|

| 1 | ||||

| 3 | ||||

| 14 | ||||

| 16 | ||||

| 60 | ||||

| 74 | ||||

| 84 | ||||

| 93 | ||||

| 96 | ||||

| 97 |

| Average | Return on | Capital and | ||||||||||||||

| Earnings After | Capital | Average Capital | Exploration | |||||||||||||

| (millions of dollars, unless noted) | Income Taxes | Employed | (1) | Employed (%) | (1) | Expenditures | (1) | |||||||||

Upstream |

29,895 | 139,442 | 21.4 | 36,084 | ||||||||||||

Downstream |

13,190 | 24,031 | 54.9 | 2,262 | ||||||||||||

Chemical |

3,898 | 20,148 | 19.3 | 1,418 | ||||||||||||

Corporate and Financing |

(2,103 | ) | (4,527 | ) | N.A. | 35 | ||||||||||

Total |

44,880 | 179,094 | 25.4 | 39,799 | ||||||||||||

Liquids production (net, thousands of barrels per day) |

2,185 | |||

Natural gas production available for sale (net, millions of cubic feet per day) |

12,322 | |||

Oil-equivalent production(2) (net, thousands of oil-equivalent barrels per day) |

4,239 | |||

Refinery throughput (thousands of barrels per day) |

5,014 | |||

Petroleum product sales (thousands of barrels per day) |

6,174 | |||

Chemical prime product sales(1) (thousands of tonnes) |

24,157 |

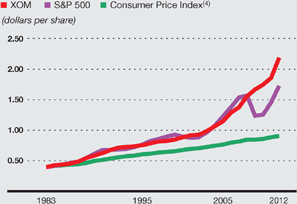

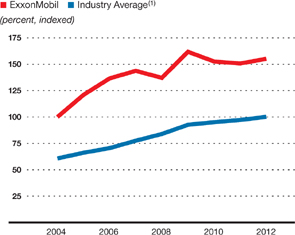

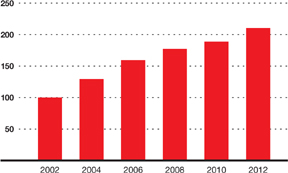

Dividend Growth Since 1983(3)

|

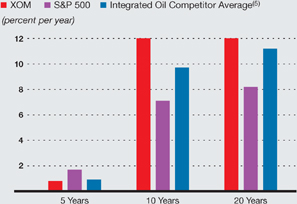

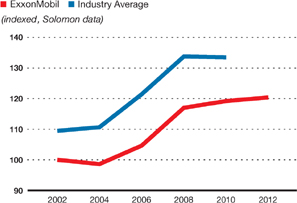

Total Shareholder Returns(1) | |

|

|

| (1) | See Frequently Used Terms on pages 93 through 95. | |

| (2) | Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels. | |

| (3) | S&P and CPI indexed to 1983 Exxon dividend. | |

| (4) | CPI based on historical yearly average from Bureau of Labor Statistics. | |

| (5) | Royal Dutch Shell, BP, and Chevron values are on a consistent basis with ExxonMobil, based on public information. |

Photo: Construction and fabrication activities are progressing on the Papua New Guinea Liquefied

Natural Gas project with start-up scheduled for 2014. |

|

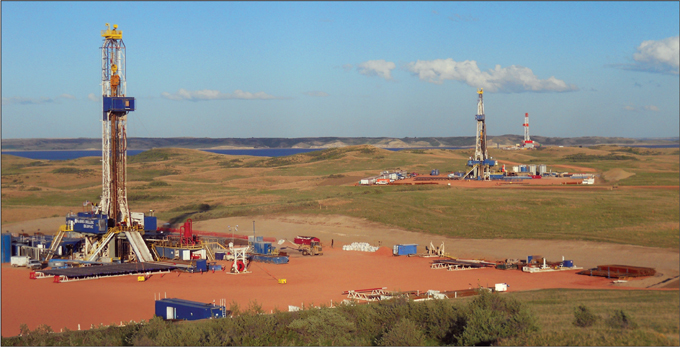

Cover Photo: Unconventional resources, such as those at our Bakken Shale play in Montana and North

Dakota, are a key part of our portfolio. In 2012, we expanded our Bakken position to approximately

585,000 net acres. |

|

| 2 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW | ||||

Our competitive advantages formed the framework for solid financial and operating results across

all key measures and businesses in 2012. We achieved strong earnings and generated robust returns

for our shareholders. We also continued to invest in attractive projects that position the company

for sustained long-term growth and profitability.

Rex W. Tillerson, Chairman and CEO |

|

||||

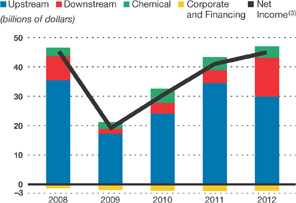

Functional Earnings and Net Income(2)

|

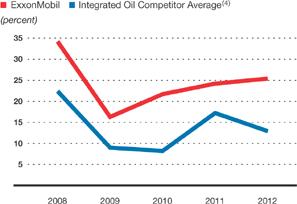

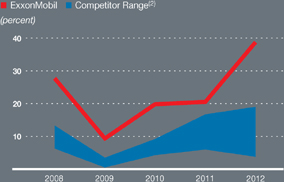

Return on Average Capital Employed(1) | |

|

|

| (1) | See Frequently Used Terms on pages 93 through 95. | |

| (2) | Earnings after income taxes including special items (2008 and 2009). | |

| (3) | Net income attributable to ExxonMobil. | |

| (4) | Royal Dutch Shell, BP, and Chevron values are on a consistent basis with ExxonMobil, based on public information. |

| 3 |

| 4 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 5 |

|

||||

ROSNEFT STRATEGIC COOPERATION AGREEMENT |

||||

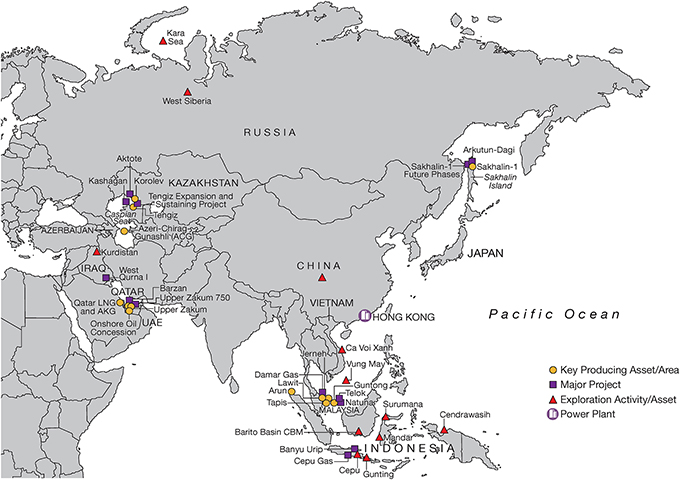

In 2012, ExxonMobil continued to progress our Strategic Cooperation Agreement with

Rosneft covering 31 million acres in the Kara Sea – an area similar to the size of

the entire leased area in the Gulf of Mexico – and nearly 2.7 million acres in West

Siberia. We are also working with Rosneft to jointly assess and develop oil and gas in

the United States and Canada. |

||||

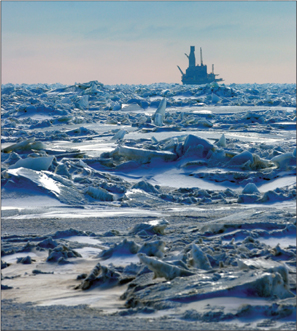

Right: Seismic data were collected in the Kara Sea in 2012, and exploration drilling is

expected to begin in 2014. |

||||

| Our geographically diverse Downstream portfolio includes a network of 32 refineries around the

globe. With five refineries located in the mid-continent region of North America, including Joliet,

Illinois (above), ExxonMobil is well positioned to benefit from growing crude oil production in the

United States and Canada. |

||

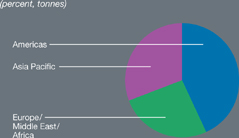

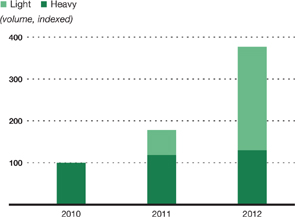

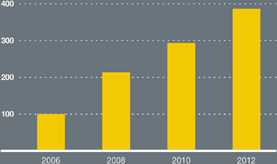

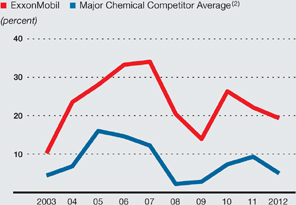

Chemical Segment Earnings

|

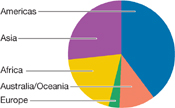

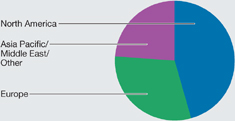

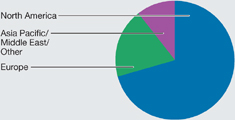

Chemical 2012 Prime Product Sales | |

|

|

|

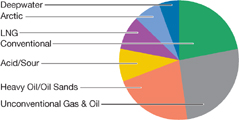

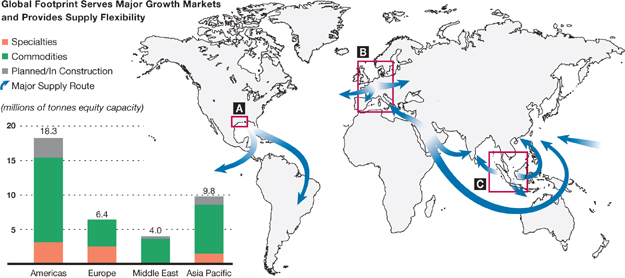

| Our unique Chemical portfolio captures the benefits of scale from commodity chemicals while

maximizing the value of specialty chemicals. High-volume commodities capture upside earnings when

industry margins are strong, while lower-volume specialties products command a market premium and

provide a stable earnings base. | ||

| 6 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 7 |

|

||

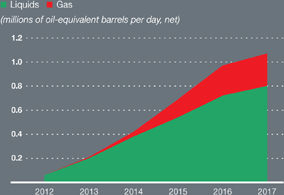

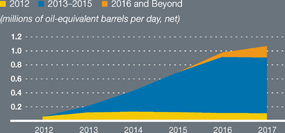

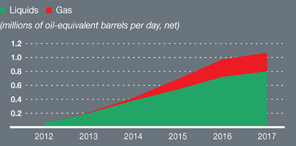

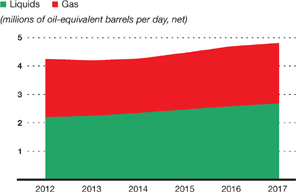

Major Upstream Project Start-Ups  |

||

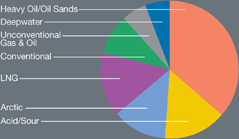

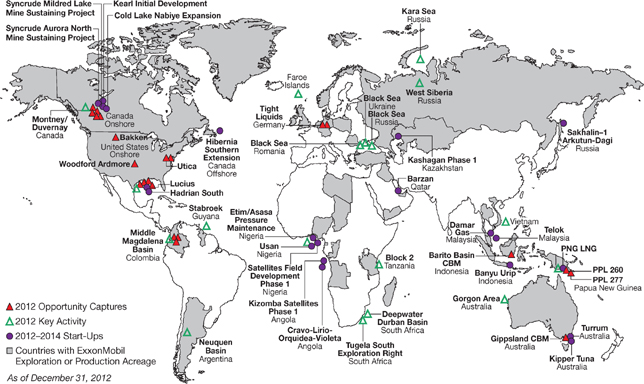

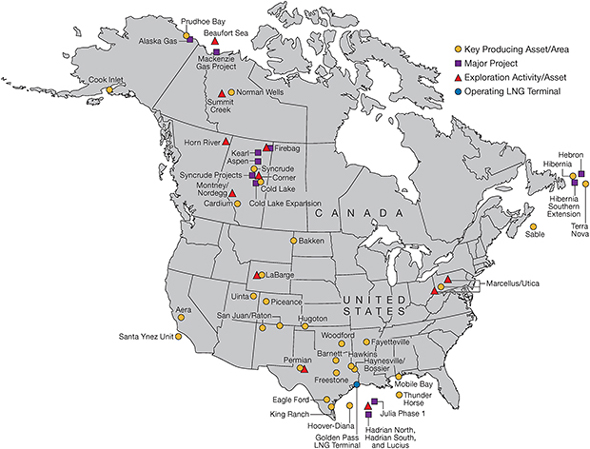

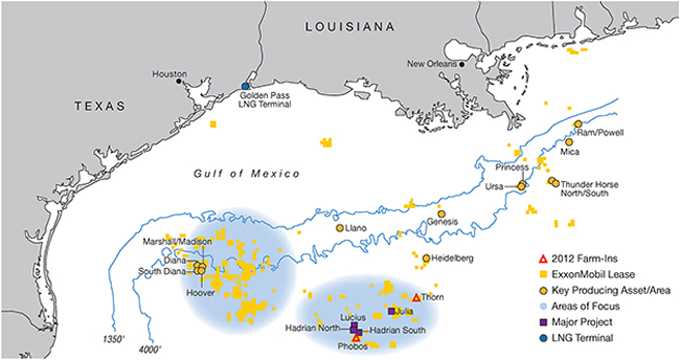

INVESTING FOR GROWTH AND VALUE |

||

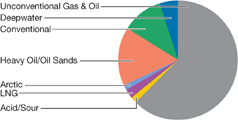

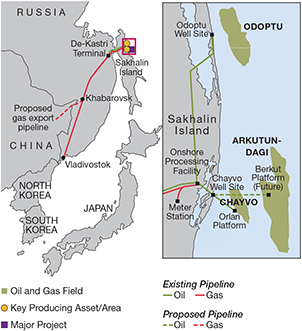

Our disciplined approach to investing encompasses everything

from initial project screening to the divestment of assets

that no longer meet our criteria. Rigorous standards are

consistently applied across our global portfolio. Our

Upstream project portfolio is geographically diverse and

represents all major resource types. Near-term major Upstream

project start-ups, including our Arkutun-Dagi development in

Russia (top right), are expected to deliver approximately 1

million net oil-equivalent barrels per day of production by 2017.

Our Papua New Guinea Liquefied Natural Gas project (below) is

scheduled to start up in 2014 and will support rapidly growing

global demand for natural gas. |

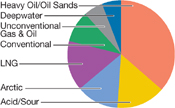

Upstream Projects by Resource Type (percent, oil-equivalent barrels)  |

| 8 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 9 |

| 10 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 11 |

| 12 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 13 | |||

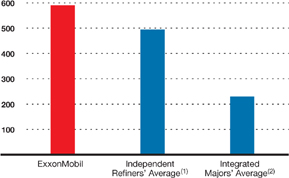

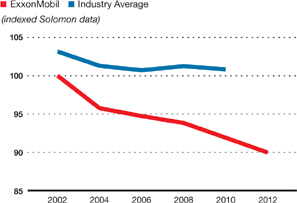

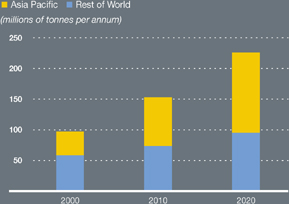

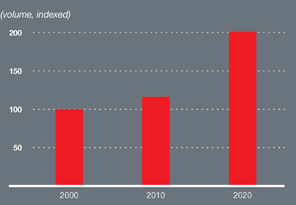

Refining Integration with Chemicals and Lubes

|

Downstream and Chemical Combined ROCE(1) | |

Source: Parpinelli Tecnon, PIRA data |

(1) See Frequently Used Terms on pages 93 through 95. (2) Royal Dutch Shell, BP, and Chevron values are on a consistent basis with ExxonMobil, based on public information. |

| 18 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| • | Apply effective risk management, safety, and operational excellence |

|

| • | Identify and selectively capture the highest-quality resources |

|

| • | Exercise a disciplined approach to investing and cost management |

|

| • | Develop and apply high-impact technologies |

|

| • | Maximize profitability of existing oil and gas production |

|

| • | Capitalize on growing natural gas and power markets |

| UPSTREAM STATISTICAL RECAP | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

Earnings (millions of dollars) |

29,895 | 34,439 | 24,097 | 17,107 | 35,402 | |||||||||||||||

Liquids production (net, thousands of barrels per day) |

2,185 | 2,312 | 2,422 | 2,387 | 2,405 | |||||||||||||||

Natural gas production available for sale (net, millions of cubic feet per day) |

12,322 | 13,162 | 12,148 | 9,273 | 9,095 | |||||||||||||||

Oil-equivalent production(1) (net, thousands of barrels

per day) |

4,239 | 4,506 | 4,447 | 3,932 | 3,921 | |||||||||||||||

Proved reserves replacement ratio(2)(3) (percent) |

124 | 116 | 211 | 100 | 143 | |||||||||||||||

Resource additions(2) (millions of oil-equivalent barrels) |

4,012 | 4,086 | 14,580 | 2,860 | 2,230 | |||||||||||||||

Average capital employed(2) (millions of dollars) |

139,442 | 129,807 | 103,287 | 73,201 | 66,064 | |||||||||||||||

Return on average capital employed(2) (percent) |

21.4 | 26.5 | 23.3 | 23.4 | 53.6 | |||||||||||||||

Capital and exploration expenditures(2) (millions of

dollars) |

36,084 | 33,091 | 27,319 | 20,704 | 19,734 | |||||||||||||||

| (1) | Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels. | |

| (2) | See Frequently Used Terms on pages 93 through 95. | |

| (3) | Proved reserves exclude asset sales. Includes non-consolidated interests and Canadian oil sands. | |

| Note: Unless otherwise stated, production rates, project capacities, and acreage values referred to on pages 16 through 49 are gross. | ||

|

19 |

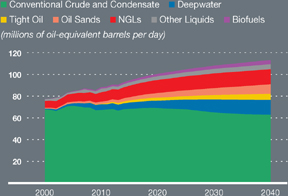

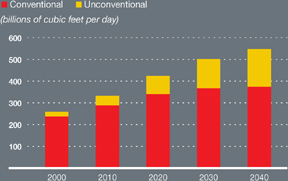

| Global Liquids Supply by Type | Global Natural Gas Production by Type | |

|

|

|

Source: ExxonMobil, 2013 The Outlook for Energy: A View to 2040 |

| 20 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

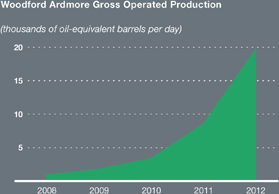

WOODFORD SHALE BASIN DEVELOPMENT |

||

In 2012, ExxonMobil completed our fifth acquisition in southern

Oklahoma since 2010, expanding our acreage position to more than

270,000 net acres in the Woodford Shale play in the Ardmore and

Marietta Basins. Both basins are attractive due to their liquids

yield and higher per-well recoveries. With a high-quality acreage

position and active drilling operations, we have the potential to

recover more than 1.5 billion oil-equivalent barrels from this

liquids-rich play at an attractive development cost. |

||

Gross operated

production more than doubled in 2012 to approximately 19 thousand

oil-equivalent barrels per day. In 2012, construction was completed

on a 117-mile gathering pipeline from our operations to processing

facilities in North Texas. We are continuing delineation efforts of

the Woodford Shale and other shales in the Marietta Basin to the

southwest. Current development plans could grow production to more

than 150 thousand net oil-equivalent barrels per day. ExxonMobil’s

systematic approach to development is key to delivering maximum

value from unconventional resources, which involves leveraging

unparalleled experience from more mature plays, optimizing

drilling and completion practices, and maximizing capital

efficiency through pad drilling.

|

|

|

| 21 |

| 22 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

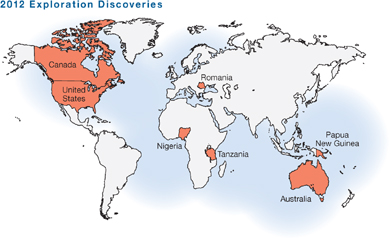

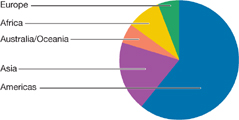

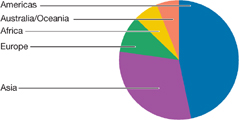

In 2012, we continued to build our diverse global portfolio of resources and reserves by adding 4

billion oil-equivalent barrels. After adjusting for production, asset sales, and revisions to

existing fields, the resource base totals more than 87 billion oil-equivalent barrels. Proved

reserves comprise approximately 29 percent of the resource base, or 25.2 billion oil-equivalent

barrels.

|

|

|

The addition of an average of 4.3 billion oil-equivalent barrels to our resource base per year over

the last decade demonstrates the success of our global strategy to identify, evaluate, pursue, and

capture high-quality opportunities. Today, ExxonMobil holds the largest global resource base among

international oil companies. The size and diversity of our resource base afford further advantage

by supporting global risk management and offering unequaled investment flexibility. |

Resource Base Distribution(1)

|

Resource Base Distribution(1) | |

(percent,

oil-equivalent barrels) By Region |

(percent, oil-equivalent

barrels) By Resource Type |

|

|

|

| 23 |

| ExxonMobil has established a significant presence of approximately 585,000 net acres in the

prolific Bakken play in North Dakota and Montana. |

Resource

Additions/Acquisitions(1)

|

Proved Reserves Distribution(1) | ||

(percent,

oil-equivalent barrels added, 2008-2012) By Resource Type |

(percent,

oil-equivalent barrels) By Region |

||

|

|

| 24 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Our Ice Management and Arctic Characterization research programs are developing technologies to take on the challenges of arctic development. |

| 25 |

We are also leveraging our drilling and completions technologies to increase recovery from

challenged reservoirs. Combining our industry-leading extended-reach drilling capability with our

proprietary stimulation technology has significantly enhanced profitable recovery. By optimizing

how and where stimulation fluid interacts with rock, we are able to sustain production rates along

the length of the wellbore, delay

|

||

compression investments, and increase recovery. Additionally, our

proprietary MazeFlo technology enhances economic recovery from reservoirs with sand control issues.

The self-healing MazeFlo sand screen increases production by improving sand control reliability.

This new technology is currently being applied in Nigeria where we anticipate improved recovery and

significant cost savings through extended well life and reduced downtime.

|

||

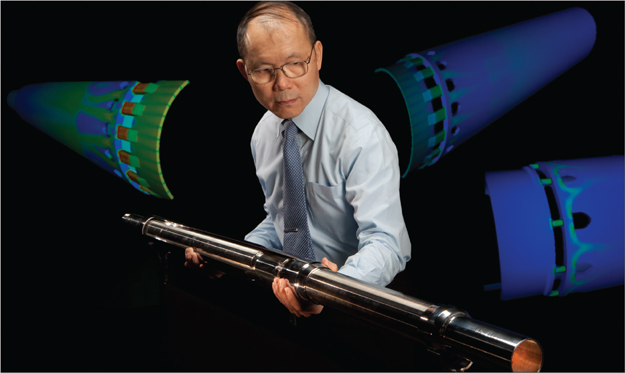

Our proprietary MazeFlo technology, which is incorporated into our sand screen designs, is

installed across a well’s producing interval. This technology extends well life and reduces

downtime, resulting in increased recovery and significant cost savings. |

||

| 26 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| (percent of plan, 2008-2012 average) | Cost | Schedule | ||||||

ExxonMobil Operated |

103 | 108 | ||||||

Operated by Others |

122 | 123 | ||||||

Projects by Geographic Region (percent, number of projects) |

Projects by Resource Type (percent, oil-equivalent barrels) |

Projects by Hydrocarbon Type (percent, oil-equivalent barrels) |

||

|

|

|

| 27 |

| Facility Capacity | ||||||||||||||||

| (Gross) | ExxonMobil | |||||||||||||||

| Liquids | Gas | Working | ||||||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||||||

| 2012 (Actual) | ||||||||||||||||

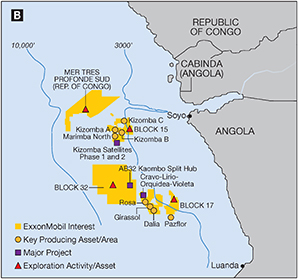

Angola |

Kizomba Satellites Phase 1 | 100 | – | 40 | n | |||||||||||

Nigeria |

Satellite Field Development | 70 | – | 40 | n | |||||||||||

| Phase 1 | ||||||||||||||||

| Usan | 180 | – | 30 | l | ||||||||||||

| 2013-2015 (Projected) | ||||||||||||||||

Angola |

Cravo-Lirio-Orquidea-Violeta | 160 | – | 20 | l | |||||||||||

| (CLOV) | ||||||||||||||||

| Kizomba Satellites Phase 2 | 70 | – | 40 | n | ||||||||||||

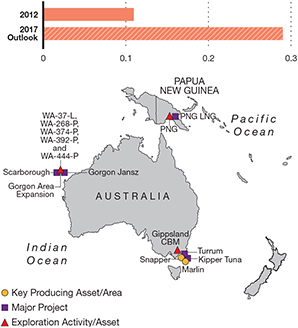

Australia |

Gorgon Jansz | 20 | 2,765 | 25 | l | |||||||||||

| Kipper Tuna | 15 | 175 | 40 | n | ||||||||||||

| Turrum | 20 | 200 | 50 | n | ||||||||||||

Canada |

Cold Lake Nabiye Expansion | 50 | – | 100 | n | |||||||||||

| Hibernia Southern Extension | 55 | – | 27 | n | ||||||||||||

| Kearl Initial Development | 170 | – | 100 | n | ||||||||||||

| Kearl Expansion | 175 | – | 100 | n | ||||||||||||

| Syncrude Aurora North Mine | 215 | – | 25 | ▲ | ||||||||||||

| Sustaining Project | ||||||||||||||||

| Syncrude Mildred Lake Mine | 180 | – | 25 | ▲ | ||||||||||||

| Sustaining Project | ||||||||||||||||

Indonesia |

Banyu Urip | 165 | 15 | 45 | n | |||||||||||

Kazakhstan |

Kashagan Phase 1 | 370 | 450 | 17 | l | |||||||||||

Malaysia |

Damar Gas | 5 | 200 | 50 | n | |||||||||||

| Telok | – | 430 | 50 | n | ||||||||||||

Nigeria |

Etim/Asasa Pressure | 50 | – | 40 | n | |||||||||||

| Maintenance | ||||||||||||||||

Papua |

PNG LNG | 30 | 1,000 | 33 | n | |||||||||||

New Guinea |

||||||||||||||||

Qatar |

Barzan | 90 | 1,400 | 7 | ▲ | |||||||||||

Russia |

Sakhalin-1 Arkutun-Dagi | 90 | – | 30 | n | |||||||||||

U.K. |

Fram | 40 | 210 | 68 | l | |||||||||||

U.S. |

Hadrian South | – | 300 | 47 | n | |||||||||||

| Lucius | 100 | 85 | 15 | l | ||||||||||||

| 2016+ (Projected) | ||||||||||||||||

Angola |

AB32 Kaombo Split Hub | 200 | – | 15 | l | |||||||||||

Australia |

Gorgon Area Expansion | 10 | 915 | 25 | l | |||||||||||

| Scarborough | – | 1,030 | 50 | n | ||||||||||||

| Facility Capacity | |||||||||||||||

| (Gross) | ExxonMobil | ||||||||||||||

| Liquids | Gas | Working | |||||||||||||

| (KBD) | (MCFD) | Interest (%) | |||||||||||||

| 2016+ (Projected, continued) | |||||||||||||||

Canada |

Aspen | 90 | – | 100 | n | ||||||||||

| Cold Lake Grand Rapids | 40 | – | 100 | n | |||||||||||

| Firebag | 380 | – | 70 | n | |||||||||||

| Hebron | 150 | – | 36 | n | |||||||||||

| Mackenzie Gas Project | 10 | 830 | 56 | n | |||||||||||

| Syncrude Aurora South | 210 | – | 25 | ▲ | |||||||||||

| Phases 1 and 2 | |||||||||||||||

| Syncrude Mildred Lake | 210 | – | 25 | ▲ | |||||||||||

| Extension | |||||||||||||||

Indonesia |

Cepu Gas | 5 | 220 | 41 | ▲ | ||||||||||

| Natuna | – | 1100 | * | * | n | ||||||||||

Iraq |

West Qurna I | 2,825 | – | 60 | ▲ | ||||||||||

Kazakhstan |

Aktote | 50 | 850 | 17 | l | ||||||||||

| Kashagan Future Phases | 1,260 | – | 17 | l | |||||||||||

| Tengiz Expansion | 260 | – | 25 | l | |||||||||||

| Tengiz Sustaining Project | 395 | – | 25 | l | |||||||||||

Nigeria |

Bonga North | 100 | 60 | 20 | l | ||||||||||

| Bonga Southwest | 225 | 15 | 16 | l | |||||||||||

| Bosi | 140 | 260 | 56 | n | |||||||||||

| Erha North Phase 2 | 60 | – | 56 | n | |||||||||||

| Satellite Field Development | 80 | – | 40 | n | |||||||||||

| Phase 2 | |||||||||||||||

| Uge | 110 | 20 | 20 | n | |||||||||||

| Usan Future Phases | 50 | – | 30 | l | |||||||||||

Norway |

Aasgard Subsea Compression | 40 | 415 | 14 | l | ||||||||||

Romania |

Domino | – | 630 | 50 | n | ||||||||||

Russia |

Sakhalin-1 Future Phases | 30 | 800 | 30 | n | ||||||||||

Tanzania |

Tanzania Block 2 | – | TBD | 35 | l | ||||||||||

United Arab |

Upper Zakum 750 | 750 | – | 28 | ▲ | ||||||||||

Emirates |

|||||||||||||||

U.S. |

Alaska Gas | 60 | 3500 | 36 | ** | ||||||||||

| Hadrian North | 100 | 100 | 50 | n | |||||||||||

| Julia Phase 1 | 30 | – | 50 | n | |||||||||||

| (1) | The term “project” as used in this publication does not necessarily have the same meaning as

under SEC Rule 13q-1 relating to government payment reporting.

For example, a single project for purposes of the rule may encompass numerous properties,

agreements, investments, developments, phases, work efforts, activities

and components, each of which we may also informally describe herein as a “project.” |

| 28 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| More than 22,000 personnel across 14 countries have been trained in our new Work Management System. |

| 30 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Americas Highlights | 2012 | 2011 | 2010 | |||||||||

Earnings (billions of dollars) |

5.5 | 7.8 | 5.9 | |||||||||

Proved Reserves (BOEB) |

11.8 | 10.8 | 9.8 | |||||||||

Acreage (gross acres, million) |

47.0 | 50.2 | 51.4 | |||||||||

Net Liquids Production (MBD) |

0.7 | 0.7 | 0.7 | |||||||||

Net Gas Available for Sale (BCFD) |

4.2 | 4.3 | 3.2 | |||||||||

|

| 31 |

| 32 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Field testing of our proprietary Controlled Freeze Zone technology is achieving stable operations across a wide range of gas compositions. |

| 33 |

|

The Hibernia Southern Extension project, offshore Newfoundland, will recover approximately 170

million gross oil-equivalent barrels via a subsea tie-back to the existing Hibernia platform (below). |

| 34 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Production started in August 2012 at the Horn River project in British Columbia. |

| 35 |

| In 2012, we continued our Argentina exploration drilling program in the highly prospective Neuquen Basin. |

| 36 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Europe Highlights | 2012 | 2011 | 2010 | |||||||||

Earnings (billions of dollars) |

4.0 | 7.1 | 3.8 | |||||||||

Proved Reserves (BOEB) |

2.5 | 2.7 | 2.9 | |||||||||

Acreage (gross acres, million) |

43.7 | 44.1 | 43.1 | |||||||||

Net Liquids Production (MBD) |

0.2 | 0.3 | 0.3 | |||||||||

Net Gas Available for Sale (BCFD) |

3.2 | 3.4 | 3.8 | |||||||||

|

| 37 |

| The South Hook LNG terminal in the United Kingdom is a key asset in our global LNG portfolio. |

| 38 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| In 2012, ExxonMobil announced the Domino gas discovery offshore Romania, and was awarded 1.65 million net acres offshore Ukraine. |

| 39 |

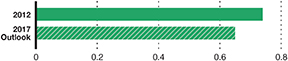

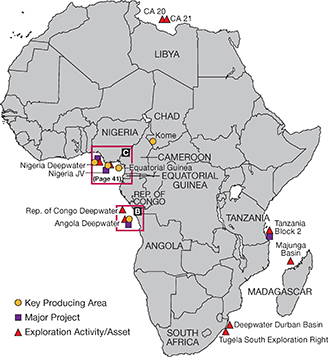

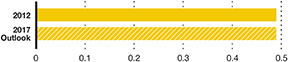

| Africa Highlights | 2012 | 2011 | 2010 | |||||||||

Earnings

(billions of dollars) |

7.2 | 5.4 | 4.4 | |||||||||

Proved

Reserves (BOEB) |

1.7 | 1.8 | 2.0 | |||||||||

Acreage

(gross acres, million) |

14.1 | 15.1 | 16.5 | |||||||||

Net Liquids

Production (MBD) |

0.5 | 0.5 | 0.6 | |||||||||

Net Gas

Available for Sale (BCFD) |

– | – | – | |||||||||

| 40 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

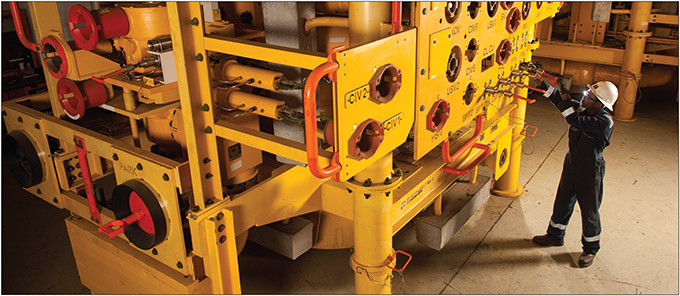

| A subsea control module is inspected as part of the Kizomba Satellites Phase 1 project. The project started up in 2012. |

| 41 |

| The Itut platform (left) was installed in 2012 as part of the Nigeria Satellite Field Development Phase 1 project. The project consists of three new offshore platforms that are the first offshore structures to be designed, procured, and constructed in Nigeria. |

| 42 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| The ocean rig Poseidon drillship works with support vessels offshore Tanzania where three deepwater discoveries were made in 2012. |

| 43 |

| Asia Highlights | 2012 | 2011 | 2010 | |||||||||

Earnings

(billions of dollars) |

12.7 | 13.4 | 9.4 | |||||||||

Proved

Reserves (BOEB) |

7.7 | 8.1 | 8.6 | |||||||||

Acreage

(gross acres, million) |

31.5 | 31.0 | 31.4 | |||||||||

Net Liquids

Production (MBD) |

0.8 | 0.8 | 0.7 | |||||||||

Net Gas

Available for Sale (BCFD) |

4.5 | 5.0 | 4.8 | |||||||||

| 44 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| The Barzan project, Qatar, will supply up to 1.4 billion cubic feet of gas per day. |

| An innovative artificial island approach is being applied to efficiently gain access to new reserves at the Upper Zakum field in the United Arab Emirates. |

| 45 |

| The Yastreb rig, Sakhalin Island, Russia, is one of the most powerful land rigs in the industry. In 2012, the rig drilled the world-record 7.7-mile-long horizontal well. |

| 46 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| The Kashagan project facilities offshore Caspian Sea are approaching completion. First oil is anticipated in 2013. |

| 47 |

| The Telok project offshore Malaysia will provide approximately 430 million cubic feet per day of gas capacity. |

| 48 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| The Marlin B production platform (far right) was installed in 2012 as part of the Turrum field development in the Bass Strait of Australia. Scheduled for a 2014 start-up, the Turrum development is expected to recover more than 270 million oil-equivalent barrels. |

| Australia/Oceania Highlights | 2012 | 2011 | 2010 | |||||||||

Earnings

(billions of dollars) |

0.5 | 0.8 | 0.6 | |||||||||

Proved

Reserves (BOEB) |

1.5 | 1.5 | 1.5 | |||||||||

Acreage

(gross acres, million) |

9.5 | 7.8 | 7.1 | |||||||||

Net Liquids

Production (MBD) |

0.1 | 0.1 | 0.1 | |||||||||

Net Gas

Available for Sale (BCFD) |

0.4 | 0.3 | 0.3 | |||||||||

| 49 |

| The PNG LNG project is scheduled to start up in 2014, delivering 6.9 million tonnes per annum. |

| 50 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| (thousands of barrels per day) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

United States |

||||||||||||||||||||

Alaska |

110 | 114 | 117 | 123 | 130 | |||||||||||||||

Lower 48 |

308 | 309 | 291 | 261 | 237 | |||||||||||||||

Total United States |

418 | 423 | 408 | 384 | 367 | |||||||||||||||

Canada/South America |

251 | 252 | 263 | 267 | 292 | |||||||||||||||

Total Americas |

669 | 675 | 671 | 651 | 659 | |||||||||||||||

Europe |

||||||||||||||||||||

United Kingdom |

20 | 55 | 80 | 90 | 123 | |||||||||||||||

Norway |

177 | 205 | 246 | 280 | 295 | |||||||||||||||

Other |

10 | 10 | 9 | 9 | 10 | |||||||||||||||

Total Europe |

207 | 270 | 335 | 379 | 428 | |||||||||||||||

Africa |

||||||||||||||||||||

Nigeria |

293 | 324 | 391 | 391 | 364 | |||||||||||||||

Angola |

120 | 99 | 141 | 194 | 181 | |||||||||||||||

Equatorial Guinea |

38 | 45 | 53 | 55 | 60 | |||||||||||||||

Other |

36 | 40 | 43 | 45 | 47 | |||||||||||||||

Total Africa |

487 | 508 | 628 | 685 | 652 | |||||||||||||||

Asia |

||||||||||||||||||||

Malaysia |

40 | 38 | 48 | 52 | 56 | |||||||||||||||

Middle East |

548 | 567 | 478 | 368 | 381 | |||||||||||||||

Russia/Caspian |

179 | 191 | 191 | 182 | 160 | |||||||||||||||

Other |

5 | 12 | 13 | 5 | 2 | |||||||||||||||

Total Asia |

772 | 808 | 730 | 607 | 599 | |||||||||||||||

Australia/Oceania |

50 | 51 | 58 | 65 | 67 | |||||||||||||||

Total worldwide |

2,185 | 2,312 | 2,422 | 2,387 | 2,405 | |||||||||||||||

Gas Plant Liquids Included Above |

||||||||||||||||||||

United States |

83 | 78 | 59 | 50 | 49 | |||||||||||||||

Non-U.S. |

184 | 213 | 207 | 173 | 164 | |||||||||||||||

Total worldwide |

267 | 291 | 266 | 223 | 213 | |||||||||||||||

| Oil Sands and Non-Consolidated Volumes Included Above | ||||||||||||||||||||

United States |

63 | 66 | 69 | 73 | 78 | |||||||||||||||

Canada/South America – Bitumen |

123 | 120 | 115 | 120 | 124 | |||||||||||||||

Canada/South America – Synthetic Oil |

69 | 67 | 67 | 65 | 62 | |||||||||||||||

Europe |

4 | 5 | 5 | 5 | 5 | |||||||||||||||

Asia |

410 | 425 | 404 | 320 | 280 | |||||||||||||||

Total worldwide |

669 | 683 | 660 | 583 | 549 | |||||||||||||||

| (1) | Net liquids production quantities are the volumes of crude oil and natural gas liquids withdrawn from ExxonMobil’s oil and gas reserves, excluding royalties and quantities due to others when produced, and are based on the volumes delivered from the lease or at the point measured for royalty and/or severance tax purposes. Volumes include 100 percent of the production of majority-owned affiliates, including liquids production from oil sands operations in Canada, and ExxonMobil’s ownership of the production by companies owned 50 percent or less. |

| 51 |

| (millions of cubic feet per day) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

United States |

3,822 | 3,917 | 2,596 | 1,275 | 1,246 | |||||||||||||||

Canada/South America |

362 | 412 | 569 | 643 | 640 | |||||||||||||||

Total Americas |

4,184 | 4,329 | 3,165 | 1,918 | 1,886 | |||||||||||||||

Europe |

||||||||||||||||||||

Netherlands |

1,841 | 1,826 | 2,041 | 1,676 | 1,748 | |||||||||||||||

United Kingdom |

306 | 441 | 550 | 594 | 750 | |||||||||||||||

Norway |

605 | 663 | 700 | 786 | 764 | |||||||||||||||

Germany |

468 | 518 | 545 | 633 | 687 | |||||||||||||||

Total Europe |

3,220 | 3,448 | 3,836 | 3,689 | 3,949 | |||||||||||||||

Africa |

17 | 7 | 14 | 19 | 32 | |||||||||||||||

Asia |

||||||||||||||||||||

Indonesia |

131 | 164 | 215 | 245 | 239 | |||||||||||||||

Malaysia |

376 | 420 | 513 | 545 | 582 | |||||||||||||||

Middle East |

3,835 | 4,261 | 3,865 | 2,367 | 1,911 | |||||||||||||||

Russia/Caspian |

177 | 184 | 187 | 153 | 114 | |||||||||||||||

Other |

19 | 18 | 21 | 22 | 24 | |||||||||||||||

Total Asia |

4,538 | 5,047 | 4,801 | 3,332 | 2,870 | |||||||||||||||

Australia/Oceania |

363 | 331 | 332 | 315 | 358 | |||||||||||||||

Total worldwide |

12,322 | 13,162 | 12,148 | 9,273 | 9,095 | |||||||||||||||

| Non-Consolidated Natural Gas Volumes Included Above | ||||||||||||||||||||

United States |

3 | – | 1 | 1 | 1 | |||||||||||||||

Europe |

1,774 | 1,747 | 1,977 | 1,618 | 1,696 | |||||||||||||||

Asia |

3,093 | 3,168 | 2,954 | 1,918 | 1,433 | |||||||||||||||

Total worldwide |

4,870 | 4,915 | 4,932 | 3,537 | 3,130 | |||||||||||||||

| (millions of cubic feet per day) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

United States |

4,816 | 5,002 | 3,166 | 1,321 | 1,292 | |||||||||||||||

Canada/South America |

407 | 517 | 696 | 739 | 845 | |||||||||||||||

Europe |

5,727 | 6,254 | 6,401 | 5,854 | 5,665 | |||||||||||||||

Africa |

17 | 7 | 14 | 19 | 32 | |||||||||||||||

Asia |

3,865 | 4,289 | 4,102 | 2,760 | 2,612 | |||||||||||||||

Australia/Oceania |

370 | 338 | 339 | 322 | 366 | |||||||||||||||

Total worldwide |

15,202 | 16,407 | 14,718 | 11,015 | 10,812 | |||||||||||||||

| (1) | Net natural gas available for sale quantities are the volumes withdrawn from ExxonMobil’s natural gas reserves, excluding royalties and volumes due to others when produced, and excluding gas purchased from others, gas consumed in producing operations, field processing plant losses, volumes used for gas lift, gas injection and cycling operations, quantities flared, and volume shrinkage due to the removal of condensate or natural gas liquids fractions. | |

| (2) | Natural gas sales include 100 percent of the sales of ExxonMobil and majority-owned affiliates and ExxonMobil’s ownership of sales by companies owned 50 percent or less. Numbers include sales of gas purchased from third parties. |

| 52 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| (net wells drilled) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

Productive |

||||||||||||||||||||

Exploratory(2) |

16 | 25 | 37 | 20 | 19 | |||||||||||||||

Development |

1,310 | 1,554 | 1,200 | 829 | 731 | |||||||||||||||

Total |

1,326 | 1,579 | 1,237 | 849 | 750 | |||||||||||||||

Dry |

||||||||||||||||||||

Exploratory(2) |

8 | 11 | 7 | 9 | 9 | |||||||||||||||

Development |

8 | 16 | 5 | 5 | 4 | |||||||||||||||

Total |

16 | 27 | 12 | 14 | 13 | |||||||||||||||

Net Wells Drilled |

||||||||||||||||||||

Exploratory(2) |

24 | 36 | 44 | 29 | 28 | |||||||||||||||

Development |

1,318 | 1,570 | 1,205 | 834 | 735 | |||||||||||||||

Total |

1,342 | 1,606 | 1,249 | 863 | 763 | |||||||||||||||

| (thousands of net acres) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

Undeveloped |

||||||||||||||||||||

United States |

5,185 | 5,326 | 4,914 | 5,111 | 5,691 | |||||||||||||||

Canada/South America |

8,700 | 9,877 | 11,977 | 17,107 | 19,953 | |||||||||||||||

Europe |

16,123 | 16,107 | 16,118 | 13,470 | 7,913 | |||||||||||||||

Africa |

7,707 | 8,100 | 8,612 | 10,555 | 26,439 | |||||||||||||||

Asia |

20,244 | 19,919 | 19,086 | 20,457 | 6,824 | |||||||||||||||

Australia/Oceania |

1,991 | 1,476 | 1,352 | 5,216 | 5,738 | |||||||||||||||

Total worldwide |

59,950 | 60,805 | 62,059 | 71,916 | 72,558 | |||||||||||||||

Developed |

||||||||||||||||||||

United States |

10,366 | 10,311 | 9,919 | 5,120 | 5,148 | |||||||||||||||

Canada/South America |

1,940 | 1,959 | 2,439 | 2,460 | 2,488 | |||||||||||||||

Europe |

2,872 | 2,868 | 2,986 | 3,806 | 4,026 | |||||||||||||||

Africa |

780 | 700 | 684 | 758 | 756 | |||||||||||||||

Asia |

1,165 | 1,230 | 1,271 | 1,160 | 1,048 | |||||||||||||||

Australia/Oceania |

719 | 719 | 719 | 719 | 719 | |||||||||||||||

Total worldwide |

17,842 | 17,787 | 18,018 | 14,023 | 14,185 | |||||||||||||||

| (millions of dollars) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

United States |

80,135 | 76,363 | 70,011 | 20,363 | 18,542 | |||||||||||||||

Canada/South America |

28,683 | 21,721 | 18,089 | 13,408 | 9,967 | |||||||||||||||

Europe |

13,042 | 11,399 | 12,845 | 14,357 | 11,477 | |||||||||||||||

Africa |

23,010 | 24,790 | 22,563 | 20,917 | 17,797 | |||||||||||||||

Asia |

26,852 | 25,594 | 23,765 | 21,859 | 19,191 | |||||||||||||||

Australia/Oceania |

9,230 | 6,864 | 5,284 | 3,725 | 2,407 | |||||||||||||||

Total worldwide |

180,952 | 166,731 | 152,557 | 94,629 | 79,381 | |||||||||||||||

| (1) | A regional breakout of this data is included on pages 11 and 12 of ExxonMobil’s 2012 Form 10-K. | |

| (2) | These include near-field and appraisal wells classified as exploratory for SEC reporting. | |

| (3) | Includes non-consolidated interests and Canadian oil sands operations. |

| 53 |

| Property | ||||||||||||||||

| Acquisition | Exploration | Development | Total | |||||||||||||

| (millions of dollars) | Costs | Costs | Costs | Costs | ||||||||||||

During 2012 |

||||||||||||||||

United States |

1,923 | 646 | 7,676 | 10,245 | ||||||||||||

Canada/South America |

76 | 405 | 7,601 | 8,082 | ||||||||||||

Europe |

119 | 488 | 2,793 | 3,400 | ||||||||||||

Africa |

15 | 520 | 3,081 | 3,616 | ||||||||||||

Asia |

43 | 554 | 3,998 | 4,595 | ||||||||||||

Australia/Oceania |

31 | 248 | 2,333 | 2,612 | ||||||||||||

Total worldwide |

2,207 | 2,861 | 27,482 | 32,550 | ||||||||||||

During 2011 |

||||||||||||||||

United States |

2,967 | 484 | 8,505 | 11,956 | ||||||||||||

Canada/South America |

178 | 372 | 5,478 | 6,028 | ||||||||||||

Europe |

– | 672 | 2,063 | 2,735 | ||||||||||||

Africa |

– | 303 | 4,316 | 4,619 | ||||||||||||

Asia |

642 | 518 | 3,618 | 4,778 | ||||||||||||

Australia/Oceania |

– | 154 | 1,710 | 1,864 | ||||||||||||

Total worldwide |

3,787 | 2,503 | 25,690 | 31,980 | ||||||||||||

During 2010 |

||||||||||||||||

United States |

45,143 | 694 | 8,270 | 54,107 | ||||||||||||

Canada/South America |

136 | 527 | 4,757 | 5,420 | ||||||||||||

Europe |

64 | 606 | 1,452 | 2,122 | ||||||||||||

Africa |

3 | 453 | 4,390 | 4,846 | ||||||||||||

Asia |

115 | 547 | 3,195 | 3,857 | ||||||||||||

Australia/Oceania |

– | 228 | 1,146 | 1,374 | ||||||||||||

Total worldwide |

45,461 | 3,055 | 23,210 | 71,726 | ||||||||||||

During 2009 |

||||||||||||||||

United States |

205 | 549 | 2,787 | 3,541 | ||||||||||||

Canada/South America |

353 | 498 | 2,394 | 3,245 | ||||||||||||

Europe |

1 | 525 | 3,639 | 4,165 | ||||||||||||

Africa |

605 | 880 | 4,596 | 6,081 | ||||||||||||

Asia |

121 | 529 | 2,946 | 3,596 | ||||||||||||

Australia/Oceania |

– | 130 | 768 | 898 | ||||||||||||

Total worldwide |

1,285 | 3,111 | 17,130 | 21,526 | ||||||||||||

During 2008 |

||||||||||||||||

United States |

281 | 453 | 2,739 | 3,473 | ||||||||||||

Canada/South America |

126 | 325 | 1,421 | 1,872 | ||||||||||||

Europe |

25 | 401 | 1,863 | 2,289 | ||||||||||||

Africa |

82 | 686 | 4,783 | 5,551 | ||||||||||||

Asia |

73 | 307 | 3,384 | 3,764 | ||||||||||||

Australia/Oceania |

76 | 100 | 443 | 619 | ||||||||||||

Total worldwide |

663 | 2,272 | 14,633 | 17,568 | ||||||||||||

| (1) | Includes non-consolidated interests and Canadian oil sands operations. |

| 54 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Liquids, Including Oil Sands and Non-Consolidated Reserves (millions of barrels at year end) | ||||||||||||||||||||

Net proved developed and undeveloped reserves |

||||||||||||||||||||

United States |

2,758 | 2,372 | 2,303 | 1,972 | 1,971 | |||||||||||||||

Canada/South America |

4,446 | 3,894 | 2,946 | 2,918 | 2,683 | |||||||||||||||

Europe |

373 | 405 | 454 | 517 | 560 | |||||||||||||||

Africa |

1,501 | 1,675 | 1,799 | 1,907 | 2,137 | |||||||||||||||

Asia |

3,488 | 3,620 | 3,896 | 4,049 | 4,424 | |||||||||||||||

Australia/Oceania |

250 | 262 | 275 | 288 | 231 | |||||||||||||||

Total worldwide |

12,816 | 12,228 | 11,673 | 11,651 | 12,006 | |||||||||||||||

Proportional interest in oil sands and non-consolidated reserves included above |

||||||||||||||||||||

United States |

348 | 353 | 351 | 356 | 327 | |||||||||||||||

Canada/South America (bitumen)(2) |

3,560 | 3,106 | 2,102 | 2,055 | 1,767 | |||||||||||||||

Canada/South America (synthetic oil)(2) |

599 | 653 | 681 | 691 | 734 | |||||||||||||||

Europe |

28 | 29 | 31 | 30 | 27 | |||||||||||||||

Asia |

1,726 | 1,733 | 1,873 | 2,050 | 2,205 | |||||||||||||||

Net proved developed reserves included above |

||||||||||||||||||||

United States |

1,753 | 1,722 | 1,749 | 1,490 | 1,521 | |||||||||||||||

Canada/South America |

1,266 | 1,281 | 1,333 | 1,311 | 1,315 | |||||||||||||||

Europe |

296 | 330 | 382 | 386 | 419 | |||||||||||||||

Africa |

1,004 | 1,050 | 1,055 | 1,122 | 1,284 | |||||||||||||||

Asia |

2,503 | 2,617 | 2,929 | 2,876 | 2,514 | |||||||||||||||

Australia/Oceania |

116 | 126 | 139 | 153 | 165 | |||||||||||||||

Total worldwide |

6,938 | 7,126 | 7,587 | 7,338 | 7,218 | |||||||||||||||

| Natural Gas, Including Non-Consolidated Reserves (billions of cubic feet at year end) | ||||||||||||||||||||

Net proved developed and undeveloped reserves |

||||||||||||||||||||

United States |

26,370 | 26,366 | 26,111 | 11,802 | 11,890 | |||||||||||||||

Canada/South America |

925 | 835 | 1,258 | 1,368 | 1,383 | |||||||||||||||

Europe |

12,784 | 13,755 | 14,788 | 16,173 | 17,284 | |||||||||||||||

Africa |

929 | 982 | 908 | 920 | 918 | |||||||||||||||

Asia |

25,515 | 27,037 | 28,399 | 30,304 | 32,383 | |||||||||||||||

Australia/Oceania |

7,568 | 7,247 | 7,351 | 7,440 | 2,021 | |||||||||||||||

Total worldwide |

74,091 | 76,222 | 78,815 | 68,007 | 65,879 | |||||||||||||||

Proportional interest in non-consolidated reserves

included above |

||||||||||||||||||||

United States |

155 | 112 | 117 | 114 | 112 | |||||||||||||||

Europe |

9,535 | 10,169 | 10,746 | 11,450 | 11,839 | |||||||||||||||

Asia |

19,670 | 20,566 | 21,139 | 22,001 | 22,526 | |||||||||||||||

Net proved developed reserves included above |

||||||||||||||||||||

United States |

14,597 | 15,533 | 15,441 | 7,582 | 7,931 | |||||||||||||||

Canada/South America |

670 | 658 | 1,077 | 1,200 | 1,148 | |||||||||||||||

Europe |

9,583 | 10,629 | 11,683 | 12,782 | 13,710 | |||||||||||||||

Africa |

814 | 853 | 711 | 739 | 738 | |||||||||||||||

Asia |

23,581 | 25,067 | 27,087 | 25,206 | 17,876 | |||||||||||||||

Australia/Oceania |

1,012 | 1,070 | 1,174 | 1,262 | 1,346 | |||||||||||||||

Total worldwide |

50,257 | 53,810 | 57,173 | 48,771 | 42,749 | |||||||||||||||

| (1) | ExxonMobil reserves using SEC historical price bases. Proved reserves as defined by the SEC are based on historical market prices: prior to 2009, the SEC defined price as the market price on December 31; beginning in 2009, the SEC changed the definition to the average of the market prices on the first day of each calendar month during the year. Mining and equity company reserves are included for all periods. See Frequently Used Terms on pages 93 through 95. | |

| (2) | Proved reserves classified as bitumen are associated with the Cold Lake and Kearl projects in Canada. Proved reserves classified as synthetic oil are associated with the Syncrude project in Canada. Cold Lake uses in situ methods, and hydrocarbons are produced from wells drilled into the subsurface. Syncrude is an oil sands mining project which includes an upgrader that converts the mined hydrocarbons into a higher gravity crude oil. Kearl is an oil sands mining project that does not incorporate an upgrader. |

| 55 |

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Oil Equivalent, Including Oil Sands and Non-Consolidated Reserves (millions of barrels at year end) | ||||||||||||||||||||

| Net proved developed and undeveloped reserves | ||||||||||||||||||||

United States |

7,153 | 6,766 | 6,654 | 3,939 | 3,953 | |||||||||||||||

Canada/South America |

4,600 | 4,033 | 3,155 | 3,146 | 2,914 | |||||||||||||||

Europe |

2,504 | 2,698 | 2,919 | 3,212 | 3,441 | |||||||||||||||

Africa |

1,656 | 1,839 | 1,951 | 2,060 | 2,290 | |||||||||||||||

Asia |

7,740 | 8,126 | 8,630 | 9,100 | 9,820 | |||||||||||||||

Australia/Oceania |

1,511 | 1,470 | 1,500 | 1,528 | 568 | |||||||||||||||

Total worldwide |

25,164 | 24,932 | 24,809 | 22,985 | 22,986 | |||||||||||||||

| (million barrels of oil or billion cubic feet of gas | Average | |||||||||||||||||||||||

| unless specified otherwise) | 2012 | 2011 | 2010 | 2009 | 2008 | 2008-2012 | ||||||||||||||||||

| Liquids (millions of barrels) | ||||||||||||||||||||||||

Revisions |

471 | 270 | 358 | 361 | 583 | 409 | ||||||||||||||||||

Improved recovery |

23 | – | 5 | 15 | 6 | 10 | ||||||||||||||||||

Extensions/discoveries |

760 | 1,166 | 185 | 142 | 1,308 | 712 | ||||||||||||||||||

Purchases |

219 | 16 | 378 | – | – | 123 | ||||||||||||||||||

Sales |

(86 | ) | (54 | ) | (21 | ) | (3 | ) | (86 | ) | (50 | ) | ||||||||||||

Total additions |

1,387 | 1,398 | 905 | 515 | 1,811 | 1,204 | ||||||||||||||||||

Production |

799 | 843 | 883 | 870 | 879 | 855 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

184 | 172 | 105 | 60 | 216 | 147 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

174 | 166 | 102 | 59 | 206 | 141 | ||||||||||||||||||

Natural Gas (billions of cubic feet) |

||||||||||||||||||||||||

Revisions |

(1,873 | ) | 64 | 879 | 135 | 643 | (30 | ) | ||||||||||||||||

Improved recovery |

– | – | – | – | 1 | – | ||||||||||||||||||

Extensions/discoveries |

4,383 | 2,682 | 1,988 | 5,694 | 692 | 3,087 | ||||||||||||||||||

Purchases |

509 | 303 | 12,789 | 8 | – | 2,722 | ||||||||||||||||||

Sales |

(353 | ) | (523 | ) | (106 | ) | (13 | ) | (82 | ) | (215 | ) | ||||||||||||

Total additions |

2,666 | 2,526 | 15,550 | 5,824 | 1,254 | 5,564 | ||||||||||||||||||

Production |

4,797 | 5,119 | 4,742 | 3,696 | 3,637 | 4,398 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

63 | 60 | 330 | 158 | 37 | 131 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

56 | 49 | 328 | 158 | 34 | 127 | ||||||||||||||||||

Oil Equivalent (millions of barrels) |

||||||||||||||||||||||||

Revisions |

159 | 281 | 505 | 383 | 690 | 404 | ||||||||||||||||||

Improved recovery |

23 | – | 5 | 15 | 7 | 10 | ||||||||||||||||||

Extensions/discoveries |

1,490 | 1,613 | 516 | 1,091 | 1,423 | 1,227 | ||||||||||||||||||

Purchases |

304 | 67 | 2,510 | 1 | – | 576 | ||||||||||||||||||

Sales |

(145 | ) | (141 | ) | (38 | ) | (5 | ) | (100 | ) | (86 | ) | ||||||||||||

Total additions |

1,831 | 1,820 | 3,498 | 1,485 | 2,020 | 2,131 | ||||||||||||||||||

Production |

1,599 | 1,697 | 1,674 | 1,486 | 1,485 | 1,588 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

124 | 116 | 211 | 100 | 143 | 140 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

115 | 107 | 209 | 100 | 136 | 134 | ||||||||||||||||||

| (1) | ExxonMobil reserves using SEC historical price bases. Proved reserves as defined by the SEC are based on historical market prices: prior to 2009, the SEC defined price as the market price on December 31; beginning in 2009, the SEC changed the definition to the average of the market prices on the first day of each calendar month during the year. Mining and equity company reserves are included for all periods. See Frequently Used Terms on pages 93 through 95. |

| 56 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Crude Oil and Natural Gas Liquids | Bitumen | Synthetic Oil | ||||||||||||||||||||||||||||||||||||||

| Canada/ | Canada/ | Canada/ | ||||||||||||||||||||||||||||||||||||||

| (million barrels of oil or billion cubic feet of gas | United | South | Australia/ | South | South | Liquids | ||||||||||||||||||||||||||||||||||

| unless noted) | States | America | Europe | Africa | Asia | Oceania | Total | America | America | Total | ||||||||||||||||||||||||||||||

| Liquids (millions of barrels) | ||||||||||||||||||||||||||||||||||||||||

Revisions |

5 | 38 | 25 | 21 | 140 | 6 | 235 | 265 | (29 | ) | 471 | |||||||||||||||||||||||||||||

Improved recovery |

22 | – | – | – | 1 | – | 23 | – | – | 23 | ||||||||||||||||||||||||||||||

Extensions/discoveries |

330 | 138 | 8 | 41 | 9 | – | 526 | 234 | – | 760 | ||||||||||||||||||||||||||||||

Purchases |

199 | – | 20 | – | – | – | 219 | – | – | 219 | ||||||||||||||||||||||||||||||

Sales |

(18 | ) | (2 | ) | (8 | ) | (58 | ) | – | – | (86 | ) | – | – | (86 | ) | ||||||||||||||||||||||||

Total additions |

538 | 174 | 45 | 4 | 150 | 6 | 917 | 499 | (29 | ) | 1,387 | |||||||||||||||||||||||||||||

Production |

152 | 22 | 77 | 178 | 282 | 18 | 729 | 45 | 25 | 799 | ||||||||||||||||||||||||||||||

Net change |

386 | 152 | (32 | ) | (174 | ) | (132 | ) | (12 | ) | 188 | 454 | (54 | ) | 588 | |||||||||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

366 | 800 | 69 | 35 | 53 | 33 | 138 | 1,109 | – | 184 | ||||||||||||||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

354 | 791 | 58 | 2 | 53 | 33 | 126 | 1,109 | – | 174 | ||||||||||||||||||||||||||||||

| Natural Gas (billions of cubic feet) | ||||||||||||||||||||||||||||||||||||||||

Revisions |

(2,839 | ) | 168 | 185 | 2 | 146 | 465 | (1,873 | ) | |||||||||||||||||||||||||||||||

Improved recovery |

– | – | – | – | – | – | – | |||||||||||||||||||||||||||||||||

Extensions/discoveries |

4,045 | 95 | 184 | – | 59 | – | 4,383 | |||||||||||||||||||||||||||||||||

Purchases |

503 | – | 6 | – | – | – | 509 | |||||||||||||||||||||||||||||||||

Sales |

(181 | ) | (20 | ) | (140 | ) | (12 | ) | – | – | (353 | ) | ||||||||||||||||||||||||||||

Total additions |

1,528 | 243 | 235 | (10 | ) | 205 | 465 | 2,666 | ||||||||||||||||||||||||||||||||

Production |

1,524 | 153 | 1,206 | 43 | 1,727 | 144 | 4,797 | |||||||||||||||||||||||||||||||||

Net change |

4 | 90 | (971 | ) | (53 | ) | (1,522 | ) | 321 | (2,131 | ) | |||||||||||||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

112 | 172 | 31 | 5 | 12 | 323 | 63 | |||||||||||||||||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

100 | 159 | 19 | – | 12 | 323 | 56 | |||||||||||||||||||||||||||||||||

| (1) | See Frequently Used Terms on pages 93 through 95. |

| 57 |

| (million barrels of oil or billion cubic feet of gas | Average | |||||||||||||||||||||||

| unless noted) | 2012 | 2011 | 2010 | 2009 | 2008 | 2008-2012 | ||||||||||||||||||

Non-U.S. |

||||||||||||||||||||||||

E&P costs (millions of dollars) |

22,305 | 20,024 | 17,619 | 17,985 | 14,095 | 18,406 | ||||||||||||||||||

Liquids reserves additions |

849 | 1,175 | 426 | 375 | 1,933 | 952 | ||||||||||||||||||

Liquids production |

647 | 689 | 735 | 731 | 747 | 710 | ||||||||||||||||||

Gas reserves additions |

1,138 | 712 | 179 | 5,340 | 2,099 | 1,894 | ||||||||||||||||||

Gas production |

3,273 | 3,560 | 3,680 | 3,124 | 3,075 | 3,342 | ||||||||||||||||||

Oil-equivalent reserves additions, excluding sales |

1,135 | 1,425 | 459 | 1,266 | 2,377 | 1,333 | ||||||||||||||||||

Oil-equivalent reserves additions,

including sales |

1,038 | 1,295 | 456 | 1,264 | 2,283 | 1,267 | ||||||||||||||||||

Oil-equivalent production |

1,193 | 1,283 | 1,348 | 1,252 | 1,259 | 1,267 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

95 | 111 | 34 | 101 | 189 | 105 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

87 | 101 | 34 | 101 | 181 | 100 | ||||||||||||||||||

Reserves replacement

costs(2) (dollars per barrel) |

19.65 | 14.05 | 38.39 | 14.21 | 5.93 | 13.81 | ||||||||||||||||||

United States |

||||||||||||||||||||||||

E&P costs (millions of dollars) |

10,245 | 11,956 | 54,107 | 3,541 | 3,473 | 16,664 | ||||||||||||||||||

Liquids reserves additions |

538 | 223 | 479 | 140 | (122 | ) | 252 | |||||||||||||||||

Liquids production |

152 | 154 | 148 | 139 | 132 | 145 | ||||||||||||||||||

Gas reserves additions |

1,528 | 1,814 | 15,371 | 484 | (845 | ) | 3,670 | |||||||||||||||||

Gas production |

1,524 | 1,559 | 1,062 | 572 | 562 | 1,056 | ||||||||||||||||||

Oil-equivalent reserves additions,

excluding sales |

841 | 536 | 3,077 | 224 | (257 | ) | 884 | |||||||||||||||||

Oil-equivalent reserves additions,

including sales |

793 | 525 | 3,041 | 221 | (263 | ) | 864 | |||||||||||||||||

Oil-equivalent production |

406 | 414 | 325 | 234 | 226 | 321 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

207 | 129 | 947 | 96 | – | 275 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

195 | 127 | 936 | 94 | – | 269 | ||||||||||||||||||

Reserves replacement

costs(2) (dollars per barrel) |

12.18 | 22.31 | 17.58 | 15.81 | – | 18.85 | ||||||||||||||||||

Worldwide |

||||||||||||||||||||||||

E&P costs (millions of dollars) |

32,550 | 31,980 | 71,726 | 21,526 | 17,568 | 35,070 | ||||||||||||||||||

Liquids reserves additions |

1,387 | 1,398 | 905 | 515 | 1,811 | 1,204 | ||||||||||||||||||

Liquids production |

799 | 843 | 883 | 870 | 879 | 855 | ||||||||||||||||||

Gas reserves additions |

2,666 | 2,526 | 15,550 | 5,824 | 1,254 | 5,564 | ||||||||||||||||||

Gas production |

4,797 | 5,119 | 4,742 | 3,696 | 3,637 | 4,398 | ||||||||||||||||||

Oil-equivalent reserves additions,

excluding sales |

1,976 | 1,961 | 3,536 | 1,490 | 2,120 | 2,217 | ||||||||||||||||||

Oil-equivalent reserves additions,

including sales |

1,831 | 1,820 | 3,497 | 1,485 | 2,020 | 2,131 | ||||||||||||||||||

Oil-equivalent production |

1,599 | 1,697 | 1,673 | 1,486 | 1,485 | 1,588 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

124 | 116 | 211 | 100 | 143 | 140 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

115 | 107 | 209 | 100 | 136 | 134 | ||||||||||||||||||

Reserves replacement

costs(2) (dollars per barrel) |

16.47 | 16.31 | 20.28 | 14.45 | 8.29 | 15.82 | ||||||||||||||||||

| (1) | ExxonMobil reserves using SEC historical price bases. Proved reserves as defined by the SEC are based on historical market prices: prior to 2009, the SEC defined price as the market price on December 31; beginning in 2009, the SEC changed the definition to the average of the market prices on the first day of each calendar month during the year. Mining and equity company reserves are included for all periods. See Frequently Used Terms on pages 93 through 95. | |

| (2) | Calculation based on exploration and production costs divided by oil-equivalent reserves additions. All values exclude the impact of asset sales; i.e., reserves sold and proceeds received. |

| 58 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Total Revenues and Costs, Including Non-Consolidated Interests and Oil Sands | Revenues and Costs per Unit of Sales or Production(1) | |||||||||||||||||||||||||||||||||||||||||||

| Canada/ | Canada/ | |||||||||||||||||||||||||||||||||||||||||||

| United | South | Australia/ | United | South | Outside | |||||||||||||||||||||||||||||||||||||||

| States | America | Europe | Africa | Asia | Oceania | Total | States | America | Americas | Worldwide | ||||||||||||||||||||||||||||||||||

| 2012 | (millions of dollars) | (dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

13,362 | 6,997 | 7,652 | 20,560 | 28,798 | 1,624 | 78,993 | 87.43 | 75.90 | 104.66 | 98.10 | |||||||||||||||||||||||||||||||||

Natural gas |

3,003 | 264 | 10,996 | 17 | 12,689 | 583 | 27,552 | 2.15 | 1.98 | 8.15 | 6.11 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

16,365 | 7,261 | 18,648 | 20,577 | 41,487 | 2,207 | 106,545 | 42.39 | 63.54 | 78.89 | 68.68 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs

excluding taxes |

4,511 | 3,079 | 2,812 | 2,395 | 2,090 | 488 | 15,375 | 11.68 | 26.94 | 7.41 | 9.91 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

5,038 | 848 | 1,711 | 2,879 | 2,461 | 264 | 13,201 | 13.05 | 7.42 | 6.96 | 8.51 | |||||||||||||||||||||||||||||||||

Exploration expenses |

400 | 292 | 291 | 234 | 513 | 136 | 1,866 | 1.04 | 2.56 | 1.12 | 1.20 | |||||||||||||||||||||||||||||||||

Taxes other than income |

2,005 | 89 | 4,082 | 1,702 | 8,906 | 446 | 17,230 | 5.20 | 0.78 | 14.39 | 11.12 | |||||||||||||||||||||||||||||||||

Related income tax |

1,561 | 720 | 6,307 | 8,091 | 14,850 | 281 | 31,810 | 4.04 | 6.30 | 28.10 | 20.50 | |||||||||||||||||||||||||||||||||

Results of producing activities |

2,850 | 2,233 | 3,445 | 5,276 | 12,667 | 592 | 27,063 | 7.38 | 19.54 | 20.91 | 17.44 | |||||||||||||||||||||||||||||||||

Other earnings(2) |

1,084 | (703 | ) | 526 | 1,943 | (200 | ) | (59 | ) | 2,591 | 2.81 | (6.15 | ) | 2.11 | 1.68 | |||||||||||||||||||||||||||||

Total earnings, excluding

power and coal |

3,934 | 1,530 | 3,971 | 7,219 | 12,467 | 533 | 29,654 | 10.19 | 13.39 | 23.02 | 19.12 | |||||||||||||||||||||||||||||||||

Power and coal |

(9 | ) | – | – | – | 250 | – | 241 | ||||||||||||||||||||||||||||||||||||

Total earnings |

3,925 | 1,530 | 3,971 | 7,219 | 12,717 | 533 | 29,895 | |||||||||||||||||||||||||||||||||||||

| 2011 | (millions of dollars) | (dollars per unit of sales) |

||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

14,362 | 7,584 | 10,149 | 20,204 | 29,411 | 1,793 | 83,503 | 92.80 | 83.06 | 102.99 | 98.97 | |||||||||||||||||||||||||||||||||

Natural gas |

4,926 | 494 | 11,278 | 7 | 11,311 | 481 | 28,497 | 3.45 | 3.29 | 7.16 | 5.93 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

19,288 | 8,078 | 21,427 | 20,211 | 40,722 | 2,274 | 112,000 | 49.10 | 69.25 | 74.58 | 68.11 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs

excluding taxes |

4,589 | 2,751 | 3,037 | 2,608 | 2,050 | 497 | 15,532 | 11.68 | 23.58 | 7.22 | 9.45 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

4,815 | 980 | 2,088 | 2,159 | 2,256 | 236 | 12,534 | 12.26 | 8.40 | 5.94 | 7.62 | |||||||||||||||||||||||||||||||||

Exploration expenses |

278 | 290 | 612 | 233 | 618 | 73 | 2,104 | 0.71 | 2.49 | 1.35 | 1.28 | |||||||||||||||||||||||||||||||||

Taxes other than income |

2,193 | 79 | 3,626 | 2,055 | 8,337 | 295 | 16,585 | 5.58 | 0.68 | 12.61 | 10.08 | |||||||||||||||||||||||||||||||||

Related income tax |

2,445 | 969 | 7,689 | 7,888 | 14,062 | 353 | 33,406 | 6.22 | 8.31 | 26.43 | 20.32 | |||||||||||||||||||||||||||||||||

Results of producing activities |

4,968 | 3,009 | 4,375 | 5,268 | 13,399 | 820 | 31,839 | 12.65 | 25.79 | 21.03 | 19.36 | |||||||||||||||||||||||||||||||||

Other earnings(2) |

133 | (322 | ) | 2,729 | 88 | (259 | ) | (9 | ) | 2,360 | 0.33 | (2.76 | ) | 2.24 | 1.44 | |||||||||||||||||||||||||||||

Total earnings, excluding

power and coal |

5,101 | 2,687 | 7,104 | 5,356 | 13,140 | 811 | 34,199 | 12.98 | 23.03 | 23.27 | 20.80 | |||||||||||||||||||||||||||||||||

Power and coal |

(5 | ) | – | – | – | 245 | – | 240 | ||||||||||||||||||||||||||||||||||||

Total earnings |

5,096 | 2,687 | 7,104 | 5,356 | 13,385 | 811 | 34,439 | |||||||||||||||||||||||||||||||||||||

| (1) | The per-unit data are divided into two sections: (a) revenue per unit of sales from ExxonMobil’s own production; and, (b) operating costs and earnings per unit of net oil-equivalent production. Units for crude oil and natural gas liquids are barrels, while units for natural gas are thousands of cubic feet. The volumes of crude oil and natural gas liquids production and net natural gas production available for sale used in this calculation are shown on pages 50 and 51. The volumes of natural gas were converted to oil-equivalent barrels based on a conversion factor of 6 thousand cubic feet per barrel. | |

| (2) | Includes earnings related to transportation operations, LNG liquefaction and transportation operations, sale of third-party purchases, technical services agreements, other nonoperating activities, and adjustments for minority interests. |

| 59 |

| Total Revenues and Costs, Including Non-Consolidated Interests and Oil Sands | Revenues and Costs per Unit of Sales or Production(1) | |||||||||||||||||||||||||||||||||||||||||||

| Canada/ | Canada/ | |||||||||||||||||||||||||||||||||||||||||||

| United | South | Australia/ | United | South | Outside | |||||||||||||||||||||||||||||||||||||||

| States | America | Europe | Africa | Asia | Oceania | Total | States | America | Americas | Worldwide | ||||||||||||||||||||||||||||||||||

| 2010 | (millions of dollars) | (dollars per unit of sales) |

||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

10,567 | 6,343 | 8,935 | 17,511 | 19,118 | 1,418 | 63,892 | 70.98 | 66.27 | 74.67 | 73.12 | |||||||||||||||||||||||||||||||||

Natural gas |

3,716 | 707 | 9,358 | 11 | 7,990 | 401 | 22,183 | 3.92 | 3.41 | 5.42 | 5.00 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

14,283 | 7,050 | 18,293 | 17,522 | 27,108 | 1,819 | 86,075 | 46.53 | 54.18 | 54.59 | 53.04 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs

excluding taxes |

3,275 | 2,612 | 3,011 | 2,215 | 1,628 | 462 | 13,203 | 10.67 | 20.07 | 6.17 | 8.14 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

3,507 | 1,015 | 2,719 | 2,580 | 1,596 | 219 | 11,636 | 11.43 | 7.80 | 6.00 | 7.17 | |||||||||||||||||||||||||||||||||

Exploration expenses |

287 | 464 | 413 | 587 | 362 | 56 | 2,169 | 0.94 | 3.57 | 1.20 | 1.34 | |||||||||||||||||||||||||||||||||

Taxes other than income |

1,220 | 86 | 2,997 | 1,742 | 5,142 | 204 | 11,391 | 3.96 | 0.67 | 8.49 | 7.02 | |||||||||||||||||||||||||||||||||

Related income tax |

2,093 | 715 | 5,543 | 6,068 | 9,147 | 262 | 23,828 | 6.82 | 5.49 | 17.73 | 14.68 | |||||||||||||||||||||||||||||||||

Results of producing

activities |

3,901 | 2,158 | 3,610 | 4,330 | 9,233 | 616 | 23,848 | 12.71 | 16.58 | 15.00 | 14.69 | |||||||||||||||||||||||||||||||||

Other earnings(2) |

379 | (538 | ) | 216 | 96 | (120 | ) | (15 | ) | 18 | 1.23 | (4.13 | ) | 0.15 | 0.02 | |||||||||||||||||||||||||||||

Total earnings, excluding

power and coal |

4,280 | 1,620 | 3,826 | 4,426 | 9,113 | 601 | 23,866 | 13.94 | 12.45 | 15.15 | 14.71 | |||||||||||||||||||||||||||||||||

Power and coal |

(8 | ) | – | – | – | 239 | – | 231 | ||||||||||||||||||||||||||||||||||||

Total earnings |

4,272 | 1,620 | 3,826 | 4,426 | 9,352 | 601 | 24,097 | |||||||||||||||||||||||||||||||||||||

| 2009 | (millions of dollars) |

(dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

7,573 | 5,135 | 7,739 | 14,868 | 12,941 | 1,311 | 49,567 | 54.02 | 51.88 | 58.53 | 57.04 | |||||||||||||||||||||||||||||||||

Natural gas |

1,442 | 748 | 9,080 | 12 | 4,237 | 341 | 15,860 | 3.10 | 3.19 | 5.09 | 4.69 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

9,015 | 5,883 | 16,819 | 14,880 | 17,178 | 1,652 | 65,427 | 41.41 | 43.02 | 46.74 | 45.58 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs

excluding taxes |

2,736 | 2,428 | 2,923 | 2,027 | 1,498 | 386 | 11,998 | 12.57 | 17.75 | 6.32 | 8.36 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

1,833 | 948 | 2,246 | 2,293 | 1,182 | 195 | 8,697 | 8.42 | 6.93 | 5.47 | 6.06 | |||||||||||||||||||||||||||||||||

Exploration expenses |

220 | 339 | 387 | 662 | 393 | 33 | 2,034 | 1.01 | 2.48 | 1.36 | 1.42 | |||||||||||||||||||||||||||||||||

Taxes other than income |

767 | 78 | 2,826 | 1,343 | 3,111 | 252 | 8,377 | 3.52 | 0.57 | 6.97 | 5.83 | |||||||||||||||||||||||||||||||||

Related income tax |

1,127 | 597 | 5,179 | 4,667 | 5,943 | 237 | 17,750 | 5.18 | 4.37 | 14.83 | 12.37 | |||||||||||||||||||||||||||||||||

Results of producing

activities |

2,332 | 1,493 | 3,258 | 3,888 | 5,051 | 549 | 16,571 | 10.71 | 10.92 | 11.79 | 11.54 | |||||||||||||||||||||||||||||||||

Other earnings(2) |

565 | (605 | ) | 325 | 81 | (86 | ) | 36 | 316 | 2.60 | (4.43 | ) | 0.33 | 0.22 | ||||||||||||||||||||||||||||||

Total earnings, excluding

power and coal |

2,897 | 888 | 3,583 | 3,969 | 4,965 | 585 | 16,887 | 13.31 | 6.49 | 12.12 | 11.76 | |||||||||||||||||||||||||||||||||

Power and coal |

(4 | ) | – | – | – | 224 | – | 220 | ||||||||||||||||||||||||||||||||||||

Total earnings |

2,893 | 888 | 3,583 | 3,969 | 5,189 | 585 | 17,107 | |||||||||||||||||||||||||||||||||||||

| 2008 | (millions of dollars) |

(dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

11,788 | 8,540 | 13,910 | 20,606 | 20,288 | 2,111 | 77,243 | 87.95 | 81.43 | 91.66 | 89.84 | |||||||||||||||||||||||||||||||||

Natural gas |

3,296 | 1,834 | 15,230 | 39 | 7,005 | 389 | 27,793 | 7.23 | 7.82 | 8.59 | 8.35 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

15,084 | 10,374 | 29,140 | 20,645 | 27,293 | 2,500 | 105,036 | 71.73 | 71.23 | 73.74 | 73.19 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs

excluding taxes |

2,675 | 2,625 | 3,051 | 1,603 | 1,392 | 332 | 11,678 | 12.72 | 18.03 | 5.91 | 8.14 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

1,427 | 1,043 | 2,662 | 2,471 | 1,231 | 179 | 9,013 | 6.79 | 7.16 | 6.06 | 6.28 | |||||||||||||||||||||||||||||||||

Exploration expenses |

189 | 251 | 183 | 439 | 292 | 109 | 1,463 | 0.90 | 1.72 | 0.95 | 1.02 | |||||||||||||||||||||||||||||||||

Taxes other than income |

2,021 | 81 | 4,248 | 1,815 | 5,457 | 665 | 14,287 | 9.61 | 0.55 | 11.29 | 9.95 | |||||||||||||||||||||||||||||||||

Related income tax |

3,191 | 1,813 | 11,979 | 8,119 | 10,691 | 399 | 36,192 | 15.17 | 12.45 | 28.90 | 25.22 | |||||||||||||||||||||||||||||||||

Results of producing

activities |

5,581 | 4,561 | 7,017 | 6,198 | 8,230 | 816 | 32,403 | 26.54 | 31.32 | 20.63 | 22.58 | |||||||||||||||||||||||||||||||||

Other earnings(2) |

687 | (997 | ) | 2,860 | 212 | (45 | ) | 29 | 2,746 | 3.27 | (6.85 | ) | 2.83 | 1.91 | ||||||||||||||||||||||||||||||

Total earnings, excluding

power and coal |

6,268 | 3,564 | 9,877 | 6,410 | 8,185 | 845 | 35,149 | 29.81 | 24.47 | 23.46 | 24.49 | |||||||||||||||||||||||||||||||||

Power and coal |

(25 | ) | – | – | – | 278 | – | 253 | ||||||||||||||||||||||||||||||||||||

Total earnings |

6,243 | 3,564 | 9,877 | 6,410 | 8,463 | 845 | 35,402 | |||||||||||||||||||||||||||||||||||||

| See footnotes on page 58. | ||

| Downstream ExxonMobil is the world’s largest integrated refiner and manufacturer of lube basestocks. We are also a leading marketer of petroleum products and finished lubricants. |

| 62 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

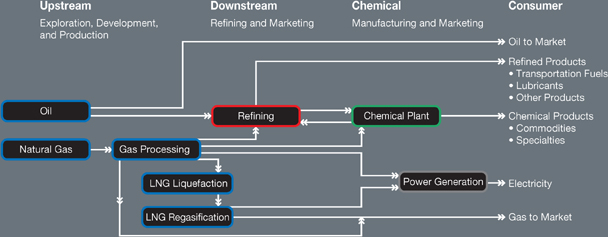

ExxonMobil’s premier Downstream business comprises

Refining & Supply; Fuels, Lubricants & Specialties

Marketing; and a world-class Research and Engineering

organization. Our integrated business model and strategies

underpin our continued success throughout the business

cycle. |

||

|

RESULTS & HIGHLIGHTS

|

||

| • | Maintain best-in-class operations | |

| • | Provide quality, valued products and services to our customers |

|

| • | Lead industry in efficiency and effectiveness | |

| • | Capitalize on integration across ExxonMobil businesses |

|

| • | Maintain capital discipline | |

| • | Maximize value from leading-edge technologies |

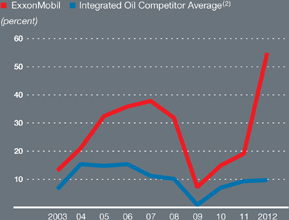

| DOWNSTREAM STATISTICAL RECAP | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

Earnings (millions of dollars) |

13,190 | 4,459 | 3,567 | 1,781 | 8,151 | |||||||||||||||

Refinery throughput (thousands of barrels per day) |

5,014 | 5,214 | 5,253 | 5,350 | 5,416 | |||||||||||||||

Petroleum product sales (thousands of barrels per day) |

6,174 | 6,413 | 6,414 | 6,428 | 6,761 | |||||||||||||||

Average capital employed(1) (millions of dollars) |

24,031 | 23,388 | 24,130 | 25,099 | 25,627 | |||||||||||||||

Return on average capital employed(1) (percent) |

54.9 | 19.1 | 14.8 | 7.1 | 31.8 | |||||||||||||||

Capital expenditures(1) (millions of dollars) |

2,262 | 2,120 | 2,505 | 3,196 | 3,529 | |||||||||||||||

| (1) | See Frequently Used Terms on pages 93 through 95. |

|

63 |

| 64 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

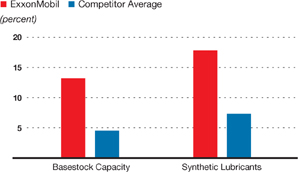

Refinery interests |

32 | |||

Distillation capacity (barrels per day) |

5.4 million | |||

Lube basestock capacity (barrels per day) |

126 thousand | |||

Retail service stations |

~19,000 | |||

Commercial customers |

~300,000 |

Market position |

No.1 supplier of lube basestocks | |||

| and marketer of synthetic lubricants | ||||

| 65 |

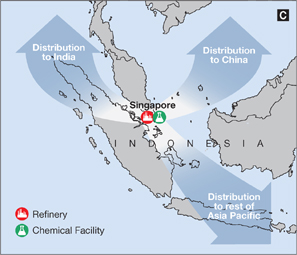

Our world-scale integrated manufacturing facilities in Singapore are well positioned to

capture opportunities presented by growing demand in the Asia Pacific region. |

| 66 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

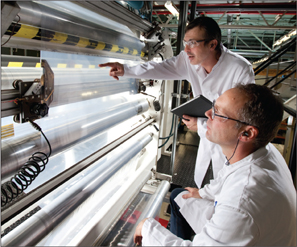

Our fuels and lubricant products are rigorously tested at our research laboratories to ensure

excellent quality and performance, including engine wear resiliency and fuel economy. |

Mobil 1 filling line at our facility in Taicang, China, ideally located to serve the

high-growth markets in that area. |

| (1) | ExxonMobil estimate based on public information. |

| 67 |

Mobil SHC industrial lubricants are valued by customers around the world due to their superior

performance under severe heavy equipment operating conditions such as our Kearl operations. |

| (1) | Solomon Associates fuels refining data available for even years only. | |

| (2) | 2012 data estimated by ExxonMobil. | |

| (3) | Constant year-end 2012 portfolio. | |

| (4) | Constant foreign exchange rates and energy price. |

| 68 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

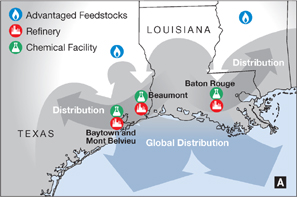

The Baton Rouge Refinery’s cogeneration unit generates enough electricity to fully power the

complex plus 30,000 homes on the regional power grid. |

| 69 |

There are more than 1,000 Mobil 1 car care centers in

China, to meet the needs of this fast-growing vehicle market. |

Asia Pacific |

||||

Sriracha Clean Fuels Project |

60 | |||

Singapore Hydrotreater |

62 | |||

Europe |

||||

Antwerp Hydrotreater |

67 | |||

Fawley Hydrotreater Conversion |

11 | |||

Middle East |

||||

SAMREF Hydrotreating and Sulfur Recovery |

||||

Facilities (ExxonMobil share) |

31 |

| * | Ultra-Low Sulfur Diesel: Sulfur content is less than or equal to 15 parts per million. | |

| Data is stated on constant year-end 2012 portfolio basis. | ||

| 70 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

Refinery Throughput(2) (thousands of barrels per day) |

||||||||||||||||||||

United States |

1,816 | 1,784 | 1,753 | 1,767 | 1,702 | |||||||||||||||

Canada |

435 | 430 | 444 | 413 | 446 | |||||||||||||||

Europe |

1,504 | 1,528 | 1,538 | 1,548 | 1,601 | |||||||||||||||

Asia Pacific |

998 | 1,180 | 1,249 | 1,328 | 1,352 | |||||||||||||||

Middle East/Other |

261 | 292 | 269 | 294 | 315 | |||||||||||||||

Total worldwide |

5,014 | 5,214 | 5,253 | 5,350 | 5,416 | |||||||||||||||

Average Refining Capacity(3) (thousands of barrels per day) |

||||||||||||||||||||

United States |

1,951 | 1,952 | 1,962 | 1,970 | 1,967 | |||||||||||||||

Canada |

506 | 506 | 505 | 502 | 502 | |||||||||||||||

Europe |

1,761 | 1,752 | 1,744 | 1,742 | 1,740 | |||||||||||||||

Asia Pacific |

1,285 | 1,685 | 1,711 | 1,686 | 1,694 | |||||||||||||||

Middle East/Other |

274 | 331 | 331 | 331 | 330 | |||||||||||||||

Total worldwide |

5,777 | 6,226 | 6,253 | 6,231 | 6,233 | |||||||||||||||

Utilization of Refining Capacity (percent) |

||||||||||||||||||||

United States |

93 | 91 | 89 | 90 | 87 | |||||||||||||||

Canada |

86 | 85 | 88 | 82 | 89 | |||||||||||||||

Europe |

85 | 87 | 88 | 89 | 92 | |||||||||||||||

Asia Pacific |

78 | 70 | 73 | 79 | 80 | |||||||||||||||

Middle East/Other |

95 | 88 | 81 | 89 | 95 | |||||||||||||||

Total worldwide |

87 | 84 | 84 | 86 | 87 | |||||||||||||||

| (1) | Excludes ExxonMobil’s interest in the Laffan Refinery in Qatar and ExxonMobil’s minor interests in certain small refineries. | |

| (2) | Refinery throughput includes 100 percent of crude oil and feedstocks sent directly to atmospheric distillation units in operations of ExxonMobil and majority-owned subsidiaries. For companies owned 50 percent or less, throughput includes the greater of either crude and feedstocks processed for ExxonMobil or ExxonMobil’s equity interest in raw material inputs. | |

| (3) | Refining capacity is the stream-day capability to process inputs to atmospheric distillation units under normal operating conditions, less the impact of shutdowns for regular repair and maintenance activities, averaged over an extended period of time. These annual averages include partial-year impacts for capacity additions or deletions during the year. Any idle capacity that cannot be made operable in a month or less has been excluded. Capacity volumes include 100 percent of the capacity of refinery facilities managed by ExxonMobil or majority-owned subsidiaries. At facilities of companies owned 50 percent or less, the greater of either that portion of capacity normally available to ExxonMobil or ExxonMobil’s equity interest is included. |

| 71 |

| Capacity at 100% | ExxonMobil | |||||||||||||||||||||||||||||||||||||||

| ExxonMobil | Atmospheric | Catalytic | Residuum | Interest | ||||||||||||||||||||||||||||||||||||

| (thousands of barrels per day) | Share | (2) | Distillation | Cracking | Hydrocracking | Conversion(3) | Lubricants(4) | % | ||||||||||||||||||||||||||||||||

United States |

||||||||||||||||||||||||||||||||||||||||

Torrance |

California | l | 150 | 150 | 83 | 21 | 50 | 0 | 100 | |||||||||||||||||||||||||||||||

Joliet |

Illinois | l | 238 | 238 | 94 | 0 | 56 | 0 | 100 | |||||||||||||||||||||||||||||||

Baton Rouge |

Louisiana | n | l | 502 | 502 | 232 | 25 | 117 | 16 | 100 | ||||||||||||||||||||||||||||||

Chalmette |

Louisiana | l | 5 | 95 | 189 | 72 | 0 | 29 | 0 | 50 | ||||||||||||||||||||||||||||||

Billings |

Montana | l | 60 | 60 | 18 | 6 | 10 | 0 | 100 | |||||||||||||||||||||||||||||||

Baytown |

Texas | n | l | 561 | 561 | 204 | 27 | 90 | 22 | 100 | ||||||||||||||||||||||||||||||

Beaumont |

Texas | n | l | 345 | 345 | 113 | 60 | 46 | 10 | 100 | ||||||||||||||||||||||||||||||

Total United States |

1,951 | 2,045 | 816 | 139 | 398 | 48 | ||||||||||||||||||||||||||||||||||

Canada |

||||||||||||||||||||||||||||||||||||||||

Strathcona |

Alberta | 189 | 189 | 63 | 0 | 0 | 2 | 69.6 | ||||||||||||||||||||||||||||||||

Dartmouth |

Nova Scotia | 5 | 85 | 85 | 31 | 0 | 0 | 0 | 69.6 | |||||||||||||||||||||||||||||||

Nanticoke |

Ontario | 5 | 113 | 113 | 48 | 0 | 0 | 0 | 69.6 | |||||||||||||||||||||||||||||||

Sarnia |

Ontario | n | l | 119 | 119 | 30 | 18 | 25 | 0 | 69.6 | ||||||||||||||||||||||||||||||

Total Canada |

506 | 506 | 172 | 18 | 25 | 2 | ||||||||||||||||||||||||||||||||||

Europe |

||||||||||||||||||||||||||||||||||||||||

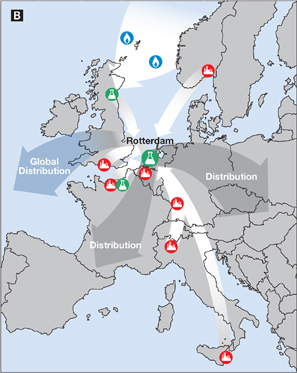

Antwerp |

Belgium | n | l | 307 | 307 | 35 | 0 | 0 | 0 | 100 | ||||||||||||||||||||||||||||||

Fos-sur-Mer |

France | l | 5 | 131 | 131 | 31 | 0 | 0 | 0 | 82.9 | ||||||||||||||||||||||||||||||

Gravenchon |

France | n | l | 235 | 235 | 39 | 0 | 0 | 13 | 82.9 | ||||||||||||||||||||||||||||||

Karlsruhe |

Germany | l | 5 | 78 | 310 | 86 | 0 | 30 | 0 | 25 | ||||||||||||||||||||||||||||||

Augusta |

Italy | l | 5 | 198 | 198 | 50 | 0 | 0 | 14 | 100 | ||||||||||||||||||||||||||||||

Trecate |

Italy | l | 5 | 126 | 126 | 35 | 0 | 0 | 0 | 75.5 | ||||||||||||||||||||||||||||||

Rotterdam |

Netherlands | n | l | 191 | 191 | 0 | 52 | 41 | 0 | 100 | ||||||||||||||||||||||||||||||

Slagen |

Norway | 116 | 116 | 0 | 0 | 32 | 0 | 100 | ||||||||||||||||||||||||||||||||

Fawley |

United Kingdom | n | l | 258 | 258 | 89 | 0 | 37 | 9 | 100 | ||||||||||||||||||||||||||||||

Total Europe |

1,640 | 1,872 | 365 | 52 | 140 | 36 | ||||||||||||||||||||||||||||||||||

| Refining Capacity at Year-End 2012, continued on page 72 | ||

| n Integrated Refinery and Chemical Complex | l Cogeneration Capacity | 5 Refineries with Some Chemical Production |

| (1) | Capacity data is based on 100 percent of rated refinery process unit stream-day capacities under normal operating conditions, less the impact of shutdowns for regular repair and maintenance activities, averaged over an extended period of time. | |

| (2) | ExxonMobil share reflects 100 percent of atmospheric distillation capacity in operations of ExxonMobil and majority-owned subsidiaries. For companies owned 50 percent or less, ExxonMobil share is the greater of ExxonMobil’s equity interest or that portion of distillation capacity normally available to ExxonMobil. | |

| (3) | Includes thermal cracking, visbreaking, coking, and hydrorefining processes. | |

| (4) | Lubricant capacity based on dewaxed oil production. | |

| (5) | Financial results incorporated into Upstream business. |

| 72 | EXXONMOBIL 2012 FINANCIAL & OPERATING REVIEW |

| Capacity at 100% | ExxonMobil | |||||||||||||||||||||||||||||||||||||||

| ExxonMobil | Atmospheric | Catalytic | Residuum | Interest | ||||||||||||||||||||||||||||||||||||