|

1-17 |

|

|

|

|

|

18-19 |

|

|

|

|

|

20-23 |

|

|

|

|

|

24-61 |

|

|

|

|

|

62-75 |

|

|

|

|

|

76-83 |

|

|

|

|

|

84 |

|

|

|

|

|

85-88 |

Projections, targets, expectations, estimates, and business plans in this report are forward-looking statements. Actual future results, including demand growth and energy mix; capacity growth; project plans, dates, and capacities; production rates and resource recoveries; and efficiency gains and savings could differ materially due to, for example, changes in market conditions affecting the oil and gas industry; war and other political or security disturbances; changes in, and adherence by countries to, OPEC quotas; weather; the occurrence and duration of economic recessions; the outcome of commercial negotiations; and other factors discussed in this report and under the the heading “Factors Affecting Future Results” on our web site and in Item 1 of ExxonMobil’s most recent Form 10-K.

Definitions of certain financial and operating measures and other terms used in this report are contained in the section titled “Frequently Used Terms” on pages 85 through 88. In the case of financial measures that we believe constitute “non-GAAP financial measures” under SEC Regulation G, the definitions also include a reconciliation to the most comparable GAAP measure and other information required by that rule.

Certain prior-period amounts include reclassifications to reflect a previously announced change in segment reporting. Earnings of divested coal and copper mining businesses are reported as discontinued operations.

EXXONMOBIL’S COMPETITIVE STRENGTHS

ExxonMobil has a long history of leadership in the petroleum and petrochemical industries. The discipline and commitment we apply in the execution of our business strategies have led to sustainable competitive advantages.

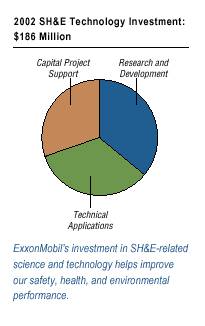

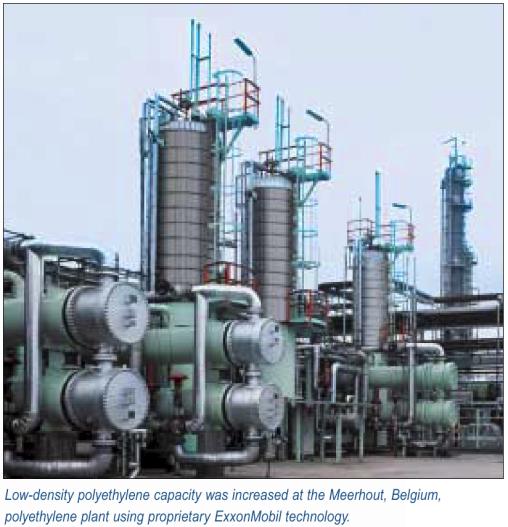

Commitment to Technology. ExxonMobil maintains a uniquely strong commitment to proprietary technology in all of our business functions — consistently investing more than competition.

Business Approach

Business Integrity. ExxonMobil’s straightforward approach to ethics and business integrity is reflected in all of our activities. Our goal is to report results that are clear and readily understood by investors.

Capital Discipline. ExxonMobil takes a disciplined, long-term approach to making investment decisions.

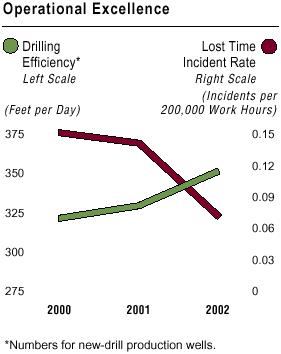

Operational Excellence. ExxonMobil has consistently maintained an unwavering focus on the performance of our base business.

Global Functional Organization. ExxonMobil implements our strategies through 10 global functional companies, providing a competitive advantage through global ranking of opportunities and effective deployment of people in ever-changing business conditions.

Long-Standing History

Employees. The exceptional quality of ExxonMobil’s workforce has long been valued as a source of competitive advantage.

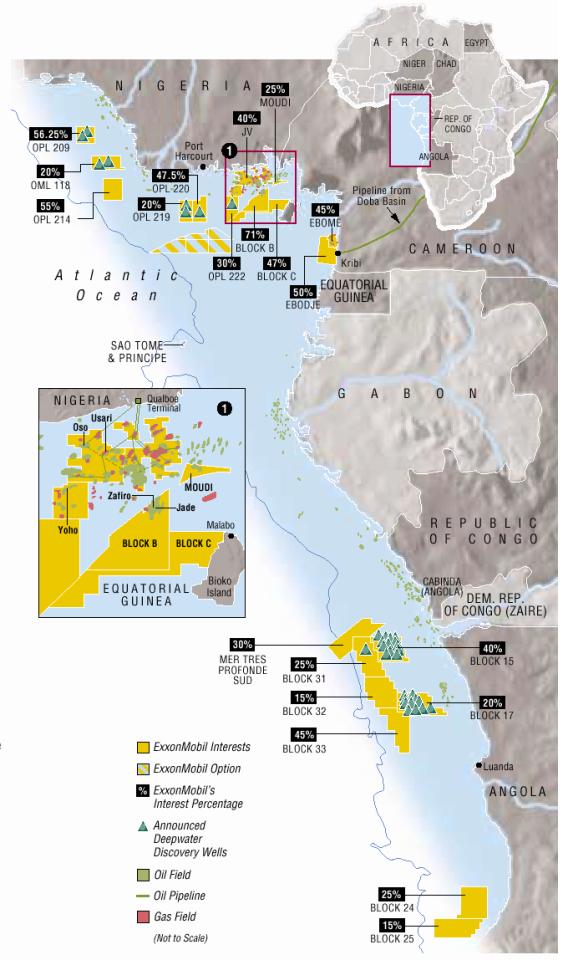

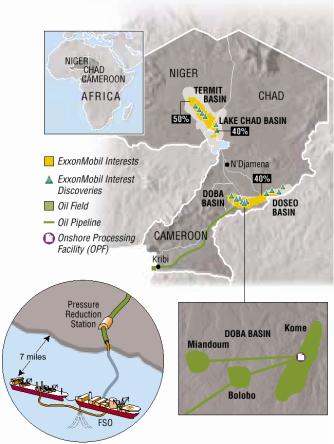

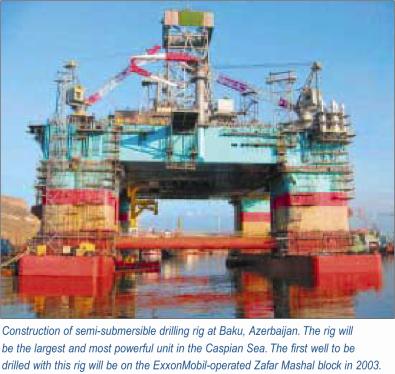

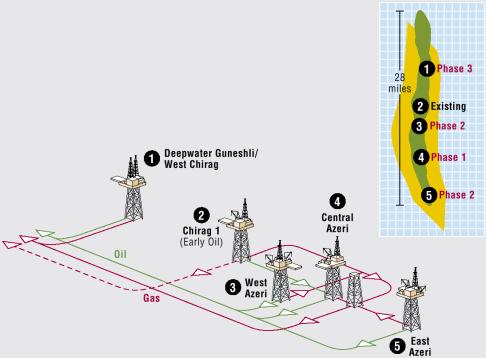

Worldwide Experience. ExxonMobil’s global presence allows us to build upon existing business experience to capture opportunities in the world’s higher-growth regions, such as the deep waters offshore West Africa and in areas recently opened to private investment, such as the Caspian region and Russia.

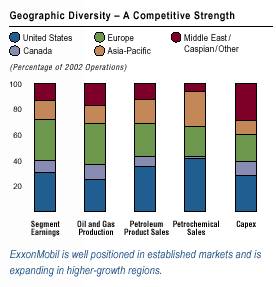

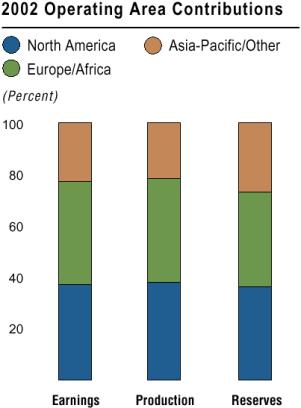

Diversity of Operations. The company’s size, geographic diversity, and the complementary nature of the Upstream, Downstream, and Chemical businesses mitigate the corporation’s sensitivity to fluctuations in individual business lines and markets.

Outstanding Portfolio of Opportunities. ExxonMobil’s worldwide businesses are pursuing a broad portfolio of profitable projects.

Industry-Leading Results

Financial Strength. A strong cash flow and financial position, combined with a long-standing triple-A credit rating, allow ExxonMobil to pursue all profitable opportunities.

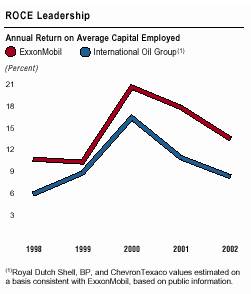

Leadership in Return on Capital Employed. ExxonMobil views return on capital employed as the most critical and best measure of capital productivity in our capital-intensive industry. In 2002, ExxonMobil remained the industry leader, with a 13.5 percent return on capital employed.

1

FINANCIAL HIGHLIGHTS

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

204,506 |

|

212,785 |

|

231,846 |

|

184,753 |

|

168,896 |

|

|

Net income |

|

11,460 |

|

15,320 |

|

17,720 |

|

7,910 |

|

8,074 |

|

|

Cash flow from operations and asset sales |

|

24,061 |

|

23,967 |

|

28,707 |

|

15,985 |

|

18,320 |

|

|

Capital and exploration expenditures |

|

13,955 |

|

12,311 |

|

11,168 |

|

13,307 |

|

15,535 |

|

|

Cash dividends to ExxonMobil shareholders |

|

6,217 |

|

6,254 |

|

6,123 |

|

5,872 |

|

5,843 |

|

|

Research and development costs |

|

631 |

|

603 |

|

564 |

|

630 |

|

753 |

|

|

Cash and cash equivalents at year end |

|

7,229 |

|

6,547 |

|

7,080 |

|

1,688 |

|

2,386 |

|

|

Total assets at year end |

|

152,644 |

|

143,174 |

|

149,000 |

|

144,521 |

|

139,335 |

|

|

Total debt at year end |

|

10,748 |

|

10,802 |

|

13,441 |

|

18,972 |

|

17,016 |

|

|

Shareholders’ equity at year end |

|

74,597 |

|

73,161 |

|

70,757 |

|

63,466 |

|

62,120 |

|

|

Average capital employed(1) |

|

88,342 |

|

88,000 |

|

87,463 |

|

83,836 |

|

80,079 |

|

|

Market valuation at year end |

|

234,101 |

|

267,577 |

|

301,239 |

|

280,150 |

|

245,536 |

|

KEY FINANCIAL RATIOS

|

Net income per common share — assuming dilution (dollars) |

|

1.68 |

|

2.21 |

|

2.52 |

|

1.12 |

|

1.14 |

|

|

Return on average capital employed(1) (percent) |

|

13.5 |

|

17.8 |

|

20.6 |

|

10.3 |

|

10.7 |

|

|

Net income to average shareholders’ equity (percent) |

|

15.5 |

|

21.3 |

|

26.4 |

|

12.6 |

|

12.9 |

|

|

Net income to total revenue (percent) |

|

5.6 |

|

7.2 |

|

7.6 |

|

4.3 |

|

4.8 |

|

|

Debt to capital(2) (percent) |

|

12.2 |

|

12.4 |

|

15.4 |

|

22.0 |

|

20.6 |

|

|

Net debt to capital (net of all cash — percent) |

|

4.4 |

|

5.3 |

|

7 9 |

|

20.4 |

|

18.2 |

|

|

Current assets to current liabilities(3) |

|

1.15 |

|

1.18 |

|

1.06 |

|

0.80 |

|

0.85 |

|

|

Fixed charge coverage (times) |

|

13.8 |

|

17.7 |

|

15.6 |

|

6.6 |

|

6.9 |

|

(1) Capital employed consists of shareholders’ equity and debt, including ExxonMobil’s share of amounts applicable to equity companies.

See Frequently Used Terms.

(2) Debt includes short- and long-term debt. Capital includes short- and long-term debt, shareholders’ equity, and minority interests.

(3) Current liabilities include short-term debt (notes and loans payable).

2

ExxonMobil is committed to our proven business approach and the long-standing fundamental strategies that capitalize on our core strengths. Our business approach is straightforward and focused on the long term, as the company achieves superior financial and operating results that enhance long-term returns to our shareholders.

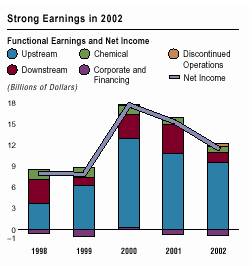

2002 HIGHLIGHTS

Ø • Record safety performance.

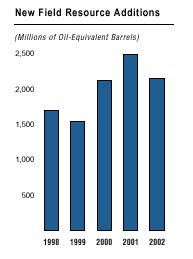

Ø • Proved reserves additions replaced 117 percent of production.

Ø • Oil-equivalent production capacity was up 1 percent.

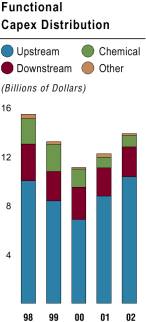

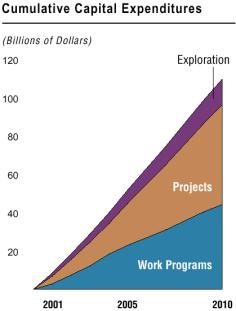

Ø • Upstream capital and exploration spending grew by $1.6 billion to $10.4 billion.

Ø • Ten new major projects brought onstream with targeted gross daily peak production of more than 490 thousand barrels and 230 million cubic feet of gas.

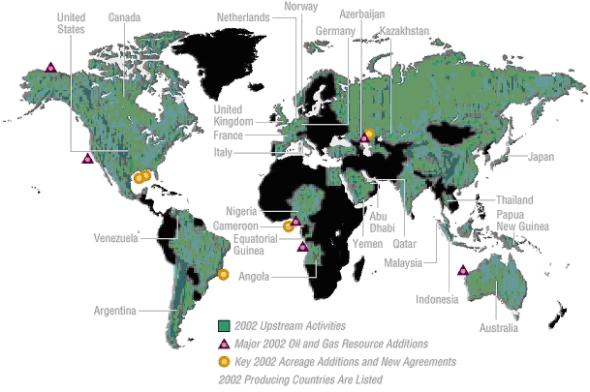

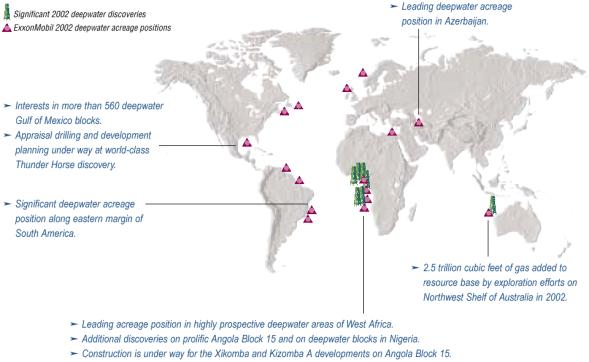

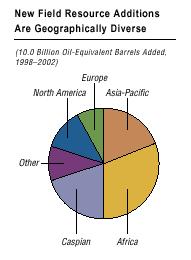

Ø • Key resource additions from Angola, Nigeria, Australia, Kazakhstan, and North America.

Ø • Downstream continued to capture substantial pre-tax efficiencies of $1.4 billion during the year.

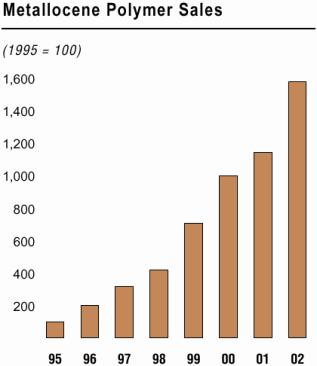

Ø • Record Chemical sales volumes for the fourth consecutive year and 4 percent above last year’s level.

Ø • Substantial earnings from divestments of our Chilean copper business and Colombian coal business.

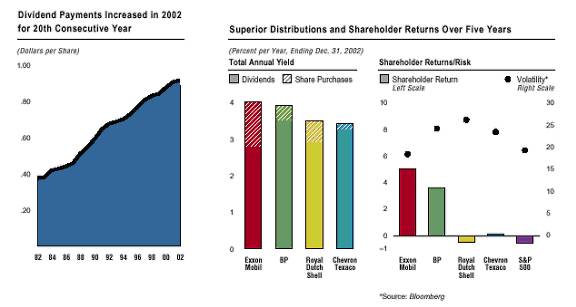

Ø • Annual dividend payments increased for the 20th consecutive year.

2002 INDUSTRY CONDITIONS

Ø • World GDP grew about 2 percent in 2002 versus 1.4 percent in 2001, extending a period of relatively weak demand growth for oil and gas. World oil demand increased by about 250 thousand barrels per day in 2002.

Ø • Brent oil prices averaged approximately $25 per barrel in 2002, about 50 cents per barrel higher versus 2001.

Ø • Natural gas prices in the United States increased through the year, but on average were about 25 percent lower versus 2001. Natural gas prices were down about 15 percent in Europe.

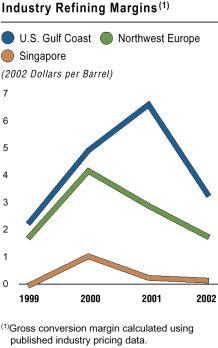

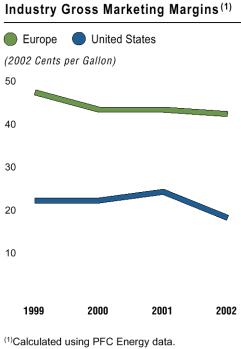

Ø • Industry refining margins in the U.S. and Europe fell significantly in 2002 due to weak product demand. In Asia-Pacific, excess refinery capacity also contributed to depressed margins.

Ø • Chemical margins remained near bottom-of-cycle levels in 2002 for most high-volume petrochemicals, reflecting sufficient supply and moderate demand growth.

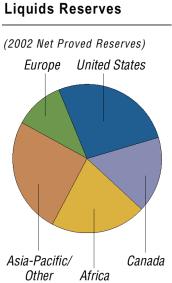

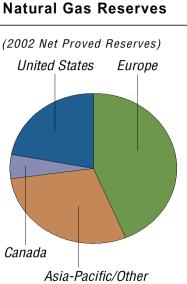

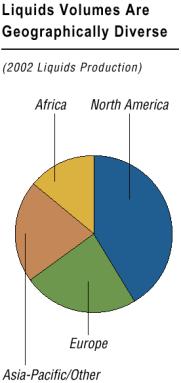

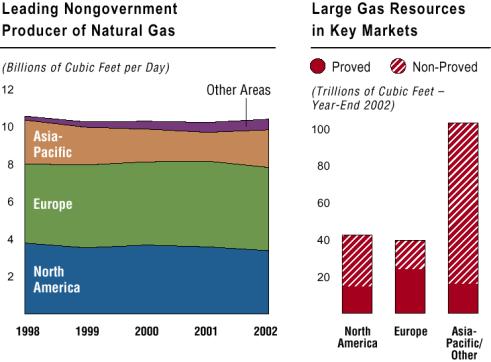

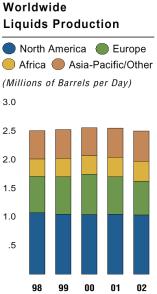

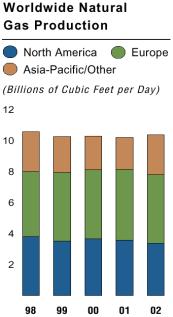

Leadership Position in Core Businesses

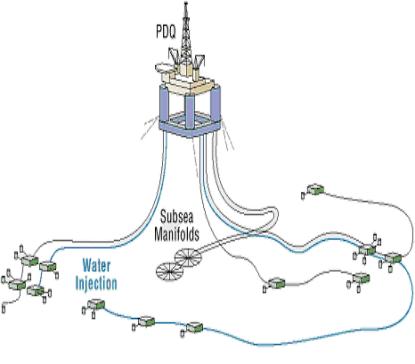

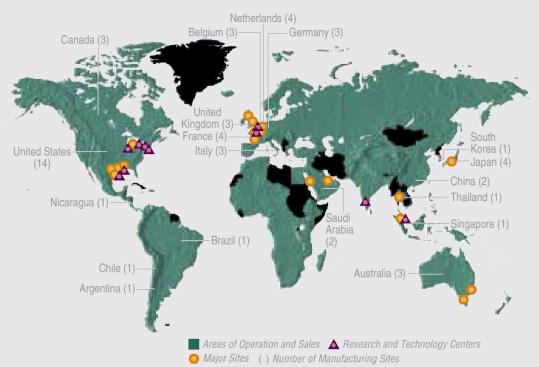

In the Upstream, ExxonMobil participates in every major producing area in the world. We have a substantial production base in the United States, Europe, and the Asia-Pacific region and are unique in having interests in the four major growth areas of West Africa, the Middle East, the Caspian, and Russia. ExxonMobil has the largest resource base of any nongovernment company in the world with 72 billion oil-equivalent barrels. Our proprietary technology, financial strength, worldwide experience, and disciplined approach make ExxonMobil the partner of choice for host governments and joint-venture partners.

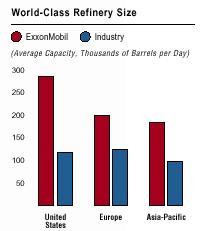

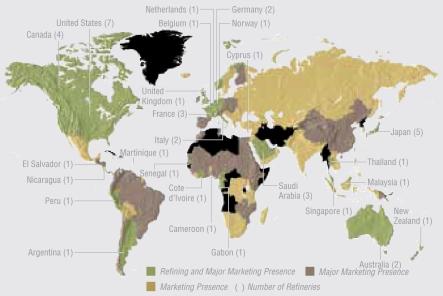

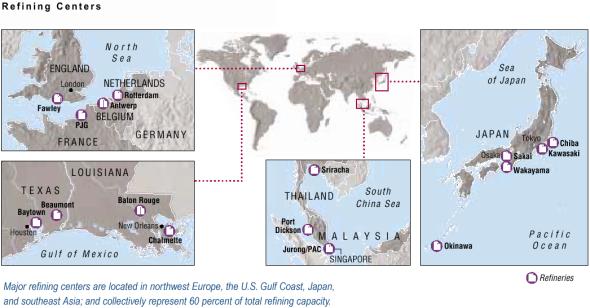

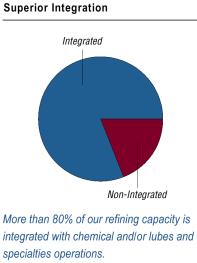

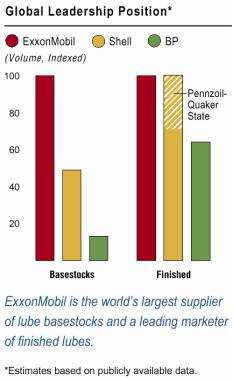

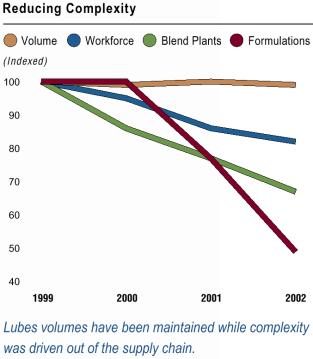

In the Downstream, ExxonMobil is the largest fuels refiner and manufacturer of lubes basestocks in the world. We market retail petroleum products and finished lubricants under three strong brands. Our refineries are 50-percent larger than industry average, with more than 80 percent of capacity integrated with other ExxonMobil manufacturing operations, which results in world-class efficiency. ExxonMobil’s range of market-focused retail formats and customer-targeted lubricant products differentiates us from the competition and provides continued competitive advantage.

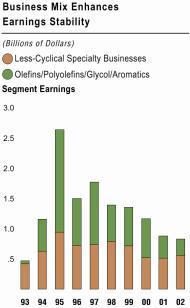

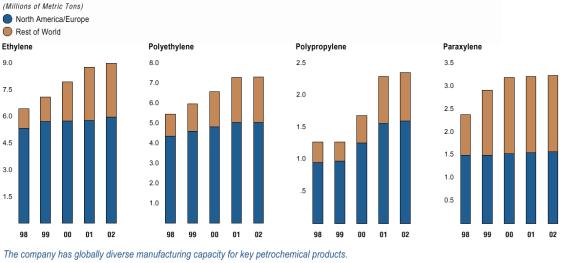

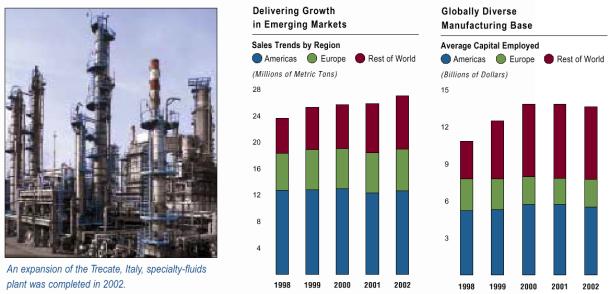

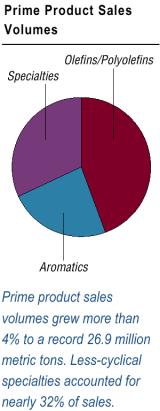

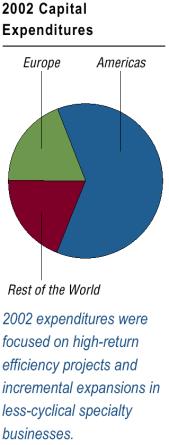

In Chemical, ExxonMobil is a leading producer and supplier of primary petrochemicals, including olefins, polyolefins, and aromatics, as well as a number of specialty petrochemicals. Our Chemical business is competitively advantaged by our leading-edge technology, integration of more than 90 percent of our assets with refineries, mix of cyclical and non-cyclical businesses, and superior cost structure.

3

INDUSTRY OUTLOOK

World Energy Demand Growing

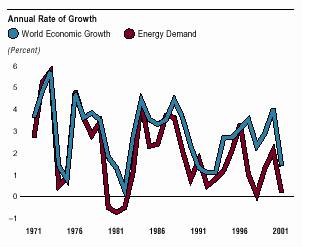

There is a long-standing, proven link between economic growth and energy use. Growing economies will continue to require reliable and affordable energy supplies. We expect hydrocarbons, which currently account for about 80 percent of energy supply, to maintain a significant share of world energy demand.

Responsible Development

Today, roughly 85 percent of the world’s population lives in developing countries, where GDP per capita is only about 6 percent of that in the developed world. Some 1.6 billion people have no access to electricity, and more than 1 billion people lack access to safe drinking water. Such needs provide a tremendous opportunity and responsibility to help improve the quality of life for people around the world.

Efficiency and Conservation Important to Meeting Future Energy Needs

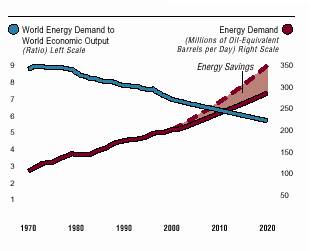

Economic growth will remain the primary driver of energy demand. The global economy has grown at an average rate of about 3 percent per year since 1970. We expect growth to continue at that pace, on average, for the next couple of decades as developing nations play a greater role in the global economy, and increases in productivity offset lower population growth.

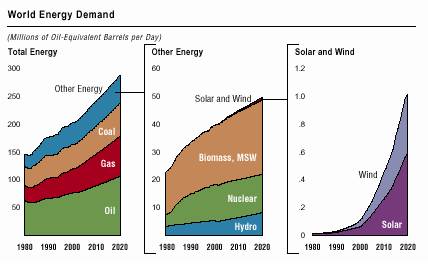

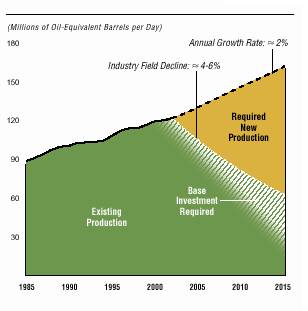

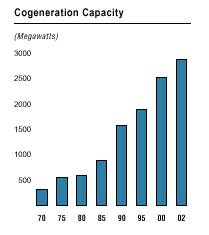

We expect worldwide energy demand to grow at about 2 percent per year, reflecting significant but yet-to-be-achieved advances in energy efficiency. Contributing to these efficiency gains will be the development and deployment of new technologies such as natural gas combined-cycle turbines for power generation, and advanced internal combustion engine and hybrid vehicles. We expect world energy demand will be close to 290 million oil-equivalent barrels per day by 2020 — or about 40 percent more than today.

Oil and Gas Will Remain Predominant Energy Sources

We anticipate that hydrocarbon fuels will remain the dominant energy source, at least through the middle of the century. Wind and solar power will continue to grow rapidly, due to significant government policies and incentives, not market economics. To put this in perspective, solar power can cost somewhere between $100 and $250 per oil-equivalent barrel.

4

The intermittent nature of solar energy can result in additional costs for backup supplies. Starting from a low base today, wind and solar energy are unlikely to exceed a 1-percent share of the world’s energy needs by 2020, even with double-digit growth rates.

This view recognizes the role and scope of hydrocarbon supplies today, including their enduring competitive advantages in terms of cost and ease of use in multiple applications. The oil and gas share of the world’s energy supply — close to 60 percent today — is expected to remain at that level over the next two decades.

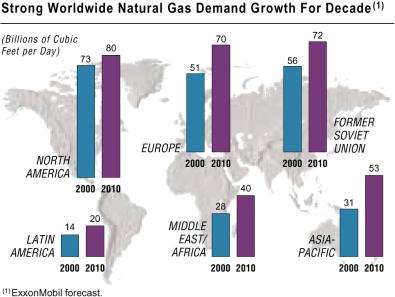

Some 50 years ago, natural gas represented about 10 percent of the world’s energy demand. Today it exceeds 20 percent of demand. Over the next couple of decades, we expect this trend to continue, with natural gas capturing about one-third of all incremental energy growth. Driving this growth is the fact that natural gas remains the fuel of choice to meet increasing electricity demand around the world. By 2020, gas is likely to supply about one-quarter of global energy requirements — second only to oil.

Growing Oil and Gas Demand Requires New Supplies

The ongoing task of our industry is to find, produce, and deliver energy products in an economic and environmentally sound manner. By 2015, the petroleum industry will likely need to add some 100 million oil-equivalent barrels per day to meet demand — an amount close to 80 percent of today’s production levels.

Meeting growing energy demand will require access to resources, technology advances, significant investments, timely development, and the cooperation of host governments. As indigenous supplies of oil and gas within mature market areas decline while demand grows, the dependency between importing and exporting countries is expected to increase. We expect growing supplies from West Africa, Russia, the Caspian region, and the Middle East to support higher imports into the United States, Europe, and Asia.

The prospect of higher import levels continues to raise concerns about security of supply. The key to security will be found in diversity of supply. Governments can do much to help this effort by promoting diversity through access to resource acreage in all regions.

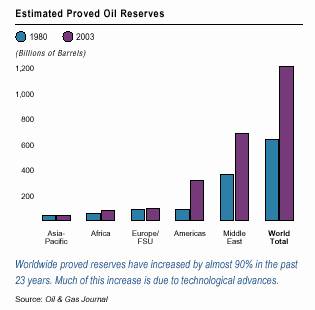

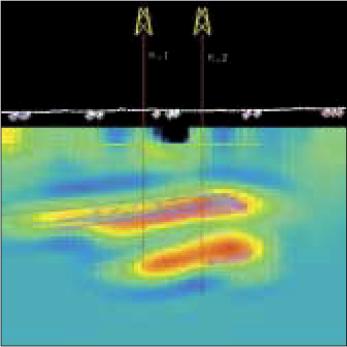

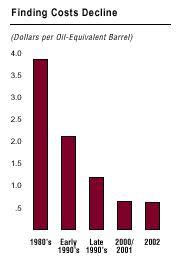

Technology Gains Required to Help Meet Future Needs

New technologies will continue to help improve the recovery of hydrocarbon resources, as demonstrated in the past by improvements in 3-D seismic imaging and reservoir modeling, advanced drilling, and arctic and deepwater resource development. ExxonMobil’s commitment to new technology will help reduce the cost of producing difficult-to-reach resources and increase the potential for discovering resources that will contribute to future energy supplies.

ExxonMobil will continue to improve on the legacy of our technology successes. Our industry-leading resource base, technology advantages, project-management discipline and financial strength provide us with a sustainable competitive advantage to capitalize on the opportunities ahead.

5

COMPETITIVE ADVANTAGES BUILD SHAREHOLDER VALUE

Unparalleled Execution of Business Strategies

ExxonMobil’s fundamental approach to our business is disciplined, straightforward, and focused on the long term. Although other companies may take a similar approach, it is the execution of our strategies that distinguishes us from competition. It is this superior execution that delivers industry-leading results in all aspects of our business.

Unwavering Capital Discipline

In our industry, where large capital investments are required, it is important to demonstrate the prudent use of capital resources. ExxonMobil’s relentless drive to maximize the value of our assets begins with the investment decision. We apply a disciplined approach to selecting and pursuing the most-attractive opportunities, and this discipline continues through execution of all phases of the project from design through start-up and ongoing operations. We continuously work to control costs. Once investments are made, a rigorous re-appraisal process is completed to ensure relevant lessons are learned and improvements are incorporated into future projects. This rigorous approach ensures that we are achieving the maximum value for our assets and clearly distinguishes us from our competition.

Operational Excellence Delivers Superior Results

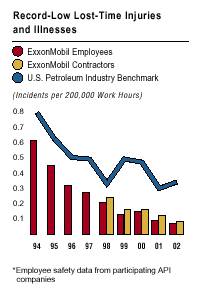

The same disciplined approach we take to making investment decisions is applied to managing our operations. We call this Operational Excellence. ExxonMobil believes that Operational Excellence starts with safety. When a company is committed to safety, as we are, the same discipline and commitment are applied in all aspects of business. In 2002, ExxonMobil set another record in safety performance, and led the industry again in this area.

Additionally, ExxonMobil management’s commitment to proven, structured management systems ensures consistent quality of work in the 200 countries and territories where the company operates. We have achieved strong results by focusing on continuous productivity improvements and cost efficiencies.

Global Functional Organization Creates Efficiencies

ExxonMobil is the only multinational integrated oil company organized to operate the functional business lines on a global basis. Through the functional organization, global opportunities are ranked and people are promptly deployed to ever-changing business conditions. The functional organization also helps to more promptly identify and prioritize high-impact technology needs, and it facilitates the rapid sharing of ideas and best practices across our global operations.

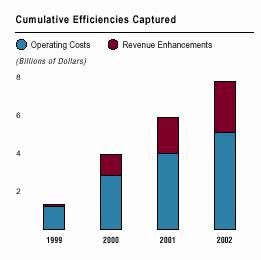

ExxonMobil’s functional approach is delivering savings to the bottom line through operating cost efficiencies and revenue enhancements. In 2002, ExxonMobil businesses delivered almost $1.9 billion before-tax in efficiencies, and we expect to deliver an additional $1 billion in 2003.

Ethics and Business Integrity Remain Core Values

At ExxonMobil, we have long recognized the importance and value of ethics and business integrity. We believe they are key to long-term, sustainable results. Our approach is straightforward and is reflected in all of our activities. We strive to ensure our results are clear and readily understood by our investors.

6

Geographic and Functional Diversity Provides Balance

The company’s size, geographic diversity, and the complementary nature of the Upstream, Downstream, and Chemical businesses mitigate the corporation’s sensitivity to fluctuations in individual business lines and markets. By taking advantage of synergies among these businesses, ExxonMobil is able to optimize total company performance.

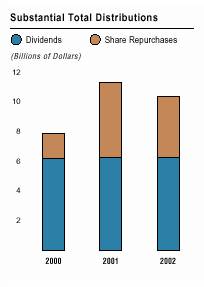

Strong Cash Flow Results from Business Approach

In 2002, we generated $24 billion in cash flow from operations and asset sales. We invested $14 billion in capital and exploration expenditures, and distributed more than $10 billion to shareholders through dividend payments and share repurchases.

During the last three years, we have generated nearly $77 billion in cash flow from operations and asset sales, invested $37 billion in capital and exploration expenditures, and distributed $29 billion to shareholders in the form of dividends and share buybacks. The company also reduced debt outstanding and grew cash balances during this time period.

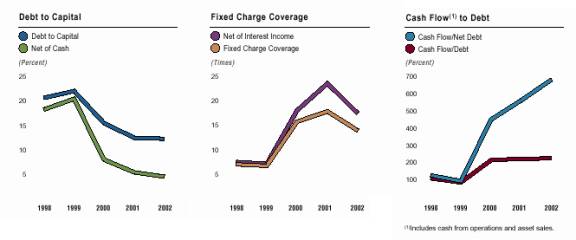

Financial Strength Enables Pursuit of all Profitable Opportunities

ExxonMobil is one of few U.S. industrial companies with a triple-A credit rating — a rating that has been sustained for 84 years. Our financial strength allows us to readily access capital markets and fund the capital needed to pursue any and all profitable opportunities. Strong business results and a prudent and well-tested approach to financial management ensure we maintain this financial strength at any stage of the industry cycle.

Net debt to capital (net of cash) ended the year at about 4 percent. Fixed charge coverage was almost 14 times for 2002, and cash flow to net debt was near 700 percent. This performance demonstrates the rigorous commitment to financial and capital investment discipline that has yielded a productive capital base throughout the business cycle.

The company’s financial position, size, and geographic and functional diversity provide a natural hedge to mitigate risk from changes in commodity prices, foreign exchange, and interest rates. As a result, the company seldom uses derivatives, and only does so to offset exposures from existing transactions.

7

Competitive Advantages (continued)

Industry Leader in Return on Capital Employed

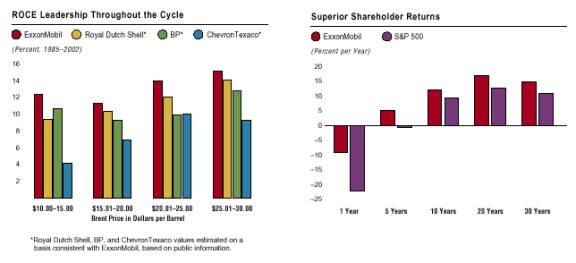

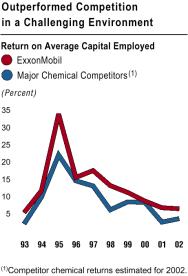

ExxonMobil views return on capital employed as the most critical and best measure of historical capital productivity in our capital-intensive, long-term industry. ExxonMobil has a long history of leadership in return on capital employed. The combination of our disciplined investments and operational excellence leads to consistent industry-leading returns. In 2002, ExxonMobil remained the industry leader in return on capital employed, with a return of 13.5 percent.

ExxonMobil’s Approach Grows Shareholder Value

Long-term growth in shareholder value is our core, fundamental objective, and our track record demonstrates we continue to provide substantial benefits for our shareholders. ExxonMobil has paid a dividend every year for more than a century, and dividend payments have increased in each of the past 20 years, reaching $0.92 per share in 2002. During 2002, we distributed more than $10 billion to shareholders through dividend payments and share repurchases, representing a total yield of about 4 percent of the company’s equity market capitalization at the beginning of the year. During the last three years, $29 billion in dividends and share buybacks has been distributed to shareholders, representing more than 10 percent of ExxonMobil’s year-end 1999 market value.

Returns on ExxonMobil shares have consistently outpaced those of the S&P 500 index. ExxonMobil shareholders have earned annualized returns of 16.9 percent and 14.8 percent during the last 20 and 30 years, respectively, compared with returns from the S&P 500 index of 12.7 percent and 10.7 percent in the same time periods.

The volatility of ExxonMobil’s stock price, a measure of the fluctuation of monthly returns around its average and a key indication of risk, has equaled the volatility of the diversified S&P 500 index during the past five years, and has been well below that of peers in our industry during that same time period.

Disciplined Management of Annuity Plans

ExxonMobil and its affiliates manage more than 100 pension plans. The funding arrangement for each plan depends on the prevailing practices and regulations of the countries where the company operates.

•Ø In several countries, such as the United States, Canada, and the United Kingdom, the prevailing practice is to fund most pension obligations through separate assets or insurance arrangements. These plans are managed in compliance with the requirements of governmental authorities, and meet or exceed required funding levels as measured by relevant actuarial and government standards at the mandated measurement dates.

•Ø Book reserves are established for plans in other countries, as well as certain smaller plans in the U.S., because tax conventions and regulatory practices do not encourage funding. Book reserves are added as additional pension costs are incurred with company service, and benefit payments are made from corporate cash flow.

The approach to managing the financial assets associated with these plans is consistent with the core principles followed in all ExxonMobil businesses. Our fund management reflects careful assessment of the risks of various asset classes, diversification to minimize the portfolio’s risk, and a long-term orientation that minimizes transaction costs and takes advantage of more-predictable, long-term asset returns.

ExxonMobil is a capital-intensive, rather than a labor-intensive, business. Pension expense represented only 2 percent of total operating costs in 2002. Pension expense is calculated based on U.S. Generally Accepted Accounting Principles, which require certain assumptions, such as discount rate and long-term expected earnings. Assumptions are developed conservatively, are reviewed by outside actuaries and senior management, and are within the range of peer practice and actual experience. For example, our long-term earnings rate assumption has been, and will continue to be, consistent with historical returns. The 2003 assumption is 9 percent for the U.S. pension plan versus 9.5 percent in 2002. Returns over the past 10- and 20-year periods were 10 percent and 11 percent, respectively.

8

NUMBER OF REGULAR EMPLOYEES AT YEAR END

|

(thousands) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

United States |

|

36 |

|

36 |

|

36 |

|

39 |

|

44 |

|

|

Outside United States |

|

56 |

|

62 |

|

64 |

|

68 |

|

68 |

|

|

Total regular employees |

|

92 |

|

98 |

|

100 |

|

107 |

|

112 |

|

|

CORS(1) employees not included above |

|

17 |

|

20 |

|

19 |

|

16 |

|

13 |

|

(1) CORS employees are employees of company-operated retail sites.

DIVIDEND AND OTHER SHAREHOLDER INFORMATION

|

|

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Net income per common share (dollars) |

|

1.69 |

|

2.23 |

|

2.55 |

|

1.14 |

|

1.15 |

|

|

Net income per common share — assuming dilution (dollars) |

|

1.68 |

|

2.21 |

|

2.52 |

|

1.12 |

|

1.14 |

|

|

Dividends per common share(1) (dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

First quarter |

|

0.23 |

|

0.22 |

|

0.22 |

|

0.208 |

|

0.208 |

|

|

Second quarter |

|

0.23 |

|

0.23 |

|

0.22 |

|

0.208 |

|

0.208 |

|

|

Third quarter |

|

0.23 |

|

0.23 |

|

0.22 |

|

0.208 |

|

0.208 |

|

|

Fourth quarter |

|

0.23 |

|

0.23 |

|

0.22 |

|

0.220 |

|

0.209 |

|

|

Total |

|

0.92 |

|

0.91 |

|

0.88 |

|

0.844 |

|

0.833 |

|

|

Annual dividend growth (percent) |

|

1.1 |

|

3.4 |

|

4.3 |

|

1.3 |

|

2.8 |

|

|

Number of common shares outstanding (millions) |

|

|

|

|

|

|

|

|

|

|

|

|

Average |

|

6,753 |

|

6,868 |

|

6,953 |

|

6,906 |

|

6,937 |

|

|

Average — assuming dilution |

|

6,803 |

|

6,941 |

|

7,033 |

|

7,036 |

|

7,067 |

|

|

Year end |

|

6,700 |

|

6,809 |

|

6,930 |

|

6,955 |

|

6,916 |

|

|

Number of registered shareholders at year-end (thousands) |

|

678 |

|

699 |

|

719 |

|

779 |

|

812 |

|

|

Annual total shareholder returns(2) (percent) |

|

(8.9 |

) |

(7.6 |

) |

10.2 |

|

12.5 |

|

22.4 |

|

|

Market quotations for common stock(3) (dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

44.58 |

|

45.84 |

|

47.72 |

|

43.63 |

|

38.66 |

|

|

Low |

|

29.75 |

|

35.01 |

|

34.94 |

|

32.16 |

|

28.31 |

|

|

Average daily close |

|

37.70 |

|

41.29 |

|

41.42 |

|

38.40 |

|

34.60 |

|

|

Year-end close |

|

34.94 |

|

39.30 |

|

43.47 |

|

40.28 |

|

36.57 |

|

|

Cash dividends paid on common stock (millions of dollars) |

|

6,217 |

|

6,254 |

|

6,123 |

|

5,836 |

|

5,783 |

|

|

Cash dividends paid on preferred stock (millions of dollars) |

|

— |

|

— |

|

— |

|

36 |

|

60 |

|

|

Total cash dividends paid (millions of dollars) |

|

6,217 |

|

6,254 |

|

6,123 |

|

5,872 |

|

5,843 |

|

|

Cash dividends paid to net income (percent) |

|

54.2 |

|

40.8 |

|

34.6 |

|

74.2 |

|

72.4 |

|

|

Cash dividends paid to cash flow(4) (percent) |

|

25.8 |

|

26.1 |

|

21.3 |

|

36.7 |

|

31.9 |

|

(1) Dividends per common share for 1998 and 1999 reflect the sum of the dividends paid by Exxon and Mobil divided by the number of shares that would have been outstanding for the periods, after adjusting the Mobil shares for the exchange ratio of 1.32015 shares of ExxonMobil common stock.

(2) Total shareholder returns are the appreciation of the stock price over a year plus the value of the dividends, with dividend reinvestment, and excluding trading commissions and taxes. See Frequently Used Terms.

(3) Market quotations for common stock reflect Exxon share prices through November 30, 1999, the effective date of the merger, and ExxonMobil share prices thereafter.

(4) Cash flow includes cash from operations and asset sales. See Frequently Used Terms.

9

FUNCTIONAL EARNINGS

|

|

|

2002 Quarters |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(millions of dollars) |

|

First |

|

Second |

|

Third |

|

Fourth |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Net Income (U.S. GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

448 |

|

677 |

|

642 |

|

757 |

|

2,524 |

|

3,933 |

|

4,542 |

|

1,873 |

|

869 |

|

|

Non-U.S. |

|

1,641 |

|

1,553 |

|

1,635 |

|

2,245 |

|

7,074 |

|

6,803 |

|

8,143 |

|

4,371 |

|

2,837 |

|

|

Total |

|

2,089 |

|

2,230 |

|

2,277 |

|

3,002 |

|

9,598 |

|

10,736 |

|

12,685 |

|

6,244 |

|

3,706 |

|

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

14 |

|

234 |

|

42 |

|

403 |

|

693 |

|

1,924 |

|

1,561 |

|

577 |

|

1,199 |

|

|

Non-U.S. |

|

(42 |

) |

148 |

|

83 |

|

418 |

|

607 |

|

2,303 |

|

1,857 |

|

650 |

|

2,275 |

|

|

Total |

|

(28 |

) |

382 |

|

125 |

|

821 |

|

1,300 |

|

4,227 |

|

3,418 |

|

1,227 |

|

3,474 |

|

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

70 |

|

87 |

|

156 |

|

71 |

|

384 |

|

398 |

|

644 |

|

738 |

|

792 |

|

|

Non-U.S. |

|

62 |

|

182 |

|

197 |

|

5 |

|

446 |

|

484 |

|

517 |

|

616 |

|

602 |

|

|

Total |

|

132 |

|

269 |

|

353 |

|

76 |

|

830 |

|

882 |

|

1,161 |

|

1,354 |

|

1,394 |

|

|

Corporate and financing |

|

(70 |

) |

(222 |

) |

(41 |

) |

(109 |

) |

(442 |

) |

(142 |

) |

(538 |

) |

(511 |

) |

(443 |

) |

|

Merger expenses |

|

(60 |

) |

(30 |

) |

(85 |

) |

(100 |

) |

(275 |

) |

(525 |

) |

(920 |

) |

(469 |

) |

0 |

|

|

Gain from required asset divestitures |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

40 |

|

1,730 |

|

0 |

|

0 |

|

|

Discontinued operations |

|

27 |

|

11 |

|

11 |

|

400 |

|

449 |

|

102 |

|

184 |

|

65 |

|

13 |

|

|

Accounting change |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

(70 |

) |

|

Net income (U.S. GAAP) |

|

2,090 |

|

2,640 |

|

2,640 |

|

4,090 |

|

11,460 |

|

15,320 |

|

17,720 |

|

7,910 |

|

8,074 |

|

|

Net income per common share (dollars) |

|

0.30 |

|

0.40 |

|

0.39 |

|

0.60 |

|

1.69 |

|

2.23 |

|

2.55 |

|

1.14 |

|

1.15 |

|

|

Net income per common share — assuming dilution (dollars) |

|

0.30 |

|

0.39 |

|

0.39 |

|

0.60 |

|

1.68 |

|

2.21 |

|

2.52 |

|

1.12 |

|

1.14 |

|

|

|

|

||||||||||||||||||

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

(185 |

) |

|

Non-U.S. |

|

0 |

|

0 |

|

(215 |

) |

0 |

|

(215 |

) |

0 |

|

0 |

|

119 |

|

(176 |

) |

|

Total |

|

0 |

|

0 |

|

(215 |

) |

0 |

|

(215 |

) |

0 |

|

0 |

|

119 |

|

(361 |

) |

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

8 |

|

|

Non-U.S. |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

(120 |

) |

(412 |

) |

|

Total |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

(120 |

) |

(404 |

) |

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

100 |

|

0 |

|

0 |

|

(8 |

) |

|

Non-U.S. |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

75 |

|

0 |

|

0 |

|

(1 |

) |

|

Total |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

175 |

|

0 |

|

0 |

|

(9 |

) |

|

Corporate and financing |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

112 |

|

|

Merger expenses |

|

(60 |

) |

(30 |

) |

(85 |

) |

(100 |

) |

(275 |

) |

(525 |

) |

(920 |

) |

(469 |

) |

0 |

|

|

Gain from required asset divestitures |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

40 |

|

1,730 |

|

0 |

|

0 |

|

|

Discontinued operations |

|

27 |

|

11 |

|

11 |

|

400 |

|

449 |

|

102 |

|

184 |

|

65 |

|

13 |

|

|

Accounting change |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

(70 |

) |

|

Corporate total |

|

(33 |

) |

(19 |

) |

(289 |

) |

300 |

|

(41 |

) |

(208 |

) |

994 |

|

(405 |

) |

(719 |

) |

|

|

|

||||||||||||||||||

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

448 |

|

677 |

|

642 |

|

757 |

|

2,524 |

|

3,933 |

|

4,542 |

|

1,873 |

|

1,054 |

|

|

Non-U.S. |

|

1,641 |

|

1,553 |

|

1,850 |

|

2,245 |

|

7,289 |

|

6,803 |

|

8,143 |

|

4,252 |

|

3,013 |

|

|

Total |

|

2,089 |

|

2,230 |

|

2,492 |

|

3,002 |

|

9,813 |

|

10,736 |

|

12,685 |

|

6,125 |

|

4,067 |

|

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

14 |

|

234 |

|

42 |

|

403 |

|

693 |

|

1,924 |

|

1,561 |

|

577 |

|

1,191 |

|

|

Non-U.S. |

|

(42 |

) |

148 |

|

83 |

|

418 |

|

607 |

|

2,303 |

|

1,857 |

|

770 |

|

2,687 |

|

|

Total |

|

(28 |

) |

382 |

|

125 |

|

821 |

|

1,300 |

|

4,227 |

|

3,418 |

|

1,347 |

|

3,878 |

|

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

70 |

|

87 |

|

156 |

|

71 |

|

384 |

|

298 |

|

644 |

|

738 |

|

800 |

|

|

Non-U.S. |

|

62 |

|

182 |

|

197 |

|

5 |

|

446 |

|

409 |

|

517 |

|

616 |

|

603 |

|

|

Total |

|

132 |

|

269 |

|

353 |

|

76 |

|

830 |

|

707 |

|

1,161 |

|

1,354 |

|

1,403 |

|

|

Corporate and financing |

|

(70 |

) |

(222 |

) |

(41 |

) |

(109 |

) |

(442 |

) |

(142 |

) |

(538 |

) |

(511 |

) |

(555 |

) |

|

Corporate total |

|

2,123 |

|

2,659 |

|

2,929 |

|

3,790 |

|

11,501 |

|

15,528 |

|

16,726 |

|

8,315 |

|

8,793 |

|

|

Earnings per common share (dollars) |

|

0.30 |

|

0.40 |

|

0.44 |

|

0.56 |

|

1.70 |

|

2.27 |

|

2.40 |

|

1.20 |

|

1.25 |

|

|

Earnings per common share — assuming dilution (dollars) |

|

0.30 |

|

0.39 |

|

0.44 |

|

0.56 |

|

1.69 |

|

2.25 |

|

2.37 |

|

1.18 |

|

1.24 |

|

10

RETURN ON AVERAGE CAPITAL EMPLOYED(1) BY BUSINESS

|

(percent) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

19.0 |

|

30.4 |

|

35.3 |

|

14.7 |

|

6.9 |

|

|

Non-U.S. |

|

23.7 |

|

25.1 |

|

28.7 |

|

15.4 |

|

11.4 |

|

|

Total |

|

22.3 |

|

26.8 |

|

30.8 |

|

15.2 |

|

9.9 |

|

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

8.6 |

|

25.0 |

|

19.6 |

|

6.9 |

|

14.1 |

|

|

Non-U.S. |

|

3.4 |

|

12.4 |

|

9.4 |

|

3.3 |

|

12.0 |

|

|

Total |

|

5.0 |

|

16.1 |

|

12.3 |

|

4.4 |

|

12.6 |

|

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

7.3 |

|

7.2 |

|

11.4 |

|

13.5 |

|

15.0 |

|

|

Non-U.S. |

|

5.3 |

|

5.8 |

|

6.3 |

|

8.8 |

|

10.9 |

|

|

Total |

|

6.1 |

|

6.4 |

|

8.4 |

|

10.9 |

|

12.9 |

|

|

Corporate and financing |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Discontinued operations |

|

63.2 |

|

7.2 |

|

12.3 |

|

4.0 |

|

0.8 |

|

|

Corporate total |

|

13.5 |

|

17.8 |

|

20.6 |

|

10.3 |

|

10.7 |

|

(1) Capital employed consists of shareholders’ equity and debt, including ExxonMobil’s share of amounts applicable to equity companies. See Frequently Used Terms.

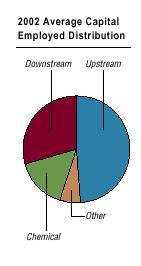

AVERAGE CAPITAL EMPLOYED(2) BY BUSINESS

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

13,264 |

|

12,952 |

|

12,864 |

|

12,728 |

|

12,522 |

|

|

Non-U.S. |

|

29,800 |

|

27,077 |

|

28,354 |

|

28,383 |

|

24,900 |

|

|

Total |

|

43,064 |

|

40,029 |

|

41,218 |

|

41,111 |

|

37,422 |

|

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

8,060 |

|

7,711 |

|

7,976 |

|

8,354 |

|

8,509 |

|

|

Non-U.S. |

|

17,985 |

|

18,610 |

|

19,756 |

|

19,679 |

|

18,986 |

|

|

Total |

|

26,045 |

|

26,321 |

|

27,732 |

|

28,033 |

|

27,495 |

|

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

5,235 |

|

5,506 |

|

5,644 |

|

5,471 |

|

5,293 |

|

|

Non-U.S. |

|

8,410 |

|

8,333 |

|

8,170 |

|

6,991 |

|

5,523 |

|

|

Total |

|

13,645 |

|

13,839 |

|

13,814 |

|

12,462 |

|

10,816 |

|

|

Corporate and financing |

|

4,878 |

|

6,399 |

|

3,198 |

|

605 |

|

2,638 |

|

|

Discontinued operations |

|

710 |

|

1,412 |

|

1,501 |

|

1,625 |

|

1,708 |

|

|

Corporate total |

|

88,342 |

|

88,000 |

|

87,463 |

|

83,836 |

|

80,079 |

|

|

Average capital employed applicable to equity companies included above |

|

14,001 |

|

13,902 |

|

15,330 |

|

14,694 |

|

11,461 |

|

(2) Average capital employed is the average of beginning and end of year business segment capital employed.

See Frequently Used Terms.

11

NET INVESTMENT IN PROPERTY, PLANT, AND EQUIPMENT AT YEAR END

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

16,924 |

|

16,697 |

|

16,216 |

|

16,249 |

|

16,141 |

|

|

Non-U.S. |

|

34,772 |

|

29,980 |

|

29,600 |

|

31,940 |

|

30,849 |

|

|

Total |

|

51,696 |

|

46,677 |

|

45,816 |

|

48,189 |

|

46,990 |

|

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

9,238 |

|

9,012 |

|

9,048 |

|

9,443 |

|

9,284 |

|

|

Non-U.S. |

|

17,682 |

|

16,548 |

|

17,682 |

|

19,531 |

|

20,128 |

|

|

Total |

|

26,920 |

|

25,560 |

|

26,730 |

|

28,974 |

|

29,412 |

|

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

5,155 |

|

5,079 |

|

5,045 |

|

5,124 |

|

5,134 |

|

|

Non-U.S. |

|

4,754 |

|

4,611 |

|

4,890 |

|

4,845 |

|

4,367 |

|

|

Total |

|

9,909 |

|

9,690 |

|

9,935 |

|

9,969 |

|

9,501 |

|

|

Other/Discontinued operations |

|

6,415 |

|

7,675 |

|

7,348 |

|

6,911 |

|

6,680 |

|

|

Corporate total |

|

94,940 |

|

89,602 |

|

89,829 |

|

94,043 |

|

92,583 |

|

DEPRECIATION AND DEPLETION EXPENSES

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Upstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

1,597 |

|

1,447 |

|

1,426 |

|

1,342 |

|

1,694 |

|

|

Non-U.S. |

|

3,551 |

|

3,221 |

|

3,469 |

|

3,497 |

|

3,330 |

|

|

Total |

|

5,148 |

|

4,668 |

|

4,895 |

|

4,839 |

|

5,024 |

|

|

Downstream |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

583 |

|

598 |

|

594 |

|

697 |

|

706 |

|

|

Non-U.S. |

|

1,399 |

|

1,476 |

|

1,489 |

|

1,670 |

|

1,516 |

|

|

Total |

|

1,982 |

|

2,074 |

|

2,083 |

|

2,367 |

|

2,222 |

|

|

Chemical |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

414 |

|

408 |

|

397 |

|

402 |

|

402 |

|

|

Non-U.S. |

|

348 |

|

289 |

|

281 |

|

274 |

|

338 |

|

|

Total |

|

762 |

|

697 |

|

678 |

|

676 |

|

740 |

|

|

Other |

|

418 |

|

409 |

|

345 |

|

293 |

|

241 |

|

|

Corporate total |

|

8,310 |

|

7,848 |

|

8,001 |

|

8,175 |

|

8,227 |

|

OPERATING COSTS EXCLUDING MERGER EXPENSES AND DISCONTINUED OPERATIONS

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Operating |

|

17,831 |

|

17,743 |

|

17,600 |

|

16,264 |

|

17,120 |

|

|

Selling, general, and administrative |

|

12,356 |

|

12,898 |

|

12,044 |

|

13,132 |

|

12,917 |

|

|

Depreciation and depletion |

|

8,310 |

|

7,848 |

|

8,001 |

|

8,175 |

|

8,227 |

|

|

Exploration |

|

920 |

|

1,175 |

|

936 |

|

1,246 |

|

1,506 |

|

|

Subtotal |

|

39,417 |

|

39,664 |

|

38,581 |

|

38,817 |

|

39,770 |

|

|

ExxonMobil’s share of equity company expenses |

|

3,800 |

|

3,832 |

|

4,355 |

|

4,835 |

|

4,276 |

|

|

Total operating costs |

|

43,217 |

|

43,496 |

|

42,936 |

|

43,652 |

|

44,046 |

|

12

CONSOLIDATED BALANCE SHEET AT YEAR END

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

7,229 |

|

6,547 |

|

7,080 |

|

1,688 |

|

2,386 |

|

|

Notes and accounts receivable — net |

|

21,163 |

|

19,549 |

|

22,996 |

|

19,155 |

|

15,829 |

|

|

Inventories |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil |

|

1,854 |

|

1,849 |

|

2,155 |

|

2,414 |

|

2,369 |

|

|

Products and merchandise |

|

4,973 |

|

4,894 |

|

5,089 |

|

4,956 |

|

5,168 |

|

|

Materials and supplies |

|

1,241 |

|

1,161 |

|

1,060 |

|

1,122 |

|

1,155 |

|

|

Prepaid taxes and expenses |

|

1,831 |

|

1,681 |

|

2,019 |

|

1,806 |

|

1,687 |

|

|

Total current assets |

|

38,291 |

|

35,681 |

|

40,399 |

|

31,141 |

|

28,594 |

|

|

Investments and advances |

|

12,111 |

|

10,768 |

|

12,618 |

|

14,544 |

|

13,915 |

|

|

Property, plant, and equipment, at cost, less accumulated depreciation and depletion |

|

94,940 |

|

89,602 |

|

89,829 |

|

94,043 |

|

92,583 |

|

|

Other assets, including intangibles — net |

|

7,302 |

|

7,123 |

|

6,154 |

|

4,793 |

|

4,243 |

|

|

Total assets |

|

152,644 |

|

143,174 |

|

149,000 |

|

144,521 |

|

139,335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Notes and loans payable |

|

4,093 |

|

3,703 |

|

6,161 |

|

10,570 |

|

8,484 |

|

|

Accounts payable |

|

14,984 |

|

13,328 |

|

15,943 |

|

14,132 |

|

11,413 |

|

|

Accrued liabilities |

|

10,202 |

|

9,534 |

|

10,812 |

|

11,360 |

|

11,741 |

|

|

Income taxes payable |

|

3,896 |

|

3,549 |

|

5,275 |

|

2,671 |

|

2,143 |

|

|

Total current liabilities |

|

33,175 |

|

30,114 |

|

38,191 |

|

38,733 |

|

33,781 |

|

|

Long-term debt |

|

6,655 |

|

7,099 |

|

7,280 |

|

8,402 |

|

8,532 |

|

|

Annuity reserves and accrued liabilities |

|

16,454 |

|

12,475 |

|

11,934 |

|

12,902 |

|

13,002 |

|

|

Deferred income tax liabilities |

|

16,484 |

|

16,359 |

|

16,442 |

|

16,251 |

|

16,749 |

|

|

Deferred credits and other long-term obligations |

|

2,511 |

|

1,141 |

|

1,166 |

|

1,079 |

|

1,524 |

|

|

Equity of minority and preferred shareholders in affiliated companies |

|

2,768 |

|

2,825 |

|

3,230 |

|

3,688 |

|

3,627 |

|

|

Total liabilities |

|

78,047 |

|

70,013 |

|

78,243 |

|

81,055 |

|

77,215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock |

|

— |

|

— |

|

— |

|

— |

|

746 |

|

|

Benefit plan related balances |

|

(450 |

) |

(159 |

) |

(235 |

) |

(298 |

) |

(793 |

) |

|

Common stock |

|

4,217 |

|

3,789 |

|

3,661 |

|

3,403 |

|

4,870 |

|

|

Earnings reinvested |

|

100,961 |

|

95,718 |

|

86,652 |

|

75,055 |

|

75,109 |

|

|

Accumulated other nonowner changes in equity |

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative foreign exchange translation adjustment |

|

(3,015 |

) |

(5,947 |

) |

(4,862 |

) |

(2,300 |

) |

(1,573 |

) |

|

Minimum pension liability adjustment |

|

(2,960 |

) |

(535 |

) |

(310 |

) |

(299 |

) |

(408 |

) |

|

Unrealized gains/(losses) on stock investments |

|

(79 |

) |

(108 |

) |

(17 |

) |

31 |

|

— |

|

|

Common stock held in treasury |

|

(24,077 |

) |

(19,597 |

) |

(14,132 |

) |

(12,126 |

) |

(15,831 |

) |

|

Total shareholders’ equity |

|

74,597 |

|

73,161 |

|

70,757 |

|

63,466 |

|

62,120 |

|

|

Total liabilities and shareholders’ equity |

|

152,644 |

|

143,174 |

|

149,000 |

|

144,521 |

|

139,335 |

|

The consolidated financial statements shown on pages 13 through 15 should be read in the context of the notes thereto provided in Appendix A of the corporation’s 2003 Proxy Statement. The notes are an integral part of these statements.

13

CONSOLIDATED STATEMENT OF INCOME

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and other operating revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas |

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum products, including excise taxes |

|

149,526 |

|

153,335 |

|

164,510 |

|

134,846 |

|

120,841 |

|

|

Crude oil |

|

20,406 |

|

22,423 |

|

29,532 |

|

20,252 |

|

17,848 |

|

|

Natural gas |

|

10,315 |

|

12,292 |

|

11,472 |

|

7,969 |

|

7,625 |

|

|

Other |

|

4,269 |

|

4,702 |

|

4,558 |

|

4,843 |

|

4,886 |

|

|

Total petroleum and natural gas |

|

184,516 |

|

192,752 |

|

210,072 |

|

167,910 |

|

151,200 |

|

|

Chemical products(1) |

|

16,408 |

|

15,943 |

|

17,501 |

|

13,777 |

|

13,589 |

|

|

Other |

|

25 |

|

20 |

|

23 |

|

72 |

|

94 |

|

|

Total sales and operating revenue |

|

200,949 |

|

208,715 |

|

227,596 |

|

181,759 |

|

164,883 |

|

|

Earnings from equity interests and other revenue |

|

3,557 |

|

4,070 |

|

4,250 |

|

2,994 |

|

4,013 |

|

|

Total revenue |

|

204,506 |

|

212,785 |

|

231,846 |

|

184,753 |

|

168,896 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Other Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil and product purchases |

|

90,950 |

|

92,257 |

|

108,913 |

|

76,991 |

|

62,099 |

|

|

Operating expenses |

|

17,831 |

|

17,743 |

|

17,600 |

|

16,264 |

|

17,120 |

|

|

Selling, general, and administrative expenses |

|

12,356 |

|

12,898 |

|

12,044 |

|

13,132 |

|

12,917 |

|

|

Depreciation and depletion |

|

8,310 |

|

7,848 |

|

8,001 |

|

8,175 |

|

8,227 |

|

|

Exploration expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Dry holes |

|

345 |

|

495 |

|

223 |

|

403 |

|

585 |

|

|

Other |

|

575 |

|

680 |

|

713 |

|

843 |

|

921 |

|

|

Total exploration expenses |

|

920 |

|

1,175 |

|

936 |

|

1,246 |

|

1,506 |

|

|

Merger related expenses |

|

410 |

|

748 |

|

1,406 |

|

625 |

|

— |

|

|

Interest expense |

|

398 |

|

293 |

|

589 |

|

694 |

|

568 |

|

|

Excise taxes |

|

22,040 |

|

21,907 |

|

22,356 |

|

21,646 |

|

20,926 |

|

|

Other taxes and duties |

|

33,572 |

|

33,377 |

|

32,708 |

|

34,765 |

|

33,203 |

|

|

Income applicable to minority and preferred interests |

|

209 |

|

569 |

|

412 |

|

145 |

|

265 |

|

|

Total costs and other deductions |

|

186,996 |

|

188,815 |

|

204,965 |

|

173,683 |

|

156,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Income Taxes |

|

17,510 |

|

23,970 |

|

26,881 |

|

11,070 |

|

12,065 |

|

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. federal |

|

1,048 |

|

2,532 |

|

3,132 |

|

608 |

|

1,040 |

|

|

Other |

|

5,451 |

|

6,435 |

|

7,943 |

|

2,617 |

|

2,894 |

|

|

Total income taxes |

|

6,499 |

|

8,967 |

|

11,075 |

|

3,225 |

|

3,934 |

|

|

Income from continuing operations |

|

11,011 |

|

15,003 |

|

15,806 |

|

7,845 |

|

8,131 |

|

|

Discontinued operations, net of income tax |

|

449 |

|

102 |

|

184 |

|

65 |

|

13 |

|

|

Extraordinary gain, net of income tax |

|

— |

|

215 |

|

1,730 |

|

— |

|

— |

|

|

Cumulative effect of accounting change, net of income tax |

|

— |

|

— |

|

— |

|

— |

|

(70 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

11,460 |

|

15,320 |

|

17,720 |

|

7,910 |

|

8,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Chemical products supplied to petroleum subsidiaries not included above |

|

3,902 |

|

3,369 |

|

4,002 |

|

2,136 |

|

2,045 |

|

|

Memo:effective income tax rate (percent) |

|

39.8 |

|

39.3 |

|

42.6 |

|

31.9 |

|

35.2 |

|

The consolidated financial statements shown on pages 13 through 15 should be read in the context of the notes thereto provided in Appendix A of the corporation’s 2003 Proxy Statement. The notes are an integral part of these statements.

14

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(millions of dollars) |

|

2002 |

|

2001 |

|

2000 |

|

1999 |

|

1998 |

|

|

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accruing to ExxonMobil shareholders |

|

11,460 |

|

15,320 |

|

17,720 |

|

7,910 |

|

8,074 |

|

|

|

Accruing to minority and preferred interests |

|

209 |

|

569 |

|

412 |

|

145 |

|

265 |

|

|

|

Adjustments for non-cash transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and depletion |

|

8,310 |

|

7,848 |

|

8,001 |

|

8,175 |

|

8,227 |

|

|

|

Deferred income tax charges/(credits) |

|

297 |

|

650 |

|

10 |

|

(1,439 |

) |

318 |

|

|

|

Annuity and accrued liability provisions |

|

(590 |

) |

498 |

|

(662 |

) |

412 |

|

(251 |

) |

|

|

Dividends received greater than/(less than) equity in current earnings of equity companies |

|

(170 |

) |

78 |

|

(387 |

) |

146 |

|

328 |

|

|

|

Extraordinary gain, before income tax |

|

— |

|

(194 |

) |

(2,038 |

) |

— |

|

— |

|

|

|

Changes in operational working capital, excluding cash and debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reduction/(increase) |

— Notes and accounts receivable |

|

(305 |

) |

3,062 |

|

(4,832 |

) |

(3,478 |

) |

2,170 |

|

|

|

— Inventories |

|

353 |

|

154 |

|

(297 |

) |

50 |

|

438 |

|

|

|

— Prepaid taxes and expenses |

|

32 |

|

118 |

|

(204 |

) |

177 |

|

8 |

|

|

Increase/(reduction) |

— Accounts and other payables |

|

365 |

|

(5,103 |

) |

5,411 |

|

3,046 |

|

(3,010 |

) |

|

All other items — net |

|

1,307 |

|

(111 |

) |

(197 |

) |

(131 |

) |

(131 |

) |

|

|

Net cash provided by operating activities |

|

21,268 |

|

22,889 |

|

22,937 |

|

15,013 |

|

16,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions to property, plant, and equipment |

|

(11,437 |

) |

(9,989 |

) |

(8,446 |

) |

(10,849 |

) |

(12,730 |

) |

|

|

Sales of subsidiaries, investments, and property, plant, and equipment |

|

2,793 |

|

1,078 |

|

5,770 |

|

972 |

|

1,884 |

|

|

|

Additional investments and advances |

|

(2,012 |

) |

(1,035 |

) |

(1,648 |

) |

(1,476 |

) |

(1,469 |

) |

|

|

Collection of advances |

|

898 |

|

1,735 |

|

985 |

|

387 |

|

336 |

|

|

|

Additions to other marketable securities |

|

— |

|

— |

|

(41 |

) |

(61 |

) |

(61 |

) |

|

|

Sales of other marketable securities |

|

— |

|

— |

|

82 |

|

42 |

|

58 |

|

|

|

Net cash used in investing activities |

|

(9,758 |

) |

(8,211 |

) |

(3,298 |

) |

(10,985 |

) |

(11,982 |

) |

|

|

Net cash generation before financing activities |

|

11,510 |

|

14,678 |

|

19,639 |

|

4,028 |

|

4,454 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions to long-term debt |

|

396 |

|

547 |

|

238 |

|

454 |

|

1,384 |

|

|

|

Reductions in long-term debt |

|

(246 |

) |

(506 |

) |

(901 |

) |

(341 |

) |

(305 |

) |

|

|

Additions to short-term debt |

|

751 |

|

705 |

|

500 |

|

1,870 |

|

930 |

|

|

|

Reductions in short-term debt |

|

(927 |

) |

(1,212 |

) |

(2,413 |

) |

(2,359 |

) |

(2,175 |

) |

|

|

Additions/(reductions) in debt with less than 90-day maturity |

|

(281 |

) |

(2,306 |

) |

(3,129 |

) |

2,210 |

|

2,384 |

|

|

|

Cash dividends to ExxonMobil shareholders |

|

(6,217 |

) |

(6,254 |