UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) | |

|

x Definitive Proxy Statement |

||

| ¨ Definitive Additional Materials | ||

| ¨ Soliciting Material Pursuant to §240.14a-12 | ||

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| NOTICE OF 2010 | ||||

| ANNUAL MEETING | ||||

| AND PROXY STATEMENT |

| |||

| April 13, 2010 | ||||

Dear Shareholder:

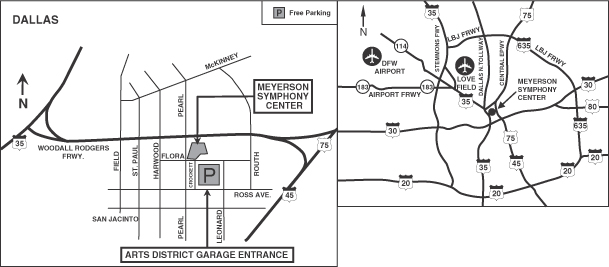

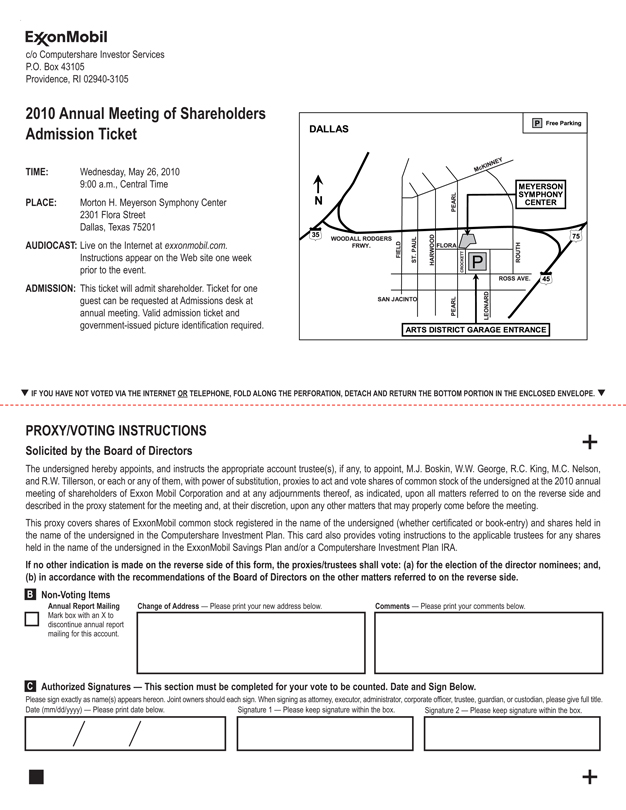

We invite you to attend the annual meeting of shareholders on Wednesday, May 26, 2010, at the Morton H. Meyerson Symphony Center, 2301 Flora Street, Dallas, Texas 75201. The meeting will begin promptly at 9:00 a.m., Central Time. At the meeting, you will hear a report on our business and vote on the following items:

| Ÿ | Election of directors; |

| Ÿ | Ratification of PricewaterhouseCoopers LLP as independent auditors; |

| Ÿ | Eleven shareholder proposals contained in this proxy statement; and, |

| Ÿ | Other matters if properly raised. |

Only shareholders of record on April 6, 2010, or their proxy holders may vote at the meeting. Attendance at the meeting is limited to shareholders or their proxy holders and ExxonMobil guests. Only shareholders or their valid proxy holders may address the meeting.

This booklet includes the formal notice of the meeting, proxy statement, and financial statements. The proxy statement tells you about the agenda, procedures, and rules of conduct for the meeting. It also describes how the Board operates, gives information about our director candidates, and provides information about the other items of business to be conducted at the meeting.

Even if you own only a few shares, we want your shares to be represented at the meeting. You can vote your shares by Internet, toll-free telephone call, or proxy card.

To attend the meeting in person, please follow the instructions on page 3. A live audiocast of the meeting and a report on the meeting will be available on our Web site at exxonmobil.com.

Sincerely,

|

|

| |||

| David S. Rosenthal | Rex W. Tillerson | |||

| Secretary | Chairman of the Board |

| Page | ||

| 1 | ||

| 4 | ||

| 4 | ||

| 17 | ||

| 20 | ||

| 22 | ||

| 22 | ||

| 23 | ||

| 24 | ||

| 40 | ||

| 51 | ||

| 52 | ||

| 53 | ||

| 54 | ||

| 55 | ||

| Item 5 – Shareholder Advisory Vote on Executive Compensation |

56 | |

| 57 | ||

| 59 | ||

| 60 | ||

| 62 | ||

| 64 | ||

| 65 | ||

| 67 | ||

| 69 | ||

| 70 | ||

| A-1 | ||

| A-69 | ||

Who May Vote

Shareholders of ExxonMobil, as recorded in our stock register on April 6, 2010, may vote at the meeting.

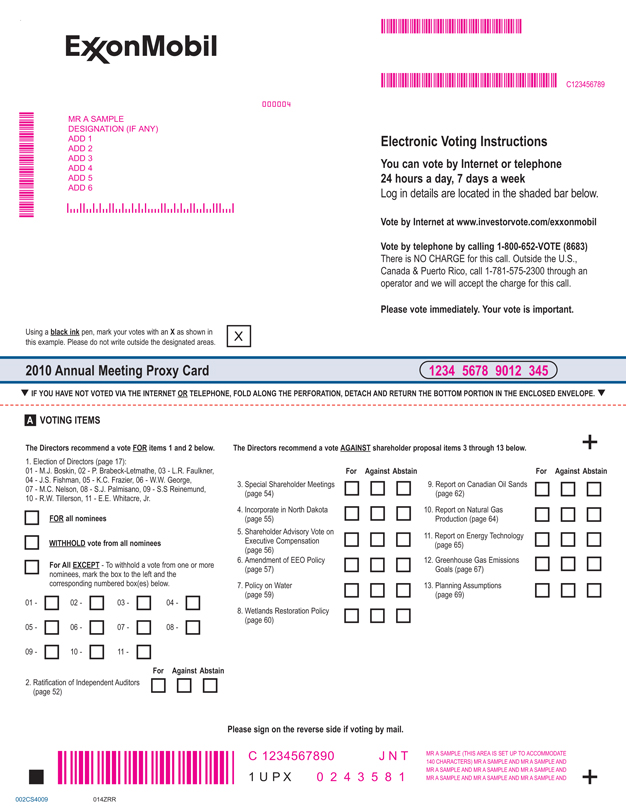

How to Vote

You may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 26, 2010.

| Ÿ | The 2010 Proxy Statement and 2009 Summary Annual Report are available at www.edocumentview.com/xom |

Electronic Delivery of Proxy Statement and Annual Report

Instead of receiving future copies of these documents by mail, shareholders can elect to receive an e-mail that will provide electronic links to the proxy materials. Opting to receive your proxy materials online will save the Company the cost of producing and mailing documents to your home or business, and will also give you an electronic link to the proxy voting site.

| Ÿ | Shareholders of Record: If you vote on the Internet at www.investorvote.com/exxonmobil, simply follow the prompts for enrolling in the electronic proxy delivery service. You may enroll in the electronic proxy delivery service at any time in the future by going directly to www.computershare.com/exxonmobil. You may also revoke an electronic delivery election at this site at any time. |

| Ÿ | Beneficial Shareholders: If you hold your shares in a brokerage account, you may also have the opportunity to receive copies of the proxy materials electronically. Please check the information provided in the proxy materials mailed to you by your bank or broker regarding the availability of this service. |

How Proxies Work

ExxonMobil’s Board of Directors is asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some, or none of our director candidates. You may also vote for or against the other proposals, or abstain from voting.

If your shares are held in your name, you can vote by proxy in one of three convenient ways:

| Ÿ | Via Internet: Go to www.investorvote.com/exxonmobil and follow the instructions. You will need to have your proxy card or electronic notice in hand. At this Web site, you can elect to access future proxy statements and annual reports via the Internet. |

| Ÿ | By Telephone: Call toll-free 1-800-652-8683 or 1-781-575-2300 (outside the United States, Canada, and Puerto Rico), and follow the instructions. You will need to have your proxy card in hand. |

| Ÿ | In Writing: Complete, sign, date, and return your proxy card in the enclosed envelope. |

Your proxy card covers all shares registered in your name and shares held in your Computershare Investment Plan account. If you own shares in the ExxonMobil Savings Plan for employees and retirees, your proxy card also covers those shares.

1

If you give us your signed proxy but do not specify how to vote, we will vote your shares in favor of our director candidates; in favor of the ratification of the appointment of independent auditors; and against the shareholder proposals.

If you hold shares through someone else, such as a stockbroker, you will receive material from that firm asking how you want to vote. Check the voting form used by that firm to see if it offers Internet or telephone voting.

Voting Shares in the ExxonMobil Savings Plan

The trustee of the ExxonMobil Savings Plan will vote Plan shares as participants direct. To the extent participants do not give instructions, the trustee will vote shares as it thinks best. The proxy card serves to give voting instructions to the trustee.

Revoking a Proxy

You may revoke your proxy before it is voted at the meeting by:

| Ÿ | Submitting a new proxy with a later date via a proxy card, the Internet, or by telephone; |

| Ÿ | Notifying ExxonMobil’s Secretary in writing before the meeting; or, |

| Ÿ | Voting in person at the meeting. |

Confidential Voting

Independent inspectors count the votes. Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy card will be sent to us if you write comments on the card.

Quorum

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person. Treasury shares, which are shares owned by ExxonMobil itself, are not voted and do not count for this purpose.

Votes Required

| Ÿ | Election of Directors Proposal: A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular seat is elected for that seat. Only votes FOR or WITHHELD count. Abstentions and broker non-votes are not counted for purposes of the election of directors. A “broker non-vote” occurs when a bank, broker, or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because the record holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. If you own shares through a broker, you must give the broker instructions to vote your shares in the election of directors. Otherwise, your shares will not be voted. |

Our Corporate Governance Guidelines, which can be found in the Corporate Governance section of our Web site at exxonmobil.com/governance, state that all directors will stand for election at the annual meeting of shareholders. In any non-contested election of directors, any director nominee who receives a greater number of votes WITHHELD from his or her election than votes FOR such election shall tender his or her resignation. Within 90 days after certification of the election results, the Board of Directors will decide, through a process managed by the Board Affairs Committee and excluding the nominee in question, whether to accept the resignation. Absent a compelling reason for the director to remain on the Board, the Board shall accept the resignation. The Board will promptly disclose its decision and, if applicable, the reasons for rejecting the tendered resignation on Form 8-K filed with the Securities and Exchange Commission (SEC).

2

| Ÿ | Other Proposals: Approval of the Ratification of Independent Auditors proposal and the shareholder proposals requires the favorable vote of a majority of the votes cast. Only votes FOR or AGAINST these proposals count. Abstentions count for quorum purposes, but not for the voting of these proposals. Broker non-votes count as votes “FOR” the proposal for Ratification of Independent Auditors but do not count for purposes of voting on shareholder proposals. |

Annual Meeting Admission

Only shareholders or their proxy holders and ExxonMobil guests may attend the meeting. For safety and security reasons, cameras, camera phones, recording equipment, electronic devices, computers, large bags, briefcases, or packages will not be permitted in the meeting. In addition each shareholder and ExxonMobil guest will be asked to present a valid government-issued picture identification, such as a driver’s license, before being admitted to the meeting.

For registered shareholders, an admission ticket is attached to your proxy card. Please detach and bring the admission ticket with you to the meeting.

If your shares are held in the name of your broker, bank, or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 6, 2010, the record date for voting. You may receive an admission ticket in advance by sending a written request with proof of ownership to the address listed under “Contact Information” below.

Shareholders who do not present admission tickets at the meeting will be admitted only upon verification of ownership at the admission counter.

Audiocast of the Annual Meeting

You are invited to visit our Web site at exxonmobil.com to hear the live audiocast of the meeting at 9:00 a.m., Central Time, on Wednesday, May 26, 2010. An archived copy of this audiocast will be available on our Web site for one year.

Conduct of the Meeting

The Chairman has broad responsibility and legal authority to conduct the annual meeting in an orderly and timely manner. This authority includes establishing rules for shareholders who wish to address the meeting. Only shareholders or their valid proxy holders may address the meeting. Copies of these rules will be available at the meeting. The Chairman may also exercise broad discretion in recognizing shareholders who wish to speak and in determining the extent of discussion on each item of business. In light of the number of business items on this year’s agenda and the need to conclude the meeting within a reasonable period of time, we cannot ensure that every shareholder who wishes to speak on an item of business will be able to do so.

Dialogue can be better accomplished with interested parties outside the meeting and, for this purpose, we have provided a method for raising issues and contacting the non-employee directors either in writing or electronically on our Web site at exxonmobil.com/directors. The Chairman may also rely on applicable law regarding disruptions or disorderly conduct to ensure that the meeting is conducted in a manner that is fair to all shareholders. Shareholders making comments during the meeting must do so in English so that the majority of shareholders present can understand what is being said.

Contact Information

If you have questions or need more information about the annual meeting, write to:

Mr. David S. Rosenthal

Secretary

Exxon Mobil Corporation

5959 Las Colinas Boulevard

Irving, TX 75039-2298

call us at 1-972-444-1157, or send a fax to 1-972-444-1505.

3

For information about shares registered in your name or your Computershare Investment Plan account, call ExxonMobil Shareholder Services at 1-800-252-1800 or 1-781-575-2058 (outside the United States, Canada, and Puerto Rico), or access your account via the Web site at www.computershare.com/exxonmobil. We also invite you to visit ExxonMobil’s Web site at exxonmobil.com. Investor information can be found at exxonmobil.com/investor. Web site materials are not part of this proxy solicitation.

Overview

The Board of Directors and its committees perform a number of functions for ExxonMobil and its shareholders, including:

| Ÿ | Overseeing the management of the Company on your behalf, including oversight of risk management; |

| Ÿ | Reviewing ExxonMobil’s long-term strategic plans; |

| Ÿ | Exercising direct decision-making authority in key areas, such as declaring dividends; |

| Ÿ | Selecting the CEO and evaluating the CEO’s performance; and, |

| Ÿ | Reviewing development and succession plans for ExxonMobil’s top executives. |

The Board has adopted Corporate Governance Guidelines that govern the structure and functioning of the Board and set out the Board’s position on a number of governance issues. A copy of our current Corporate Governance Guidelines is posted on our Web site at exxonmobil.com/governance.

All ExxonMobil directors stand for election at the annual meeting. Non-employee directors cannot stand for election after they have reached age 72, unless the Board makes an exception on a case-by-case basis. Employee directors resign from the Board when they are no longer employed by ExxonMobil.

Risk Oversight

Responsibility for risk oversight rests with the full Board of Directors. Committees help the Board carry out this responsibility by focusing on specific key areas of risk inherent in our business.

| Ÿ | The Audit Committee oversees risks associated with financial and accounting matters, including compliance with legal and regulatory requirements, and the Company’s financial reporting and internal control systems. |

| Ÿ | The Board Affairs Committee oversees risks associated with corporate governance, including Board structure and director succession planning. |

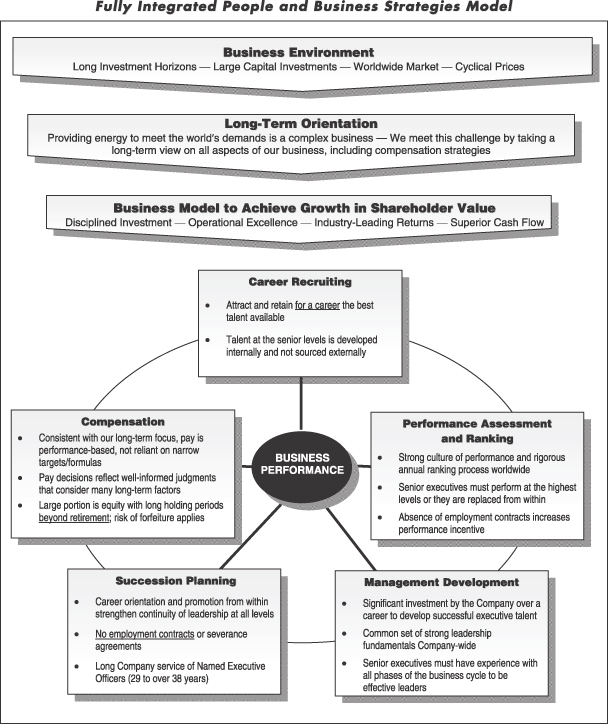

| Ÿ | The Compensation Committee helps ensure that the Corporation’s compensation policies and practices support the retention and development of executive talent with the experience required to manage risks inherent to the business and do not encourage or reward excessive risk-taking by our executives. |

| Ÿ | The Finance Committee oversees risks associated with financial instruments, financial policies and strategies, and capital structure. |

| Ÿ | The Public Issues and Contributions Committee oversees operational risks such as those relating to employee and community safety, health, environmental and security matters. |

4

The Board receives regular updates from the committees about their activities in this regard and at least annually participates in reviews with management addressing the progress of significant projects and operational activities. Updates are measured against benchmark expectations, all of which reflect identified risk factors and the impact of those identified risks on expected outcomes and results.

Board Leadership Structure

The Company’s By-Laws currently provide that, subject to the authority of the Board of Directors, the Chairman of the Board “shall have general care and supervision of the business and affairs of the corporation,” and in the absence of a President, shall also “direct the current administration of the business and affairs of the corporation.”

The Board believes the interests of all shareholders are best served at the present time through a leadership model with a combined Chairman/CEO position and an independent Presiding Director. However, the Board retains authority to amend the By-Laws to separate the positions of Chairman and CEO at any time.

The current CEO possesses an in-depth knowledge of the Company, its integrated, multinational operations, the evolving energy industry supply and demand, and the array of challenges to be faced, gained through over 34 years of successful experience in progressively more senior positions, including domestic and international responsibilities.

The Board believes that these experiences and other insights put the CEO in the best position to provide broad leadership for the Board as it considers strategy and as it exercises its fiduciary responsibilities to its shareholders.

Further, the Board has demonstrated its commitment and ability to provide independent oversight of management.

The Board is comprised entirely of independent directors except the CEO, and 100 percent of the Audit, Compensation, Board Affairs, and Public Issues and Contributions Committee members are independent. Each independent director has access to the CEO and other Company executives on request; may call meetings of the independent directors; and may request agenda topics to be added or dealt with in more detail at meetings of the full Board or an appropriate Board committee.

In addition, after considering evolving governance practices and shareholder input regarding Board independence, the Board established the role of Presiding Director. The Board believes the Presiding Director can provide effective, independent Board leadership. S.J. Palmisano has served as Presiding Director for the past year and is expected to remain in the position at least through the annual meeting of shareholders. In accordance with the specific duties prescribed in the Corporate Governance Guidelines, the Presiding Director chairs executive sessions of the independent directors, which are held several times per year, normally coincident with meetings of the Board and without management present; chairs meetings of the Board in the absence of the Chairman; and, works closely with the Chairman in developing Board agendas, topics, schedules, and in reviewing materials provided to the directors.

Director Qualifications

The Board has adopted guidelines outlining the qualifications sought when considering non-employee director candidates and they are published on our Web site at exxonmobil.com/governance.

In part, the guidelines describe the necessary experiences and skills expected of director candidates as follows:

“Candidates for non-employee director of Exxon Mobil Corporation should be individuals who have achieved prominence in their fields, with experience and demonstrated expertise in managing large, relatively complex organizations, and/or, in a professional or scientific capacity, be accustomed to dealing with complex situations preferably those with worldwide scope.”

The key criteria the Board seeks across its membership to achieve a balance of experiences important to the Corporation include: financial expertise; experience as the CEO of a significant company or

5

organization or as a next-level executive with responsibilities for global operations; experience managing large, complex organizations; experience on one or more boards of significant public or non-profit organizations; and, expertise resulting from significant academic, scientific or research activities.

The table below describes the particular experience, qualifications, attributes, and skills of each director nominee that led the Board to conclude that such person should serve as a director of the Company.

| M.J. Boskin |

Ÿ | Public finance, tax, budget and macroeconomic policy experience as senior fellow at the Hoover Institution and the T.M. Friedman Professor of Economics at Stanford University | ||

| Ÿ | Financial expertise | |||

| Ÿ | Government/research experience as chairman of the President’s Council of Economic Advisors and an associate at the National Bureau of Economic Research | |||

| Ÿ | Experience advising the federal government, heads of state, finance ministries, and central banks around the world | |||

| Ÿ | Outside board experience as a director of Oracle, Shinsei Bank, and the Vodaphone Group | |||

| P. Brabeck-Letmathe |

Ÿ | Global leadership position as chairman of Nestlé | ||

| Ÿ | Outside board experience at Nestlé, and as a director of L’Oréal, Credit Suisse Group, Roche Holding, and Alcon | |||

| Ÿ | Experience with worldwide leadership of strategic business groups | |||

| Ÿ | Affiliation with leading business associations (European Round Table of Industrialists and Foundation Board of the World Economic Forum) | |||

| Ÿ | Recipient of awards, including “La Orden Mexicana del Aguila Azteca,” the Schumpeter Prize for outstanding contribution in Economics, and the Austrian Cross of Honour for service to the Republic of Austria | |||

| L.R. Faulkner |

Ÿ | Leadership position as president of the Houston Endowment | ||

| Ÿ | Leadership experience as president of the University of Texas at Austin | |||

| Ÿ | Financial expertise | |||

| Ÿ | Academic/administration experience at major universities such as the University of Illinois and Harvard University | |||

| Ÿ | Expertise in chemistry, electrochemistry, and materials | |||

| Ÿ | Outside board experience as a director of Temple-Inland and Guaranty Financial Group | |||

| Ÿ | Recognition by the American Academy of Arts and Sciences and leadership of the National Mathematics Advisory Panel | |||

| J.S. Fishman |

Ÿ | Global leadership position as chairman and chief executive officer of The Travelers Companies | ||

| Ÿ | Outside board experience at The Travelers Companies, and as a director of Platinum Underwriters Holdings Ltd. and Nuveen Investments | |||

| Ÿ | Affiliation with a leading academic institution as a member of the Board of Trustees, the Board of Overseers of the Graduate School of Education, and the Industry Advisory Board of the Financial Institutions Center for The Wharton School | |||

| Ÿ | Affiliation with leading business associations (the Business Council, the Kennedy Center Corporate Fund Board in Washington D.C., The National Academy Foundation, and the American Insurance Association) | |||

| K.C. Frazier |

Ÿ | Global leadership position as executive vice president and president of Global Human Health at Merck & Co. | ||

| Ÿ | Affiliation with leading legal, business and public policy associations (the Council on Foreign Relations, the American Law Institute, and the European Federation of Pharmaceutical Industries and Associations) | |||

| Ÿ | Outside board experience at non-profit organizations | |||

| Ÿ | Recipient of award for extraordinary achievement in pro bono and public service |

6

| W.W. George |

Ÿ | Global business experience as former chairman, president, and chief executive officer at Medtronic | ||

| Ÿ | Leadership position as professor of management practice at Harvard University | |||

| Ÿ | Academic experience at Harvard Business School and Yale School of Management | |||

| Ÿ | Outside board experience as a director of Goldman Sachs, Novartis, and Target | |||

| Ÿ | Authorship of books and articles on leadership and corporate governance | |||

| M.C. Nelson |

Ÿ | Global business experience as chairman and chief executive officer at Carlson | ||

| Ÿ | Recipient of leadership awards from Forbes magazine and U.S. News and World Report | |||

| Ÿ | Outside board experience at Carlson and as a director of Rezidor Hotel Group | |||

| Ÿ | Affiliation with leading business associations (the World Economic Forum’s International Business Council, the National Women’s Business Council, the World Travel and Tourism Council, the Foreign Policy Association, and the Business Roundtable) | |||

| S.J. Palmisano |

Ÿ | Global business experience as chairman, president, and chief executive officer of IBM | ||

| Ÿ | Outside board experience at IBM | |||

| Ÿ | Affiliation with leading business and public policy associations (the Business Roundtable and the Executive Committee of the Council on Competitiveness) | |||

| Ÿ | Awarded honorary fellowship from the London Business School | |||

| S.S Reinemund |

Ÿ | Global business experience as former chairman, president, and chief executive officer of PepsiCo | ||

| Ÿ | Leadership position as dean of business at Wake Forest University | |||

| Ÿ | Academic experience as professor of leadership and strategy at Wake Forest University | |||

| Ÿ | Financial expertise | |||

| Ÿ | Outside board experience as a director of American Express, Marriott, and Johnson & Johnson | |||

| Ÿ | Affiliation with leading charitable and business associations (United States Naval Academy Foundation, National Minority Supplier Development Council, and National Advisory Board of the Salvation Army) | |||

| R.W. Tillerson |

Ÿ | Global business experience as chairman and chief executive officer of ExxonMobil since January 2006 with demonstrated leadership skills resulting from a more-than-34-year career involving positions of increasing responsibility with the Company’s domestic and international business operations | ||

| Ÿ | Affiliation with leading business and public policy associations (the Executive Committee and the Policy Committee of the American Petroleum Institute, the Center for Strategic and International Studies, the National Petroleum Council, the Business Council, the Business Roundtable and its Energy Task Force, the Business Council for International Understanding, and the Emergency Committee for American Trade) | |||

| Ÿ | Leadership as a member of the Executive Board of the Boy Scouts of America, a director of the United Negro College Fund, and vice-chairman of the Ford’s Theatre Society | |||

| E.E. Whitacre, Jr. |

Ÿ | Global business experience as chairman and chief executive officer of General Motors Company | ||

| Ÿ | Global business experience as former chairman and chief executive officer of AT&T and SBC Communications | |||

| Ÿ | Outside board experience at General Motors and as a director of Burlington Northern Santa Fe and Anheuser Busch | |||

| Ÿ | Affiliation with leading business and community organizations (Institute for International Economics, the Business Council, Boy Scouts of America, Board of Regents of Texas Tech University, and the United Way) |

7

Director Independence

Our Corporate Governance Guidelines require that a substantial majority of the Board consist of independent directors. In general the Guidelines require that an independent director must have no material relationship with ExxonMobil, directly or indirectly, except as a director. The Board determines independence on the basis of the standards specified by the New York Stock Exchange (NYSE), the additional standards referenced in our Corporate Governance Guidelines, and other facts and circumstances the Board considers relevant.

Under ExxonMobil’s Corporate Governance Guidelines, a director will not be independent if a reportable “related person transaction” exists with respect to that director or a member of the director’s family for the current or most recently completed fiscal year. See the Guidelines for Review of Related Person Transactions posted on the Corporate Governance section of our Web site and described in more detail under “Related Person Transactions and Procedures” on pages 14-16.

The Board has reviewed relevant relationships between ExxonMobil and each non-employee director and director nominee to determine compliance with the NYSE standards and ExxonMobil’s additional standards. The Board has also evaluated whether there are any other facts or circumstances that might impair a director’s independence. Based on that review, the Board has determined that all ExxonMobil non-employee directors and director nominees are independent. The Board has also determined that each member of the Audit, Board Affairs, Compensation, and Public Issues and Contributions Committees (see membership table on page 9) is independent.

In recommending that each director and nominee be found independent, the Board Affairs Committee reviewed the following transactions, relationships, or arrangements. All matters described below fall within the NYSE and ExxonMobil independence standards.

| Name | Matters Considered | |

| P. Brabeck-Letmathe |

Ordinary course business with Nestlé (purchases of food and nutrition products; sales of fuels and plastic film) | |

| K.C. Frazier |

Ordinary course business with Merck (purchases of pharmaceuticals; sales of chemicals and oils) | |

| M.C. Nelson |

Ordinary course business with Carlson (purchases of travel, hotel, and event services; sales of lubricants) | |

| S.J. Palmisano |

Ordinary course business with IBM (purchases of consulting and IT maintenance services) | |

|

E.E. Whitacre, Jr. |

Ordinary course business with General Motors (purchases of fleet vehicles; sales of lubricants, plastics, and specialty chemicals) |

Board Meetings and Committees; Annual Meeting Attendance

The Board met 11 times in 2009. ExxonMobil’s incumbent directors, on average, attended approximately 94 percent of Board and committee meetings during 2009; and no director attended less than 75 percent of such meetings. ExxonMobil’s non-employee directors held three executive sessions in 2009.

As specified in our Corporate Governance Guidelines, it is ExxonMobil’s policy that directors should make every effort to attend the annual meeting of shareholders. All incumbent directors attended last year’s meeting except Mr. Frazier, who was first elected to the Board in May 2009.

The Board appoints committees to help carry out its duties. Board committees work on key issues in greater detail than would be possible at full Board meetings. Only non-employee directors may serve on the Audit, Compensation, Board Affairs, and Public Issues and Contributions Committees. Each committee has a written charter. The charters are posted on the Corporate Governance section of our Web site at exxonmobil.com/governance.

8

The table below shows the current membership of each Board committee and the number of meetings each committee held in 2009. Committee membership reflecting the addition of two new director nominees once elected by shareholders and the retirement of Dr. King, will be published on our Web site soon after the annual meeting.

| Director | Audit | Compensation | Board Affairs |

Finance | Public Issues and |

Executive (1) | ||||||

| M.J. Boskin |

C | Ÿ | Ÿ | |||||||||

| L.R. Faulkner |

Ÿ | Ÿ | ||||||||||

| K.C. Frazier |

Ÿ | Ÿ | ||||||||||

| W.W. George |

C | Ÿ | ||||||||||

| R.C. King |

Ÿ | C | Ÿ | |||||||||

| M.C. Nelson |

C | Ÿ | Ÿ | |||||||||

| S.J. Palmisano |

Ÿ | Ÿ | Ÿ | |||||||||

| S.S Reinemund |

Ÿ | Ÿ | ||||||||||

| R.W. Tillerson |

C | C | ||||||||||

| E.E. Whitacre, Jr. |

Ÿ | Ÿ | ||||||||||

| 2009 Meetings |

11 | 9 | 7 | 2 | 5 | 0 |

C = Chair

Ÿ = Member

| (1) | Other directors serve as alternate members on a rotational basis. |

Below is additional information about each Board committee.

Board Affairs Committee

The Board Affairs Committee serves as ExxonMobil’s nominating and corporate governance committee. The Committee recommends director candidates, reviews non-employee director compensation, and reviews other corporate governance practices, including the Corporate Governance Guidelines. The Committee also reviews any issue involving an executive officer or director under ExxonMobil’s Code of Ethics and Business Conduct and administers ExxonMobil’s Related Person Transaction Guidelines.

The Committee has adopted Guidelines for the Selection of Non-Employee Directors that describe the qualifications the Committee looks for in director candidates. These Selection Guidelines, as well as the Committee’s charter, are posted on the Corporate Governance section of our Web site, and are described in more detail in the section titled Director Qualifications, pages 5-7.

A substantial majority of the Board must meet the independence standards described in the Corporation’s Corporate Governance Guidelines, and all candidates must be free from any relationship with management or the Corporation that would interfere with the exercise of independent judgment. Candidates should be committed to representing the interests of all shareholders and not any particular constituency. The Board must include members with the particular experience required for service on key Board committees, as described in the Committee charters.

The Guidelines for the Selection of Non-Employee Directors state:

“ExxonMobil recognizes the strength and effectiveness of the Board reflects the balance, experience, and diversity of the individual directors; their commitment; and importantly, the ability of directors to work effectively as a group in carrying out their responsibilities. ExxonMobil seeks candidates with diverse backgrounds who possess knowledge and skills in areas of importance to the Corporation.”

9

In addition to seeking a diverse set of business or academic experiences, the Committee seeks a mix of nominees whose perspectives reflect diverse life experiences and backgrounds, as well as gender and ethnic diversity. The Committee does not use quotas but considers diversity along with the other requirements of the Selection Guidelines when evaluating potential new directors. The Committee has also instructed its executive search firm to include diversity as part of the candidate search criteria.

The Committee identifies director candidates primarily through recommendations made by the non-employee directors. These recommendations are developed based on the directors’ own knowledge and experience in a variety of fields, and research conducted by ExxonMobil staff at the Committee’s direction. The Committee has also engaged an executive search firm to help the Committee identify new director candidates. The firm identifies potential director candidates for the Committee to consider and helps research candidates identified by the Committee. Additionally the Committee considers recommendations made by the employee directors, shareholders, and others. All recommendations, regardless of the source, are evaluated on the same basis against the criteria contained in the Selection Guidelines.

The recommendations of Messrs. Brabeck-Letmathe and Fishman were made by an incumbent non-employee director of the Board Affairs Committee.

Shareholders may send recommendations for director candidates to the Secretary at the address given under “Contact Information” on page 3. A submission recommending a candidate should include:

| Ÿ | Sufficient biographical information to allow the Committee to evaluate the candidate in light of the Selection Guidelines; |

| Ÿ | Information concerning any relationship between the candidate and the shareholder recommending the candidate; and, |

| Ÿ | Material indicating the willingness of the candidate to serve if nominated and elected. |

The procedures by which shareholders may recommend nominees have not changed materially since last year’s proxy statement.

The Committee also administers provisions of the Corporate Governance Guidelines that require a director to tender a resignation when there is a substantial change in the director’s circumstances. The Committee reviews the relevant facts to determine whether the director’s continued service would be appropriate and makes a recommendation to the Board. During 2009, the Committee considered Mr. Whitacre’s new role as Chairman of General Motors. The Committee believed that Mr. Whitacre would continue to be a valuable and effective member of the ExxonMobil Board and, on the Committee’s recommendation, the Board declined Mr. Whitacre’s offer to resign.

Another responsibility of the Committee is to review and make recommendations to the Board regarding the compensation of the non-employee directors. The Committee uses an independent consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

Audit Committee

The Audit Committee oversees accounting and internal control matters. Its responsibilities include oversight of:

| Ÿ | Management’s conduct of the Corporation’s financial reporting process; |

| Ÿ | The integrity of the financial statements and other financial information provided by the Corporation to the SEC and the public; |

| Ÿ | The Corporation’s system of internal accounting and financial controls; |

| Ÿ | The Corporation’s compliance with legal and regulatory requirements; |

10

| Ÿ | The performance of the Corporation’s internal audit function; |

| Ÿ | The independent auditors’ qualifications, performance, and independence; and, |

| Ÿ | The annual independent audit of the Corporation’s financial statements. |

The Committee has direct authority and responsibility to appoint (subject to shareholder ratification), compensate, retain, and oversee the independent auditors.

The Committee also prepares the report that SEC rules require be included in the Corporation’s annual proxy statement. This report is on pages 51-52.

The Audit Committee has adopted specific policies and procedures for pre-approving fees paid to the independent auditors. Under the Audit Committee’s approach, an annual program of work is approved each October for the following categories of services: Audit, Audit-Related, and Tax. Additional engagements may be brought forward from time to time for pre-approval by the Audit Committee. Pre-approvals apply to engagements within a category of service, and cannot be transferred between categories. If fees might otherwise exceed pre-approved amounts for any category of permissible services, the incremental amounts must be reviewed and pre-approved prior to commitment. The complete text of the Audit Committee’s pre-approval policies and procedures is posted on the Corporate Governance section of ExxonMobil’s Web site.

The Board has determined that all members of the Committee are financially literate within the meaning of the NYSE standards, and that all are “audit committee financial experts” as defined in the SEC rules.

Compensation Committee

The Compensation Committee oversees compensation for ExxonMobil’s senior executives, including their salary, bonus, incentive awards, and succession plans for key executive positions. The Committee’s charter is available on the Corporate Governance section of our Web site.

During 2009 the Committee established the ceiling for the 2009 short term and long term incentive award programs, endorsed the salary program for 2010, reviewed the individual performance and contributions of each senior executive, granted individual incentive awards and set salaries for the senior executives, and reviewed progress on executive development and succession planning for senior positions.

The Compensation Committee’s report is on page 23.

The Committee does not delegate its responsibilities with respect to ExxonMobil’s executive officers and other senior executives (approximately 25 positions). For other employees, the Committee delegates authority to determine individual salaries and incentive awards to a committee consisting of the Chairman and the Senior Vice Presidents of the Corporation. That committee’s actions are subject to a salary budget and aggregate annual ceilings on cash and equity incentive awards established by the Compensation Committee.

The Committee utilizes the expertise of an external independent consultant, Pearl Meyer & Partners, whom the Committee retains and works with during the year. At the direction of the Chair of the Compensation Committee, the consultant provides the following services:

| Ÿ | Attends meetings of the Compensation Committee. |

| Ÿ | Makes an annual presentation to the Compensation Committee regarding: |

| – | General trends in executive compensation across industries, particularly trends that reflect a change in compensation practices. The consultant advises the Committee on whether changes in compensation practices are relevant to ExxonMobil’s compensation programs. |

| – | A perspective on the structure and competitive standing of ExxonMobil’s compensation program for senior executives. |

11

| Ÿ | Participates in the Committee’s deliberations regarding compensation for Named Executive Officers that include items such as: |

| – | How to interpret the level of compensation of each Named Executive Officer compared to similar positions across industries. |

| – | The appropriate level of each element of compensation for individual Named Executive Officers considering their career experience and tenure in their positions, as well as general performance of the Company within the industry. |

| – | The pace at which compensation levels should be adjusted over future years. |

| – | How to weigh or consider the impact of a compensation change today on future retirement income. |

| – | The interpretation of issues involving executive compensation raised by shareholders and the appropriate responses from management. |

| – | The relationship between compensation and executive succession planning. |

| – | How the Committee should emphasize or weigh one element of compensation versus another to address the long-term nature of the business and long planning lead times. |

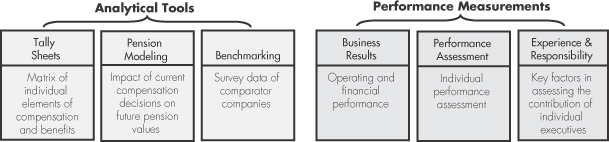

| Ÿ | Prepares the analysis of comparator company compensation used by the Compensation Committee. |

The input of the independent consultant is given serious consideration as part of the Committee’s decision-making process but is not assigned a weight versus the other matters considered by the Committee as described in the “Compensation Discussion and Analysis” beginning on page 24.

In addition at the direction of the Chair of the Board Affairs Committee, Pearl Meyer & Partners provides an annual survey of non-employee director compensation for use by that Committee.

ExxonMobil management does not use Pearl Meyer & Partners to advise on ExxonMobil’s general employee compensation and benefit programs. The Compensation Committee retains sole discretion to hire and fire the independent consultant and to negotiate the terms of the consultant’s engagement.

The Committee meets with ExxonMobil’s CEO and other senior executives during the year to review the Corporation’s business results and progress against strategic plans. The Committee uses this input to help determine the aggregate annual ceilings to be set for the Corporation’s cash and equity incentive award programs. The CEO also provides input to the Committee regarding performance assessments for ExxonMobil’s other senior executives and makes recommendations to the Committee with respect to salary and incentive awards for these executives and succession planning for senior positions.

The Committee uses tally sheets to assess total compensation for the Corporation’s senior executives. The tally sheets value all elements of cash compensation; incentive awards, including restricted stock grants; the annual change in pension value; and other benefits and perquisites. The tally sheets also display the value of outstanding awards and lump sum pension estimates.

See pages 33-34 for additional information on tally sheets and other analytical tools used by the Committee to facilitate compensation decisions.

The Compensation Committee determines whether ExxonMobil’s compensation policies and practices could result in inappropriate risk-taking. Based on its assessment, the Committee does not believe that ExxonMobil’s compensation policies and practices create any material adverse risks for the Company for the following reasons:

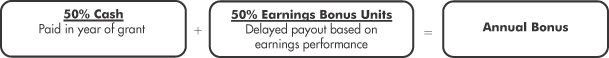

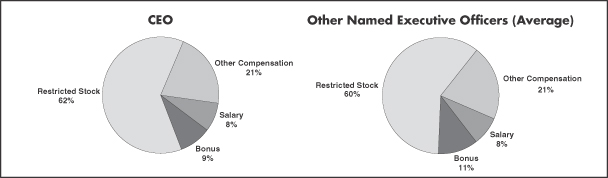

| Ÿ | Inappropriate risk-taking is discouraged by requiring senior executives to hold a substantial portion of their equity incentive award for their entire career and beyond retirement. These lengthy holding periods are tailored to our business model. The Compensation Committee requires that these equity grants with long holding periods comprise 50 to 70 percent of total compensation for Named Executive Officers as depicted on page 37 of the “Compensation Discussion and Analysis,” whereas the annual bonus award was only about 10 percent of total annual compensation in 2009. |

12

| Ÿ | Payout of 50 percent of the annual bonus is delayed and subject to risk of forfeiture, which is a unique feature of the annual bonus program relative to many comparator companies and further discourages inappropriate risk-taking; the timing of the delayed payout is determined by earnings performance. |

| Ÿ | Executives below the Named Executive Officers participate in the same plans which are also reviewed by the Compensation Committee; therefore, inappropriate risk-taking is discouraged at all levels of the Company through similar compensation design features and allocation of awards. |

| Ÿ | Finally, it should also be noted that a large percentage of career compensation for all executives and employees is in the form of a defined benefit pension which requires many years of dedicated service to the Company to have material value and is based on a standard retirement age of 65, with early retirement eligibility at age 55 with a minimum of 15 years of service. This is another dimension of total compensation that discourages inappropriate risk-taking; instead, it encourages executives to take a long-term view when making business decisions and to focus on achieving sustainable growth for shareholders. |

For more information on the Committee’s approach to executive compensation and the decisions made by the Committee for 2009, refer to the “Compensation Discussion and Analysis” beginning on page 24.

Finance Committee

The Finance Committee reviews ExxonMobil’s financial policies and strategies, including our capital structure, dividends, and share purchase program. The Committee authorizes the issuance of corporate debt subject to limits set by the Board. The Committee’s charter is available on the Corporate Governance section of our Web site.

Public Issues and Contributions Committee

The Public Issues and Contributions Committee reviews the effectiveness of the Corporation’s policies, programs, and practices with respect to safety, security, health, the environment, and social issues. The Committee hears reports from operating units on safety and environmental activities, and also visits operating sites to observe and comment on current operating practices. In addition the Committee reviews the level of ExxonMobil’s support for education and other public service programs, including the Company’s contributions to the ExxonMobil Foundation. The Foundation works to improve the quality of education in the United States at all levels, with special emphasis on math and science. The Foundation also supports the Company’s other cultural and public service giving. The Committee’s charter is available on the Corporate Governance section of our Web site.

Executive Committee

The Executive Committee has broad power to act on behalf of the Board. In practice the Committee meets only when it is impractical to call a meeting of the full Board.

Shareholder Communications

The Board Affairs Committee has approved and implemented procedures for shareholders and other interested persons to send written or electronic communications to individual directors, including the Presiding Director, Board Committees, or the non-employee directors as a group.

| Ÿ | Written Communications: Written correspondence should be addressed to the director or directors in care of the Secretary at the address given under “Contact Information” on page 3. |

| Ÿ | Electronic Communications: You may send e-mail to individual non-employee directors, Board Committees, or the non-employee directors as a group by using the form provided for that purpose on our Web site at exxonmobil.com/directors. |

Additional instructions and procedures for communicating with the directors are posted on the Corporate Governance section of our Web site at exxonmobil.com/proceduresdircom.

13

Code of Ethics and Business Conduct

The Board maintains policies and procedures (which we refer to in this proxy statement as the “Code”) that represent both the code of ethics for the principal executive officer, principal financial officer, and principal accounting officer under SEC rules, and the code of business conduct and ethics for directors, officers, and employees under NYSE listing standards. The Code applies to all directors, officers, and employees. The Code includes a Conflicts of Interest Policy under which directors, officers, and employees are expected to avoid any actual or apparent conflict between their own personal interests and the interests of the Corporation.

The Code is posted on the ExxonMobil Web site at exxonmobil.com/governance. The Code is also included as an exhibit to our Annual Report on Form 10-K. Any amendment of the Code will be posted promptly on our Web site.

The Corporation maintains procedures for administering and reviewing potential issues under the Code, including procedures that allow employees to make complaints without identifying themselves. The Corporation also conducts periodic mandatory business practice training sessions, and requires each regular employee and non-employee director to make an annual compliance certification.

The Board Affairs Committee will initially review any suspected violation of the Code involving an executive officer or director and will report its findings to the Board. The Board does not envision that any waiver of the Code will be granted. Should such a waiver occur, it will be promptly disclosed on our Web site.

Related Person Transactions and Procedures

In accordance with SEC rules, ExxonMobil maintains Guidelines for Review of Related Person Transactions. These Guidelines are available on the Corporate Governance section of our Web site.

In accordance with the Related Person Transaction Guidelines, all executive officers, directors, and director nominees are required to identify, to the best of their knowledge after reasonable inquiry, business and financial affiliations involving themselves or their immediate family members that could reasonably be expected to give rise to a reportable related person transaction. Covered persons must also advise the Secretary of the Corporation promptly of any change in the information provided, and will be asked periodically to review and re-affirm their information.

For the above purposes, “immediate family member” includes a person’s spouse, parents, siblings, children, in-laws, and step-relatives.

Based on this information, we review the Company’s own records and make follow-up inquiries as may be necessary to identify potentially reportable transactions. A report summarizing such transactions and including a reasonable level of detail is then provided to the Board Affairs Committee. The Committee oversees the Related Person Transaction Guidelines generally and reviews specific items to assess materiality.

In assessing materiality for this purpose, information will be considered material if, in light of all the circumstances, there is a substantial likelihood a reasonable investor would consider the information important in deciding whether to buy or sell ExxonMobil stock or in deciding how to vote shares of ExxonMobil stock. A director will abstain from the decision on any transactions involving that director or his or her immediate family members.

Under SEC rules, certain transactions are deemed not to involve a material interest (including transactions in which the amount involved in any 12-month period is less than $120,000 and transactions with entities where a related person’s interest is limited to service as a non-employee director). In addition based on a consideration of ExxonMobil’s facts and circumstances, the Committee will presume that the following transactions do not involve a material interest for purposes of reporting under SEC rules:

| Ÿ | Transactions in the ordinary course of business with an entity for which a related person serves as an executive officer, provided (1) the affected director or executive officer did not participate in the |

14

| decision on the part of ExxonMobil to enter into such transactions; and, (2) the amount involved in any related category of transactions in a 12-month period is less than 1 percent of the entity’s gross revenues. |

| Ÿ | Grants or membership payments in the ordinary course of business to nonprofit organizations, provided (1) the affected director or executive officer did not participate in the decision on the part of ExxonMobil to make such payments; and, (2) the amount of general-purpose grants in a 12-month period is less than 1 percent of the recipient’s gross revenues. |

| Ÿ | Payments under ExxonMobil plans and arrangements that are available generally to U.S. salaried employees (including contributions under the ExxonMobil Foundation’s Educational and Cultural Matching Gift Programs and payments to providers under ExxonMobil health care plans). |

| Ÿ | Employment by ExxonMobil of a family member of an executive officer, provided the executive officer does not participate in decisions regarding the hiring, performance evaluation, or compensation of the family member. |

Transactions or relationships not covered by the above standards will be assessed by the Committee on the basis of the specific facts and circumstances.

The following disclosures are made as of February 24, 2010, the date of the most recent Board Affairs Committee review of potential related person transactions.

ExxonMobil and its affiliates have about 81,000 employees around the world and employees related by birth or marriage may be found at all levels of the organization. The spouse of T.R. Walters, a Vice President of the Corporation, retired from ExxonMobil in 2009. Excluding pension and other retirement-related distributions, her partial-year compensation was less than $120,000.

ExxonMobil employees do not receive preferential treatment by reason of being related to an executive officer, and executive officers do not participate in hiring, performance evaluation, or compensation decisions for family members. ExxonMobil’s employment guidelines state: “Relatives of Company employees may be employed on a non-preferential basis. However an employee should not be employed by or assigned to work under the direct supervision of a relative, or to report to a supervisor who in turn reports to a relative of the employee.” Accordingly, consistent with ExxonMobil’s Related Person Transaction Guidelines, we do not consider the relationship noted above to be material within the meaning of the related person transaction disclosure rules.

P.T. Mulva (Vice President and Controller) has a brother currently serving as Chairman and CEO of ConocoPhillips. As is the case with most other major companies in the oil and gas industry, ExxonMobil has a variety of business transactions with ConocoPhillips. These transactions include routine purchases and sales of crude oil, petroleum products, and pipeline transportation capacity. Affiliates of ExxonMobil and ConocoPhillips have joint ownership of a refinery in Germany and a number of pipelines, terminals, emergency response companies, and service companies, and also have undivided interests in a variety of exploration, development, and production projects. All of these transactions are entered into in the ordinary course of business without influence from P.T. Mulva. Neither P.T. Mulva nor, to our knowledge after reasonable inquiry, his brother, has any interest in these transactions different from the general interest of other employees and shareholders. Accordingly, consistent with ExxonMobil’s Related Person Transaction Guidelines, we do not consider these transactions to be material within the meaning of the related person transaction disclosure rules.

S.R. LaSala (retired Vice President and General Tax Counsel) has a son who is a partner of a law firm that performs work for ExxonMobil. Mr. LaSala was not involved in decisions to retain the firm, and, therefore, we do not consider the relationship to be material within the meaning of the related person transaction disclosure rules.

S.J. Glass, Jr. (Vice President) has a brother who is a partner of a law firm that performs work for ExxonMobil. Mr. Glass is not involved in decisions to retain the firm, and, therefore, we do not consider the relationship to be material within the meaning of the related person transaction disclosure rules.

15

The Board Affairs Committee also reviewed ExxonMobil’s ordinary course business with companies for which non-employee directors serve as executive officers and determined that, in accordance with the categorical standards described above, none of those matters represent reportable related person transactions. See “Director Independence” on page 8.

We are not aware of any related person transaction required to be reported under applicable SEC rules since the beginning of the last fiscal year where our policies and procedures did not require review, or where such policies and procedures were not followed.

The Corporation’s Related Person Transaction Guidelines are intended to assist the Corporation in complying with its disclosure obligations under SEC rules. These procedures are in addition to, not in lieu of, the Corporation’s Code of Ethics and Business Conduct.

Litigation

Two shareholder derivative petitions filed in September 2009 have been consolidated and captioned In re Exxon Mobil Corp. Derivative Litigation, in the District Court of Dallas County, Texas, naming certain current and former directors (including Messrs. Boskin, George, Palmisano, Reinemund, and Tillerson and Ms. Nelson) as defendants and ExxonMobil as a nominal defendant. The petitions claim that the individual defendants breached their fiduciary duties by, among other things, allegedly failing to properly supervise the management of land leases overlaying hydrocarbon resources in the Point Thomson Unit on the Northern Slope of Alaska. The petitions also allege that the individual defendants caused the Company to make materially false and misleading statements concerning the leases and caused the waste of corporate assets. The petitions seek damages from the individual defendants in favor of ExxonMobil, equitable relief to remedy their alleged breaches, and costs and expenses of the action. The defendants have filed pleadings with the court seeking dismissal of both cases for failure to make a demand on the Corporation and failure to plead particularized facts to excuse a demand. The Corporation is defending the case on behalf of all defendants.

In October 2009, a purported shareholder complaint captioned Resnik v. Boskin et al., alleging direct and derivative claims, was filed in the United States District Court for the District of New Jersey, naming the present directors (including each of the incumbent nominees), the “named executive officers” (as defined in SEC regulations) listed in the Corporation’s 2009 proxy statement, and ExxonMobil as defendants. The complaint was amended in December 2009, alleging that the defendants made materially false or misleading proxy solicitations in connection with the 2008 and 2009 shareholder votes regarding the election of directors, and failed to seek stockholder reapproval of the Exxon Mobil Corporation 2003 Incentive Program to qualify certain incentive compensation paid to the named executive officers as properly deductible expenditures. The amended complaint also alleges, on behalf of the Corporation, that these acts injured the Corporation, breached fiduciary duties, and constituted waste. The amended complaint seeks various injunctive remedies, including corrective disclosure, new election of directors after corrective disclosure, enjoining candidates from serving on the Board until a new election occurs, stockholder reapproval of the program, enjoining payments under the program and short term incentive program to the named executive officers, damages from the individual defendants in favor of ExxonMobil, and costs and expenses of the action. The defendants have filed a motion seeking dismissal of the lawsuit on several grounds, including, that the plaintiff’s allegations concerning the Corporation’s proxy solicitations do not state claims under the federal securities laws and that the plaintiff’s derivative claims cannot stand since the plaintiff failed to make a demand on the Corporation or allege facts that would excuse such a demand. The Corporation is defending the case on behalf of all defendants.

16

ITEM 1 – ELECTION OF DIRECTORS

The Board of Directors has nominated the director candidates named on the following pages. Personal information on each of our nominees, including public company directorships during the past five years, is provided. All of our nominees currently serve as ExxonMobil directors except Messrs. Brabeck-Letmathe and Fishman, who have been nominated by the Board for first election as a director at the annual meeting. Dr. King has reached the usual retirement age and is not standing for re-election this year.

If a director nominee becomes unavailable before the election, your proxy authorizes the people named as proxies to vote for a replacement nominee if the Board names one.

The Board recommends you vote FOR each of the following candidates:

| Michael J. Boskin

Age 64 Director since 1996 |

Principal Occupation: T.M. Friedman Professor of Economics and Senior Fellow, Hoover Institution, Stanford University

Business Experience: Dr. Boskin is also a Research Associate, National Bureau of Economic Research. He is Chief Executive Officer and President of Boskin & Co., an economic consulting company.

Current Public Company Directorships: Oracle Past Public Company Directorships: Shinsei Bank; Vodafone | |

| Peter Brabeck-Letmathe

Age 65 Director nominee |

Principal Occupation: Chairman of the Board, Nestlé

Business Experience: Mr. Brabeck-Letmathe was elected Chairman of Nestlé in 2005, and Chief Executive Officer in 1997, relinquishing the role of CEO in 2008. He also served as Vice Chairman, Executive Vice President, and Senior Vice President of Nestlé.

Current Public Company Directorships: Nestlé; Credit Suisse Group; L’Oréal Past Public Company Directorships: Alcon; Roche Holding | |

| Larry R. Faulkner

Age 65 Director since 2008 |

Principal Occupation: President, Houston Endowment; President Emeritus, the University of Texas at Austin

Business Experience: Dr. Faulkner served as President of the University of Texas at Austin from 1998 to 2006. He also served on the chemistry faculties of the University of Texas, the University of Illinois, and Harvard University. At the University of Illinois, he also held a number of positions in academic administration including Provost and Vice Chancellor for Academic Affairs.

Current Public Company Directorships: Temple-Inland Past Public Company Directorships: Guaranty Financial Group | |

17

| Jay S. Fishman

Age 57 Director nominee |

Principal Occupation: Chairman of the Board and Chief Executive Officer, The Travelers Companies

Business Experience: Mr. Fishman was elected Chairman of The Travelers Companies in 2005, and Chief Executive Officer in 2004 upon the merger of The St. Paul Companies and Travelers Property Casualty Corporation. From 2001 to 2004 he was Chairman, Chief Executive Officer, and President of The St. Paul Companies.

Current Public Company Directorships: Travelers Past Public Company Directorships: Platinum Underwriters Holdings Ltd.; Nuveen Investments | |

| Kenneth C. Frazier

Age 55 Director since 2009 |

Principal Occupation: Executive Vice President and President, Global Human Health, Merck & Co.

Business Experience: Mr. Frazier was elected Executive Vice President and President, Global Human Health, at Merck in 2007, and Executive Vice President and General Counsel in 2006. He served as Senior Vice President and General Counsel at Merck from 1999 to 2006.

Current Public Company Directorships: None Past Public Company Directorships: None | |

| William W. George

Age 67 Director since 2005 |

Principal Occupation: Professor of Management Practice, Harvard University

Business Experience: Mr. George was elected Chairman of Medtronic in 1996, and retired in 2002; Chief Executive Officer in 1991; and President and Chief Operating Officer in 1989.

Current Public Company Directorships: Goldman Sachs Past Public Company Directorships: Novartis; Target | |

| Marilyn Carlson Nelson

Age 70 Director since 1991 |

Principal Occupation: Chairman of the Board, Carlson

Business Experience: Mrs. Nelson was elected Chairman and Chief Executive Officer of Carlson in 1998, and relinquished the role of CEO in 2008. She has held a number of other management positions at Carlson including President, Chief Operating Officer, Vice Chair, and Senior Vice President.

Current Company Directorships: Carlson Past Public Company Directorships: Rezidor Hotel Group | |

18

| Samuel J. Palmisano

Age 58 Director since 2006 Presiding Director since 2008 |

Principal Occupation: Chairman of the Board, President, and Chief Executive Officer, IBM

Business Experience: Mr. Palmisano was elected Chairman, President, and Chief Executive Officer of IBM in 2003. Mr. Palmisano also served as President, Senior Vice President, and Group Executive for IBM’s Enterprise Systems Group, IBM Global Services, and IBM’s Personal Systems Group.

Current Public Company Directorships: IBM Past Public Company Directorships: None | |

| Steven S Reinemund

Age 62 Director since 2007 |

Principal Occupation: Dean of Business, Wake Forest University

Business Experience: Mr. Reinemund served as Executive Chairman of the Board of PepsiCo from 2006 to 2007, and retired in 2007; was elected Chief Executive Officer and Chairman of the Board in 2001; President and Chief Operating Officer in 1999; and Director in 1996. He was also elected President and CEO of Frito-Lay in 1992 and Pizza Hut in 1986.

Current Public Company Directorships: American Express; Marriott Past Public Company Directorships: Johnson & Johnson; PepsiCo | |

| Rex W. Tillerson

Age 58 Director since 2004 |

Principal Occupation: Chairman of the Board and Chief Executive Officer, Exxon Mobil Corporation

Business Experience: Mr. Tillerson was elected Chairman and Chief Executive Officer of ExxonMobil in 2006; President and Director in 2004; and Senior Vice President in 2001. Mr. Tillerson has held a variety of management positions in domestic and foreign operations since joining the Exxon organization in 1975, including President, Exxon Yemen Inc. and Esso Exploration and Production Khorat Inc.; Vice President, Exxon Ventures (CIS) Inc.; President, Exxon Neftegas Limited; and Executive Vice President, ExxonMobil Development Company.

Current Public Company Directorships: None Past Public Company Directorships: None | |

19

| Edward E. Whitacre, Jr.

Age 68 Director since 2008 |

Principal Occupation: Chairman of the Board and Chief Executive Officer, General Motors; Chairman Emeritus, AT&T

Business Experience: Mr. Whitacre joined General Motors in July 2009 as Chairman and became CEO in December 2009. At AT&T, Mr. Whitacre was elected Chairman and Chief Executive Officer upon its merger with SBC Communications in 2005, and retired in 2007. He was elected Chairman and Chief Executive Officer of SBC in 1990; and President and Chief Operating Officer in 1988.

Current Public Company Directorships: General Motors Past Public Company Directorships: Anheuser Busch; AT&T; Burlington Northern Santa Fe | |

Director compensation elements are designed to:

| Ÿ | Ensure alignment with long-term shareholder interests; |

| Ÿ | Ensure the Company can attract and retain outstanding director candidates who meet the selection criteria outlined in the Guidelines for Selection of Non-Employee Directors, which can be found on the Corporate Governance section of our Web site; |

| Ÿ | Recognize the substantial time commitments necessary to oversee the affairs of the Corporation; and, |

| Ÿ | Support the independence of thought and action expected of directors. |

Non-employee director compensation levels are reviewed by the Board Affairs Committee each year, and resulting recommendations are presented to the full Board for approval. The Committee uses an independent consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

ExxonMobil employees receive no additional pay for serving as directors.

Non-employee directors receive compensation consisting of cash and equity in the form of restricted stock. Non-employee directors are also reimbursed for reasonable expenses incurred to attend board meetings or other functions relating to their responsibilities as a director of Exxon Mobil Corporation.

The annual cash retainer for non-employee directors is $100,000 per year. Chairs of the Audit and Compensation Committees and the Presiding Director (effective January 2010) receive an additional $10,000 per year.

A significant portion of director compensation is paid in restricted stock to align director compensation with the long-term interests of shareholders. The annual restricted stock award grant for incumbent non-employee directors is 2,500 shares. A new non-employee director receives a one-time grant of 8,000 shares of restricted stock upon first being elected to the Board.

While on the Board, the non-employee director receives the same cash dividends on restricted shares as a holder of regular common stock, but the non-employee director is not allowed to sell the shares. The restricted shares may be forfeited if the non-employee director leaves the Board early, i.e., before the retirement age of 72, as specified for non-employee directors.

Current and former non-employee directors of Exxon Mobil Corporation are eligible to participate in the ExxonMobil Foundation’s Educational and Cultural Matching Gift Programs under the same terms as the Corporation’s U.S. employees.

20

Director Compensation for 2009

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($)(a) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change

in Earnings ($) |

Other Compensation ($)(b) |

Total ($) | |||||||

| M.J. Boskin |

105,962 | 201,263 | 0 | 0 | 0 | 388 | 307,613 | |||||||

| L.R. Faulkner |

100,000 | 201,263 | 0 | 0 | 0 | 388 | 301,651 | |||||||

| K.C. Frazier |

59,615 | 554,280 | 0 | 0 | 0 | 388 | 614,283 | |||||||

| W.W. George |

110,000 | 201,263 | 0 | 0 | 0 | 388 | 311,651 | |||||||

| J.R. Houghton |

44,423 | 201,263 | 0 | 0 | 0 | 388 | 246,074 | |||||||

| R.C. King |

100,000 | 201,263 | 0 | 0 | 0 | 388 | 301,651 | |||||||

| M.C. Nelson |

100,000 | 201,263 | 0 | 0 | 0 | 388 | 301,651 | |||||||

| S.J. Palmisano |

100,000 | 201,263 | 0 | 0 | 0 | 388 | 301,651 | |||||||

| S.S Reinemund |

100,000 | 201,263 | 0 | 0 | 0 | 388 | 301,651 | |||||||

| W.V. Shipley |

40,385 | 201,263 | 0 | 0 | 0 | 388 | 242,036 | |||||||

| E.E. Whitacre, Jr. |

100,000 | 201,263 | 0 | 0 | 0 | 388 | 301,651 |

| (a) | In accordance with SEC rules, the valuation of stock awards in this table represents fair value on the date of grant. Dividends on stock awards are not shown in the table because those amounts are factored into the grant date fair value. |

| Each director (other than Mr. Frazier, who joined the Board in May 2009) received an annual grant of 2,500 restricted shares in January 2009. The valuation of these awards is based on a market price of $80.51 on the date of grant. |

| Mr. Frazier received a one-time grant of 8,000 restricted shares upon being first elected to the Board in May 2009. The valuation of this award is based on a market price of $69.29 on the date of grant. |

| At year-end 2009, the aggregate number of restricted shares held by each director was as follows: |

| Name | Restricted Shares (#) | |

| M.J. Boskin |

49,300 | |

| L.R. Faulkner |

10,500 | |

| K.C. Frazier |

8,000 | |

| W.W. George |

21,000 | |

| R.C. King |

48,100 | |

| M.C. Nelson |

53,300 | |

| S.J. Palmisano |

17,000 | |

| S.S Reinemund |

13,000 | |

| E.E. Whitacre, Jr. |

10,500 |

| (b) | The amount shown for each director is the prorated cost of travel accident insurance covering death, dismemberment, or loss of sight, speech, or hearing under a policy purchased by the Corporation with a maximum benefit of $500,000 per individual. |

The non-employee directors are not entitled to any additional payments or benefits as a result of leaving the Board or death except as described above. The non-employee directors are not entitled to any payments or benefits resulting from a change in control of the Corporation.

21

Based on our review of ownership reports filed with the SEC, the firm listed below is the only beneficial owner of more than 5 percent of ExxonMobil’s outstanding common stock as of December 31, 2009.

| Name and Address of Beneficial Owner |

Shares Owned |

Percent of Class | ||

| BlackRock Inc. 40 East 52nd Street New York, NY 10022 |

273,289,117 | 5.76 |

DIRECTOR AND EXECUTIVE OFFICER STOCK OWNERSHIP

These tables show the number of ExxonMobil common stock shares each executive named in the “Summary Compensation Table” on page 40 and each non-employee director or director nominee owned on February 28, 2010. In these tables, ownership means the right to direct the voting or the sale of shares, even if those rights are shared with someone else. None of these individuals owns more than 0.04 percent of the outstanding shares.

| Named Executive Officer | Shares Owned | Shares Covered by Exercisable Options | |||

| R.W. Tillerson |

1,325,613 | (1) | 327,307 | ||

| D.D. Humphreys |

615,458 | (2) | 175,097 | ||

| M.J. Dolan |

388,794 | (3) | 59,998 | ||

| H.R. Cramer |

858,558 | 210,000 | |||

| S.D. Pryor |

839,501 | (4) | 350,000 |

| (1) | Includes 1,525 shares owned by dependent child. |

| (2) | Includes 69,179 shares jointly owned with spouse. |

| (3) | Includes 37,599 shares jointly owned with spouse. |

| (4) | Includes 23,022 shares owned by spouse. |

| Non-Employee Director/Nominee | Shares Owned | ||

| M.J. Boskin |

51,800 | ||

| P. Brabeck-Letmathe |

0 | ||

| L.R. Faulkner |

13,000 | ||

| J.S. Fishman |

0 | ||

| K.C. Frazier |

10,500 | ||

| W.W. George |

33,500 | (1) | |

| R.C. King |

53,404 | (2) | |

| M.C. Nelson |

73,800 | (3) | |

| S.J. Palmisano |

19,500 | ||

| S.S Reinemund |

17,775 | (4) | |

| E.E. Whitacre, Jr. |

13,000 |

| (1) | Includes 10,000 shares held as co-trustee of family foundation. |

| (2) | Includes 1,000 shares owned by spouse. |

| (3) | Includes 18,000 shares held as co-trustee of family trusts. |