Exhibit 99.3

Frequently Used Terms

Listed below are definitions of several of ExxonMobil’s key business and financial performance measures and

other terms. These definitions are provided to facilitate understanding of the terms and their calculation. In the case of financial measures that we believe constitute “non-GAAP financial measures” under Securities and Exchange Commission

Regulation G, we provide a reconciliation to the most comparable Generally Accepted Accounting Principles (GAAP) measure and other information required by that rule.

EARNINGS EXCLUDING ACCOUNTING CHANGE AND OTHER SPECIAL ITEMS

In addition to reporting U.S. GAAP defined net income,

ExxonMobil also presents a measure of earnings that excludes earnings from a required accounting change and other special items quantified and described in our quarterly and annual earnings press releases. Earnings excluding the aforementioned items

is a non-GAAP financial measure, and is included to facilitate comparisons of base business performance across periods. A reconciliation to net income is shown on page 5. We also refer to earnings excluding accounting changes and other special items

as normalized earnings. Earnings per share amounts use the same average common shares outstanding as used for the calculation of net income per common share and net income per common share – assuming dilution.

OPERATING COSTS

Operating costs are the combined total of

production, manufacturing, selling, general, administrative, exploration, depreciation, and depletion expenses from the Consolidated Statement of Income and ExxonMobil’s share of similar costs for equity companies. Operating costs are the costs

during the period to produce, manufacture, and otherwise prepare the company’s products for sale – including energy costs, staffing, maintenance, and other costs to explore for and produce oil and gas, and operate refining and chemical

plants. Distribution and marketing expenses are also included. Operating costs exclude the cost of raw materials, taxes, and interest expense. These expenses are on a before-tax basis. While ExxonMobil’s management is responsible for all

revenue and expense elements of net income, operating costs, as defined below, represent the expenses most directly under management’s control. Information regarding these costs is therefore useful for investors and ExxonMobil management in

evaluating management’s performance.

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Reconciliation of Operating Costs |

|

|

|

|

|

|

|

|

|

|

| From ExxonMobil’s Consolidated Statement of Income |

|

|

|

|

|

|

|

|

|

|

| Total costs and other deductions |

|

334,078 |

|

310,233 |

|

311,248 |

|

256,794 |

|

214,772 |

| Less: |

|

|

|

|

|

|

|

|

|

|

| Crude oil and product purchases |

|

199,498 |

|

182,546 |

|

185,219 |

|

139,224 |

|

107,658 |

| Interest expense |

|

400 |

|

654 |

|

496 |

|

638 |

|

207 |

| Sales-based taxes |

|

31,728 |

|

30,381 |

|

30,742 |

|

27,263 |

|

23,855 |

| Other taxes and duties |

|

40,953 |

|

39,203 |

|

41,554 |

|

40,954 |

|

37,645 |

| Income applicable to minority and preferred interests |

|

1,005 |

|

1,051 |

|

799 |

|

776 |

|

694 |

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

60,494 |

|

56,398 |

|

52,438 |

|

47,939 |

|

44,713 |

| ExxonMobil’s share of equity-company expenses |

|

5,619 |

|

4,947 |

|

4,520 |

|

4,209 |

|

3,937 |

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs |

|

66,113 |

|

61,345 |

|

56,958 |

|

52,148 |

|

48,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Components of Operating Costs |

|

|

|

|

|

|

|

|

|

|

| From ExxonMobil’s Consolidated Statement of Income |

|

|

|

|

|

|

|

|

|

|

| Production and manufacturing expenses |

|

31,885 |

|

29,528 |

|

26,819 |

|

23,225 |

|

21,260 |

| Selling, general, and administrative expenses |

|

14,890 |

|

14,273 |

|

14,402 |

|

13,849 |

|

13,396 |

| Depreciation and depletion |

|

12,250 |

|

11,416 |

|

10,253 |

|

9,767 |

|

9,047 |

| Exploration expenses, including dry holes |

|

1,469 |

|

1,181 |

|

964 |

|

1,098 |

|

1,010 |

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

60,494 |

|

56,398 |

|

52,438 |

|

47,939 |

|

44,713 |

| ExxonMobil’s share of equity-company expenses |

|

5,619 |

|

4,947 |

|

4,520 |

|

4,209 |

|

3,937 |

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs |

|

66,113 |

|

61,345 |

|

56,958 |

|

52,148 |

|

48,650 |

|

|

|

|

|

|

|

|

|

|

|

PRODUCTION SHARING CONTRACT NET INTEREST REDUCTIONS

Production Sharing Contract (PSC) net interest reductions are contractual reductions in ExxonMobil’s share of production volumes covered by PSCs. These reductions

typically occur when cumulative investment returns or production volumes achieve thresholds as specified in the PSCs. Once a net interest reduction has occurred, it typically will not be reversed by subsequent events, such as lower crude oil prices.

1

PRICE AND SPEND IMPACTS ON VOLUMES

Price and spend impacts on volumes are fluctuations in ExxonMobil’s share of production volumes caused by changes in oil and gas prices or spending levels from one period to another. For example, at higher prices

fewer barrels are required for ExxonMobil to recover its costs. According to the terms of contractual arrangements or government royalty regimes, price or spending variability can increase or decrease royalty burdens and/or volumes attributable to

ExxonMobil. These effects generally vary from period to period with field spending patterns or market prices for crude oil or natural gas.

CAPITAL

EMPLOYED

Capital employed is a measure of net investment. When viewed from the perspective of how the capital is used by the businesses, it includes

ExxonMobil’s net share of property, plant, and equipment and other assets less liabilities, excluding both short-term and long-term debt. When viewed from the perspective of the sources of capital employed in total for the Corporation, it

includes ExxonMobil’s share of total debt and shareholders’ equity. Both of these views include ExxonMobil’s share of amounts applicable to equity companies, which the Corporation believes should be included to provide a more

comprehensive measure of capital employed.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

|

2006 |

|

|

2005 |

|

|

2004 |

|

|

2003 |

|

| Business uses: asset and liability perspective |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

242,082 |

|

|

219,015 |

|

|

208,335 |

|

|

195,256 |

|

|

174,278 |

|

| Less liabilities and minority share of assets and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities excluding notes and loans payable |

|

(55,929 |

) |

|

(47,115 |

) |

|

(44,536 |

) |

|

(39,701 |

) |

|

(33,597 |

) |

| Total long-term liabilities excluding long-term debt and equity of minority and preferred shareholders in affiliated companies |

|

(50,543 |

) |

|

(45,905 |

) |

|

(41,095 |

) |

|

(41,554 |

) |

|

(37,839 |

) |

| Minority share of assets and liabilities |

|

(5,332 |

) |

|

(4,948 |

) |

|

(4,863 |

) |

|

(5,285 |

) |

|

(4,945 |

) |

| Add ExxonMobil share of debt-financed equity-company net assets |

|

3,386 |

|

|

2,808 |

|

|

3,450 |

|

|

3,914 |

|

|

4,151 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capital employed |

|

133,664 |

|

|

123,855 |

|

|

121,291 |

|

|

112,630 |

|

|

102,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total corporate sources: debt and equity perspective |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes and loans payable |

|

2,383 |

|

|

1,702 |

|

|

1,771 |

|

|

3,280 |

|

|

4,789 |

|

| Long-term debt |

|

7,183 |

|

|

6,645 |

|

|

6,220 |

|

|

5,013 |

|

|

4,756 |

|

| Shareholders’ equity |

|

121,762 |

|

|

113,844 |

|

|

111,186 |

|

|

101,756 |

|

|

89,915 |

|

| Less minority share of total debt |

|

(1,050 |

) |

|

(1,144 |

) |

|

(1,336 |

) |

|

(1,333 |

) |

|

(1,563 |

) |

| Add ExxonMobil share of equity-company debt |

|

3,386 |

|

|

2,808 |

|

|

3,450 |

|

|

3,914 |

|

|

4,151 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capital employed |

|

133,664 |

|

|

123,855 |

|

|

121,291 |

|

|

112,630 |

|

|

102,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN ON AVERAGE CAPITAL EMPLOYED (ROCE)

Return on average capital employed is a performance measure ratio. From the perspective of the business segments, ROCE is annual business segment earnings divided by average business segment capital employed (average

of beginning- and end-of-year amounts). These segment earnings include ExxonMobil’s share of segment earnings of equity companies, consistent with our capital employed definition, and exclude the cost of financing. The Corporation’s total

ROCE is net income excluding the after-tax cost of financing, divided by total corporate average capital employed. The Corporation has consistently applied its ROCE definition for many years and views it as the best measure of historical capital

productivity in our capital-intensive, long-term industry, both to evaluate management’s performance and to demonstrate to shareholders that capital has been used wisely over the long term. Additional measures, which are more cash-flow based,

are used to make investment decisions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

|

2006 |

|

|

2005 |

|

|

2004 |

|

|

2003 |

|

| Return on Average Capital Employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

40,610 |

|

|

39,500 |

|

|

36,130 |

|

|

25,330 |

|

|

21,510 |

|

| Financing costs (after tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross third-party debt |

|

(339 |

) |

|

(264 |

) |

|

(261 |

) |

|

(461 |

) |

|

(490 |

) |

| ExxonMobil share of equity companies |

|

(204 |

) |

|

(156 |

) |

|

(144 |

) |

|

(185 |

) |

|

(172 |

) |

| All other financing costs – net |

|

268 |

|

|

499 |

|

|

(35 |

) |

|

378 |

|

|

2,196 |

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total financing costs |

|

(275 |

) |

|

79 |

|

|

(440 |

) |

|

(268 |

) |

|

1,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings excluding financing costs |

|

40,885 |

|

|

39,421 |

|

|

36,570 |

|

|

25,598 |

|

|

19,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average capital employed |

|

128,760 |

|

|

122,573 |

|

|

116,961 |

|

|

107,339 |

|

|

95,373 |

|

|

|

|

|

|

|

| Return on average capital employed – corporate total |

|

31.8 |

% |

|

32.2 |

% |

|

31.3 |

% |

|

23.8 |

% |

|

20.9 |

% |

| (1) |

“All other financing costs – net” in 2003 includes interest income (after tax) associated with the settlement of a U.S. tax dispute. |

2

TOTAL SHAREHOLDER RETURN

Shareholder return measures the change in value of an investment in stock over a specified period of time, assuming dividend reinvestment. We calculate shareholder return over a particular measurement period by: dividing (1) the sum of

(a) the cumulative value of dividends received during the measurement period, assuming reinvestment, plus (b) the difference between the stock price at the end and at the beginning of the measurement period; by (2) the stock price at

the beginning of the measurement period. For this purpose, we assume dividends are reinvested in stock at market prices at approximately the same time actual dividends are paid. Shareholder return is usually quoted on an annualized basis.

CAPITAL AND EXPLORATION EXPENDITURES (Capex)

Capital

and exploration expenditures are the combined total of additions at cost to property, plant, and equipment and exploration expenses on a before-tax basis from the Consolidated Statement of Income. ExxonMobil’s Capex includes its share of

similar costs for equity companies. Capex excludes depreciation on the cost of exploration support equipment and facilities recorded to property, plant, and equipment when acquired. While ExxonMobil’s management is responsible for all

investments and elements of net income, particular focus is placed on managing the controllable aspects of this group of expenditures.

FINDING AND

RESOURCE-ACQUISITION COSTS

Finding and resource-acquisition costs per oil-equivalent barrel is a performance measure that is calculated using the

Exploration portion of Upstream capital and exploration expenditures and proved property acquisition costs divided by resource additions (in oil-equivalent barrels). ExxonMobil refers to new discoveries and acquisitions of discovered resources as

resource additions. In addition to proved reserves, resource additions include quantities of oil and gas that are not yet classified as proved reserves, but which ExxonMobil believes will likely be moved into the proved reserves category and

produced in the future.

|

|

|

|

|

|

|

|

|

|

|

| |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Exploration portion of Upstream capital and exploration expenditures (millions of dollars) |

|

1,909 |

|

2,044 |

|

1,693 |

|

1,283 |

|

1,215 |

| Proved property acquisition costs (millions of dollars) |

|

37 |

|

234 |

|

174 |

|

93 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Total exploration and proved property acquisition costs (millions of dollars) |

|

1,946 |

|

2,278 |

|

1,867 |

|

1,376 |

|

1,215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Resource additions (millions of oil-equivalent barrels) |

|

2,010 |

|

4,270 |

|

4,365 |

|

2,940 |

|

2,115 |

| Finding and resource-acquisition costs per oil-equivalent barrel (dollars) |

|

0.97 |

|

0.53 |

|

0.43 |

|

0.47 |

|

0.57 |

LIQUIDS AND NATURAL GAS PROVED RESERVES

In this report, we use the term “proved reserves” to mean quantities of oil and gas that ExxonMobil has determined to be reasonably certain of recovery under existing economic and operating conditions on the

basis of our long-standing, rigorous management review process. We only book proved reserves when we have made significant funding commitments for the related projects. In this report, we aggregate proved reserves of consolidated and equity

companies, excluding royalties and quantities due others, since ExxonMobil does not view these reserves differently from a management perspective. To reflect management’s view of ExxonMobil’s total liquids reserves, proved reserves in this

report also include oil sands reserves from Canadian Syncrude operations, which are reported separately as mining reserves in our Form 10-K and proxy statement. Oil sands reserves included in this report totaled 694 million barrels at year-end

2007, 718 million barrels at year-end 2006, 738 million barrels at year-end 2005, 757 million barrels at year-end 2004, and 781 million barrels at year-end 2003. For our own management purposes and as discussed in this report, we

determine proved reserves based on price and cost assumptions that are consistent with those used to make investment decisions. Therefore, the proved reserves in this report are not directly comparable to the data reported in our Form 10-K and proxy

statement. Based on regulatory guidance, ExxonMobil began in 2004 to state our results in the Form 10-K and proxy statement to reflect the impacts on proved reserves of utilizing December 31 liquids and natural gas prices (“year-end

price/cost effects”). On this basis, year-end proved reserves, including year-end price/cost effects, 2007 proved reserves totaled 22.5 billion oil-equivalent barrels, 22.8 billion oil-equivalent barrels in 2006, 22.4 billion oil-equivalent

barrels in 2005, and 21.7 billion oil-equivalent barrels in 2004. Excluding year-end price/cost effects, 2007 proved reserves totaled 22.7 billion oil-equivalent barrels, 2006 proved reserves totaled 22.7 billion oil-equivalent barrels, 2005 proved

reserves totaled 22.4 billion oil-equivalent barrels, while 2004 proved reserves totaled 22.2 billion oil-equivalent barrels.

RESOURCES, RESOURCE BASE,

AND RECOVERABLE RESOURCES

Resources, resource base, recoverable oil, recoverable hydrocarbons, recoverable resources, and similar terms used in this

report are the total remaining estimated quantities of oil and gas that are expected to be ultimately recoverable. In addition to proved reserves, the resource base includes quantities of oil and gas that are not yet classified as proved reserves,

but which ExxonMobil believes will likely be moved into the proved reserves category and produced in the future.

PROVED RESERVES REPLACEMENT RATIO

Proved reserves replacement ratio is a performance measure that is calculated using proved oil-equivalent reserves additions divided by oil-equivalent

production. Both proved reserves additions and production include amounts applicable to equity companies. The ratio usually reported by ExxonMobil excludes sales and year-end price/cost effects, and includes Canadian oil sands mining operations in

both additions and production volumes. See the definition of “liquids and natural gas proved reserves” above. When reporting the ratio, the listing of inclusions and exclusions are used as appropriate.

3

PROVED RESERVES REPLACEMENT COSTS

Proved reserves replacement costs per oil-equivalent barrel is a performance measure ratio. Proved reserves replacement costs per barrel are costs incurred in property acquisition and exploration, plus costs incurred

in development activities, divided by proved oil-equivalent reserves additions, excluding sales. Both the costs incurred and the proved reserves additions include amounts applicable to equity companies as well as Canadian oil sands operations and

exclude year-end price/cost effects. See the definition of “liquids and natural gas proved reserves” on the preceding page.

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Costs incurred |

|

|

|

|

|

|

|

|

|

|

| Property acquisition costs |

|

194 |

|

597 |

|

453 |

|

134 |

|

45 |

| Exploration costs |

|

1,762 |

|

1,685 |

|

1,420 |

|

1,255 |

|

1,181 |

| Development costs |

|

11,570 |

|

12,103 |

|

10,561 |

|

9,122 |

|

9,856 |

|

|

|

|

|

|

|

|

|

|

|

| Total costs incurred |

|

13,526 |

|

14,385 |

|

12,434 |

|

10,511 |

|

11,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (millions of barrels) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Proved oil-equivalent reserves additions |

|

|

|

|

|

|

|

|

|

|

| Revisions |

|

1,793 |

|

390 |

|

377 |

|

140 |

|

619 |

| Improved recovery |

|

35 |

|

29 |

|

31 |

|

28 |

|

116 |

| Extensions/discoveries |

|

251 |

|

881 |

|

1,461 |

|

1,809 |

|

961 |

| Purchases |

|

2 |

|

755 |

|

122 |

|

11 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

| Total oil-equivalent reserves additions |

|

2,081 |

|

2,055 |

|

1,991 |

|

1,988 |

|

1,698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proved reserves replacement costs (dollars per barrel) |

|

6.50 |

|

7.00 |

|

6.25 |

|

5.29 |

|

6.53 |

HEAVY OIL

Heavy oil, for the purpose of this report, includes heavy oil, extra heavy oil, and bitumen, as defined by the World Petroleum Congress in 1987 based on API gravity and viscosity at reservoir conditions. Heavy oil has an API gravity between

10 and 22.3 degrees. The API gravity of extra heavy oil and bitumen is less than 10 degrees. Extra heavy oil has a viscosity less than 10 thousand centipoise, whereas the viscosity of bitumen is greater than 10 thousand centipoise. The

term “oil sands” is used to indicate heavy oil (generally bitumen) that is recovered in a mining operation.

CASH FLOW FROM OPERATIONS AND

ASSET SALES

Cash flow from operations and asset sales is the sum of the net cash provided by operating activities and proceeds from sales of

subsidiaries, investments, and property, plant, and equipment from the Summary Statement of Cash Flows. This cash flow is the total sources of cash from both operating the Corporation’s assets and from the divesting of assets. The Corporation

employs a longstanding and regular disciplined review process to ensure that all assets are contributing to the Corporation’s strategic and financial objectives. Assets are divested when they are no longer meeting these objectives or are worth

considerably more to others. Because of the regular nature of this activity, we believe it is useful for investors to consider sales proceeds together with cash provided by operating activities when evaluating cash available for investment in the

business and financing activities, including shareholder distributions.

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Net cash provided by operating activities |

|

52,002 |

|

49,286 |

|

48,138 |

|

40,551 |

|

28,498 |

| Sales of subsidiaries, investments and property, plant, and equipment |

|

4,204 |

|

3,080 |

|

6,036 |

|

2,754 |

|

2,290 |

|

|

|

|

|

|

|

|

|

|

|

| Cash flow from operations and asset sales |

|

56,206 |

|

52,366 |

|

54,174 |

|

43,305 |

|

30,788 |

|

|

|

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO SHAREHOLDERS

The Corporation distributes cash to shareholders in the form of both dividends and share purchases. Shares are purchased both to reduce shares outstanding and to offset shares issued in conjunction with company

benefit plans and programs. For purposes of calculating distributions to shareholders, the Corporation only includes the cost of those shares purchased to reduce shares outstanding.

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Dividends paid to ExxonMobil shareholders |

|

7,621 |

|

7,628 |

|

7,185 |

|

6,896 |

|

6,515 |

| Cost of shares purchased to reduce shares outstanding |

|

28,000 |

|

25,000 |

|

16,000 |

|

8,000 |

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

| Distributions to ExxonMobil shareholders |

|

35,621 |

|

32,628 |

|

23,185 |

|

14,896 |

|

11,515 |

|

|

|

|

|

|

|

|

|

|

|

| Memo: Gross cost of shares purchased to offset shares issued under benefit plans and programs |

|

3,822 |

|

4,558 |

|

2,221 |

|

1,951 |

|

881 |

4

FUNCTIONAL EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2007 Quarters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (millions of dollars) |

|

First |

|

Second |

|

|

Third |

|

|

Fourth |

|

2007 |

|

|

2006 |

|

2005 |

|

|

2004 |

|

|

2003 |

|

| Net Income (U.S. GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

1,177 |

|

1,222 |

|

|

1,196 |

|

|

1,275 |

|

4,870 |

|

|

5,168 |

|

6,200 |

|

|

4,948 |

|

|

3,905 |

|

| Non-U.S. |

|

4,864 |

|

4,731 |

|

|

5,103 |

|

|

6,929 |

|

21,627 |

|

|

21,062 |

|

18,149 |

|

|

11,727 |

|

|

10,597 |

|

| Total |

|

6,041 |

|

5,953 |

|

|

6,299 |

|

|

8,204 |

|

26,497 |

|

|

26,230 |

|

24,349 |

|

|

16,675 |

|

|

14,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

839 |

|

1,745 |

|

|

914 |

|

|

622 |

|

4,120 |

|

|

4,250 |

|

3,911 |

|

|

2,186 |

|

|

1,348 |

|

| Non-U.S. |

|

1,073 |

|

1,648 |

|

|

1,087 |

|

|

1,645 |

|

5,453 |

|

|

4,204 |

|

4,081 |

|

|

3,520 |

|

|

2,168 |

|

| Total |

|

1,912 |

|

3,393 |

|

|

2,001 |

|

|

2,267 |

|

9,573 |

|

|

8,454 |

|

7,992 |

|

|

5,706 |

|

|

3,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

346 |

|

204 |

|

|

296 |

|

|

335 |

|

1,181 |

|

|

1,360 |

|

1,186 |

|

|

1,020 |

|

|

381 |

|

| Non-U.S. |

|

890 |

|

809 |

|

|

906 |

|

|

777 |

|

3,382 |

|

|

3,022 |

|

2,757 |

|

|

2,408 |

|

|

1,051 |

|

| Total |

|

1,236 |

|

1,013 |

|

|

1,202 |

|

|

1,112 |

|

4,563 |

|

|

4,382 |

|

3,943 |

|

|

3,428 |

|

|

1,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and financing |

|

91 |

|

(99 |

) |

|

(92 |

) |

|

77 |

|

(23 |

) |

|

434 |

|

(154 |

) |

|

(479 |

) |

|

1,510 |

|

| Accounting change |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (U.S. GAAP) |

|

9,280 |

|

10,260 |

|

|

9,410 |

|

|

11,660 |

|

40,610 |

|

|

39,500 |

|

36,130 |

|

|

25,330 |

|

|

21,510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share (dollars) |

|

1.64 |

|

1.85 |

|

|

1.72 |

|

|

2.15 |

|

7.36 |

|

|

6.68 |

|

5.76 |

|

|

3.91 |

|

|

3.24 |

|

| Net income per common share – assuming dilution (dollars) |

|

1.62 |

|

1.83 |

|

|

1.70 |

|

|

2.13 |

|

7.28 |

|

|

6.62 |

|

5.71 |

|

|

3.89 |

|

|

3.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting Change and Other Special Items |

|

|

|

|

|

|

|

|

|

|

|

| Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

| Non-U.S. |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

1,620 |

|

|

— |

|

|

1,700 |

|

| Total |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

1,620 |

|

|

— |

|

|

1,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

(200 |

) |

|

(550 |

) |

|

— |

|

| Non-U.S. |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

310 |

|

|

— |

|

|

— |

|

| Total |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

110 |

|

|

(550 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

| Non-U.S. |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

540 |

|

|

— |

|

|

— |

|

| Total |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

540 |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and financing |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

410 |

|

— |

|

|

— |

|

|

2,230 |

|

| Accounting change |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate total |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

410 |

|

2,270 |

|

|

(550 |

) |

|

4,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Excluding accounting change and other special items(1) |

|

|

|

|

|

|

|

|

|

|

|

| Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

1,177 |

|

1,222 |

|

|

1,196 |

|

|

1,275 |

|

4,870 |

|

|

5,168 |

|

6,200 |

|

|

4,948 |

|

|

3,905 |

|

| Non-U.S. |

|

4,864 |

|

4,731 |

|

|

5,103 |

|

|

6,929 |

|

21,627 |

|

|

21,062 |

|

16,529 |

|

|

11,727 |

|

|

8,897 |

|

| Total |

|

6,041 |

|

5,953 |

|

|

6,299 |

|

|

8,204 |

|

26,497 |

|

|

26,230 |

|

22,729 |

|

|

16,675 |

|

|

12,802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

839 |

|

1,745 |

|

|

914 |

|

|

622 |

|

4,120 |

|

|

4,250 |

|

4,111 |

|

|

2,736 |

|

|

1,348 |

|

| Non-U.S. |

|

1,073 |

|

1,648 |

|

|

1,087 |

|

|

1,645 |

|

5,453 |

|

|

4,204 |

|

3,771 |

|

|

3,520 |

|

|

2,168 |

|

| Total |

|

1,912 |

|

3,393 |

|

|

2,001 |

|

|

2,267 |

|

9,573 |

|

|

8,454 |

|

7,882 |

|

|

6,256 |

|

|

3,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

346 |

|

204 |

|

|

296 |

|

|

335 |

|

1,181 |

|

|

1,360 |

|

1,186 |

|

|

1,020 |

|

|

381 |

|

| Non-U.S. |

|

890 |

|

809 |

|

|

906 |

|

|

777 |

|

3,382 |

|

|

3,022 |

|

2,217 |

|

|

2,408 |

|

|

1,051 |

|

| Total |

|

1,236 |

|

1,013 |

|

|

1,202 |

|

|

1,112 |

|

4,563 |

|

|

4,382 |

|

3,403 |

|

|

3,428 |

|

|

1,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and financing |

|

91 |

|

(99 |

) |

|

(92 |

) |

|

77 |

|

(23 |

) |

|

24 |

|

(154 |

) |

|

(479 |

) |

|

(720 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate total |

|

9,280 |

|

10,260 |

|

|

9,410 |

|

|

11,660 |

|

40,610 |

|

|

39,090 |

|

33,860 |

|

|

25,880 |

|

|

17,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share (dollars) |

|

1.64 |

|

1.85 |

|

|

1.72 |

|

|

2.15 |

|

7.36 |

|

|

6.61 |

|

5.40 |

|

|

3.99 |

|

|

2.57 |

|

| Earnings per common share – assuming dilution (dollars) |

|

1.62 |

|

1.83 |

|

|

1.70 |

|

|

2.13 |

|

7.28 |

|

|

6.55 |

|

5.35 |

|

|

3.97 |

|

|

2.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

See Frequently Used Terms. |

5

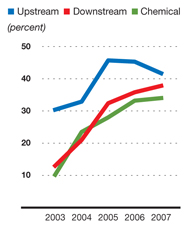

RETURN ON AVERAGE CAPITAL EMPLOYED(1) BY BUSINESS

|

|

|

|

|

|

|

|

|

|

|

| (percent) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Upstream |

|

|

|

|

|

|

|

|

|

|

| United States |

|

34.7 |

|

37.1 |

|

46.0 |

|

37.0 |

|

28.9 |

| Non-U.S. |

|

43.7 |

|

47.9 |

|

45.6 |

|

31.5 |

|

31.0 |

| Total |

|

41.7 |

|

45.3 |

|

45.7 |

|

32.9 |

|

30.4 |

|

|

|

|

|

|

|

|

|

|

|

| Downstream |

|

|

|

|

|

|

|

|

|

|

| United States |

|

65.1 |

|

65.8 |

|

58.8 |

|

28.6 |

|

16.7 |

| Non-U.S. |

|

28.7 |

|

24.5 |

|

22.6 |

|

18.0 |

|

11.5 |

| Total |

|

37.8 |

|

35.8 |

|

32.4 |

|

21.0 |

|

13.0 |

|

|

|

|

|

|

|

|

|

|

|

| Chemical |

|

|

|

|

|

|

|

|

|

|

| United States |

|

24.9 |

|

27.7 |

|

23.1 |

|

19.4 |

|

7.3 |

| Non-U.S. |

|

39.0 |

|

36.5 |

|

30.9 |

|

25.7 |

|

11.8 |

| Total |

|

34.0 |

|

33.2 |

|

28.0 |

|

23.5 |

|

10.2 |

|

|

|

|

|

|

|

|

|

|

|

| Corporate and financing |

|

NA |

|

NA |

|

NA |

|

NA |

|

NA |

|

|

|

|

|

|

|

|

|

|

|

| Corporate total |

|

31.8 |

|

32.2 |

|

31.3 |

|

23.8 |

|

20.9 |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Capital employed consists of shareholders’ equity and their

share of consolidated debt, including ExxonMobil’s share of amounts applicable to equity companies. See Frequently Used Terms. Return on Average Capital Employed

AVERAGE CAPITAL EMPLOYED(1) BY BUSINESS |

|

|

|

|

|

|

| (millions of dollars) |

|

2007 |

|

2006 |

|

2005 |

|

2004 |

|

2003 |

| Upstream |

|

|

|

|

|

|

|

|

|

|

| United States |

|

14,026 |

|

13,940 |

|

13,491 |

|

13,355 |

|

13,508 |

| Non-U.S. |

|

49,539 |

|

43,931 |

|

39,770 |

|

37,287 |

|

34,164 |

| Total |

|

63,565 |

|

57,871 |

|

53,261 |

|

50,642 |

|

47,672 |

|

|

|

|

|

|

|

|

|

|

|

| Downstream |

|

|

|

|

|

|

|

|

|

|

| United States |

|

6,331 |

|

6,456 |

|

6,650 |

|

7,632 |

|

8,090 |

| Non-U.S. |

|

18,983 |

|

17,172 |

|

18,030 |

|

19,541 |

|

18,875 |

| Total |

|

25,314 |

|

23,628 |

|

24,680 |

|

27,173 |

|

26,965 |

|

|

|

|

|

|

|

|

|

|

|

| Chemical |

|

|

|

|

|

|

|

|

|

|

| United States |

|

4,748 |

|

4,911 |

|

5,145 |

|

5,246 |

|

5,194 |

| Non-U.S. |

|

8,682 |

|

8,272 |

|

8,919 |

|

9,362 |

|

8,905 |

| Total |

|

13,430 |

|

13,183 |

|

14,064 |

|

14,608 |

|

14,099 |

|

|

|

|

|

|

|

|

|

|

|

| Corporate and financing |

|

26,451 |

|

27,891 |

|

24,956 |

|

14,916 |

|

6,637 |

|

|

|

|

|

|

|

|

|

|

|

| Corporate total |

|

128,760 |

|

122,573 |

|

116,961 |

|

107,339 |

|

95,373 |

|

|

|

|

|

|

|

|

|

|

|

| Average capital employed applicable to equity companies included above |

|

24,267 |

|

22,106 |

|

20,256 |

|

18,049 |

|

15,587 |

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Average capital employed is the average of beginning- and end-of-year business segment capital employed. |

| |

See Frequently Used Terms. |

Average Capital Employed

6