EXHIBIT 99

Overview

CONTENTS

|

||

| 1-17 | ||

| 18-21 | ||

| 22-28 | ||

| 29 | ||

| 30-71 | ||

| 72-87 | ||

| 88-95 | ||

| 96-99 | ||

| 100 | ||

| Inside Back Cover |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 1 |

| FINANCIAL HIGHLIGHTS | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

(millions of dollars, unless noted) |

||||||||||||||||||||

Sales and other operating revenue(1)(2) |

459,579 | 390,328 | 365,467 | 358,955 | 291,252 | |||||||||||||||

Net income |

45,220 | 40,610 | 39,500 | 36,130 | 25,330 | |||||||||||||||

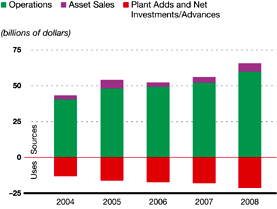

Cash flow from operations and asset sales(3) |

65,710 | 56,206 | 52,366 | 54,174 | 43,305 | |||||||||||||||

Capital and exploration expenditures(3) |

26,143 | 20,853 | 19,855 | 17,699 | 14,885 | |||||||||||||||

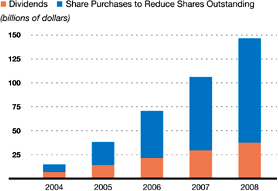

Cash dividends to ExxonMobil shareholders |

8,058 | 7,621 | 7,628 | 7,185 | 6,896 | |||||||||||||||

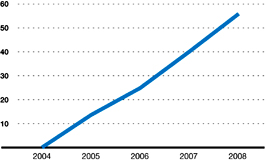

Common stock purchases (gross) |

35,734 | 31,822 | 29,558 | 18,221 | 9,951 | |||||||||||||||

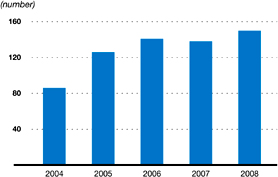

Research and development costs |

847 | 814 | 733 | 712 | 649 | |||||||||||||||

Cash and cash equivalents at year end(4) |

31,437 | 33,981 | 28,244 | 28,671 | 18,531 | |||||||||||||||

Total assets at year end |

228,052 | 242,082 | 219,015 | 208,335 | 195,256 | |||||||||||||||

Total debt at year end |

9,425 | 9,566 | 8,347 | 7,991 | 8,293 | |||||||||||||||

Shareholders’ equity at year end |

112,965 | 121,762 | 113,844 | 111,186 | 101,756 | |||||||||||||||

Average capital employed(3) |

129,683 | 128,760 | 122,573 | 116,961 | 107,339 | |||||||||||||||

Share price at year end (dollars) |

79.83 | 93.69 | 76.63 | 56.17 | 51.26 | |||||||||||||||

Market valuation at year end |

397,239 | 504,220 | 438,990 | 344,491 | 328,128 | |||||||||||||||

Regular employees at year end (thousands) |

79.9 | 80.8 | 82.1 | 83.7 | 85.9 | |||||||||||||||

| KEY FINANCIAL RATIOS | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Net income per common share (dollars) |

8.78 | 7.36 | 6.68 | 5.76 | 3.91 | |||||||||||||||

Net income per common share – assuming dilution (dollars) |

8.69 | 7.28 | 6.62 | 5.71 | 3.89 | |||||||||||||||

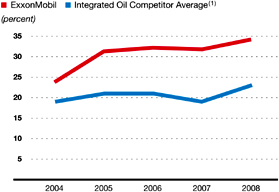

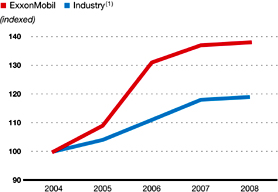

Return on average capital employed(3) (percent) |

34.2 | 31.8 | 32.2 | 31.3 | 23.8 | |||||||||||||||

Net income to average shareholders’ equity (percent) |

38.5 | 34.5 | 35.1 | 33.9 | 26.4 | |||||||||||||||

Debt to capital(5) (percent) |

7.4 | 7.1 | 6.6 | 6.5 | 7.3 | |||||||||||||||

Net debt to capital(6) (percent) |

(23.0) | (24.0) | (20.4) | (22.0) | (10.7) | |||||||||||||||

Ratio of current assets to current liabilities (times) |

1.47 | 1.47 | 1.55 | 1.58 | 1.40 | |||||||||||||||

Fixed charge coverage (times) |

52.2 | 49.9 | 46.3 | 50.2 | 36.1 | |||||||||||||||

| (1) | Sales and other operating revenue includes sales-based taxes of $34,508 million for 2008, $31,728 million for 2007, $30,381 million for 2006, $30,742 million for 2005, and $27,263 million for 2004. | |

| (2) | Sales and other operating revenue includes $30,810 million for 2005 and $25,289 million for 2004 for purchases/sales contracts with the same counterparty. Associated costs were included in Crude oil and product purchases. Effective January 1, 2006, these purchases/sales were recorded on a net basis with no resulting impact on net income. | |

| (3) | See Frequently Used Terms on pages 96 through 99. | |

| (4) | Excluding restricted cash of $4,604 million in 2006, 2005, and 2004. | |

| (5) | Debt includes short- and long-term debt. Capital includes short- and long-term debt, shareholders’ equity, and minority interests. | |

| (6) | Debt net of cash and cash equivalents, excluding restricted cash. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 3 |

Superior 2008 Results |

|

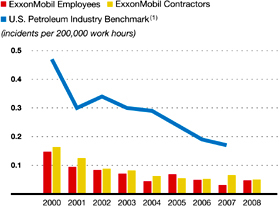

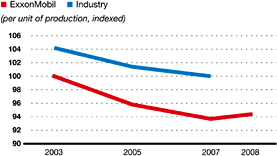

| • | Workforce safety performance continues to lead industry. |

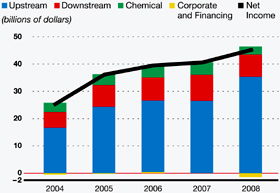

| • | Record earnings of $45.2 billion, with strong performance in each of our business functions. |

| • | Annual dividend per share growth of 13 percent versus 2007, the 26th

consecutive year of dividend per share increases. |

| • | Total shareholder distributions of $40.1 billion, an increase of $4.4 billion versus 2007. |

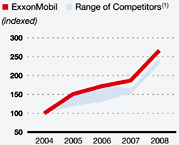

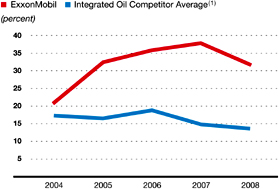

| • | Industry-leading return on average capital employed of 34 percent. |

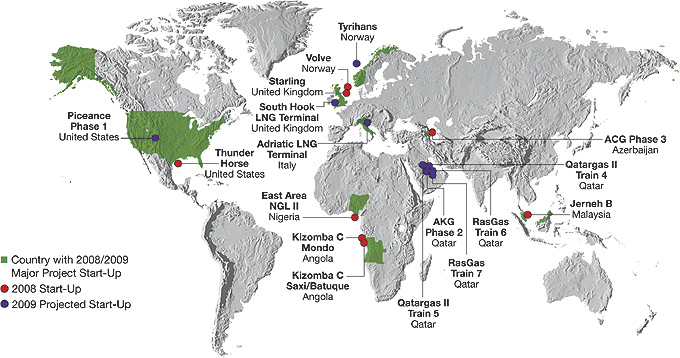

| • | Start-up of eight major Upstream projects. |

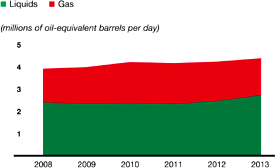

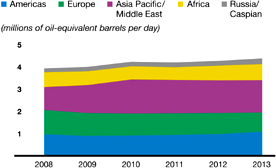

| • | Total liquids production and natural gas production available for sale of 3.9 million oil-equivalent barrels per day. |

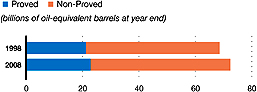

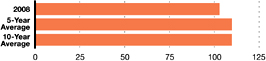

| • | Replaced 103 percent of production with proved oil and gas reserve additions of 1.5 billion oil-equivalent barrels, including asset sales and excluding year-end price/cost effects. |

4 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 5 |

6 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||||||

Net income per common share (dollars) |

8.78 | 7.36 | 6.68 | 5.76 | 3.91 | |||||||||||||||

Net income per common share – assuming dilution (dollars) |

8.69 | 7.28 | 6.62 | 5.71 | 3.89 | |||||||||||||||

Dividends per common share (dollars) |

||||||||||||||||||||

First quarter |

0.35 | 0.32 | 0.32 | 0.27 | 0.25 | |||||||||||||||

Second quarter |

0.40 | 0.35 | 0.32 | 0.29 | 0.27 | |||||||||||||||

Third quarter |

0.40 | 0.35 | 0.32 | 0.29 | 0.27 | |||||||||||||||

Fourth quarter |

0.40 | 0.35 | 0.32 | 0.29 | 0.27 | |||||||||||||||

Total |

1.55 | 1.37 | 1.28 | 1.14 | 1.06 | |||||||||||||||

Dividends per share growth (annual percent) |

13.1 | 7.0 | 12.3 | 7.5 | 8.2 | |||||||||||||||

Number of common shares outstanding (millions) |

||||||||||||||||||||

Average |

5,149 | 5,517 | 5,913 | 6,266 | 6,482 | |||||||||||||||

Average – assuming dilution |

5,203 | 5,577 | 5,970 | 6,322 | 6,519 | |||||||||||||||

Year end |

4,976 | 5,382 | 5,729 | 6,133 | 6,401 | |||||||||||||||

Cash dividends paid on common stock (millions of dollars) |

8,058 | 7,621 | 7,628 | 7,185 | 6,896 | |||||||||||||||

Cash dividends paid to net income (percent) |

18 | 19 | 19 | 20 | 27 | |||||||||||||||

Cash dividends paid to cash flow(1) (percent) |

13 | 15 | 15 | 15 | 17 | |||||||||||||||

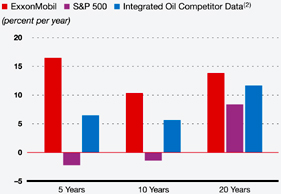

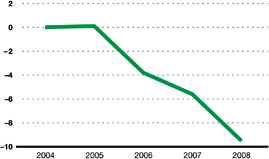

Total return to shareholders (annual percent) |

(13.2 | ) | 24.3 | 39.2 | 11.7 | 27.9 | ||||||||||||||

Market quotations for common stock (dollars) |

||||||||||||||||||||

High |

96.12 | 95.27 | 79.00 | 65.96 | 52.05 | |||||||||||||||

Low |

56.51 | 69.02 | 56.42 | 49.25 | 39.91 | |||||||||||||||

Average daily close |

82.68 | 83.23 | 65.35 | 58.24 | 45.29 | |||||||||||||||

Year-end close |

79.83 | 93.69 | 76.63 | 56.17 | 51.26 | |||||||||||||||

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 7 |

| • | Workforce safety performance continues to lead industry | |

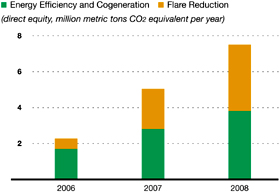

| • | Reduction in Upstream hydrocarbon flaring | |

| • | Over 60-percent reduction in total spills greater than one barrel from 2001 | |

| • | Zero spills from company-operated marine vessels | |

| • | Reduction in greenhouse gas emissions |

8 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| • | Deliver superior environmental performance, which will lead to competitive advantage. | |

| • | Continually improve performance and drive incidents with environmental impact to zero. | |

| • | Achieve industry leadership in key environmental performance areas. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 9 |

10 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| 2008 Quarters | ||||||||||||||||||||||||||||||||||||

| (millions of dollars) | First | Second | Third | Fourth | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||||

Net Income (U.S. GAAP) |

||||||||||||||||||||||||||||||||||||

Upstream |

||||||||||||||||||||||||||||||||||||

United States |

1,631 | 2,034 | 1,879 | 699 | 6,243 | 4,870 | 5,168 | 6,200 | 4,948 | |||||||||||||||||||||||||||

Non-U.S. |

7,154 | 7,978 | 9,092 | 4,935 | 29,159 | 21,627 | 21,062 | 18,149 | 11,727 | |||||||||||||||||||||||||||

Total |

8,785 | 10,012 | 10,971 | 5,634 | 35,402 | 26,497 | 26,230 | 24,349 | 16,675 | |||||||||||||||||||||||||||

Downstream |

||||||||||||||||||||||||||||||||||||

United States |

398 | 293 | 978 | (20 | ) | 1,649 | 4,120 | 4,250 | 3,911 | 2,186 | ||||||||||||||||||||||||||

Non-U.S. |

768 | 1,265 | 2,035 | 2,434 | 6,502 | 5,453 | 4,204 | 4,081 | 3,520 | |||||||||||||||||||||||||||

Total |

1,166 | 1,558 | 3,013 | 2,414 | 8,151 | 9,573 | 8,454 | 7,992 | 5,706 | |||||||||||||||||||||||||||

Chemical |

||||||||||||||||||||||||||||||||||||

United States |

284 | 102 | 257 | 81 | 724 | 1,181 | 1,360 | 1,186 | 1,020 | |||||||||||||||||||||||||||

Non-U.S. |

744 | 585 | 830 | 74 | 2,233 | 3,382 | 3,022 | 2,757 | 2,408 | |||||||||||||||||||||||||||

Total |

1,028 | 687 | 1,087 | 155 | 2,957 | 4,563 | 4,382 | 3,943 | 3,428 | |||||||||||||||||||||||||||

Corporate and financing |

(89 | ) | (577 | ) | (241 | ) | (383 | ) | (1,290 | ) | (23 | ) | 434 | (154 | ) | (479 | ) | |||||||||||||||||||

Net income (U.S. GAAP) |

10,890 | 11,680 | 14,830 | 7,820 | 45,220 | 40,610 | 39,500 | 36,130 | 25,330 | |||||||||||||||||||||||||||

Net income per common share (dollars)(1) |

2.05 | 2.25 | 2.89 | 1.57 | 8.78 | 7.36 | 6.68 | 5.76 | 3.91 | |||||||||||||||||||||||||||

Net income per common share – assuming dilution (dollars)(1) |

2.03 | 2.22 | 2.86 | 1.55 | 8.69 | 7.28 | 6.62 | 5.71 | 3.89 | |||||||||||||||||||||||||||

Special Items |

||||||||||||||||||||||||||||||||||||

Upstream |

||||||||||||||||||||||||||||||||||||

United States |

— | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Non-U.S. |

— | — | 1,620 | — | 1,620 | — | — | 1,620 | — | |||||||||||||||||||||||||||

Total |

— | — | 1,620 | — | 1,620 | — | — | 1,620 | — | |||||||||||||||||||||||||||

Downstream |

||||||||||||||||||||||||||||||||||||

United States |

— | — | — | — | — | — | — | (200 | ) | (550 | ) | |||||||||||||||||||||||||

Non-U.S. |

— | — | — | — | — | — | — | 310 | — | |||||||||||||||||||||||||||

Total |

— | — | — | — | — | — | — | 110 | (550 | ) | ||||||||||||||||||||||||||

Chemical |

||||||||||||||||||||||||||||||||||||

United States |

— | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Non-U.S. |

— | — | — | — | — | — | — | 540 | — | |||||||||||||||||||||||||||

Total |

— | — | — | — | — | — | — | 540 | — | |||||||||||||||||||||||||||

Corporate and financing |

— | (290 | ) | (170 | ) | — | (460 | ) | — | 410 | — | — | ||||||||||||||||||||||||

Corporate total |

— | (290 | ) | 1,450 | — | 1,160 | — | 410 | 2,270 | (550 | ) | |||||||||||||||||||||||||

Earnings Excluding Special Items(2) |

||||||||||||||||||||||||||||||||||||

Upstream |

||||||||||||||||||||||||||||||||||||

United States |

1,631 | 2,034 | 1,879 | 699 | 6,243 | 4,870 | 5,168 | 6,200 | 4,948 | |||||||||||||||||||||||||||

Non-U.S. |

7,154 | 7,978 | 7,472 | 4,935 | 27,539 | 21,627 | 21,062 | 16,529 | 11,727 | |||||||||||||||||||||||||||

Total |

8,785 | 10,012 | 9,351 | 5,634 | 33,782 | 26,497 | 26,230 | 22,729 | 16,675 | |||||||||||||||||||||||||||

Downstream |

||||||||||||||||||||||||||||||||||||

United States |

398 | 293 | 978 | (20 | ) | 1,649 | 4,120 | 4,250 | 4,111 | 2,736 | ||||||||||||||||||||||||||

Non-U.S. |

768 | 1,265 | 2,035 | 2,434 | 6,502 | 5,453 | 4,204 | 3,771 | 3,520 | |||||||||||||||||||||||||||

Total |

1,166 | 1,558 | 3,013 | 2,414 | 8,151 | 9,573 | 8,454 | 7,882 | 6,256 | |||||||||||||||||||||||||||

Chemical |

||||||||||||||||||||||||||||||||||||

United States |

284 | 102 | 257 | 81 | 724 | 1,181 | 1,360 | 1,186 | 1,020 | |||||||||||||||||||||||||||

Non-U.S. |

744 | 585 | 830 | 74 | 2,233 | 3,382 | 3,022 | 2,217 | 2,408 | |||||||||||||||||||||||||||

Total |

1,028 | 687 | 1,087 | 155 | 2,957 | 4,563 | 4,382 | 3,403 | 3,428 | |||||||||||||||||||||||||||

Corporate and financing |

(89 | ) | (287 | ) | (71 | ) | (383 | ) | (830 | ) | (23 | ) | 24 | (154 | ) | (479 | ) | |||||||||||||||||||

Corporate total |

10,890 | 11,970 | 13,380 | 7,820 | 44,060 | 40,610 | 39,090 | 33,860 | 25,880 | |||||||||||||||||||||||||||

Earnings per common share (dollars)(1) |

2.05 | 2.30 | 2.62 | 1.57 | 8.56 | 7.36 | 6.61 | 5.40 | 3.99 | |||||||||||||||||||||||||||

Earnings per common share – assuming dilution (dollars)(1) |

2.03 | 2.27 | 2.59 | 1.55 | 8.47 | 7.28 | 6.55 | 5.35 | 3.97 | |||||||||||||||||||||||||||

| (1) | Computed using the average number of shares outstanding during each period. The sum of the four quarters may not add to the full year. | |

| (2) | See Frequently Used Terms on pages 96 through 99. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 11 |

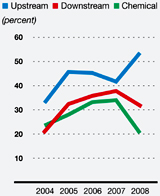

| (percent) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Upstream |

||||||||||||||||||||

United States |

42.6 | 34.7 | 37.1 | 46.0 | 37.0 | |||||||||||||||

Non-U.S. |

56.7 | 43.7 | 47.9 | 45.6 | 31.5 | |||||||||||||||

Total |

53.6 | 41.7 | 45.3 | 45.7 | 32.9 | |||||||||||||||

Downstream |

||||||||||||||||||||

United States |

23.7 | 65.1 | 65.8 | 58.8 | 28.6 | |||||||||||||||

Non-U.S. |

34.8 | 28.7 | 24.5 | 22.6 | 18.0 | |||||||||||||||

Total |

31.8 | 37.8 | 35.8 | 32.4 | 21.0 | |||||||||||||||

Chemical |

||||||||||||||||||||

United States |

16.0 | 24.9 | 27.7 | 23.1 | 19.4 | |||||||||||||||

Non-U.S. |

22.4 | 39.0 | 36.5 | 30.9 | 25.7 | |||||||||||||||

Total |

20.4 | 34.0 | 33.2 | 28.0 | 23.5 | |||||||||||||||

Corporate and financing |

NA | NA | NA | NA | NA | |||||||||||||||

Corporate total |

34.2 | 31.8 | 32.2 | 31.3 | 23.8 | |||||||||||||||

| (1) | Capital employed consists of shareholders’ equity and their share of consolidated debt, including ExxonMobil’s share of amounts applicable to equity companies. See Frequently Used Terms on pages 96 through 99. |

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Upstream |

||||||||||||||||||||

United States |

14,651 | 14,026 | 13,940 | 13,491 | 13,355 | |||||||||||||||

Non-U.S. |

51,413 | 49,539 | 43,931 | 39,770 | 37,287 | |||||||||||||||

Total |

66,064 | 63,565 | 57,871 | 53,261 | 50,642 | |||||||||||||||

Downstream |

||||||||||||||||||||

United States |

6,963 | 6,331 | 6,456 | 6,650 | 7,632 | |||||||||||||||

Non-U.S. |

18,664 | 18,983 | 17,172 | 18,030 | 19,541 | |||||||||||||||

Total |

25,627 | 25,314 | 23,628 | 24,680 | 27,173 | |||||||||||||||

Chemical |

||||||||||||||||||||

United States |

4,535 | 4,748 | 4,911 | 5,145 | 5,246 | |||||||||||||||

Non-U.S. |

9,990 | 8,682 | 8,272 | 8,919 | 9,362 | |||||||||||||||

Total |

14,525 | 13,430 | 13,183 | 14,064 | 14,608 | |||||||||||||||

Corporate and financing |

23,467 | 26,451 | 27,891 | 24,956 | 14,916 | |||||||||||||||

Corporate total |

129,683 | 128,760 | 122,573 | 116,961 | 107,339 | |||||||||||||||

Average capital

employed applicable

to equity companies

included above |

25,651 | 24,267 | 22,106 | 20,256 | 18,049 | |||||||||||||||

| (1) | Average capital employed is the average of beginning- and end-of-year business segment capital employed, including ExxonMobil’s share of amounts applicable to equity companies. See Frequently Used Terms on pages 96 through 99. |

12 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

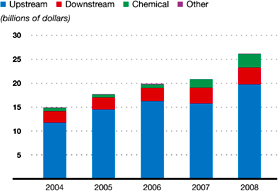

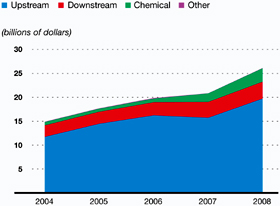

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Upstream |

||||||||||||||||||||

Exploration |

||||||||||||||||||||

United States |

734 | 415 | 425 | 297 | 248 | |||||||||||||||

Non-U.S. |

2,137 | 1,494 | 1,619 | 1,396 | 1,035 | |||||||||||||||

Total |

2,871 | 1,909 | 2,044 | 1,693 | 1,283 | |||||||||||||||

Production(2) |

||||||||||||||||||||

United States |

2,600 | 1,792 | 2,058 | 1,841 | 1,669 | |||||||||||||||

Non-U.S. |

14,011 | 11,913 | 12,059 | 10,844 | 8,629 | |||||||||||||||

Total |

16,611 | 13,705 | 14,117 | 12,685 | 10,298 | |||||||||||||||

Power and Coal |

||||||||||||||||||||

United States |

— | 5 | 3 | 4 | 5 | |||||||||||||||

Non-U.S. |

252 | 105 | 67 | 88 | 129 | |||||||||||||||

Total |

252 | 110 | 70 | 92 | 134 | |||||||||||||||

Total Upstream |

19,734 | 15,724 | 16,231 | 14,470 | 11,715 | |||||||||||||||

Downstream |

||||||||||||||||||||

Refining |

||||||||||||||||||||

United States |

1,430 | 906 | 559 | 497 | 550 | |||||||||||||||

Non-U.S. |

1,248 | 1,267 | 1,051 | 871 | 774 | |||||||||||||||

Total |

2,678 | 2,173 | 1,610 | 1,368 | 1,324 | |||||||||||||||

Marketing |

||||||||||||||||||||

United States |

176 | 201 | 233 | 217 | 201 | |||||||||||||||

Non-U.S. |

638 | 876 | 852 | 859 | 811 | |||||||||||||||

Total |

814 | 1,077 | 1,085 | 1,076 | 1,012 | |||||||||||||||

Pipeline/Marine |

||||||||||||||||||||

United States |

30 | 21 | 32 | 39 | 24 | |||||||||||||||

Non-U.S. |

7 | 32 | 2 | 12 | 45 | |||||||||||||||

Total |

37 | 53 | 34 | 51 | 69 | |||||||||||||||

Total Downstream |

3,529 | 3,303 | 2,729 | 2,495 | 2,405 | |||||||||||||||

Chemical |

||||||||||||||||||||

United States |

441 | 360 | 280 | 243 | 262 | |||||||||||||||

Non-U.S. |

2,378 | 1,422 | 476 | 411 | 428 | |||||||||||||||

Total Chemical |

2,819 | 1,782 | 756 | 654 | 690 | |||||||||||||||

Other |

||||||||||||||||||||

United States |

61 | 44 | 130 | 80 | 66 | |||||||||||||||

Non-U.S. |

— | — | 9 | — | 9 | |||||||||||||||

Total other |

61 | 44 | 139 | 80 | 75 | |||||||||||||||

Total capital and exploration expenditures |

26,143 | 20,853 | 19,855 | 17,699 | 14,885 | |||||||||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. | |

| (2) | Including related transportation. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 13 |

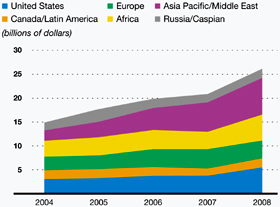

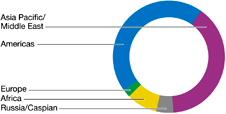

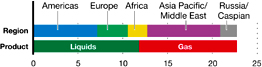

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

United States |

5,472 | 3,744 | 3,720 | 3,218 | 3,025 | |||||||||||||||

Canada/Latin America |

1,926 | 1,522 | 1,862 | 1,940 | 1,867 | |||||||||||||||

Europe |

3,727 | 4,042 | 3,721 | 2,829 | 2,845 | |||||||||||||||

Africa |

5,422 | 3,639 | 4,019 | 3,815 | 3,330 | |||||||||||||||

Asia Pacific/Middle East |

7,669 | 6,156 | 4,601 | 3,241 | 2,168 | |||||||||||||||

Russia/Caspian |

1,927 | 1,750 | 1,932 | 2,656 | 1,650 | |||||||||||||||

Total worldwide |

26,143 | 20,853 | 19,855 | 17,699 | 14,885 | |||||||||||||||

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Consolidated Companies’ Expenditures |

||||||||||||||||||||

Capital expenditures |

19,841 | 15,242 | 15,361 | 13,792 | 11,901 | |||||||||||||||

Exploration costs charged to expense |

||||||||||||||||||||

United States |

189 | 280 | 243 | 157 | 192 | |||||||||||||||

Non-U.S. |

1,252 | 1,177 | 925 | 795 | 891 | |||||||||||||||

Depreciation on support equipment(1) |

10 | 12 | 13 | 12 | 15 | |||||||||||||||

Total exploration expenses |

1,451 | 1,469 | 1,181 | 964 | 1,098 | |||||||||||||||

Total consolidated companies’ capital

and exploration expenditures |

||||||||||||||||||||

(excluding Depreciation on support equipment) |

21,282 | 16,699 | 16,529 | 14,744 | 12,984 | |||||||||||||||

ExxonMobil’s Share of Non-Consolidated

Companies’ Expenditures |

||||||||||||||||||||

Capital expenditures |

4,845 | 4,122 | 3,315 | 2,938 | 1,865 | |||||||||||||||

Exploration costs charged to expense |

16 | 32 | 11 | 17 | 36 | |||||||||||||||

Total non-consolidated companies’ capital

and exploration expenditures |

4,861 | 4,154 | 3,326 | 2,955 | 1,901 | |||||||||||||||

Total capital and exploration expenditures |

26,143 | 20,853 | 19,855 | 17,699 | 14,885 | |||||||||||||||

| (1) | Not included as part of total capital and exploration expenditures, but included as part of exploration expenses, including dry holes, in the Summary Statement of Income, page 16. |

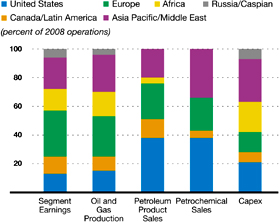

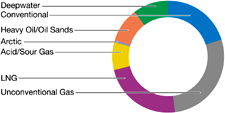

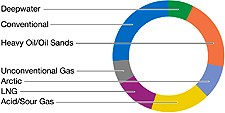

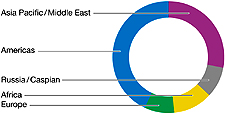

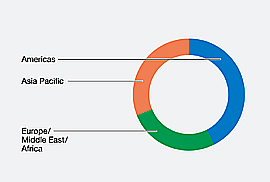

Functional

Capex Distribution

|

Geographic Capex Distribution | |

|

|

14 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Upstream |

||||||||||||||||||||

United States |

17,920 | 16,714 | 16,467 | 16,222 | 16,410 | |||||||||||||||

Non-U.S. |

55,493 | 56,810 | 51,943 | 46,595 | 45,603 | |||||||||||||||

Total |

73,413 | 73,524 | 68,410 | 62,817 | 62,013 | |||||||||||||||

Downstream |

||||||||||||||||||||

United States |

10,492 | 9,705 | 9,320 | 9,334 | 9,408 | |||||||||||||||

Non-U.S. |

18,762 | 20,443 | 19,598 | 18,695 | 20,402 | |||||||||||||||

Total |

29,254 | 30,148 | 28,918 | 28,029 | 29,810 | |||||||||||||||

Chemical |

||||||||||||||||||||

United States |

4,396 | 4,448 | 4,553 | 4,685 | 4,887 | |||||||||||||||

Non-U.S. |

7,034 | 5,623 | 4,766 | 4,619 | 5,162 | |||||||||||||||

Total |

11,430 | 10,071 | 9,319 | 9,304 | 10,049 | |||||||||||||||

Other |

7,249 | 7,126 | 7,040 | 6,860 | 6,767 | |||||||||||||||

Total net investment |

121,346 | 120,869 | 113,687 | 107,010 | 108,639 | |||||||||||||||

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Upstream |

||||||||||||||||||||

United States |

1,391 | 1,469 | 1,263 | 1,293 | 1,453 | |||||||||||||||

Non-U.S. |

7,266 | 7,126 | 6,482 | 5,407 | 4,758 | |||||||||||||||

Total |

8,657 | 8,595 | 7,745 | 6,700 | 6,211 | |||||||||||||||

Downstream |

||||||||||||||||||||

United States |

656 | 639 | 632 | 615 | 618 | |||||||||||||||

Non-U.S. |

1,672 | 1,662 | 1,605 | 1,611 | 1,646 | |||||||||||||||

Total |

2,328 | 2,301 | 2,237 | 2,226 | 2,264 | |||||||||||||||

Chemical |

||||||||||||||||||||

United States |

410 | 405 | 427 | 416 | 408 | |||||||||||||||

Non-U.S. |

422 | 418 | 473 | 410 | 400 | |||||||||||||||

Total |

832 | 823 | 900 | 826 | 808 | |||||||||||||||

Other |

562 | 531 | 534 | 501 | 484 | |||||||||||||||

Total depreciation and depletion expenses |

12,379 | 12,250 | 11,416 | 10,253 | 9,767 | |||||||||||||||

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Production and manufacturing expenses |

37,905 | 31,885 | 29,528 | 26,819 | 23,225 | |||||||||||||||

Selling, general, and administrative |

15,873 | 14,890 | 14,273 | 14,402 | 13,849 | |||||||||||||||

Depreciation and depletion |

12,379 | 12,250 | 11,416 | 10,253 | 9,767 | |||||||||||||||

Exploration |

1,451 | 1,469 | 1,181 | 964 | 1,098 | |||||||||||||||

Subtotal |

67,608 | 60,494 | 56,398 | 52,438 | 47,939 | |||||||||||||||

ExxonMobil’s share of equity company expenses |

7,204 | 5,619 | 4,947 | 4,520 | 4,209 | |||||||||||||||

Total operating costs |

74,812 | 66,113 | 61,345 | 56,958 | 52,148 | |||||||||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 15 |

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Assets |

||||||||||||||||||||

Current assets |

||||||||||||||||||||

Cash and cash equivalents |

31,437 | 33,981 | 28,244 | 28,671 | 18,531 | |||||||||||||||

Cash and cash equivalents – restricted |

— | — | 4,604 | 4,604 | 4,604 | |||||||||||||||

Marketable securities |

570 | 519 | — | — | — | |||||||||||||||

Notes and accounts receivable,

less estimated doubtful amounts |

24,702 | 36,450 | 28,942 | 27,484 | 25,359 | |||||||||||||||

Inventories |

||||||||||||||||||||

Crude oil, products and merchandise |

9,331 | 8,863 | 8,979 | 7,852 | 8,136 | |||||||||||||||

Materials and supplies |

2,315 | 2,226 | 1,735 | 1,469 | 1,351 | |||||||||||||||

Other current assets |

3,911 | 3,924 | 3,273 | 3,262 | 2,396 | |||||||||||||||

Total current assets |

72,266 | 85,963 | 75,777 | 73,342 | 60,377 | |||||||||||||||

Investments, advances, and long-term receivables |

28,556 | 28,194 | 23,237 | 20,592 | 18,404 | |||||||||||||||

Property, plant and equipment, at cost,

less accumulated depreciation and depletion |

121,346 | 120,869 | 113,687 | 107,010 | 108,639 | |||||||||||||||

Other assets, including intangibles, net |

5,884 | 7,056 | 6,314 | 7,391 | 7,836 | |||||||||||||||

Total assets |

228,052 | 242,082 | 219,015 | 208,335 | 195,256 | |||||||||||||||

Liabilities |

||||||||||||||||||||

Current liabilities |

||||||||||||||||||||

Notes and loans payable |

2,400 | 2,383 | 1,702 | 1,771 | 3,280 | |||||||||||||||

Accounts payable and accrued liabilities |

36,643 | 45,275 | 39,082 | 36,120 | 31,763 | |||||||||||||||

Income taxes payable |

10,057 | 10,654 | 8,033 | 8,416 | 7,938 | |||||||||||||||

Total current liabilities |

49,100 | 58,312 | 48,817 | 46,307 | 42,981 | |||||||||||||||

Long-term debt |

7,025 | 7,183 | 6,645 | 6,220 | 5,013 | |||||||||||||||

Postretirement benefits reserves |

20,729 | 13,278 | 13,931 | 10,220 | 10,850 | |||||||||||||||

Deferred income tax liabilities |

19,726 | 22,899 | 20,851 | 20,878 | 21,092 | |||||||||||||||

Other long-term obligations |

13,949 | 14,366 | 11,123 | 9,997 | 9,612 | |||||||||||||||

Equity of minority interests |

4,558 | 4,282 | 3,804 | 3,527 | 3,952 | |||||||||||||||

Total liabilities |

115,087 | 120,320 | 105,171 | 97,149 | 93,500 | |||||||||||||||

Commitments and contingencies(1) |

||||||||||||||||||||

Shareholders’ Equity |

||||||||||||||||||||

Common stock without par value |

5,314 | 4,933 | 4,786 | 4,477 | 4,053 | |||||||||||||||

Earnings reinvested |

265,680 | 228,518 | 195,207 | 163,335 | 134,390 | |||||||||||||||

Accumulated other comprehensive income |

||||||||||||||||||||

Cumulative foreign exchange translation adjustment |

1,146 | 7,972 | 3,733 | 979 | 3,598 | |||||||||||||||

Postretirement benefits reserves adjustment |

(11,077 | ) | (5,983 | ) | (6,495 | ) | — | — | ||||||||||||

Minimum pension liability adjustment |

— | — | — | (2,258 | ) | (2,499 | ) | |||||||||||||

Unrealized gains/(losses) on stock investments |

— | — | — | — | 428 | |||||||||||||||

Common stock held in treasury |

(148,098 | ) | (113,678 | ) | (83,387 | ) | (55,347 | ) | (38,214 | ) | ||||||||||

Total shareholders’ equity |

112,965 | 121,762 | 113,844 | 111,186 | 101,756 | |||||||||||||||

Total liabilities and shareholders’ equity |

228,052 | 242,082 | 219,015 | 208,335 | 195,256 | |||||||||||||||

| (1) | For more information, please refer to Appendix A, Note 15 of ExxonMobil’s 2009 Proxy Statement. | |

| The information in the Summary Statement of Income (for 2006 to 2008), the Summary Balance Sheet (for 2007 and 2008), and the Summary Statement of Cash Flows (for 2006 to 2008), shown on pages 15 through 17, corresponds to the information in the Consolidated Statement of Income, Consolidated Balance Sheet, and the Consolidated Statement of Cash Flows in the financial statements of ExxonMobil’s 2009 Proxy Statement. For complete consolidated financial statements, including notes, please refer to Appendix A of ExxonMobil’s 2009 Proxy Statement. See also Management’s Discussion and Analysis of Financial Condition and Results of Operations and other information in Appendix A of the 2009 Proxy Statement. | ||

16 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Revenues and Other Income |

||||||||||||||||||||

Sales and other operating revenue(1)(2) |

459,579 | 390,328 | 365,467 | 358,955 | 291,252 | |||||||||||||||

Income from equity affiliates |

11,081 | 8,901 | 6,985 | 7,583 | 4,961 | |||||||||||||||

Other income(3) |

6,699 | 5,323 | 5,183 | 4,142 | 1,822 | |||||||||||||||

Total revenues and other income |

477,359 | 404,552 | 377,635 | 370,680 | 298,035 | |||||||||||||||

Costs and Other Deductions |

||||||||||||||||||||

Crude oil and product purchases |

249,454 | 199,498 | 182,546 | 185,219 | 139,224 | |||||||||||||||

Production and manufacturing expenses |

37,905 | 31,885 | 29,528 | 26,819 | 23,225 | |||||||||||||||

Selling, general and administrative expenses |

15,873 | 14,890 | 14,273 | 14,402 | 13,849 | |||||||||||||||

Depreciation and depletion |

12,379 | 12,250 | 11,416 | 10,253 | 9,767 | |||||||||||||||

Exploration expenses, including dry holes |

1,451 | 1,469 | 1,181 | 964 | 1,098 | |||||||||||||||

Interest expense |

673 | 400 | 654 | 496 | 638 | |||||||||||||||

Sales-based taxes(1) |

34,508 | 31,728 | 30,381 | 30,742 | 27,263 | |||||||||||||||

Other taxes and duties |

41,719 | 40,953 | 39,203 | 41,554 | 40,954 | |||||||||||||||

Income applicable to minority interests |

1,647 | 1,005 | 1,051 | 799 | 776 | |||||||||||||||

Total costs and other deductions |

395,609 | 334,078 | 310,233 | 311,248 | 256,794 | |||||||||||||||

Income before income taxes |

81,750 | 70,474 | 67,402 | 59,432 | 41,241 | |||||||||||||||

Income taxes |

36,530 | 29,864 | 27,902 | 23,302 | 15,911 | |||||||||||||||

Net income |

45,220 | 40,610 | 39,500 | 36,130 | 25,330 | |||||||||||||||

Net Income per Common Share (dollars) |

8.78 | 7.36 | 6.68 | 5.76 | 3.91 | |||||||||||||||

Net Income per Common Share –

Assuming Dilution (dollars) |

8.69 | 7.28 | 6.62 | 5.71 | 3.89 | |||||||||||||||

| (1) | Sales and other operating revenue includes sales-based taxes of $34,508 million for 2008, $31,728 million for 2007, $30,381 million for 2006, $30,742 million for 2005, and $27,263 million for 2004. | |

| (2) | Sales and other operating revenue includes $30,810 million for 2005 and $25,289 million for 2004 for purchases/sales contracts with the same counterparty. Associated costs were included in Crude oil and product purchases. Effective January 1, 2006, these purchases/sales were recorded on a net basis with no resulting impact on net income. | |

| (3) | Other income for 2008 includes a $62 million gain from the sale of a non-U.S. investment and a related $143 million foreign exchange loss. | |

| The information in the Summary Statement of Income (for 2006 to 2008), the Summary Balance Sheet (for 2007 and 2008), and the Summary Statement of Cash Flows (for 2006 to 2008), shown on pages 15 through 17, corresponds to the information in the Consolidated Statement of Income, Consolidated Balance Sheet, and the Consolidated Statement of Cash Flows in the financial statements of ExxonMobil’s 2009 Proxy Statement. For complete consolidated financial statements, including notes, please refer to Appendix A of ExxonMobil’s 2009 Proxy Statement. See also Management’s Discussion and Analysis of Financial Condition and Results of Operations and other information in Appendix A of the 2009 Proxy Statement. | ||

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 17 |

| (millions of dollars) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Cash Flows from Operating Activities |

||||||||||||||||||||

Net income |

||||||||||||||||||||

Accruing to ExxonMobil shareholders |

45,220 | 40,610 | 39,500 | 36,130 | 25,330 | |||||||||||||||

Accruing to minority interests |

1,647 | 1,005 | 1,051 | 799 | 776 | |||||||||||||||

Adjustments for noncash transactions |

||||||||||||||||||||

Depreciation and depletion |

12,379 | 12,250 | 11,416 | 10,253 | 9,767 | |||||||||||||||

Deferred income tax charges/(credits) |

1,399 | 124 | 1,717 | (429 | ) | (1,134 | ) | |||||||||||||

Postretirement benefits expense in excess of/

(less than) payments |

57 | (1,314 | ) | (1,787 | ) | 254 | 886 | |||||||||||||

Other long-term obligation provisions

in excess of/(less than) payments |

(63 | ) | 1,065 | (666 | ) | 398 | 806 | |||||||||||||

Dividends received greater than/(less than)

equity in current earnings of equity companies |

921 | (714 | ) | (579 | ) | (734 | ) | (1,643 | ) | |||||||||||

Changes in operational working capital, excluding cash and debt

Reduction/(increase) – Notes and accounts receivable |

8,641 | (5,441 | ) | (181 | ) | (3,700 | ) | (472 | ) | |||||||||||

– Inventories |

(1,285 | ) | 72 | (1,057 | ) | (434 | ) | (223 | ) | |||||||||||

– Other current assets |

(509 | ) | 280 | (385 | ) | (7 | ) | 11 | ||||||||||||

Increase/(reduction)

– Accounts and other payables |

(5,415 | ) | 6,228 | 1,160 | 7,806 | 6,333 | ||||||||||||||

Net (gain) on asset sales |

(3,757 | ) | (2,217 | ) | (1,531 | ) | (1,980 | ) | (268 | ) | ||||||||||

All other items – net |

490 | 54 | 628 | (218 | ) | 382 | ||||||||||||||

Net cash provided by operating activities |

59,725 | 52,002 | 49,286 | 48,138 | 40,551 | |||||||||||||||

Cash Flows from Investing Activities |

||||||||||||||||||||

Additions to property, plant and equipment |

(19,318 | ) | (15,387 | ) | (15,462 | ) | (13,839 | ) | (11,986 | ) | ||||||||||

Sales of subsidiaries, investments, and property,

plant and equipment |

5,985 | 4,204 | 3,080 | 6,036 | 2,754 | |||||||||||||||

Decrease/(increase) in restricted cash and cash equivalents |

— | 4,604 | — | — | (4,604 | ) | ||||||||||||||

Additional investments and advances |

(2,495 | ) | (3,038 | ) | (2,604 | ) | (2,810 | ) | (2,287 | ) | ||||||||||

Collection of advances |

574 | 391 | 756 | 343 | 1,213 | |||||||||||||||

Additions to marketable securities |

(2,113 | ) | (646 | ) | — | — | — | |||||||||||||

Sales of marketable securities |

1,868 | 144 | — | — | — | |||||||||||||||

Net cash used in investing activities |

(15,499 | ) | (9,728 | ) | (14,230 | ) | (10,270 | ) | (14,910 | ) | ||||||||||

Cash Flows from Financing Activities |

||||||||||||||||||||

Additions to long-term debt |

79 | 592 | 318 | 195 | 470 | |||||||||||||||

Reductions in long-term debt |

(192 | ) | (209 | ) | (33 | ) | (81 | ) | (562 | ) | ||||||||||

Additions to short-term debt |

1,067 | 1,211 | 334 | 377 | 450 | |||||||||||||||

Reductions in short-term debt |

(1,624 | ) | (809 | ) | (451 | ) | (687 | ) | (2,243 | ) | ||||||||||

Additions/(reductions) in debt with three months

or less maturity |

143 | (187 | ) | (95 | ) | (1,306 | ) | (66 | ) | |||||||||||

Cash dividends to ExxonMobil shareholders |

(8,058 | ) | (7,621 | ) | (7,628 | ) | (7,185 | ) | (6,896 | ) | ||||||||||

Cash dividends to minority interests |

(375 | ) | (289 | ) | (239 | ) | (293 | ) | (215 | ) | ||||||||||

Changes in minority interests and

sales/(purchases) of affiliate stock |

(419 | ) | (659 | ) | (493 | ) | (681 | ) | (215 | ) | ||||||||||

Tax benefits related to stock-based awards |

333 | 369 | 462 | — | — | |||||||||||||||

Common stock acquired |

(35,734 | ) | (31,822 | ) | (29,558 | ) | (18,221 | ) | (9,951 | ) | ||||||||||

Common stock sold |

753 | 1,079 | 1,173 | 941 | 960 | |||||||||||||||

Net cash used in financing activities |

(44,027 | ) | (38,345 | ) | (36,210 | ) | (26,941 | ) | (18,268 | ) | ||||||||||

Effects of exchange rate changes on cash |

(2,743 | ) | 1,808 | 727 | (787 | ) | 532 | |||||||||||||

Increase/(decrease) in cash and cash equivalents |

(2,544 | ) | 5,737 | (427 | ) | 10,140 | 7,905 | |||||||||||||

Cash and cash equivalents at beginning of year |

33,981 | 28,244 | 28,671 | 18,531 | 10,626 | |||||||||||||||

Cash and cash equivalents at end of year |

31,437 | 33,981 | 28,244 | 28,671 | 18,531 | |||||||||||||||

| The information in the Summary Statement of Income (for 2006 to 2008), the Summary Balance Sheet (for 2007 and 2008), and the Summary Statement of Cash Flows (for 2006 to 2008), shown on pages 15 through 17, corresponds to the information in the Consolidated Statement of Income, Consolidated Balance Sheet, and the Consolidated Statement of Cash Flows in the financial statements of ExxonMobil’s 2009 Proxy Statement. For complete consolidated financial statements, including notes, please refer to Appendix A of ExxonMobil’s 2009 Proxy Statement. See also Management’s Discussion and Analysis of Financial Condition and Results of Operations and other information in Appendix A of the 2009 Proxy Statement. | ||

18 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 19 |

20 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

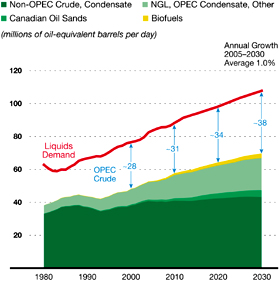

Liquids Supply and Demand

|

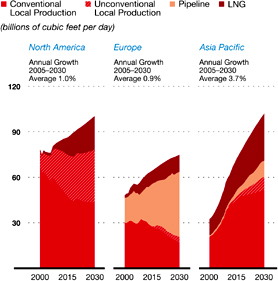

Gas Supply and Demand Balance | |

OPEC —Organization of the

Petroleum Exporting Countries

|

|

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 21 |

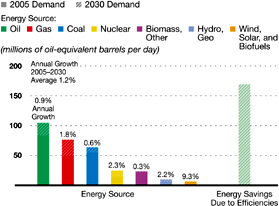

Growth in Global Energy Demand

|

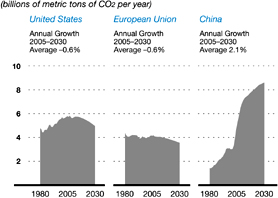

Energy-Related CO2 Outlook by Region | |

|

|

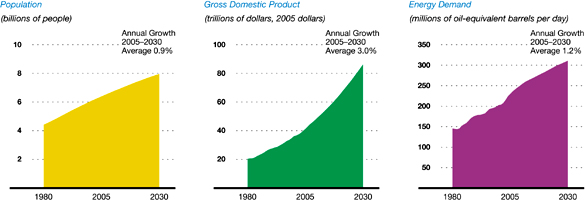

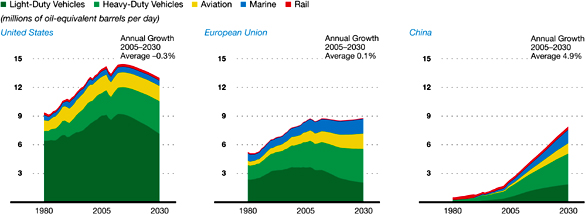

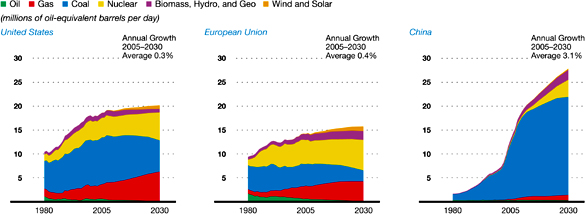

| • | Growing populations and expanding economies will drive global energy demand approximately 35 percent higher from 2005 to 2030 – even with substantial gains in energy efficiency. | |

| • | Oil, natural gas, and coal will continue to provide the majority of the world’s energy needs, meeting close to 80 percent of global demand through 2030 – due to their abundance, affordability, and availability. Nuclear energy will grow as emphasis on low-carbon fuels increases. Renewable fuels will also grow rapidly. | |

| • | Reducing global energy-related CO2 emissions growth will be difficult given the energy needs of developing countries. | |

| This Outlook makes clear that the world’s energy challenges are formidable. We believe that meeting these global energy challenges requires an integrated set of solutions that includes: | ||

| • | Moderating demand through new technologies that improve energy efficiency in our vehicles, homes, and businesses. | |

| • | Expanding access to all economically viable energy sources – oil, natural gas, coal, nuclear, and alternative and renewable sources such as wind, solar, and biofuels. | |

| • | Mitigating the risks of climate change through technologies that advance energy efficiency, enable widespread use of renewables, and capture and store CO2 emissions. | |

22 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

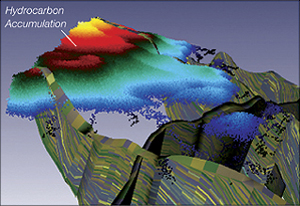

Enhanced Basin Modeling

ExxonMobil uses advanced computer modeling to help identify

the most promising exploration areas within a hydrocarbon basin.

This technology provides valuable insight into the location, quantity,

and timing of hydrocarbon formation and movement through the subsurface.

New capabilities have been added to the proprietary basin modeling

software Stellar, integrating a broader spectrum of subsurface data

to improve analytical predictions. As a result, ExxonMobil researchers are

able to evaluate various scenarios of hydrocarbon accumulation to identify

the areas with the greatest probability of hydrocarbon occurrence. This

capability has proven effective in supporting decisions that range in scope

from capturing new exploration acreage to positioning new wells.

|

A Stellar model of the subsurface shows the likelihood of encountering hydrocarbons. |

ExxonMobil geologists study outcrops

to improve the

understanding of deepwater reservoir systems. |

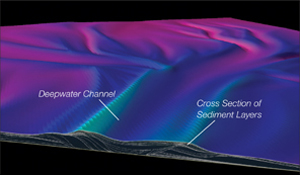

Effective Deepwater Reservoir Modeling Many of the hydrocarbon resources currently under development by ExxonMobil are in reservoirs

deposited in deepwater environments. Deepwater reservoirs typically have a complex sedimentary

structure that can make reservoir management challenging. To improve deepwater reservoir

management, ExxonMobil researchers have developed novel analytical tools and an industry-leading,

integrated evaluation process. The new approach incorporates reservoir modeling, outcrop

interpretation of reservoir analogs, experimental sediment studies, and seismic prediction of

reservoir quality. ExxonMobil has used this technology in deepwater fields in West Africa to

increase hydrocarbon recovery, and plans to apply it globally. |

Unique Depositional Modeling Seismic data typically cannot define all of

the features affecting the performance of a

subsurface reservoir. To improve reservoir

characterization, ExxonMobil has developed

unique capabilities to simulate mathematically

the sediment erosion, transport, and deposition

processes that act together to form a reservoir.

Results from this process-based simulation enable

researchers to create numerical reservoir models

with more detailed sedimentary structures and rock

properties than seismic data alone can provide.

This information provides a superior understanding

of the reservoir to improve resource recovery.

|

Results of a process-based simulation of a channel

deposited in deep water show the channel topography and geometries. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 23 |

24 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

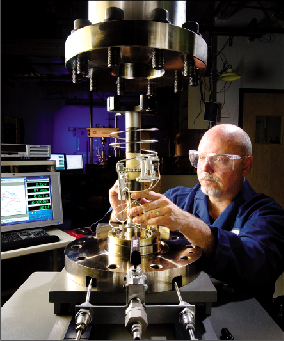

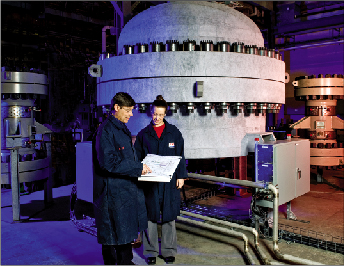

ExxonMobil’s large-scale laboratory apparatus can recreate geologic and

reservoir conditions to test new bitumen recovery methods. |

Economical Recovery from Thin Bitumen Reservoirs ExxonMobil is actively researching new

approaches for hydrocarbon recovery from

bitumen, also referred to as heavy oil, that exists

in reservoirs too thin to be produced economically

with current technology. These innovative

recovery approaches have the potential to extract

the bitumen without the use of either steam or

heat and to recover a far higher percentage of

bitumen than is currently possible. By minimizing

the use of steam and heat, these new methods

could significantly reduce energy use and carbon

dioxide (CO2) emissions. Laboratory tests and

numerical modeling have yielded encouraging

results for the future application of these

technologies. |

|

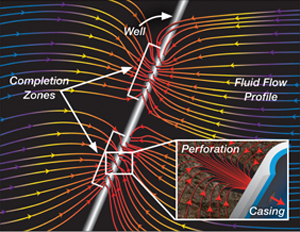

Optimal Well Performance Improving individual well performance is an important component

in maximizing the value of hydrocarbon resources. Modern high-

production wells routinely produce fluids from multiple zones

measuring thousands of feet long, increasing the importance of

optimal well design. ExxonMobil has developed a new process

for evaluating various well-completion designs to predict which

design will be the most productive. This process extends traditional

reservoir simulation and takes into account the dynamics of fluid

flow in the completion interval and near-well region. The resulting

predictions lead to completion designs that ensure maximum

production throughout the life of the well. This technology has

been used in Middle East carbonate wells to reduce completion

times and increase production rates, and broader deployment

is planned. |

Advanced modeling capabilities allow ExxonMobil to optimize

well performance. |

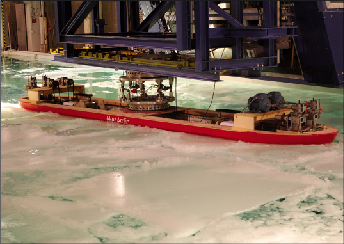

|

A model of an arctic drillship is being tested under varying

ice thicknesses,

ice drift speeds, and vessel directions. |

Specialized Arctic Technology The U.S. Geological Survey estimates that

more than one-fifth of the world’s undiscovered

recoverable hydrocarbon resources are in the

Arctic, and more than 80 percent of those

resources are offshore. Because current

technology limits offshore arctic operations to the

open-water season, which may last just weeks,

drilling a well typically requires multiple seasons.

To extend the drilling season, ExxonMobil

scientists and engineers are developing drillship

technology that equips ships with special

reinforced hulls and advanced propulsion systems

for arctic environments. These innovations will

allow wells to be completed in fewer seasons.

Efforts are under way to apply this technology in

the exploration of the Canadian Beaufort Sea. |

|

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 25 |

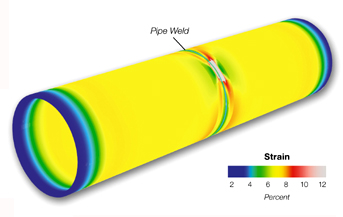

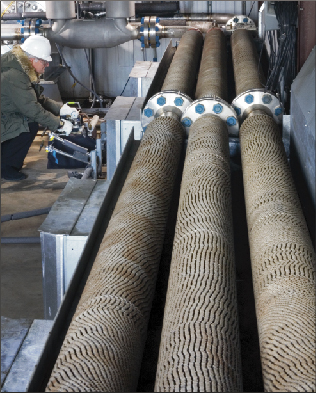

Robust Pipeline Design

The commercial development of remote oil and gas

resources often requires pipeline construction in very challenging

environments. Through a suite

of advanced pipeline technologies, ExxonMobil has addressed

the technical issues of fabricating pipelines that

ensure operational integrity in these environments.

These technologies include new laboratory

methods for quantifying the effect of complex

loads, physics-based computational models

for predicting load response, and techniques

for welding and materials-joining. Using these

technologies, large pipelines can be constructed

that are able to withstand ground deformation

from earthquakes as well as pressure exerted

from arctic soil and ice movements. ExxonMobil’s

advanced pipeline technologies are being applied in

projects worldwide.

|

ExxonMobil’s advanced pipeline technologies are underpinned by

computational models and validated by rigorous experiments. |

|

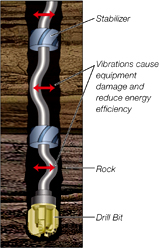

Enhanced Drilling Design

Equipment vibration during drilling, especially for extended-reach wells, leads to

significant energy loss and can damage drilling equipment. In response ExxonMobil

has developed an industry-leading design process for reducing drilling vibrations.

This process includes the unique capability to make design upgrades in real time

at the well site. Field trials of this process have demonstrated increased drilling

equipment life and significantly higher rates of penetration, thereby reducing

drilling costs. As an extension of ExxonMobil’s proven Fast Drill Process, the new

technology is yielding positive results in worldwide drilling operations, including

those in Russia, the United States, and offshore Canada.

|

|

|

ExxonMobil’s new design

process enhances drilling performance by reducing equipment vibrations. |

||

|

||

Innovative Flow Assurance One of the challenges of producing hydrocarbons in

extreme environments such as ultra-deep water and

the Arctic is the formation of hydrates, solids that can

clog production flow lines. ExxonMobil is developing

an innovative, reliable solution to avoid the formation

of hydrate blockages without the need for costly

chemicals or insulation. The method uses static mixers

that create water droplets to enhance the production

of small hydrate particles. The small particles are able

to move freely without clumping or sticking to pipe

walls, assuring unrestricted flow. Pilot laboratory

studies have proven the concept, and field tests of

the technology are planned. ExxonMobil’s pilot-scale hydrate flow loop enables development

and evaluation of new flow-assurance technologies in a

controlled environment.

|

||

26 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

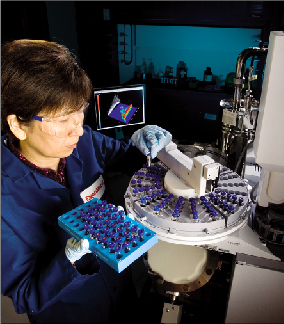

Catalysis ExxonMobil is a leader in the discovery, development,

and deployment of advantaged catalyst technology.

Catalysts accelerate the rate of desired chemical reactions

and are used in over 85 percent of ExxonMobil’s refinery

conversion units. We continue to build upon our history

of leadership in delivering novel catalyst technologies

that add value to our business. Utilizing state-of-the-art

experimentation and modeling tools, we are enhancing

our ability to rapidly discover and commercialize new

catalysts. These new catalysts allow efficient upgrading

of feeds, such as high-sulfur heavy crudes, into cleaner

finished products.

|

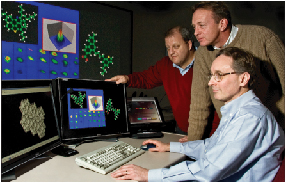

ExxonMobil scientists use a state-of-the-art visualization facility to

review results from advanced modeling of hydroprocessing catalysts. |

|

Two RCPSA units were successfully commercialized in one of our

European refineries.

|

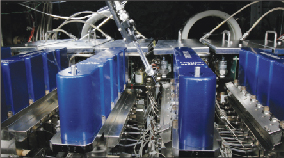

Rapid Cycle Pressure Swing Adsorption

Hydrogen is a key component used in refineries to

manufacture cleaner fuels. Efficient management of

hydrogen molecules within a refinery is becoming

increasingly important to meet more stringent sulfur

specifications in fuel products. ExxonMobil recently

commercialized new rapid cycle pressure swing adsorption

(RCPSA) technology to recover hydrogen from fuels

process units. The simplicity and compactness of this

skid-mounted technology will enable new opportunities to

expand process unit capacity by recovering hydrogen from

product gas streams that otherwise would be burned in

the refinery fuel gas system. The new RCPSA technology,

which was jointly developed with QuestAir Technologies,

can cost up to 50 percent less than conventional PSA

technology, depending on the scale and type of application.

ExxonMobil is currently pursuing additional hydrogen

recovery opportunities in refineries and chemical plants. |

|

Unconventional Energy Resources

ExxonMobil is actively working on a variety of

unconventional fuel technologies including gasification, methanol to

gasoline, and biofuels. Gasification • ExxonMobil entered into an agreement with Pratt & Whitney Rocketdyne to develop advanced gasification technology to convert coal, coke, or biomass into synthesis gas. Synthesis gas can be converted into chemical products or transportation fuels, or used as fuel for power generation. This technology could also facilitate the use of carbon capture and storage to reduce greenhouse gas emissions from processing carbon rich feedstocks such as coal and coke. |

Methanol to Gasoline •

ExxonMobil’s Methanol

to Gasoline (MTG) technology efficiently converts

methanol into high-quality gasoline. When coupled with

commercially proven gasification and methanol synthesis

technology, MTG is an effective way to produce premium

transportation fuel from coal. We recently began licensing

this technology and have several signed licensees. Biofuels •

ExxonMobil continues to evaluate a number of

short- and longer-term biofuel options and opportunities.

As an example, we have developed a proprietary test

method to fingerprint biodiesel mixtures. This unique

methodology will allow us to improve the efficiency and

reliability of our blending operations, while continuing to

meet product quality specifications. |

|

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 27 |

Heat Exchanger Fouling Mitigation Refinery heat exchanger networks are designed to

efficiently transfer heat from hot process streams to cold

feed streams, thereby minimizing process heat input

requirements. The performance of this equipment is an

important part of overall site energy usage. Corrosion

and fouling in heat exchangers can impair performance

by creating a thermal-insulating deposit that reduces the

heat exchange efficiency between the hot and cold fluids.

These effects are particularly detrimental in exchangers

that operate under high-temperature conditions.

|

ExxonMobil researchers have discovered that formation of

a unique surface on the metal tubes of a heat exchanger

can significantly reduce corrosion and fouling. Heat

exchangers with these characteristics are being evaluated

at two Gulf Coast refineries and additional exchangers

will be tested at two other ExxonMobil refineries in 2009.

When deployed, the technology will reduce furnace firing

and associated CO2 emissions. An engineer inspects a modified heat exchanger tube bundle prior

to installation at a U.S. Gulf Coast refinery. |

||

|

|||

|

Advanced Modeling ExxonMobil is using advanced computational fluid

dynamics (CFD) modeling to enhance the performance

and utilization of existing refinery assets. For example,

detailed CFD analysis of our proprietary Fluid Coking

process led to a new hardware design that better

utilizes existing reactor volume. The new configuration

increases the yield of gasoline and distillate products

and improves energy efficiency.

|

|

||

Computational Fluid Dynamics modeling enables evaluation of time-varying behavior of multiphase refinery processes. |

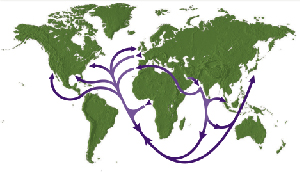

Supply Chain Optimization ExxonMobil operates one of the world’s largest and most

complex supply chains. The company’s business experts

and engineers work constantly to improve its effectiveness

and reduce costs. We are actively developing and

deploying unique supply chain optimization technologies

that place us at the forefront of industry. One example

is our METEORITE supply chain program that aids in

the scheduling, transportation, and optimization of our

feedstock shipments around the world. |

||

28 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

Lower-Cost Processes

We have a number of programs targeting more efficient,

lower-cost processes as we continually strive to lower

operating costs at our chemical manufacturing facilities

by delivering improved efficiency, greater reliability, and

increased asset utilization. Technology activities include breakthrough developments such as our new butyl rubber polymerization process, as well as incremental improvements from implementation of many smaller, focused efficiency initiatives. These developments are enabled by sophisticated computer process simulations, advanced materials engineering, proprietary equipment design, and novel product and catalyst chemistry. |

ExxonMobil Chemical has received American Chemistry Council

energy efficiency awards for 11 consecutive years as a result of

continued implementation of technology best practices. |

|

Advantaged Feeds Many of our technology programs are focused on developing innovative ways to

allow processing of lower-cost feeds. Through proprietary design of processing

equipment, we have increased the flexibility of our units to handle a wide

variety of hydrocarbon feed streams. In addition we have developed complex

computational tools, including integrated real-time optimization programs, which

allow us to rapidly change feeds into our chemical plants and refineries to

maximize the value of all molecules. These technology best practices are also incorporated into new equipment

design. For example the new ethylene steam cracker currently under

construction in Singapore has been designed to have the greatest feed flexibility

of any ExxonMobil steam cracker in the world. Our steam cracker technology is a competitive advantage. New furnaces are larger and more

efficient than those typically used in industry. We have also qualified more than 300 new feeds

over the past four years, increasing flexibility to use the most-advantaged feeds. |

Premium Product Development

We continue to develop premium products across our

chemical portfolio. Breakthroughs in metallocene catalyst

technology have given us the ability to create whole new

families of higher-value chemical products from commodity

chemical building blocks. For example:

Enable metallocene polyethylene produces strong and clear

films that can reduce packaging weight by up to 20 percent

versus typical films, delivering energy savings throughout

the supply chain in uses from packaging to greenhouse

coverings. |

Use of high-throughput experimentation (HTE) catalyst screening

has allowed us to accelerate design and commercialization of next-

generation products from metallocene catalysts. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 29 |

| • | Identify and pursue all attractive exploration opportunities | |

| • | Invest in projects that deliver superior returns | |

| • | Maximize profitability of existing oil and gas production | |

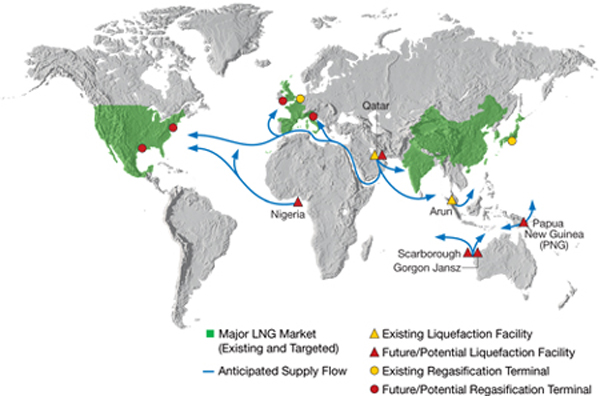

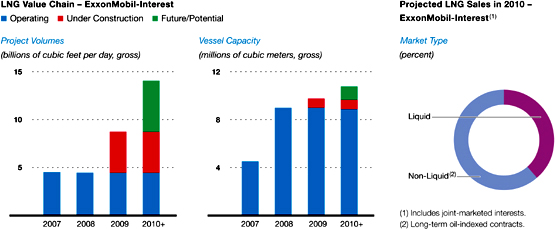

| • | Capitalize on growing natural gas and power markets |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 31 |

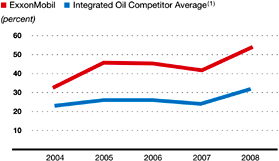

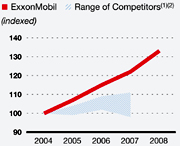

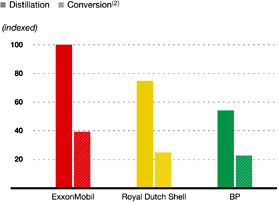

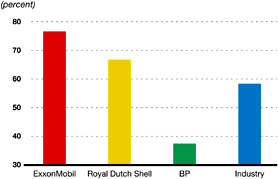

| (1) Royal Dutch Shell, BP, and Chevron values are estimated on a consistent basis with ExxonMobil, based on public information. | ||

| UPSTREAM STATISTICAL RECAP | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Earnings (millions of dollars) |

35,402 | 26,497 | 26,230 | 24,349 | 16,675 | |||||||||||||||

Liquids production (thousands of barrels per day) |

2,405 | 2,616 | 2,681 | 2,523 | 2,571 | |||||||||||||||

Natural gas production

available for sale (millions of cubic feet per day) |

9,095 | 9,384 | 9,334 | 9,251 | 9,864 | |||||||||||||||

Oil-equivalent production (thousands of barrels per day) |

3,921 | 4,180 | 4,237 | 4,065 | 4,215 | |||||||||||||||

Proved reserves replacement(1)(2) (percent) |

110 | 132 | 129 | 129 | 125 | |||||||||||||||

Resource additions(2) (millions of oil-equivalent barrels) |

2,230 | 2,010 | 4,270 | 4,365 | 2,940 | |||||||||||||||

Average capital employed(2) (millions of dollars) |

66,064 | 63,565 | 57,871 | 53,261 | 50,642 | |||||||||||||||

Return on average capital employed(2) (percent) |

53.6 | 41.7 | 45.3 | 45.7 | 32.9 | |||||||||||||||

Capital and exploration expenditures(2) (millions of dollars) |

19,734 | 15,724 | 16,231 | 14,470 | 11,715 | |||||||||||||||

| (1) | Excluding asset sales, the 2007 Venezuela expropriation, and year-end price/cost effects. | |

| (2) | See Frequently Used Terms on pages 96 through 99. |

32 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| • | New exploration plays and concepts that typically have high uncertainty but large potential to provide significant long-term resource growth. | |

| • | Unconventional resources such as tight gas, shale gas, heavy oil, and oil sands that can provide profitable, long-plateau production. | |

| • | Further exploration of established hydrocarbon provinces and mature plays that provide near-term resource additions and production. | |

| • | Discovered fields that are undeveloped or partially developed. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 33 |

34 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 35 |

| (1) Royal Dutch Shell, BP, and Chevron values calculated on a consistent basis with ExxonMobil, based on public information. | ||

36 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 37 |

|

38 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

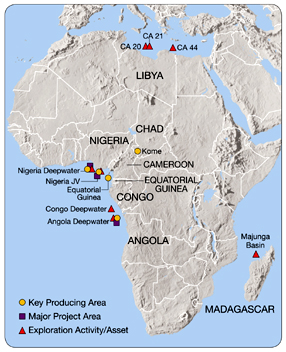

| • | Local fabrication of the high-strength steel turret components for the Kizomba C project – the first of their kind in Angola. | |

| • | Approximately $220 million of the East Area Natural Gas Liquids (NGL) II project was financed by Nigerian banks – the first for oil and gas ventures in Nigeria. | |

| • | Conducted subsea systems integration test in Nigeria for the deepwater Erha project – the first ever in West Africa. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 39 |

|

40 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

|

|

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 41 |

| Target Peak | ||||||||||||

| Production (Gross) | ExxonMobil | |||||||||||

| Liquids | Gas | Working | ||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||

2008

(Actual) |

||||||||||||

Angola |

Kizomba C Mondo | 100 | — | 40 | < | |||||||

| Kizomba C Saxi/Batuque | 100 | — | 40 | < | ||||||||

Azerbaijan |

ACG Phase 3 | 300 | — | 8 | = | |||||||

Malaysia |

Jerneh B | — | 150 | 100 | < | |||||||

Nigeria |

East Area NGL II | 50 | — | 51 | < | |||||||

Norway |

Volve | 50 | 30 | 30 | = | |||||||

U.K. |

Starling | 15 | 160 | 72 | = | |||||||

U.S. |

Thunder Horse | 250 | 200 | 25 | = | |||||||

2009

(Projected) |

||||||||||||

Italy |

Adriatic LNG Terminal | — | — | 45 | 5 | |||||||

Norway |

Tyrihans | 80 | 335 | 12 | = | |||||||

Qatar |

Al Khaleej Gas Phase 2 | 70 | 1250 | 80* | < | |||||||

| Qatargas II Train 4** | 80 | 1250 | 30 | 5 | ||||||||

| Qatargas II Train 5 | 80 | 1250 | 18 | 5 | ||||||||

| RasGas Train 6 | 75 | 1250 | 30 | 5 | ||||||||

| RasGas Train 7 | 75 | 1250 | 30 | 5 | ||||||||

U.K. |

South Hook LNG Terminal | — | — | 24 | 5 | |||||||

U.S. |

Piceance Phase 1 | 2 | 200 | 100 | < | |||||||

2010-2011

(Projected) |

||||||||||||

Angola |

Kizomba Satellites | 125 | — | 40 | < | |||||||

| Pazflor | 200 | — | 20 | = | ||||||||

Australia |

Kipper/Tuna | 15 | 175 | 40 | < | |||||||

| Turrum | 20 | 200 | 50 | < | ||||||||

Canada |

Hibernia Southern Extension | 65 | — | 28 | < | |||||||

Nigeria |

Etim/Asasa Pressure | 50 | — | 40 | < | |||||||

| Maintenance | ||||||||||||

Russia |

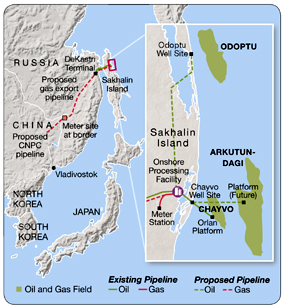

Sakhalin-1 Odoptu | 35 | — | 30 | < | |||||||

U.S. |

Golden Pass LNG Terminal | — | — | 18 | 5 | |||||||

| Prudhoe Bay Western Region | 50 | — | 36 | = | ||||||||

2012+

(Projected) |

||||||||||||

Angola |

Cravo-Lirio-Orquidea-Violeta | 160 | — | 20 | = | |||||||

| AB32 Southeast Hub | 210 | — | 15 | = | ||||||||

| Palas-Astrea-Juno | 150 | — | 25 | = | ||||||||

| Plutao-Saturno-Venus-Marte | 150 | — | 25 | = | ||||||||

| Target Peak | ||||||||||||||||

| Production (Gross) | ExxonMobil | |||||||||||||||

| Liquids | Gas | Working | ||||||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||||||

| 2012+ (continued) | ||||||||||||||||

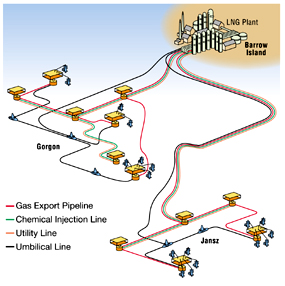

Australia |

Gorgon Jansz | 15 | 2250 | 25 | = | |||||||||||

| Scarborough | — | 1190 | 50 | < | ||||||||||||

Canada |

Cold Lake Expansion | 35 | — | 100 | < | |||||||||||

| Cold Lake LASER Expansion | 20 | — | 100 | < | ||||||||||||

| Hebron | 140 | — | 36 | < | ||||||||||||

| Kearl Phase 1 | 110 | — | 100 | < | ||||||||||||

| Kearl Future Phases | 200 | — | 100 | < | ||||||||||||

| Mackenzie Gas Project | 10 | 830 | 56 | < | ||||||||||||

| Syncrude Aurora South | 180 | — | 25 | 5 | ||||||||||||

| Phase 1 & 2 | ||||||||||||||||

Indonesia |

Banyu Urip | 165 | — | 45 | < | |||||||||||

| Natuna | — | 1100 | 76 | < | ||||||||||||

Italy |

Tempa Rossa | 50 | 5 | 25 | = | |||||||||||

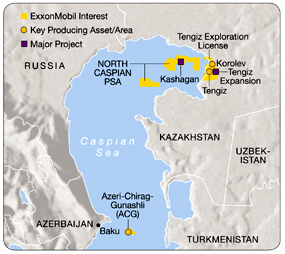

Kazakhstan |

Kashagan Phase 1 | 360 | — | 17 | = | |||||||||||

| Kashagan Future Phases | 1190 | — | 17 | = | ||||||||||||

| Tengiz Expansion | 370 | — | 25 | = | ||||||||||||

Nigeria |

Bonga North | 100 | 60 | 20 | = | |||||||||||

| Bonga Southwest | 140 | 105 | 16 | = | ||||||||||||

| Bosi | 135 | — | 56 | < | ||||||||||||

| Erha North Phase 2 | 45 | — | 56 | < | ||||||||||||

| LNG IPP Upstream | — | 700 | 40 | < | ||||||||||||

| Satellite Field Development | 125 | — | 40 | < | ||||||||||||

| Usan | 180 | — | 30 | = | ||||||||||||

| Usari Pressure Maintenance | 50 | — | 40 | < | ||||||||||||

Norway |

Trestakk | 55 | 50 | 33 | = | |||||||||||

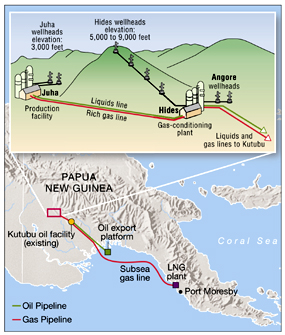

Papua New |

PNG LNG | 40 | 940 | 33 | < | |||||||||||

Guinea |

||||||||||||||||

Qatar |

Barzan | 100 | 1500 | 10* | 5 | |||||||||||

Russia |

Sakhalin-1 Arkutun-Dagi | 90 | — | 30 | < | |||||||||||

| Sakhalin-1 Future Phases | — | 800 | 30 | < | ||||||||||||

U.K. |

Fram | 5 | 105 | 72 | = | |||||||||||

U.S. |

Alaska Gas/Point Thomson | 70 | 4500 | 36 | * | |||||||||||

| Piceance Future Phases | 10 | 780 | 100 | < | ||||||||||||

| < = ExxonMobil Operated | 5 = Joint Operation = = Co-Venturer Operated | |||||||||

| * Pending Final Agreements | ** Offshore production started up in 2008. | – Not Applicable | ||||||||

42 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

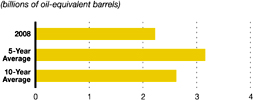

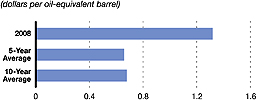

| 5-Year | ||||||||

| (billions of oil-equivalent barrels) | 2008 | Average | ||||||

Resource additions/acquisitions |

2.2 | 3.2 | ||||||

Revisions to existing fields |

— | (0.5 | ) | |||||

Production |

(1.5 | ) | (1.6 | ) | ||||

Sales |

(0.4 | ) | (1.0 | )(1) | ||||

Net change |

0.3 | 0.1 | ||||||

| (1) | Includes impact of the Venezuela expropriation in 2007. | |

| (2) | See Frequently Used Terms on pages 96 through 99. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 43 |

| (1) Excludes year-end price/cost effects. Proved reserves reflecting December 31 prices can be found on pages 67-68. | ||

| (2) Includes asset sales and the 2007 Venezuela expropriation. | ||

44 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

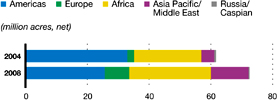

ExxonMobil has interests in exploration and production acreage in 38 countries and production operations in 23 countries.

| 2008 | 2007 | 2006 | ||||||||||

Earnings (billions of dollars) |

9.8 | 7.6 | 8.9 | |||||||||

Proved Reserves(1) (BOEB) |

7.2 | 6.2 | 6.2 | |||||||||

Acreage (gross acres, million) |

56.4 | 56.3 | 56.4 | |||||||||

Net Liquids Production (MBD) |

0.7 | 0.7 | 0.8 | |||||||||

Net Gas Available for Sale (BCFD) |

1.9 | 2.3 | 2.5 | |||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 45 |

46 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 47 |

48 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 49 |

50 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| 2008 | 2007 | 2006 | |||||||||||

Earnings (billions of dollars) |

9.9 | 6.1 | 6.5 | ||||||||||

Proved Reserves(1) (BOEB) |

3.4 | 3.8 | 3.9 | ||||||||||

Acreage (gross acres, million) |

27.0 | 24.3 | 18.8 | ||||||||||

Net Liquids Production (MBD) |

0.4 | 0.5 | 0.5 | ||||||||||

Net Gas Available for Sale (BCFD) |

4.0 | 3.8 | 4.1 | ||||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. | |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 51 |

52 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

53 |

|

54 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| 2008 | 2007 | 2006 | |||||||||||

Earnings (billions of dollars) |

6.4 | 5.5 | 5.5 | ||||||||||

Proved Reserves(1) (BOEB) |

2.1 | 2.4 | 2.4 | ||||||||||

Acreage (gross acres, million) |

42.4 | 41.8 | 41.1 | ||||||||||

Net Liquids Production (MBD) |

0.6 | 0.7 | 0.8 | ||||||||||

Net Gas Available for Sale (BCFD) |

— | — | — | ||||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. | |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 55 |

56 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 57 |

58 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| 2008 | 2007 | 2006 | |||||||||||

Earnings (billions of dollars) |

6.2 | 4.9 | 4.1 | ||||||||||

Proved Reserves(1) (BOEB) |

8.2 | 8.3 | 8.1 | ||||||||||

Acreage (gross acres, million) |

26.9 | 29.0 | 21.7 | ||||||||||

Net Liquids Production (MBD) |

0.5 | 0.5 | 0.5 | ||||||||||

Net Gas Available for Sale (BCFD) |

3.1 | 3.2 | 2.6 | ||||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. | |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 59 |

60 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

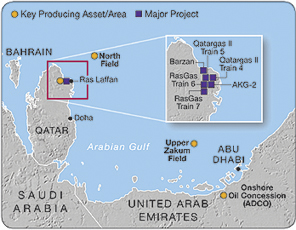

| Joint | Capacity | Working | Scheduled | |||||||||||

| Venture | Train | (MTA)(1) | Interest (%) | Completion | ||||||||||

Qatargas |

1,2,3 | 9.7 | 10 | Complete | ||||||||||

Qatargas II |

4 | 7.8 | 30 | 2009 | ||||||||||

| 5 | 7.8 | 18 | 2009 | |||||||||||

RasGas |

1,2 | 6.6 | 25 | Complete | ||||||||||

| 3 | 4.7 | 30 | Complete | |||||||||||

| 4 | 4.7 | 34 | Complete | |||||||||||

| 5 | 4.7 | 30 | Complete | |||||||||||

| 6 | 7.8 | 30 | 2009 | |||||||||||

| 7 | 7.8 | 30 | 2009 | |||||||||||

Total |

61.6 | |||||||||||||

| (1) | Million tons per year. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 61 |

62 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

| 2008 | 2007 | 2006 | ||||||||||

Earnings (billions of dollars) |

3.1 | 2.4 | 1.2 | |||||||||

Proved Reserves(1) (BOEB) |

1.9 | 2.0 | 2.1 | |||||||||

Acreage (gross acres, million) |

2.5 | 2.5 | 2.7 | |||||||||

Net Liquids Production (MBD) |

0.2 | 0.2 | 0.1 | |||||||||

Net Gas Available for Sale (BCFD) |

0.1 | 0.1 | 0.1 | |||||||||

| (1) | See Frequently Used Terms on pages 96 through 99. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 63 |

64 |

EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW |

|

NET LIQUIDS PRODUCTION(1) – Including Oil Sands and Non-Consolidated Operations

|

||||||||||||||||||||

| (thousands of barrels per day) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

United States |

||||||||||||||||||||

Alaska |

130 | 132 | 127 | 159 | 174 | |||||||||||||||

Lower 48 |

237 | 260 | 287 | 317 | 383 | |||||||||||||||

Total United States |

367 | 392 | 414 | 477 | 557 | |||||||||||||||

Canada/South America |

292 | 324 | 354 | 395 | 408 | |||||||||||||||

Total Americas |

659 | 716 | 768 | 872 | 965 | |||||||||||||||

Europe |

||||||||||||||||||||

United Kingdom |

123 | 150 | 186 | 202 | 235 | |||||||||||||||

Norway |

295 | 319 | 320 | 327 | 328 | |||||||||||||||

Other |

10 | 11 | 14 | 17 | 20 | |||||||||||||||

Total Europe |

428 | 480 | 520 | 546 | 583 | |||||||||||||||

Africa |

||||||||||||||||||||

Nigeria |

364 | 415 | 427 | 299 | 276 | |||||||||||||||

Angola |

181 | 173 | 193 | 181 | 95 | |||||||||||||||

Equatorial Guinea |

60 | 76 | 103 | 122 | 136 | |||||||||||||||

Other |

47 | 53 | 58 | 64 | 65 | |||||||||||||||

Total Africa |

652 | 717 | 781 | 666 | 572 | |||||||||||||||

Asia Pacific/Middle East |

||||||||||||||||||||

Australia |

59 | 66 | 69 | 73 | 91 | |||||||||||||||

Malaysia |

56 | 67 | 64 | 82 | 94 | |||||||||||||||

Middle East |

381 | 374 | 340 | 163 | 158 | |||||||||||||||

Other |

10 | 11 | 12 | 14 | 17 | |||||||||||||||

Total Asia Pacific/Middle East |

506 | 518 | 485 | 332 | 360 | |||||||||||||||

Russia/Caspian |

160 | 185 | 127 | 107 | 91 | |||||||||||||||

Total worldwide |

2,405 | 2,616 | 2,681 | 2,523 | 2,571 | |||||||||||||||

Gas Plant Liquids Included Above |

||||||||||||||||||||

United States |

49 | 57 | 61 | 68 | 86 | |||||||||||||||

Non-U.S. |

164 | 166 | 175 | 172 | 168 | |||||||||||||||

Total worldwide |

213 | 223 | 236 | 240 | 254 | |||||||||||||||

Oil Sands and Non-Consolidated Volumes Included Above |

||||||||||||||||||||

United States |

78 | 82 | 87 | 93 | 101 | |||||||||||||||

Canada/South America |

62 | 65 | 58 | 53 | 59 | |||||||||||||||

Europe |

5 | 6 | 6 | 7 | 9 | |||||||||||||||

Asia Pacific/Middle East |

193 | 190 | 172 | 146 | 140 | |||||||||||||||

Russia/Caspian |

87 | 75 | 71 | 72 | 74 | |||||||||||||||

Total worldwide |

425 | 418 | 394 | 371 | 383 | |||||||||||||||

| (1) | Net liquids production quantities are the volumes of crude oil and natural gas liquids withdrawn from ExxonMobil’s oil and gas reserves, excluding royalties and quantities due to others when produced, and are based on the volumes delivered from the lease or at the point measured for royalty and/or severance tax purposes. Volumes include 100 percent of the production of majority-owned affiliates, including liquids production from oil sands operations in Canada, and ExxonMobil’s ownership of the production by companies owned 50 percent or less. |

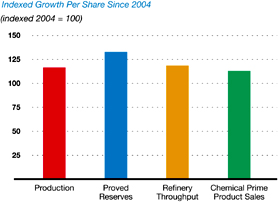

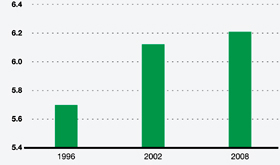

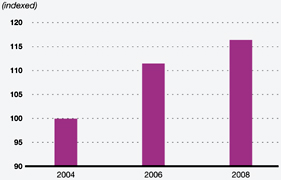

Proved Reserves per Share Growth

|

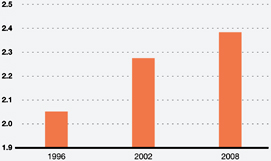

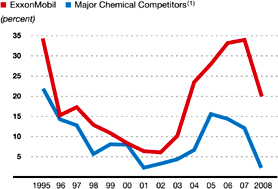

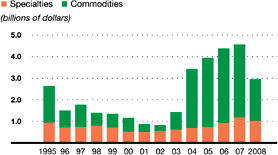

Production per Share Growth | Upstream Earnings per Share Growth | ||

|

|

|

| (1) | Royal Dutch Shell, BP, and Chevron values are calculated on a consistent basis with ExxonMobil, based on public information. | |

| (2) | 2008 competitor data not available. |

| EXXON MOBIL CORPORATION • 2008 FINANCIAL & OPERATING REVIEW | 65 |

| (millions of cubic feet per day) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

United States |

1,246 | 1,468 | 1,625 | 1,739 | 1,947 | |||||||||||||||

Canada/South America |

640 | 808 | 935 | 1,006 | 1,069 | |||||||||||||||

Total Americas |

1,886 | 2,276 | 2,560 | 2,745 | 3,016 | |||||||||||||||

Europe |

||||||||||||||||||||

The Netherlands |

1,748 | 1,551 | 1,536 | 1,595 | 1,725 | |||||||||||||||

United Kingdom |

750 | 779 | 990 | 1,126 | 1,196 | |||||||||||||||

Norway |

764 | 705 | 686 | 709 | 645 | |||||||||||||||

Germany |

687 | 775 | 874 | 885 | 1,048 | |||||||||||||||

Total Europe |

3,949 | 3,810 | 4,086 | 4,315 | 4,614 | |||||||||||||||

Africa |

32 | 26 | — | — | — | |||||||||||||||

Asia Pacific/Middle East |

||||||||||||||||||||

Australia |

358 | 389 | 330 | 338 | 397 | |||||||||||||||

Malaysia |

582 | 583 | 519 | 488 | 511 | |||||||||||||||

Middle East |

1,911 | 1,875 | 1,353 | 846 | 642 | |||||||||||||||

Indonesia |

239 | 286 | 365 | 410 | 578 | |||||||||||||||

Other |

24 | 29 | 29 | 32 | 33 | |||||||||||||||

Total Asia Pacific/Middle East |

3,114 | 3,162 | 2,596 | 2,114 | 2,161 | |||||||||||||||

Russia/Caspian |

114 | 110 | 92 | 77 | 73 | |||||||||||||||

Total worldwide |

9,095 | 9,384 | 9,334 | 9,251 | 9,864 | |||||||||||||||

Non-Consolidated Natural Gas Volumes Included Above |

||||||||||||||||||||

United States |

1 | 1 | 1 | 2 | 2 | |||||||||||||||

Europe |

1,696 | 1,503 | 1,500 | 1,548 | 1,667 | |||||||||||||||

Asia Pacific/Middle East |

1,356 | 1,272 | 1,000 | 807 | 642 | |||||||||||||||

Russia/Caspian |

77 | 79 | 75 | 73 | 74 | |||||||||||||||

Total worldwide |

3,130 | 2,855 | 2,576 | 2,430 | 2,385 | |||||||||||||||