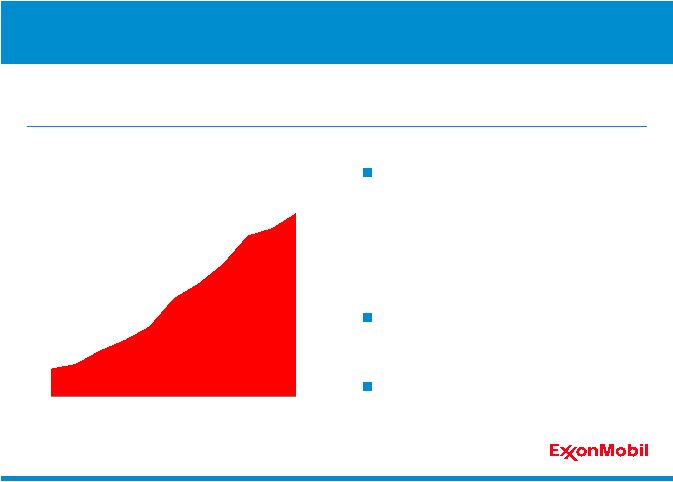

Cumulative Cash Flow from Asset Sales

since Exxon and Mobil Merger

$B

0

10

20

30

40

'00

'05

'10

Portfolio Management

Active asset management across the business cycle to capture

shareholder value.

Ongoing portfolio management

fundamental to business model

•

Cumulative cash flow from asset

sales of almost $40B

•

Cumulative earnings impact of

approximately $11B

Targeted divestments across all

business lines

Retained assets which hold long-

term shareholder value

Disciplined Investments Focused on Long-Term Value |

30

2010 Financial and Operating Results

Industry-Leading Safety Performance

Superior Financial and Operating Results

Unmatched Shareholder Distributions

Disciplined Investments Focused on Long-Term Value

ExxonMobil delivered strong results across all key measures and all

business lines. |

Rex Tillerson

Chairman and CEO

Competitive Advantages |

32

Competitive Advantages

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value. |

33

Competitive Advantages

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value. |

34

0

30

60

90

0

30

60

90

0

30

60

90

BOEB

Resource Base

Liquids

Gas

Africa

Australia/Oceania

Asia

Americas

Unconventional

Gas and Oil

Arctic

Conventional

Heavy Oil / Oil Sands

Deepwater

Acid / Sour

Liquefied Natural Gas

BOEB

BOEB

Europe

Type

Geography

Oil / Gas

2010 Resource Base

Upstream

Balanced Portfolio Quality

ExxonMobil’s resource base of over 84 billion oil-equivalent barrels is

diverse by resource type, geography, and oil / gas mix.

|

35

Markets

0

20

40

0

5

10

15

Gas-Indexed

Oil-Indexed

Divertible

Africa

Europe

Asia

Americas

LNG

Shale Gas

Conventional

Deepwater

Acid / Sour

Tight Gas

Arctic

Contract Structures

BOEB

Gas Resource Base

BCFD

CBM

Global Gas Position

Upstream

Balanced Portfolio Quality

A robust gas portfolio of quality operations and advantaged projects spans

all resource types, major markets, and commercial structures.

79 TCF proved gas reserves

Diverse by resource type, major

markets, and commercial structures

Leading unconventional position with

significant growth potential

Wide range of contracts ensures

flexibility and market optionality |

36

0

1

2

3

4

5

2010 Production

2010 Contract Mix

Gas

Oil

Oil

Oil

Indexed

Gas

Indexed

2010 Production by Contract

MOEBD

2010 Production and Contract Mix

Approximately 70 percent of total

2010 production linked to oil pricing

•

One-third of gas sales pricing

linked to oil prices

More flexible contracts also allow

ability to divert gas to the most

attractive markets

Advantaged developments continue

to provide diverse contract structures

A wide range of gas contracts provides ExxonMobil with the flexibility to

maximize the value of a strong global gas position.

Upstream

Balanced Portfolio Quality |

37

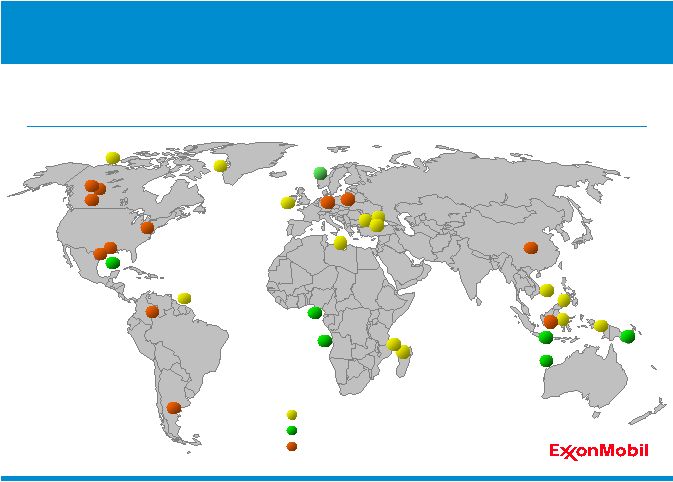

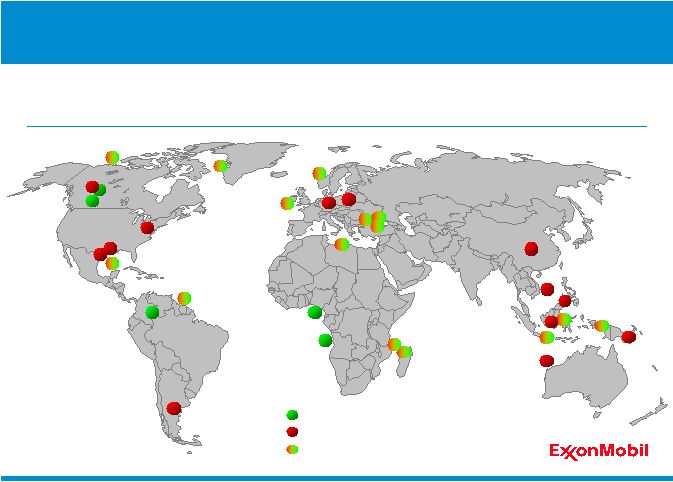

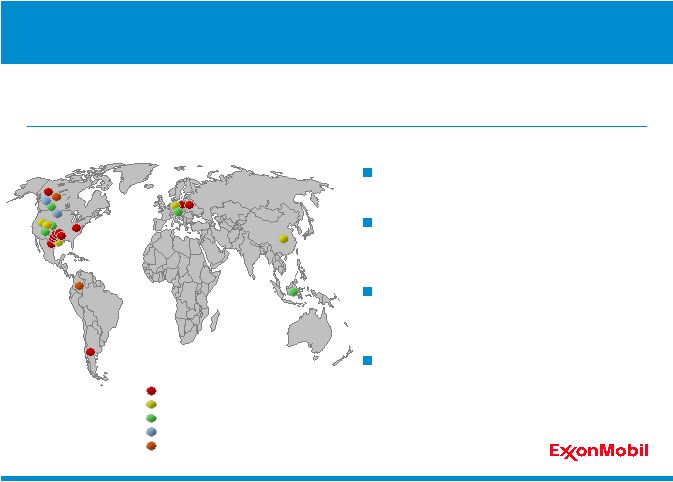

Turkey

Poland

Germany

Nigeria

Romania

Ireland

Norway

Indonesia

Madagascar

Vietnam

Tanzania

PNG

China

West

Greenland

Beaufort

Athabasca

GoM

Horn River

Haynesville /

Bossier

Eagle Ford

Guyana

Argentina

Cardium

Colombia

Marcellus

Angola

Australia

Libya

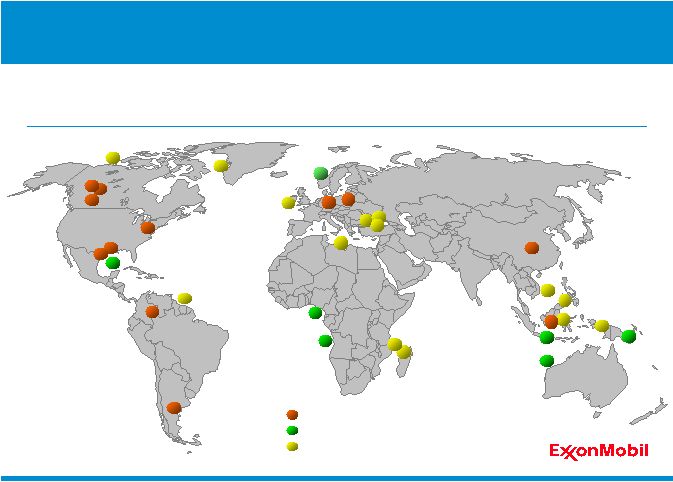

Unconventional

New Play Tests

Established Basin

Unconventional

New Play Tests

Established Basin

Philippines

Russia

New Opportunity Growth

A diverse global portfolio of high-quality resource opportunities.

Upstream

Balanced Portfolio Quality |

38

Scale Advantage

Refineries 60 percent larger than

industry

•

Largest lubricant basestock

capacity

Constant focus on cost efficiency,

circuit optimization, and reliability

Feedstock flexibility advantage

•

Challenged crude runs 60 percent

more than industry average

ExxonMobil is the largest global refiner and manufacturer of lube basestocks

as well as a leading marketer of petroleum products.

Downstream

Balanced Portfolio Quality

* ExxonMobil average global refinery distillation capacity compared to industry (YE

2010). Equity share capacity calculated on a consistent basis using public

information. 100

150

200

250

XOM

BP

RDS

Industry

Average

Average Refinery Size*

KBD |

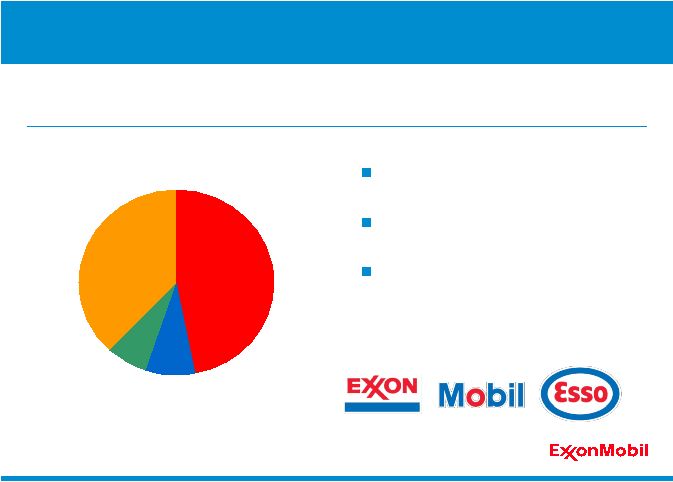

39

Diverse business channels

Highly integrated with refining

Leveraging our globally recognized

brands

•

Product quality

•

Supply reliability

Global reach, trusted brands, and high-quality products position ExxonMobil

as a reliable supplier to a wide range of customers.

World-class Brands

Downstream

Balanced Portfolio Quality

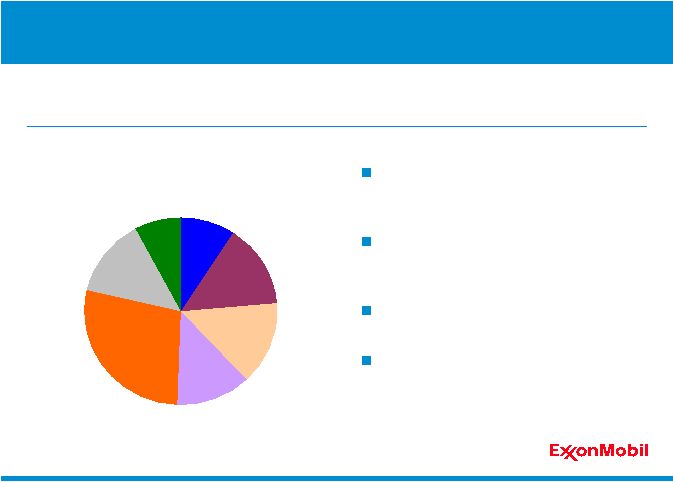

Global Fuels Marketing Sales

Aviation

Marine

Retail

Industrial and

Wholesale

47%

8%

7%

38%

Global Fuels Marketing Sales

Aviation

Marine

Retail

Industrial and

Wholesale

47%

8%

7%

38% |

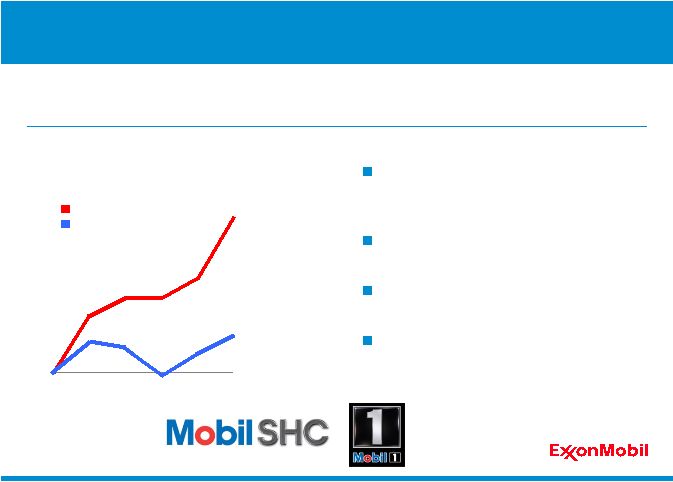

40

0

10

20

30

40

50

60

'06

'08

'10

Synthetic Lubricants Sales Growth

Percent Change since 2005

ExxonMobil

Industry

Industry-leading Sales Growth

Continued growth in high-value lubes, well above industry.

Market leader in high-value synthetic

lubes

Legacy of technology leadership

Efficient global business model

Well-positioned to capture superior

growth

Balanced Portfolio Quality

Downstream |

41

0

1

2

3

4

5

'02

'03

'04

'05

'06

'07

'08

'09

'10

Earnings

$B

Commodity

Specialty

Commodities capture upside earnings

potential

Specialties provide stable yet growing

earnings base

Portfolio backed by proprietary

technology

Both commodities and specialties

delivering strong results

Unique Chemical portfolio captures benefits of scale in commodities while

maximizing value from specialties.

Product Strength and Diversity

Chemical

Balanced Portfolio Quality |

42

0

2

4

6

XOM

RDS

TOT

CVX

DOW

Asia Pacific / Middle East Capacity

Ethylene & Paraxylene

Million Metric Tons

Existing

Announced

Asia Pacific Growth

Investments in increasing capacity to meet future demand growth in key

Asia Pacific Markets.

Asia Pacific 60 percent of future

growth

•

Supported by Middle East exports

Fujian start-up in 2009

Singapore expansion entering

commissioning and start-up phase

Saudi specialties progressing

Source: Chemical Market Associates, Incorporated.

Chemical

Balanced Portfolio Quality |

43

Competitive Advantages

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value. |

44

Major Project Distribution by Project Type

Percent, resource

Unconventional

Gas and Oil

Heavy Oil /

Oil Sands

Deepwater

Conventional

LNG

Acid /

Sour

Arctic

28%

14%

8%

9%

15%

14%

12%

Developing 26 net BOEB, across all

regions and resource types

Industry-leading project management

processes

High-impact technology

Capital efficient implementation

Extensive Upstream portfolio of 130+ major projects supports selective

investment decisions.

Major Project Inventory

Upstream

Disciplined Investing |

45

Upstream

Disciplined Investing

Eleven major project start-ups are planned between 2011 and 2013.

Near-Term Project Start-Ups

Conventional Etim / Asasa

Pressure Maintenance

Deepwater

Pazflor

Acid / Sour

Kashagan Ph 1

Conventional

Kipper / Tuna

Deepwater

Kizomba Satellites

Deepwater

Usan

Oil Sands

Kearl Initial Development

Conventional

Nigeria Satellites Ph 1

Courtesy of Total

Courtesy of Total |

46

Upstream

Disciplined Investing

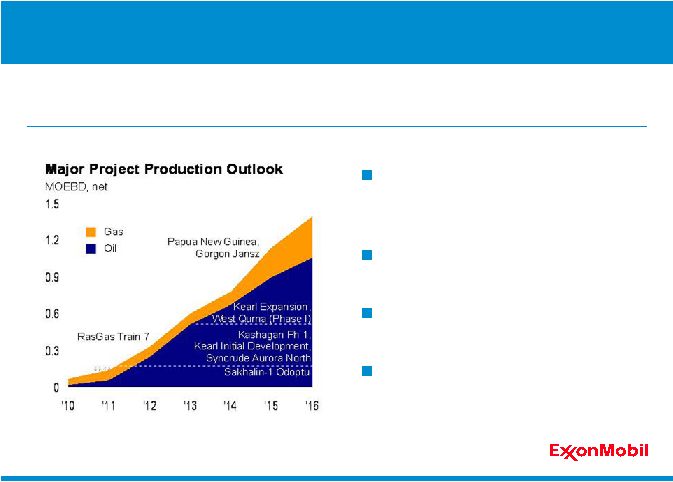

Major Project Production Outlook

Significant new long-plateau production from major projects supports

long- term volumes.

Nearly 1.4 MOEBD added by

2016

80% oil volumes

Significant long-plateau volumes

Long-term growth supported by

diverse portfolio |

47

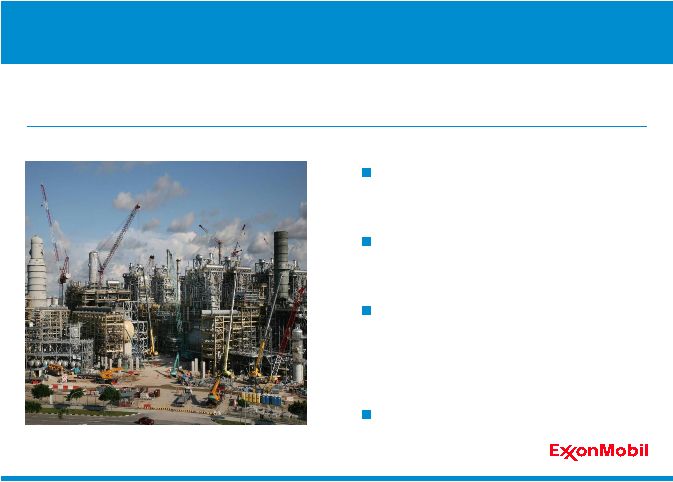

Lower-Sulfur Motor Fuels

ExxonMobil’s global investments continue to expand production

of

lower-sulfur motor fuels.

New ultra-low sulfur diesel (ULSD)

facilities in Baytown, TX; Baton Rouge,

LA; and Antwerp, Belgium

•

More than $1B invested to meet

expanding diesel demand

•

Adds 6 million gallons per day

Additional projects underway

•

Scanfiner unit and distillate

hydrofiner upgrade at Sriracha,

Thailand, refinery

•

Diesel hydrotreater at Singapore

Baytown Refinery, United States

Downstream

Disciplined Investing |

48

Downstream Average Capital Employed

$B

0

25

50

'00

'05

'10

ExxonMobil

Competitor Average

(1)

ExxonMobil

Competitor Average

(1)

Efficient Use of Capital

Disciplined capital management

Robust portfolio management

processes

Significant portfolio divestments*

•

Interests in 11 refineries

•

5K+ miles of pipeline assets

•

140 product terminals

•

40 lube oil blend plants

•

20K+ retail sites

ExxonMobil is the most capital efficient among competitors and actively

manages capital employed across the business cycle.

*

Asset

management

activities,

2000

–

2010

Downstream

Disciplined Investing

(1)

RDS, BP, and CVX values are estimated on a consistent basis with

ExxonMobil, based on public information. |

49

Singapore Expansion

2.5 million metric tons of new

capacity

Underpinned by proprietary

technologies

Advantaged project

•

Significant feed flexibility

•

World-scale efficiency

•

Premium products

Highly integrated with refining

Major expansion in Singapore to meet demand growth in Asia Pacific will

add shareholder value, building on key competitive advantages.

Singapore Expansion

Chemical

Disciplined Investing |

50

Chemical Average Capital Employed

$B

0

20

40

'00

'05

'10

ExxonMobil

Major Chemical Company Average

(1)

Efficient Use of Capital

Disciplined investment selection

Engineering and project excellence

Growth via internal technology

development

ExxonMobil Chemical is the most capital efficient of the large, international

chemical companies.

Chemical

Disciplined Investing

(1)

Dow Chemical and BASF values are estimated on a consistent basis

with ExxonMobil, based on public information. |

51

Competitive Advantages

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value. |

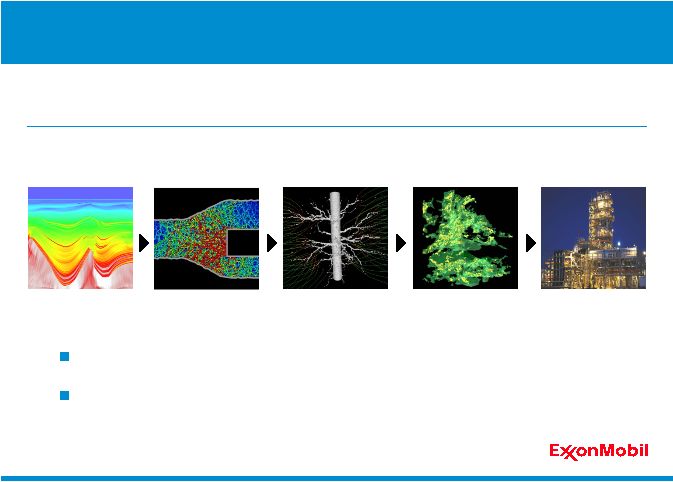

52

Research and Development

Upstream

High-Impact Technologies

ExxonMobil delivers advantaged technologies across the business while

progressing significant breakthrough

research. Integrated

technologies provide advantaged business solutions Developing

high-reward, risk-reduction technologies for the future Imaging

Shale Gas

Drilling

Flow Stimulation

Sour Gas

Exploration

Development

Production |

Upper

Zakum Upstream

High-Impact Technologies

Employing advantaged technologies to progress resource development with

partners.

Abu Dhabi Technology Center

Leading Reservoir Simulator

Building artificial islands with co-

located drilling and processing

Technology Center is catalyst for

collaboration and innovation

Use of extended-reach drilling

technology demonstrated feasibility of

island development concept

Significant savings in development cost

and reduced environmental footprint

Upper Zakum

Development Plan

53 |

Leading-edge technologies

•

Fundamental composition models

•

Advanced catalysts and processes

•

Heavy oil characterization /

conversion

•

Energy efficiency / management

Maximize value through entire supply

and production chain

•

Rapidly assess and select

advantaged feeds

•

Model optimum feedstock routing

•

Formulate advanced products

Discovering, developing, and deploying proprietary technologies provide

near-term and longer-term competitive advantages to our businesses.

Legacy of Technology Leadership

High-Impact Technologies

Downstream

54 |

ExxonMobil and Synthetic Genomics are researching large-scale

production and commercialization of algae-based biofuels.

Numerous potential benefits of biofuels

production from algae

•

Provides GHG mitigation benefits

unlike conventional fuels

•

No impact on food production

•

Yields greater volume of biofuels per

acre than other sources

•

Produces biofuels similar to existing

transportation fuels

Expect to spend $600 million if project

milestones are met

Next Generation Technology

Downstream

High-Impact Technologies

Algae consume carbon dioxide as they grow

Algae secreting oil

55 |

Advantaged Technology

Advantaged feedstock

•

High level of feed flexibility

Lower-cost manufacturing processes

•

Advanced processes and catalysts

•

Improved energy efficiency and

reliability

Premium products

•

Innovative, higher-value products

Development and deployment of industry-leading chemical technology

provide a competitive advantage.

Chemical

High-Impact Technologies

56 |

Worldwide

Feedstock* 0

25

50

75

100

Industry

ExxonMobil Chemical

Percent

Ethane

LPG +

Naphtha

Heavy

Feedstock Advantage

ExxonMobil Chemical proprietary technology enables processing both

heavy and light feedstocks for competitive advantage.

Technology critical in delivering

flexibility

North America ethane advantage

Access to low-cost heavy feeds

Source: Chemical Market Associates, Incorporated.

* Ethylene feedstock, 2009 data; ExxonMobil data includes ExxonMobil share of JV

production. Chemical

High-Impact Technologies

57 |

Competitive Advantages

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value.

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

58 |

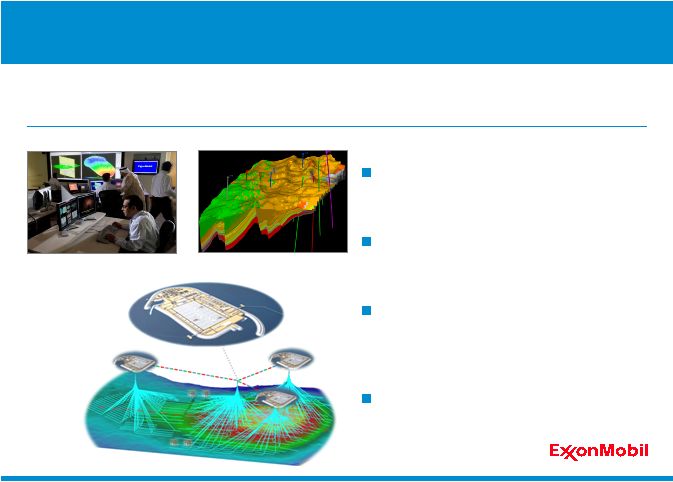

Reliability and Cost Management

Achieving superior reliability

•

Operated uptime > 3 percent

higher than assets operated-by-

others

Maintaining integrity of facilities

Focusing on investment selectivity

and cost management

•

Efficiency identification and

capture

Upstream

Operational Excellence

Standardize

Integrate

Operate and Maintain

Plan and Execute

-

Global best practice deployment delivers superior reliability and life cycle

cost performance.

59 |

0

50

100

150

ExxonMobil Operated

Operated-by-Others

114%

101%

Cost Performance*

Percent

Rigorous, high-quality project management processes consistently deliver

industry-leading project execution performance.

Unmatched ability to implement

complex projects

Deliver projects faster than

competitors

Track record of superior cost

and schedule delivery

Maximize project efficiencies to

deliver superior returns

Project Execution

* Actual versus funded cost variance (%), ‘06 to ‘10 project

start-ups. Upstream

Operational Excellence

60 |

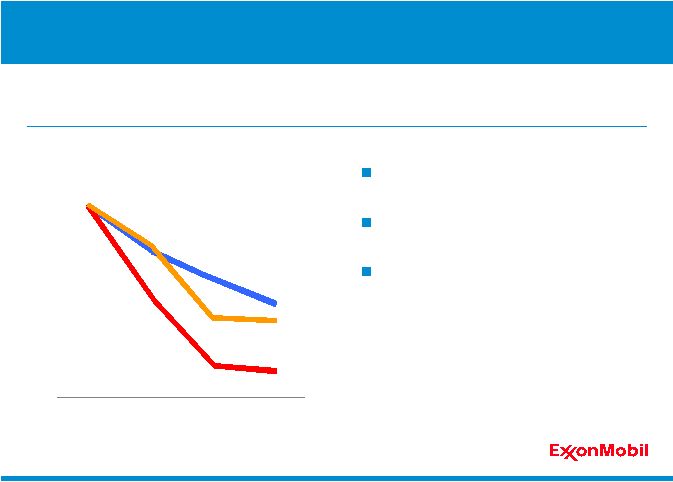

0

5

10

15

20

25

'05

'06

'07

'08

'09

Total Costs per OEB*

CVX

RDS

BP

XOM

$/OEB

Disciplined and consistent

approach to cost management

Continual effort to maximize the

value of each asset

Mature contracting strategies

Ongoing portfolio management

ExxonMobil effectively mitigated cost growth through the business cycle, as

a result of superior cost management.

Cost Management

* Upstream technical costs normalized using 10-K/20-F information; beginning

in 2009, equity companies and oil sands mining operations are included.

Upstream

Operational Excellence

61 |

Superior

reliability

performance

combined

with

unmatched

project

execution

and

life

cycle

cost

performance

generate

maximum

value.

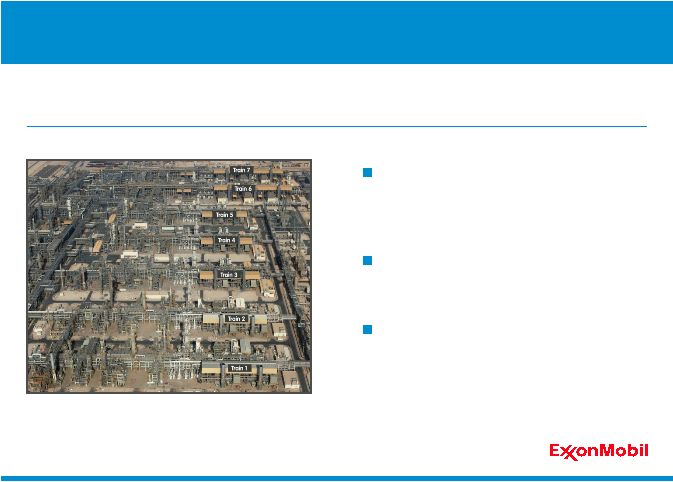

Qatar Liquefied Natural Gas

Delivering 62 million metric tons per

year capacity through Qatar joint

ventures

96 percent uptime performance in

2010

Supplying global major markets

Upstream

Operational Excellence

62 |

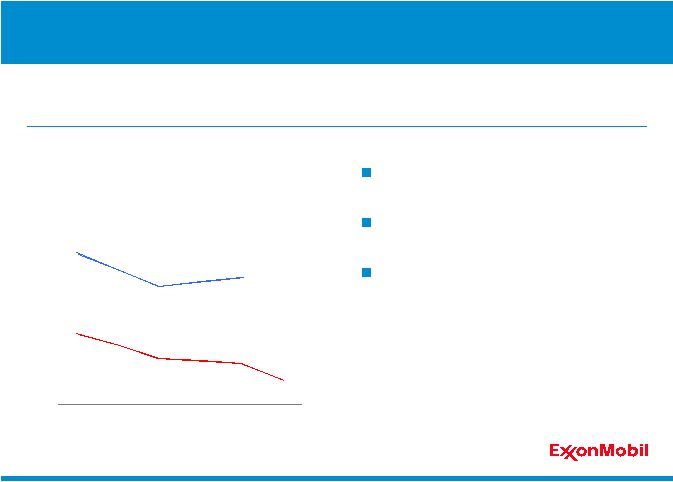

95

100

105

110

'04

'06

'08

'10

Refining Energy Intensity*

ExxonMobil

Indexed

Industry

Source: Solomon Associates fuels refining benchmarking data; available for even

years. * 2010 results estimated by ExxonMobil. Data indexed to ExxonMobil

('04). Maintaining refining cost leadership

•

Global average in top quartile

Leveraging chemical integration

Reducing energy costs / emissions

•

Global Energy Management

System

•

Cogeneration investments

•

Upgrade high energy-consuming

systems

ExxonMobil continues to increase competitive advantage by focusing on

operations reliability, energy efficiencies, and integration.

Operating Cost Efficiencies

Downstream

Operational Excellence

63 |

-80

-40

0

'04

'06

'08

'10

Lubes & Specialties Operating Efficiencies

Indexed

Products

Blend Plants

Order Centers

Improving Productivity

On-going consolidation activities

Streamlined product offering

Global resources drive lower

operating expenses

•

Organization, systems, and

processes

A continuous focus on optimizing productivity delivers a long-term

competitive advantage.

Operational Excellence

Downstream

64 |

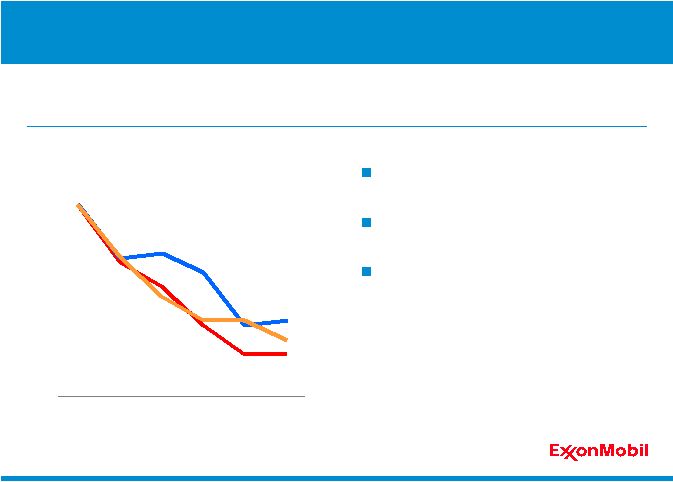

Source: Solomon Associates benchmarking data; available for odd years only.

* 2010 results estimated by ExxonMobil. Data indexed to ExxonMobil ('05).

Operating Efficiencies

A relentless focus on operating efficiencies creates a competitive

advantage and steady performance improvement over time.

Globally shared best practices

Advanced technology

Record performance in 2010

Chemical

Operational Excellence

65

Global

Steam

Cracker

Energy

Intensity*

95

100

105

110

'05

'07

'09

'10

Indexed

ExxonMobil

Industry |

-40

-30

-20

-10

0

'05

'06

'07

'08

'09

'10

Indexed Percent Change

Marketing & Supply Chain Simplification

Finished Product

Inventory

Supply Points

Finished Grades

Business Simplification

Simplification delivers cost savings and operational efficiencies.

Focus on value capture

Eliminate unnecessary complexity

Lower cost, improve reliability to

customers

Chemical

Operational Excellence

66 |

Competitive Advantages

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value.

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

67 |

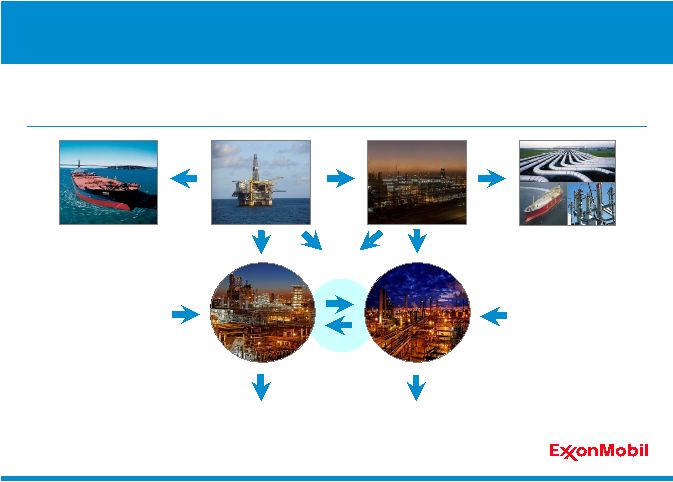

Value

of the Integrated Model ExxonMobil’s effective execution of a complex

integrated business model creates significant value for the

shareholder. Maximize resource upgrade across the value chain

Joint feedstock and facilities planning

Highest-value outlets for products

Global competency networks, shared services, and best practices

Standardization of key processes including risk management

Efficient development and deployment of new technologies

Global Integration

68 |

ExxonMobil maximizes value across the entire supply chain, from the

wellhead to the customer. The level of integration is unmatched.

Integrated Supply Chain

Global Integration

Commodities

and

Specialties

Fuels

Marketing,

Lubricants and

Specialties

Crude and

Feedstocks

Crude

Oil

Natural

Gas

Feedstocks

Refinery

Chemical

Plant

Production

3rd

Party Sales

Power Plant

LNG Plant

Gas

Processing

3rd

Party Sales

69 |

Integration with

Chemicals/Lubes* Percent

25

50

75

XOM

RDS

Industry

BP

* Calculated on a consistent basis using public information; YE 2010.

Higher-value products

Integrated molecular optimization

Assets with unparalleled feed

flexibility

Common site management, utilities,

and infrastructure

Global scale and integration are structural advantages that are difficult for

competitors to replicate.

Downstream/Chemical

Integrated Manufacturing

Global Integration

70 |

Return on Average

Capital Employed* 2000 -

2010

Percent

0

5

10

15

20

25

XOM

XOM

Downstream

Chemical

Competitor

Average**

Competitor

Average***

Downstream/Chemical

Proven business strategies enabled

by technology

Businesses optimized together to

maximize shareholder value

Combined 2000 –

2010

average annual results

•

$8B earnings

•

20 percent ROCE

ExxonMobil has unequaled performance across the Downstream and

Chemical platforms.

*

Competitor data estimated on a consistent basis with ExxonMobil and based on public

information. **

RDS, BP, CVX.

***BP (through '04), RDS, CVX (through '09), Dow Chemical.

Industry-leading Returns

Global Integration

71 |

Competitive Advantages

ExxonMobil possesses unique competitive advantages which create long-

term shareholder value.

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

72 |

Mark Albers

Senior Vice President

Global Exploration |

Turkey

Poland

Germany

Nigeria

Romania

Ireland

Norway

Indonesia

Madagascar

Vietnam

Tanzania

PNG

China

West

Greenland

Beaufort

Athabasca

GoM

Horn River

Haynesville /

Bossier

Eagle Ford

Guyana

Argentina

Cardium

Colombia

Marcellus

Angola

Australia

Libya

Philippines

Russia

New Play Tests

Unconventional

Established Basin

New Opportunity Growth

A diverse global portfolio of high-quality resource opportunities.

74 |

Gas

Mixed / To be determined

Oil

Poland

Germany

Nigeria

Romania

Ireland

Norway

Indonesia

Madagascar

Vietnam

Tanzania

PNG

China

West

Greenland

Beaufort

Athabasca

GoM

Horn River

Haynesville /

Bossier

Eagle Ford

Guyana

Argentina

Cardium

Colombia

Marcellus

Angola

Libya

Turkey

Philippines

Australia

Russia

New Opportunity Growth

A diverse global portfolio of high-quality resource opportunities,

representing a balance between oil and gas.

75 |

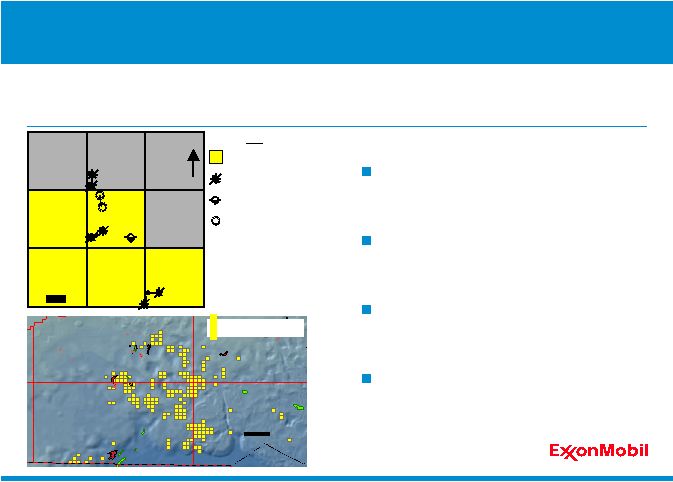

Established Exploration –

U.S. Gulf of Mexico

2.1 million net acres with exposure to

multiple plays

Recent discoveries at Hadrian South

and Hadrian North

Seismic processing and drilling

planned in 2011

Actively building Gulf of Mexico

prospect inventory

Active exploration programs in established basins such as the U.S. Gulf of

Mexico.

EM 50% (Operator)

Plugged oil and gas well

Plugged well with oil shows

Planned well location

Key

N

KC875

KC876

KC874

Lucius

Hadrian-5

(Planned)

KC964

Hadrian-2

Hadrian-4

KC962

KC963

KC920

Hadrian-1

KC918

KC919

Hadrian-3

1 Mile

Hadrian

North

Hadrian

South

Keathley Canyon

Diana

Hoover

Great White

Garden Banks

Tiber

20 miles

East Breaks

Alaminos Canyon

ExxonMobil

Interest Acreage

76 |

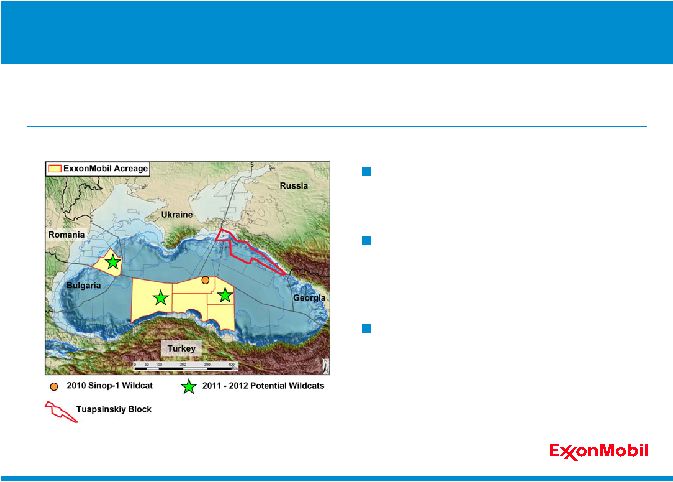

Leading acreage position in the

Black Sea with 6.3 million net acres

Sinop-1 wildcat completed

•

Evaluating results to assist in

future exploration

Multiple new play tests are planned

in 2011-2012 in Turkey and Romania

ExxonMobil maintains an active exploration program which includes select

new play tests in basins with significant upside potential.

New Basin Tests –

Black Sea

77 |

0.0

0.5

1.0

1.5

2.0

2.5

3.0

XOM

XOM

CVX

BP

RDS

0

1

2

3

4

5

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

Annual Resource Additions

(2001 –

2010)

BOEB

Discovered Undeveloped*

By-the-Bit*

2002 -

2008

2004 -

2008

2006 -

2010

2001 -

2010

2005 -

2009

Finding Cost

(as reported)**

$/OEB

Production

$2-3

ExxonMobil consistently adds quality resource additions at attractive finding

costs.

Resource Base Growth

* Excludes XTO acquisition and the proved portion of discovered undeveloped

additions. ** Source: Chevron Analyst Presentation (March 2010), BP Strategy

Presentation (March 2010), Shell Analyst Presentation (March 2010).

78 |

Mark Albers

Senior Vice President

Upstream Projects |

Expected to produce an additional

100 kbd of oil in Angola

Innovative loop development

between existing Kizomba A and B

producing facilities

Advancing three new projects in

Block 17

Delivering significant value through opportunities such as Kizomba

Satellites Phase 1 in West Africa.

Deepwater –

Blocks 15 and 17, Angola

80 |

Arctic –

Sakhalin-1, Eastern Russia

Odoptu project started-up on time

and producing 50 kbd

Developed with world record

extended-reach drilling

Funded development of Arkutun Dagi

field with start-up planned in 2014

Disciplined project management processes continue to deliver industry-

leading project execution performance.

81 |

Awarded Hebron topsides and

gravity based structure front-end

engineering and design contracts

Leveraging global arctic experience

and proprietary technology

applications

Full funding targeted mid-2012

Delivering significant value through conventional development opportunities

such as Hebron.

Conventional –

Hebron, Eastern Canada

82 |

83

High-quality oil sands resource coupled with ExxonMobil technology and

execution capability provide long-life earnings contribution.

Oil Sands –

Kearl, Canada

Long-term plateau production

profile

Lower combined unit

development and operating

costs

Competitive with industry Gulf

of Mexico deepwater

developments

0

100

200

300

400

Initial Development

Expansion

0

40

80

Kearl

Industry GOM

Deepwater

Development

Cost

Operating

Earnings /

Government

Take

Bitumen

Discount

Kearl Comparison

KOEBD, net

GOM

Deepwater

Revenue Components at 2010 Oil Price

Source: Wood MacKenzie.

Earnings /

Government

Take

Operating

Cost

Development

$ per OEB |

Conventional –

West Qurna (Phase I), Iraq

Signed 25-year agreement

Amended agreement to include

discovered but undeveloped

reservoirs

Established ExxonMobil presence in

Basra and Baghdad

Commenced field activities including

well work and facilities enhancement

ExxonMobil is advancing the redevelopment of this world-class field to

maximize production capability.

Iraq

84 |

High-quality 9 TCF gross resource

Two-train 6.6 MTA LNG plant

Upstream facilities and 450 mile

pipeline

Commenced pipe laying

Anticipate start-up in 2014

Liquefied Natural Gas -

Papua New Guinea

PNG

LNG

project

utilizes

global

LNG

experience,

strengthening

ExxonMobil’s

presence

in

the

attractive

Asia

Pacific

gas

market.

85 |

Exploration and Development Performance

ExxonMobil

consistently

delivers

competitive

reserves

replacement

with

the

most

efficient

use

of

exploration

and

development

capital.

Source: Company specific 10-K/20-F disclosures.

Exploration expenditures per unit of production ($ per boe)

Unit exploration & development expenditures ($ per boe)

86

50%

100%

150%

5

10

15

20

25

50%

100%

150%

2

4

6

8

Exploration Expenditures vs. Organic Reserve

Replacement Ratio

(2005-09)

Exploration

&

Development

Expenditures

vs.

Organic

Reserve

Replacement

Ratio

XOM

BP

CVX

RDS

XOM

BP

CVX

RDS

Organic RRR

Organic RRR

(2005-09) |

Unconventional Portfolio

Andy Swiger

Senior Vice President |

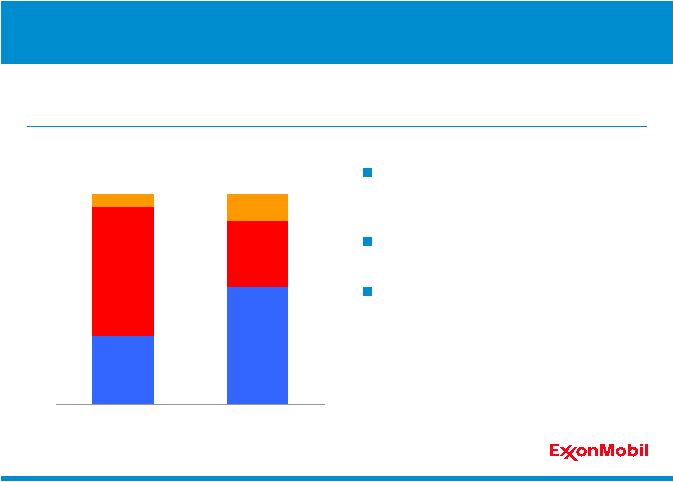

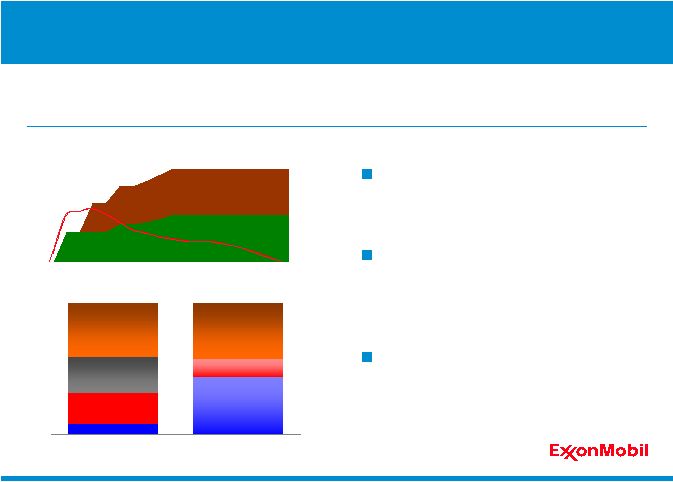

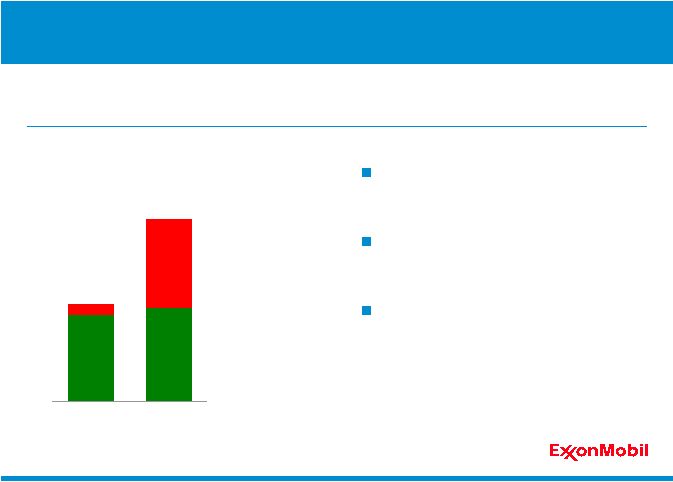

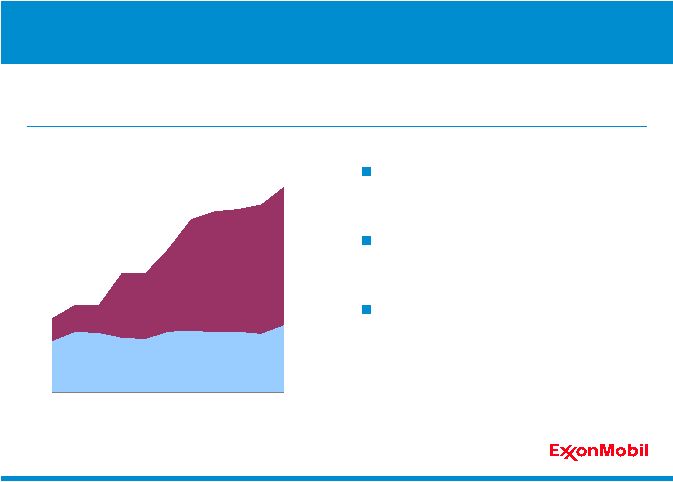

BOEB

Unconventional Resource Base

Unconventional

Gas and Light Oil

0

10

20

30

40

YE 2005

YE 2010

Heavy Oil /

Oil Sands

Almost 90 percent growth over 2005-

2010

Unconventional accounts for over 40

percent of total resource base

Gas growth balanced by strong

position in heavy oil / oil sands

ExxonMobil’s

global

unconventional

resource

base

of

almost

35

billion

oil-

equivalent

barrels

is

growing

and

includes

several

new

strategic

additions.

Unconventional Resource Base

88 |

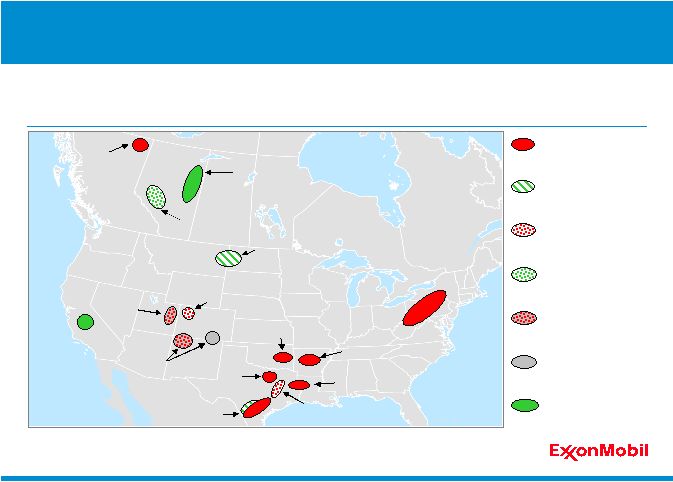

Shale Gas

Tight Oil

Tight Gas

CBM

Tight Gas / CBM

Heavy Oil /

Oil sands

Fayetteville

550K

Woodford

205K

Bakken

410K

San Juan/Raton

400K

Uinta

260K

Piceance

300K

Barnett

245K

Eagle Ford

120K

Freestone

290K

Haynesville/Bossier

240K

Athabasca

745K

Horn River

340K

Marcellus

390K

Cardium

235K

San Joaquin

Valley

122K

Shale Oil

(incl. liquids rich)

Unconventional –

North America

ExxonMobil’s North American unconventional resource base is diverse

by location and play type.

89 |

Mcfd

0

50

100

150

200

250

Dec-08

Dec-09

Dec-10

0

10

20

30

Gross Op

Production*

Rigs

Mcfd

Haynesville Shale

0

50

100

150

200

250

300

Dec-08

Dec-09

Dec-10

0

10

20

30

Fayetteville Shale

Gross Op

Production*

Rigs

Rigs

Rigs

Mcfd

0

50

100

150

200

250

Dec-08

Dec-09

Dec-10

0

10

20

30

Gross Op

Production*

Rigs

Mcfd

Haynesville Shale

0

50

100

150

200

250

300

Dec-08

Dec-09

Dec-10

0

10

20

30

Fayetteville Shale

Gross Op

Production*

Rigs

Rigs

Rigs

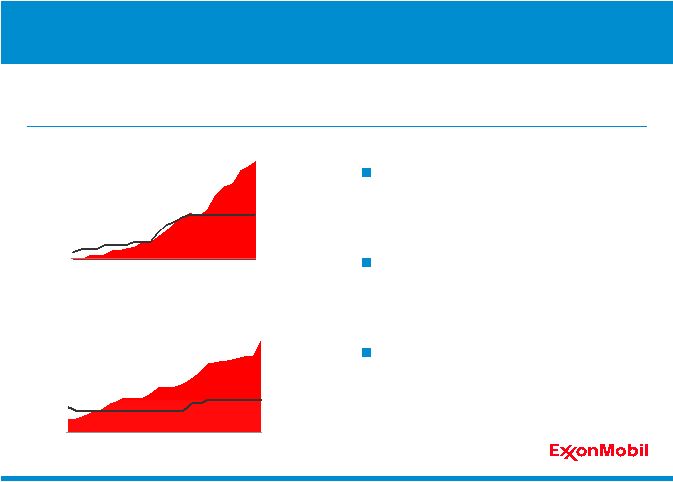

Unconventional Gas Plays

ExxonMobil holds a leadership position in multiple unconventional plays

such as the Haynesville and Fayetteville shales.

Haynesville: increased production

four-fold in 2010

•

Hold 240,000 net acres

Fayetteville: production more than

doubled in 2010

•

Hold 550,000 net acres

2010 strategic additions:

•

Haynesville (Ellora)

•

Fayetteville (Petrohawk)

•

Continued leasing and minor

acquisitions

*

Represents

gross

operated

production

pre-

and

post-XTO

acquisition.

90 |

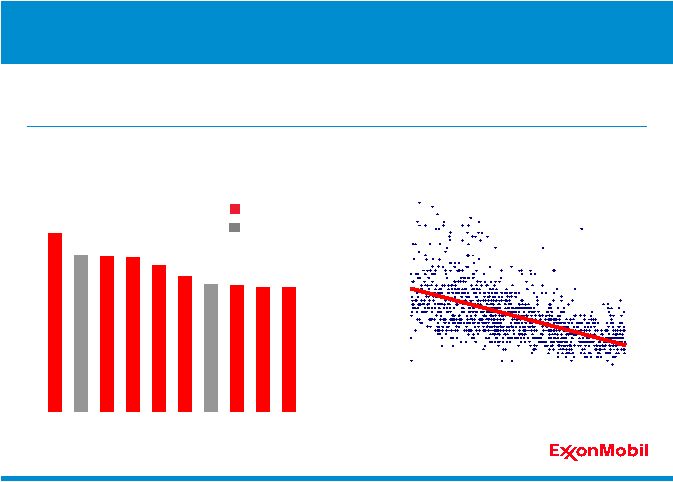

91

Operational Excellence

0

10

20

30

40

50

'05

'06

'07

'08

'09

'10

Best practices in unconventional gas build value through higher recoveries

and increasing operational efficiency.

Source: Cumulative Production through May 2010, Powell Barnett

Shale Newsletter, 8/31/10.

Drilled 8 of 10 largest Cumulative

Production Wells in Barnett Shale

Drilling Days, Spud to Rig Release

Barnett Shale, 2005-2010

0

1

2

3

4

5

6

XOM well

Competitor well

BCF Produced |

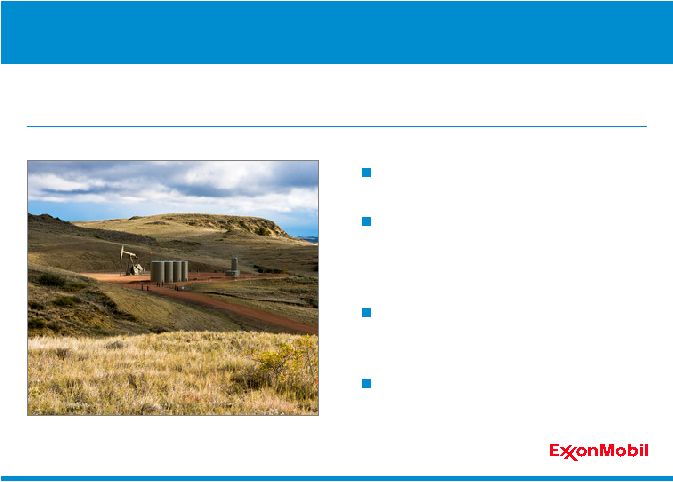

Unconventional Liquids Rich Plays

Strong acreage position

Drilling in Bakken/Three Forks with

potential to ramp-up

•

Hold 410,000 net acres

Delineating Eagle Ford position

•

Hold 120,000 net acres

Building position in other liquids-rich

plays

Unconventional liquids-rich plays such as the Eagle Ford and Bakken

provide upside value potential.

92 |

XTO

Integration Attrition consistent with historic levels

Technology and expertise are key to

unlocking greater value

Consolidating activities to grow

operational capabilities

Creating significant long-term value

XTO’s experience and capabilities are further enhanced by leveraging

ExxonMobil’s global functional organization.

Research

Exploration

Gas Marketing

Drilling

Production

93 |

Argentina

Colombia

U.S.

Canada

Germany

Poland

China

Indonesia

Shale Gas

Tight Gas

Coal Bed Methane

Tight / Shale Oil

Heavy Oil / Oil Sands

Global Growth Opportunities

Diverse global portfolio

Access to greater than 10 million net

acres globally

Technology key to unlocking full

resource potential

Significant value creation through

sizeable long-life resources

ExxonMobil holds a leadership position in emerging global unconventional

plays.

94 |

U.S. Unconventional

Production (2010-2020)

0.0

0.2

0.4

0.6

0.8

1.0

'10*

'12

'14

'16

'18

'20

Tight

CBM

Shale

MOEBD

Value Creation –

Unconventional Gas and Oil

Unconventional gas and oil production has the potential to unlock significant

future value with strong volume growth.

100 Tcfe global resource base

~50,000 drillwell inventory in the U.S.

U.S. production doubles by 2020

Shale plays drive growth

* 2010 includes full-year XTO production.

95 |

0.0

0.2

0.4

0.6

'10

'12

'14

'16

'18

'20

Heavy Oil

Oil Sands

Heavy Oil / Oil Sands Production

(2010-2020)

MOEBD

Value Creation -

Heavy Oil and Oil Sands

Extensive inventory of long-life projects provides growth in long-plateau

volumes.

18 BOEB heavy oil / oil sands

resource base

Over 500 percent growth in oil

sands production by 2020

Canadian oil sands drive growth

•

In-situ

•

Mining

96 |

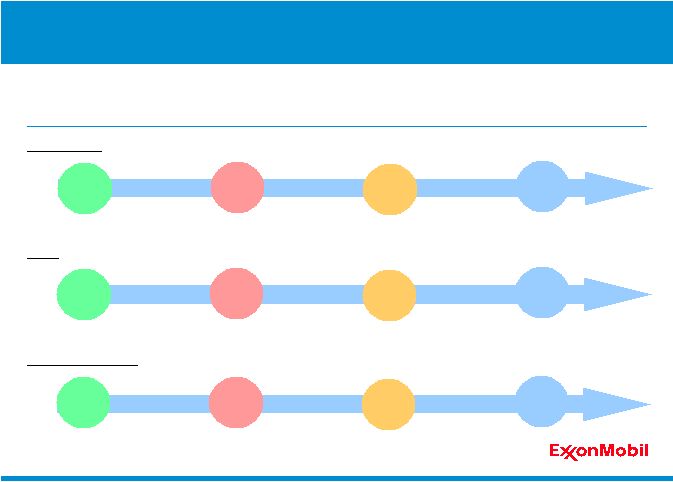

1995

2000

2005

2010

2000

2005

2010

Unlocking Greater Value

Deepwater

Resources

Unconventional

Resources

Global Oil

Markets

Established

Markets

Deepwater

Technologies

Unconventional

Technologies

Leading

Deepwater

Capability

Leading

Unconventional

Capability

Superior value creation relies on high-quality resources, growth markets,

enabling technologies, and growing organizational capability.

Stranded Gas

Resources

Global LNG

Markets

Value Chain

Technologies

Leading

LNG

Capability

Deepwater

LNG

Unconventional

97 |

Rex Tillerson

Chairman and CEO

Summary |

0

3

6

9

12

20 Years

10 Years

5 Years

$K

Shareholder Returns

Value of $1,000 Invested (as of YE 2010)

ExxonMobil

Competitor average*

S&P 500

Share Performance

ExxonMobil’s performance exceeds competitor average and S&P 500.

* RDS, BP, and CVX.

Financial results and stock market

returns best viewed over long-term

Performance consistent with

investment horizon

Supported by competitive

advantages and financial strength

99 |

0.8

0.9

1.0

1.1

1.2

1.3

'06

'07

'08

'09

'10

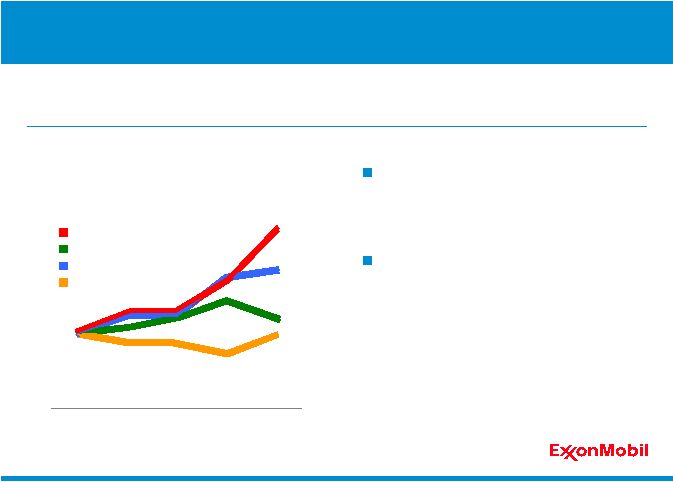

Production Growth per Share since 2006*

Indexed; 2006 = 100

Indexed Growth

XOM

BP

CVX

RDS

Increasing Ownership -

Production

Increasing production plus share

reductions yield strong growth in

production per share

Ahead of competition

* Competitor data estimated on a consistent basis with ExxonMobil and based on

public information. Share purchases have enhanced per share ownership of oil

and gas production. Annualized production growth per share of 6.3

percent. 100 |

0.8

0.9

1.0

1.1

1.2

1.3

1.4

'06

'07

'08

'09

'10

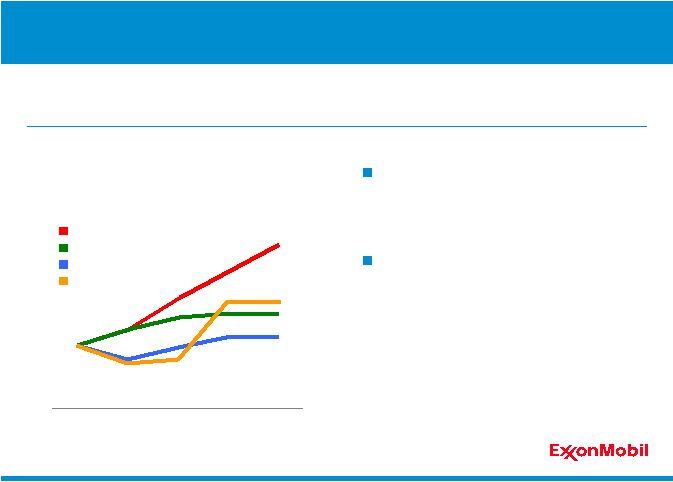

Reserves Growth per Share since 2006*

Indexed; 2006 = 100

Indexed Growth

XOM

BP

CVX

RDS

Increasing Ownership -

Reserves

Expanding reserve base plus share

reductions yield strong growth in

reserves per share

Ahead of competition

* Competitor data estimated on a consistent basis with ExxonMobil and based on

public information. **

Reserves

based

on

SEC

pricing

bases,

including

oil

sands

and

equity

companies.

2009

reserves

data used for competitors since 2010 data was not yet available.

Share purchases have enhanced per share ownership of oil and gas

reserves. Reserves per share increased 32 percent since 2006.

101 |

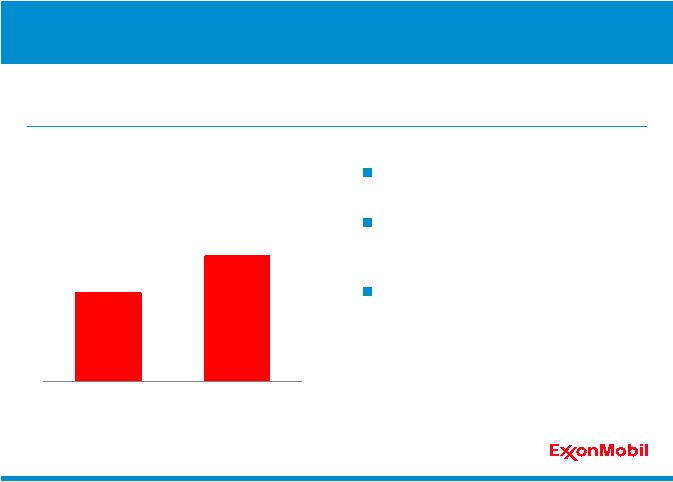

0

2

4

6

8

2010 EPS without Share

Reduction

2010 EPS

$ per share

Impact of Share Purchases since

Exxon and Mobil Merger on 2010 EPS

Value per Share

2010 EPS of $6.24 per share

EPS 42 percent higher than

without share purchases*

Ongoing benefit to shareholders

Earnings per share is enhanced by a robust share purchase program.

* Average shares outstanding reduced by 29.4 percent since beginning of 2001.

102 |

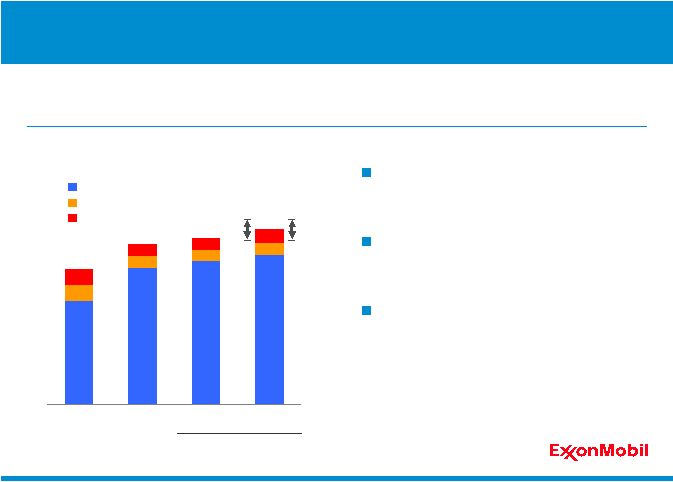

0

10

20

30

40

'09

'10

'11

'12 - '15

$B

Capex by Business Line

Estimate

Upstream

Upstream

Downstream

Downstream

Chemical / Other

Chemical / Other

Estimate Range

Investment Plan

ExxonMobil

is

committed

to

investing

through

the

business

cycle.

Expect

to

invest

$33

to

$37

billion

per

year

through

2015.

Progressing large inventory of high-

quality projects

Aggressively pursuing cost

reduction opportunities

Delivering advantaged projects

103 |

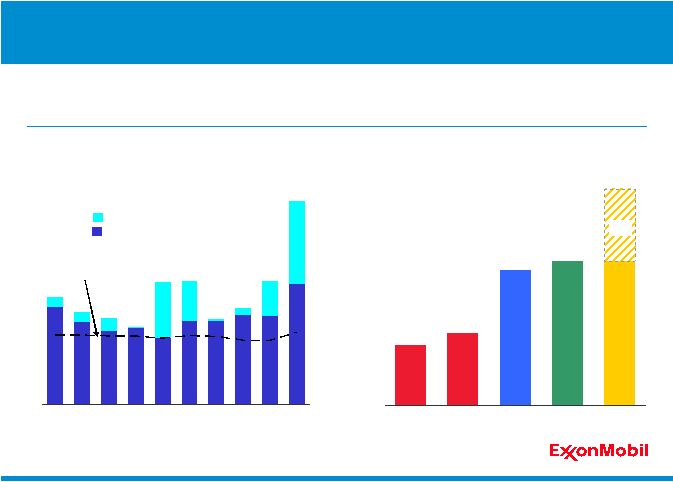

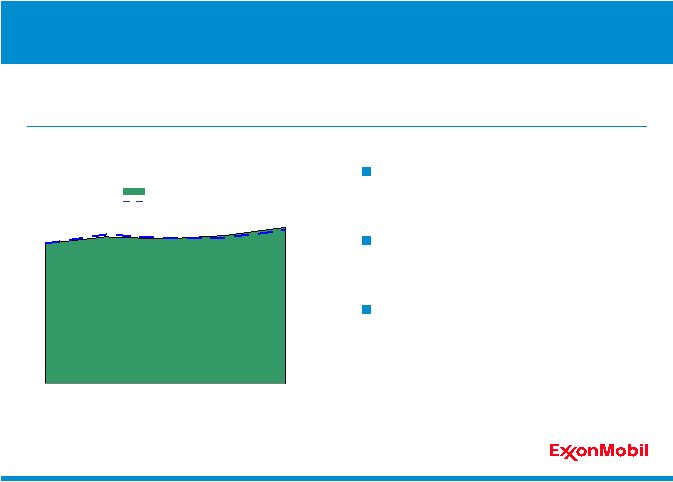

0

1

2

3

4

5

'09

'10

'11

'12

'13

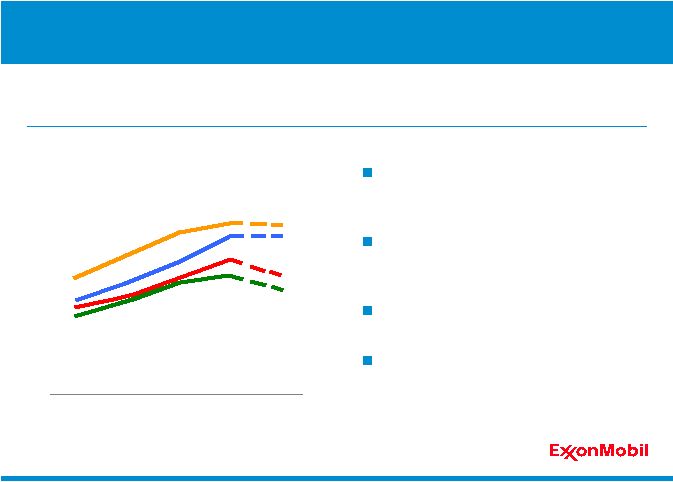

Total Production Outlook

MOEBD, net

2010 Outlook

2011 Outlook (excluding XTO)

Upstream Production Outlook

Production outlook, excluding XTO, remains unchanged at 2 to 3 percent

growth per year from 2009 to 2013.

2010 outlook assumed 3 to 4 percent

growth from 2009 to 2010

2010 production growth of 6 percent

exceeded outlook

2009 to 2013 outlook remains

unchanged

104 |

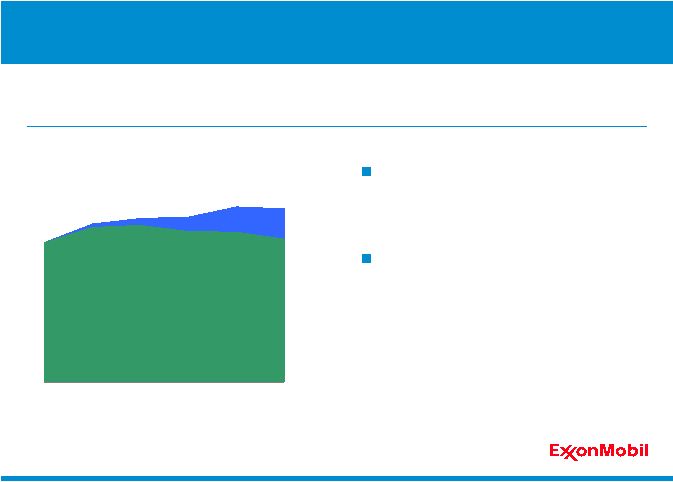

0

1

2

3

4

5

'09

'10

'11

'12

'13

'14

Total Production Outlook*

MOEBD, net

Project Volumes

Base Production

Upstream Production Outlook

Production growth delivered by strong base performance, high-quality

projects, and new resource potential.

* Excludes divestments and OPEC quota effects.

Volumes growth remains strong

•

2010-2011: 3 to 4 percent

•

2009-2014: 4 to 5 percent

Decline rate of 3 percent

•

Compared to historic rate of 5 to 6

percent

•

Unconventional and long-plateau

volumes mitigate decline

105 |

0

1

2

3

4

5

'09

'10

'11

'12

'13

'14

Total Production Outlook*

MOEBD, net

Gas

Liquids

Upstream Production Outlook

ExxonMobil has a balanced portfolio with strong contributions from both

liquids and natural gas.

*

Excludes

divestments

and

OPEC

quota

effects

.

Liquids growth averages 2 to 3

percent driven by major projects

Increasing level of long-plateau

volumes

106 |

ExxonMobil Strengths

Superior Financial and Operating Performance

Balanced Portfolio Quality

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

ExxonMobil’s strengths and competitive advantages sustain long-term

success.

107 |

Sum

of the Parts Plus 108

ExxonMobil is an industry leader across the business, and competitive

advantages create value greater than the sum of the individual parts.

Largest IOC Producer of Liquids

Leader in LNG Value Chain

Largest Global Refiner

Highest-Return

Chemical Company

among Peers

High-Quality, Low-Cost Oil Sands

Premier Unconventional Gas Company

No. 1 Supplier of Lube Basestocks |