SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant

¨

Filed by a Party

other than the Registrant þ

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| þ |

Definitive Additional Materials |

| ¨ |

Soliciting Material Under Rule 14a-12 |

Exxon Mobil Corporation

(Name of Registrant as Specified in Its Charter)

Engine No. 1 LLC

Engine No. 1 LP

Engine No. 1 NY LLC

Christopher James

Charles Penner

Gregory J. Goff

Kaisa Hietala

Alexander Karsner

Anders Runevad

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of Filing Fee (check the appropriate box):

| þ |

No fee required. |

| |

|

| ¨ |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

Protect Your Investment in ExxonMobil

Vote the WHITE Proxy Card Today

Dear Fellow Shareholders,

ExxonMobil’s Board of Directors has overseen the staggering

decline of a once-iconic American company. Engine No. 1 has nominated four highly qualified, independent directors who have created billions

in value in the energy industry and can help protect your investment, and the 2nd largest US pension fund is supporting

our nominees.

| |

ExxonMobil 10 Years

Ago  |

ExxonMobil

Today

|

Market

Capitalization |

Largest in the Dow Jones (DJIA) |

Ejected from the DJIA. “It has been a stunning

fall from grace for Exxon Mobil Corp.” (Wall Street Journal)

|

| Credit Rating |

AAA |

Debt downgraded 3 times by S&P |

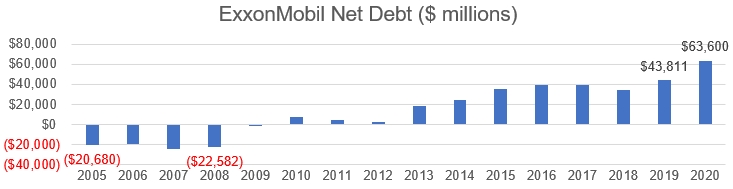

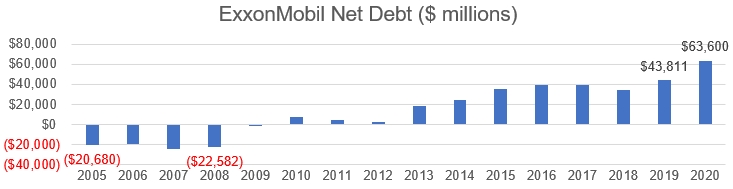

Financial

Strength |

$7bn in net debt with dividend funded through free cash flow |

$60bn+ in net debt leaving ExxonMobil highly vulnerable with

dividend funded through borrowings

|

Rather than defending this record of value destruction,

however, the Board is trying to distort the facts.

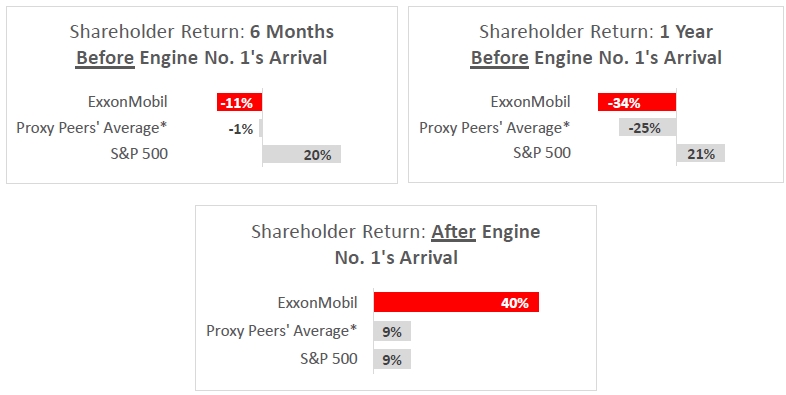

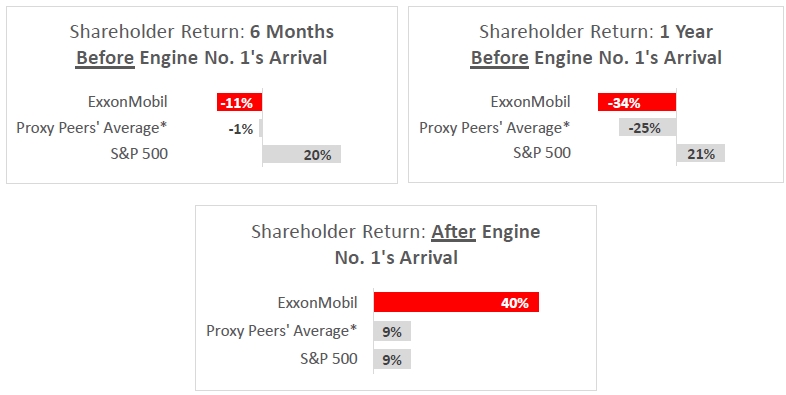

Rhetoric: The Board says its recent short-term

stock price performance proves it can now be trusted.

Reality: The Board fails to mention that this stock

price improvement came after we proposed Board change. Without adding successful energy experience to the Board, however,

ExxonMobil’s future could look like its past.

VOTE THE WHITE PROXY CARD TODAY

| · | Rhetoric: The Board has gotten its reckless

spending under control. |

| · | Reality: ExxonMobil destroyed billions

in value through heavy spending on low return projects that caused it to underperform all of its peers for the last 3, 5, and 10 years

prior to our arrival, even during higher oil and gas prices. While the Board now claims to have turned over a new leaf, the market is

highly skeptical. |

“[M]ost investors are uncertain as to whether [ExxonMobil] will stick

to the $20-25B long-term budget in a higher … price environment.” – JP Morgan, January 19, 2021.

“Chevron now targets free cash flow, returns and constrained emissions,

while Exxon is sticking to the traditional oil major mega-projects tactic.” - Bloomberg, March 23, 2021

| · | Rhetoric: ExxonMobil’s current

Board says it will protect your dividend. |

| · | Reality: ExxonMobil has been borrowing

money to fund its dividend. As The Wall Street Journal has noted, “[ExxonMobil] had been unable to fund its dividends through

free cash flow alone even in 2019 before the pandemic.” |

“Analysts say a quest for fast oil-production growth and an

addiction to risky, high-cost projects have hobbled the company in recent years.” – Financial Times, October

27, 2020.

| · | Rhetoric: The Board claims that our

nominees lack sufficient management experience at U.S. public companies. |

| · | Reality: This is a baffling claim given that

the Board just added two people with zero management experience at a publicly listed US company, and a third who was the CFO of a cable

company. Compare that to our nominees, who include former energy industry CEOs Greg Goff and Anders Runevad, who have each been named

as among the “Best Performing CEOs in the World” by Harvard Business Review; Kaisa Hietala, who led an oil and gas

company transformation that was named as one of the “Top 20 Business Transformations of the Last Decade” by Harvard Business

Review, and Alexander Karsner, who helps lead energy technology investment at X (formerly Google X) and served as U.S. Assistant Secretary

of Energy. |

“[ExxonMobil’s] board should have been

a better overseer of management, capital allocation and strategy. Yet even with new appointments, it has limited experience in energy.

That needs to change … The slate of four put up by activist Engine No. 1 could help.” – Reuters Breakingviews,

March 22, 2021.

| · | Rhetoric: The Board claims that it is

committed to the “development of scalable, lower-carbon technologies.” |

| · | Reality: ExxonMobil is widely acknowledged

as – and in fact until our arrival took pride in – being the company least interested in planning for the long-term evolution

of the energy industry (an evolution in which our nominees have highly valuable strategic experience). In fact, in a recent Bloomberg

analysis ExxonMobil scored dead last in this regard among all of the Oil Majors. |

In short, there is a serious debate to be had about how best to protect your investment and

position ExxonMobil for long-term value creation, rather than continued long-term decline and value destruction. While the Board may wish

to avoid this debate, we encourage all shareholders to review the facts and decide for yourselves.

Vote the WHITE proxy card today to Reenergize

ExxonMobil.

If you have already voted using the Blue proxy card, you

can change your vote by clicking on the “Vote Now” button on the email with this message.

Sincerely,

Engine No. 1

Sources:

Christopher M. Matthews (Sept. 13, 2020). ExxonMobil Used

to Be America’s Most Valuable Company. What Happened? The Wall Street Journal.

Fernando Valle (March 23, 2021). Big Oil Brethren Chevron,

ExxonMobil Charting Different Paths. Bloomberg Professional Services. Bloomberg Intelligence.

Jinjoo Lee (March 19, 2021). Oil Investors Hunt for Cash

Gushers, Wall Street Journal.

Derek Brower (October 27, 2020). Why ExxonMobil is Sticking

with Oil as Rivals Look to a Greener Future. Financial Times.

Rob Cyran (March 22, 2021). More Than This. Reuters

Breakingviews.

Bloomberg BNEF (March 24, 2021). BNEF Oil and Gas Transitions

Scores.

Important Information

Engine No. 1 LLC, Engine No. 1 LP, Engine No. 1 NY LLC, Christopher

James, Charles Penner (collectively, “Engine No. 1”), Gregory J. Goff, Kaisa Hietala, Alexander Karsner, and Anders Runevad

(collectively and together with Engine No. 1, the “Participants”) have filed with the Securities and Exchange Commission (the

“SEC”) a definitive proxy statement and accompanying form of WHITE proxy to be used in connection with the solicitation of

proxies from the shareholders of Exxon Mobil Corporation (the “Company”). All shareholders of the Company are advised to read

the definitive proxy statement and other documents related to the solicitation of proxies by the Participants, as they contain important

information, including additional information related to the Participants. The definitive proxy statement and an accompanying WHITE proxy

card will be furnished to some or all of the Company’s shareholders and is, along with other relevant documents, available at no

charge on Engine No.1’s campaign website at https://reenergizexom.com/materials/ and the SEC website at http://www.sec.gov/.

Information about the Participants and a description of their

direct or indirect interests by security holdings is contained in the definitive proxy statement filed by the Participants with the SEC

on March 15, 2021. This document is available free of charge from the sources described above.