NOTICE OF EXEMPT SOLICITATION SUBMITTED BY NON-MANAGEMENT

U.S. Securities and Exchange Commission

Washington, DC 20549

Notice of Exempt Solicitation under Rule 14a-103

Name of Registrant: ExxonMobil Corporation

Name of person relying on exemption: Bowyer Research

Address of person relying on exemption: P.O. Box 120, McKeesport PA 15135

Statement Regarding Item 1 – Election of Directors

Bowyer Research is posting this letter from the State Financial Officers Foundation as pertinent to Item 1, Election of Directors. This letter has been circulated to 19 asset managers, and the below version was submitted to BlackRock on May 23, 2024.

Summary

May 23, 2024

Mr. Larry Fink CEO

BlackRock Inc.

55 East 52nd Street

New York, NY 10055-0003

Dear Mr. Fink:

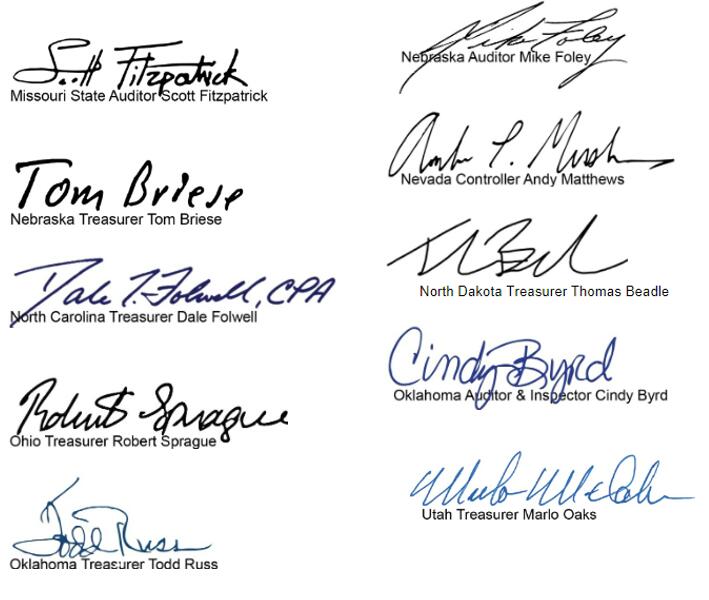

This letter is from 21 State Financial Officers representing 19 states across the country with varying responsibilities which include overseeing state finances, investment management, pension fund governance and other related functions.

We are writing to you to urge you to uphold your fiduciary duty and not to give in to pressure to vote against all or part of the board of ExxonMobil in retaliation for the company’s legal actions seeking clarity from the courts regarding the excesses of shareholder activists. We support these actions by the duly elected members of the board, who deserve our thanks and support, not politically motivated threats, for seeking to reign in activist shareholders. These activists have been flooding corporate proxy statements with politically motivated proposals thinly veiled as business risk mitigation measures. Those of you who lead publicly traded companies know well that ESG proposals have been increasing in frequency year by year.

This is partly due to more activist groups increasing their output of proposals. It is also because a higher proportion of those proposals have withstood no-action letter requests from company personnel, both due to recent rule changes making it easier for activists to force their way onto company ballots and also because SEC staff appear to have developed more favorable attitudes towards shareholder activists in their interpretation of existing rules. No matter the cause, you know that every year you are forced to spend more on expensive law firms, more valuable staff time, scarce proxy statement space, and even scarcer executive and board time and attention on unwanted proposals from serial proponents, often with business models based on activism instead of investment returns.

You and Exxon are in the same boat, besieged by the same serial proponents with the same demands repackaged in slightly different forms year after year. Non-activist investors are in the same boat too. Ordinary shareholders do not see proxy statements as a substitute for electoral politics, as places to work out controversies such as climate politics, abortion, racial justice, the Second Amendment, the alleged misdeeds of "the apartheid state of Israel," and animal rights.

The matter of Exxon vs. Arjuna Capital perfectly illustrates everything that is wrong with the system as it currently stands. Arjuna and Follow This are by their own admission in the business of social activism. The business model of Follow This is an activism-based one, not an investment returns model. They explicitly admit that it does not have a goal of making investment returns on oil and gas companies.1

1 https://www.follow-this.org/wp-content/uploads/2022/11/Articles-of-Association-English.pdf

Arjuna Capital uses "legacy holdings" of clients in order to engage in activism which the company's founder admits has the goal "to shrink oil and gas companies.”2 In other words, these entities are not aligned with the interests of the vast majority of investors for whom financial returns on the investment are the goal, not social change as the goal with investments as the means. In short, for those of us who oversee investments for other people, we have a fiduciary duty to seek returns for our beneficiaries, as does the board of Exxon for their shareholders.

The SEC estimates that such proposals can cost shareholders up to $150,000 each in direct costs. Exxon estimates that it has spent roughly $21 million directly defending itself against such escapades,3 and that does not count the distraction and unproductive theatrics these proposals often add to the annual meetings.

Arjuna's proposal is designed to get Exxon to minimize not just its own carbon emissions, but under "Scope 3" disclosures that of its customers. This is not a call to tweak around the edges; it is a direct assault on Exxon's core business. Combustion of hydrocarbons creates carbon dioxide. No amount of activism can wish away the basics of chemistry. The only way that Exxon can eliminate Scope 3 emissions is to shut down its operations, cap its wells, shutter its windows, and fire its employees.

Apparently, a bipartisan group of legislators in Illinois feels the same way.4 We believe that if government entities use political pressure to substantially change the composition of the board of directors of a private company, a dangerous breach in the wall separating public and private spheres will occur. The precedent set if this new form of ‘nationalization’ via state-level entities would be an extremely dangerous precedent. They won’t stop at Exxon; eventually, they’ll come for you too. We note that the proxy service Glass Lewis is pledging to punish Exxon.

In his most recent annual chairman's letter, JPMorgan Chase's CEO Jamie Dimon incisively described the brokenness of the current system, referring to "The Hijacking of Annual Shareholder Meetings"5 and describing "the spiraling frivolousness of the annual shareholder meeting, which has devolved into mostly a showcase of grandstanding and competing special interest groups." Goldman Sachs CEO David Solomon is reportedly working to mend fences6 and Blackrock CEO Larry Fink has decried the politicization around ESG.7 On its own proxy

2 https://finance.yahoo.com/sec-filing/XOM/0001193125-24-092545_34088/

3 https://investor.exxonmobil.com/company-information/annual-reports-proxy

4https://ilga.gov/legislation/BillStatus.asp?DocNum=1003&GAID=17&DocTypeID=SR&LegID=154932&Sessio

nID=112&SpecSess=&Session=&GA=103

5 https://fortune.com/2024/04/16/jpmorgan-ceo-jamie-dimon-agm-shareholder-meeting-investors-broken- fix/#

6 https://nypost.com/2024/04/27/business/goldman-sachs-gold-panning-in-utah-as-stock-keeps-rising/

7 https://www.reuters.com/business/environment/blackrocks-fink-says-hes-stopped-using-weaponised- term-esg-2023-06-26/

statements, Blackrock opposes shareholder proposals pushing for decarbonization, stakeholder capitalism, or in the most recent proxy, higher levels of ESG voting. You don't want those proposals on your proxy statement, and neither does Exxon, for the same reasons, because they are quite often simply not constructive and certainly do not adhere to a fiduciary standard for shareholders.

When it comes to demands that you punish the Exxon board for opposing the same activist investors with the same agenda that you oppose, we recommend the ancient principle, "That which you would not have done to you, do not to others."

Submitted by Jerry Bowyer, President BOWYER RESEARCH

P.O. Box 120

McKeesport, PA 15135

This is not a solicitation of authority to vote your proxy. Please do not send us your

proxy card as it will not be accepted.