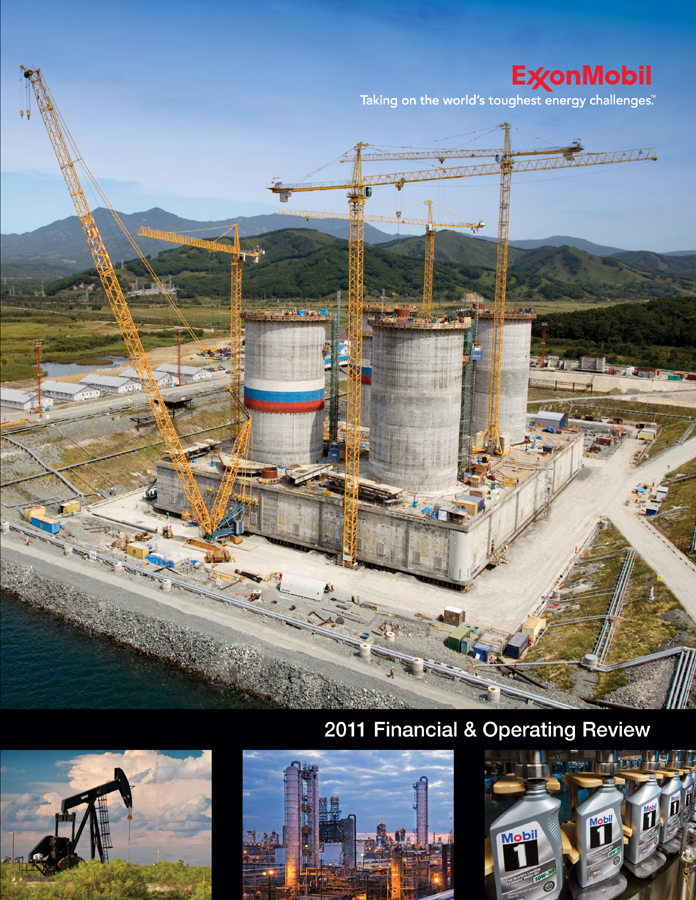

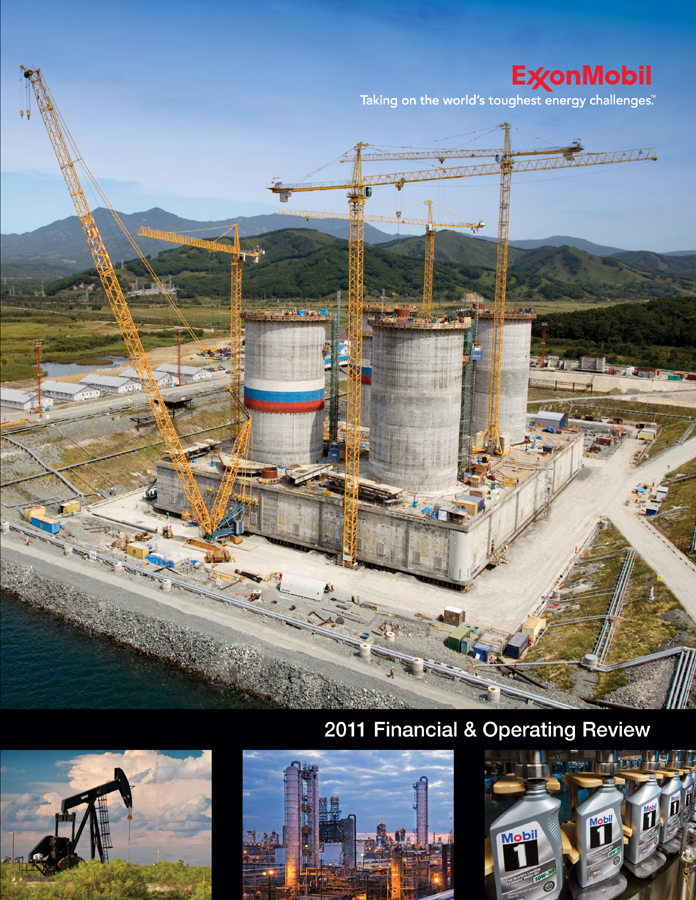

| ExxonMobil Taking on the world’s toughest energy challenges. 2011 Financial & Operating Review |

| ExxonMobil Taking on the world’s toughest energy challenges. 2011 Financial & Operating Review |

|

Financial & Operating Summary |

1 | |||

Business Model |

2 | |||

Competitive Advantages |

3 | |||

Global Operations |

4 | |||

Upstream |

6 | |||

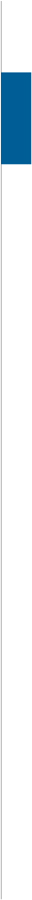

Downstream |

52 | |||

Chemical |

70 | |||

Financial Information |

84 | |||

Frequently Used Terms |

93 | |||

Index |

96 | |||

General Information |

97 |

|

| Average | Return on | Capital and | ||||||||||||||

| Earnings After | Capital | Average Capital | Exploration | |||||||||||||

| (millions of dollars, unless noted) | Income Taxes | Employed | (1) | Employed (%) | (1) | Expenditures | (1) | |||||||||

Upstream |

34,439 | 129,807 | 26.5 | 33,091 | ||||||||||||

Downstream |

4,459 | 23,388 | 19.1 | 2,120 | ||||||||||||

Chemical |

4,383 | 19,798 | 22.1 | 1,450 | ||||||||||||

Corporate and Financing |

(2,221 | ) | (2,272 | ) | N.A. | 105 | ||||||||||

Total |

41,060 | 170,721 | 24.2 | 36,766 | ||||||||||||

Liquids

production (net, thousands of barrels per day) |

2,312 | |||

Natural gas production available for sale (net, millions of cubic feet per day) |

13,162 | |||

Oil-equivalent production(2) (net, thousands of oil-equivalent barrels per day) |

4,506 | |||

Refinery

throughput (thousands of barrels per day) |

5,214 | |||

Petroleum

product sales (thousands of barrels per day) |

6,413 | |||

Chemical

prime product sales (thousands of tonnes) |

25,006 |

Safety performance remains strong in industry

|

Total shareholder return of 19 percent(1) | |

Strong cash flow from operations and asset sales

of $66.5 billion(1)

|

Total shareholder distributions of $29 billion(1) | |

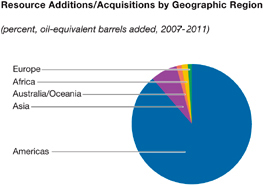

Proved oil and gas reserve additions of 2.0 billion oil-equivalent barrels, replacing 116 percent of production, excluding asset sales(1) |

Annual dividend per share growth of 6 percent

versus 2010, the 29th consecutive year of dividend per share increases |

2

|

ExxonMobil • 2011 Financial & Operating Review |

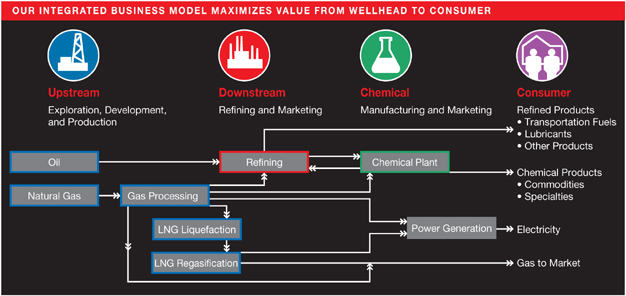

Business

Model We employ a business model focused on achieving excellence in our daily operations, generating superior cash flow, and creating long-term shareholder value. As a result of the consistent application of this proven business model, we possess competitive advantages that support strong results today and position us well for decades to come. Rex W. Tillerson Chairman and CEO |

|

3

|

| Global Operations |

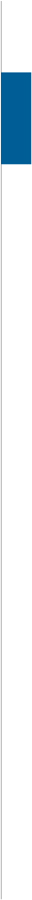

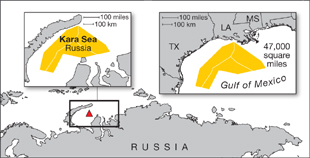

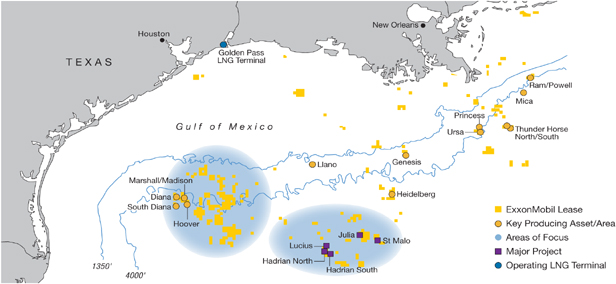

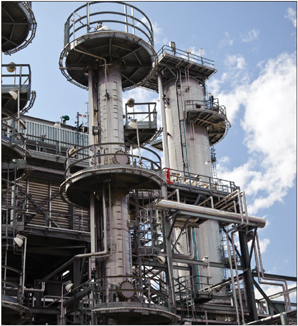

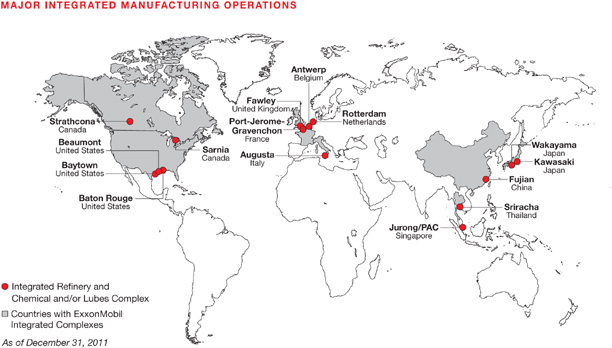

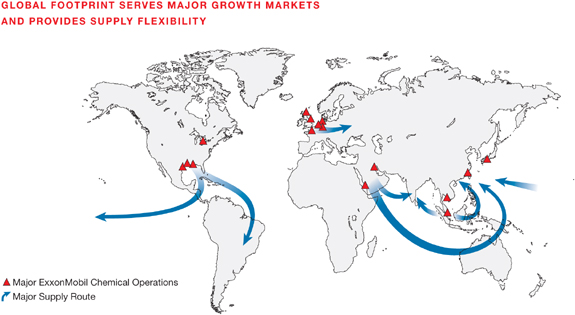

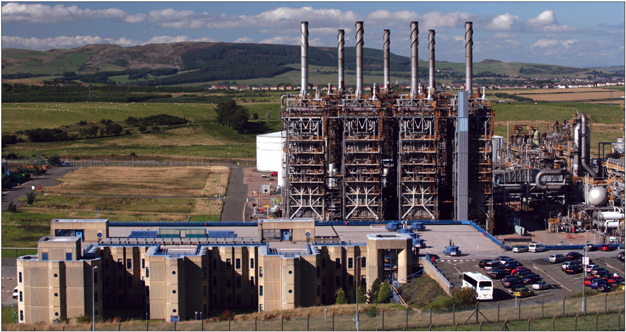

| ExxonMobil • 2011 Financial & Global Operations As the world’s largest publicly held oil and gas company, ExxonMobil has a diverse and balanced portfolio of high-quality resources, projects, and assets across our Upstream, Downstream, and Chemical businesses. CANADA The Kearl oil sands project in Canada is developing a world-class resource in northern Alberta expected to exceed 4 billion barrels. Construction and fabrication activities are progressing on the Kearl Initial Development project with start-up scheduled for 2012. Initial production is projected to be approximately 110 thousand barrels of bitumen per day with future debottlenecking and expansion increasing production to 345 thousand barrels of bitumen per day. ARGENTINA We have an interest in the Chihuidos concession and the Aguarague concession in Argentina. In addition, we acquired 767,900 net acres in the Neuquen Basin through license rounds and joint ventures in 2010 and 2011. Exploration drilling on this acreage commenced in late 2011. Upstream Downstream Chemical As of December 31, 2011 |

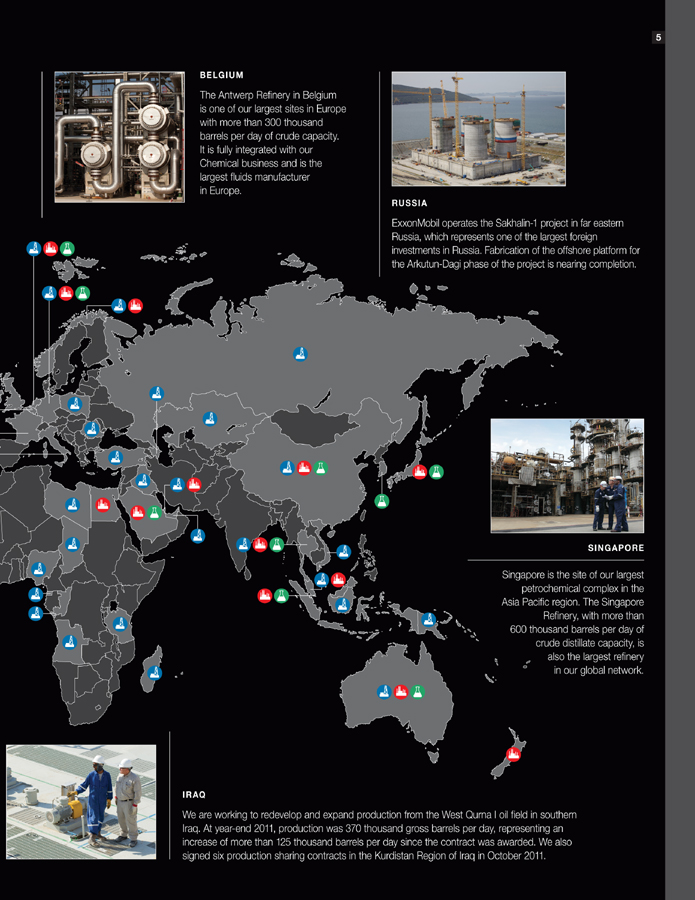

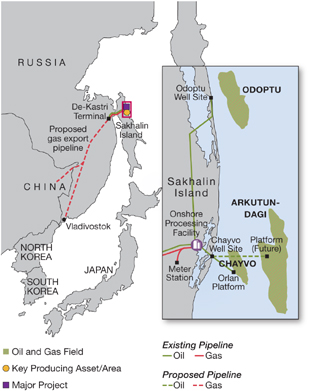

| BELGIUM The Antwerp Refinery in Belgium is one of our largest sites in Europe with more than 300 thousand barrels per day of crude capacity. It is fully integrated with our Chemical business and is the largest fluids manufacturer in Europe. RUSSIA ExxonMobil operates the Sakhalin-1 project in far eastern Russia, which represents one of the largest foreign investments in Russia. Fabrication of the offshore platform for the Arkutun-Dagi phase of the project is nearing completion. SINGAPORE Singapore is the site of our largest petrochemical complex in the Asia Pacific region. The Singapore Refinery, with more than 600 thousand barrels per day of crude distillate capacity, is also the largest refinery in our global network. IRAQ We are working to redevelop and expand production from the West Qurna I oil field in southern Iraq. At year-end 2011, production was 370 thousand gross barrels per day, representing an increase of more than 125 thousand barrels per day since the contract was awarded. We also signed six production sharing contracts in the Kurdistan Region of Iraq in October 2011. |

| In the U.S. Gulf of Mexico, we made a significant oil discovery in 2011 with the Hadrian-5 exploration well. The well encountered more than 1000 feet of net pay. |

| Upstream |

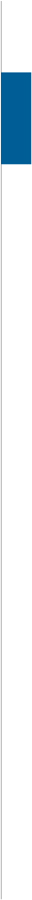

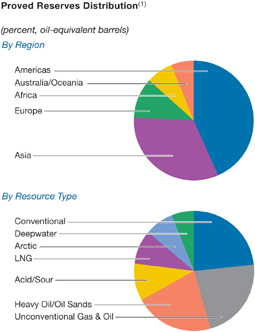

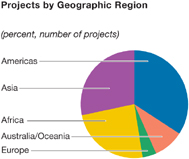

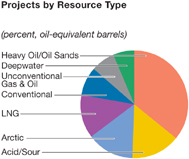

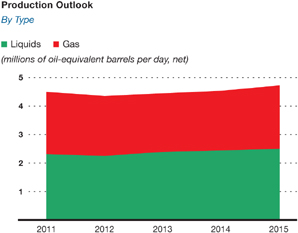

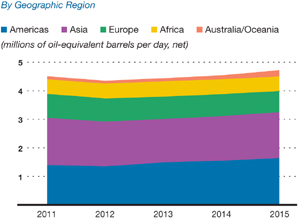

| ExxonMobil • 2011 Financial & 7 Upstream ExxonMobil’s Upstream portfolio includes high-quality exploration opportunities, an industry-leading resource base, a broad range of world-class projects, and a set of diverse producing assets. Production of Reserves of 4.5 24.9 million billion oil-equivalent oil-equivalent barrels per day barrels |

|

8 |

| UPSTREAM STATISTICAL RECAP | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Earnings (millions of dollars) |

34,439 | 24,097 | 17,107 | 35,402 | 26,497 | |||||||||||||||

Liquids production (net, thousands of barrels per day) |

2,312 | 2,422 | 2,387 | 2,405 | 2,616 | |||||||||||||||

Natural gas production available for sale

(net, millions of cubic feet per day) |

13,162 | 12,148 | 9,273 | 9,095 | 9,384 | |||||||||||||||

Oil-equivalent production(1) (net, thousands of barrels per day) |

4,506 | 4,447 | 3,932 | 3,921 | 4,180 | |||||||||||||||

Proved reserves replacement(2)(3) (percent) |

116 | 211 | 100 | 143 | 107 | |||||||||||||||

Resource additions(2) (millions of oil-equivalent barrels) |

4,086 | 14,580 | 2,860 | 2,230 | 2,010 | |||||||||||||||

Average capital employed(2) (millions of dollars) |

129,807 | 103,287 | 73,201 | 66,064 | 63,565 | |||||||||||||||

Return on average capital employed(2) (percent) |

26.5 | 23.3 | 23.4 | 53.6 | 41.7 | |||||||||||||||

Capital and exploration expenditures(2) (millions of dollars) |

33,091 | 27,319 | 20,704 | 19,734 | 15,724 | |||||||||||||||

| (1) | Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels. | |

| (2) | See Frequently Used Terms on pages 93 through 95. | |

| (3) | Proved reserves exclude asset sales and the 2007 Venezuela expropriation. Includes non-consolidated interests and Canadian oil sands. | |

| Note: Unless otherwise stated, production rates, project capacities, and acreage values referred to on pages 8 through 41 are gross. | ||

9

|

|

|

10

|

11

|

|

|

12

|

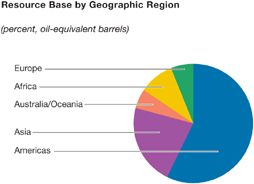

| 5-Year | ||||||||

| (billions of oil-equivalent barrels) | 2011 | Average | ||||||

Resource additions/acquisitions |

4.1 | 5.2 | ||||||

Revisions to existing fields |

0.9 | (0.3 | ) | |||||

Production |

(1.7 | ) | (1.6 | ) | ||||

Sales |

(0.6 | ) | (0.6 | )(2) | ||||

Net change versus year-end 2010 |

2.7 | 2.7 | ||||||

| (1) | See Frequently Used Terms on pages 93 through 95. | |

| (2) | Includes impact of the Venezuela expropriation in 2007. |

| (1) | See Frequently Used Terms on pages 93 through 95. | |

| (2) | Includes asset sales and the 2007 Venezuela expropriation. |

13

|

|

|

14

|

| (Percent of plan, 2007-2011 Average) | Cost | Schedule | ||||||

ExxonMobil Operated |

103 | 109 | ||||||

Operated by Others |

109 | 114 | ||||||

| Target Peak | ||||||||||||||||

| Production (Gross) | ExxonMobil | |||||||||||||||

| Liquids | Gas | Working | ||||||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||||||

| 2011 (Actual) | ||||||||||||||||

| Angola | Pazflor |

220 | – | 20 | l | |||||||||||

| 2012-2014 (Projected) | ||||||||||||||||

| Angola | Cravo-Lirio-Orquidea-Violeta |

160 | – | 20 | l | |||||||||||

Kizomba Satellites Phase 1 |

100 | – | 40 | n | ||||||||||||

| Australia | Kipper/Tuna |

15 | 175 | 40 | n | |||||||||||

Turrum |

20 | 200 | 50 | n | ||||||||||||

| Canada | Cold Lake Nabiye Expansion |

40 | – | 100 | n | |||||||||||

Hibernia Southern Extension |

55 | – | 27 | n | ||||||||||||

Kearl Initial Development |

170 | – | 100 | n | ||||||||||||

Syncrude Aurora North |

215 | – | 25 | ▲ | ||||||||||||

Mine Sustaining Project |

||||||||||||||||

Syncrude

Mildred Lake |

180 | – | 25 | ▲ | ||||||||||||

Mine Sustaining Project |

||||||||||||||||

| Indonesia | Banyu Urip |

165 | 15 | 45 | n | |||||||||||

| Kazakhstan | Kashagan Phase 1 |

290 | – | 17 | l | |||||||||||

| Malaysia | Damar Gas |

5 | 200 | 50 | n | |||||||||||

Telok |

– | 370 | 50 | n | ||||||||||||

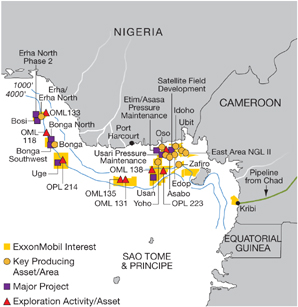

| Nigeria | Etim/Asasa Pressure Maintenance |

50 | – | 40 | n | |||||||||||

Usan |

180 | – | 30 | l | ||||||||||||

Satellite Field Development Phase 1 |

70 | – | 40 | n | ||||||||||||

| Papua

New Guinea |

PNG LNG |

30 | 940 | 33 | n | |||||||||||

| Russia | Sakhalin-1 Arkutun-Dagi |

90 | – | 30 | n | |||||||||||

| Qatar | Barzan |

85 | 1400 | 7 | ▲ | |||||||||||

| U.S. | Hadrian South |

– | 300 | 47 | n | |||||||||||

Lucius |

100 | 90 | 25 | l | ||||||||||||

| 2015+ (Projected) | ||||||||||||||||

| Angola | AB32 Kaombo Split Hub |

210 | – | 15 | l | |||||||||||

Kizomba Satellites Phase 2 |

65 | – | 40 | n | ||||||||||||

| Australia | Gorgon Area Expansion |

10 | 850 | 25 | l | |||||||||||

Gorgon Jansz |

20 | 2835 | 25 | l | ||||||||||||

Scarborough |

– | 1190 | 50 | n |

||||||||||||

| Target Peak | ||||||||||||||||

| Production (Gross) | ExxonMobil | |||||||||||||||

| Liquids | Gas | Working | ||||||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||||||

| 2015+ (Projected, continued) | ||||||||||||||||

Canada |

Aspen | 80 | – | 100 | n | |||||||||||

| Firebag | 280 | – | 80 | n | ||||||||||||

| Hebron | 130 | – | 36 | n | ||||||||||||

| Kearl Expansion | 175 | – | 100 | n | ||||||||||||

| Mackenzie Gas Project | 10 | 830 | 56 | n | ||||||||||||

| Syncrude Aurora South Phase 1 and 2 |

200 | – | 25 | ▲ | ||||||||||||

Indonesia |

Cepu Gas | – | 210 | 41 | n | |||||||||||

| Natuna | – | 1100 | ** | n | ||||||||||||

Iraq |

West Qurna I* | 2825 | – | 60 | ▲ | |||||||||||

Kazakhstan |

Kashagan Future Phases | 1260 | – | 17 | l | |||||||||||

| Aktote | 50 | 850 | 17 | l | ||||||||||||

| Tengiz Expansion | 250 | – | 25 | l | ||||||||||||

Nigeria |

Bonga North | 100 | 60 | 20 | l | |||||||||||

| Bonga Southwest | 200 | 15 | 16 | l | ||||||||||||

| Bosi | 135 | 140 | 56 | n | ||||||||||||

| Erha North Phase 2 | 60 | – | 56 | n | ||||||||||||

| Satellite Field Development Phase 2 |

80 | – | 40 | n | ||||||||||||

| Uge | 110 | 20 | 20 | n | ||||||||||||

| Usan Future Phases | 50 | – | 30 | l | ||||||||||||

| Usari Pressure Maintenance | 50 | – | 40 | n | ||||||||||||

Norway |

Aasgard Subsea Compression | 35 | 360 | 14 | l | |||||||||||

| Dagny | 65 | 185 | 33 | l | ||||||||||||

| Luva | – | 600 | 15 | l | ||||||||||||

Russia |

Sakhalin-1 Future Phases | 30 | 800 | 30 | n | |||||||||||

United Arab Emirates |

Upper Zakum 750 | 750 | – | 28 | ▲ | |||||||||||

U.K. |

Fram | 20 | 140 | 69 | l | |||||||||||

U.S. |

Alaska Gas/Point Thomson | 70 | 4500 | 36 | ** | |||||||||||

| Hadrian North | 100 | 100 | 50 | n | ||||||||||||

| Julia Phase 1 | 30 | – | 50 | n | ||||||||||||

15

|

|

|

16

|

|

|

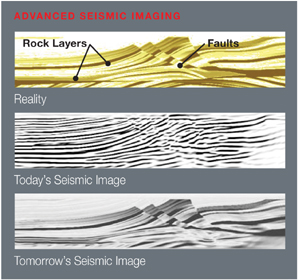

Our petascale computational capability allows 1015 operations per second |

17

|

|

|

18

|

19

|

|

|

20

|

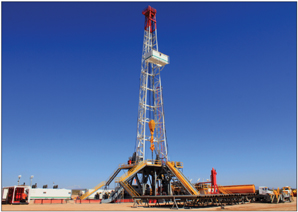

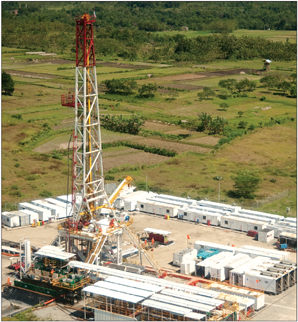

| Worldwide Upstream Operations Construction and fabrication activities are progressing on the Kearl Initial Development project with start-up scheduled for late 2012. |

|

22

|

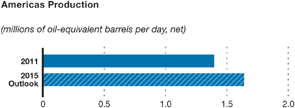

| Americas Highlights | 2011 | 2010 | 2009 | |||||||||

Earnings (billions of dollars) |

7.8 | 5.9 | 3.8 | |||||||||

Proved Reserves (BOEB) |

10.8 | 9.8 | 7.1 | |||||||||

Acreage (gross acres, million) |

50.2 | 51.4 | 49.5 | |||||||||

Net Liquids Production (MBD) |

0.7 | 0.7 | 0.7 | |||||||||

Net Gas Available for Sale (BCFD) |

4.3 | 3.2 | 1.9 | |||||||||

23

|

|

|

24

|

25

|

|

|

26

|

27

|

|

|

28

|

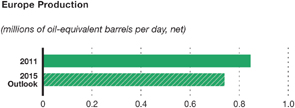

| Europe Highlights | 2011 | 2010 | 2009 | |||||||||

Earnings (billions of dollars) |

7.1 | 3.8 | 3.6 | |||||||||

Proved Reserves (BOEB) |

2.7 | 2.9 | 3.2 | |||||||||

Acreage (gross acres, million) |

44.1 | 43.1 | 35.2 | |||||||||

Net Liquids Production (MBD) |

0.3 | 0.3 | 0.4 | |||||||||

Net Gas Available for Sale (BCFD) |

3.4 | 3.8 | 3.7 | |||||||||

29

|

|

|

30

|

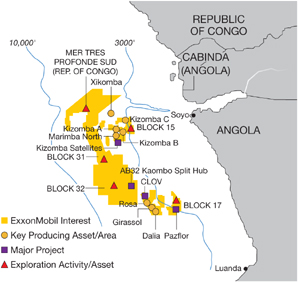

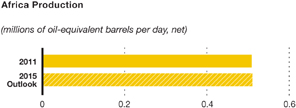

| Africa Highlights | 2011 | 2010 | 2009 | |||||||||

Earnings (billions of dollars) |

5.4 | 4.4 | 3.9 | |||||||||

Proved Reserves (BOEB) |

1.8 | 2.0 | 2.1 | |||||||||

Acreage (gross acres, million) |

15.1 | 16.5 | 17.7 | |||||||||

Net Liquids Production (MBD) |

0.5 | 0.6 | 0.7 | |||||||||

Net Gas Available for Sale (BCFD) |

– | – | – | |||||||||

31

|

|

|

32

|

33

|

|

|

34

|

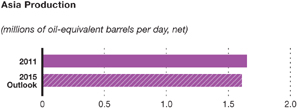

| Asia Highlights | 2011 | 2010 | 2009 | |||||||||

Earnings

(billions of

dollars) |

13.4 | 9.4 | 5.2 | |||||||||

Proved Reserves

(BOEB) |

8.1 | 8.6 | 9.1 | |||||||||

Acreage (gross

acres, million) |

31.0 | 31.4 | 32.9 | |||||||||

Net Liquids

Production (MBD) |

0.8 | 0.7 | 0.6 | |||||||||

Net Gas

Available for Sale

(BCFD) |

5.0 | 4.8 | 3.3 | |||||||||

35

|

|

|

36

|

37

|

|

|

38

|

39

|

|

|

40

|

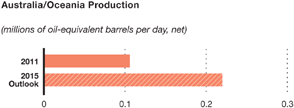

| Australia/Oceania Highlights | 2011 | 2010 | 2009 | |||||||

Earnings (billions of

dollars) |

0.8 | 0.6 | 0.6 | |||||||

Proved Reserves (BOEB) |

1.5 | 1.5 | 1.5 | |||||||

Acreage (gross acres,

million) |

7.8 | 7.1 | 11.7 | |||||||

Net Liquids Production (MBD) |

0.1 | 0.1 | 0.1 | |||||||

Net Gas Available for Sale

(BCFD) |

0.3 | 0.3 | 0.3 | |||||||

41

|

|

|

42

|

| (thousands of barrels per day) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

United States |

||||||||||||||||||||

Alaska |

114 | 117 | 123 | 130 | 132 | |||||||||||||||

Lower 48 |

309 | 291 | 261 | 237 | 260 | |||||||||||||||

Total United States |

423 | 408 | 384 | 367 | 392 | |||||||||||||||

Canada/South America |

252 | 263 | 267 | 292 | 324 | |||||||||||||||

Total Americas |

675 | 671 | 651 | 659 | 716 | |||||||||||||||

Europe |

||||||||||||||||||||

United Kingdom |

55 | 80 | 90 | 123 | 150 | |||||||||||||||

Norway |

205 | 246 | 280 | 295 | 319 | |||||||||||||||

Other |

10 | 9 | 9 | 10 | 11 | |||||||||||||||

Total Europe |

270 | 335 | 379 | 428 | 480 | |||||||||||||||

Africa |

||||||||||||||||||||

Nigeria |

324 | 391 | 391 | 364 | 415 | |||||||||||||||

Angola |

99 | 141 | 194 | 181 | 173 | |||||||||||||||

Equatorial Guinea |

45 | 53 | 55 | 60 | 76 | |||||||||||||||

Other |

40 | 43 | 45 | 47 | 53 | |||||||||||||||

Total Africa |

508 | 628 | 685 | 652 | 717 | |||||||||||||||

Asia |

||||||||||||||||||||

Malaysia |

38 | 48 | 52 | 56 | 67 | |||||||||||||||

Middle East |

567 | 478 | 368 | 381 | 374 | |||||||||||||||

Russia/Caspian |

191 | 191 | 182 | 160 | 185 | |||||||||||||||

Other |

12 | 13 | 5 | 2 | 3 | |||||||||||||||

Total Asia |

808 | 730 | 607 | 599 | 629 | |||||||||||||||

Australia/Oceania |

51 | 58 | 65 | 67 | 74 | |||||||||||||||

Total worldwide |

2,312 | 2,422 | 2,387 | 2,405 | 2,616 | |||||||||||||||

Gas Plant Liquids Included Above |

||||||||||||||||||||

United States |

78 | 59 | 50 | 49 | 57 | |||||||||||||||

Non-U.S. |

213 | 207 | 173 | 164 | 166 | |||||||||||||||

Total worldwide |

291 | 266 | 223 | 213 | 223 | |||||||||||||||

Oil Sands and Non-Consolidated Volumes Included Above |

||||||||||||||||||||

United States |

66 | 69 | 73 | 78 | 82 | |||||||||||||||

Canada/South America – Bitumen |

120 | 115 | 120 | 124 | 130 | |||||||||||||||

Canada/South America – Synthetic Oil |

67 | 67 | 65 | 62 | 65 | |||||||||||||||

Europe |

5 | 5 | 5 | 5 | 6 | |||||||||||||||

Asia |

425 | 404 | 320 | 280 | 265 | |||||||||||||||

Total worldwide |

683 | 660 | 583 | 549 | 548 | |||||||||||||||

| (1) | Net liquids production quantities are the volumes of crude oil and natural gas liquids withdrawn from ExxonMobil’s oil and gas reserves, excluding royalties and quantities due to others when produced, and are based on the volumes delivered from the lease or at the point measured for royalty and/or severance tax purposes. Volumes include 100 percent of the production of majority-owned affiliates, including liquids production from oil sands operations in Canada, and ExxonMobil’s ownership of the production by companies owned 50 percent or less. |

| (millions of cubic feet per day) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

United States |

3,917 | 2,596 | 1,275 | 1,246 | 1,468 | |||||||||||||||

Canada/South America |

412 | 569 | 643 | 640 | 808 | |||||||||||||||

Total Americas |

4,329 | 3,165 | 1,918 | 1,886 | 2,276 | |||||||||||||||

Europe |

||||||||||||||||||||

Netherlands |

1,826 | 2,041 | 1,676 | 1,748 | 1,551 | |||||||||||||||

United Kingdom |

441 | 550 | 594 | 750 | 779 | |||||||||||||||

Norway |

663 | 700 | 786 | 764 | 705 | |||||||||||||||

Germany |

518 | 545 | 633 | 687 | 775 | |||||||||||||||

Total Europe |

3,448 | 3,836 | 3,689 | 3,949 | 3,810 | |||||||||||||||

Africa |

7 | 14 | 19 | 32 | 26 | |||||||||||||||

Asia |

||||||||||||||||||||

Indonesia |

164 | 215 | 245 | 239 | 286 | |||||||||||||||

Malaysia |

420 | 513 | 545 | 582 | 583 | |||||||||||||||

Middle East |

4,261 | 3,865 | 2,367 | 1,911 | 1,875 | |||||||||||||||

Russia/Caspian |

184 | 187 | 153 | 114 | 110 | |||||||||||||||

Other |

18 | 21 | 22 | 24 | 29 | |||||||||||||||

Total Asia |

5,047 | 4,801 | 3,332 | 2,870 | 2,883 | |||||||||||||||

Australia/Oceania |

331 | 332 | 315 | 358 | 389 | |||||||||||||||

Total worldwide |

13,162 | 12,148 | 9,273 | 9,095 | 9,384 | |||||||||||||||

Non-Consolidated Natural Gas Volumes Included Above |

||||||||||||||||||||

United States |

– | 1 | 1 | 1 | 1 | |||||||||||||||

Europe |

1,747 | 1,977 | 1,618 | 1,696 | 1,503 | |||||||||||||||

Asia |

3,168 | 2,954 | 1,918 | 1,433 | 1,351 | |||||||||||||||

Total worldwide |

4,915 | 4,932 | 3,537 | 3,130 | 2,855 | |||||||||||||||

| (1) | Net natural gas available for sale quantities are the volumes withdrawn from ExxonMobil’s natural gas reserves, excluding royalties and volumes due to others when produced, and excluding gas purchased from others, gas consumed in producing operations, field processing plant losses, volumes used for gas lift, gas injection and cycling operations, quantities flared, and volume shrinkage due to the removal of condensate or natural gas liquids fractions. |

| (millions of cubic feet per day) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

United States |

5,002 | 3,166 | 1,321 | 1,292 | 1,560 | |||||||||||||||

Canada/South America |

517 | 696 | 739 | 845 | 968 | |||||||||||||||

Europe |

6,254 | 6,401 | 5,854 | 5,665 | 5,396 | |||||||||||||||

Africa |

7 | 14 | 19 | 32 | 26 | |||||||||||||||

Asia |

4,289 | 4,102 | 2,760 | 2,612 | 2,631 | |||||||||||||||

Australia/Oceania |

338 | 339 | 322 | 366 | 398 | |||||||||||||||

Total worldwide |

16,407 | 14,718 | 11,015 | 10,812 | 10,979 | |||||||||||||||

| (1) | Natural gas sales include 100 percent of the sales of ExxonMobil and majority-owned affiliates and ExxonMobil’s ownership of sales by companies owned 50 percent or less. Numbers include sales of gas purchased from third parties. |

43

|

|

|

44

|

NUMBER OF NET WELLS DRILLED ANNUALLY(1)

|

||||||||||||||||||||

(net wells drilled) |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Productive |

||||||||||||||||||||

Exploratory(2) |

25 | 37 | 20 | 19 | 19 | |||||||||||||||

Development |

1,554 | 1,200 | 829 | 731 | 917 | |||||||||||||||

Total |

1,579 | 1,237 | 849 | 750 | 936 | |||||||||||||||

Dry |

||||||||||||||||||||

Exploratory(2) |

11 | 7 | 9 | 9 | 16 | |||||||||||||||

Development |

16 | 5 | 5 | 4 | 19 | |||||||||||||||

Total |

27 | 12 | 14 | 13 | 35 | |||||||||||||||

Net Wells Drilled |

||||||||||||||||||||

Exploratory(2) |

36 | 44 | 29 | 28 | 35 | |||||||||||||||

Development |

1,570 | 1,205 | 834 | 735 | 936 | |||||||||||||||

Total |

1,606 | 1,249 | 863 | 763 | 971 | |||||||||||||||

NET ACREAGE AT YEAR END(3)

|

||||||||||||||||||||

(thousands of net acres) |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Undeveloped |

||||||||||||||||||||

United States |

5,326 | 4,914 | 5,111 | 5,691 | 5,539 | |||||||||||||||

Canada/South America |

9,877 | 11,977 | 17,107 | 19,953 | 22,563 | |||||||||||||||

Europe |

16,107 | 16,118 | 13,470 | 7,913 | 6,002 | |||||||||||||||

Africa |

8,100 | 8,612 | 10,555 | 26,439 | 24,835 | |||||||||||||||

Asia |

19,919 | 19,086 | 20,457 | 6,824 | 7,715 | |||||||||||||||

Australia/Oceania |

1,476 | 1,352 | 5,216 | 5,738 | 5,844 | |||||||||||||||

Total worldwide |

60,805 | 62,059 | 71,916 | 72,558 | 72,498 | |||||||||||||||

Developed |

||||||||||||||||||||

United States |

10,311 | 9,919 | 5,120 | 5,148 | 5,174 | |||||||||||||||

Canada/South America |

1,959 | 2,439 | 2,460 | 2,488 | 2,366 | |||||||||||||||

Europe |

2,868 | 2,986 | 3,806 | 4,026 | 4,194 | |||||||||||||||

Africa |

700 | 684 | 758 | 756 | 729 | |||||||||||||||

Asia |

1,230 | 1,271 | 1,160 | 1,048 | 1,037 | |||||||||||||||

Australia/Oceania |

719 | 719 | 719 | 719 | 728 | |||||||||||||||

Total worldwide |

17,787 | 18,018 | 14,023 | 14,185 | 14,228 | |||||||||||||||

NET CAPITALIZED COSTS AT YEAR END(3)

|

||||||||||||||||||||

(millions of dollars) |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

United States |

76,363 | 70,011 | 20,363 | 18,542 | 16,948 | |||||||||||||||

Canada/South America |

21,721 | 18,089 | 13,408 | 9,967 | 11,338 | |||||||||||||||

Europe |

11,399 | 12,845 | 14,357 | 11,477 | 15,426 | |||||||||||||||

Africa |

24,790 | 22,563 | 20,917 | 17,797 | 15,149 | |||||||||||||||

Asia |

25,594 | 23,765 | 21,859 | 19,191 | 17,186 | |||||||||||||||

Australia/Oceania |

6,864 | 5,284 | 3,725 | 2,407 | 2,630 | |||||||||||||||

Total worldwide |

166,731 | 152,557 | 94,629 | 79,381 | 78,677 | |||||||||||||||

| (1) | A regional breakout of this data is included on pages 11 and 12 of ExxonMobil’s 2011 Form 10-K. | |

| (2) | These include near-field and appraisal wells classified as exploratory for SEC reporting. | |

| (3) | Includes non-consolidated interests and Canadian oil sands operations. |

| Property | ||||||||||||||||

| Acquisition | Exploration | Development | Total | |||||||||||||

| (millions of dollars) | Costs | Costs | Costs | Costs | ||||||||||||

During 2011 |

||||||||||||||||

United States |

2,967 | 484 | 8,505 | 11,956 | ||||||||||||

Canada/South America |

178 | 372 | 5,478 | 6,028 | ||||||||||||

Europe |

– | 672 | 2,063 | 2,735 | ||||||||||||

Africa |

– | 303 | 4,316 | 4,619 | ||||||||||||

Asia |

642 | 518 | 3,618 | 4,778 | ||||||||||||

Australia/Oceania |

– | 154 | 1,710 | 1,864 | ||||||||||||

Total worldwide |

3,787 | 2,503 | 25,690 | 31,980 | ||||||||||||

During 2010 |

||||||||||||||||

United States |

45,143 | 694 | 8,270 | 54,107 | ||||||||||||

Canada/South America |

136 | 527 | 4,757 | 5,420 | ||||||||||||

Europe |

64 | 606 | 1,452 | 2,122 | ||||||||||||

Africa |

3 | 453 | 4,390 | 4,846 | ||||||||||||

Asia |

115 | 547 | 3,195 | 3,857 | ||||||||||||

Australia/Oceania |

– | 228 | 1,146 | 1,374 | ||||||||||||

Total worldwide |

45,461 | 3,055 | 23,210 | 71,726 | ||||||||||||

During 2009 |

||||||||||||||||

United States |

205 | 549 | 2,787 | 3,541 | ||||||||||||

Canada/South America |

353 | 498 | 2,394 | 3,245 | ||||||||||||

Europe |

1 | 525 | 3,639 | 4,165 | ||||||||||||

Africa |

605 | 880 | 4,596 | 6,081 | ||||||||||||

Asia |

121 | 529 | 2,946 | 3,596 | ||||||||||||

Australia/Oceania |

– | 130 | 768 | 898 | ||||||||||||

Total worldwide |

1,285 | 3,111 | 17,130 | 21,526 | ||||||||||||

During 2008 |

||||||||||||||||

United States |

281 | 453 | 2,739 | 3,473 | ||||||||||||

Canada/South America |

126 | 325 | 1,421 | 1,872 | ||||||||||||

Europe |

25 | 401 | 1,863 | 2,289 | ||||||||||||

Africa |

82 | 686 | 4,783 | 5,551 | ||||||||||||

Asia |

73 | 307 | 3,384 | 3,764 | ||||||||||||

Australia/Oceania |

76 | 100 | 443 | 619 | ||||||||||||

Total worldwide |

663 | 2,272 | 14,633 | 17,568 | ||||||||||||

During 2007 |

||||||||||||||||

United States |

63 | 377 | 1,859 | 2,299 | ||||||||||||

Canada/South America |

93 | 231 | 902 | 1,226 | ||||||||||||

Europe |

– | 229 | 2,016 | 2,245 | ||||||||||||

Africa |

13 | 584 | 2,847 | 3,444 | ||||||||||||

Asia |

21 | 210 | 3,721 | 3,952 | ||||||||||||

Australia/Oceania |

4 | 131 | 225 | 360 | ||||||||||||

Total worldwide |

194 | 1,762 | 11,570 | 13,526 | ||||||||||||

| (1) | Includes non-consolidated interests and Canadian oil sands operations. |

45

|

|

|

46

|

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Liquids, Including Oil Sands and Non-Consolidated Reserves (millions of barrels at year end) | ||||||||||||||||||||

Net proved developed and undeveloped reserves |

||||||||||||||||||||

United States |

2,372 | 2,303 | 1,972 | 1,971 | 2,225 | |||||||||||||||

Canada/South America |

3,894 | 2,946 | 2,918 | 2,683 | 1,633 | |||||||||||||||

Europe |

405 | 454 | 517 | 560 | 699 | |||||||||||||||

Africa |

1,675 | 1,799 | 1,907 | 2,137 | 2,058 | |||||||||||||||

Asia |

3,620 | 3,896 | 4,049 | 4,424 | 4,246 | |||||||||||||||

Australia/Oceania |

262 | 275 | 288 | 231 | 213 | |||||||||||||||

Total worldwide |

12,228 | 11,673 | 11,651 | 12,006 | 11,074 | |||||||||||||||

Proportional interest in oil sands and non-consolidated

reserves included above |

||||||||||||||||||||

United States |

353 | 351 | 356 | 327 | 374 | |||||||||||||||

Canada/South America (bitumen)(2) |

3,106 | 2,102 | 2,055 | 1,767 | 717 | |||||||||||||||

Canada/South America (synthetic oil)(2) |

653 | 681 | 691 | 734 | 694 | |||||||||||||||

Europe |

29 | 31 | 30 | 27 | 26 | |||||||||||||||

Asia |

1,733 | 1,873 | 2,050 | 2,205 | 2,236 | |||||||||||||||

Net proved developed reserves included above |

||||||||||||||||||||

United States |

1,722 | 1,749 | 1,490 | 1,521 | 1,626 | |||||||||||||||

Canada/South America |

1,281 | 1,333 | 1,311 | 1,315 | 1,376 | |||||||||||||||

Europe |

330 | 382 | 386 | 419 | 526 | |||||||||||||||

Africa |

1,050 | 1,055 | 1,122 | 1,284 | 1,202 | |||||||||||||||

Asia |

2,617 | 2,929 | 2,876 | 2,514 | 2,214 | |||||||||||||||

Australia/Oceania |

126 | 139 | 153 | 165 | 185 | |||||||||||||||

Total worldwide |

7,126 | 7,587 | 7,338 | 7,218 | 7,129 | |||||||||||||||

| Natural Gas, Including Non-Consolidated Reserves (billions of cubic feet at year end) | ||||||||||||||||||||

Net proved developed and undeveloped reserves |

||||||||||||||||||||

United States |

26,366 | 26,111 | 11,802 | 11,890 | 13,297 | |||||||||||||||

Canada/South America |

835 | 1,258 | 1,368 | 1,383 | 1,559 | |||||||||||||||

Europe |

13,755 | 14,788 | 16,173 | 17,284 | 18,853 | |||||||||||||||

Africa |

982 | 908 | 920 | 918 | 1,006 | |||||||||||||||

Asia |

27,037 | 28,399 | 30,304 | 32,383 | 31,790 | |||||||||||||||

Australia/Oceania |

7,247 | 7,351 | 7,440 | 2,021 | 1,757 | |||||||||||||||

Total worldwide |

76,222 | 78,815 | 68,007 | 65,879 | 68,262 | |||||||||||||||

Proportional interest in non-consolidated reserves

included above |

||||||||||||||||||||

United States |

112 | 117 | 114 | 112 | 125 | |||||||||||||||

Europe |

10,169 | 10,746 | 11,450 | 11,839 | 12,341 | |||||||||||||||

Asia |

20,566 | 21,139 | 22,001 | 22,526 | 23,186 | |||||||||||||||

Net proved developed reserves included above |

||||||||||||||||||||

United States |

15,533 | 15,441 | 7,582 | 7,931 | 8,477 | |||||||||||||||

Canada/South America |

658 | 1,077 | 1,200 | 1,148 | 1,303 | |||||||||||||||

Europe |

10,629 | 11,683 | 12,782 | 13,710 | 14,743 | |||||||||||||||

Africa |

853 | 711 | 739 | 738 | 773 | |||||||||||||||

Asia |

25,067 | 27,087 | 25,206 | 17,876 | 14,021 | |||||||||||||||

Australia/Oceania |

1,070 | 1,174 | 1,262 | 1,346 | 1,403 | |||||||||||||||

Total worldwide |

53,810 | 57,173 | 48,771 | 42,749 | 40,720 | |||||||||||||||

| (1) | ExxonMobil reserves using SEC historical price bases. Proved reserves as defined by the SEC are based on historical market prices: prior to 2009, the SEC defined price as the market price on December 31; beginning in 2009, the SEC changed the definition to the average of the market prices on the first day of each calendar month during the year. Mining and equity company reserves are included for all periods. See Frequently Used Terms on pages 93 through 95. | |

| (2) | Proved reserves classified as bitumen are associated with the Cold Lake and Kearl projects in Canada. Proved reserves classified as synthetic oil are associated with the Syncrude project in Canada. Cold Lake uses in situ methods, and hydrocarbons are produced from wells drilled into the subsurface. Syncrude is an oil sands mining project which includes an upgrader that converts the mined hydrocarbons into a higher gravity crude oil. Kearl is an oil sands mining project that does not incorporate an upgrader. |

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Oil-Equivalent, Including Oil Sands and Non-Consolidated Reserves (millions of barrels at year end) | ||||||||||||||||||||

Net proved developed and undeveloped reserves |

||||||||||||||||||||

United States |

6,766 | 6,654 | 3,939 | 3,953 | 4,441 | |||||||||||||||

Canada/South America |

4,033 | 3,155 | 3,146 | 2,914 | 1,893 | |||||||||||||||

Europe |

2,698 | 2,919 | 3,212 | 3,441 | 3,841 | |||||||||||||||

Africa |

1,839 | 1,951 | 2,060 | 2,290 | 2,226 | |||||||||||||||

Asia |

8,126 | 8,630 | 9,100 | 9,820 | 9,544 | |||||||||||||||

Australia/Oceania |

1,470 | 1,500 | 1,528 | 568 | 506 | |||||||||||||||

Total worldwide |

24,932 | 24,809 | 22,985 | 22,986 | 22,451 | |||||||||||||||

| (million barrels of oil or billion cubic feet of gas | Average | |||||||||||||||||||||||

| unless specified otherwise) | 2011 | 2010 | 2009 | 2008 | 2007 | 2007-2011 | ||||||||||||||||||

Liquids (millions of barrels) |

||||||||||||||||||||||||

Revisions |

270 | 358 | 361 | 583 | 666 | 447 | ||||||||||||||||||

Improved recovery |

– | 5 | 15 | 6 | 35 | 12 | ||||||||||||||||||

Extensions/discoveries |

1,166 | 185 | 142 | 1,308 | 194 | 599 | ||||||||||||||||||

Purchases |

16 | 378 | – | – | – | 79 | ||||||||||||||||||

Sales |

(54 | ) | (21 | ) | (3 | ) | (86 | ) | (436 | ) | (120 | ) | ||||||||||||

Total additions |

1,398 | 905 | 515 | 1,811 | 459 | 1,017 | ||||||||||||||||||

Production |

843 | 883 | 870 | 879 | 953 | 886 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

172 | 105 | 60 | 216 | 94 | 128 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

166 | 102 | 59 | 206 | 48 | 115 | ||||||||||||||||||

Natural Gas (billions of cubic feet) |

||||||||||||||||||||||||

Revisions |

64 | 879 | 135 | 643 | 4,435 | 1,231 | ||||||||||||||||||

Improved recovery |

– | – | – | 1 | 4 | 1 | ||||||||||||||||||

Extensions/discoveries |

2,682 | 1,988 | 5,694 | 692 | 324 | 2,276 | ||||||||||||||||||

Purchases |

303 | 12,789 | 8 | – | 9 | 2,622 | ||||||||||||||||||

Sales |

(523 | ) | (106 | ) | (13 | ) | (82 | ) | (320 | ) | (209 | ) | ||||||||||||

Total additions |

2,526 | 15,550 | 5,824 | 1,254 | 4,452 | 5,921 | ||||||||||||||||||

Production |

5,119 | 4,742 | 3,696 | 3,637 | 3,750 | 4,189 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

60 | 330 | 158 | 37 | 127 | 146 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

49 | 328 | 158 | 34 | 119 | 141 | ||||||||||||||||||

Oil-Equivalent (millions of barrels) |

||||||||||||||||||||||||

Revisions |

281 | 505 | 383 | 690 | 1,405 | 653 | ||||||||||||||||||

Improved recovery |

– | 5 | 15 | 7 | 36 | 13 | ||||||||||||||||||

Extensions/discoveries |

1,613 | 516 | 1,091 | 1,423 | 248 | 978 | ||||||||||||||||||

Purchases |

67 | 2,510 | 1 | – | 2 | 516 | ||||||||||||||||||

Sales |

(141 | ) | (38 | ) | (5 | ) | (100 | ) | (490 | ) | (155 | ) | ||||||||||||

Total additions |

1,820 | 3,498 | 1,485 | 2,020 | 1,201 | 2,005 | ||||||||||||||||||

Production |

1,697 | 1,674 | 1,486 | 1,485 | 1,578 | 1,584 | ||||||||||||||||||

Reserves replacement ratio,

excluding sales (percent) |

116 | 211 | 100 | 143 | 107 | 136 | ||||||||||||||||||

Reserves replacement ratio,

including sales (percent) |

107 | 209 | 100 | 136 | 76 | 127 | ||||||||||||||||||

| (1) | ExxonMobil reserves using SEC historical price bases. Proved reserves as defined by the SEC are based on historical market prices: prior to 2009, the SEC defined price as the market price on December 31; beginning in 2009, the SEC changed the definition to the average of the market prices on the first day of each calendar month during the year. Mining and equity company reserves are included for all periods. See Frequently Used Terms on pages 93 through 95. | |

| (2) | The term “sales” includes the impact of expropriation of proved reserves in Venezuela (462 million oil-equivalent barrels) in 2007. |

47

|

|

|

48

|

| Crude Oil and Natural Gas Liquids | Bitumen | Synthetic Oil | ||||||||||||||||||||||||||||||||||||||

| Canada/ | Canada/ | Canada/ | ||||||||||||||||||||||||||||||||||||||

| (million barrels of oil or billion cubic feet of gas | United | South | Australia/ | South | South | Liquids | ||||||||||||||||||||||||||||||||||

| unless noted) | States | America | Europe | Africa | Asia | Oceania | Total | America | America | Total | ||||||||||||||||||||||||||||||

Liquids (millions of barrels) |

||||||||||||||||||||||||||||||||||||||||

Revisions |

139 | 13 | 78 | 60 | (75 | ) | 6 | 221 | 53 | (4 | ) | 270 | ||||||||||||||||||||||||||||

Improved recovery |

– | – | – | – | – | – | – | – | – | – | ||||||||||||||||||||||||||||||

Extensions/discoveries |

73 | – | 3 | 1 | 94 | – | 171 | 995 | – | 1,166 | ||||||||||||||||||||||||||||||

Purchases |

16 | – | – | – | – | – | 16 | – | – | 16 | ||||||||||||||||||||||||||||||

Sales |

(5 | ) | (18 | ) | (31 | ) | – | – | – | (54 | ) | – | – | (54 | ) | |||||||||||||||||||||||||

Total additions |

223 | (5 | ) | 50 | 61 | 19 | 6 | 354 | 1,048 | (4 | ) | 1,398 | ||||||||||||||||||||||||||||

Production |

154 | 23 | 99 | 185 | 295 | 19 | 775 | 44 | 24 | 843 | ||||||||||||||||||||||||||||||

Net change |

69 | (28 | ) | (49 | ) | (124 | ) | (276 | ) | (13 | ) | (421 | ) | 1,004 | (28 | ) | 555 | |||||||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

148 | 57 | 82 | 33 | 6 | 32 | 53 | 2,382 | – | 172 | ||||||||||||||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

145 | – | 51 | 33 | 6 | 32 | 46 | 2,382 | – | 166 | ||||||||||||||||||||||||||||||

Natural Gas (billions of cubic feet) |

||||||||||||||||||||||||||||||||||||||||

Revisions |

(235 | ) | 55 | 363 | 113 | (260 | ) | 28 | 64 | |||||||||||||||||||||||||||||||

Improved recovery |

– | – | – | – | – | – | – | |||||||||||||||||||||||||||||||||

Extensions/discoveries |

1,779 | 42 | 42 | – | 819 | – | 2,682 | |||||||||||||||||||||||||||||||||

Purchases |

303 | – | – | – | – | – | 303 | |||||||||||||||||||||||||||||||||

Sales |

(33 | ) | (347 | ) | (143 | ) | – | – | – | (523 | ) | |||||||||||||||||||||||||||||

Total additions |

1,814 | (250 | ) | 262 | 113 | 559 | 28 | 2,526 | ||||||||||||||||||||||||||||||||

Production |

1,559 | 173 | 1,295 | 39 | 1,921 | 132 | 5,119 | |||||||||||||||||||||||||||||||||

Net change |

255 | (423 | ) | (1,033 | ) | 74 | (1,362 | ) | (104 | ) | (2,593 | ) | ||||||||||||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

118 | 56 | 31 | 290 | 29 | 21 | 60 | |||||||||||||||||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

116 | – | 20 | 290 | 29 | 21 | 49 | |||||||||||||||||||||||||||||||||

| (1) | See Frequently Used Terms on pages 93 through 95. |

| (million barrels of oil or billion cubic feet of gas | Average | |||||||||||||||||||||||

| unless noted) | 2011 | 2010 | 2009 | 2008 | 2007 | 2007-2011 | ||||||||||||||||||

Non-U.S. |

||||||||||||||||||||||||

E&P costs (millions of dollars) |

20,024 | 17,619 | 17,985 | 14,095 | 11,227 | 16,190 | ||||||||||||||||||

Liquids reserves additions |

1,175 | 426 | 375 | 1,933 | 368 | 855 | ||||||||||||||||||

Liquids production |

689 | 735 | 731 | 747 | 812 | 743 | ||||||||||||||||||

Gas reserves additions |

712 | 179 | 5,340 | 2,099 | 2,685 | 2,203 | ||||||||||||||||||

Gas production |

3,560 | 3,680 | 3,124 | 3,075 | 3,101 | 3,308 | ||||||||||||||||||

Oil-equivalent reserves additions, excluding sales |

1,425 | 459 | 1,266 | 2,377 | 1,293 | 1,364 | ||||||||||||||||||

Oil-equivalent reserves additions, including sales |

1,295 | 456 | 1,264 | 2,283 | 815 | 1,223 | ||||||||||||||||||

Oil-equivalent production |

1,283 | 1,348 | 1,252 | 1,259 | 1,329 | 1,294 | ||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

111 | 34 | 101 | 189 | 97 | 105 | ||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

101 | 34 | 101 | 181 | 61 | 95 | ||||||||||||||||||

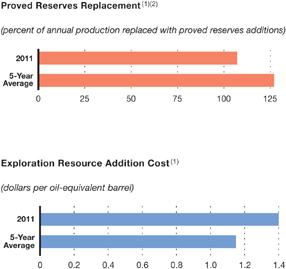

Reserves replacement costs(2) (dollars per barrel) |

14.05 | 38.39 | 14.21 | 5.93 | 8.68 | 11.87 | ||||||||||||||||||

United States |

||||||||||||||||||||||||

E&P costs (millions of dollars) |

11,956 | 54,107 | 3,541 | 3,473 | 2,299 | 15,075 | ||||||||||||||||||

Liquids reserves additions |

223 | 479 | 140 | (122 | ) | 91 | 162 | |||||||||||||||||

Liquids production |

154 | 148 | 139 | 132 | 141 | 143 | ||||||||||||||||||

Gas reserves additions |

1,814 | 15,371 | 484 | (845 | ) | 1,767 | 3,718 | |||||||||||||||||

Gas production |

1,559 | 1,062 | 572 | 562 | 649 | 881 | ||||||||||||||||||

Oil-equivalent reserves additions, excluding sales |

536 | 3,077 | 224 | (257 | ) | 398 | 796 | |||||||||||||||||

Oil-equivalent reserves additions, including sales |

525 | 3,041 | 221 | (263 | ) | 386 | 782 | |||||||||||||||||

Oil-equivalent production |

414 | 325 | 234 | 226 | 249 | 290 | ||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

129 | 947 | 96 | – | 160 | 274 | ||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

127 | 936 | 94 | – | 155 | 270 | ||||||||||||||||||

Reserves replacement costs(2) (dollars per barrel) |

22.31 | 17.58 | 15.81 | – | 5.78 | 18.94 | ||||||||||||||||||

Worldwide |

||||||||||||||||||||||||

E&P costs (millions of dollars) |

31,980 | 71,726 | 21,526 | 17,568 | 13,526 | 31,265 | ||||||||||||||||||

Liquids reserves additions |

1,398 | 905 | 515 | 1,811 | 459 | 1,017 | ||||||||||||||||||

Liquids production |

843 | 883 | 870 | 879 | 953 | 886 | ||||||||||||||||||

Gas reserves additions |

2,526 | 15,550 | 5,824 | 1,254 | 4,452 | 5,921 | ||||||||||||||||||

Gas production |

5,119 | 4,742 | 3,696 | 3,637 | 3,750 | 4,189 | ||||||||||||||||||

Oil-equivalent reserves additions, excluding sales |

1,961 | 3,536 | 1,490 | 2,120 | 1,691 | 2,160 | ||||||||||||||||||

Oil-equivalent reserves additions, including sales |

1,820 | 3,497 | 1,485 | 2,020 | 1,201 | 2,005 | ||||||||||||||||||

Oil-equivalent production |

1,697 | 1,673 | 1,486 | 1,485 | 1,578 | 1,584 | ||||||||||||||||||

Reserves replacement ratio, excluding sales (percent) |

116 | 211 | 100 | 143 | 107 | 136 | ||||||||||||||||||

Reserves replacement ratio, including sales (percent) |

107 | 209 | 100 | 136 | 76 | 127 | ||||||||||||||||||

Reserves replacement costs(2) (dollars per barrel) |

16.31 | 20.28 | 14.45 | 8.29 | 8.00 | 14.47 | ||||||||||||||||||

| (1) | ExxonMobil reserves using SEC historical price bases. Proved reserves as defined by the SEC are based on historical market prices: prior to 2009, the SEC defined price as the market price on December 31; beginning in 2009, the SEC changed the definition to the average of the market prices on the first day of each calendar month during the year. Mining and equity company reserves are included for all periods. See Frequently Used Terms on pages 93 through 95. | |

| (2) | Calculation based on exploration and production costs divided by oil-equivalent reserves additions. All values exclude the impact of asset sales; i.e., reserves sold and proceeds received. |

49

|

|

|

50

|

| Total Revenues and Costs, Including Non-Consolidated Interests and Oil Sands | Revenues and Costs per Unit of Sales or Production(1) | |||||||||||||||||||||||||||||||||||||||||||

| Canada/ | Canada/ | |||||||||||||||||||||||||||||||||||||||||||

| United | South | Australia/ | United | South | Outside | |||||||||||||||||||||||||||||||||||||||

| States | America | Europe | Africa | Asia | Oceania | Total | States | America | Americas | Worldwide | ||||||||||||||||||||||||||||||||||

| 2011 | (millions of dollars) | (dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

14,362 | 7,584 | 10,149 | 20,204 | 29,411 | 1,793 | 83,503 | 92.80 | 83.06 | 102.99 | 98.97 | |||||||||||||||||||||||||||||||||

Natural gas |

4,926 | 494 | 11,278 | 7 | 11,311 | 481 | 28,497 | 3.45 | 3.29 | 7.16 | 5.93 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

19,288 | 8,078 | 21,427 | 20,211 | 40,722 | 2,274 | 112,000 | 49.10 | 69.25 | 74.58 | 68.11 | |||||||||||||||||||||||||||||||||

Less costs: Production costs excluding taxes |

4,589 | 2,751 | 3,037 | 2,608 | 2,050 | 497 | 15,532 | 11.68 | 23.58 | 7.22 | 9.45 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

4,815 | 980 | 2,088 | 2,159 | 2,256 | 236 | 12,534 | 12.26 | 8.40 | 5.94 | 7.62 | |||||||||||||||||||||||||||||||||

Exploration expenses |

278 | 290 | 612 | 233 | 618 | 73 | 2,104 | 0.71 | 2.49 | 1.35 | 1.28 | |||||||||||||||||||||||||||||||||

Taxes other than income |

2,193 | 79 | 3,626 | 2,055 | 8,337 | 295 | 16,585 | 5.58 | 0.68 | 12.61 | 10.08 | |||||||||||||||||||||||||||||||||

Related income tax |

2,445 | 969 | 7,689 | 7,888 | 14,062 | 353 | 33,406 | 6.22 | 8.31 | 26.43 | 20.32 | |||||||||||||||||||||||||||||||||

Results of producing activities |

4,968 | 3,009 | 4,375 | 5,268 | 13,399 | 820 | 31,839 | 12.65 | 25.79 | 21.03 | 19.36 | |||||||||||||||||||||||||||||||||

Other

earnings(2) |

133 | (322 | ) | 2,729 | 88 | (259 | ) | (9 | ) | 2,360 | 0.33 | (2.76 | ) | 2.24 | 1.44 | |||||||||||||||||||||||||||||

Total earnings, excluding power and coal |

5,101 | 2,687 | 7,104 | 5,356 | 13,140 | 811 | 34,199 | 12.98 | 23.03 | 23.27 | 20.80 | |||||||||||||||||||||||||||||||||

Power and coal |

(5 | ) | – | – | – | 245 | – | 240 | ||||||||||||||||||||||||||||||||||||

Total earnings |

5,096 | 2,687 | 7,104 | 5,356 | 13,385 | 811 | 34,439 | |||||||||||||||||||||||||||||||||||||

| 2010 | (millions of dollars) | (dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

10,567 | 6,343 | 8,935 | 17,511 | 19,118 | 1,418 | 63,892 | 70.98 | 66.27 | 74.67 | 73.12 | |||||||||||||||||||||||||||||||||

Natural gas |

3,716 | 707 | 9,358 | 11 | 7,990 | 401 | 22,183 | 3.92 | 3.41 | 5.42 | 5.00 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

14,283 | 7,050 | 18,293 | 17,522 | 27,108 | 1,819 | 86,075 | 46.53 | 54.18 | 54.59 | 53.04 | |||||||||||||||||||||||||||||||||

Less costs: Production costs excluding taxes |

3,275 | 2,612 | 3,011 | 2,215 | 1,628 | 462 | 13,203 | 10.67 | 20.07 | 6.17 | 8.14 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

3,507 | 1,015 | 2,719 | 2,580 | 1,596 | 219 | 11,636 | 11.43 | 7.80 | 6.00 | 7.17 | |||||||||||||||||||||||||||||||||

Exploration expenses |

287 | 464 | 413 | 587 | 362 | 56 | 2,169 | 0.94 | 3.57 | 1.20 | 1.34 | |||||||||||||||||||||||||||||||||

Taxes other than income |

1,220 | 86 | 2,997 | 1,742 | 5,142 | 204 | 11,391 | 3.96 | 0.67 | 8.49 | 7.02 | |||||||||||||||||||||||||||||||||

Related income tax |

2,093 | 715 | 5,543 | 6,068 | 9,147 | 262 | 23,828 | 6.82 | 5.49 | 17.73 | 14.68 | |||||||||||||||||||||||||||||||||

Results of producing activities |

3,901 | 2,158 | 3,610 | 4,330 | 9,233 | 616 | 23,848 | 12.71 | 16.58 | 15.00 | 14.69 | |||||||||||||||||||||||||||||||||

Other

earnings(2) |

379 | (538 | ) | 216 | 96 | (120 | ) | (15 | ) | 18 | 1.23 | (4.13 | ) | 0.15 | 0.02 | |||||||||||||||||||||||||||||

Total earnings, excluding power and coal |

4,280 | 1,620 | 3,826 | 4,426 | 9,113 | 601 | 23,866 | 13.94 | 12.45 | 15.15 | 14.71 | |||||||||||||||||||||||||||||||||

Power and coal |

(8 | ) | – | – | – | 239 | – | 231 | ||||||||||||||||||||||||||||||||||||

Total earnings |

4,272 | 1,620 | 3,826 | 4,426 | 9,352 | 601 | 24,097 | |||||||||||||||||||||||||||||||||||||

| (1) | The per-unit data are divided into two sections: (a) revenue per unit of sales from ExxonMobil’s own production; and, (b) operating costs and earnings per unit of net oil-equivalent production. Units for crude oil and natural gas liquids are barrels, while units for natural gas are thousands of cubic feet. The volumes of crude oil and natural gas liquids production and net natural gas production available for sale used in this calculation are shown on pages 42 and 43. The volumes of natural gas were converted to oil-equivalent barrels based on a conversion factor of 6 thousand cubic feet per barrel. | |

| (2) | Includes earnings related to transportation operations, LNG liquefaction and transportation operations, sale of third-party purchases, technical services agreements, other nonoperating activities, and adjustments for minority interests. |

| Total Revenues and Costs, Including Non-Consolidated Interests and Oil Sands | Revenues and Costs per Unit of Sales or Production(1) | |||||||||||||||||||||||||||||||||||||||||||

| Canada/ | Canada/ | |||||||||||||||||||||||||||||||||||||||||||

| United | South | Australia/ | United | South | Outside | |||||||||||||||||||||||||||||||||||||||

| States | America | Europe | Africa | Asia | Oceania | Total | States | America | Americas | Worldwide | ||||||||||||||||||||||||||||||||||

| 2009 | (millions of dollars) | (dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

7,573 | 5,135 | 7,739 | 14,868 | 12,941 | 1,311 | 49,567 | 54.02 | 51.88 | 58.53 | 57.04 | |||||||||||||||||||||||||||||||||

Natural gas |

1,442 | 748 | 9,080 | 12 | 4,237 | 341 | 15,860 | 3.10 | 3.19 | 5.09 | 4.69 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

9,015 | 5,883 | 16,819 | 14,880 | 17,178 | 1,652 | 65,427 | 41.41 | 43.02 | 46.74 | 45.58 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs

excluding taxes |

2,736 | 2,428 | 2,923 | 2,027 | 1,498 | 386 | 11,998 | 12.57 | 17.75 | 6.32 | 8.36 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

1,833 | 948 | 2,246 | 2,293 | 1,182 | 195 | 8,697 | 8.42 | 6.93 | 5.47 | 6.06 | |||||||||||||||||||||||||||||||||

Exploration expenses |

220 | 339 | 387 | 662 | 393 | 33 | 2,034 | 1.01 | 2.48 | 1.36 | 1.42 | |||||||||||||||||||||||||||||||||

Taxes other than income |

767 | 78 | 2,826 | 1,343 | 3,111 | 252 | 8,377 | 3.52 | 0.57 | 6.97 | 5.83 | |||||||||||||||||||||||||||||||||

Related income tax |

1,127 | 597 | 5,179 | 4,667 | 5,943 | 237 | 17,750 | 5.18 | 4.37 | 14.83 | 12.37 | |||||||||||||||||||||||||||||||||

Results of producing activities |

2,332 | 1,493 | 3,258 | 3,888 | 5,051 | 549 | 16,571 | 10.71 | 10.92 | 11.79 | 11.54 | |||||||||||||||||||||||||||||||||

Other

earnings(2) |

565 | (605 | ) | 325 | 81 | (86 | ) | 36 | 316 | 2.60 | (4.43 | ) | 0.33 | 0.22 | ||||||||||||||||||||||||||||||

Total earnings, excluding power and coal |

2,897 | 888 | 3,583 | 3,969 | 4,965 | 585 | 16,887 | 13.31 | 6.49 | 12.12 | 11.76 | |||||||||||||||||||||||||||||||||

Power and coal |

(4 | ) | – | – | – | 224 | – | 220 | ||||||||||||||||||||||||||||||||||||

Total earnings |

2,893 | 888 | 3,583 | 3,969 | 5,189 | 585 | 17,107 | |||||||||||||||||||||||||||||||||||||

| 2008 | (millions of dollars) | (dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

11,788 | 8,540 | 13,910 | 20,606 | 20,288 | 2,111 | 77,243 | 87.95 | 81.43 | 91.66 | 89.84 | |||||||||||||||||||||||||||||||||

Natural gas |

3,296 | 1,834 | 15,230 | 39 | 7,005 | 389 | 27,793 | 7.23 | 7.82 | 8.59 | 8.35 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

15,084 | 10,374 | 29,140 | 20,645 | 27,293 | 2,500 | 105,036 | 71.73 | 71.23 | 73.74 | 73.19 | |||||||||||||||||||||||||||||||||

Less costs: Production costs excluding taxes |

2,675 | 2,625 | 3,051 | 1,603 | 1,392 | 332 | 11,678 | 12.72 | 18.03 | 5.91 | 8.14 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

1,427 | 1,043 | 2,662 | 2,471 | 1,231 | 179 | 9,013 | 6.79 | 7.16 | 6.06 | 6.28 | |||||||||||||||||||||||||||||||||

Exploration expenses |

189 | 251 | 183 | 439 | 292 | 109 | 1,463 | 0.90 | 1.72 | 0.95 | 1.02 | |||||||||||||||||||||||||||||||||

Taxes other than income |

2,021 | 81 | 4,248 | 1,815 | 5,457 | 665 | 14,287 | 9.61 | 0.55 | 11.29 | 9.95 | |||||||||||||||||||||||||||||||||

Related income tax |

3,191 | 1,813 | 11,979 | 8,119 | 10,691 | 399 | 36,192 | 15.17 | 12.45 | 28.90 | 25.22 | |||||||||||||||||||||||||||||||||

Results of producing activities |

5,581 | 4,561 | 7,017 | 6,198 | 8,230 | 816 | 32,403 | 26.54 | 31.32 | 20.63 | 22.58 | |||||||||||||||||||||||||||||||||

Other

earnings(2) |

687 | (997 | ) | 2,860 | 212 | (45 | ) | 29 | 2,746 | 3.27 | (6.85 | ) | 2.83 | 1.91 | ||||||||||||||||||||||||||||||

Total earnings, excluding power and coal |

6,268 | 3,564 | 9,877 | 6,410 | 8,185 | 845 | 35,149 | 29.81 | 24.47 | 23.46 | 24.49 | |||||||||||||||||||||||||||||||||

Power and coal |

(25 | ) | – | – | – | 278 | – | 253 | ||||||||||||||||||||||||||||||||||||

Total earnings |

6,243 | 3,564 | 9,877 | 6,410 | 8,463 | 845 | 35,402 | |||||||||||||||||||||||||||||||||||||

| 2007 | (millions of dollars) | (dollars per unit of sales) | ||||||||||||||||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||||||||||

Liquids |

8,997 | 6,569 | 11,986 | 17,834 | 15,878 | 1,752 | 63,016 | 62.86 | 55.27 | 69.32 | 66.58 | |||||||||||||||||||||||||||||||||

Natural gas |

3,176 | 1,704 | 9,911 | 21 | 4,763 | 400 | 19,975 | 5.93 | 5.77 | 5.82 | 5.83 | |||||||||||||||||||||||||||||||||

| (dollars per barrel of net oil-equivalent production) | ||||||||||||||||||||||||||||||||||||||||||||

Total revenue |

12,173 | 8,273 | 21,897 | 17,855 | 20,641 | 2,152 | 82,991 | 52.42 | 49.40 | 55.55 | 54.40 | |||||||||||||||||||||||||||||||||

Less costs: |

||||||||||||||||||||||||||||||||||||||||||||

Production costs excluding taxes |

2,275 | 2,206 | 3,243 | 1,180 | 1,163 | 266 | 10,333 | 9.80 | 13.17 | 5.20 | 6.77 | |||||||||||||||||||||||||||||||||

Depreciation and depletion |

1,493 | 1,256 | 2,657 | 2,101 | 1,229 | 172 | 8,908 | 6.43 | 7.50 | 5.47 | 5.85 | |||||||||||||||||||||||||||||||||

Exploration expenses |

282 | 273 | 170 | 470 | 205 | 102 | 1,502 | 1.21 | 1.63 | 0.84 | 0.98 | |||||||||||||||||||||||||||||||||

Taxes other than income |

1,347 | 126 | 2,528 | 1,599 | 3,561 | 570 | 9,731 | 5.80 | 0.75 | 7.33 | 6.38 | |||||||||||||||||||||||||||||||||

Related income tax |

2,429 | 1,190 | 8,190 | 7,263 | 8,140 | 331 | 27,543 | 10.46 | 7.11 | 21.25 | 18.05 | |||||||||||||||||||||||||||||||||

Results of producing activities |

4,347 | 3,222 | 5,109 | 5,242 | 6,343 | 711 | 24,974 | 18.72 | 19.24 | 15.46 | 16.37 | |||||||||||||||||||||||||||||||||

Other earnings(2) |

609 | (504 | ) | 944 | 277 | (13 | ) | (1 | ) | 1,312 | 2.62 | (3.01 | ) | 1.07 | 0.86 | |||||||||||||||||||||||||||||

Total earnings, excluding power and coal |

4,956 | 2,718 | 6,053 | 5,519 | 6,330 | 710 | 26,286 | 21.34 | 16.23 | 16.53 | 17.23 | |||||||||||||||||||||||||||||||||

Power and coal |

(86 | ) | – | – | – | 297 | – | 211 | ||||||||||||||||||||||||||||||||||||

Total earnings |

4,870 | 2,718 | 6,053 | 5,519 | 6,627 | 710 | 26,497 | |||||||||||||||||||||||||||||||||||||

51

|

|

|

54

|

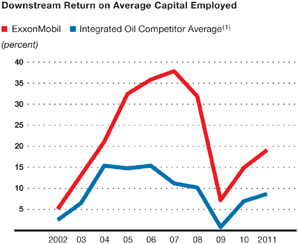

| DOWNSTREAM STATISTICAL RECAP | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Earnings (millions of dollars) |

4,459 | 3,567 | 1,781 | 8,151 | 9,573 | |||||||||||||||

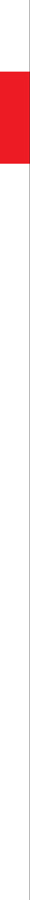

Refinery throughput (thousands of barrels per day) |

5,214 | 5,253 | 5,350 | 5,416 | 5,571 | |||||||||||||||

Petroleum product sales (thousands of barrels per day) |

6,413 | 6,414 | 6,428 | 6,761 | 7,099 | |||||||||||||||

Average capital employed

(1)

(millions of dollars) |

23,388 | 24,130 | 25,099 | 25,627 | 25,314 | |||||||||||||||

Return on average capital employed

(1)

(percent) |

19.1 | 14.8 | 7.1 | 31.8 | 37.8 | |||||||||||||||

Capital

expenditures(1)

(millions of dollars) |

2,120 | 2,505 | 3,196 | 3,529 | 3,303 | |||||||||||||||

55

|

|

|

56

|

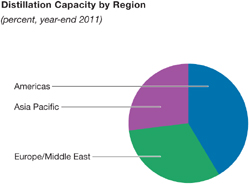

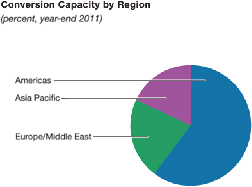

Refinery interests |

36 | |||

Distillation

capacity (barrels per day) |

6.2 million | |||

Lube

basestock capacity (barrels per day) |

131 thousand | |||

Branded service stations |

~25,000 | |||

Commercial customers |

~500,000 |

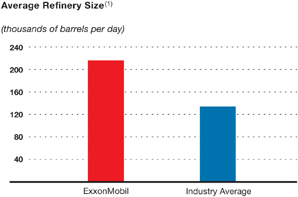

Market position

|

No.1 supplier of lube basestocks

and marketer of synthetic lubricants |

57

|

|

|

58

|

59

|

|

|

60

|

61

|

|

|

62

|

63

|

|

|

64

|

65

|

|

|

66

|

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

Refinery Throughput(2) (thousands of barrels per day) |

||||||||||||||||||||

United States |

1,784 | 1,753 | 1,767 | 1,702 | 1,746 | |||||||||||||||

Canada |

430 | 444 | 413 | 446 | 442 | |||||||||||||||

Europe |

1,528 | 1,538 | 1,548 | 1,601 | 1,642 | |||||||||||||||

Japan |

520 | 536 | 556 | 563 | 618 | |||||||||||||||

Asia Pacific excluding Japan |

660 | 713 | 772 | 789 | 798 | |||||||||||||||

Middle East/Latin America/Other |

292 | 269 | 294 | 315 | 325 | |||||||||||||||

Total worldwide |

5,214 | 5,253 | 5,350 | 5,416 | 5,571 | |||||||||||||||

Average Refining Capacity(3) (thousands of barrels per day) |

||||||||||||||||||||

United States |

1,952 | 1,962 | 1,970 | 1,967 | 1,963 | |||||||||||||||

Canada |

506 | 505 | 502 | 502 | 502 | |||||||||||||||

Europe |

1,752 | 1,744 | 1,742 | 1,740 | 1,759 | |||||||||||||||

Japan |

653 | 681 | 680 | 702 | 769 | |||||||||||||||

Asia Pacific excluding Japan |

1,032 | 1,030 | 1,006 | 992 | 983 | |||||||||||||||

Middle East/Latin America/Other |

331 | 331 | 331 | 330 | 330 | |||||||||||||||

Total worldwide |

6,226 | 6,253 | 6,231 | 6,233 | 6,306 | |||||||||||||||

Utilization of Refining Capacity (percent) |

||||||||||||||||||||

United States |

91 | 89 | 90 | 87 | 89 | |||||||||||||||

Canada |

85 | 88 | 82 | 89 | 88 | |||||||||||||||

Europe |

87 | 88 | 89 | 92 | 93 | |||||||||||||||

Japan |

80 | 79 | 82 | 80 | 80 | |||||||||||||||

Asia Pacific excluding Japan |

64 | 69 | 77 | 80 | 81 | |||||||||||||||

Middle East/Latin America/Other |

88 | 81 | 89 | 95 | 98 | |||||||||||||||

Total worldwide |

84 | 84 | 86 | 87 | 88 | |||||||||||||||

| (1) | Excludes ExxonMobil’s interest in the Laffan Refinery in Qatar and ExxonMobil’s minor interests in certain small refineries. |

| (2) | Refinery throughput includes 100 percent of crude oil and feedstocks sent directly to atmospheric distillation units in operations of ExxonMobil and majority-owned subsidiaries. For companies owned 50 percent or less, throughput includes the greater of either crude and feedstocks processed for ExxonMobil or ExxonMobil’s equity interest in raw material inputs. |

| (3) | Refining capacity is the stream-day capability to process inputs to atmospheric distillation units under normal operating conditions, less the impact of shutdowns for regular repair and maintenance activities, averaged over an extended period of time. These annual averages include partial-year impacts for capacity additions or deletions during the year. Any idle capacity that cannot be made operable in a month or less has been excluded. Capacity volumes include 100 percent of the capacity of refinery facilities managed by ExxonMobil or majority-owned subsidiaries. At facilities of companies owned 50 percent or less, the greater of either that portion of capacity normally available to ExxonMobil or ExxonMobil’s equity interest is included. |

| Capacity at 100% | ||||||||||||||||||||||||||||||||||||

| ExxonMobil | ||||||||||||||||||||||||||||||||||||

| ExxonMobil | Atmospheric | Catalytic | Residuum | Interest | ||||||||||||||||||||||||||||||||

| (thousands of barrels per day) | Share(2) | Distillation | Cracking | Hydrocracking | Conversion(3) | Lubricants(4) | % | |||||||||||||||||||||||||||||

United States |

||||||||||||||||||||||||||||||||||||

Torrance |

California | l | 150 | 150 | 83 | 21 | 50 | 0 | 100 | |||||||||||||||||||||||||||

Joliet |

Illinois | l | 238 | 238 | 94 | 0 | 56 | 0 | 100 | |||||||||||||||||||||||||||

Baton Rouge |

Louisiana | n | l | 502 | 502 | 231 | 25 | 117 | 16 | 100 | ||||||||||||||||||||||||||

Chalmette |

Louisiana | l | 5 | 95 | 189 | 72 | 0 | 29 | 0 | 50 | ||||||||||||||||||||||||||

Billings |

Montana | l | 60 | 60 | 19 | 6 | 10 | 0 | 100 | |||||||||||||||||||||||||||

Baytown |

Texas | n | l | 561 | 561 | 205 | 27 | 90 | 22 | 100 | ||||||||||||||||||||||||||

Beaumont |

Texas | n | l | 345 | 345 | 113 | 60 | 46 | 10 | 100 | ||||||||||||||||||||||||||

Total United States |

1,951 | 2,045 | 817 | 139 | 398 | 48 | ||||||||||||||||||||||||||||||

Canada |

||||||||||||||||||||||||||||||||||||

Strathcona |

Alberta | 189 | 189 | 63 | 0 | 0 | 2 | 69.6 | ||||||||||||||||||||||||||||

Dartmouth |

Nova Scotia | 5 | 85 | 85 | 31 | 0 | 0 | 0 | 69.6 | |||||||||||||||||||||||||||

Nanticoke |

Ontario | 5 | 113 | 113 | 48 | 0 | 0 | 0 | 69.6 | |||||||||||||||||||||||||||

Sarnia |

Ontario | n | l | 119 | 119 | 30 | 18 | 25 | 0 | 69.6 | ||||||||||||||||||||||||||

Total Canada |

506 | 506 | 172 | 18 | 25 | 2 | ||||||||||||||||||||||||||||||

Europe |

||||||||||||||||||||||||||||||||||||

Antwerp |

Belgium | n | l | 307 | 307 | 35 | 0 | 0 | 0 | 100 | ||||||||||||||||||||||||||

Fos-sur-Mer |

France | l | 5 | 129 | 129 | 31 | 0 | 0 | 0 | 82.9 | ||||||||||||||||||||||||||

Port-Jerome- |

||||||||||||||||||||||||||||||||||||

Gravenchon |

France | n | l | 235 | 235 | 39 | 0 | 0 | 13 | 82.9 | ||||||||||||||||||||||||||

Karlsruhe |

Germany | l | 5 | 78 | 310 | 86 | 0 | 30 | 0 | 25 | ||||||||||||||||||||||||||

Augusta |

Italy | l | 5 | 198 | 198 | 50 | 0 | 0 | 14 | 100 | ||||||||||||||||||||||||||

Trecate |

Italy | l | 5 | 174 | 174 | 35 | 0 | 0 | 0 | 74.1 | ||||||||||||||||||||||||||

Rotterdam |

Netherlands | n | l | 191 | 191 | 0 | 52 | 41 | 0 | 100 | ||||||||||||||||||||||||||

Slagen |

Norway | 116 | 116 | 0 | 0 | 32 | 0 | 100 | ||||||||||||||||||||||||||||

Fawley |

United Kingdom | n | l | 330 | 330 | 89 | 0 | 37 | 9 | 100 | ||||||||||||||||||||||||||

Total Europe |

1,758 | 1,990 | 365 | 52 | 140 | 36 | ||||||||||||||||||||||||||||||

Japan |

||||||||||||||||||||||||||||||||||||

Chiba |

Japan | l | 5 | 86 | 172 | 33 | 39 | 0 | 0 | 50 | ||||||||||||||||||||||||||

Kawasaki |

Japan | n | l | 240 | 240 | 87 | 23 | 0 | 0 | 50.1 | ||||||||||||||||||||||||||

Sakai |

Japan | l | 5 | 139 | 139 | 40 | 0 | 0 | 0 | 50.1 | ||||||||||||||||||||||||||

Wakayama |

Japan | l | 5 | 160 | 160 | 37 | 0 | 0 | 7 | 50.1 | ||||||||||||||||||||||||||

Total Japan |

625 | 711 | 197 | 62 | 0 | 7 | ||||||||||||||||||||||||||||||

| (1) | Capacity data is based on 100 percent of rated refinery process unit stream-day capacities under normal operating conditions, less the impact of shutdowns for regular repair and maintenance activities, averaged over an extended period of time. |

| (2) | ExxonMobil share reflects 100 percent of atmospheric distillation capacity in operations of ExxonMobil and majority-owned subsidiaries. For companies owned 50 percent or less, ExxonMobil share is the greater of ExxonMobil’s equity interest or that portion of distillation capacity normally available to ExxonMobil. |

| (3) | Includes thermal cracking, visbreaking, coking, and hydrorefining processes. |

| (4) | Lubes capacity based on dewaxed oil production. |

| (5) | Announced divestment in 2011. |

| (6) | Financial results incorporated into Upstream business. |

67

|

|

|

68

|

| Capacity at 100% | ||||||||||||||||||||||||||||||||||||

| ExxonMobil | ||||||||||||||||||||||||||||||||||||

| ExxonMobil | Atmospheric | Catalytic | Residuum | Interest | ||||||||||||||||||||||||||||||||

| (thousands of barrels per day) | Share(2) | Distillation | Cracking | Hydrocracking | Conversion(3) | Lubricants(4) | % | |||||||||||||||||||||||||||||

| Asia Pacific excluding Japan | ||||||||||||||||||||||||||||||||||||

Altona |

Australia | 5 | 78 | 78 | 28 | 0 | 0 | 0 | 100 | |||||||||||||||||||||||||||

Fujian |

China | n | l | 63 | 252 | 37 | 41 | 10 | 0 | 25 | ||||||||||||||||||||||||||

Port Dickson(5) |

Malaysia | 86 | 86 | 0 | 0 | 0 | 0 | 65 | ||||||||||||||||||||||||||||

Whangarei |

New Zealand | 27 | 134 | 0 | 31 | 0 | 0 | 19.2 | ||||||||||||||||||||||||||||

Jurong/PAC |

Singapore | n | l | 605 | 605 | 0 | 36 | 106 | 38 | 100 | ||||||||||||||||||||||||||

Sriracha |

Thailand | n | l | 174 | 174 | 42 | 0 | 0 | 0 | 66 | ||||||||||||||||||||||||||

Total Asia Pacific excluding Japan |

1,033 | 1,329 | 107 | 108 | 116 | 38 | ||||||||||||||||||||||||||||||

Middle East |

||||||||||||||||||||||||||||||||||||

Laffan(6) |

Qatar | 14 | 139 | 0 | 0 | 0 | 0 | 10 | ||||||||||||||||||||||||||||

Yanbu |

Saudi Arabia | 200 | 400 | 91 | 0 | 46 | 0 | 50 | ||||||||||||||||||||||||||||

Total Middle East |

214 | 539 | 91 | 0 | 46 | 0 | ||||||||||||||||||||||||||||||

Latin America/Other |

||||||||||||||||||||||||||||||||||||

Campana(5) |

Argentina | l | 5 | 87 | 87 | 27 | 0 | 24 | 0 | 100 | ||||||||||||||||||||||||||

Acajutla(5) |

El Salvador | 22 | 22 | 0 | 0 | 0 | 0 | 65 | ||||||||||||||||||||||||||||

Martinique |

Martinique | 2 | 17 | 0 | 0 | 0 | 0 | 14.5 | ||||||||||||||||||||||||||||

Managua(5) |

Nicaragua | 5 | 20 | 20 | 0 | 0 | 0 | 0 | 100 | |||||||||||||||||||||||||||

Total Latin America/Other |

131 | 146 | 27 | 0 | 24 | 0 | ||||||||||||||||||||||||||||||

Total worldwide |

6,218 | 7,266 | 1,776 | 379 | 749 | 131 | ||||||||||||||||||||||||||||||

| (number of sites at year end) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Worldwide |

||||||||||||||||||||

Owned/leased |

7,753 | 8,710 | 9,965 | 10,516 | 11,446 | |||||||||||||||

Distributors/resellers |

17,267 | 17,568 | 17,755 | 18,158 | 20,940 | |||||||||||||||

Total worldwide |

25,020 | 26,278 | 27,720 | 28,674 | 32,386 | |||||||||||||||

| (thousands of barrels per day) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

United States |

||||||||||||||||||||

Motor gasoline, naphthas |

1,372 | 1,445 | 1,425 | 1,449 | 1,601 | |||||||||||||||

Heating oils, kerosene, diesel oils |

564 | 480 | 517 | 501 | 470 | |||||||||||||||

Aviation fuels |

178 | 181 | 207 | 224 | 235 | |||||||||||||||

Heavy fuels |

129 | 122 | 106 | 108 | 121 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

287 | 283 | 268 | 258 | 290 | |||||||||||||||

Total United States |

2,530 | 2,511 | 2,523 | 2,540 | 2,717 | |||||||||||||||

Canada |

||||||||||||||||||||

Motor gasoline, naphthas |

219 | 217 | 199 | 203 | 207 | |||||||||||||||

Heating oils, kerosene, diesel oils |

126 | 125 | 119 | 131 | 139 | |||||||||||||||

Aviation fuels |

31 | 27 | 23 | 25 | 25 | |||||||||||||||

Heavy fuels |

29 | 27 | 27 | 30 | 33 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

50 | 54 | 45 | 55 | 57 | |||||||||||||||

Total Canada |

455 | 450 | 413 | 444 | 461 | |||||||||||||||

Europe |

||||||||||||||||||||

Motor gasoline, naphthas |

433 | 423 | 409 | 409 | 414 | |||||||||||||||

Heating oils, kerosene, diesel oils |

706 | 707 | 710 | 730 | 723 | |||||||||||||||

Aviation fuels |

116 | 116 | 127 | 149 | 177 | |||||||||||||||

Heavy fuels |

166 | 179 | 175 | 183 | 220 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

175 | 186 | 204 | 241 | 239 | |||||||||||||||

Total Europe |

1,596 | 1,611 | 1,625 | 1,712 | 1,773 | |||||||||||||||

Asia Pacific |

||||||||||||||||||||

Motor gasoline, naphthas |

347 | 365 | 379 | 378 | 403 | |||||||||||||||

Heating oils, kerosene, diesel oils |

405 | 432 | 455 | 467 | 477 | |||||||||||||||

Aviation fuels |

102 | 95 | 116 | 123 | 111 | |||||||||||||||

Heavy fuels |

213 | 209 | 234 | 238 | 276 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

137 | 140 | 145 | 153 | 152 | |||||||||||||||

Total Asia Pacific |

1,204 | 1,241 | 1,329 | 1,359 | 1,419 | |||||||||||||||

Latin America |

||||||||||||||||||||

Motor gasoline, naphthas |

79 | 80 | 83 | 139 | 151 | |||||||||||||||

Heating oils, kerosene, diesel oils |

111 | 113 | 113 | 161 | 173 | |||||||||||||||

Aviation fuels |

31 | 29 | 28 | 45 | 48 | |||||||||||||||

Heavy fuels |

31 | 34 | 33 | 47 | 48 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

24 | 24 | 22 | 27 | 27 | |||||||||||||||

Total Latin America |

276 | 280 | 279 | 419 | 447 | |||||||||||||||

Middle East/Africa |

||||||||||||||||||||

Motor gasoline, naphthas |

91 | 81 | 78 | 76 | 74 | |||||||||||||||

Heating oils, kerosene, diesel oils |

107 | 94 | 99 | 106 | 112 | |||||||||||||||

Aviation fuels |

34 | 28 | 35 | 41 | 45 | |||||||||||||||

Heavy fuels |

20 | 32 | 23 | 30 | 17 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

100 | 86 | 24 | 34 | 34 | |||||||||||||||

Total Middle East/Africa |

352 | 321 | 259 | 287 | 282 | |||||||||||||||

Worldwide |

||||||||||||||||||||

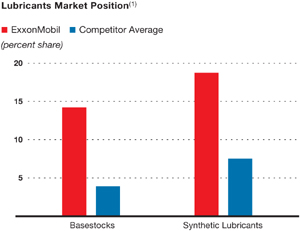

Motor gasoline, naphthas |

2,541 | 2,611 | 2,573 | 2,654 | 2,850 | |||||||||||||||

Heating oils, kerosene, diesel oils |

2,019 | 1,951 | 2,013 | 2,096 | 2,094 | |||||||||||||||

Aviation fuels |

492 | 476 | 536 | 607 | 641 | |||||||||||||||

Heavy fuels |

588 | 603 | 598 | 636 | 715 | |||||||||||||||

Lubricants, specialty, and other petroleum products |

773 | 773 | 708 | 768 | 799 | |||||||||||||||

Total worldwide |

6,413 | 6,414 | 6,428 | 6,761 | 7,099 | |||||||||||||||

| (1) | Petroleum product sales include 100 percent of the sales of ExxonMobil and majority-owned subsidiaries, and the ExxonMobil equity interest in sales by companies owned 50 percent or less. |

69

|

|

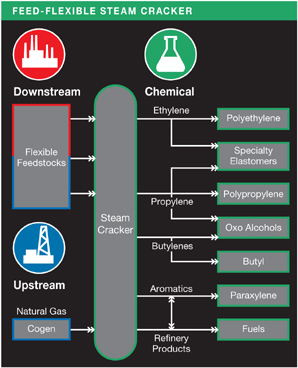

| Our Baytown chemical facilities are fully integrated with our adjacent refinery, which together comprise our largest manufacturing location in the United States. The plant is capable of producing 2.2 million tonnes per year of ethylene, a key raw material for plastics. |

|

72

|

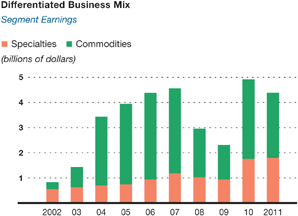

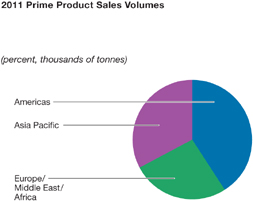

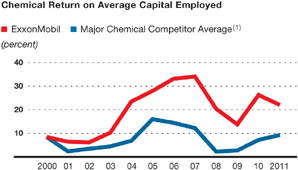

| CHEMICAL STATISTICAL RECAP | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Earnings (millions of dollars) |

4,383 | 4,913 | 2,309 | 2,957 | 4,563 | |||||||||||||||

Prime product sales(1) (thousands of tonnes) |

25,006 | 25,891 | 24,825 | 24,982 | 27,480 | |||||||||||||||

Average capital employed(2) (millions of dollars) |

19,798 | 18,680 | 16,560 | 14,525 | 13,430 | |||||||||||||||

Return on average capital employed(2) (percent) |

22.1 | 26.3 | 13.9 | 20.4 | 34.0 | |||||||||||||||

Capital expenditures(2) (millions of dollars) |

1,450 | 2,215 | 3,148 | 2,819 | 1,782 | |||||||||||||||

| (1) | Prime product sales include ExxonMobil’s share of equity-company volumes and finished-product transfers to the Downstream. | |

| (2) | See Frequently Used Terms on pages 93 through 95. |

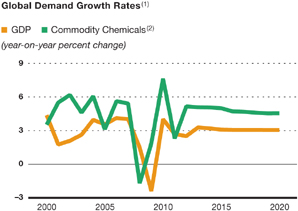

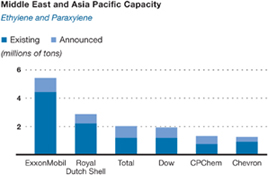

| (1) ExxonMobil estimates

for chemical growth and third-party consensus opinion for GDP. |

||

| (2) | Includes polyethylene, polypropylene, and paraxylene. | |

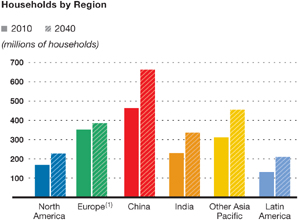

| (1) | Includes Russia/Caspian. | |

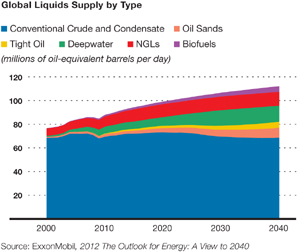

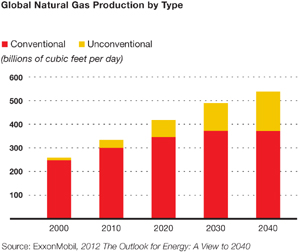

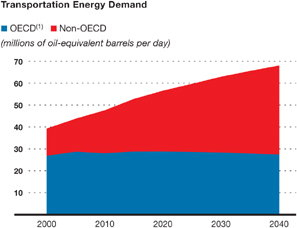

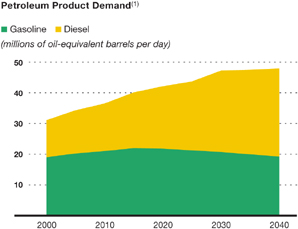

| Source: ExxonMobil, 2012 The Outlook for Energy: A View to 2040 | ||

73

|

|

|

74

|

|

|

75

|

|

|

76

|

Approved Chemical Capacity Additions |

||||

| Capacity | ||||

| (thousand tonnes per year) | Addition | |||

Singapore |

||||

Ethylene |

1000 | |||

Polyethylene |

1300 | |||

Polypropylene |

500 | |||

Specialty Elastomers |

300 | |||

Benzene |

340 | |||

Oxo Alcohol |

125 | |||

Baytown, United States |

||||

Synthetic lubricant basestock |

50 | |||

77

|

|

|

78

|

79

|

|

|

80

|

81

|

|

|

82

|

| (millions of tonnes per year) | Ethylene | Polyethylene | Polypropylene | Paraxylene | Additional Products | ||||||||||||||

North America |

|||||||||||||||||||

Baton Rouge, Louisiana |

1.0 | 1.3 | 0.4 | – | P B E A F O | ||||||||||||||

Baytown, Texas |

2.2 | – | 0.8 | 0.6 | P B F | ||||||||||||||

Beaumont, Texas |

0.8 | 1.0 | – | 0.3 | P S | ||||||||||||||

Mont Belvieu, Texas |

– | 1.0 | – | – | |||||||||||||||

Sarnia, Ontario |

0.3 | 0.5 | – | – | P F O | ||||||||||||||

Europe |

|||||||||||||||||||

Antwerp, Belgium |

0.5 | 0.4 | – | – | P F O | ||||||||||||||

Fawley, United Kingdom |

– | – | – | – | B F O | ||||||||||||||

Fife, United Kingdom |

0.4 | – | – | – | |||||||||||||||

Meerhout, Belgium |

– | 0.5 | – | – | |||||||||||||||

Notre-Dame-de- Gravenchon, France |

0.4 | 0.4 | 0.3 | – | P B E A O S Z | ||||||||||||||

Rotterdam, Netherlands |

– | – | – | 0.7 | O | ||||||||||||||

Middle East |

|||||||||||||||||||

Al Jubail, Saudi Arabia |

0.6 | 0.6 | – | – | |||||||||||||||

Yanbu, Saudi Arabia |

1.0 | 0.7 | 0.2 | – | P | ||||||||||||||

Asia Pacific |

|||||||||||||||||||

Fujian, China |

0.2 | 0.2 | 0.1 | 0.2 | P | ||||||||||||||

Kawasaki, Japan |

0.5 | 0.1 | – | – | P B A F | ||||||||||||||

Singapore |

0.9 | 0.6 | 0.4 | 0.9 | P F O Z | ||||||||||||||

Sriracha, Thailand |

– | – | – | 0.5 | F | ||||||||||||||

All other |

– | – | – | 0.6 | |||||||||||||||

Total worldwide |

8.8 | 7.3 | 2.2 | 3.8 | |||||||||||||||

| (1) | Based on size or breadth of product slate. | |

| (2) | Capacity reflects 100 percent for operations of ExxonMobil and majority-owned subsidiaries. For companies owned 50 percent or less, capacity is ExxonMobil’s interest. |