March 11, 2010 New York Stock Exchange Exhibit 99.2 |

March 11, 2010 New York Stock Exchange Exhibit 99.2 |

2 Cautionary Statement

Outlooks, projections, estimates, targets,

business plans, and other statements of future events or conditions in this presentation or the

subsequent discussion period are forward-looking statements. Actual future results,

including demand growth and mix; ExxonMobil’s own production growth and mix; the amount and

mix of capital expenditures; resource additions and recoveries; finding and development costs;

project plans, timing, costs, and capacities; revenue enhancements and cost efficiencies; industry margins; margin enhancements and integration benefits; product mix; the impact of technology; and benefits of

the XTO Energy transaction could differ materially due to a number of factors. These include

changes in long- term oil or gas prices or other market conditions affecting the oil, gas, and

petrochemical industries; reservoir performance; timely completion of development projects; war

and other political or security disturbances; changes in law or government regulation; the

outcome of commercial negotiations; the actions of competitors; unexpected technological

developments; the occurrence and duration of economic recessions; unforeseen technical

difficulties; our ability to integrate effectively XTO Energy's business with our own; and other factors discussed here and under the heading "Factors Affecting Future Results" in the Investors

section of our Web site at exxonmobil.com. See also Item 1A of ExxonMobil’s

2009 Form 10-K. Forward-looking statements are based on management’s knowledge

and reasonable expectations on the date hereof, and we assume no duty to update these statements

as of any future date.

References to resources, resource base, recoverable resources, and similar terms include quantities of oil and gas that are not yet classified as proved reserves but that we believe will

likely be moved into the proved reserves category and produced in the future. Unless otherwise

noted, "proved reserves" discussed in this presentation are presented on ExxonMobil's

basis using the same prices and costs we use to make investment decisions, not the SEC basis that

uses historical costs. For definitions of, and information regarding, reserves, return on

average capital employed, normalized earnings, cash flow from operations and asset sales, and

other terms used in this presentation, including information required by SEC Regulation G, see the "Frequently Used Terms" posted on the Investors section of our Web site. The Financial and

Operating Review on our Web site also shows ExxonMobil's net interest in specific projects.

Frequently Used Terms. Forward-Looking Statements. |

9

AM Welcome David Rosenthal Vice President, Investor Relations Corporate Rex Tillerson Chairman and CEO Upstream Mark Albers Senior Vice President Andy Swiger Senior Vice President Downstream Don Humphreys Senior Vice President Mike Dolan Senior Vice President Chemical Mike Dolan Senior Vice President Break Summary Remarks Rex Tillerson Chairman and CEO Q&A 12 PM Meeting Concludes Agenda Agenda 3 |

Rex

Tillerson Chairman and CEO Corporate Overview 4 |

5 2009 Results * Includes dividends and share purchases to reduce shares outstanding **Determined on ExxonMobil’s basis and including asset sales ExxonMobil delivered strong results during a year of significant challenges. Industry-leading safety performance Solid financial performance • Earnings $19.3 B • ROCE 16 % • Cash flow from operations and asset sales $30 B Total distributions to shareholders* $26 B Capex $27 B Reserves replacement** 133 % Total shareholder return -12.6 % |

6 0.0 0.1 0.2 0.3 0.4 '05 '06 '07 '08 '09 Safety 2009 safety performance continued to lead the industry Our Vision: Nobody Gets Hurt Committed to maintaining and improving our performance Lost Time Incident Rate U.S. petroleum industry contractor benchmark* U.S. petroleum industry employee benchmark* Employee Contractor Incidents per 200K hours We achieved best-ever lost time incident rates for our combined employee and contractor workforce in 2009. * 2009 industry data not available |

7 0 2 4 6 8 '05 '06 '07 '08 '09 Strong environmental management Improving energy efficiency Reducing flaring, spills, and releases Protect Tomorrow. Today. Hydrocarbon Flaring from Upstream Oil and Gas Production Environmental Performance We are committed to reducing our impact on the environment while expanding energy supplies needed to fuel economic growth. Million Metric Tons |

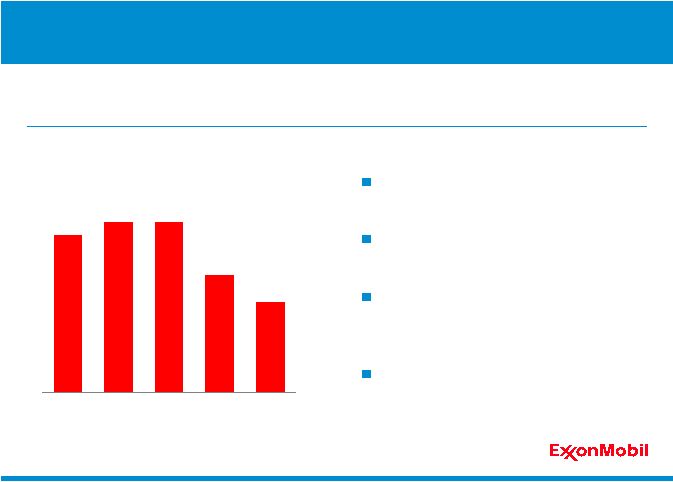

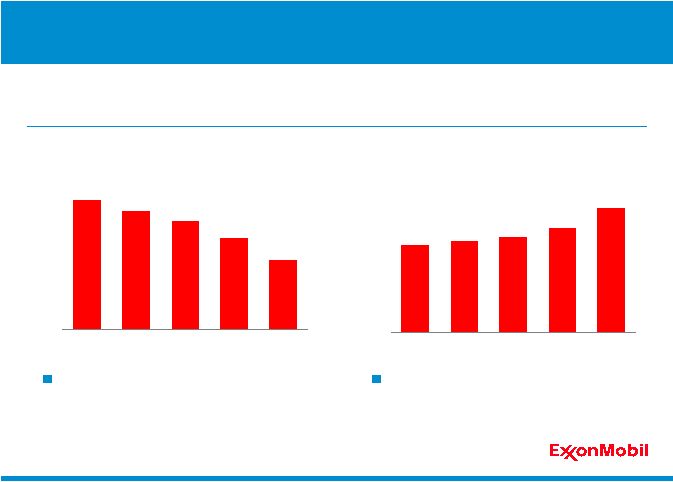

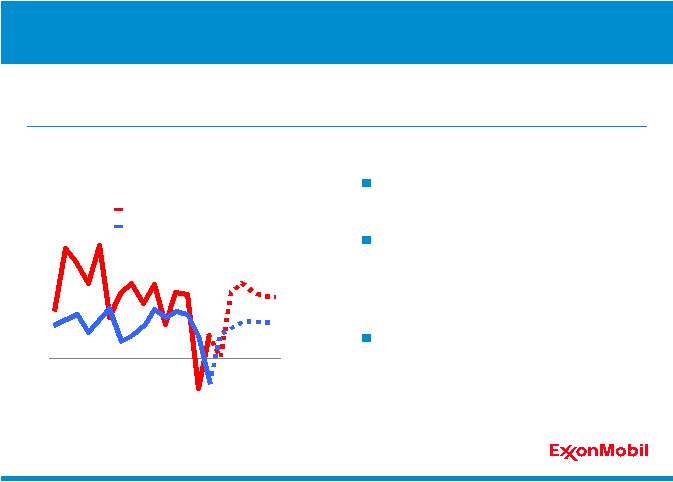

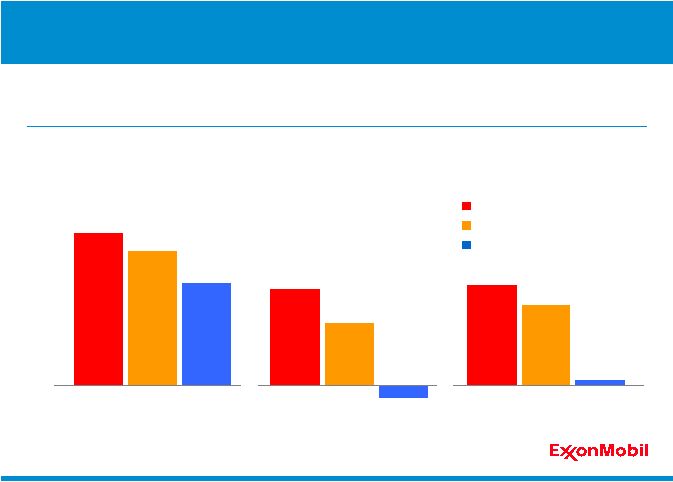

8 0 10 20 30 40 50 '05 '06 '07 '08 '09 Earnings Industry-leading results in all business segments Commitment to operational excellence Capitalizing on competitive advantages ExxonMobil earned $19.3 billion in 2009 during a period of volatile and challenging industry conditions. Earnings Excluding Special Items $ B Upstream Downstream Chemical Earnings Upstream Downstream Chemical Earnings |

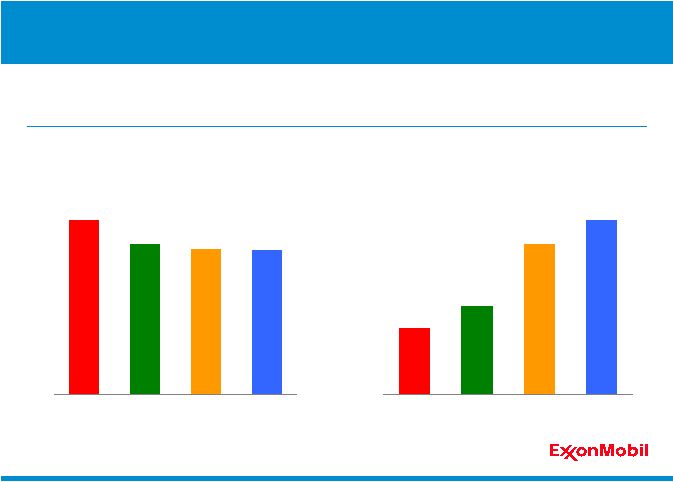

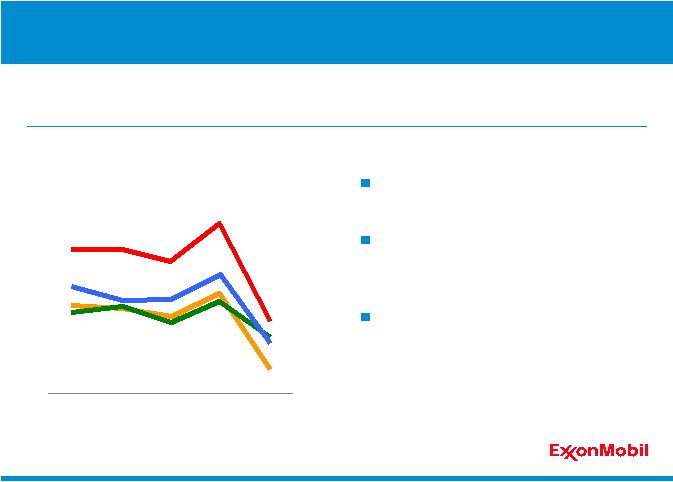

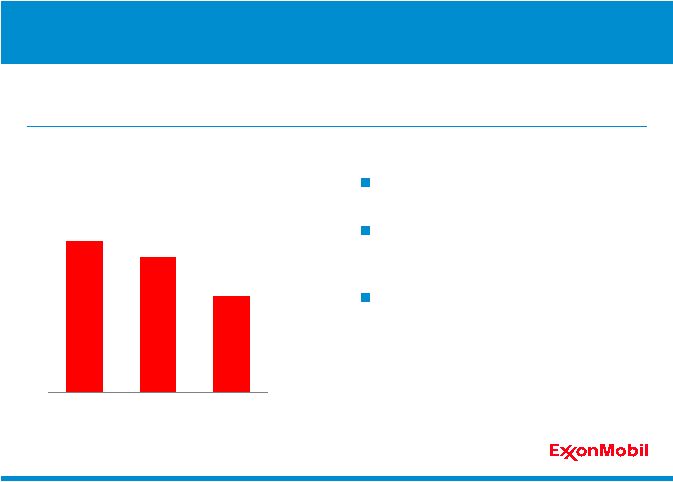

9 0 5 10 15 20 25 XOM CVX RDS BP Return on Capital Employed Strength of integrated portfolio Consistent execution of business model Disciplined investment through the business cycle Return on Average Capital Employed* Upstream Downstream Chemical Percent * Competitor data estimated on a consistent basis with ExxonMobil, and based on public

information Our 2009 ROCE continued to lead industry across all business

segments. |

10 Cash Flow $28.4 billion in 2009 Reduction in-line with lower commodity prices and margins Funded all attractive investments and dividends * Excludes asset sales Cash Flow from Operating Activities* $ B Strong cash flows underpin our investment plans and shareholder distributions. 0 10 20 30 40 50 60 '05 '06 '07 '08 '09 |

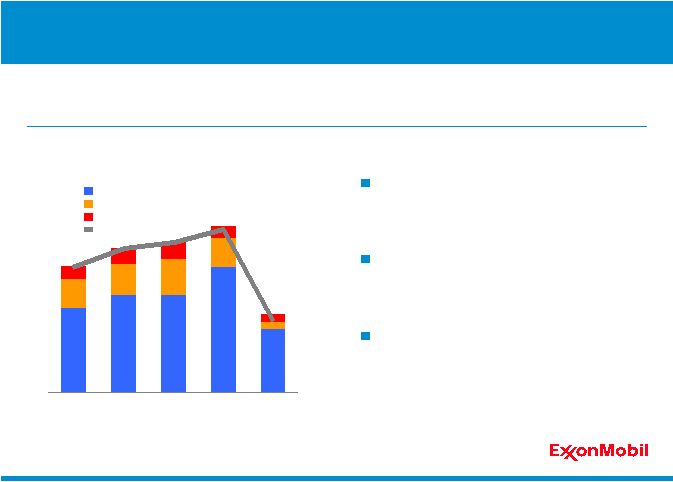

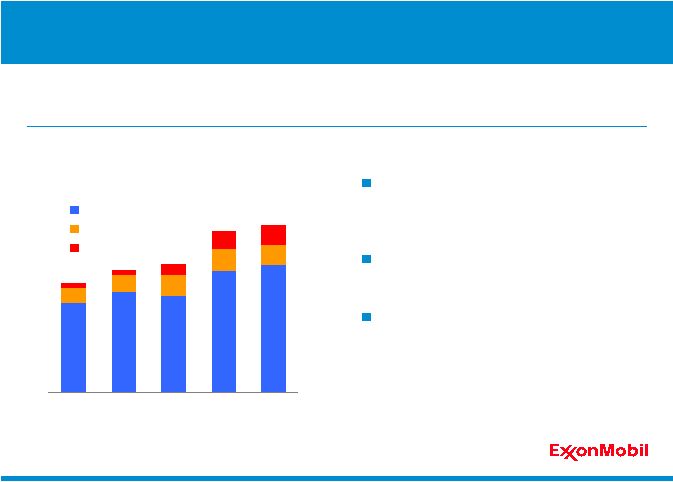

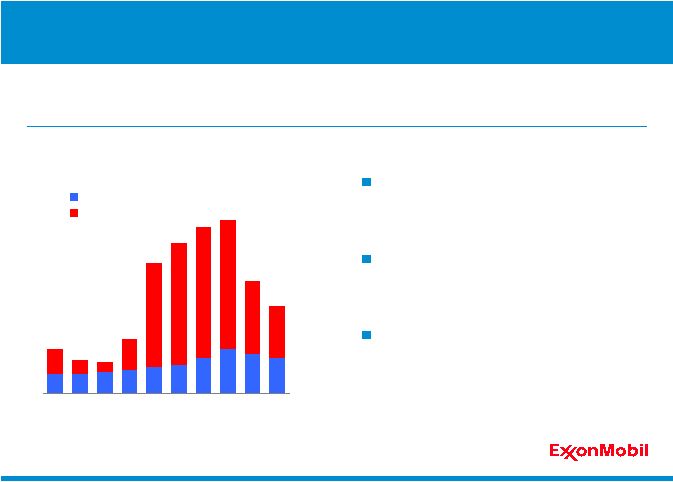

11 0 5 10 15 20 25 30 '05 '06 '07 '08 '09 Capex Capex by Business Line $ B We invested record levels of Capex, despite the economic downturn, growing the business for the long term. Invested over $110 billion during the past five years Maintained capital efficiency Executing business plans Upstream Downstream Chemical |

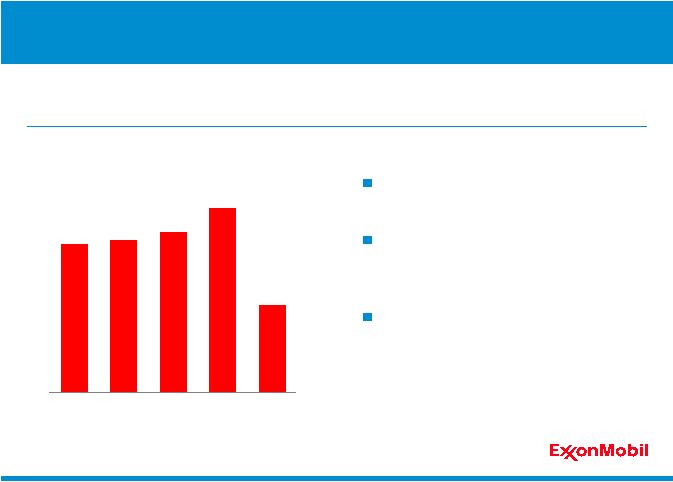

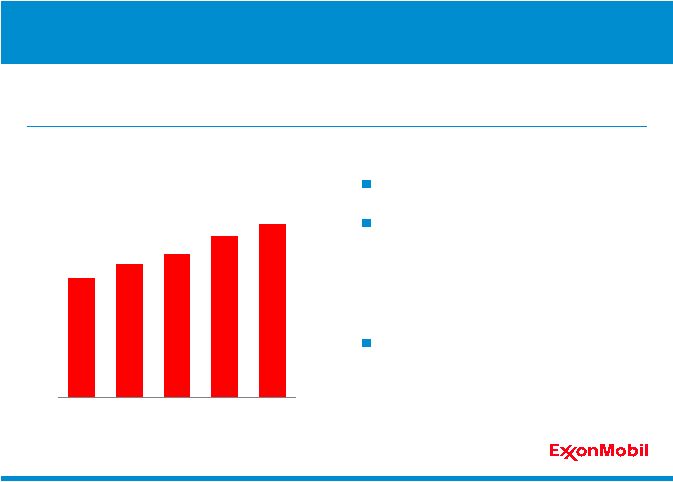

12 Dividends Dividend growth through the cycle Per share increase of 57% over the last five years • Average growth 9.4% per year • U.S. inflation average 2.6% per year* Annual per share increases since 1983 We provide reliable and growing dividends through the business cycle. Dividends per Share $ 0.00 0.45 0.90 1.35 1.80 '05 '06 '07 '08 '09 * All Urban CPI, compound annual growth rate 2004-2009 |

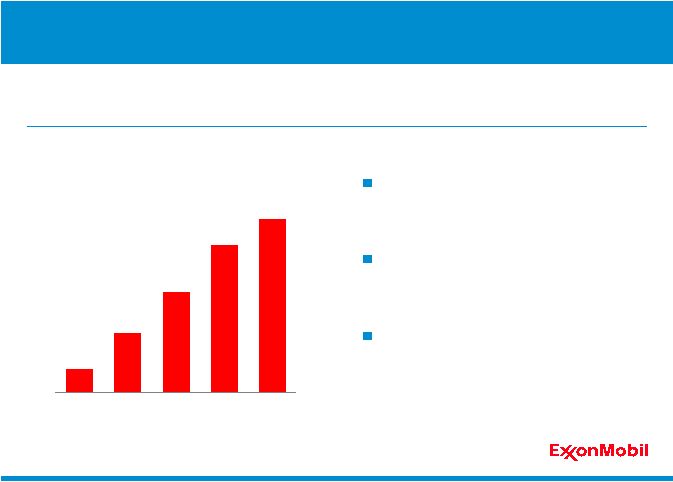

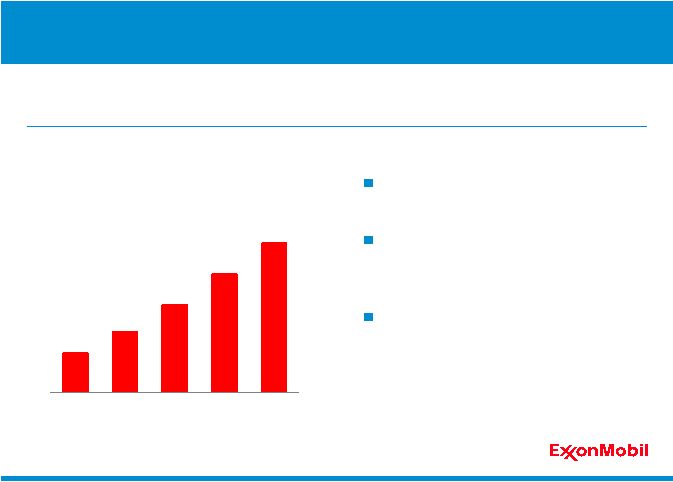

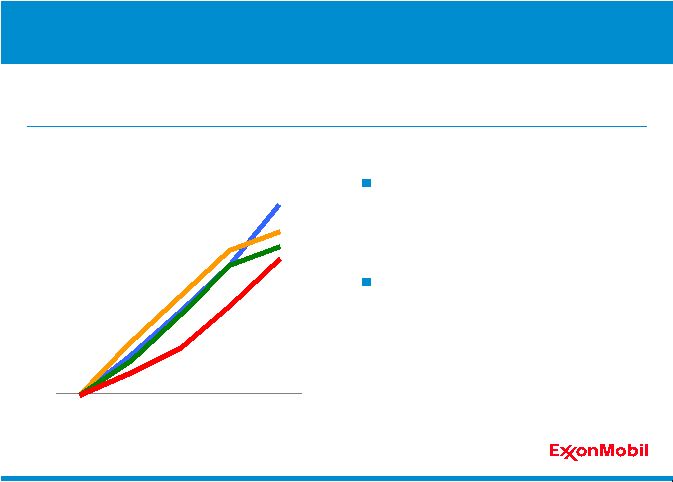

13 Share Purchases $119 billion distributed over the last five years Reduced shares outstanding by 26% since the beginning of 2005 Effective way to distribute value for shareholders In 2009, we distributed $18 billion to shareholders through share purchases. Cumulative Purchases to Reduce Shares Outstanding 0 30 60 90 120 '05 '06 '07 '08 '09 $ B |

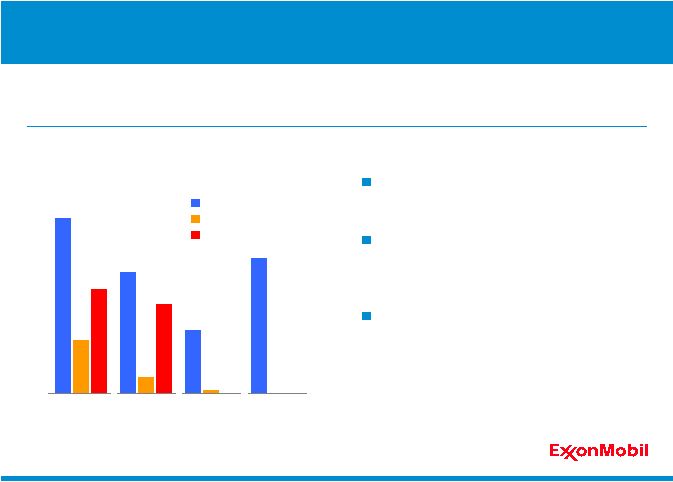

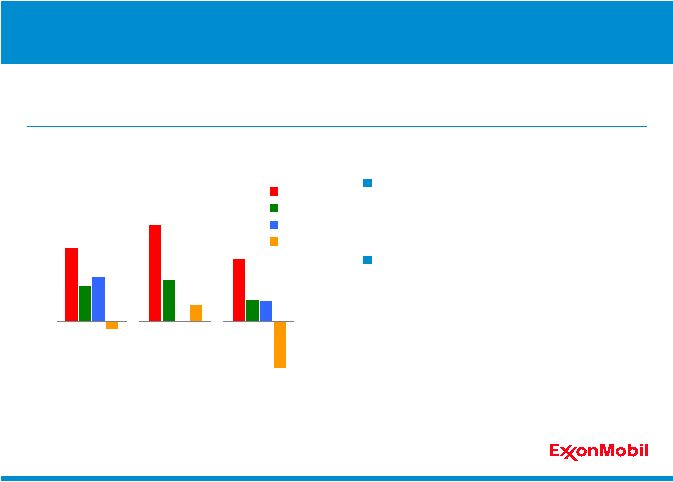

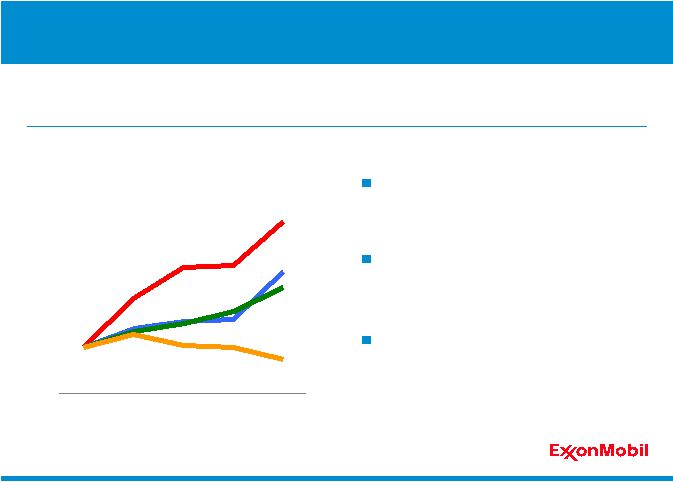

14 -20 -10 0 10 20 30 40 Production Proved Reserves Refinery Throughput Increasing Ownership Strong per share growth in key business metrics Ahead of competition Growth per Share Since 2005* Strong business results and share purchases increase per share ownership for our shareholders. Percent XOM BP CVX RDS ** * Competitor data estimated on a consistent basis with ExxonMobil, and based on public information ** Reserves based on SEC pricing bases, including oil sands and equity companies; 2008 reserves data used for competitors as 2009 data not yet available |

15 0 10 20 30 40 50 '05 '06 '07 '08 '09 Value per Share 2009 EPS $3.98 per share EPS 44% higher than without share purchases* Ongoing benefit to all shareholders Percent Impact of Share Purchases on EPS Since ExxonMobil Merger Earnings per share is enhanced by our share purchase program. * Average shares outstanding reduced 30.4% since beginning of 2000

|

16 Business Environment Financial markets stabilizing Pace of economic recovery uncertain Near-term supply / demand balance linked to economic recovery Uncertain commodity prices and depressed margins Some competitors re-evaluating near-term business plans ExxonMobil is well-positioned for the unique set of challenges and opportunities in the current business environment. |

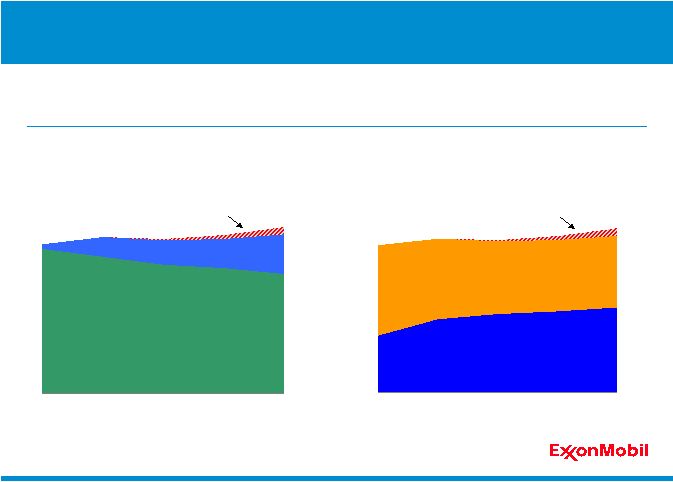

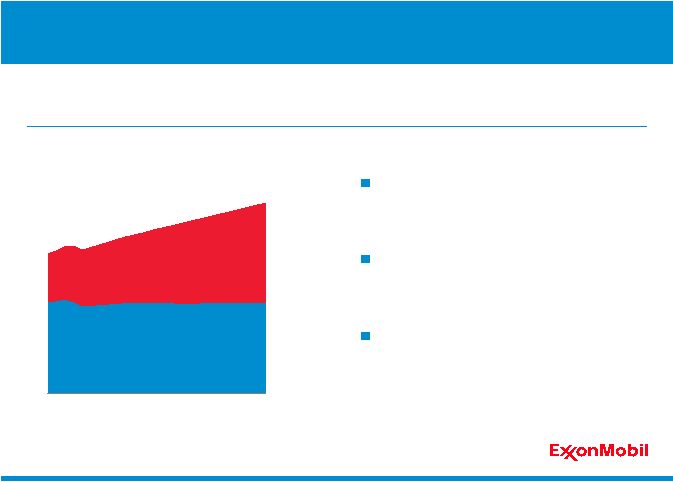

17 Energy Demand to 2030 Global energy mix will remain relatively stable to 2030 • Fossil fuels continue to provide Strong growth in natural gas • Driven by power generation Energy Demand Quadrillion BTUs 0 50 100 150 200 250 300 Oil Coal Gas Other* '05–'30 Annual Growth Rate to 2030 0.5% 1.8% 1.2% 1.9% * Other includes nuclear, hydro, geothermal, biomass, wind, solar, and biofuels

'30 '05 '30 '05 '30 '05 '30 '05 '30 '05 '30 '05 '30 '05 '30 '05 Total Energy Growth 0.8% Global energy demand is expected to grow almost 35% by 2030 – led by economic progress in developing nations – even with large efficiency gains. about 80% of the world’s energy |

18 Energy Demand to 2030 Global energy mix will remain relatively stable to 2030 • Fossil fuels continue to provide about 80% of the world’s energy Strong growth in natural gas • Driven by power generation Energy savings in 2030 about twice the growth in projected energy use Energy Demand Quadrillion BTUs 0 50 100 150 200 250 300 Oil Coal Gas Other* '05–'30 '30 Annual Growth Rate to 2030 0.5% 1.8% 1.2% 1.9% * Other includes nuclear, hydro, geothermal, biomass, wind, solar, and biofuels

'30 '05 '30 '05 '30 '05 '30 '05 '30 '05 '30 '05 '30 '05 '30 '05 Total Energy Growth Annual Energy Savings 0.8% Global energy demand is expected to grow almost 35% by 2030 – led by economic progress in developing nations – even with large efficiency gains. |

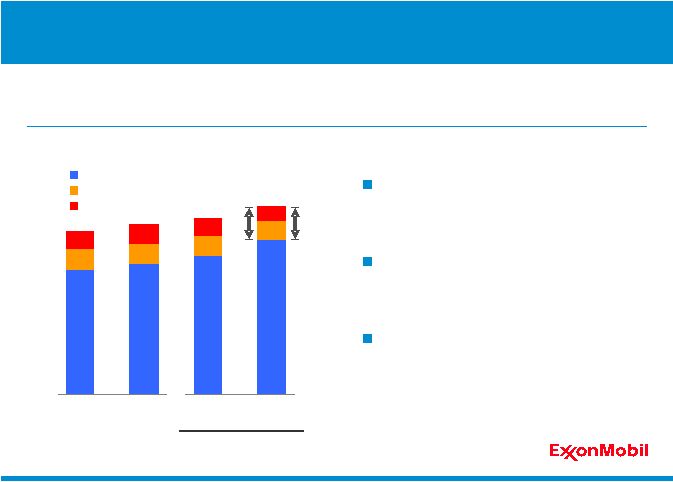

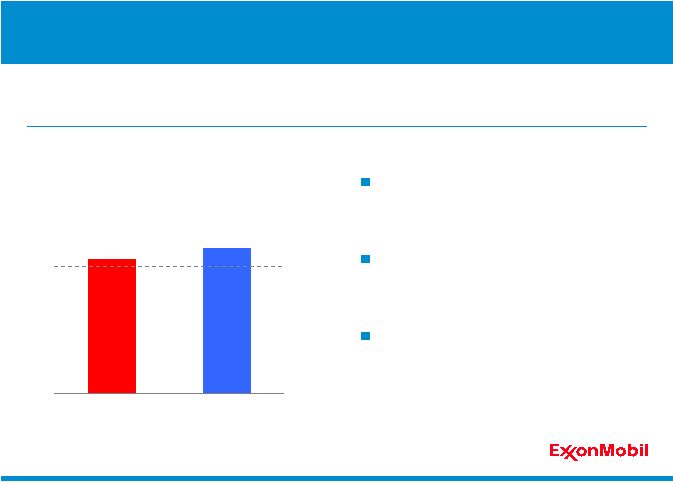

19 0 5 10 15 20 25 30 '08 '09 '10 '11 - '14 Average Investment Plan $ B Capex by Business Line Estimate Estimate Range Progressing large inventory of high -quality projects Aggressively pursuing cost reduction opportunities Delivering advantaged projects Upstream Upstream Downstream Downstream Chemical / Other Chemical / Other ExxonMobil is committed to investing through the business cycle. We expect to invest $25 to $30 billion per year through 2014.

|

20 ExxonMobil Strengths Portfolio quality Global integration Discipline and consistency Value maximization Long-term perspective Industry leadership through the business cycle ExxonMobil’s strengths form the foundation of our business and sustain our success. Underpinned by superior technology, organization, and financial strength

|

Upstream Overview Mark Albers Senior Vice President Andy Swiger Senior Vice President 21 |

22 2009 Upstream Highlights Earnings $17.1 B ROCE

23.4 % Production volumes 3.9 MOEBD Resource adds 2.9 BOEB Proved reserves adds* 2.0 BOEB Capex $20.7 B We maintained our industry-leading earnings position, delivered superior returns, and added profitable volumes to our resource base. * ExxonMobil basis |

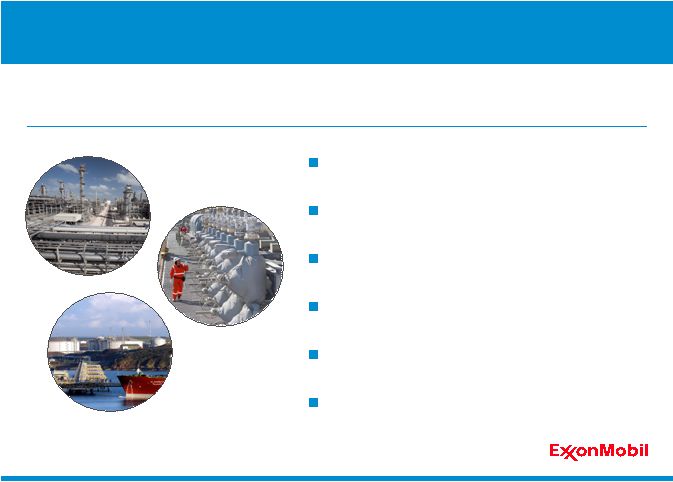

23 Ensure operational integrity: best-in-class performance Identify and selectively pursue the highest-quality exploration opportunities Invest in projects that deliver superior returns Maximize resource value through highest-impact technologies and integrated solutions Maximize profitability of existing oil and gas production Capitalize on growing natural gas and power markets Upstream Strategies Consistent execution of our clearly defined strategies delivers superior results. |

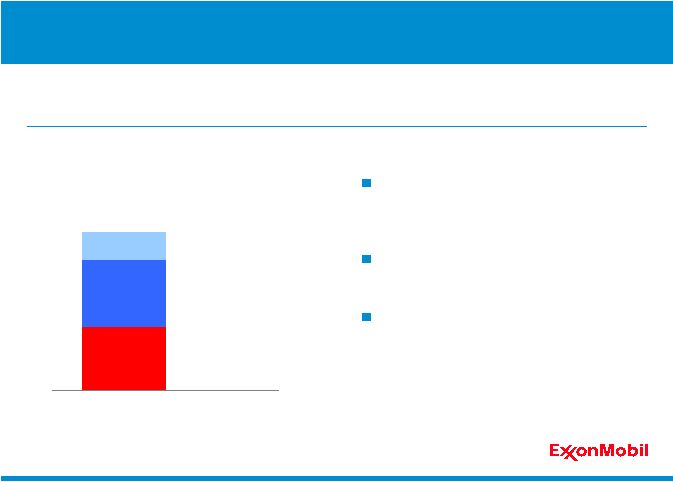

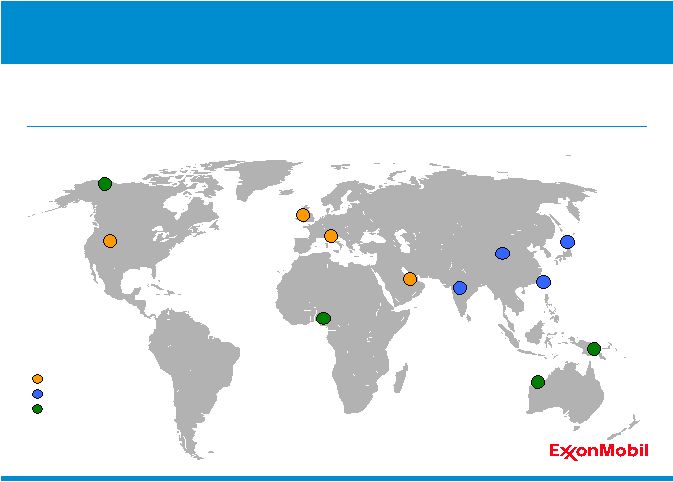

24 Unconventional Gas Arctic High-quality resources in all geographic regions Continued to grow our resource base through: • By-the-bit drilling success • Undeveloped resource capture • Improved recovery from existing fields ExxonMobil has the industry’s largest, high-quality resource base and is

well-positioned for profitable future growth. 2009 Resource Base 0 40 80 YE 2009 Conventional Heavy Oil/Oil Sands Deepwater Acid/Sour Gas Liquefied Natural Gas BOEB Resource Base |

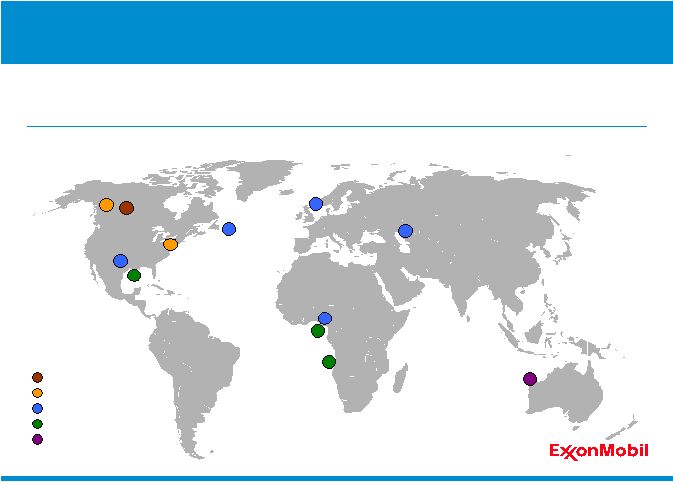

25 U.S. Gulf of Mexico Canada Horn River Canada Athabasca 2009 Resource Base Increase We added 3.9 BOEB to our resource base from consistent by-the-bit success, undeveloped resource capture, and additional field recovery. U.S. West Texas U.S. Marcellus U.K. North Caspian Canada Hibernia Angola Nigeria Australia Major 2009 Increases Heavy Oil/Oil Sands Unconventional Gas Conventional Deepwater LNG |

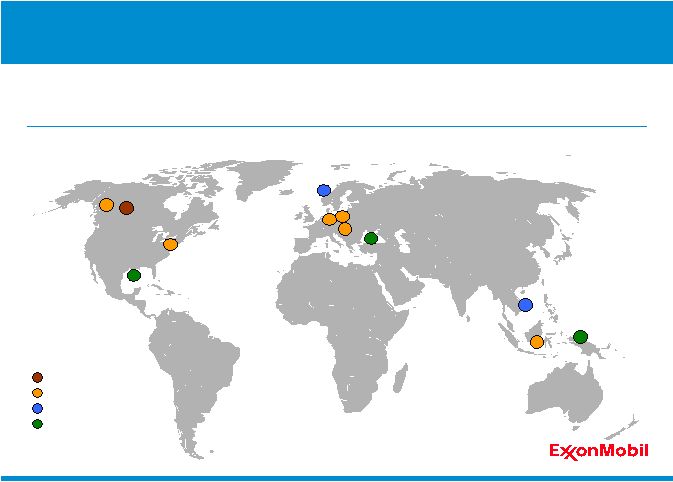

26 Norway Canada Horn River Poland Turkey Indonesia Onshore Indonesia Offshore Vietnam 2009 Acreage Acquisition We acquired material acreage positions across the world in highly prospective plays. Heavy Oil/Oil Sands Unconventional Gas Conventional Deepwater 2009 Acreage Captures Hungary Canada Athabasca U.S. Gulf of Mexico U.S. Marcellus Germany |

27 We are executing a major exploration program focused on high-potential opportunities. Key Exploration Wells Planned wells 2010 / 2011 Brazil Canada Orphan Australia Angola Nigeria Indonesia Onshore Libya Indonesia Offshore Turkey Philippines U.S. Eagle Ford U.S. Gulf of Mexico Canada Horn River U.S. Marcellus Germany Poland Vietnam |

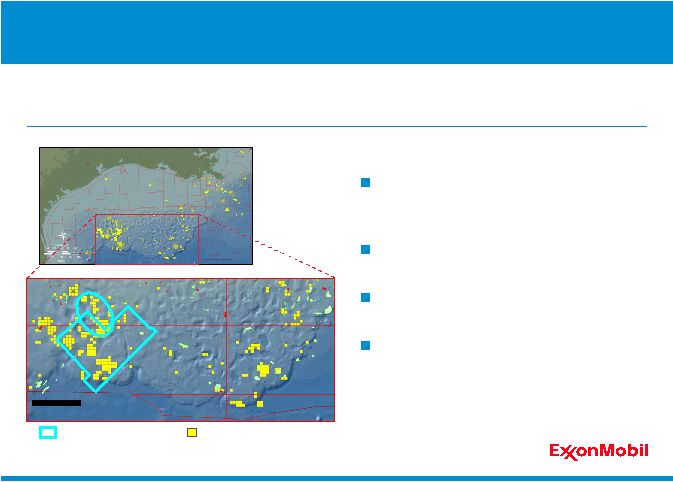

28 2.2 million net acres with exposure to Pliocene, Miocene, and Paleogene plays Successful Hadrian discovery Progressing Julia development planning Drilling and seismic acquisition program in 2010 We have made significant discoveries at Hadrian and Julia and have a strong acreage position to provide future growth opportunities. U.S. – Gulf of Mexico Houston New Orleans Kaskida Buckskin Hadrian Jack Das Bump St Malo Tucker Julia Keathley Canyon Walker Ridge Amery Terrace Cascade Chinnock Shenandoah Sigsbee Escarpment Stones Diana Hoover Great White Mad Dog Green Canyon Garden Banks Tiber Planned Seismic Data 50 miles ExxonMobil Acreage Interest Lucius |

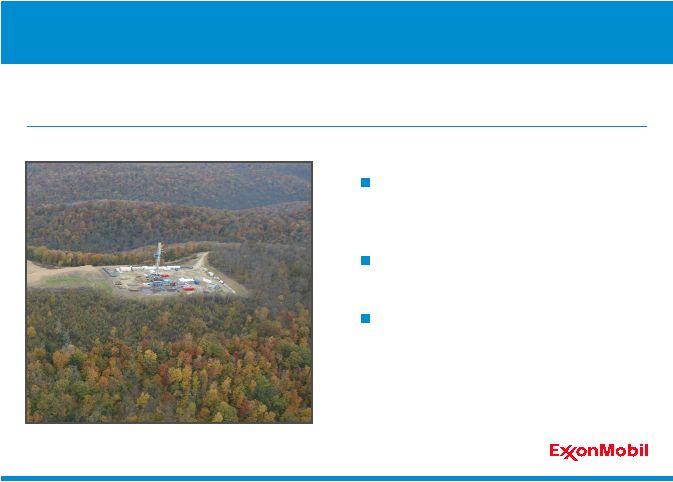

29 Growing acreage position • 290K gross acres Cost effective acquisition Active exploration/appraisal program • Production testing under way We have established a material position in this high-quality U.S. shale gas play. U.S. – Marcellus |

30 Acquisition cost 40% less than industry average Ramping up drilling and seismic activities Building infrastructure for year-round access We achieved early entry and have established the leading acreage position in this emerging high-potential shale gas basin. Canada – Horn River |

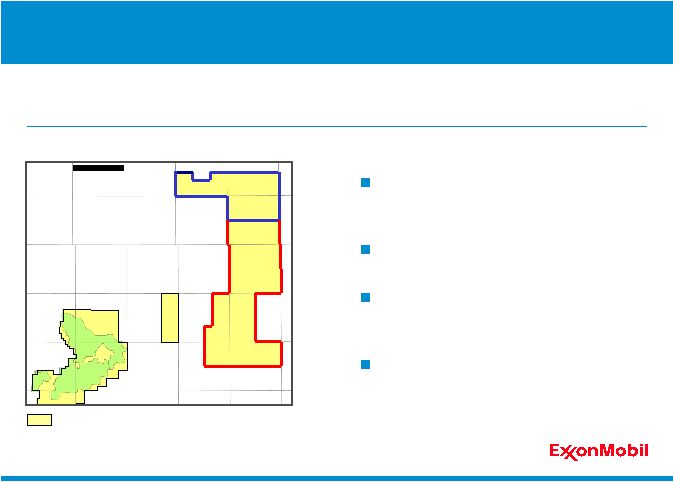

31 Firebag North acquisition, extended existing strong position Potential synergies with Kearl Attractive acquisition cost under $0.20/OEB Active winter exploration program Successful acquisition of additional oil sands acreage in a world-class resource area. Canada – Firebag Firebag North Firebag Kearl 6 miles ExxonMobil / Imperial Oil Acreage |

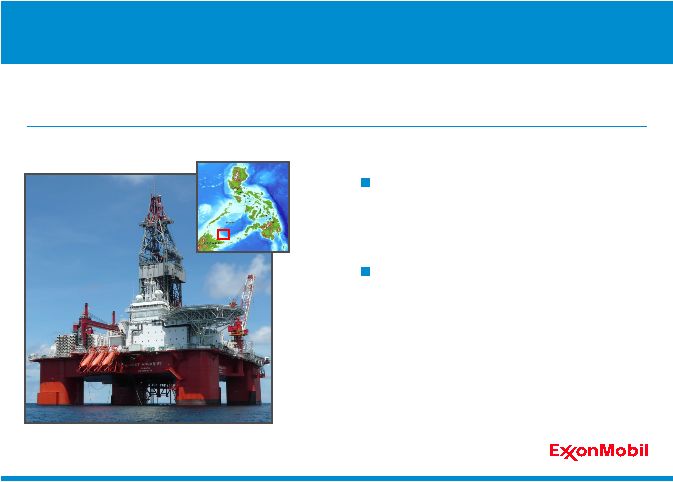

32 Philippines – Sulu Sea Successful exploration in frontier basin utilizing our extensive deepwater capabilities. Successful Dabakan-1 wildcat well • Encountered hydrocarbons in multiple reservoir intervals Multiple prospects remaining to be drilled • Additional wildcat well in 2010 |

33 We have established a significant acreage position in the Black Sea and have commenced an active deepwater exploration program. Largest IOC acreage holder Completed large-scale seismic surveys Multiple exploration play tests planned for 2010/2011 Black Sea Exploration Turkey Russia Georgia Bulgaria Romania Ukraine ExxonMobil Acreage 100 miles |

34 Major Project Distribution by Region Americas Africa Asia Pacific Russia / Caspian Middle East Europe Percent, number of projects Develop 24 net BOEB, across all regions and resource types Industry-leading project management capabilities Cost-effective implementation High-impact technology Our extensive portfolio of over 130 major projects allows selective investment decisions to deliver superior financial performance. Major Project Inventory |

35 Delivered eight major start-ups with forecast production of 400 KOEBD net in 2010. Tyrihans South Hook LNG Terminal Qatargas 2 Train 5 RasGas Train 6 2009 Project Start-ups Piceance Phase 1 Qatargas 2 Train 4 Adriatic LNG Terminal Al Khaleej Gas Phase 2 |

36 Our rigorous, high-quality project management processes consistently deliver industry-leading project execution performance. Unmatched ability to implement complex projects Deliver projects faster than our competitors Track record of superior cost and schedule delivery Project Execution 0 50 100 150 ExxonMobil Operated Operated by Others 115% 106% Cost Performance Percent Variance: actual versus funded (%), '05 to '09 start-ups

|

37 Twelve major project start-ups planned between 2010 and 2012. Arctic Sakhalin-1 Odoptu Deepwater Pazflor LNG RasGas Train 7 Deepwater Kizomba Satellites Conventional Kipper / Tuna LNG Golden Pass Terminal Oil Sands Kearl Phase 1 Near-Term Project Start-Ups Conventional Nigeria Satellites Ph 1 |

38 0.0 0.4 0.8 1.2 1.6 '09 '10 '11 '12 '13 '14 '15 Major Project Production Outlook Significant long-plateau production contribution from our major projects supports our long-term growth. Over 1.5 MOEBD added by 2015 80% long-plateau volumes Long-term growth supported by diverse portfolio Major Project Production Outlook Other Flowstreams MOEBD, net QG 2 Train 4 & 5, RG Train 6, AKG Ph 2 RG Train 7, Kearl Ph 1 Kashagan Ph 1 Syncrude Aurora Nth Long-Plateau PNG LNG

Kearl Ph 2 Gorgon Jansz |

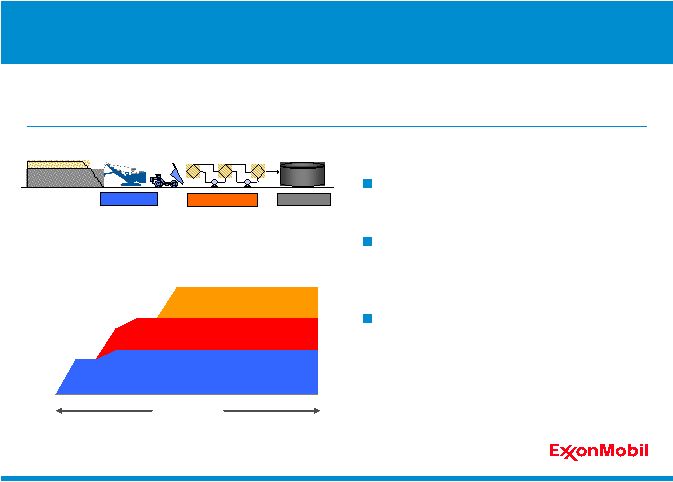

39 The efficient development of Kearl, coupled with the highest-quality resource, delivers the lowest-cost oil sands development. Highest -quality oil sands resource Proprietary bitumen treatment technology, upgrader not required Increased Phase 1 plateau production outlook to 140 KBD Canada – Kearl Oil Sands Project Mining Treatment Oil Sands Diluted Bitumen Market KOEBD, net 0 100 200 300 400 30 Years 2012 - Phase 1 Phase 3 Phase 2 Production |

40 High-quality 9 TCF gross resource Two-train 6.6 MTA LNG plant Secured long-term SPAs Anticipate start-up in 2014 We will develop the PNG LNG project utilizing our global LNG experience, and grow our presence in the attractive Asia Pacific gas market. Papua New Guinea – PNG LNG Project |

41 Achieved early oil start-up in August 2009, 20 KBD capacity Full field development to deliver 165 KBD Evaluating gas commercialization We are progressing full field development of this significant conventional oil

project in Indonesia. Indonesia – Banyu Urip Project |

42 Delivering advantaged technologies across our business and progressing significant breakthrough research. Recently commercialized breakthrough technologies delivering benefits Developing high-reward technologies for the future Imaging Oil Shale Extraction Drilling Upstream Research and Development Flow Assurance Improved Recovery Exploration Development Production |

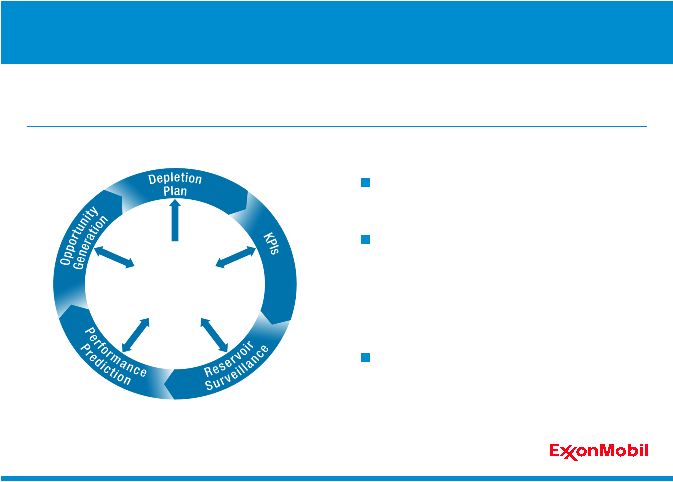

43 Reservoir management best practices applied globally Technology application • Reservoir characterization • Improved reservoir recovery • Efficient development and operation Global opportunity prioritization delivering profitable volumes Proven track record of maximizing recovery through accurate resource characterization and efficient ongoing development. Resource Recovery Subsurface Characterization |

44 Abu Dhabi – Upper Zakum Pursuing innovative development approach • Artificial islands • Extended-reach drilling • Targeted well completions ExxonMobil Technology Center established, co-located with the operating organization Applying high-impact technology and cost effective design to maximize recovery from one of the world’s largest oil fields.

|

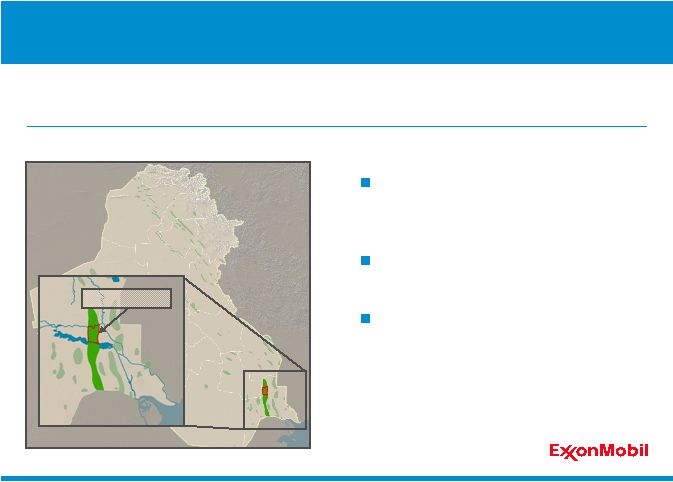

45 Iraq – West Qurna-1 Signed agreement in January 2010 • Effective date March 1, 2010 Completed initial production tests Leveraging global experience to achieve significant production ramp- up ExxonMobil is well-positioned to redevelop this field to achieve its maximum potential. Iraq West Qurna-1 |

46 0 5 10 15 20 25 2009 0 5 10 15 20 25 2009 Pursuit of quality exploration opportunities Disciplined project investment Selective investment in existing operations to add value ExxonMobil’s financial strength allows ongoing investment in our portfolio,

positioning us for future growth. Capital Spending $ B Upstream Capex Exploration Major New Projects Existing Operations |

47 Standardize Integrate Operate and Maintain Plan and Execute - Global best practice deployment delivers superior reliability and life cycle cost performance. Achieving superior reliability • Operated uptime 2% higher than assets operated-by-others Relentless focus on cost management • Efficiency identification and capture • Market savings capture Deployment of global best practices to new start-ups Operational Excellence |

48 0 1 2 3 4 5 '09 '10 '11 '12 '13 Production Outlook Production outlook delivered by strong base performance, high-quality projects, and new resource potential. 0 1 2 3 4 5 '09 '10 '11 '12 '13 Total Production Outlook MOEBD, net Project Volumes Base Production New Resource Additions Conventional Flow Streams Long-Plateau New Resource Additions MOEBD, net |

49 2009 Gas Marketing Activities New SPA’s Sales Start -ups Project Milestones Major 2009 Activities Alaska Pipeline Project Piceance Ph 1 South Hook Terminal Adriatic LNG Terminal PetroChina, Sinopec Petronet Tepco, Osaka Gas CPC Gorgon Jansz Qatar Mega - Trains, Al Khaleej Ph 2 Nigeria Domestic Power Plant Feed PNG LNG We leveraged our global gas marketing footprint to commercialize our natural gas resources. |

50 Significant gas portfolio of quality operations and advantaged projects,

spans all major markets, resource types, and contract structures. Projected Gas Sales Portfolio 69 TCF proved gas reserves* Diverse global portfolio Range of contracts ensures market access optionality Advantaged developments will secure future markets Gas Marketing Position Gas-Indexed Oil-Indexed Flexible Other 2010 ExxonMobil-Interest * ExxonMobil basis |

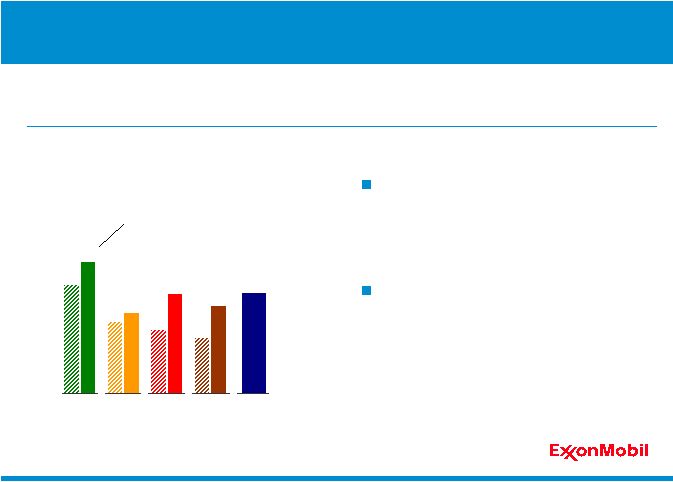

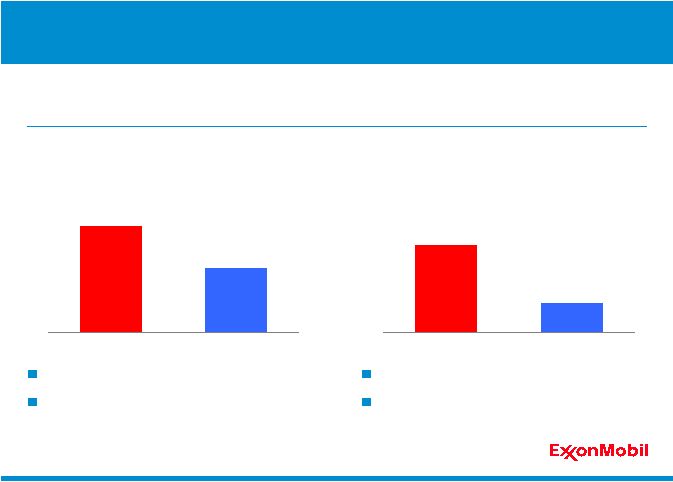

51 Reserves Replacement * Reserves based on SEC pricing bases, includes oil sands and equity companies; excludes

asset sales. ** Costs incurred in property acquisition & exploration plus development activities,

divided by proved oil-equivalent reserves additions, including purchases.

Competitor data estimated on a consistent basis with ExxonMobil, and based on

public information. ExxonMobil consistently replaces more reserves than we

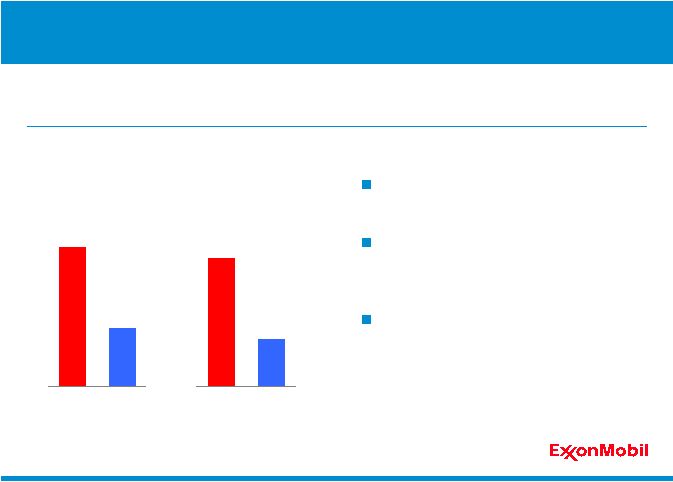

produce, at a lower cost than competitors. Reserves Replacement Cost** $ per OEB, '05-'08 Average Reserves Replacement Ratio* Percent, '05-'08 Average 0 50 100 150 XOM BP RDS CVX 0 5 10 15 20 XOM BP RDS CVX |

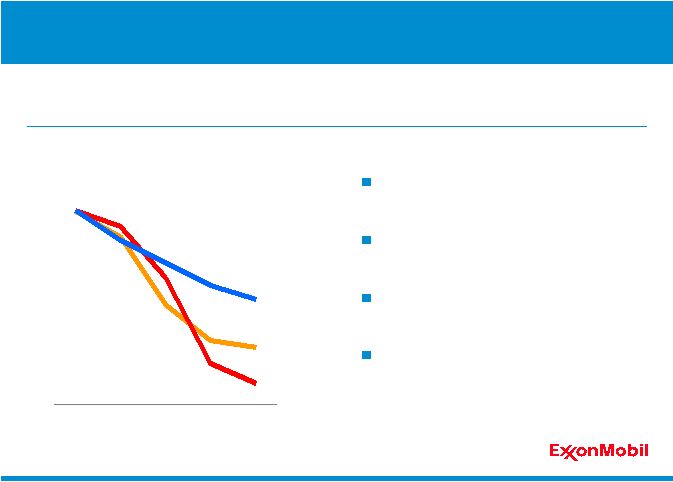

52 Mature contracting strategies • Capturing savings • Mitigated market impact Underpinned by operational excellence and disciplined approach We have effectively mitigated cost growth through the business cycle, delivering superior cost management. Cost Management 100 120 140 160 180 200 '04 '05 '06 '07 '08 Total Costs per OEB* CVX RDS BP XOM Indexed * Upstream technical costs normalized using 10-K/20-F information; 2009

competitor data not yet available. |

53 Significantly enhanced share value over 5-year period Annual average per share increase: • Production 6% • Reserves 8%** Underpinned by superior and consistent reserves replacement Delivered best production growth per share versus competition. Growth per Share 90 100 110 120 130 '05 '06 '07 '08 '09 Production per Share Indexed* CVX BP XOM RDS * Competitor data estimated on a consistent basis with ExxonMobil, and

based on public information. ** Reserves based on SEC pricing

bases, including oil sands and equity companies; 2008 reserves data used for

competitors as 2009 data not yet available |

54 * Competitor data estimated on a consistent basis with ExxonMobil, and based on public

information Strength of portfolio Benefit of disciplined approach Delivered over $2/BBL above nearest competitor over 5-year period Earnings per Barrel Underlying profitability of portfolio continues to ensure industry-leading

earnings per barrel. 0 4 8 12 16 20 XOM CVX RDS BP Earnings per Barrel* $ per OEB 2009 '05-'09, average |

55 * Competitor data estimated on a consistent basis with ExxonMobil, and based on public

information Our disciplined approach continues to deliver industry-leading

returns through business cycles. 2009 ROCE 23% Maintained consistent leadership position Underpinned by strong earnings and disciplined capital investment Upstream Return on Capital Employed 0 10 20 30 40 50 60 '05 '06 '07 '08 '09 Return on Average Capital Employed* Percent BP RDS XOM CVX |

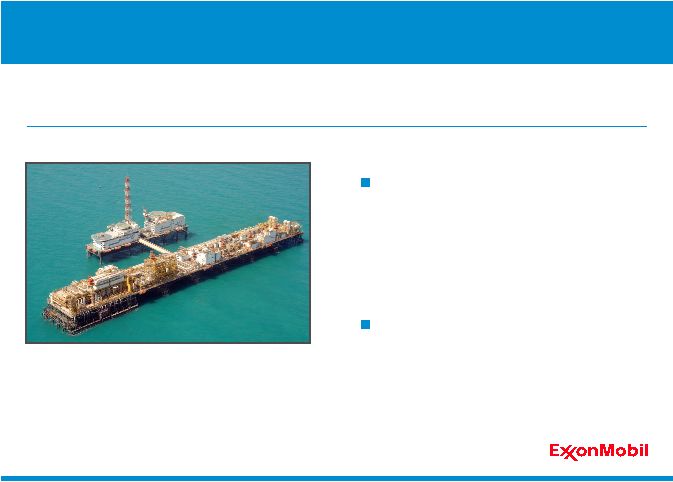

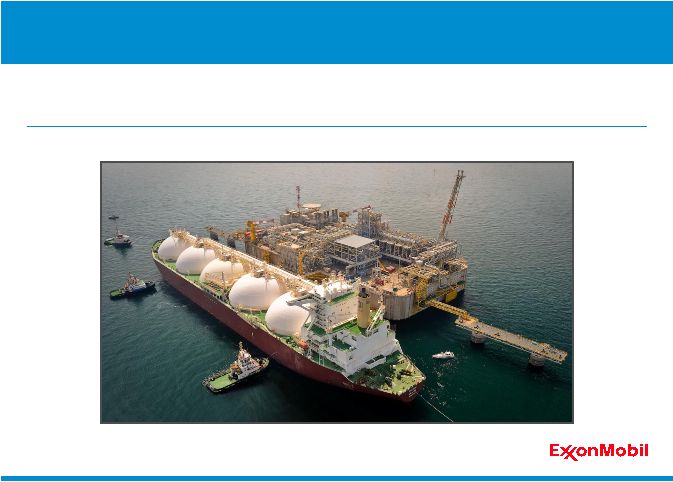

56 ExxonMobil is a significant LNG producer with a strong global position. LNG Adriatic LNG Terminal, Italy |

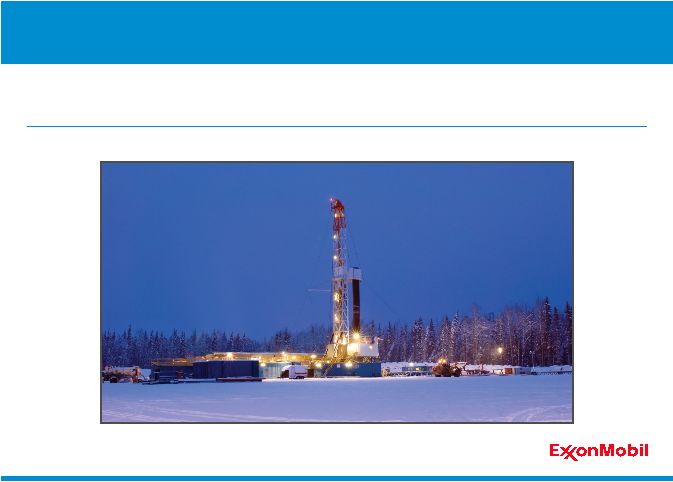

57 Our active exploration is building a leading global unconventional gas portfolio, and we are leveraging our technology to maximize asset value. Unconventional Gas Horn River Basin, Canada |

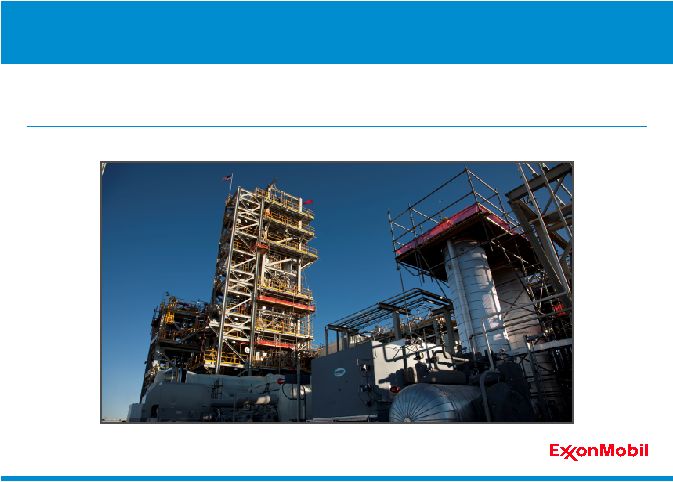

58 Controlled Freeze Zone technology has the potential to commercialize additional sour gas resources and assist meeting the global GHG challenge. Acid/Sour Gas Controlled Freeze Zone™ Demonstration Plant, Wyoming, U.S. TM |

59 We are well-placed to deliver our portfolio of projects, applying our experience and proprietary technology in this challenging environment. Arctic Sakhalin-1 Odoptu, Russia |

60 We have extensive oil sands experience and a high-quality project portfolio.

Heavy Oil / Oil Sands Cold Lake, Alberta, Canada |

61 Our industry-leading deepwater development capabilities will be deployed to

commercialize discoveries from our active exploration program. Deepwater Kizomba C Mondo FPSO, Angola |

62 Our attractive conventional assets are developed efficiently to maximize value, with best practices leveraged globally. Conventional Jerneh B, Malaysia |

63 Largest, highest-quality opportunity portfolio Successfully growing the portfolio Lowest life-cycle cost, exploration to production Proprietary suite of industry-leading technologies Uniquely positioned for attractive growth Upstream Summary ExxonMobil is well-positioned to continue to deliver superior value to our shareholders. |

Downstream Overview Don Humphreys Senior Vice President Mike Dolan Senior Vice President 64 |

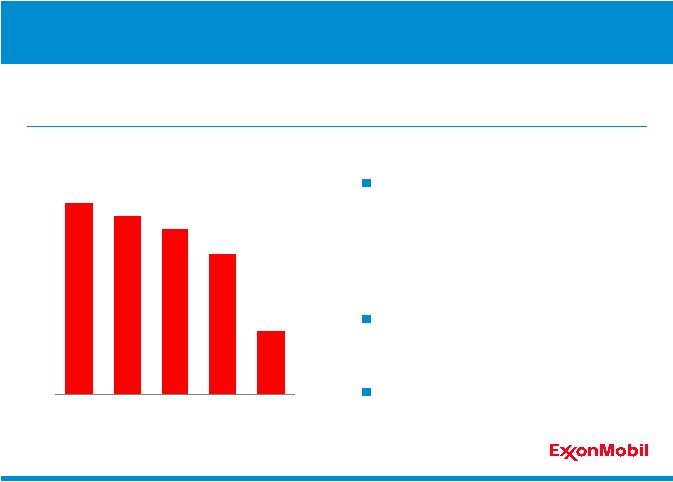

65 ExxonMobil delivers industry-leading Downstream ROCE. 2009 Downstream Highlights Earnings $ 1.8 B ROCE 7 % Refinery Throughput 5.4 MBD Petroleum Product Sales 6.4 MBD Capex $3.2 B |

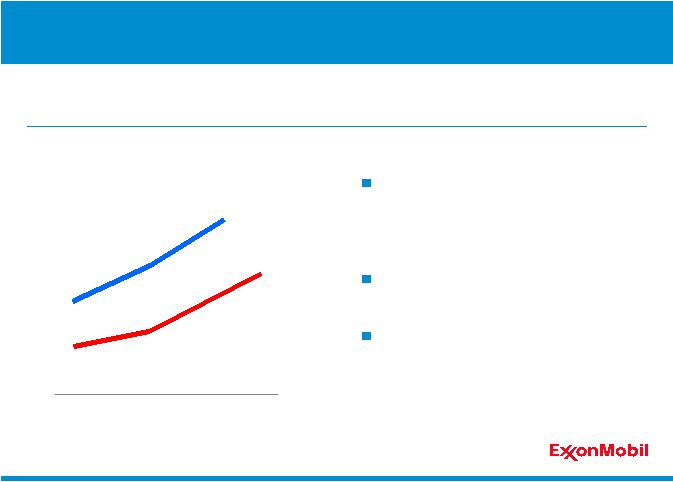

66 0 10 20 30 40 50 60 '05 '10 '15 '20 '25 '30 Downstream Industry Environment Transportation Energy Demand MOEBD OECD Non-OECD Source: ExxonMobil Outlook for Energy: A View to 2030 Long-term demand growth driven by developing countries Investments in new capacity impacting supply / demand balances Significant regulatory pressures continue Long-term demand is expected to increase, but the current business environment remains very challenging. |

67 Downstream Strategies Maintain best-in-class operations, in all respects Provide quality, valued products and services to our customers Lead industry in efficiency and effectiveness Capitalize on integration with other ExxonMobil businesses Selectively invest for resilient, advantaged returns Maximize value from leading-edge technologies Consistent strategies drive our performance in both high- and low-margin periods. |

68 Downstream Strengths Our Downstream strengths provide long-term competitive advantage. Technology Leadership Integration Capital Discipline Global Functional Organization Operational Excellence Efficiency |

69 Downstream Business Overview Refining & Supply Fuels Marketing Lubricants & Specialties Global refiner Highly integrated sites Diesel & cogen investments 6.3 MBD refining capacity Diverse portfolio U.S. retail transition Robust B2B businesses 28,000 retail sites Global brands Synthetic technology Growth opportunities 30 blend plants The ExxonMobil global Downstream portfolio is robust and includes unique integration synergies. |

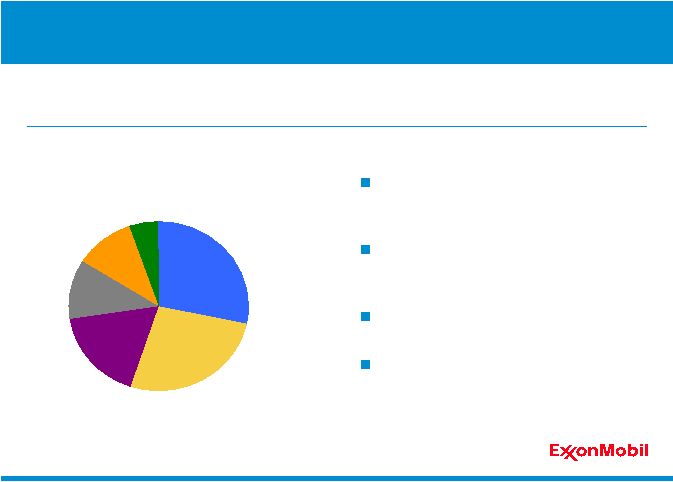

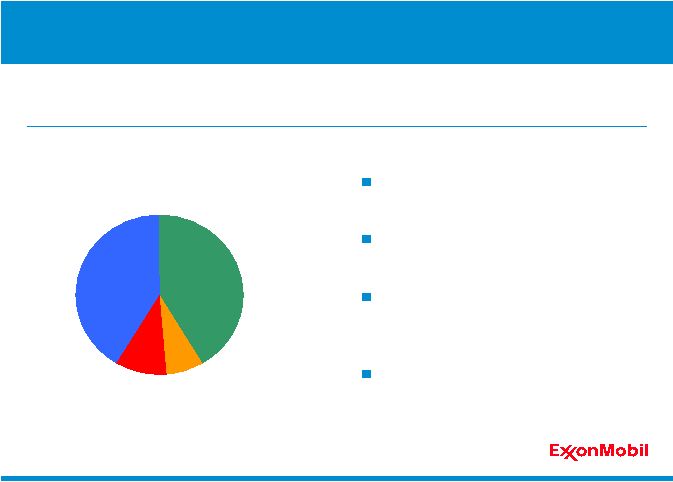

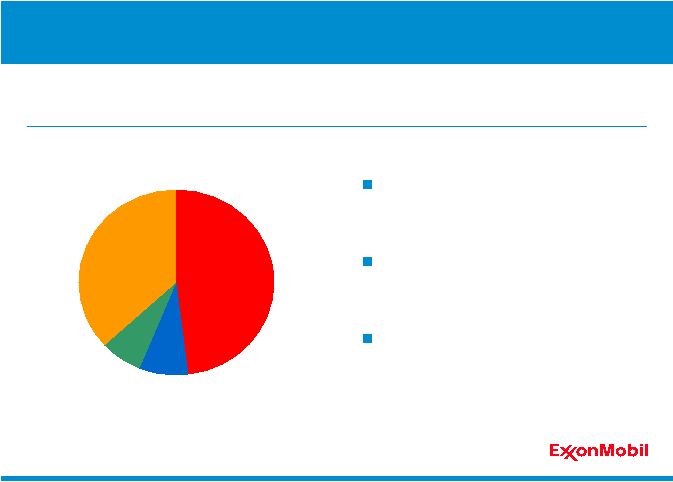

70 Diverse sales channels provide secure, ratable, and profitable outlets for our refineries. Access to broad spectrum of customer channels Global systems, work processes, and best practices Integrated Business Teams drive highest -value outlets Global Fuels Marketing Sales Aviation Marine Retail Industrial and Wholesale 48% 8% 7% 37% Fuels Marketing |

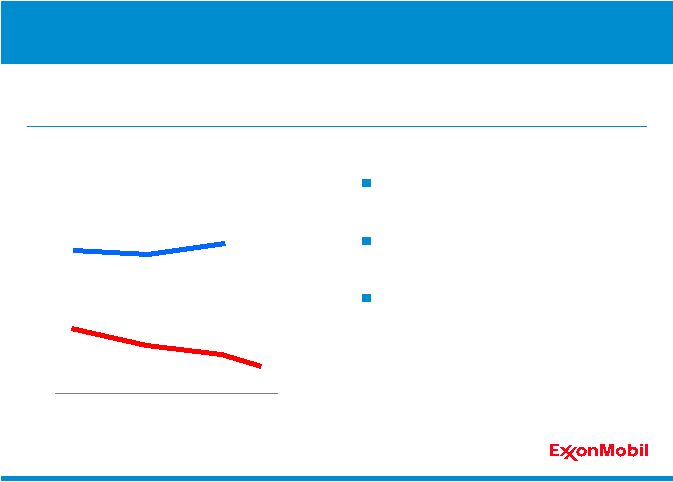

71 Operating Expense Global resources drive lower operating expenses • Functional organization • Systems • Processes Continuous focus on optimizing productivity Global solutions enhance ability to meet customer needs Indexed ExxonMobil’s competitive cost advantage is captured by global solutions. 85 90 95 100 '05 '06 '07 '08 '09 Operating Cost Efficiency – Fuels Marketing |

72 Average Capital Employed Indexed Productivity (Sales/Avg. Capital Employed) Indexed Asset optimization initiatives and productivity increases underpin improved results. 0 20 40 60 80 100 '05 '06 '07 '08 '09 0 50 100 150 '05 '06 '07 '08 '09 Focusing on long-term, sustainable growth areas High-grading assets and selectively investing in attractive opportunities Capital Productivity – Fuels Marketing |

73 Select Market Investments Efficient global business models Product Technology Basestock Manufacturing Well-positioned to capture value growth Integration advantages • Refining • Chemical Our Lubricants & Specialties business adds value by leveraging integration,

technology, and brands. Lubricants & Specialties |

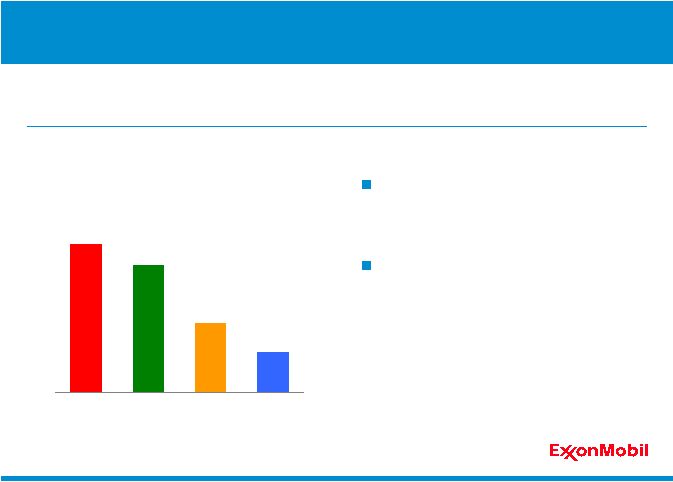

74 Source: ExxonMobil estimates based on available industry data and public information; YE

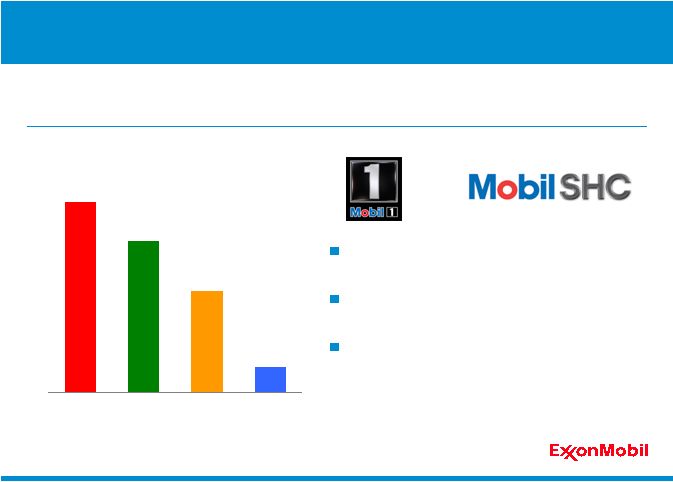

2009 Market leader in high-value synthetic lubes Legacy of technology leadership Global and reliable distribution network Globally recognized brands and leading-edge technology deliver value to our customers. Synthetic Market Share Percent 0 5 10 15 XOM BP RDS CVX Brands and Technology – Lubricants & Specialties |

75 -60 -40 -20 0 '05 '07 '09 Operational excellence Optimized asset base Consistent global processes Productive world-class workforce Operating Efficiencies Number, Percent Change Our focus on operating efficiencies drives long-term competitive advantage.

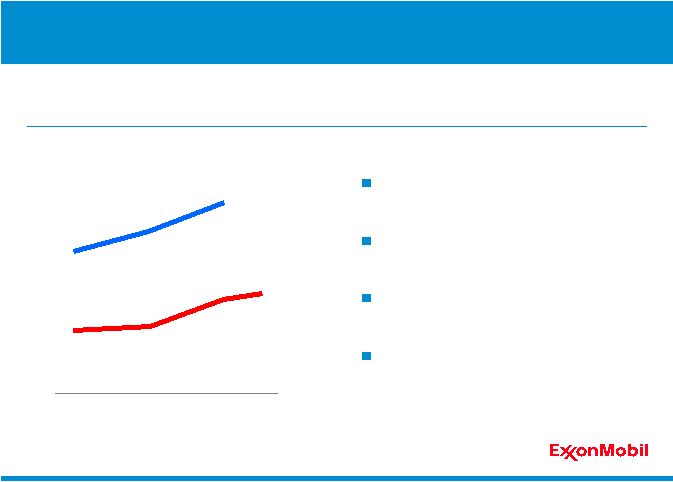

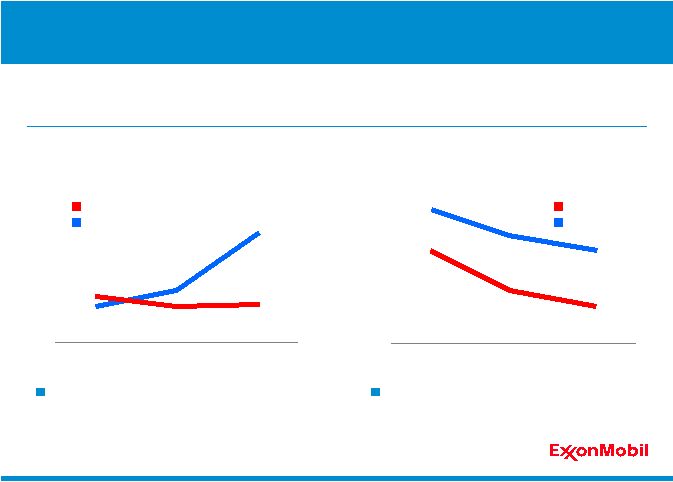

Products Blend Plants Order Centers Operating Efficiency – Lubricants & Specialties |

76 0 10 20 30 40 ExxonMobil Industry 0 10 20 30 40 ExxonMobil Industry Synthetic Lubricants Sales Growth Percent Change versus 2005 Source: ExxonMobil estimates based on available industry data and public

information * Passenger, commercial, and industrial finished lubricants

Developing Markets Sales Growth* Percent Change versus 2005 Equipment builder relationships Efficient business models Technology and brand leadership Superior growth Growing high-value opportunities faster than industry drives our strong performance. Growth – Lubricants & Specialties |

77 100 150 200 250 XOM BP RDS Industry Average Average Refinery Size KBD Refineries 60% larger than industry* • Most conversion capacity • High -performing assets • Efficient and cost effective • Disciplined operations • Proven project management skills Refining & Supply Largest lube basestock capacity ExxonMobil is the largest global refiner and has a scale advantage. Source: Equity share capacity calculated on consistent basis using public information; YE

2009 * ExxonMobil average global refinery distillation capacity compared to

industry |

78 Integration with Chemicals or Lubes Percent Integrated molecular optimization Higher-value products Common site management, utilities, and infrastructure Our integration with Chemicals or Lubes reduces costs and increases margins. 25 50 75 XOM RDS Industry BP Integration – Refining & Supply Source: Calculated on consistent basis using public information; YE 2009 |

79 Challenged Crudes* Throughput, Indexed * Crudes discounted in market due to properties that make them challenging to

process Lower-cost feedstocks improve margins Technology advantages • Virtual molecular assays • Expanding feed flexibility Processing 2X industry average • Increasing capability • Global real-time data sharing ExxonMobil improves margins by processing raw materials sold at a discount in the market. 80 100 120 140 160 '04 '05 '06 '07 '08 '09 Feed Flexibility – Refining & Supply |

80 90 100 110 120 130 '04 '06 '08 '09 Source: Solomon Associates fuels refining benchmarking data through '08 available on even

years; data at constant foreign exchange rates and energy prices; ExxonMobil

estimate for '09; Data indexed to ExxonMobil ('04) Unit Cash Operating Expense

Indexed ExxonMobil Industry Maintaining cost leadership • Global circuit average in top quartile Leveraging scale and integration Focusing on efficiency capture We continue to increase our cost advantage over the industry. Operating Cost Efficiency – Refining & Supply |

81 95 100 105 110 '04 '06 '08 '09 Source: Solomon Associates fuels refining benchmarking data through '08 available on even

years; ExxonMobil estimate for '09; Data indexed to ExxonMobil

('04) Energy Intensity ExxonMobil Cogeneration investments Global Energy Management System Energy saving investments worldwide Our energy efficiency initiatives improve our competitive advantage. Indexed Industry Energy Efficiency – Refining & Supply |

82 75 100 125 150 '04 '06 '08 '09 Personnel Indexed ExxonMobil Industry Our scale, global processes, and talented workforce drive superior productivity. High-quality workforce Extensive automation Global support / networks Standardized, state-of-the-art training Source: Solomon Associates fuels refining benchmarking data through '08 available on even

years; ExxonMobil estimate for '09; Data indexed to ExxonMobil ('04)

Personnel Efficiency – Refining & Supply |

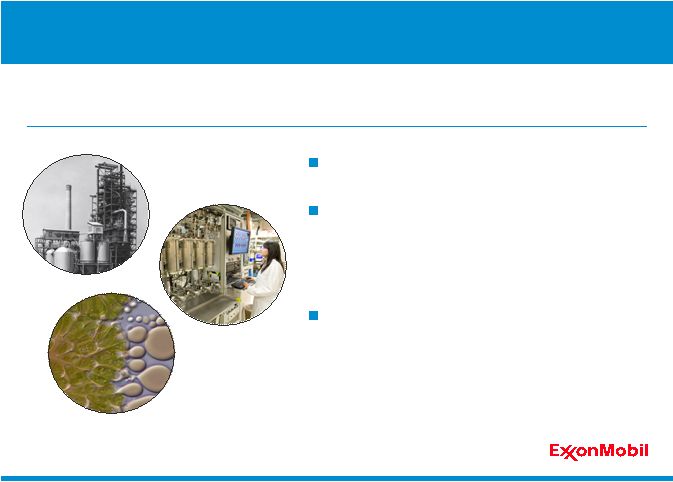

83 Legacy of technology leadership Near-term technologies include: • Advanced catalysts and processes • Heavy oil characterization and conversion • Energy efficiency / management Longer-term opportunities include: • Gasification • On-board hydrogen generation • Second generation biofuels (algae) ExxonMobil continues to build on our Downstream technology leadership to help provide the energy solutions the world needs today and for the future. Downstream Technology Leadership |

84 Downstream Portfolio Management Average Capital Employed $B 20 25 30 '99 '04 '09 We actively manage our capital employed through all parts of the business cycle. Disciplined capital management Robust portfolio management processes Significant portfolio activities* • 10 refineries • 5,000 miles of pipeline assets • 140 product terminals • 40 lube oil blend plants • 20,000 retail sites * Asset management activities, reductions YE 1999 – 2009 |

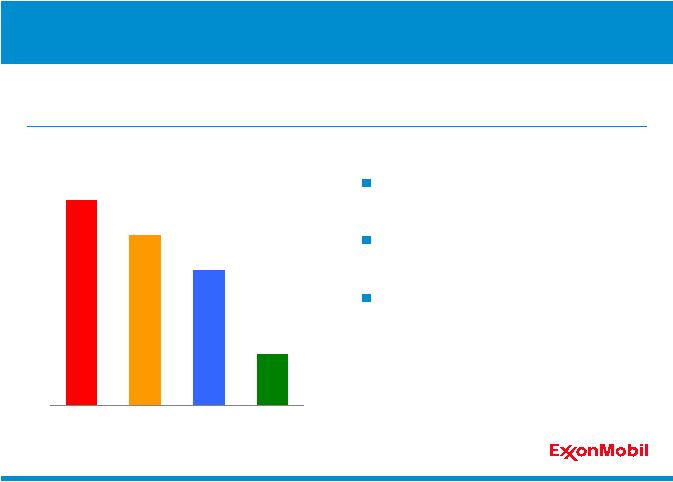

85 0 10 20 30 40 '00 '02 '04 '06 '08 '09 Proven business strategies Leveraging corporate strengths Well-managed portfolio * Competitor data estimated on a consistent basis with ExxonMobil, and based on

public information ** BP, RDS and CVX ExxonMobil Percent Return on Average Capital Employed* Average Average Competition** Operational excellence and capital discipline deliver advantaged returns for our shareholders. Downstream Return on Capital Employed |

Chemical Overview Mike Dolan Senior Vice President 86 |

87 One of the three largest chemical companies in the world Earnings $2.3 B ROCE 13.9 % Sales volume 24.8 MT Capex $3.1 B ExxonMobil Chemical financial performance exceeded our major chemical competitors. 2009 Chemical Highlights |

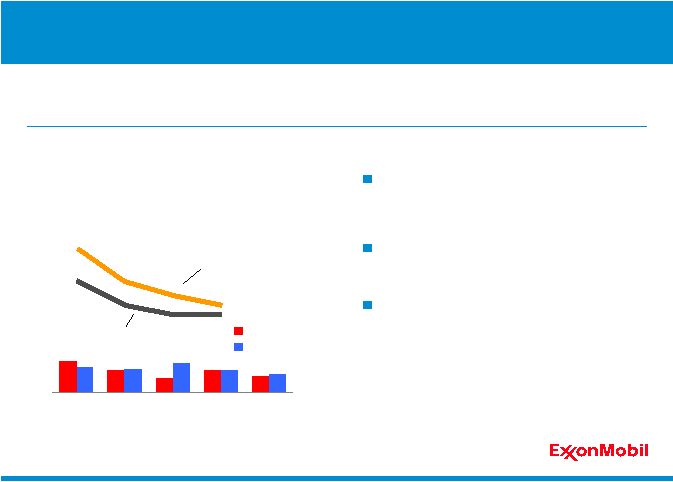

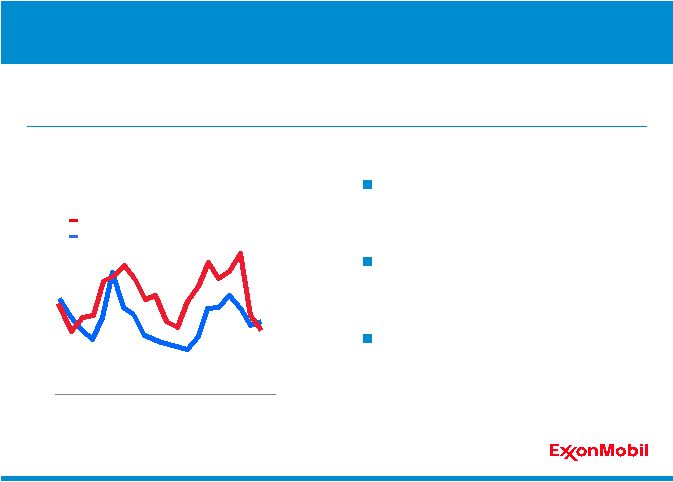

88 -3 0 3 6 9 12 '95 '00 '05 '10 '15 Global Demand Global demand growth above GDP Driven by penetration into new markets and material substitution • Significant sustainability benefits Asia Pacific 60% of future growth Our products feed a wide range of growing markets and applications. Commodities Demand and Global GDP Year-on-Year Change Percent * ExxonMobil estimates; Includes Polyethylene, Polypropylene, and Paraxylene Chemical Commodity Demand* Global GDP |

89 0 50 100 150 200 250 '90 '95 '00 '05 75 80 85 90 95 * ExxonMobil estimates; Includes Polyethylene, Polypropylene, and Paraxylene Chemical Industry Industry recovering from weak demand Additional capacity coming on stream Near -term margins weakened Chemical industry capacity utilization and margins are cyclical. Key Chemical Commodity Trends* Nominal Margin Indexed Capacity Utilization Percent Capacity Utilization Margin '09 |

90 Chemical Strategies Unique portfolio of global businesses Integration across ExxonMobil operations Relentless focus on operational excellence Disciplined investment in advantaged projects Technology leadership The consistent execution of our strategies over multiple business cycles is the foundation of our financial return leadership among our competitors.

|

91 0 1 2 3 4 5 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 Business Portfolio Commodities capture upside earnings potential at peak of cycle Specialties provide stable earnings base Over 90% of our businesses have a #1 or #2 global market position Our portfolio captures the benefits of scale from commodities while maximizing the value of specialties. Earnings $ B Commodity Specialty |

92 Integration and Feed Flexibility Our ability to extract value from integration is a competitive advantage. Crude and Feedstocks Commodities and Specialties Molecules upgraded to highest value Assets with unparalleled feed flexibility Shared facilities / best practices Refinery Chemical Plant |

93 Operational Excellence 80 100 120 140 '03 '05 '07 90 95 100 105 '03 '05 '07 Continuous improvement across business cycles Operating Costs* North America Steam Cracker Fixed Costs, Indexed ExxonMobil Industry Energy Intensity* Global Steam Cracker Energy Intensity, Indexed ExxonMobil Industry Global functional organization leverages best practices Source: Solomon Associates Our relentless focus on operational excellence in all aspects of our business creates a competitive advantage. * Only odd-year Solomon data available '03 – '07; Data indexed to ExxonMobil ('03) |

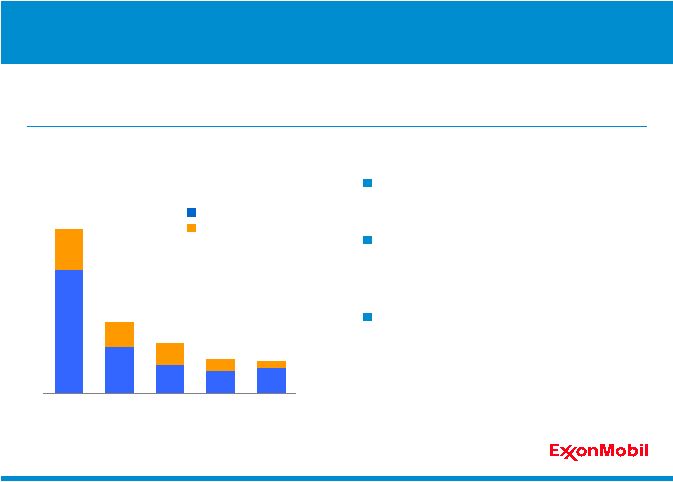

94 0 2 4 6 XOM RDS TOT CVX DOW Asia Pacific Growth We have been a key supplier in Asia Pacific and are increasing our capacity to meet future demand growth. Asia Pacific / Middle East Capacity Ethylene & Paraxylene Million Metric Tons Asia Pacific 60% of future growth Middle East exports strategic to support Asia Pacific growth Fujian start-up in 2009 Existing Announced Source: Chemical Market Associates, Incorporated |

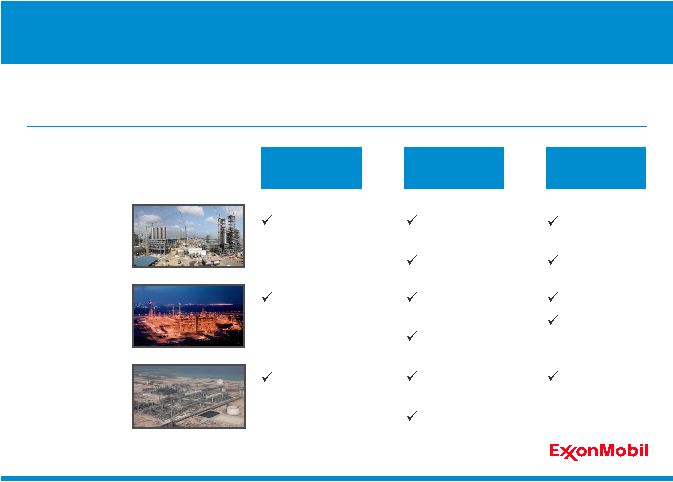

95 Advantaged Growth Projects Our major investments maximize returns through a unique combination of advantaged feeds, lower-cost processes, and premium products. Lower-Cost Processes Premium Products Advantaged Feeds Singapore Expansion Significant feed flexibility Qatar Petrochemical Complex Ethane Saudi Elastomers Ethane TPE / TPO Butyl Rubber Metallocene Polyethylene Elastomers Metallocene Polyethylene Proprietary Technology Scale Proprietary Technology Scale Proprietary Technology Scale |

96 Chemical Technology Advantaged feeds • High level of feed flexibility Lower-cost manufacturing processes • Advanced processes and catalysts • Improved energy efficiency and reliability Premium products • Innovative, higher-value products Development and deployment of industry-leading chemical technology provide a competitive advantage. |

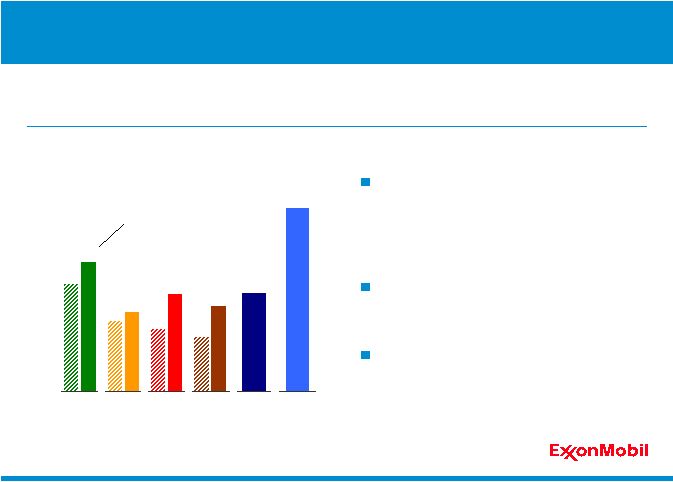

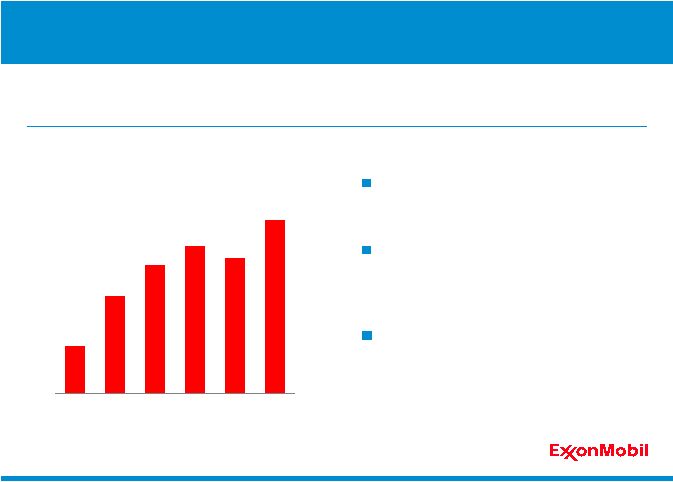

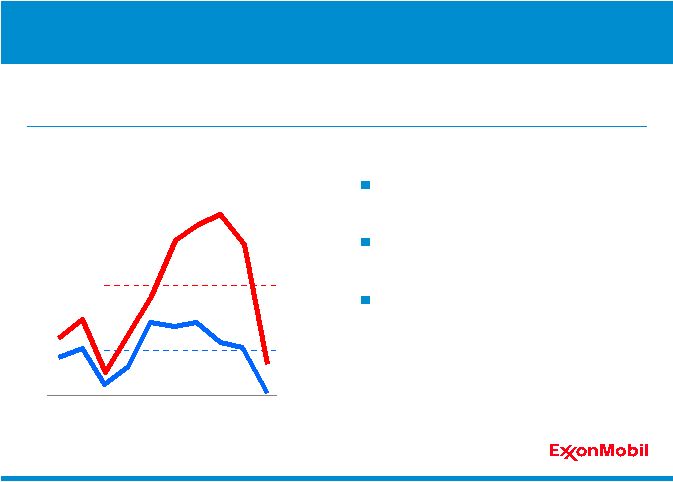

97 0 10 20 30 40 '95 '97 '99 '01 '03 '05 '07 '09 Chemical Return on Capital Employed Consistent strategy execution Unique scale and integration Unmatched financial performance ExxonMobil Chemical has outperformed our major competitors across the last cycle. Return on Average Capital Employed* Percent ExxonMobil Major Competitors** Average Average * Competitor data estimated on a consistent basis with ExxonMobil, and based

on public information ** BP (through '04), RDS (through '08), CVX, Dow

Chemical |

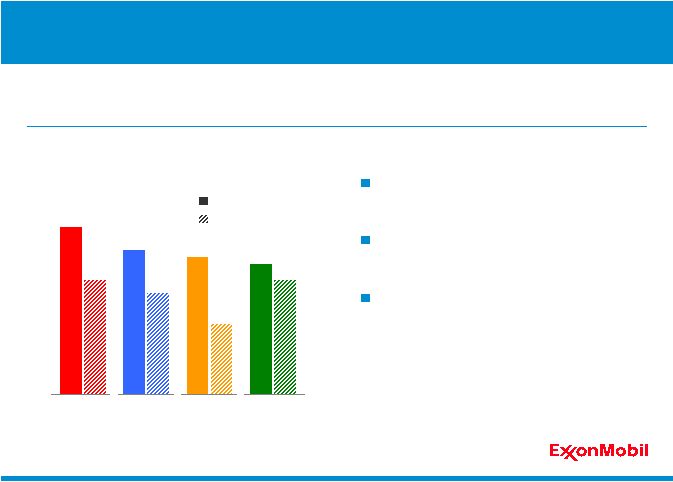

98 Summary Businesses optimized together to maximize shareholder value Combined 2002 – 2009 average annual results • $8.8B earnings • 22% ROCE ExxonMobil has unequaled performance across the Downstream and Chemical platforms. * ** *** Return on Average Capital Employed* 2002 - 2009 Percent 0 5 10 15 20 25 XOM XOM Downstream Chemical Competitor Average** Competitor Average*** Competitor data estimated on a consistent basis with ExxonMobil, and based on public information BP, RDS, CVX BP (through '04), RDS (through '08), CVX, Dow Chemical Industry-leading integration |

Summary Rex Tillerson Chairman and CEO 99 |

100 Proven Business Model ExxonMobil’s business model delivers superior results and provides a unique, competitive advantage. |

101 Risk Management Financial Geopolitical Environmental Technology We manage risk with well-developed processes and Board oversight.

|

102 -2 0 2 4 6 8 10 12 14 20 years 10 years 5 years * RDS, CVX and BP Percent Annualized Shareholder Returns Shareholder Value Financial results and stock market returns are best viewed over a longer time-frame, consistent with our investment horizon. ExxonMobil Competitor Average* S&P 500 |

103 ExxonMobil Industry-leading portfolio of businesses and assets Disciplined and consistent approach across the business Commitment to technology leadership Superior financial flexibility Relentless focus on maximizing long-term value Uniquely well-positioned for the future ExxonMobil is strong, resilient, and well-positioned for continued success.

|

104 XTO Energy Transaction – Strategic Incentives The agreement between ExxonMobil and XTO Energy will provide long-term benefits to shareholders in both companies. Outstanding resource base Extensive unconventional technical capabilities and operating expertise Complements ExxonMobil’s strengths Significant long-term growth potential Creation of a premier, global unconventional resource organization Sustainable, long-term value creation |

105 XTO Energy Transaction – Status Update The regulatory clearance process is proceeding as planned. Proxy Shareholder approval Regulatory clearance Timing |