Filed by Exxon Mobil Corporation

(Commission File No.: 001-02256)

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: Denbury Inc.

(Commission File No.: 001-12935)

The following presentation was made by Dan Ammann, President, ExxonMobil Low Carbon Solutions, at a Denbury employee forum on July 24, 2023:

ExxonMobil/Denbury Introduction Dan Ammann President, ExxonMobil Low Carbon Solutions 07.24.23

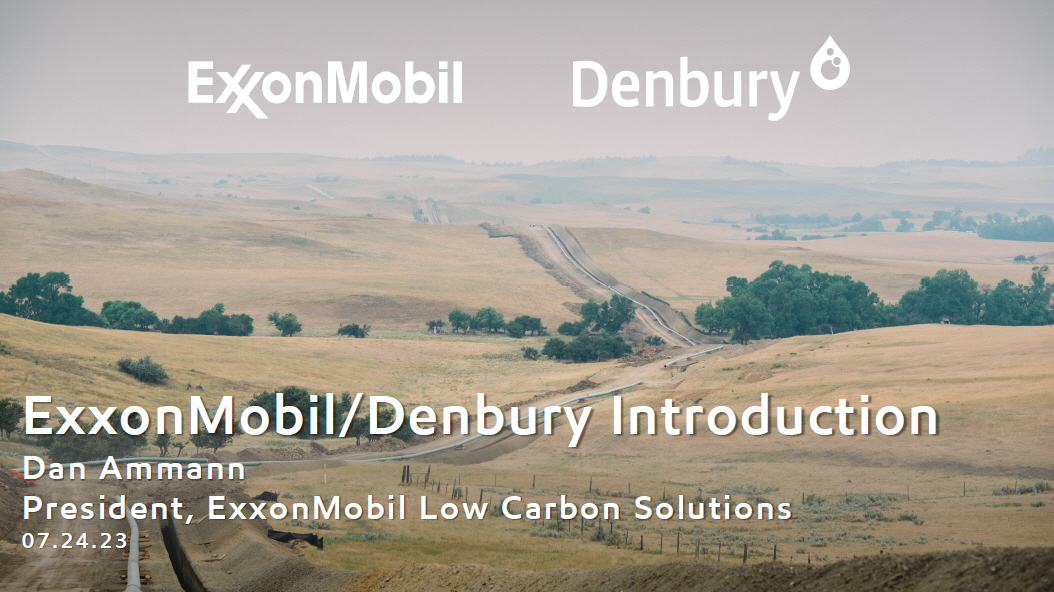

Denbury ExxonMobil Combined Capability Assets Capability Assets Capability Assets Capture √ √ √ √ Transportation √ √ √ √ √ Sequest r a tion (onshore) √ √ √ √ √ √ Sequest r a tion (offshore) √ √ √ √ EOR flex √ √ √ √ √ Balance sheet capacity √ √ √ √ Network / r e dunda n cy √ √ √ √ √ 2

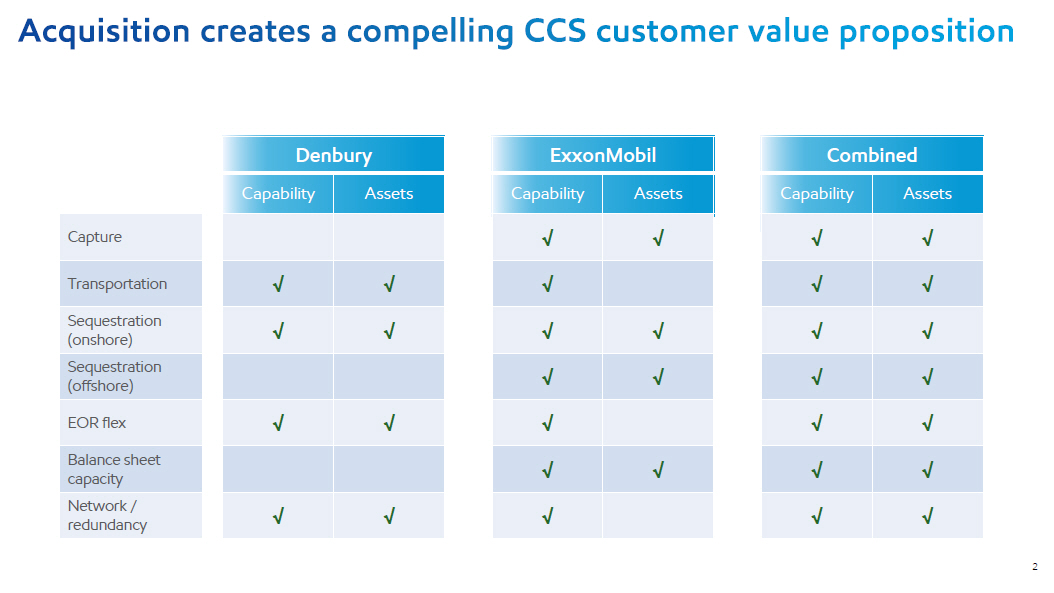

Close proximity to ExxonMobil industrial sites : ~50 miles to ExxonMobil Baytown site ~4 miles to ExxonMobil Beaumont site ~9 miles to ExxonMobil Baton Rouge site Note: all information shown is approximate (e.g. storage / pipeline location) and has potential to change as projects are developed and implemented. 3 Emissions sources ExxonMobil industrial sites and projects ExxonMobil storage Denbury Gulf Coast storage (announced) Denbury EOR Denbury pipeline ExxonMobil pipeline (future)

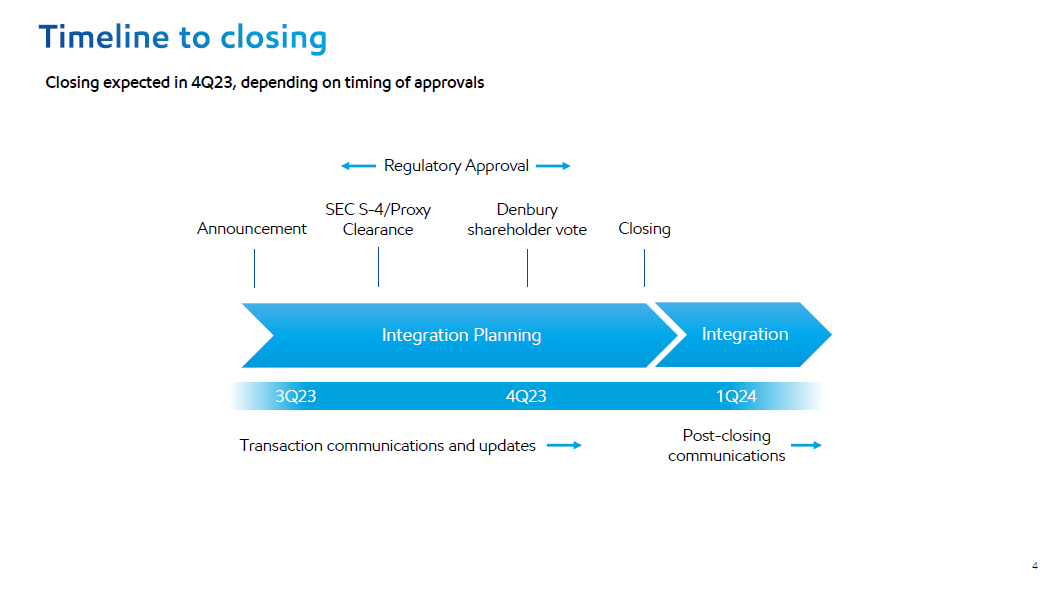

Closing expected in 4Q23, depending on timing of approvals Integration Planning I n tegra tion Announcement Denbury shareholder vote 3Q23 4Q23 1Q24 SEC S - 4/Proxy Clearance Transaction communications and updates Post - closing communi c at ions Regulatory Approval Closing 4

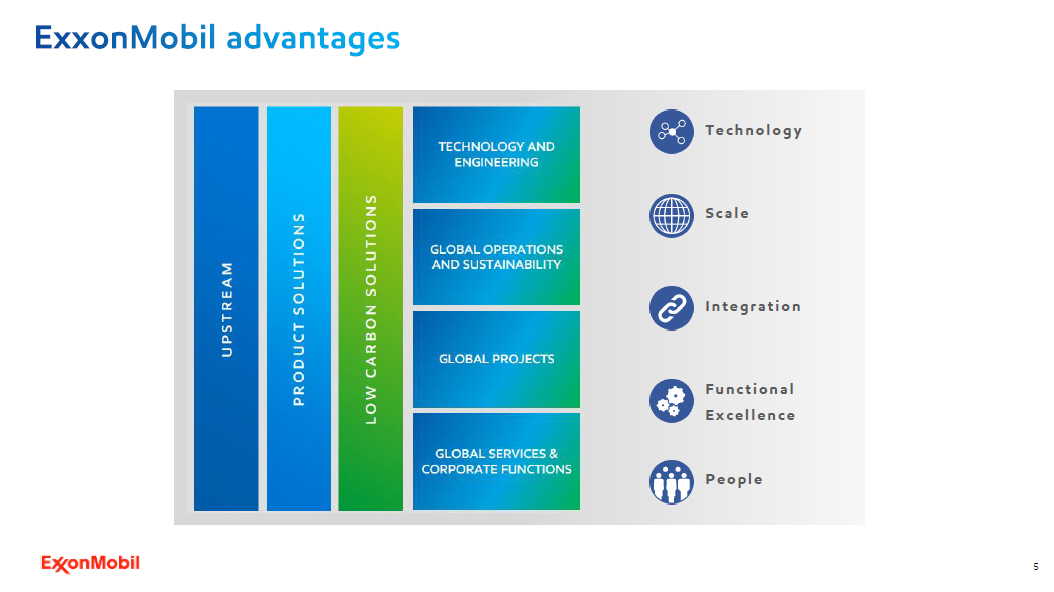

T e c h n o l o gy S c a l e I n t e gr a t i o n F u n c t i o n a l E xc e l l e n c e P e o p l e 5

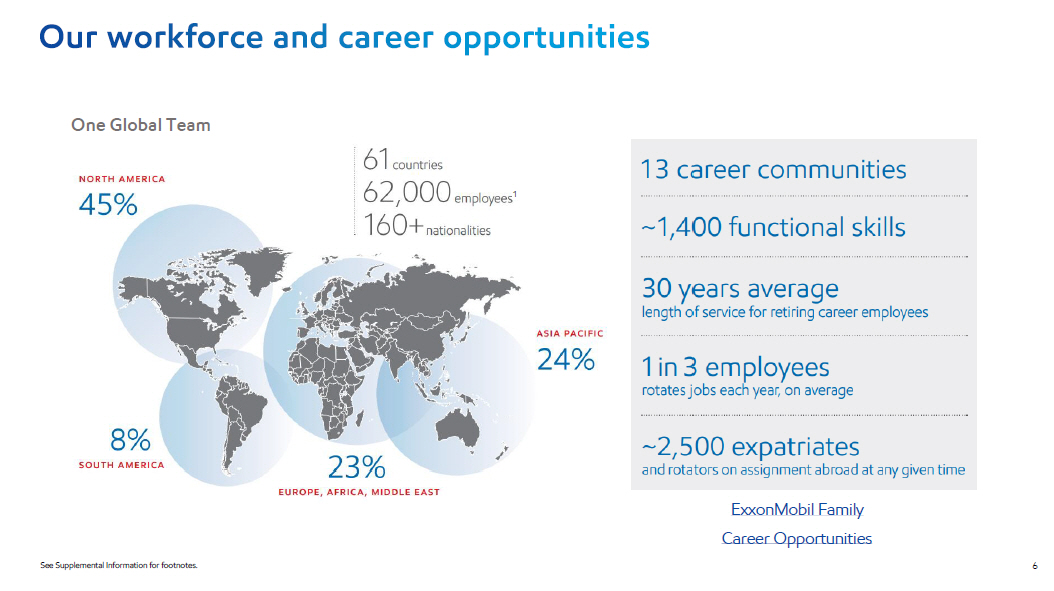

1 One Global Team ExxonMobil Family Career Opportunities 6 See Supplemental Information for footnotes.

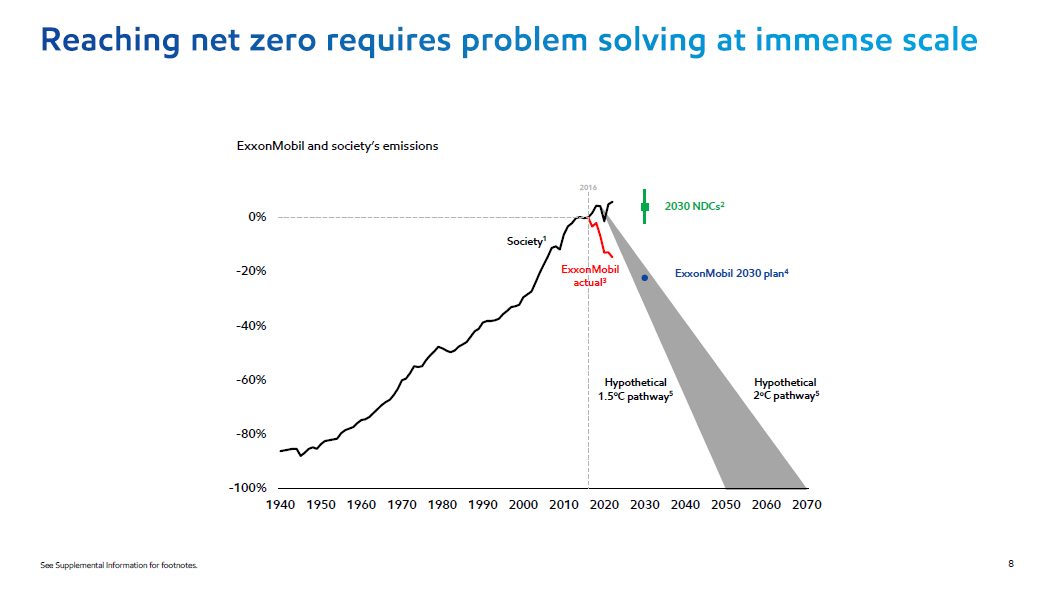

ExxonMobil and society’s emissions - 8 0 % - 6 0 % - 4 0 % - 2 0 % 0% - 100% 194 0 195 0 196 0 197 0 198 0 199 0 200 0 201 0 202 0 203 0 204 0 205 0 206 0 2070 Hypothetical 1.5 o C pathway 5 Hypothetical 2 o C pathway 5 Society 1 ExxonMobil 2030 plan 4 2030 NDCs 2 2016 Exxo nMobi l actual 3 8 See Supplemental Information for footnotes.

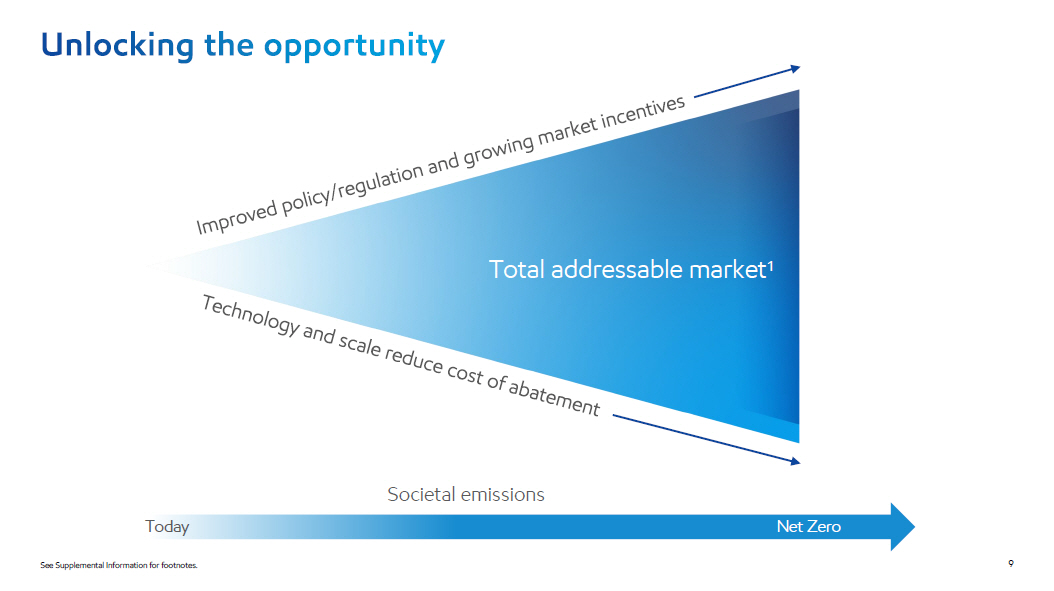

Societal emissions Today Total addressable market 1 9 See Supplemental Information for footnotes. Net Zero

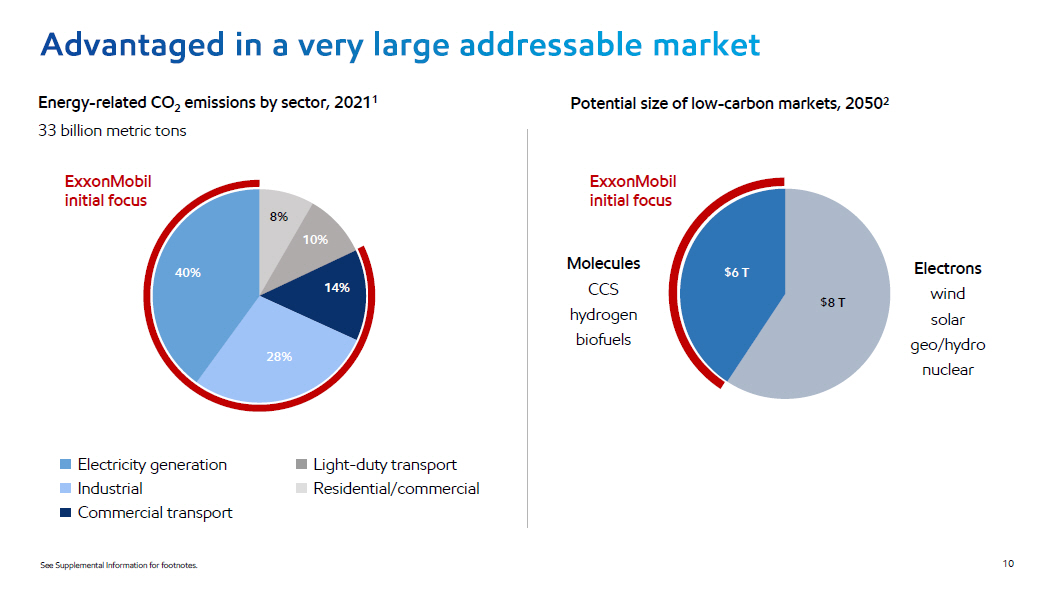

Ex x on M obil initial focus Potential size of low - carbon markets, 2050 2 Ex x on M obil initial focus Molecules CCS hydrogen biofuels 8% 10% 14% 28% 40% Electricity generation Industrial Commercial transport Light - duty transport Residential/commercial Energy - related CO 2 emissions by sector, 2021 1 33 billion metric tons $8 T 10 See Supplemental Information for footnotes. $6 T Ele c tr ons wind solar g e o / hy d r o nuclear

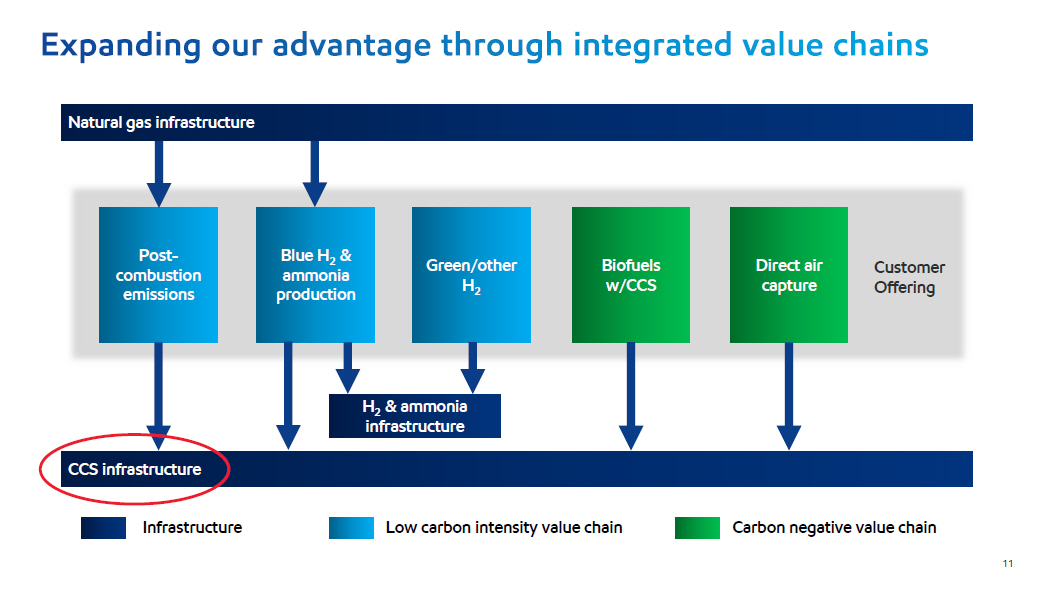

Blue H 2 & ammonia produ c ti on Post - co m bu s ti on emissions Bio fu els w/CCS Direct air capture Low carbon intensity value chain Carbon negative value chain Gr e e n/o t h e r H 2 Infrastructure Natural gas infrastructure CCS infrastructure H 2 & ammonia infrastructure Cu s to m e r Offering 11

Slide #6 / Our workforce and career opportunities 1. Global workforce is defined as all active, regular executive, management, professional, technical (EMPT), and wage employees, who work full - time or part - time for ExxonMobil, and are covered by ExxonMobil’s benefit plans and programs. Employees at our company - operated retail stores are not included. Slide #8 / Reaching net zero requires problem solving at immense scale 1. 1940 - 2022 global society CO 2 emissions estimates based on data from IEA CO 2 Emissions in 2022 Report; includes energy - related combustion and industrial process CO 2 emissions. 2. Projected 2030 global society GHG emissions based on latest announced Nationally Determined Contributions, as per UNFCCC 2022 Synthesis Report and ExxonMobil analysis. Land use, land - use change and forestry excluded. 3. ExxonMobil Scope 1 and 2 greenhouse gas emission estimates from operated assets compared to 2016 levels. 4. ExxonMobil 2030 GHG emission - reduction plans are intensity - based and for Scope 1 and 2 greenhouse gas emissions from operated assets compared to 2016 levels. These plans include actions that are also expected to achieve absolute reduction in corporate - wide greenhouse gas emissions by approximately 20%, compared to 2016 levels. See https://corporate.exxonmobil.com/news/newsroom/news - releases/2021/1201_exxonmobil - announces - plans - to - 2027 - doubling - earnings - and - cash - flow - potential - reducing - emissions 5. The IPCC Global Warming of 1.5ºC special report states that in model pathways with no or limited overshoot of 1.5 Σ C, global net anthropogenic CO₂ emissions reach net zero around 2050, and for limiting global warming to below 2 Σ C (with at least 67% probability of likelihood) CO₂ emissions are projected to reach net zero around 2070. The Hypothetical 1.5 Σ C Pathway and Hypothetical 2 Σ C Pathway are derived from the 2050 and 2070 net zero end points, respectively, using a linear relationship from societal greenhouse gas emissions in 2019 as the starting point. ExxonMobil uses the Hypothetical 1.5 Σ C and 2 Σ C pathways to illustrate the company’s expected operated Scope 1 and 2 emissions performance relative to the Paris Agreement goal of limiting global temperature increase to well below 2 degrees Celsius and the pursuit of limiting the increase to 1.5 degrees. (Article 2, Paris Agreement). Emission figures for future years are hypothetical, and are subject to change. ExxonMobil analysis. Slide #9 / Unlocking the opportunity 1. Total Addressable Market refers to the total revenue potential of low carbon markets as defined on Slide #10. Slide #10 / Advantaged in very large addressable market 1. ExxonMobil 2022 Outlook for Energy Outlook for Energy | ExxonMobil 2. Total addressable market based on ExxonMobil analysis of the IPCC’s Sixth Assessment Report Scenarios Database hosted by IIASA for carbon capture and storage, wind, solar, hydrogen, nuclear, biofuels, geothermal and hydropower. Secondary energy demand and prices in 2050 in the Lower 2 Σ C scenarios (Category C3) were used, where available, to calculate an estimate of potential market revenue. Carbon capture and storage estimate includes both CCS and Direct Air Capture and used price of carbon for pricing estimate. Biofuels estimate used liquids pricing for pricing estimate. 2020 dollars. 13

Important Information about the Transaction and Where to Find It In connection with the proposed transaction between Exxon Mobil Corporation (“ExxonMobil”) and Denbury Inc. (“Denbury”), ExxonMobil and Denbury will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a registration statement on Form S - 4 filed by ExxonMobil that will include a proxy statement of Denbury that also constitutes a prospectus of ExxonMobil. A definitive proxy statement/prospectus will be mailed to stockholders of Denbury. This communication is not a substitute for the registration statement, proxy statement or prospectus or any other document that ExxonMobil or Denbury (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EXXONMOBIL AND DENBURY ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing important information about ExxonMobil or Denbury, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by ExxonMobil will be available free of charge on ExxonMobil’s internet website at www.exxonmobil.com under the tab “investors” and then under the tab “SEC Filings” or by contacting ExxonMobil’s Investor Relations Department at investor.relations@exxonmobil.com. Copies of the documents filed with the SEC by Denbury will be available free of charge on Denbury’s internet website at https://investors.denbury.com/investors/financial - information/sec - filings/ or by directing a request to Denbury Inc., ATTN: Investor Relations, 5851 Legacy Circle, Suite 1200, Plano, TX 75024, Tel. No. (800) 348 - 9030. The information included on, or accessible through, ExxonMobil’s or Denbury’s website is not incorporated by reference into this communication. Participants in the Solicitation ExxonMobil, Denbury, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Denbury is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 18, 2023, and in its Form 10 - K for the year ended December 31, 2022, which was filed with the SEC on February 23, 2023. Information about the directors and executive officers of ExxonMobil is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, and in its Form 10 - K for the year ended December 31, 2022, which was filed with the SEC on February 22, 2023. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available. No Offer or Solicitation This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualifica 1 ti 4 on under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. 14

Forward - Looking Statements This communication contains “forward - looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward - looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words, but not all forward - looking statements include such words. Forward - looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward - looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of ExxonMobil and Denbury, that could cause actual results to differ materially from those expressed in such forward - looking statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the proposed transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required on anticipated terms and Denbury stockholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the merger, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the ability of ExxonMobil and Denbury to integrate the business successfully and to achieve anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be instituted against ExxonMobil, Denbury or their respective directors; the risk that disruptions from the proposed transaction will harm ExxonMobil’s or Denbury’s business, including current plans and operations and that management’s time and attention will be diverted on transaction - related issues; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger; rating agency actions and ExxonMobil and Denbury’s ability to access short - and long - term debt markets on a timely and affordable basis; legislative, regulatory and economic developments, including regulatory implementation of the Inflation Reduction Act, timely and attractive permitting for carbon capture and storage by applicable federal and state regulators, and other regulatory actions targeting public companies in the oil and gas industry and changes in local, national, or international laws, regulations, and policies affecting ExxonMobil and Denbury including with respect to the environment; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the merger that could affect ExxonMobil’s and/or Denbury’s financial performance and operating results; certain restrictions during the pendency of the merger that may impact Denbury’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against ExxonMobil or Denbury, and other political or security disturbances; dilution caused by ExxonMobil’s issuance of additional shares of its common stock in connection with the proposed transaction; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in policy and consumer support for emission - reduction products and technology; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; global or regional changes in the supply and demand for oil, natural gas, petrochemicals, and feedstocks and other market or economic conditions that impact demand, prices and differentials, including reservoir performance; changes in technical or operating conditions, including unforeseen technical difficulties; those risks described in Item 1A of ExxonMobil’s Annual Report on Form 10 - K, filed with the SEC on February 22, 2023, and subsequent reports on Forms 10 - Q and 8 - K, as well as under the heading “Factors Affecting Future Results” on the Investors page of ExxonMobil’s website at www.exxonmobil.com (information included on or accessible through ExxonMobil’s website is not incorporated by reference into this communication); those risks described in Item 1A of Denbury’s Annual Report on Form 10 - K, filed with the SEC on February 23, 2023, and subsequent reports on Forms 10 - Q and 8 - K; and those risks that will be described in the registration statement on Form S - 4 and accompanying prospectus available from the sources indicated above. References to resources or other quantities of oil or natural gas may include amounts that ExxonMobil or Denbury believe will ultimately be produced, but that are not yet classified as “proved reserves” under SEC definitions. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S - 4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S - 4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward - looking statements. We caution you not to place undue reliance on any of these forward - looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation 1 , 5 our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward - looking statements contained in this communication. Neither ExxonMobil nor Denbury assumes any obligation to publicly provide revisions or updates to any forward - looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on ExxonMobil’s or Denbury’s website should be deemed to constitute an update or re - affirmation of these statements as of any future date. 15