UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) | |

|

x Definitive Proxy Statement |

||

| ¨ Definitive Additional Materials | ||

| ¨ Soliciting Material Pursuant to §240.14a-12 | ||

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| NOTICE OF 2007 | ||||

| ANNUAL MEETING | ||||

| AND PROXY STATEMENT |

| |||

| April 11, 2007 | ||||

Dear Shareholder:

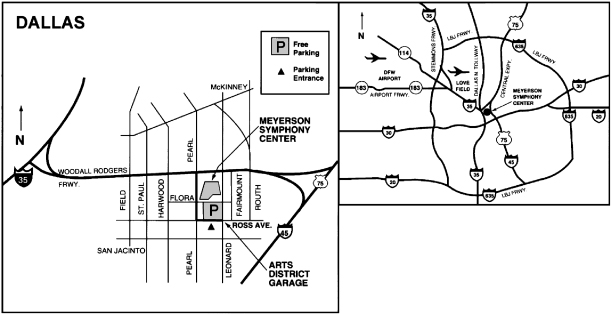

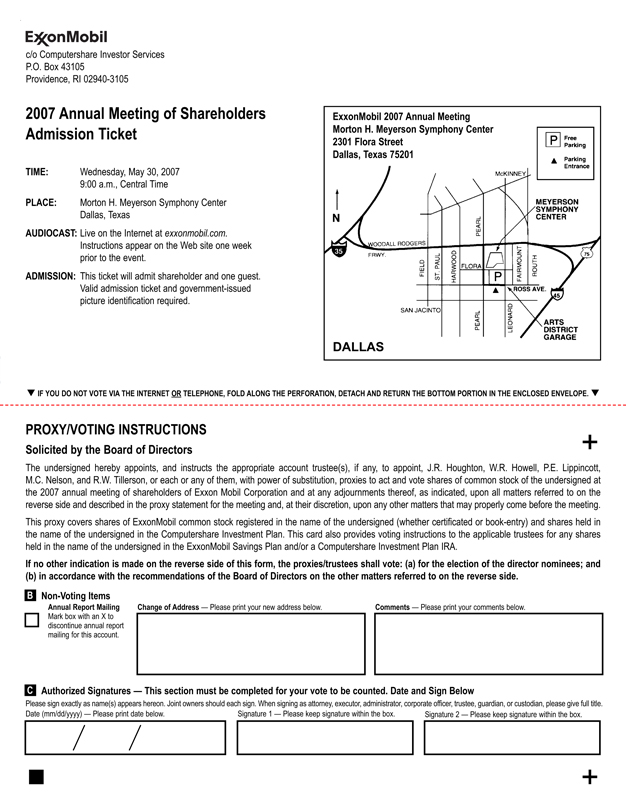

We invite you to attend the annual meeting of shareholders on Wednesday, May 30, 2007, at the Morton H. Meyerson Symphony Center, 2301 Flora Street, Dallas, Texas 75201. The meeting will begin promptly at 9:00 a.m., Central Time. At the meeting, you will hear a report on our business and vote on the following items:

| Ÿ | Election of directors; |

| Ÿ | Ratification of independent auditors; |

| Ÿ | Fifteen shareholder proposals; and, |

| Ÿ | Other matters if properly raised. |

Only shareholders of record on April 5, 2007, or their proxy holders may vote at the meeting. Attendance at the meeting is limited to shareholders or their proxy holders and ExxonMobil’s guests. Only shareholders or their valid proxy holders may address the meeting.

This booklet includes the formal notice of the meeting, proxy statement, and financial statements. The proxy statement tells you about the agenda, procedures, and rules of conduct for the meeting. It also describes how the Board operates, gives personal information about our director candidates, and provides information about the other items of business to be conducted at the meeting.

Even if you own only a few shares, we want your shares to be represented at the meeting. You can vote your shares by Internet, toll-free telephone call, or proxy card.

To attend the meeting in person, please follow the instructions on page 2. A live audiocast of the meeting and a report on the meeting will be available on our Web site at exxonmobil.com.

Sincerely,

|

| |||

| Henry H. Hubble | Rex W. Tillerson | |||

| Secretary | Chairman of the Board |

| Page | ||

| 1 | ||

| 4 | ||

| 4 | ||

| 12 | ||

| 15 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 31 | ||

| 43 | ||

| 44 | ||

| 45 | ||

| 45 | ||

| 47 | ||

| 47 | ||

| 48 | ||

| Item 7 – Shareholder Advisory Vote on Executive Compensation |

50 | |

| 51 | ||

| 52 | ||

| 53 | ||

| 54 | ||

| 55 | ||

| 57 | ||

| 58 | ||

| 60 | ||

| 61 | ||

| 62 | ||

| 64 | ||

| A1 | ||

| A66 | ||

Who May Vote

Shareholders of ExxonMobil, as recorded in our stock register on April 5, 2007, may vote at the meeting.

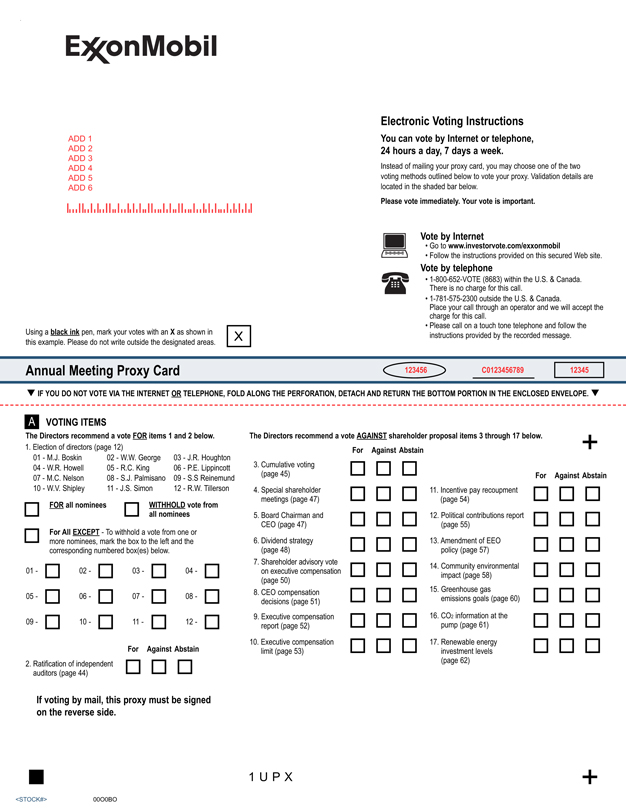

How to Vote

You may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting.

How Proxies Work

ExxonMobil’s Board of Directors is asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some, or none of our director candidates. You may also vote for or against the other proposals, or abstain from voting.

If your shares are held in your name, you can vote by proxy in one of three convenient ways:

| Ÿ | Via Internet: Go to www.investorvote.com/exxonmobil and follow the instructions. You will need to have your proxy card in hand. At this Web site, you can elect to access future proxy statements and annual reports via the Internet. |

| Ÿ | By telephone: Call toll-free 1-800-652-8683 (within the United States and Canada) or 1-781-575-2300 (outside the United States and Canada), and follow the instructions. You will need to have your proxy card in hand. |

| Ÿ | In writing: Complete, sign, date, and return your proxy card in the enclosed envelope. |

Your proxy card covers all shares registered in your name and shares held in your Computershare Investment Plan account. If you own shares in the ExxonMobil Savings Plan for employees and retirees, your proxy card also covers those shares.

If you give us your signed proxy but do not specify how to vote, we will vote your shares in favor of our director candidates; in favor of the ratification of the appointment of independent auditors; and against the shareholder proposals.

If you hold shares through someone else, such as a stockbroker, you will receive material from that firm asking how you want to vote. Check the voting form used by that firm to see if it offers Internet or telephone voting.

Voting Shares in the ExxonMobil Savings Plan

The trustee of the ExxonMobil Savings Plan will vote Plan shares as participants direct. To the extent participants do not give instructions, the trustee will vote shares as it thinks best. The proxy card serves to give voting instructions to the trustee.

Revoking a Proxy

You may revoke your proxy before it is voted at the meeting by:

| Ÿ | Submitting a new proxy with a later date via a proxy card, the Internet, or by telephone; |

| Ÿ | Notifying ExxonMobil’s Secretary in writing before the meeting; or, |

| Ÿ | Voting in person at the meeting. |

1

Confidential Voting

Independent inspectors count the votes. Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy card will be sent to us if you write comments on the card.

Quorum

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person. Treasury shares, which are shares owned by ExxonMobil itself, are not voted and do not count for this purpose.

Votes Required

| Ÿ | Election of Directors Proposal: A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular seat is elected for that seat. Only votes FOR or WITHHELD count. Abstentions are not counted for purposes of the election of directors. |

Our Corporate Governance Guidelines, which can be found in the Corporate Governance section of our Web site at exxonmobil.com/governance, state that all directors will stand for election at the annual meeting of shareholders. In any non-contested election of directors, any director nominee who receives a greater number of votes WITHHELD from his or her election than votes FOR such election shall tender his or her resignation. Within 90 days after certification of the election results, the Board of Directors will decide, through a process managed by the Board Affairs Committee and excluding the nominee in question, whether to accept the resignation. Absent a compelling reason for the director to remain on the Board, the Board shall accept the resignation. The Board will promptly disclose its decision and, if applicable, the reasons for rejecting the tendered resignation on Form 8-K filed with the Securities and Exchange Commission.

| Ÿ | Other Proposals: Approval of the Ratification of Independent Auditors proposal and the shareholder proposals requires the favorable vote of a majority of the votes cast. Only votes FOR or AGAINST these proposals count. Abstentions and broker non-votes count for quorum purposes, but not for the voting of these proposals. A “broker non-vote” occurs when a bank, broker, or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. |

Annual Meeting Admission

Only shareholders or their proxy holders and ExxonMobil’s guests may attend the meeting. For safety and security reasons, no cameras, camera phones, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the meeting. In addition, each shareholder and ExxonMobil guest will be asked to present a valid government-issued picture identification, such as a driver’s license, before being admitted to the meeting.

For registered shareholders, an admission ticket is attached to your proxy card. Please detach and bring the admission ticket with you to the meeting.

If your shares are held in the name of your broker, bank, or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 5, 2007, the record date for voting. You may receive an admission ticket in advance by sending a written request with proof of ownership to the address listed under “Contact Information” on the next page.

Shareholders who do not present admission tickets at the meeting will be admitted only upon verification of ownership at the admission counter.

2

Audiocast of the Annual Meeting

You are invited to visit our Web site at exxonmobil.com to hear the live audiocast of the meeting at 9:00 a.m., Central Time, on Wednesday, May 30, 2007. An archived copy of this audiocast will be available on our Web site for one year.

Conduct of the Meeting

The Chairman has broad responsibility and legal authority to conduct the annual meeting in an orderly and timely manner. This authority includes establishing rules for shareholders who wish to address the meeting. Only shareholders or their valid proxy holders may address the meeting. Copies of these rules will be available at the meeting. The Chairman may also exercise broad discretion in recognizing shareholders who wish to speak and in determining the extent of discussion on each item of business. In light of the number of business items on this year’s agenda and the need to conclude the meeting within a reasonable period of time, we cannot assure that every shareholder who wishes to speak on an item of business will be able to do so.

Dialogue can better be accomplished with interested parties outside the meeting and, for this purpose, we have provided a method for raising issues and contacting the non-employee directors either in writing or electronically via our Web site at exxonmobil.com/directors. The Chairman may also rely on applicable law regarding disruptions or disorderly conduct to ensure that the meeting is conducted in a manner that is fair to all shareholders. Shareholders making comments during the meeting must do so in English so that the majority of shareholders present can understand what is being said.

Contact Information

If you have questions or need more information about the annual meeting, write to:

Mr. Henry H. Hubble

Secretary

Exxon Mobil Corporation

5959 Las Colinas Boulevard

Irving, TX 75039-2298

call us at 1-972-444-1157,

or send a fax to us at 1-972-444-1505.

For information about shares registered in your name or your Computershare Investment Plan account, call ExxonMobil Shareholder Services at 1-800-252-1800 (within the United States and Canada), or 1-781-575-2058 (outside the United States and Canada), or access your account via the Web site at computershare.com/exxonmobil. We also invite you to visit ExxonMobil’s Web site at exxonmobil.com. Investor information can be found at exxonmobil.com/investorinfo. Web site materials are not part of this proxy solicitation.

3

Overview

The Board of Directors and its committees perform a number of functions for ExxonMobil and its shareholders, including:

| Ÿ | Overseeing the management of the Company on your behalf; |

| Ÿ | Reviewing ExxonMobil’s long-term strategic plans; |

| Ÿ | Exercising direct decision-making authority in key areas, such as declaring dividends; |

| Ÿ | Selecting the CEO and evaluating the CEO’s performance; and, |

| Ÿ | Reviewing development and succession plans for ExxonMobil’s top executives. |

The Board has adopted Corporate Governance Guidelines that govern the structure and functioning of the Board and set out the Board’s position on a number of governance issues. A copy of our current Corporate Governance Guidelines is posted on our Web site at exxonmobil.com/governance. The Guidelines are also available to any shareholder on request to the Secretary at the address given under “Contact Information” on page 3.

All ExxonMobil directors stand for election at the annual meeting. Non-employee directors cannot stand for election after they have reached age 72. Employee directors resign from the Board when they are no longer employed by ExxonMobil.

Director Independence

Our Corporate Governance Guidelines require that a substantial majority of the Board consist of independent directors. In general, the Guidelines require that an independent director must have no material relationship with ExxonMobil, directly or indirectly, except as a director. The Board determines independence on the basis of the standards specified by the New York Stock Exchange (NYSE); the additional categorical standards referenced in our Corporate Governance Guidelines; and other facts and circumstances the Board considers relevant.

The NYSE standards generally provide that a director will not be independent if: (1) the director is, or in the past three years has been, an employee of ExxonMobil; or a member of the director’s immediate family is, or in the past three years has been, an executive officer of ExxonMobil; (2) the director or a member of the director’s immediate family has received more than $100,000 per year in direct compensation from ExxonMobil other than for service as a director; (3) the director or a member of the director’s immediate family currently is a partner of PricewaterhouseCoopers LLP (PwC), our independent auditors; or an employee in PwC’s audit, assurance, or tax compliance practices; or within the past three years has been a PwC partner or employee who worked on ExxonMobil’s audit; (4) the director or a member of the director’s immediate family is, or in the past three years has been, employed as an executive officer of a company where an ExxonMobil executive officer serves on the compensation committee; or, (5) the director or a member of the director’s immediate family is an executive officer of a company that makes payments to, or receives payments from, ExxonMobil in an amount which, in any 12-month period during the past three years, exceeds the greater of $1 million or 2 percent of that other company’s consolidated gross revenues.

ExxonMobil’s Corporate Governance Guidelines also provide that a director will not be independent if a reportable “related person transaction” exists with respect to that director or a member of the director’s family for the current or most recently completed fiscal year. See the Guidelines for Review of Related Person Transactions posted on the Corporate Governance section of our Web site and described in more

4

detail under “Related Person Transactions and Procedures” below. The categorical standards provided in the Related Person Transaction Guidelines also serve as ExxonMobil’s additional categorical standards for determining director independence.

The Board has reviewed business and charitable relationships between ExxonMobil and each non-employee director to determine compliance with the NYSE standards and ExxonMobil’s additional categorical standards. The Board has also evaluated whether there are any other facts or circumstances that might impair a director’s independence. Based on that review, the Board has determined that all ExxonMobil non-employee directors and director nominees (M.J. Boskin, W.W. George, J.R. Houghton, W.R. Howell, R.C. King, P.E. Lippincott, H.A. McKinnell, M.C. Nelson, S.J. Palmisano, S.S Reinemund, and W.V. Shipley) are independent. The Board has also determined that each member of the Audit, Board Affairs, and Compensation Committees (see membership table below) is independent.

In recommending that each director and nominee be found independent, the Board Affairs Committee reviewed the following transactions, relationships, or arrangements. All matters described below fall within the NYSE and ExxonMobil independence standards.

| Name | Matters Considered | |

| J.R. Houghton |

Ordinary course business with Corning (purchases of chemical specialties; sales of chemical products and oil) | |

| H.A. McKinnell |

Ordinary course business with Pfizer (purchases of drilling analysis services, pharmaceuticals, chemicals, dyes, and test equipment; sales of chemical products and oil) | |

| M.C. Nelson |

Ordinary course business with Carlson (purchases of travel services; sales of lubricants) | |

| S.J. Palmisano |

Ordinary course business with IBM (purchases of consulting and IT maintenance services; sales of fuel and oil) | |

| S.S Reinemund |

Ordinary course business with PepsiCo (purchases of food, beverages, and merchandise for resale; sales of fuel and lubricants) |

The Committee also reviewed grants to nonprofit organizations with which each director or nominee is affiliated. No director or nominee is employed as an executive officer of any such organization, and all such matters fall within the NYSE and ExxonMobil independence standards.

Board Meetings and Committees; Annual Meeting Attendance

The Board met nine times in 2006. ExxonMobil’s incumbent directors, on average, attended approximately 96 percent of Board and committee meetings during 2006; and no director attended less than 75 percent of such meetings.

As specified in our Corporate Governance Guidelines, it is ExxonMobil’s policy that directors should make every effort to attend the annual meeting of shareholders. All incumbent directors attended last year’s meeting except for Mrs. Nelson.

ExxonMobil’s non-employee directors held eight executive sessions in 2006. Normally, the Chair of the Board Affairs Committee (Mr. Shipley) or the Chair of the Compensation Committee (Mr. Howell) presides at executive sessions on a rotational basis, but the non-employee directors may, in light of the subject matter under discussion, select another presiding director for a particular session.

The Board appoints committees to help carry out its duties. Board committees work on key issues in greater detail than would be possible at full Board meetings. Only non-employee directors may serve on the Audit, Compensation, Board Affairs, Contributions, and Public Issues Committees. Each Committee has a written charter. The charters are posted on the Corporate Governance section of our Web site and are available free of charge on request to the Secretary at the address given under “Contact Information” on page 3.

5

The table below shows the current membership of each Board committee and the number of meetings each Committee held in 2006.

| Director | Audit | Compensation | Board Affairs |

Contributions | Finance | Public Issues |

Executive(1) | |||||||

| M.J. Boskin |

Ÿ | Ÿ | C | |||||||||||

| W.W. George |

Ÿ | Ÿ | Ÿ | |||||||||||

| J.R. Houghton |

C | Ÿ | Ÿ | Ÿ | ||||||||||

| W.R. Howell |

Ÿ | C | Ÿ | Ÿ | ||||||||||

| R.C. King |

Ÿ | Ÿ | Ÿ | |||||||||||

| P.E. Lippincott |

Ÿ | Ÿ | Ÿ | Ÿ | ||||||||||

| H.A. McKinnell |

Ÿ | Ÿ | Ÿ | |||||||||||

| M.C. Nelson |

C | Ÿ | Ÿ | Ÿ | ||||||||||

| S.J. Palmisano |

Ÿ | Ÿ | Ÿ | |||||||||||

| W.V. Shipley |

Ÿ | C | Ÿ | |||||||||||

| R.W. Tillerson |

C | C | ||||||||||||

| 2006 Meetings |

11 | 6 | 7 | 3 | 2 | 3 | 1 |

| C | = Chair |

| Ÿ | = Member |

| (1) | Other directors serve as alternate members on a rotational basis. |

Below is additional information about each Board committee.

Board Affairs Committee

The Board Affairs Committee serves as ExxonMobil’s nominating and corporate governance committee. The Committee recommends director candidates, reviews non-employee director compensation, and reviews other corporate governance practices, including the Corporate Governance Guidelines. The Committee also reviews any issue involving an executive officer or director under ExxonMobil’s Code of Ethics and Business Conduct and administers ExxonMobil’s Related Person Transaction Guidelines.

The Committee has adopted Guidelines for the Selection of Non-Employee Directors that describe the qualifications the Committee looks for in director candidates. These Selection Guidelines, as well as the Committee’s charter, are posted on the Corporate Governance section of our Web site.

The Selection Guidelines provide that candidates for non-employee director of ExxonMobil should be individuals who have achieved prominence in their fields, with experience and demonstrated expertise in managing large, relatively complex organizations, and/or, in a professional or scientific capacity, be accustomed to dealing with complex situations preferably with worldwide scope.

A substantial majority of the Board must meet the independence standards described in the Corporation’s Corporate Governance Guidelines, and all candidates must be free from any relationship with management or the Corporation that would interfere with the exercise of independent judgment. Candidates should be committed to representing the interests of all shareholders and not any particular constituency.

The Board believes a director should be able to serve for at least several years. Candidates should bring integrity, insight, energy, and analytical skills to Board deliberations, and must have a commitment to devote the necessary time and attention to oversee the affairs of a corporation as large and complex as ExxonMobil. ExxonMobil recognizes that the strength and effectiveness of the Board reflect the balance, experience, and diversity of the individual directors; their commitment; and importantly, the ability of

6

directors to work effectively as a group in carrying out their responsibilities. ExxonMobil seeks candidates with diverse backgrounds who possess knowledge and skills in areas of importance to the Corporation. The Board must include members with particular experience required for service on key Board committees, as described in the committee charters on our Web site.

The Committee identifies director candidates primarily through recommendations made by the non-employee directors. These recommendations are developed based on the directors’ own knowledge and experience in a variety of fields, and research conducted by ExxonMobil staff at the Committee’s direction. The Committee also considers recommendations made by the employee directors, shareholders, and others, including search firms. The Committee has the authority to engage consultants to help identify or evaluate potential director nominees but has not done so recently. All recommendations, regardless of the source, are evaluated on the same basis against the criteria contained in the Selection Guidelines.

The recommendation of Mr. Reinemund was made by the incumbent non-employee directors on the Board Affairs Committee.

Shareholders may send recommendations for director candidates to the Secretary at the address given under “Contact Information” on page 3. A submission recommending a candidate should include:

| Ÿ | Sufficient biographical information to allow the Committee to evaluate the candidate in light of the Selection Guidelines; |

| Ÿ | Information concerning any relationship between the candidate and the shareholder recommending the candidate; and, |

| Ÿ | Material indicating the willingness of the candidate to serve if nominated and elected. |

The procedures by which shareholders may recommend nominees have not changed materially since last year’s proxy statement.

The Committee is also responsible for reviewing and making recommendations to the Board regarding the compensation of the non-employee directors. The Committee uses an outside consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

Audit Committee

The Audit Committee oversees accounting and internal control matters. Its responsibilities include oversight of:

| Ÿ | Management’s conduct of the Corporation’s financial reporting process; |

| Ÿ | The integrity of the financial statements and other financial information provided by the Corporation to the Securities and Exchange Commission (SEC) and the public; |

| Ÿ | The Corporation’s system of internal accounting and financial controls; |

| Ÿ | The Corporation’s compliance with legal and regulatory requirements; |

| Ÿ | The performance of the Corporation’s internal audit function; |

| Ÿ | The independent auditors’ qualifications, performance, and independence; and, |

| Ÿ | The annual independent audit of the Corporation’s financial statements. |

The Committee has direct authority and responsibility to appoint (subject to shareholder ratification), compensate, retain, and oversee the independent auditors.

The Committee also prepares the report that the SEC rules require be included in the Corporation’s annual proxy statement. This report is on pages 43-44.

7

The Committee has adopted specific policies and procedures for pre-approving fees paid to the independent auditors. These policies and procedures, as well as the Committee’s charter, are posted on the Corporate Governance section of our Web site.

The Board has determined that all members of the Committee are financially literate within the meaning of the NYSE standards, and that Mr. Houghton, Mr. Howell, and Mr. Lippincott are “audit committee financial experts” as defined in the SEC rules.

Compensation Committee

The Compensation Committee oversees compensation for ExxonMobil’s senior executives, including their salary, bonus, and incentive awards, as well as succession plans for key executive positions. The Committee’s charter is available on the Corporate Governance section of our Web site.

During 2006, the Committee reviewed the planning basis for the 2006 short term and long term incentive award programs; the salary program for 2007; changes in the SEC disclosure rules; executive perquisites; ExxonMobil’s benefit programs; the individual performance and contributions of each senior executive; individual incentive awards and salaries for the senior executives; and, progress on executive development and succession planning for senior positions.

The Compensation Committee’s report is on page 18.

The Committee does not delegate its responsibilities with respect to ExxonMobil’s executive officers and other senior executives (approximately 32 individuals). For other employees, the Committee delegates authority to determine individual salaries and incentive awards to a committee consisting of the Chairman and the Senior Vice Presidents of the Corporation. That committee’s actions are subject to a salary budget and aggregate annual ceilings on cash and equity incentive awards established by the Compensation Committee.

The Committee utilizes the expertise of an external consultant, Pearl Meyer & Partners, whom the Committee retains and works with during the year and who provides insight into compensation trends and issues. The consultant also provides a perspective on the structure and competitive standing of the ExxonMobil compensation program for senior executives. Pearl Meyer & Partners does not provide other services to ExxonMobil beyond supporting the Committee and assisting the Board Affairs Committee on non-employee director compensation. ExxonMobil management uses different consulting firms to advise on ExxonMobil’s general employee compensation and benefit programs. The Chair of the Compensation Committee negotiates the terms of Pearl Meyer & Partners’ engagement.

The Committee meets with ExxonMobil’s Chairman and other senior executives during the year to review the Corporation’s business results and progress against strategic plans. The Committee uses this input to help determine the aggregate annual ceilings to be set for the Corporation’s cash and equity incentive award programs. The Chairman also provides input to the Committee regarding performance assessments for ExxonMobil’s other senior executives and makes recommendations to the Committee with respect to salary and incentive awards for these executives and succession planning for senior positions.

The Committee uses tally sheets to assess total compensation for the Corporation’s senior executives. The tally sheets value all elements of cash compensation; incentive awards, including restricted stock grants; the annual change in pension value; and other benefits and perquisites. The tally sheets also display the value of outstanding awards and lump sum pension estimates. For tally sheet purposes, the Committee considers restricted stock awards on the basis of grant date fair value as shown in the “Grants of Plan-Based Awards” table, not on the financial accounting method used for the “Summary Compensation Table.”

See the “Compensation Discussion and Analysis” beginning on page 19 for more information on the Committee’s approach to executive compensation and the decisions made by the Committee for 2006.

8

Advisory Committee on Contributions

The Advisory Committee on Contributions reviews the level of ExxonMobil’s support for education and other public service programs, including the Company’s contributions to the ExxonMobil Foundation. The Foundation works to improve the quality of education in America at all levels, with special emphasis on math and science. The Foundation also supports the Company’s other cultural and public service giving. The Committee’s charter is available on the Corporate Governance section of our Web site.

Finance Committee

The Finance Committee reviews ExxonMobil’s financial policies and strategies, including our capital structure, dividends, and share repurchase program. The Committee authorizes the issuance of corporate debt subject to limits set by the Board. The Committee’s charter is available on the Corporate Governance section of our Web site.

Public Issues Committee

The Public Issues Committee reviews the effectiveness of the Corporation’s policies, programs, and practices with respect to safety, health, the environment, and social issues. The Committee hears reports from operating units on safety and environmental activities. The Committee also visits operating sites to observe and comment on current operating practices. The Committee’s charter is available on the Corporate Governance section of our Web site.

Executive Committee

The Executive Committee has broad power to act on behalf of the Board. In practice, the Committee meets only when it is impractical to call a meeting of the full Board.

Shareholder Communications

The Board Affairs Committee has approved and implemented procedures for shareholders and other interested persons to send communications to individual directors or the non-employee directors as a group.

| Ÿ | Written Communications: Written correspondence should be addressed to the director or directors in care of the Secretary at the address given under “Contact Information” on page 3. All correspondence will either be forwarded to the intended recipient and to the Chair of the Board Affairs Committee, as appropriate, or held for review at the next regular Board meeting. A log of all correspondence addressed to the directors will also be kept for periodic review by the Board Affairs Committee and any other interested director. |

| Ÿ | Electronic Communications: You may also send e-mail to individual non-employee directors or the non-employee directors as a group by using the form provided for that purpose on our Web site at exxonmobil.com/directors. These communications are sent directly to the specified director’s electronic mailbox. E-mail can be viewed by staff of the Office of the Secretary, but can only be deleted by the director to whom it is addressed. More information about our procedures for handling communications to non-employee directors is posted on the Corporate Governance section of our Web site. |

Code of Ethics and Business Conduct

The Board maintains policies and procedures (which we refer to in this proxy statement as the “Code”) that represent both the code of ethics for the principal executive officer, principal financial officer, and principal accounting officer under SEC rules, and the code of business conduct and ethics for directors, officers, and employees under NYSE listing standards. The Code applies to all directors, officers, and employees. The Code includes a Conflicts of Interest Policy under which directors, officers, and employees are expected to avoid any actual or apparent conflict between their own personal interests and the interests of the Corporation.

9

The Code is posted on the Corporate Governance section of our Web site and is available free of charge on request to the Secretary at the address given under “Contact Information” on page 3. The Code is also included as an exhibit to our Annual Report on Form 10-K. Any amendment of the Code will be promptly posted on our Web site.

The Corporation maintains procedures for administering and reviewing potential issues under the Code, including procedures that allow employees to make complaints without identifying themselves. The Corporation also conducts periodic mandatory business practice training sessions and requires each regular employee and non-employee director to make an annual compliance certification.

The Board Affairs Committee will initially review any suspected violation of the Code involving an executive officer or director and will report its findings to the Board. The Board does not envision that any waiver of the Code will be granted. Should such a waiver occur, it will be promptly disclosed on our Web site.

Related Person Transactions and Procedures

In accordance with SEC rules, ExxonMobil maintains Guidelines for Review of Related Person Transactions. These Guidelines are available on the Corporate Governance section of our Web site.

In accordance with the Related Person Transaction Guidelines, all executive officers, directors, and director nominees are required to identify, to the best of their knowledge after reasonable inquiry, business and financial affiliations involving themselves or their immediate family members that could reasonably be expected to give rise to a reportable related person transaction. Covered persons must also advise the Secretary of the Corporation promptly of any change in the information provided, and will be asked periodically to review and re-affirm their information.

For the above purposes, “immediate family member” includes a person’s spouse, parents, siblings, children, in-laws, and step-relatives.

Based on this information, we review the Company’s own records and make follow-up inquiries as may be necessary to identify potentially reportable transactions. A report summarizing such transactions and including a reasonable level of detail is then provided to the Board Affairs Committee. The Committee oversees the Related Person Transaction Guidelines generally and reviews specific items to assess materiality.

In assessing materiality for this purpose, information will be considered material if, in light of all the circumstances, there is a substantial likelihood a reasonable investor would consider the information important in deciding whether to buy or sell ExxonMobil stock or in deciding how to vote shares of ExxonMobil stock. A director will abstain from the decision on any transactions involving that director or his or her family members.

Under SEC rules, certain transactions are deemed not to involve a material interest (including transactions in which the amount involved in any 12-month period is less than $120,000 and transactions with entities where a related person’s interest is limited to service as a non-employee director). In addition, based on a consideration of ExxonMobil’s facts and circumstances, the Committee will presume that the following transactions do not involve a material interest for purposes of reporting under SEC rules:

| Ÿ | Transactions in the ordinary course of business with an entity for which a related person serves as an executive officer, provided (i) the affected director or executive officer did not participate in the decision on the part of ExxonMobil to enter into such transactions; and, (ii) the amount involved in any related category of transactions in a 12-month period is less than 1 percent of the entity’s gross revenues. |

| Ÿ | Grants or membership payments in the ordinary course of business to nonprofit organizations, provided (i) the affected director or executive officer did not participate in the decision on the part of ExxonMobil to make such payments; and, (ii) the amount of general-purpose grants in a 12-month period is less than 1 percent of the recipient’s gross revenues. |

10

| Ÿ | Payments under ExxonMobil plans and arrangements that are available generally to U.S. salaried employees (including contributions under ExxonMobil’s Educational and Cultural Matching Gift Programs and payments to providers under ExxonMobil health care plans). |

| Ÿ | Employment by ExxonMobil of a family member of an executive officer, provided the executive officer does not participate in decisions regarding the hiring, performance evaluation, or compensation of the family member. |

Transactions or relationships not covered by the above standards will be assessed by the Committee on the basis of the specific facts and circumstances.

ExxonMobil and its affiliates have over 82 thousand employees around the world and employees related by birth or marriage may be found at all levels of the organization. Two current executive officers have family members who are also employed by the Corporation: J.S. Simon (Senior Vice President and Director) has a son-in-law who works for ExxonMobil Fuels Marketing Company and H.H. Hubble (Vice President, Investor Relations and Secretary) has a son who works for ExxonMobil Development Company. In addition, one executive officer who retired in 2006, P.J. Dingle (former President, ExxonMobil Gas & Power Marketing), has a brother and a sister-in-law who work for Imperial Oil Limited, an ExxonMobil affiliate in Canada.

ExxonMobil employees do not receive preferential treatment by reason of being related to an executive officer, and executive officers do not participate in hiring, performance evaluation, or compensation decisions for family members. ExxonMobil’s employment guidelines state “Relatives of Company employees may be employed on a non-preferential basis. However, an employee should not be employed by or assigned to work under the direct supervision of a relative, or to report to a supervisor who in turn reports to a relative of the employee.” Accordingly, consistent with ExxonMobil’s Related Person Transaction Guidelines, we do not consider the relationships noted above to be material within the meaning of the related person transaction disclosure rules.

P.T. Mulva (Vice President and Controller) has a brother currently serving as CEO of ConocoPhillips. As is the case with most other major companies in the oil and gas industry, ExxonMobil has a variety of business transactions with ConocoPhillips. These transactions include routine purchases and sales of crude oil, petroleum products, and pipeline transportation capacity. Affiliates of ExxonMobil and ConocoPhillips have joint ownership of a refinery in Germany and a number of pipelines, terminals, and service companies, and also have undivided interests in a variety of exploration, development, and production projects. All of these transactions are entered into in the ordinary course of business without influence from P.T. Mulva. Neither P.T. Mulva nor, to our knowledge after reasonable inquiry, his brother has any interest in these transactions different from the general interest of other employees and shareholders. Accordingly, consistent with ExxonMobil’s Related Person Transaction Guidelines, we do not consider these transactions to be material within the meaning of the related person transaction disclosure rules.

The Board Affairs Committee also reviewed ExxonMobil’s ordinary course business with companies for which non-employee directors serve as executive officers and determined that, in accordance with the categorical standards described above, none of those matters represent reportable related person transactions. See “Director Independence” on page 4.

We are not aware of any related person transaction required to be reported under applicable SEC rules since the beginning of the last fiscal year where our policies and procedures did not require review, or where such policies and procedures were not followed.

The Corporation’s Related Person Transaction Guidelines are intended to assist the Corporation in complying with its disclosure obligations under SEC rules. These procedures are in addition to, not in lieu of, the Corporation’s Code of Ethics and Business Conduct.

11

ITEM 1 – ELECTION OF DIRECTORS

The Board of Directors has nominated the director candidates named on the following pages. Personal information on each of our nominees is also provided. All of our nominees currently serve as ExxonMobil directors except for Mr. Steven S Reinemund, who has been nominated by the Board for first election as a director at the annual meeting. Dr. Henry A. McKinnell is not standing for election.

If a director nominee becomes unavailable before the election, your proxy authorizes the people named as proxies to vote for a replacement nominee if the Board names one.

The Board recommends you vote FOR each of the following candidates:

| Michael J. Boskin

Age 61 Director since 1996 |

Principal Occupation: T.M. Friedman Professor of Economics and Senior Fellow, Hoover Institution, Stanford University

Recent Business Experience: Dr. Boskin is also a Research Associate, National Bureau of Economic Research; and serves on the Commerce Department’s Advisory Committee on the National Income and Product Accounts. He is Chief Executive Officer and President of Boskin & Co., an economic consulting company.

Public Company Directorships: Oracle Corporation; Shinsei Bank; Vodafone Group | |

| William W. George

Age 64 Director since 2005

|

Principal Occupation: Professor of Management Practice, Harvard University

Recent Business Experience: Mr. George was elected Chairman of Medtronic in 1996, and retired in 2002; Chief Executive Officer in 1991; and President and Chief Operating Officer in 1989.

Public Company Directorships: Goldman Sachs; Novartis AG | |

| James R. Houghton

Age 71 Director since 1994 |

Principal Occupation: Non-Executive Chairman of the Board, Corning Incorporated

Recent Business Experience: Mr. Houghton resumed his role as Chairman and Chief Executive Officer of Corning Incorporated in 2002, relinquished the role of CEO in 2005, and retired in 2006. He now serves as Non-Executive Chairman. He also served as Non-Executive Chairman in 2001-2002 and Chairman Emeritus from 1996-2001. He was elected Chairman and Chief Executive Officer of Corning Incorporated in 1983, and retired in 1996.

Public Company Directorships: Corning Incorporated; MetLife | |

12

| William R. Howell

Age 71 Director since 1982 |

Principal Occupation: Chairman Emeritus, J.C. Penney Company

Recent Business Experience: Mr. Howell was elected Chairman and Chief Executive Officer of J.C. Penney Company in 1983, and retired in 1997.

Public Company Directorships: American Electric Power; Halliburton; Pfizer; Williams; Deutsche Bank Trust Corporation and Deutsche Bank Trust Company Americas (non-public, wholly owned subsidiaries of Deutsche Bank AG) | |

| Reatha Clark King

Age 69 Director since 1997 |

Principal Occupation: Former Chairman, Board of Trustees, General Mills Foundation

Recent Business Experience: Dr. King was elected Chairman, Board of Trustees, General Mills Foundation in 2002, and retired in 2003; President and Executive Director, General Mills Foundation, and Vice President, General Mills, Inc. from 1988-2002. Prior to joining the General Mills Foundation, Dr. King held a variety of positions in chemical research, education, and academic administration.

Public Company Directorships: Lenox Group | |

| Philip E. Lippincott

Age 71 Director since 1986 |

Principal Occupation: Retired Chairman of the Board and Chief Executive Officer, Scott Paper Company; Retired Chairman of the Board, Campbell Soup Company

Recent Business Experience: Mr. Lippincott was elected Chairman of Campbell Soup Company in 1999, and retired in 2001. He was elected Chairman and Chief Executive Officer of Scott Paper Company in 1983, and retired in 1994; Chief Executive Officer in 1982; and Director in 1978.

Public Company Directorships: Campbell Soup Company; Penn Mutual Life Insurance Company | |

| Marilyn Carlson Nelson

Age 67 Director since 1991

|

Principal Occupation: Chairman of the Board and Chief Executive Officer, Carlson Companies

Recent Business Experience: Mrs. Nelson has held a number of management positions at Carlson Companies including Senior Vice President, President, Chief Operating Officer, and Vice Chair.

Company Directorships: Carlson Companies | |

13

| Samuel J. Palmisano

Age 55 Director since 2006 |

Principal Occupation: Chairman of the Board, President, and Chief Executive Officer, IBM Corporation

Recent Business Experience: Mr. Palmisano was elected Chairman, President, and Chief Executive Officer of IBM in 2003. Mr. Palmisano also served as President, Senior Vice President, and Group Executive for IBM’s Enterprise Systems Group, IBM Global Services, and IBM’s Personal Systems Group.

Public Company Directorships: IBM Corporation | |

| Steven S Reinemund

Age 59 |

Principal Occupation: Chairman of the Board, PepsiCo until May 2007

Recent Business Experience: Mr. Reinemund was elected Chairman and Chief Executive Officer of PepsiCo in 2001, and relinquished the role of CEO in 2006; President and Chief Operating Officer in 1999; Director in 1996. He was also elected President and CEO of Frito-Lay in 1996 and Pizza Hut in 1986.

Public Company Directorships: Johnson & Johnson | |

| Walter V. Shipley

Age 71 Director since 1998 |

Principal Occupation: Retired Chairman of the Board, The Chase Manhattan Corporation and The Chase Manhattan Bank

Recent Business Experience: Mr. Shipley was elected Chairman and Chief Executive Officer of Chase Manhattan upon its merger with Chemical Bank in 1996, and retired in 1999. He was elected Chairman and Chief Executive Officer of Chemical Bank in 1983; President and Director in 1982; and Senior Executive Vice President in 1979.

Public Company Directorships: Verizon Communications; Wyeth | |

| J. Stephen Simon

Age 63 Director since 2006 |

Principal Occupation: Senior Vice President, Exxon Mobil Corporation

Recent Business Experience: Mr. Simon was elected Director of ExxonMobil in 2006; Senior Vice President in 2004; and Vice President in 1999. Mr. Simon has held a variety of management positions in domestic and foreign operations since joining the Exxon organization in 1967, including President, ExxonMobil Refining & Supply Company; Executive Vice President, Exxon Company, International; and President, Esso Italiana.

Public Company Directorships: None | |

14

| Rex W. Tillerson

Age 55 Director since 2004 |

Principal Occupation: Chairman of the Board and Chief Executive Officer, Exxon Mobil Corporation

Recent Business Experience: Mr. Tillerson was elected Chairman and Chief Executive Officer of ExxonMobil in 2006; President and Director in 2004; and Senior Vice President in 2001. Mr. Tillerson has held a variety of management positions in domestic and foreign operations since joining the Exxon organization in 1975, including President, Exxon Yemen Inc. and Esso Exploration and Production Khorat Inc.; Vice President, Exxon Ventures (CIS) Inc.; President, Exxon Neftegas Limited; and Executive Vice President, ExxonMobil Development Company.

Public Company Directorships: None | |

Director compensation elements are designed to:

| Ÿ | Ensure alignment with long-term shareholder interests; |

| Ÿ | Ensure the Company can attract and retain outstanding director candidates who meet the selection criteria outlined in the Guidelines for Selection of Non-Employee Directors, which can be found in the Corporate Governance section of our Web site; |

| Ÿ | Recognize the substantial time commitments necessary to oversee the affairs of the Corporation; and, |

| Ÿ | Support the independence of thought and action expected of directors. |

Non-employee director compensation levels are reviewed by the Board Affairs Committee each year, and resulting recommendations are presented to the full Board for approval. The Committee uses an outside consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

ExxonMobil employees receive no extra pay for serving as directors. Non-employee directors receive compensation consisting of cash and restricted stock. The base fee is $75,000 a year. Members of the Audit and Compensation Committees receive a fee of $15,000 per year, and the Chairs of those Committees receive an additional fee of $10,000 per year. For other Committees, non-employee directors receive $8,000 per year for each Committee on which they serve, and the Chairs receive an additional fee of $7,000 per year. No fees are paid to members of the Executive Committee. Non-employee directors are reimbursed for reasonable expenses incurred to attend board meetings or other functions relating to their responsibilities as a director of Exxon Mobil Corporation.

Non-employee directors may elect to defer all or part of these fees either in ExxonMobil notional stock with dividend equivalents or in a deferred account that earns interest at the prime rate. Deferred fees are payable in cash in one to five annual installments after the director leaves the Board.

In addition to the fees described above, we pay a significant portion of director compensation in stock to strongly align director compensation with the long-term interests of shareholders. At present, each incumbent non-employee director receives an annual award of 4,000 shares of restricted stock. Each new non-employee director receives a one-time grant of 8,000 shares of restricted stock upon first being elected to the Board. While on the Board, the non-employee director receives the same cash dividends on restricted shares as a holder of regular common stock, but the director is not allowed to sell the shares. The restricted shares may be forfeited if the director leaves the Board early, i.e., before the mandatory retirement age of 72, as specified for directors.

Current and former non-employee directors of Exxon Mobil Corporation are eligible to participate in the ExxonMobil Foundation’s Educational and Cultural Matching Gift Programs under the same terms as the Corporation’s U.S. employees.

15

Director Compensation for 2006

| Name | Fees ($) |

Stock ($)(a) |

Option ($) |

Non-Equity ($) |

Change in ($)(b) |

Other ($)(c) |

Total ($) | |||||||

| M.J. Boskin |

110,096 | 230,680 | 0 | 0 | 0 | 350 | 341,126 | |||||||

| W.W. George |

103,096 | 415,347 | 0 | 0 | 0 | 350 | 518,793 | |||||||

| J.R. Houghton |

118,904 | 230,680 | 0 | 0 | 0 | 350 | 349,934 | |||||||

| W.R. Howell |

123,000 | 230,680 | 0 | 0 | 18,537 | 350 | 372,567 | |||||||

| R.C. King |

113,000 | 230,680 | 0 | 0 | 3,809 | 350 | 347,839 | |||||||

| P.E. Lippincott |

106,000 | 230,680 | 0 | 0 | 0 | 350 | 337,030 | |||||||

| H.A. McKinnell |

101,904 | 230,680 | 0 | 0 | 3,380 | 350 | 336,314 | |||||||

| M.C. Nelson |

106,000 | 230,680 | 0 | 0 | 0 | 350 | 337,030 | |||||||

| S.J. Palmisano |

98,934 | 484,640 | 0 | 0 | 0 | 350 | 583,924 | |||||||

| W.V. Shipley |

113,000 | 230,680 | 0 | 0 | 0 | 350 | 344,030 |

| (a) | In accordance with SEC rules, the valuation of stock awards in this table represents the compensation cost of awards recognized for financial statement purposes for 2006 under Statement of Financial Accounting Standards No. 123, as revised (123R). The Company recognizes compensation cost for restricted stock granted to the non-employee director over a 12-month period following the grant date. Dividends on stock awards are not shown in the table because those amounts are factored into the grant date fair value. |

| Each director (other than Mr. Palmisano, who joined the Board in January 2006) received an annual grant of 4,000 restricted shares at the beginning of 2006. The compensation cost recognized for these awards and shown in the table for 2006 is the same as the grant date fair value of these grants, which was $230,680. |

| Mr. Palmisano received a one-time grant of 8,000 restricted shares upon being first elected to the Board in January 2006. The compensation cost recognized for this award and shown in the table for 2006 is the same as the grant date fair value of this grant, which was $484,640. Mr. George received a one-time grant of 8,000 restricted shares upon being first elected to the Board in May 2005. The compensation cost recognized for this award and shown in the table for 2006 was five-twelfths of the grant date fair value of this grant recognized in 2006, which was $184,667. |

| At year-end 2006, the aggregate number of restricted shares held by each director was as follows: |

| Name | Restricted Shares (#) | |

| M.J. Boskin |

40,300 | |

| W.W. George |

12,000 | |

| J.R. Houghton |

41,900 | |

| W.R. Howell |

45,900 | |

| R.C. King |

39,100 | |

| P.E. Lippincott |

45,900 | |

| H.A. McKinnell |

22,400 | |

| M.C. Nelson |

44,300 | |

| S.J. Palmisano |

8,000 | |

| W.V. Shipley |

37,900 |

| (b) | The amounts shown are earnings during 2006 on interest-bearing deferred fee accounts that were in excess of the federal long-term interest rate published pursuant to Section 1274(d) of the Internal Revenue Code. The |

16

| federal rate averaged approximately 6 percent during the year. The interest rate under the directors’ deferred fee plan is the prime rate, which averaged approximately 8 percent during 2006. |

| (c) | The amount shown for each director is the pro-rated cost of travel accident insurance covering death, dismemberment, and loss of sight, speech, or hearing under a policy purchased by the Corporation with a maximum benefit of $500,000 per individual. |

The non-employee directors are not entitled to any additional payments or benefits as a result of leaving the Board or death except as described above. The non-employee directors are not entitled to any payments or benefits resulting from a change in control of the Corporation.

DIRECTOR AND EXECUTIVE OFFICER STOCK OWNERSHIP

These tables show the number of ExxonMobil common stock shares each executive named in the “Summary Compensation Table” on page 31 and each non-employee director or director nominee owned on February 28, 2007. In these tables, ownership means the right to direct the voting or the sale of shares, even if those rights are shared with someone else. None of these individuals owns more than 0.02 percent of the outstanding shares.

| Named Executive Officer | Shares Owned |

Shares Covered by Exercisable Options | |||

| R.W. Tillerson |

759,004 | (1) | 407,307 | ||

| D.D. Humphreys |

355,150 | (2) | 237,307 | ||

| S.R. McGill |

869,862 | (3) | 482,705 | ||

| J.S. Simon |

696,387 | (4) | 560,000 | ||

| H.R. Cramer |

561,529 | 629,964 | |||

| E.G. Galante |

545,167 | 459,943 |

| (1) | Includes 1,800 shares owned by dependent child. |

| (2) | Includes 55,135 shares jointly owned with spouse. |

| (3) | Includes 3,200 shares owned by spouse. |

| (4) | Includes 11,177 shares jointly owned with spouse. |

17

| Non-Employee Director/Nominee | Shares Owned | ||

| M.J. Boskin |

44,300 | ||

| W.W. George |

56,000 | (1) | |

| J.R. Houghton |

52,900 | (2) | |

| W.R. Howell |

50,700 | (3) | |

| R.C. King |

45,904 | (4) | |

| P.E. Lippincott |

53,900 | ||

| H.A. McKinnell |

36,400 | ||

| M.C. Nelson |

66,300 | (5) | |

| S.J. Palmisano |

12,000 | ||

| S.S Reinemund |

1,175 | (6) | |

| W.V. Shipley |

44,540 |

| (1) | Includes 10,000 shares held as co-trustee of family foundation. |

| (2) | Includes 5,000 shares owned by spouse. |

| (3) | Includes 5,400 restricted shares held as constructive trustee for former spouse. |

| (4) | Includes 1,000 shares owned by spouse. |

| (5) | Includes 18,000 shares held as co-trustee of family trusts. |

| (6) | Shares held by family foundation of which Mr. Reinemund is a director. |

On February 28, 2007, ExxonMobil’s incumbent directors and executive officers (26 people) together owned 6,993,416 shares of ExxonMobil stock and 5,175,423 shares covered by exercisable options, representing about 0.21 percent of the outstanding shares.

The Compensation Committee of the Board of Directors has reviewed and discussed the “Compensation Discussion and Analysis” for 2006 with management of the Corporation. Based on that review and discussion, we recommended to the Board that the “Compensation Discussion and Analysis” be included in the Corporation’s proxy statement for the 2007 annual meeting of shareholders, and also incorporated by reference in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2006.

| William R. Howell, Chair | Reatha Clark King | Walter V. Shipley | ||

| William W. George | Samuel J. Palmisano |

18

COMPENSATION DISCUSSION AND ANALYSIS

This report will provide an overview of the following:

| Ÿ | The interrelationship between the business model of ExxonMobil and the compensation program. |

| Ÿ | An explanation of the priorities and behaviors the compensation program is designed to encourage and reward among executives and other employees. |

| Ÿ | A description of all elements of the compensation program from current cash compensation to the value of future retirement benefits. |

| Ÿ | An explanation of the reasons why the Compensation Committee has selected these elements of compensation as the best way to achieve stated objectives. |

| Ÿ | How each element of compensation is determined. |

The business model of ExxonMobil has the primary objective of providing superior returns to shareholders over the long term. The executive performance and development objectives and compensation program are designed to support successful implementation of our business model. These interrelationships are illustrated by the framework and descriptions that follow:

| The Business Model | Executive Performance and Development Objectives | Compensation Program | ||||||||||||

| Ÿ Growth in shareholder value

Ÿ Disciplined investment strategy with a long-term focus

Ÿ Operational excellence

Ÿ Industry-leading returns

Ÿ Superior cash flow |

« | Ÿ Alignment of executive priorities with those of shareholders

Ÿ An effective process of assessing executive performance

Ÿ Development and continuous growth of expertise and contributions

Ÿ Retention of the best talent through career orientation |

« | Ÿ Base salaries that reward experience and highly differentiate performance

Ÿ Annual incentive awards based on performance of the business and individual contributions

Ÿ Large percentage of performance-based incentive compensation paid in stock with long mandatory holding periods and risk of forfeiture

Ÿ Salary, incentive, and benefit programs that encourage career orientation |

||||||||||

19

The Business Model

Disciplined Investment Strategy with a Long-Term Focus

Three key aspects of ExxonMobil’s business drive the structure of our compensation program.

| Ÿ | First, the investment lead times and project life spans in our business are very long term. In addition, projects and operations are global in scope adding complexity to our investment strategy. The pursuit of investment opportunities may span many years. Once an investment opportunity is identified and approved, it can take several years for the necessary capital and technology to generate returns to shareholders. The productive life of a project often extends decades thereafter. The economic life cycle of capital projects is longer than an executive’s tenure in a particular position. |

| Ÿ | Second, our businesses are largely commodity-based, which means they are highly cyclical. |

| Ÿ | Finally, ExxonMobil’s business is very large with a global presence involving diverse cultures and government regimes. We currently have $124 billion in capital employed, which includes ExxonMobil’s share of total debt and shareholders’ equity. In 2006, we invested nearly $20 billion in capital and exploration expenditures, and expect a similar level of annual investment over the next several years. The annual average capital and exploration expenditures over the last five years have been $16.4 billion. |

To manage this business and the associated risks successfully, our executives must have the experience and knowledge to consistently identify and execute large investment opportunities that perform well through multiple economic cycles and commodity price environments and contribute to superior Company performance versus competitors. This must be accomplished under a wide range of varying government and regulatory regimes.

Operational Excellence

We operate upstream, downstream and chemical businesses, with each one having global scope and complexity. A core management principle and priority in each functional business is achievement of operational excellence. Operational excellence means industry leadership in managing costs, controlling risks, executing projects, and leveraging the best technical expertise, all of which optimize profits and grow shareholder value on a sustainable, long-term basis. It is also our highest priority to be an industry leader in the areas of safety, health, and the environment. Given the broad global scope and technical complexity of our businesses, this can only be accomplished through consistent and disciplined application of common operating standards, management systems and best practices in each of the hundreds of facilities globally in which we conduct business. Throughout our workforce, substantial technical, operational, and financial experience are required to support this principle. This experience takes years to acquire and must be supported by our compensation and benefit programs.

Industry-Leading Returns and Superior Cash Flow

Our investment strategy and focus on operational excellence are directed at our objective to generate industry-leading returns. This is a main priority and our performance demonstrates consistent achievement of this objective. Our five-year average return on capital employed has exceeded that of other large, integrated oil companies over the last 17 years. These returns are responsible for the financial strength and superior cash flow of the Company, which has allowed us to prudently reinvest capital in the business and increase shareholder distributions. Dividend payments per share increased for the 24th consecutive year. Since the merger between Exxon and Mobil in 1999, we have returned nearly $112 billion to shareholders including $47 billion via dividend payments and $65 billion via share purchases. Shares outstanding have been reduced by 18 percent since the merger, favorably affecting earnings per share. Maintaining this level of performance requires that we continue to employ and retain the best talent in an industry where competition for experienced, proven executives is significant.

20

Executive Performance and Development Objectives

Shareholder Alignment

A main priority is aligning the interests of executives with the long-term interests of shareholders. This requires proven programs and strategies that integrate executive development and performance objectives with the business model.

Assessing Executive Performance and Results

The Compensation Committee assesses the performance of the CEO, and it works with the CEO in determining the performance assessments of the other Named Executive Officers. Performance is assessed and recognized through the annual planning and budget process. During this process, key strategies and objectives are established for each business line for both the short and long term. During the initial planning meeting and then each quarter, results are stewarded against prior commitments. Each year, the Named Executive Officers are assessed on how well they are executing the long-term strategies outlined in the matrix below. They are assessed on the performance of the Corporation overall and each of the respective business lines for which they have responsibility on an absolute basis and relative to companies of comparable size and scope of business activities. As discussed in more detail in the “Compensation Program” section of this report, the Corporation does not use specific quantitative targets or formulas to assess executive performance or determine compensation. Formula-based performance assessments and compensation typically require emphasis on two or three business metrics. However, for the Company to continue to be an industry leader, and effectively manage the technical complexity and global scope of ExxonMobil, the Named Executive Officers must advance multiple strategies and objectives in parallel, versus emphasizing one or two at the expense of others that require equal attention.

Each long-term strategy outlined in the matrix on the next two pages is responsible for multiple results illustrated on the right side of the matrix. The results are dependent on how well the long-term strategies are implemented in parallel to optimize the integrated business model and drive sustainable growth in shareholder value. The results are considered collectively and over multiyear periods to assess effectiveness of the long-term strategies.

21

| Long-Term Strategies | Results | |||||

| CORPORATE | ||||||

| Ÿ Disciplined investment

Ÿ Operational excellence

Ÿ Industry-leading returns

Ÿ Superior cash flow |

|

Ÿ Total shareholder return of 39 percent. Ten-year annual average of 15 percent.

Ÿ Record earnings of $39.5 billion. Five-year annual average of $26.8 billion.

Ÿ Industry-leading return on average capital employed of 32 percent, with an average of 23 percent since the beginning of 2000.

Ÿ $7.6 billion distributed to shareholders as dividends in 2006. $47 billion in dividends distributed to shareholders since the beginning of 2000. Dividend payments per share increased for the 24th consecutive year.

Ÿ $65 billion distributed to shareholders through share buyback program since the beginning of 2000.

Ÿ Strong results in the areas of safety, health, and environment

– Best-ever annual workforce lost time incident rate of 0.048 (prior best 0.053 in 2004).

Ÿ Continued maintenance of sound business controls and a strong corporate governance environment. | ||||

| UPSTREAM | ||||||

| Ÿ Maximize profitability of existing oil and gas production

Ÿ Identify and pursue all attractive exploration opportunities

Ÿ Invest in projects that deliver superior returns

Ÿ Capitalize on growing natural gas and power markets |

|

Ÿ Record earnings of $26.2 billion, driven by favorable industry conditions and continued operational excellence. Five-year annual average of $18.3 billion.

Ÿ Return on capital employed of 45 percent with an average of 35 percent over the past five years.

Ÿ Earnings per oil equivalent barrel of $16.96, exceeding those of our competitors.

Ÿ Total liquids and gas production available for sale of 4,237 thousand oil-equivalent barrels per day (koebd). Five-year annual average of oil-equivalent production was 4,192 koebd.

Ÿ The Corporation replaced 118 percent of production on average over the last three years including sales and year-end price/cost effects.

Ÿ Successful capture of 15 new resource opportunities.

Ÿ Finding and resource acquisition costs of $0.53 per oil-equivalent barrel. Five-year annual average is $0.51 per oil-equivalent barrel.

Ÿ Capital and exploration spending of $16.2 billion.

Ÿ Seven major projects commenced production in 2006.

Ÿ Strong results in the areas of safety, health, and environment

– Second-best annual workforce lost time incident rate of 0.049 in 2006 (best-ever 0.041 in 2005). | ||||

22

| Long-Term Strategies | Results | |||||

| DOWNSTREAM | ||||||

| Ÿ Maintain best-in-class operations

Ÿ Provide quality, valued products and services to customers

Ÿ Lead industry in efficiency and effectiveness

Ÿ Capitalize on integration with other ExxonMobil businesses

Ÿ Selectively invest for resilient, advantaged returns

Ÿ Maximize value from leading-edge technology |

|

Ÿ Record earnings of $8.5 billion, driven by favorable industry conditions and continued operational excellence. Five-year annual average of $5.4 billion.

Ÿ Return on capital employed of 36 percent. Continue to lead competition over the long term, with a five-year average of 21 percent.

Ÿ Capital expenditures of $2.7 billion.

Ÿ Refinery throughput was 5.6 million barrels per day, third-highest since the merger, despite increased turnaround workload.

Ÿ Petroleum product sales were strong at 7.2 million barrels per day, consistent with strong refinery throughput.

Ÿ Strong results in the areas of safety, health, and environment

– Best-ever annual workforce lost time incident rate of 0.048 (prior best 0.056 in 2004). | ||||

| CHEMICAL | ||||||

| Ÿ Focus on businesses that capitalize on core competencies

Ÿ Capture full benefits of integration across ExxonMobil operations

Ÿ Continuously reduce costs to achieve best-in-class performance

Ÿ Build proprietary technology positions

Ÿ Selectively invest in advantaged products |

|

Ÿ Record earnings of $4.4 billion, driven by favorable industry conditions and continued operational excellence. Five-year annual average of $2.8 billion.

Ÿ Return on capital employed of 33 percent. Continue to lead competition over the long term, with a five-year average of 20 percent.

Ÿ Prime product sales volume of 27.4 million metric tons, approaching 2004 record results. Five-year annual average prime product sales are 27.0 million metric tons.

Ÿ Capital expenditures of $756 million.

Ÿ Strong results in the areas of safety, health, and environment

– Best-ever annual workforce lost time incident rate of 0.065 (prior best 0.073 in 2004). | ||||

During the annual executive development review with the Board in October of each year, the CEO reviews the performance of the other Named Executive Officers in achieving results in line with these long-term business strategies. The same criteria are key elements in the assessment of the CEO’s performance by the Compensation Committee. The performance of the Named Executive Officers is also assessed by the Board throughout the year during specific business reviews and Board committee meetings that provide reports on strategy development; operating and financial results; safety, health, and environmental results; business controls; and other areas pertinent to the general performance of the Company.

In assessing the performance of the Named Executive Officers, the Compensation Committee does not assign specific weights to the factors considered. An executive’s performance must be high in all key performance areas in order for the executive to receive an overall superior evaluation. Outstanding performance in one area will not cancel out poor performance in another. For example, a problem in safety, health, or environmental performance in a business unit for which the executive is responsible

23

could result in an executive’s incentive award being reduced even though the executive’s performance against financial and other criteria was superior. Similarly, a violation of the Company’s code of business conduct could result in elimination of an executive’s incentive award for the year, as well as termination of employment and cancellation of all previously granted awards that have not yet vested or been paid.

Named Executive Officers are expected to perform at the highest level or they are replaced. If it is determined that another executive is ready and would make a stronger contribution than one of the Named Executive Officers, a replacement plan is implemented. Reinforcing these high performance standards is the fact that Named Executive Officers and other senior executives do not have employment contracts, severance agreements, or change-in-control arrangements, which increases the risk and consequences of performance that does not meet the highest standards. For these reasons, the interests of the Corporation and its shareholders are best served when executive compensation decisions are made using careful judgments that take all relevant facts and circumstances into account, rather than by predetermined formulas.

Below the level of the Named Executive Officers, the performance of other executives and managers is assessed against objectives and metrics specific to their business units and through a rigorous performance assessment and ranking process. The Management Committee of the Company, which is comprised of four of the Named Executive Officers, is responsible for overseeing the performance assessment and ranking process. This process applies to over 43,000 managers and professionals worldwide (including over 1,600 executives). It is part of a well-developed, disciplined process that integrates performance assessments, compensation, and career development and succession planning. The assessment of individual performance and ranking takes into account results and the means through which those results are achieved. Ranking results are translated into salary and other compensation targets to create differentiation in pay between the lowest and highest performers to reward strong performance and motivate employees to continuously improve their contributions. Assessments of executive potential are conducted concurrently and implemented through a consistently applied, common process. The results of this annual exercise are also primary inputs to the executive development process described in more detail below.

Executive Development, Succession Planning, and Continuity of Leadership

A key responsibility of the CEO and the Board is ensuring that an effective process is in place to provide continuity of leadership over the long term at all levels in the Company. Each year, executive development reviews are held at every significant organizational level of the Company culminating in a full review of executive talent by the Board in late October. During this review, the following key topics are discussed: the performance of the Senior Vice Presidents, Business Line Presidents, and Corporate Vice Presidents; future candidates for senior positions; succession timing for the senior positions; and development plans for the highest potential resources across the Company.