Filed by Exxon Mobil Corporation (Commission File No.: 001-02256)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Pioneer Natural Resources Company

(Commission File No.: 001-13245)

The following communication was presented in Exxon Mobil Corporation's third-quarter 2023 earnings call on 10/27/2023.

Jennifer Driscoll

Good morning, everyone. Welcome to ExxonMobil’s third-quarter 2023 earnings call. We appreciate your joining the call today. I’m Jennifer Driscoll, Vice President - Investor Relations. I’m joined by Darren Woods, Chairman and CEO; Kathy Mikells, Senior Vice President, and CFO; and Neil Chapman, Senior Vice President.

This presentation and prerecorded remarks are available on the Investors section of our website. They are meant to accompany the third-quarter earnings release, which is posted in the same location.

In conjunction with our recent announcements regarding Pioneer Natural Resources and Denbury, we’ve included additional information on slide 2 related to comments or information included in today’s presentation.

Please be aware that this presentation is not intended to be a solicitation of any vote or approval.

During today’s presentation, we’ll make forward-looking statements, which are subject to risks and uncertainties. Please read our cautionary statement on slide 3. You can find more information on the risks and uncertainties that apply to any forward-looking statements in our SEC filings on our website. Please note that we also provided supplemental information at the end of our earnings slides, which are posted on the website.

And now, please turn to slide 4 for Darren’s opening remarks.

Darren Woods

Good morning. Thanks for joining us today.

We delivered another robust quarter of earnings, cash flow, and shareholder returns, reflecting our ongoing efforts to structurally improve our company and drive sustained industry-leading performance.

We reported $9.1 billion of earnings – an increase of $1.2 billion compared to the last quarter. While the market provided a bit of a tailwind, our success was enabled by the continued strength of our operational performance, which reflects the hard work of our people across the company. Whether it’s continuing to drive efficiencies in maintenance and turnarounds, running at high throughputs and utilization rates, or delivering big projects at first-quintile cost and schedule, the excellent work of our people underpins our results and sustains our drive to deliver industry-leading performance in everything we do. Their work is fundamentally strengthening the underlying earnings power of the company, establishing a strong foundation to deliver industry-leading results in any price environment.

Consistent with our capital allocation strategy, we continue to share the success of the company with our shareholders. This morning, we were pleased to announce a 4% increase to the quarterly dividend, to $0.95 cents per share. This year is our 41st consecutive year of annual dividend increases, a record that we’re proud of and that we know our investors value highly.

We continue to strengthen our portfolio of businesses by investing in advantaged, high-return opportunities while divesting businesses that are no longer a strategic fit. During the quarter,

we closed on the sale of our Thailand refinery, bringing our year-to-date cash proceeds from asset sales to more than $3 billion. We followed this in October with the close of the refinery sale in Italy.

Recently announced acquisitions are great examples of the “and” equation: meeting the world’s needs for energy and essential products AND reducing emissions.

Acquiring Denbury strengthens our position to economically reduce emissions in hard-to- decarbonize industries, which today have limited practical options. We see the potential to drive strong returns with the capacity to reduce the nation’s carbon emissions by 100 million tons per year.i That’s 20 times our current CO2 offtake agreements with CF Industries, Linde, and Nucor – which, by themselves, could reduce CO2 emissions by an amount equivalent to replacing 2 million cars with EVs, roughly the same number of electric vehicles currently on U.S. roads.ii We expect to close the transaction in early November, with Denbury shareholders scheduled to vote next week.

Earlier this month, we signed an agreement to acquire Pioneer Natural Resources in another all- stock transaction. This combination will further strengthen our already advantaged Upstream portfolio and create significant value for the shareholders of both companies. Together we will recover more resource, more efficiently, and with a lower environmental impact. We plan to accelerate Pioneer’s Permian net zero ambition by 15 years and fully leverage their advances in water recycling. This deal is a win any way you look at it: good for our shareholders, good for the environment, good for the economy, and good for U.S. energy security. Neil will say more about the benefits of the transaction in a few moments.

We’re also continuing to drive profitable growth organically. In Energy Products, we achieved the highest third-quarter refinery throughput on record, driven by our Beaumont refinery expansion. At a time of strong demand and low inventories, this project is providing 250,000 barrels per day of much-needed new capacity to the market.

In addition, we recently started up our Baytown Chemical expansion, which grows volume and improves mix. It provides 750,000 tons per year of new performance chemical capacity – including 350,000 tons of Linear Alpha Olefins, marking our entry into this growing market.

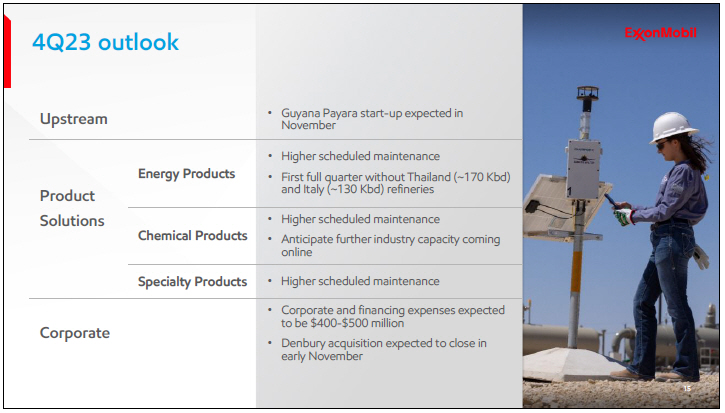

Looking ahead to the fourth quarter, we expect higher Upstream volumes primarily driven by growth from our advantaged assets, including start-up of the Guyana Payara development next month. We continue to expect annual average net production in 2023 to be about 3.7 million oil- equivalent barrels per day.

In Product Solutions, we expect higher scheduled maintenance.

In Energy Products, the fourth quarter will be the first full quarter without the Thailand and Italy refineries. The two sites had combined capacity of approximately 300 Kbd. While we don’t guide forward quarter price and margins, I’d note that industry refining margins began to decline in mid-September with that trend continuing in October.

In Chemical Products, we expect further industry capacity coming online.

Corporate and financing expenses are anticipated to be between $400 million and $500 million in the fourth quarter. I’d also note that we typically see seasonally higher operating expenses across our businesses in the fourth quarter. For details on that, you can see prior-year quarterly operating expense trends in the Financial and Operating data tables posted to the Resources section of our investor relations website.

Denbury is holding its special shareholders meeting on October 31st, and we expect to close the acquisition soon after that, triggering the issuance of about 45 million shares of common stock.

And with that, I’ll turn it over to Neil.

Neil Chapman

Thank you, Kathy. Hello, everyone.

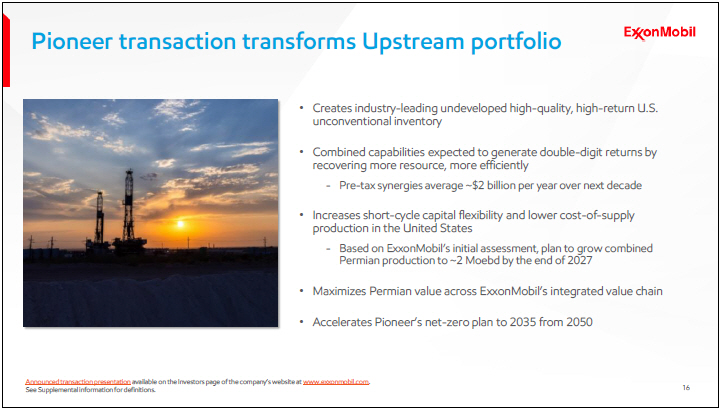

As we shared with you recently, Pioneer is arguably the best Permian pure-play company with the largest undeveloped tier-one inventory in the Midland basin.

Pioneer’s premier asset base is matched by the quality of its workforce. Its employees are innovative and hard-working, and possess a deep knowledge of unconventional operations in the Permian. When you combine these attributes with our technology and industry-leading operational capabilities, we’re confident we can unlock far more value together than either of us could do alone.

We expect synergies of approximately $1 billion before tax annually beginning in the second year post-closing and an average of about $2 billion per year over the next decade, driving double-digit returns.

This transaction not only strengthens our current position, but it also transforms our portfolio – increasing our exposure to short-cycle, low cost-of-supply liquids in the United States. Based on our initial assessment, we expect our combined Permian production to increase to approximately 2 million oil-equivalent barrels per day by the end of 2027.

Downstream, this merger also increases the integration between high-value, light Permian crude and our premier refinery and chemical footprint on the U.S. Gulf Coast.

Finally, we’ve said many times that we’re working to solve the “and” equation, providing the energy and products society needs AND reducing emissions, both ours and others’.

This transaction reflects both parts of our commitment. We will increase our Permian production with plans to accelerate Pioneer’s net-zero plan to 2035 from 2050 and decrease our combined Permian emissions.

Over the next few charts, I’ll provide additional context on the expected synergies resulting from the merger.

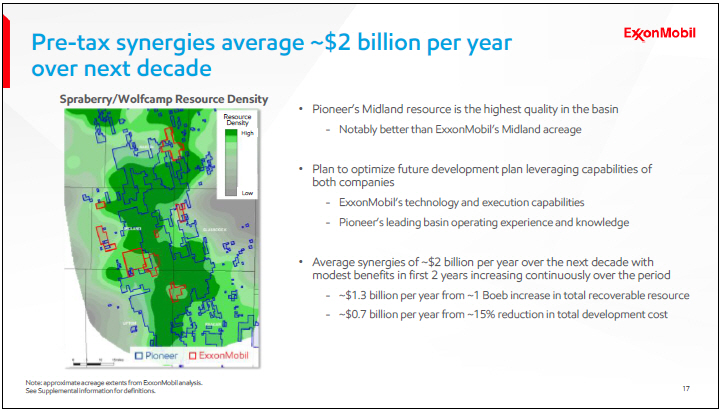

To explain this further, it’s important to recognize that Pioneer’s highly contiguous, tier one acreage is the best in the basin, and is notably higher quality than ExxonMobil’s Midland footprint.

By combining Pioneer’s assets, experience, and knowledge with ExxonMobil’s industry-leading technology, development philosophy, and execution capabilities, we’ll create an optimized field development plan that significantly enhances value.

We expect to see an improvement in recovery from Pioneer’s undeveloped resource simply by applying the technology and techniques we’re already using in our own Permian operations.

This will result in better recovery rates than either of us are achieving today, and represents the most material component of our synergies moving forward.

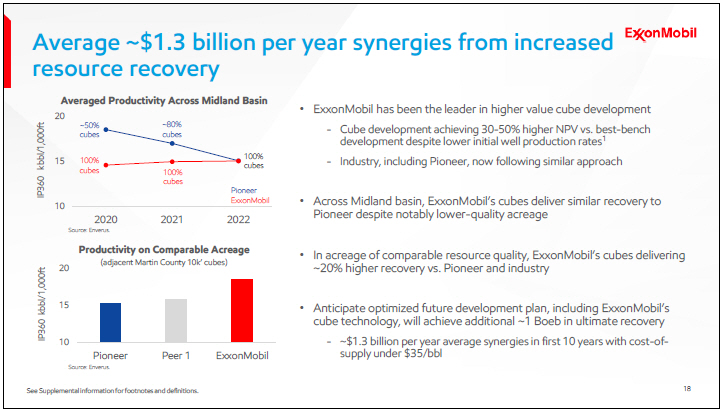

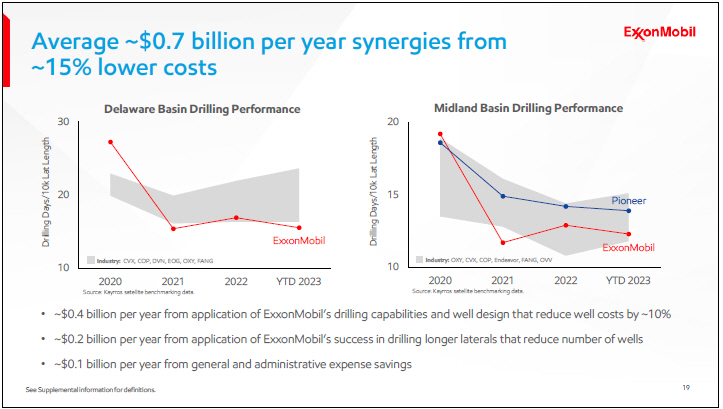

Breaking down the $2 billion of annual synergies - $1.3 billion per year comes from an increase in total recoverable resource of one billion oil-equivalent barrels over the field life. The remaining $700 million per year is largely achieved from a reduction of approximately 15% in total development cost.

It is now widely accepted that cube developments achieve a significantly higher net present value than a best-bench approach. ExxonMobil was an early adopter of this philosophy, drilling our first cube in 2018.

Since 2020 we’ve exclusively progressed cube developments and created a differentiated position in our cube performance. In these developments, we drill wells in multiple benches and produce all the connected, stacked resources simultaneously. This approach minimizes well interference, optimizes long-term recovery, and maximizes value, despite lower initial well production rates.

The rest of industry has now recognized this and has been following suit. The chart on the top left illustrates productivity for ExxonMobil and Pioneer across all the Midland Basin assets. It demonstrates that in 2022, ExxonMobil’s cubes delivered similar recoveries to Pioneer despite our notably lower quality resource.

The chart on the bottom reinforces this further, illustrating cube productivity on comparable acreage for three operators in adjacent positions in Martin County. To derive a true comparison of differing development approaches, the resource quality has to be the same.

Assessing performance over an extended geography, such as across a county or the whole basin, will provide misleading results. The bottom chart demonstrates that when normalized for resource quality, ExxonMobil’s advantaged cubes recover significantly more than industry, including Pioneer.

Overall, we expect our optimized development plan, combined with other proprietary technologies, will result in an incremental recovery of approximately one billion oil-equivalent barrels, at a very competitive cost-of-supply.

Our drilling and completions performance is industry leading. Our teams continue to set records for drilling efficiency. Recently, we drilled a 3-mile well in the Delaware Basin in under 12 days; it’s an extraordinary achievement.

In the Midland Basin, as shown on the right-hand chart, our drilling and completion performance combined with a lower-cost well design is expected to reduce Pioneer well costs by around 10%.

We’re also the leader in length of horizontal wells. We’ve already drilled well over one hundred 3-mile laterals to access even more resource from the same well, while maintaining equivalent recovery per foot. With a development program that requires fewer wells, we’ll increase overall capital efficiency and reduce total development costs.

In summary, the combined capabilities from this merger will enable us to get more resource out of the ground, more efficiently, with a faster trajectory to net zero in the Permian. It’s as simple as that.

Now, let me turn it back to Darren.

Darren Woods

Thanks, Neil. I’ll close with a few key takeaways.

First and foremost, I want to recognize and thank our people. Through their hard work and commitment, we delivered another quarter of strong operational and financial performance. Their relentless focus on safety, the environment, and value led to another strong quarter and an even stronger foundation for continued growth in value while reducing emissions.

We’ve challenged ourselves to strengthen our advantages – and grow our lead over competition. The organization is delivering. We are driving higher throughput and utilization, executing large projects at industry-leading pace and cost, growing performance product sales and exceeding our planned structural savings to name just a few.

Our strong cash flow generation and balance sheet continue to support a robust and balanced program of dividends and share repurchases.

Looking to the future, we’re strengthening our portfolio of businesses through advantaged growth, both organically and inorganically. We have a compelling set of strategic projects to deliver value in the years ahead, including developments in Guyana and the Permian, a portfolio of LNG opportunities, and our first Chemical plant in Guangdong Province, China.

The planned Denbury and Pioneer transactions provide additional opportunities to leverage our competitive advantages and create value, for both our shareholders and society.

As we head towards the end of the year, I remain confident in our strategy and am pleased with the delivery of our plans. We are providing the energy and products society needs, lowering our emissions intensity and helping others to lower theirs, and delivering attractive returns to our shareholders.

That’s a winning proposition. Thank you.

i Subject to additional investment by ExxonMobil and permitting for carbon capture and storage projects.

ii ExxonMobil analysis based on assumptions for U.S. in 2022, including average distance traveled, fuel efficiency, average power grid carbon intensity, electric vehicle charging efficiency and other factors. Gas-powered cars include light-duty vehicles (cars, light trucks and SUVs).

Important Information about the Pioneer Transaction and the Denbury Transaction and Where to Find It

In connection with the proposed transaction between Exxon Mobil Corporation (“ExxonMobil”) and Pioneer Natural Resources Company (“Pioneer”) (the “Pioneer Transaction”), ExxonMobil and Pioneer will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 filed by ExxonMobil that will include a proxy statement of Pioneer that also constitutes a prospectus of ExxonMobil. A definitive proxy statement/prospectus will be mailed to stockholders of Pioneer.

In connection with the proposed transaction between ExxonMobil and Denbury Inc. (“Denbury”) (the “Denbury Transaction”), ExxonMobil and Denbury have filed and will file relevant materials with the SEC. On August 29, 2023, ExxonMobil filed with the SEC a registration statement on Form S-4, as amended (No. 333-274252) to register the shares of ExxonMobil common stock to be issued in connection with the Denbury Transaction. The registration statement, which was declared effective by the SEC on September 29, 2023, includes a definitive proxy statement of Denbury that also constitutes a prospectus of ExxonMobil. Such definitive proxy statement/prospectus was mailed to the stockholders of Denbury on September 29, 2023.

This communication is not a substitute for the registration statement, proxy statement or prospectus or any other document that ExxonMobil, Pioneer or Denbury (as applicable) has filed or may file with the SEC in connection with the Pioneer Transaction or the Denbury Transaction (as applicable).

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EXXONMOBIL, PIONEER AND DENBURY ARE URGED TO READ THE APPLICABLE REGISTRATION STATEMENT, THE APPLICABLE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS (AS APPLICABLE), CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PIONEER TRANSACTION OR THE DENBURY TRANSACTION (AS APPLICABLE) AND RELATED MATTERS.

Investors and security holders may obtain free copies of the applicable registration statement and the proxy statement/prospectus (in the case of the Pioneer Transaction, when they become available), as well as other filings containing important information about ExxonMobil, Pioneer or Denbury, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by ExxonMobil are and will be available free of charge under the tab “SEC Filings” on the “Investors” page of ExxonMobil’s internet website at www.exxonmobil.com or by contacting ExxonMobil’s Investor Relations Department at investor.relations@exxonmobil.com. Copies of the documents filed with the SEC by Pioneer are and will be available free of charge on Pioneer’s internet website at https:// investors.pxd.com/investors/financials/sec-filings/. Copies of the documents filed with the SEC by Denbury are and will be available free of charge on Denbury’s internet website at https://investors.denbury.com/investors/financial-information/sec-filings/ or by directing a request to Denbury Inc., ATTN: Investor Relations, 5851 Legacy Circle, Suite 1200, Plano, TX 75024, Tel. No. (972) 673-2000 or by contacting Denbury’s Investor Relations Department at IR@denbury.com. The information included on, or accessible through, ExxonMobil’s, Pioneer’s or Denbury’s website is not incorporated by reference into this communication.

Participants in the Solicitations

ExxonMobil, Pioneer, Denbury, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the Pioneer Transaction or the Denbury Transaction (as applicable). Information about the directors and executive officers of Pioneer is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 23, 2023, in its Form 8-K filed on May 30, 2023, in its Form 8-K filed on April 26, 2023 and in its Form 8-K filed on February 13, 2023. Information about the directors and executive officers of Denbury is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 18, 2023, and in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 23, 2023. Information about the directors and executive officers of ExxonMobil is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 22, 2023, in its Form 8-K filed on June 6, 2023 and in its Form 8-K filed on February 24, 2023. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, is (or, in the case of the Pioneer Transaction, will be) contained in the applicable proxy statement/prospectus and will be contained in other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the Pioneer Transaction or Denbury Transaction, as applicable, and the anticipated benefits thereof. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of ExxonMobil, Pioneer, or Denbury, as applicable, that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the Pioneer Transaction or Denbury Transaction, as applicable, on anticipated

terms and timing, or at all, including obtaining regulatory approvals that may be required on anticipated terms, and Pioneer stockholder approval (in the case of the Pioneer Transaction) and Denbury stockholder approval (in the case of the Denbury Transaction); anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the Pioneer Transaction or Denbury Transaction, as applicable, including the possibility that any of the anticipated benefits of the Pioneer Transaction or Denbury Transaction, as applicable, will not be realized or will not be realized within the expected time period; the ability of ExxonMobil, Pioneer (in the case of the Pioneer Transaction) and Denbury (in the case of the Denbury Transaction), as applicable, to integrate the business successfully and to achieve anticipated synergies and value creation; potential litigation relating to the Pioneer Transaction or the Denbury Transaction, as applicable, that could be instituted against ExxonMobil, Pioneer or their respective directors (in the case of the Pioneer Transaction), or Denbury or their respective directors (in the case of the Denbury Transaction); the risk that disruptions from the Pioneer Transaction or Denbury Transaction, as applicable, will harm ExxonMobil’s, Pioneer’s business (in the case of the Pioneer Transaction) or Denbury’s business (in the case of the Denbury Transaction), including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Pioneer Transaction or Denbury Transaction, as applicable; rating agency actions and ExxonMobil, Pioneer’s (in the case of the Pioneer Transaction) or Denbury’s (in the case of the Denbury Transaction), as applicable, ability to access short- and long-term debt markets on a timely and affordable basis; legislative, regulatory and economic developments, including regulatory implementation of the Inflation Reduction Act, timely and attractive permitting for carbon capture and storage by applicable federal and state regulators, and other regulatory actions targeting public companies in the oil and gas industry and changes in local, national, or international laws, regulations, and policies affecting ExxonMobil, Pioneer (in the case of the Pioneer Transaction) or Denbury (in the case of the Denbury Transaction), as applicable, including with respect to the environment; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the Pioneer Transaction or the Denbury Transaction, as applicable, that could affect ExxonMobil’s, Pioneer’s, and/or Denbury’s financial performance and operating results; certain restrictions during the pendency of the Pioneer Transaction or the Denbury Transaction, as applicable, that may impact Pioneer’s or Denbury’s, as applicable, ability to pursue certain business opportunities or strategic transactions or otherwise operate its business, respectively; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against ExxonMobil, Pioneer (in the case of the Pioneer Transaction) or Denbury (in the case of the Denbury Transaction), and other political or security disturbances; dilution caused by ExxonMobil’s issuance of additional shares of its common stock in connection with the Pioneer Transaction or the Denbury Transaction, as applicable; the possibility that the Pioneer Transaction or the Denbury Transaction, as applicable, may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in policy and consumer support for emission- reduction products and technology; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; global or regional changes in the supply and demand for oil, natural gas, petrochemicals, and feedstocks and other market or economic conditions that impact demand, prices and differentials, including reservoir performance; changes in technical or operating conditions, including unforeseen technical

difficulties; those risks described in Item 1A of ExxonMobil’s Annual Report on Form 10-K, filed with the SEC on February 22, 2023, and subsequent reports on Forms 10-Q and 8-K, as well as under the heading “Factors Affecting Future Results” under the tab “Resources” on the Investors page of ExxonMobil’s website at www.exxonmobil.com (information included on or accessible through ExxonMobil’s website is not incorporated by reference into this communication); in the case of the Pioneer Transaction, those risks described in Item 1A of Pioneer’s Annual Report on Form 10-K, filed with the SEC on February 23, 2023, and subsequent reports on Forms 10-Q and 8-K; and those risks that are or will be described in the registration statements on Form S-4 and accompanying prospectus available from the sources indicated above; in the case of the Denbury Transaction, those risks described in Item 1A of Denbury’s Annual Report on Form 10-K, filed with the SEC on February 23, 2023, and subsequent reports on Forms 10-Q and 8-K; and those risks described (or, in the case of the Pioneer Transaction, that will be described) in the registration statement on Form S-4 and accompanying prospectus available from the sources indicated above. References to resources or other quantities of oil or natural gas may include amounts that ExxonMobil, Pioneer (in the case of the Pioneer Transaction) or Denbury (in the case of the Denbury Transaction) believe will ultimately be produced, but that are not yet classified as “proved reserves” under SEC definitions.

These risks, as well as other risks associated with the Pioneer Transaction or Denbury Transaction, as applicable, (x) will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the Pioneer Transaction and (y) are more fully discussed in the proxy statement/prospectus that is included in the registration statement on Form S-4 that was filed with the SEC in connection with the Denbury Transaction. While the list of factors presented here is, and the list of factors to be presented in the respective registration statements on Forms S-4 is or will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. None of ExxonMobil, Pioneer and Denbury assumes any obligation to publicly provide revisions or updates to any forward- looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on ExxonMobil’s, Pioneer’s or Denbury’s website should be deemed to constitute an update or re-affirmation of these statements as of any future date.

Actions needed to advance ExxonMobil’s 2030 and 2035 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually. The reference case for planning beyond 2030 is based on the Company’s Energy Outlook research and publication. The Outlook is reflective of the existing global policy environment, the Energy Outlook does not attempt to project the degree of required future policy and technology advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge, they will be incorporated into the Outlook, and the Company’s business plans will be updated accordingly. Actual future results, including the achievement of net zero in Upstream Permian Basin unconventional operated assets by 2030/2035 and plans to lower methane emissions from operated assets, to increase water recycling in our combined Permian operations, and to feed hydrogen, ammonia, and carbon

capture projects could vary depending on the ability to execute operational objectives on a timely and successful basis; policy support for emission-reduction products and technologies; changes in laws, regulations and international treaties regarding lower emission technologies and projects; government incentives; unforeseen technical or operational difficulties; the outcome of research efforts and future technology developments, including the ability to scale projects, technologies, and markets on a commercially competitive basis; changes in supply and demand and other market factors affecting future prices of oil, gas, and petrochemical products; the actions of competitors; and other factors discussed in this release and in the additional Forward Looking Statement disclaimer included above.

All references to production rates, project capacity, resource size, and acreage are on a gross basis, unless otherwise noted.