FALSE00000340882025Q1--12-31http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#ReceivablesNetCurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#ReceivablesNetCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureutr:bblutr:MMBTU00000340882025-01-012025-03-310000034088us-gaap:CommonStockMember2025-01-012025-03-310000034088xom:ZeroPointFiveTwoFourPercentNotesDue2028Member2025-01-012025-03-310000034088xom:ZeroPointEightThreeFivePercentNotesDue2032Member2025-01-012025-03-310000034088xom:OnePointFourZeroEightPercentNotesDue2039Member2025-01-012025-03-3100000340882025-03-310000034088xom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088xom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088xom:IncomeFromEquityAffiliatesMember2025-01-012025-03-310000034088xom:IncomeFromEquityAffiliatesMember2024-01-012024-03-310000034088xom:OtherRevenueMember2025-01-012025-03-310000034088xom:OtherRevenueMember2024-01-012024-03-3100000340882024-01-012024-03-3100000340882024-12-310000034088us-gaap:RelatedPartyMember2025-03-310000034088us-gaap:RelatedPartyMember2024-12-310000034088us-gaap:NonrelatedPartyMember2025-03-310000034088us-gaap:NonrelatedPartyMember2024-12-3100000340882023-12-3100000340882024-03-310000034088us-gaap:CommonStockMember2023-12-310000034088us-gaap:RetainedEarningsMember2023-12-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000034088us-gaap:TreasuryStockCommonMember2023-12-310000034088us-gaap:ParentMember2023-12-310000034088us-gaap:NoncontrollingInterestMember2023-12-310000034088us-gaap:CommonStockMember2024-01-012024-03-310000034088us-gaap:ParentMember2024-01-012024-03-310000034088us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000034088us-gaap:RetainedEarningsMember2024-01-012024-03-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000034088us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000034088us-gaap:CommonStockMember2024-03-310000034088us-gaap:RetainedEarningsMember2024-03-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000034088us-gaap:TreasuryStockCommonMember2024-03-310000034088us-gaap:ParentMember2024-03-310000034088us-gaap:NoncontrollingInterestMember2024-03-310000034088us-gaap:CommonStockMember2024-12-310000034088us-gaap:RetainedEarningsMember2024-12-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000034088us-gaap:TreasuryStockCommonMember2024-12-310000034088us-gaap:ParentMember2024-12-310000034088us-gaap:NoncontrollingInterestMember2024-12-310000034088us-gaap:CommonStockMember2025-01-012025-03-310000034088us-gaap:ParentMember2025-01-012025-03-310000034088us-gaap:RetainedEarningsMember2025-01-012025-03-310000034088us-gaap:NoncontrollingInterestMember2025-01-012025-03-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310000034088us-gaap:TreasuryStockCommonMember2025-01-012025-03-310000034088us-gaap:CommonStockMember2025-03-310000034088us-gaap:RetainedEarningsMember2025-03-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310000034088us-gaap:TreasuryStockCommonMember2025-03-310000034088us-gaap:ParentMember2025-03-310000034088us-gaap:NoncontrollingInterestMember2025-03-310000034088xom:PioneerNaturalResourcesMergerMember2024-05-032024-05-030000034088xom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:ZeroPointTwoFiveNotesDueMay2025Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:ZeroPointTwoFiveNotesDueMay2025Member2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:OnePointOneTwoFiveNotesDueJanuary2026Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:OnePointOneTwoFiveNotesDueJanuary2026Member2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:FivePointOneNotesDueMarch2026Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:FivePointOneNotesDueMarch2026Member2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:SevenPointTwoNotesDueJanuary2028Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:SevenPointTwoNotesDueJanuary2028Member2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:FourPointOneTwoFiveNotesDueFebruary2028Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:FourPointOneTwoFiveNotesDueFebruary2028Member2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:OnePointNineNotesDueAugust2030Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:OnePointNineNotesDueAugust2030Member2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:TwoPointOneFiveNotesDueJanuary2031Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:TwoPointOneFiveNotesDueJanuary2031Member2024-05-020000034088xom:EquityCompanyObligationsMemberxom:DebtRelatedGuaranteesMember2025-03-310000034088xom:OtherThirdPartyObligationsMemberxom:DebtRelatedGuaranteesMember2025-03-310000034088xom:DebtRelatedGuaranteesMember2025-03-310000034088xom:EquityCompanyObligationsMemberxom:OtherGuaranteesMember2025-03-310000034088xom:OtherThirdPartyObligationsMemberxom:OtherGuaranteesMember2025-03-310000034088xom:OtherGuaranteesMember2025-03-310000034088xom:EquityCompanyObligationsMember2025-03-310000034088xom:OtherThirdPartyObligationsMember2025-03-310000034088srt:ParentCompanyMember2023-12-310000034088srt:ParentCompanyMember2024-01-012024-03-310000034088srt:ParentCompanyMember2024-03-310000034088srt:ParentCompanyMember2024-12-310000034088srt:ParentCompanyMember2025-01-012025-03-310000034088srt:ParentCompanyMember2025-03-310000034088country:USus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-03-310000034088country:USus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-03-310000034088us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2025-01-012025-03-310000034088us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-03-310000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2025-01-012025-03-310000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-03-310000034088us-gaap:FairValueInputsLevel1Member2025-03-310000034088us-gaap:FairValueInputsLevel2Member2025-03-310000034088us-gaap:FairValueDisclosureItemAmountsDomain2025-03-310000034088xom:EffectOfCounterpartyNettingMember2025-03-310000034088xom:EffectOfCollateralNettingMember2025-03-310000034088us-gaap:CarryingReportedAmountFairValueDisclosureMember2025-03-310000034088us-gaap:FairValueInputsLevel3Member2025-03-310000034088xom:DifferenceInCarryingValueAndFairValueMember2025-03-310000034088us-gaap:FairValueInputsLevel1Member2024-12-310000034088us-gaap:FairValueInputsLevel2Member2024-12-310000034088us-gaap:FairValueDisclosureItemAmountsDomain2024-12-310000034088xom:EffectOfCounterpartyNettingMember2024-12-310000034088xom:EffectOfCollateralNettingMember2024-12-310000034088us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000034088us-gaap:FairValueInputsLevel3Member2024-12-310000034088xom:DifferenceInCarryingValueAndFairValueMember2024-12-310000034088xom:LineOfCreditShortTermMember2025-03-310000034088xom:LineOfCreditLongTermMember2025-03-310000034088srt:CrudeOilMemberus-gaap:LongMember2025-01-012025-03-310000034088srt:CrudeOilMemberus-gaap:LongMember2024-01-012024-12-310000034088xom:ProductsMemberus-gaap:ShortMember2025-01-012025-03-310000034088xom:ProductsMemberus-gaap:ShortMember2024-01-012024-12-310000034088xom:NaturalGasMemberus-gaap:ShortMember2025-01-012025-03-310000034088xom:NaturalGasMemberus-gaap:ShortMember2024-01-012024-12-310000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2025-01-012025-03-310000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2024-01-012024-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:UpstreamMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:UpstreamMember2025-01-012025-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:EnergyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:EnergyProductsMember2025-01-012025-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:OperatingSegmentsMemberxom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:UpstreamMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:UpstreamMember2025-01-012025-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:EnergyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:EnergyProductsMember2025-01-012025-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:OperatingSegmentsMemberxom:IncomeFromEquityAffiliatesMember2025-01-012025-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:UpstreamMember2025-01-012025-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:UpstreamMember2025-01-012025-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:EnergyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:EnergyProductsMember2025-01-012025-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:IntersegmentEliminationMember2025-01-012025-03-310000034088country:USxom:OtherRevenueMemberxom:UpstreamMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:UpstreamMember2025-01-012025-03-310000034088country:USxom:OtherRevenueMemberxom:EnergyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:EnergyProductsMember2025-01-012025-03-310000034088country:USxom:OtherRevenueMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088country:USxom:OtherRevenueMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:OperatingSegmentsMemberxom:OtherRevenueMember2025-01-012025-03-310000034088country:USxom:UpstreamMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:UpstreamMember2025-01-012025-03-310000034088country:USxom:EnergyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:EnergyProductsMember2025-01-012025-03-310000034088country:USxom:ChemicalProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:ChemicalProductsMember2025-01-012025-03-310000034088country:USxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:SpecialtyProductsMember2025-01-012025-03-310000034088us-gaap:OperatingSegmentsMember2025-01-012025-03-310000034088us-gaap:CorporateNonSegmentMember2025-01-012025-03-310000034088country:USxom:UpstreamMember2025-03-310000034088us-gaap:NonUsMemberxom:UpstreamMember2025-03-310000034088country:USxom:EnergyProductsMember2025-03-310000034088us-gaap:NonUsMemberxom:EnergyProductsMember2025-03-310000034088country:USxom:ChemicalProductsMember2025-03-310000034088us-gaap:NonUsMemberxom:ChemicalProductsMember2025-03-310000034088country:USxom:SpecialtyProductsMember2025-03-310000034088us-gaap:NonUsMemberxom:SpecialtyProductsMember2025-03-310000034088us-gaap:OperatingSegmentsMember2025-03-310000034088us-gaap:CorporateNonSegmentMember2025-03-310000034088us-gaap:CorporateNonSegmentMemberxom:OtherRevenueInterestMember2025-01-012025-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:UpstreamMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:UpstreamMember2024-01-012024-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:EnergyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:EnergyProductsMember2024-01-012024-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:OperatingSegmentsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:UpstreamMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:UpstreamMember2024-01-012024-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:EnergyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:EnergyProductsMember2024-01-012024-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088country:USxom:IncomeFromEquityAffiliatesMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:IncomeFromEquityAffiliatesMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:OperatingSegmentsMemberxom:IncomeFromEquityAffiliatesMember2024-01-012024-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:UpstreamMember2024-01-012024-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:UpstreamMember2024-01-012024-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:EnergyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:EnergyProductsMember2024-01-012024-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088country:USus-gaap:IntersegmentEliminationMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberus-gaap:IntersegmentEliminationMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:IntersegmentEliminationMember2024-01-012024-03-310000034088country:USxom:OtherRevenueMemberxom:UpstreamMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:UpstreamMember2024-01-012024-03-310000034088country:USxom:OtherRevenueMemberxom:EnergyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:EnergyProductsMember2024-01-012024-03-310000034088country:USxom:OtherRevenueMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088country:USxom:OtherRevenueMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:OtherRevenueMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:OperatingSegmentsMemberxom:OtherRevenueMember2024-01-012024-03-310000034088country:USxom:UpstreamMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:UpstreamMember2024-01-012024-03-310000034088country:USxom:EnergyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:EnergyProductsMember2024-01-012024-03-310000034088country:USxom:ChemicalProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:ChemicalProductsMember2024-01-012024-03-310000034088country:USxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:SpecialtyProductsMember2024-01-012024-03-310000034088us-gaap:OperatingSegmentsMember2024-01-012024-03-310000034088us-gaap:CorporateNonSegmentMember2024-01-012024-03-310000034088country:USxom:UpstreamMember2024-12-310000034088us-gaap:NonUsMemberxom:UpstreamMember2024-12-310000034088country:USxom:EnergyProductsMember2024-12-310000034088us-gaap:NonUsMemberxom:EnergyProductsMember2024-12-310000034088country:USxom:ChemicalProductsMember2024-12-310000034088us-gaap:NonUsMemberxom:ChemicalProductsMember2024-12-310000034088country:USxom:SpecialtyProductsMember2024-12-310000034088us-gaap:NonUsMemberxom:SpecialtyProductsMember2024-12-310000034088us-gaap:OperatingSegmentsMember2024-12-310000034088us-gaap:CorporateNonSegmentMember2024-12-310000034088us-gaap:CorporateNonSegmentMemberxom:OtherRevenueInterestMember2024-01-012024-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088country:USxom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088country:CAxom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088country:CAxom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088country:GBxom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088country:GBxom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088country:SGxom:SalesAndOtherOperatingRevenueMember2025-01-012025-03-310000034088country:SGxom:SalesAndOtherOperatingRevenueMember2024-01-012024-03-310000034088us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2025-01-012025-03-310000034088us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2025

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to__________

Commission File Number 1-2256

Exxon Mobil Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New Jersey | | 13-5409005 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

22777 Springwoods Village Parkway, Spring, Texas 77389-1425

(Address of principal executive offices) (Zip Code)

(972) 940-6000

(Registrant's telephone number, including area code)

_______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, without par value | | XOM | | New York Stock Exchange |

| 0.524% Notes due 2028 | | XOM28 | | New York Stock Exchange |

| 0.835% Notes due 2032 | | XOM32 | | New York Stock Exchange |

| 1.408% Notes due 2039 | | XOM39A | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

|

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding as of March 31, 2025 |

| Common stock, without par value | | 4,309,638,821 |

EXXON MOBIL CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2025

TABLE OF CONTENTS

| | | | | |

| PART I. FINANCIAL INFORMATION |

| | |

| Item 1. Financial Statements | |

| | |

Condensed Consolidated Statement of Income - Three months ended March 31, 2025 and 2024 | |

| | |

Condensed Consolidated Statement of Comprehensive Income - Three months ended March 31, 2025 and 2024 | |

| | |

Condensed Consolidated Balance Sheet - As of March 31, 2025 and December 31, 2024 | |

| | |

Condensed Consolidated Statement of Cash Flows - Three months ended March 31, 2025 and 2024 | |

| | |

| |

| |

Condensed Consolidated Statement of Changes in Equity - Three months ended March 31, 2025 and 2024 | |

| |

| |

| | |

| Notes to Condensed Consolidated Financial Statements | |

| | |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | |

| | |

| Item 4. Controls and Procedures | |

| | |

| | |

| PART II. OTHER INFORMATION |

| |

| Item 1. Legal Proceedings | |

| |

| |

| | |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| | |

| Item 5. Other Information | |

| |

Item 6. Exhibits | |

| | |

| Index to Exhibits | |

| | |

| Signature | |

| | |

PART I. FINANCIAL INFORMATION

| | | | | | | | | | | | | | |

| ITEM 1. FINANCIAL STATEMENTS | | |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| | | | | | | | | | |

(millions of dollars, unless noted) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| Revenues and other income | | | | |

| Sales and other operating revenue | 81,058 | | 80,411 | | | |

| Income from equity affiliates | 1,369 | | 1,842 | | | |

| Other income | 703 | | 830 | | | |

| Total revenues and other income | 83,130 | | 83,083 | | | |

| Costs and other deductions | | | | |

| Crude oil and product purchases | 46,788 | | 47,601 | | | |

| Production and manufacturing expenses | 10,083 | | 9,091 | | | |

| Selling, general and administrative expenses | 2,540 | | 2,495 | | | |

| Depreciation and depletion (includes impairments) | 5,702 | | 4,812 | | | |

| Exploration expenses, including dry holes | 64 | | 148 | | | |

| Non-service pension and postretirement benefit expense | 113 | | 23 | | | |

| Interest expense | 205 | | 221 | | | |

| Other taxes and duties | 6,035 | | 6,323 | | | |

| Total costs and other deductions | 71,530 | | 70,714 | | | |

| Income (loss) before income taxes | 11,600 | | 12,369 | | | |

| Income tax expense (benefit) | 3,567 | | 3,803 | | | |

| Net income (loss) including noncontrolling interests | 8,033 | | 8,566 | | | |

| Net income (loss) attributable to noncontrolling interests | 320 | | 346 | | | |

| Net income (loss) attributable to ExxonMobil | 7,713 | | 8,220 | | | |

| | | | |

Earnings (loss) per common share (dollars) | 1.76 | | 2.06 | | | |

| | | | |

Earnings (loss) per common share - assuming dilution (dollars) | 1.76 | | 2.06 | | | |

| | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME |

| | | | | | | | | | |

| (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| Net income (loss) including noncontrolling interests | 8,033 | | 8,566 | | | |

| | | | |

| Other comprehensive income (net of income taxes) | | | | |

| Foreign exchange translation adjustment | 302 | | (1,267) | | | |

| | | | |

| Postretirement benefits reserves adjustment (excluding amortization) | (34) | | (42) | | | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | 23 | | 9 | | | |

| Total other comprehensive income (loss) | 291 | | (1,300) | | | |

| Comprehensive income (loss) including noncontrolling interests | 8,324 | | 7,266 | | | |

| Comprehensive income (loss) attributable to noncontrolling interests | 330 | | 226 | | | |

| Comprehensive income (loss) attributable to ExxonMobil | 7,994 | | 7,040 | | | |

| | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| | | | | | | | |

(millions of dollars, unless noted) | March 31, 2025 | December 31, 2024 |

| | |

| ASSETS | | |

| Current assets | | |

| Cash and cash equivalents | 17,036 | | 23,029 | |

| Cash and cash equivalents – restricted | 1,476 | | 158 | |

| Notes and accounts receivable – net | 46,303 | | 43,681 | |

| Inventories | | |

| Crude oil, products and merchandise | 20,502 | | 19,444 | |

| Materials and supplies | 3,976 | | 4,080 | |

| Other current assets | 1,940 | | 1,598 | |

| Total current assets | 91,233 | | 91,990 | |

| Investments, advances and long-term receivables | 47,853 | | 47,200 | |

| Property, plant and equipment – net | 292,646 | | 294,318 | |

| Other assets, including intangibles – net | 20,176 | | 19,967 | |

| Total Assets | 451,908 | | 453,475 | |

| | |

| LIABILITIES | | |

| Current liabilities | | |

| Notes and loans payable | 4,728 | | 4,955 | |

| Accounts payable and accrued liabilities | 63,987 | | 61,297 | |

| Income taxes payable | 5,114 | | 4,055 | |

| Total current liabilities | 73,829 | | 70,307 | |

| Long-term debt | 32,823 | | 36,755 | |

| Postretirement benefits reserves | 10,015 | | 9,700 | |

| Deferred income tax liabilities | 39,091 | | 39,042 | |

| Long-term obligations to equity companies | 1,381 | | 1,346 | |

| Other long-term obligations | 24,963 | | 25,719 | |

| Total Liabilities | 182,102 | | 182,869 | |

| | |

Commitments and contingencies (Note 3) | | |

| | |

| EQUITY | | |

Common stock without par value (9,000 million shares authorized, 8,019 million shares issued) | 46,426 | | 46,238 | |

| Earnings reinvested | 474,290 | | 470,903 | |

| Accumulated other comprehensive income | (14,338) | | (14,619) | |

Common stock held in treasury (3,709 million shares at March 31, 2025 and 3,666 million shares at December 31, 2024) | (243,658) | | (238,817) | |

| ExxonMobil share of equity | 262,720 | | 263,705 | |

| Noncontrolling interests | 7,086 | | 6,901 | |

| Total Equity | 269,806 | | 270,606 | |

| Total Liabilities and Equity | 451,908 | | 453,475 | |

| | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS |

| | | | | | | | |

| (millions of dollars) | Three Months Ended March 31, |

| 2025 | 2024 |

| | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | |

| Net income (loss) including noncontrolling interests | 8,033 | | 8,566 | |

| Depreciation and depletion (includes impairments) | 5,702 | | 4,812 | |

| Changes in operational working capital, excluding cash and debt | (878) | | 2,008 | |

| All other items – net | 96 | | (722) | |

| Net cash provided by operating activities | 12,953 | | 14,664 | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | |

| Additions to property, plant and equipment | (5,898) | | (5,074) | |

| Proceeds from asset sales and returns of investments | 1,823 | | 703 | |

| Additional investments and advances | (153) | | (421) | |

| Other investing activities including collection of advances | 93 | | 215 | |

| | |

| Net cash used in investing activities | (4,135) | | (4,577) | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | |

| Additions to long-term debt | 280 | | 108 | |

| Reductions in long-term debt | (7) | | — | |

| | |

Reductions in short-term debt | (4,541) | | (1,106) | |

| Additions/(reductions) in debt with three months or less maturity | (41) | | (5) | |

| | |

| Cash dividends to ExxonMobil shareholders | (4,335) | | (3,808) | |

| Cash dividends to noncontrolling interests | (141) | | (166) | |

| Changes in noncontrolling interests | (12) | | (6) | |

Inflows from noncontrolling interests for major projects | 22 | | 12 | |

| Common stock acquired | (4,804) | | (3,011) | |

| Net cash used in financing activities | (13,579) | | (7,982) | |

| | |

| Effects of exchange rate changes on cash | 86 | | (324) | |

| Increase/(decrease) in cash and cash equivalents (including restricted) | (4,675) | | 1,781 | |

| Cash and cash equivalents at beginning of period (including restricted) | 23,187 | | 31,568 | |

| Cash and cash equivalents at end of period (including restricted) | 18,512 | | 33,349 | |

| | |

| SUPPLEMENTAL DISCLOSURES | | |

| Income taxes paid | 2,596 | | 2,718 | |

| Cash interest paid | | |

| Included in cash flows from operating activities | 211 | | 301 | |

| Capitalized, included in cash flows from investing activities | 326 | | 297 | |

| Total cash interest paid | 537 | | 598 | |

| | |

| Noncash right of use assets recorded in exchange for lease liabilities | | |

| Operating leases | 243 | | 351 | |

| Finance leases | 6 | | — | |

| | |

|

| | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | |

| | ExxonMobil Share of Equity | | |

| | | | | | | |

(millions of dollars, unless noted) | Common Stock | Earnings Reinvested | Accumulated Other Comprehensive Income | Common Stock Held

in Treasury | ExxonMobil Share of Equity | Non-controlling Interests | Total

Equity |

| | | | | | | |

| Balance as of December 31, 2023 | 17,781 | | 453,927 | | (11,989) | | (254,917) | | 204,802 | | 7,736 | | 212,538 | |

| Amortization of stock-based awards | 197 | | — | | — | | — | | 197 | | — | | 197 | |

| Other | (7) | | — | | — | | — | | (7) | | 6 | | (1) | |

| Net income (loss) for the period | — | | 8,220 | | — | | — | | 8,220 | | 346 | | 8,566 | |

| Dividends - common shares | — | | (3,808) | | — | | — | | (3,808) | | (166) | | (3,974) | |

| | | | | | | |

| Other comprehensive income (loss) | — | | — | | (1,180) | | — | | (1,180) | | (120) | | (1,300) | |

| Share repurchases, at cost | — | | — | | — | | (2,978) | | (2,978) | | — | | (2,978) | |

| | | | | | | |

| Dispositions | — | | — | | — | | 4 | | 4 | | — | | 4 | |

| Balance as of March 31, 2024 | 17,971 | | 458,339 | | (13,169) | | (257,891) | | 205,250 | | 7,802 | | 213,052 | |

| | | | | | | |

| Balance as of December 31, 2024 | 46,238 | | 470,903 | | (14,619) | | (238,817) | | 263,705 | | 6,901 | | 270,606 | |

| Amortization of stock-based awards | 194 | | — | | — | | — | | 194 | | — | | 194 | |

| Other | (6) | | 9 | | — | | — | | 3 | | (4) | | (1) | |

| Net income (loss) for the period | — | | 7,713 | | — | | — | | 7,713 | | 320 | | 8,033 | |

| Dividends - common shares | — | | (4,335) | | — | | — | | (4,335) | | (141) | | (4,476) | |

| | | | | | | |

| Other comprehensive income (loss) | — | | — | | 281 | | — | | 281 | | 10 | | 291 | |

| Share repurchases, at cost | — | | — | | — | | (4,852) | | (4,852) | | — | | (4,852) | |

| | | | | | | |

| Dispositions | — | | — | | — | | 11 | | 11 | | — | | 11 | |

| Balance as of March 31, 2025 | 46,426 | | 474,290 | | (14,338) | | (243,658) | | 262,720 | | 7,086 | | 269,806 | |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2025 | Three Months Ended March 31, 2024 |

| | | | | | |

Common Stock Share Activity (millions of shares) | Issued | Held in Treasury | Outstanding | Issued | Held in Treasury | Outstanding |

| Balance as of December 31 | 8,019 | | (3,666) | | 4,353 | | 8,019 | | (4,048) | | 3,971 | |

| Share repurchases, at cost | — | | (43) | | (43) | | — | | (28) | | (28) | |

| | | | | | |

| Dispositions | — | | — | | — | | — | | — | | — | |

| Balance as of March 31 | 8,019 | | (3,709) | | 4,310 | | 8,019 | | (4,076) | | 3,943 | |

| | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

Note 1. Basis of Financial Statement Preparation

These unaudited condensed consolidated financial statements should be read in the context of the consolidated financial statements and notes thereto filed with the Securities and Exchange Commission in the Corporation's 2024 Annual Report on Form 10-K. In the opinion of the Corporation, the information furnished herein reflects all known accruals and adjustments necessary for a fair statement of the results for the periods reported herein. All such adjustments are of a normal recurring nature.

Restricted cash represents sale proceeds required to be set aside by a contractual arrangement for any potential like kind exchange. The restriction will lapse upon the earlier of completion of the exchange or the expiry of the underlying time period, which is less than one year.

The Corporation's exploration and production activities are accounted for under the "successful efforts" method.

Note 2. Pioneer Natural Resources Merger

On May 3, 2024, the Corporation acquired Pioneer Natural Resources Company ("Pioneer"), an independent oil and gas exploration and production company. In connection with the acquisition, we issued 545 million shares of ExxonMobil common stock having a fair value of $63 billion on the acquisition date, and assumed debt with a fair value of $5 billion.

The transaction was accounted for as a business combination in accordance with ASC 805, which requires that assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date. The following table summarizes the provisional fair values of the assets acquired and liabilities assumed.

| | | | | |

| (billions of dollars) | Pioneer |

Current assets (1) | 3 | |

| Other non-current assets | 1 | |

Property, plant & equipment (2) | 84 | |

| Total identifiable assets acquired | 88 | |

| |

Current liabilities (1) | 3 | |

Long-term debt (3) | 5 | |

Deferred income tax liabilities (4) | 16 | |

| Other non-current liabilities | 2 | |

| Total liabilities assumed | 26 | |

| Net identifiable assets acquired | 62 | |

| |

Goodwill (5) | 1 | |

Net assets (6) | 63 | |

| |

(1) Current assets and current liabilities consist primarily of accounts receivable and payable, with their respective fair values approximating historical values given their short-term duration, expectation of insignificant bad debt expense, and our credit rating. |

(2) Property, plant and equipment, of which a significant portion relates to crude oil and natural gas properties, was primarily valued using the income approach. Significant inputs and assumptions used in the income approach included estimates for commodity prices, future oil and gas production volumes, drilling and development costs, and risk-adjusted discount rates. Collectively, these inputs are level 3 inputs. |

(3) Long-term debt was valued using market prices as of the acquisition date, which reflects the use of level 1 inputs. |

(4) Deferred income taxes represent the tax effects of differences in the tax basis and acquisition date fair values of assets acquired and liabilities assumed. |

(5) Goodwill was allocated to the Upstream segment. |

(6) Provisional fair value measurements were made for assets acquired and liabilities assumed. Adjustments to those measurements may be made in subsequent periods, up to one year from the date of acquisition, as we continue to evaluate the information necessary to complete the analysis. |

Debt Assumed in the Merger

The following table presents long-term debt assumed at closing:

| | | | | | | | |

(millions of dollars) | Par Value | Fair Value

as of May 2, 2024 |

0.250% Convertible Senior Notes due May 2025 (1) | 450 | | 1,327 | |

1.125% Senior Notes due January 2026 | 750 | | 699 | |

5.100% Senior Notes due March 2026 | 1,100 | | 1,096 | |

7.200% Senior Notes due January 2028 | 241 | | 252 | |

4.125% Senior Notes due February 2028 | 138 | | 130 | |

1.900% Senior Notes due August 2030 | 1,100 | | 914 | |

2.150% Senior Notes due January 2031 | 1,000 | | 832 | |

(1) In June 2024, the Corporation redeemed in full all of the Convertible Senior Notes assumed from Pioneer for an amount consistent with the acquisition date fair value. |

Note 3. Litigation and Other Contingencies

Litigation

A variety of claims have been made against ExxonMobil and certain of its consolidated subsidiaries in a number of pending lawsuits. Management has regular litigation reviews, including updates from corporate and outside counsel, to assess the need for accounting recognition or disclosure of these contingencies. The Corporation accrues an undiscounted liability for those contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated. If a range of amounts can be reasonably estimated and no amount within the range is a better estimate than any other amount, then the minimum of the range is accrued. The Corporation does not record liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be reasonably estimated or when the liability is believed to be only reasonably possible or remote. For contingencies where an unfavorable outcome is reasonably possible and which are significant, the Corporation discloses the nature of the contingency and, where feasible, an estimate of the possible loss. For purposes of our contingency disclosures, “significant” includes material matters, as well as other matters, which management believes should be disclosed.

State and local governments and other entities in various jurisdictions across the United States and its territories have filed a number of legal proceedings against several oil and gas companies, including ExxonMobil, requesting unprecedented legal and equitable relief for various alleged injuries purportedly connected to climate change. These lawsuits assert a variety of novel, untested claims under statutory and common law. Additional such lawsuits may be filed. We believe the legal and factual theories set forth in these proceedings are meritless and represent an inappropriate attempt to use the court system to usurp the proper role of policymakers in addressing the societal challenges of climate change.

Local governments in Louisiana have filed unprecedented legal proceedings against a number of oil and gas companies, including ExxonMobil, requesting compensation for the restoration of coastal marsh erosion in the state. We believe the factual and legal theories set forth in these proceedings are meritless.

While the outcome of any litigation can be unpredictable, we believe the likelihood is remote that the ultimate outcomes of these lawsuits will have a material adverse effect on the Corporation’s operations, financial condition, or financial statements taken as a whole. We will continue to defend vigorously against these claims.

Other Contingencies

The Corporation and certain of its consolidated subsidiaries were contingently liable at March 31, 2025, for guarantees relating to notes, loans and performance under contracts. Where guarantees for environmental remediation and other similar matters do not include a stated cap, the amounts reflect management’s estimate of the maximum potential exposure. Where it is not possible to make a reasonable estimation of the maximum potential amount of future payments, future performance is expected to be either immaterial or have only a remote chance of occurrence.

| | | | | | | | | | | |

| | March 31, 2025 |

| | | |

| (millions of dollars) | Equity Company Obligations (1) | Other Third-Party Obligations | Total |

| Guarantees | | | |

| Debt-related | 1,051 | | 165 | | 1,216 | |

| Other | 675 | | 6,075 | | 6,750 | |

| Total | 1,726 | | 6,240 | | 7,966 | |

| | | |

(1) ExxonMobil share. | | | |

Additionally, the Corporation and its affiliates have numerous long-term sales and purchase commitments in their various business activities, all of which are expected to be fulfilled with no adverse consequences material to the Corporation’s operations or financial condition.

Note 4. Other Comprehensive Income Information

| | | | | | | | | | | |

ExxonMobil Share of Accumulated Other Comprehensive Income (millions of dollars) | Cumulative Foreign

Exchange

Translation

Adjustment | Postretirement

Benefits Reserves

Adjustment | Total |

| Balance as of December 31, 2023 | (13,056) | | 1,067 | | (11,989) | |

Current period change excluding amounts reclassified from accumulated other comprehensive income (2) | (1,138) | | (48) | | (1,186) | |

| Amounts reclassified from accumulated other comprehensive income | — | | 6 | | 6 | |

| Total change in accumulated other comprehensive income | (1,138) | | (42) | | (1,180) | |

| Balance as of March 31, 2024 | (14,194) | | 1,025 | | (13,169) | |

| | | |

| Balance as of December 31, 2024 | (16,166) | | 1,547 | | (14,619) | |

Current period change excluding amounts reclassified from accumulated other comprehensive income (2) | 295 | | (36) | | 259 | |

| Amounts reclassified from accumulated other comprehensive income | — | | 22 | | 22 | |

| Total change in accumulated other comprehensive income | 295 | | (14) | | 281 | |

| Balance as of March 31, 2025 | (15,871) | | 1,533 | | (14,338) | |

| | | |

(2) Cumulative Foreign Exchange Translation Adjustment includes net investment hedge gain/(loss) net of taxes of $(99) million and $84 million in 2025 and 2024, respectively. |

| | | | | | | | | | |

Amounts Reclassified Out of Accumulated Other Comprehensive Income - Before-tax Income/(Expense) (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| | | | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | | | |

| (Statement of Income line: Non-service pension and postretirement benefit expense) | (30) | | (12) | | | |

| | | | | | | | | | |

Income Tax (Expense)/Credit For Components of Other Comprehensive Income (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| Foreign exchange translation adjustment | 59 | | (75) | | | |

| Postretirement benefits reserves adjustment (excluding amortization) | 22 | | 4 | | | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | (7) | | (3) | | | |

| Total | 74 | | (74) | | | |

Note 5. Earnings Per Share

| | | | | | | | | | |

| Earnings per common share | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

Net income (loss) attributable to ExxonMobil (millions of dollars) | 7,713 | | 8,220 | | | |

Weighted-average number of common shares outstanding (millions of shares) (1) | 4,372 | | 3,998 | | | |

Earnings (loss) per common share (dollars) (2) | 1.76 | | 2.06 | | | |

Dividends paid per common share (dollars) | 0.99 | | 0.95 | | | |

| | | | |

(1) Includes restricted shares not vested. |

(2) Earnings (loss) per common share and earnings (loss) per common share – assuming dilution are the same in each period shown. |

Note 6. Pension and Other Postretirement Benefits

| | | | | | | | | | |

| (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| Components of net benefit cost | | | | |

| Pension Benefits - U.S. | | | | |

| Service cost | 136 | | 113 | | | |

| Interest cost | 170 | | 168 | | | |

| Expected return on plan assets | (149) | | (181) | | | |

| Amortization of actuarial loss/(gain) | 18 | | 21 | | | |

| Amortization of prior service cost | (7) | | (8) | | | |

| Net pension enhancement and curtailment/settlement cost | 36 | | 3 | | | |

| Net benefit cost | 204 | | 116 | | | |

| | | | |

| Pension Benefits - Non-U.S. | | | | |

| Service cost | 78 | | 83 | | | |

| Interest cost | 222 | | 227 | | | |

| Expected return on plan assets | (221) | | (261) | | | |

| Amortization of actuarial loss/(gain) | 9 | | 25 | | | |

| Amortization of prior service cost | 13 | | 13 | | | |

| | | | |

| Net benefit cost | 101 | | 87 | | | |

| | | | |

| Other Postretirement Benefits | | | | |

| Service cost | 23 | | 18 | | | |

| Interest cost | 65 | | 63 | | | |

| Expected return on plan assets | (4) | | (5) | | | |

| Amortization of actuarial loss/(gain) | (24) | | (26) | | | |

| Amortization of prior service cost | (15) | | (16) | | | |

| | | | |

| Net benefit cost | 45 | | 34 | | | |

Note 7. Financial Instruments and Derivatives

The estimated fair value of financial instruments and derivatives at March 31, 2025 and December 31, 2024, and the related hierarchy level for the fair value measurement was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2025 |

| | | | | | | | |

| | Fair Value | | | | |

| (millions of dollars) | Level 1 | Level 2 | Level 3 | Total Gross Assets

& Liabilities | Effect of

Counterparty Netting | Effect of

Collateral

Netting | Difference in Carrying Value and Fair Value | Net

Carrying

Value |

| Assets | | | | | | | | |

Derivative assets (1) | 5,240 | | 887 | | — | | 6,127 | | (5,516) | | (70) | | — | | 541 | |

| | | | | | | | |

Advances to/receivables from equity companies (2)(6) | — | | 2,435 | | 4,688 | | 7,123 | | — | | — | | 374 | | 7,497 | |

Other long-term financial assets (3) | 1,497 | | — | | 1,509 | | 3,006 | | — | | — | | 234 | | 3,240 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

Derivative liabilities (4) | 5,438 | | 859 | | — | | 6,297 | | (5,516) | | (268) | | — | | 513 | |

| | | | | | | | |

Long-term debt (5) | 25,109 | | 2,096 | | — | | 27,205 | | — | | — | | 3,560 | | 30,765 | |

| | | | | | | | |

Long-term obligations to equity companies (6) | — | | — | | 1,427 | | 1,427 | | — | | — | | (46) | | 1,381 | |

Other long-term financial liabilities (7) | — | | — | | 557 | | 557 | | — | | — | | 55 | | 612 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2024 |

| | | | | | | | |

| | Fair Value | | | | |

| (millions of dollars) | Level 1 | Level 2 | Level 3 | Total Gross Assets

& Liabilities | Effect of

Counterparty Netting | Effect of

Collateral

Netting | Difference in Carrying Value and Fair Value | Net

Carrying

Value |

| Assets | | | | | | | | |

Derivative assets (1) | 3,223 | | 1,206 | | — | | 4,429 | | (3,913) | | (3) | | — | | 513 | |

| | | | | | | | |

Advances to/receivables from equity companies (2)(6) | — | | 2,466 | | 4,167 | | 6,633 | | — | | — | | 451 | | 7,084 | |

Other long-term financial assets (3) | 1,468 | | — | | 1,504 | | 2,972 | | — | | — | | 247 | | 3,219 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

Derivative liabilities (4) | 3,561 | | 1,416 | | — | | 4,977 | | (3,913) | | (341) | | — | | 723 | |

| | | | | | | | |

Long-term debt (5) | 28,884 | | 1,813 | | — | | 30,697 | | — | | — | | 3,935 | | 34,632 | |

| | | | | | | | |

Long-term obligations to equity companies (6) | — | | — | | 1,393 | | 1,393 | | — | | — | | (47) | | 1,346 | |

Other long-term financial liabilities (7) | — | | — | | 583 | | 583 | | — | | — | | 57 | | 640 | |

| | |

(1) Included in the Balance Sheet lines: Notes and accounts receivable - net and Other assets, including intangibles - net. |

(2) Included in the Balance Sheet line: Investments, advances and long-term receivables. |

(3) Included in the Balance Sheet lines: Investments, advances and long-term receivables and Other assets, including intangibles - net. |

(4) Included in the Balance Sheet lines: Accounts payable and accrued liabilities and Other long-term obligations. |

(5) Excluding finance lease obligations. |

(6) Advances to/receivables from equity companies and long-term obligations to equity companies are mainly designated as hierarchy level 3 inputs. The fair value is calculated by discounting the remaining obligations by a rate consistent with the credit quality and industry of the equity company. |

(7) Included in the Balance Sheet line: Other long-term obligations. Includes contingent consideration related to a prior year acquisition where fair value is based on expected drilling activities and discount rates. |

At March 31, 2025 and December 31, 2024, respectively, the Corporation had $538 million and $491 million of collateral under master netting arrangements not offset against the derivatives on the Condensed Consolidated Balance Sheet, primarily related to initial margin requirements.

The Corporation may use non-derivative financial instruments, such as its foreign currency-denominated debt, as hedges of its net investments in certain foreign subsidiaries. Under this method, the change in the carrying value of the financial instruments due to foreign exchange fluctuations is reported in accumulated other comprehensive income. As of March 31, 2025, the Corporation has designated $3.2 billion of its Euro-denominated debt and related accrued interest as a net investment hedge of its European business. The net investment hedge is deemed to be perfectly effective.

The Corporation had undrawn short-term committed lines of credit of $0.2 billion and undrawn long-term committed lines of credit of $1.0 billion as of the end of first quarter 2025.

Derivative Instruments

The Corporation’s size, strong capital structure, geographic diversity, and the complementary nature of its business segments reduce the Corporation’s enterprise-wide risk from changes in commodity prices, currency rates and interest rates. In addition, the Corporation uses commodity-based contracts, including derivatives, to manage commodity price risk and to generate returns from trading. Commodity contracts held for trading purposes are presented in the Condensed Consolidated Statement of Income on a net basis in the line “Sales and other operating revenue" and in the Consolidated Statement of Cash Flows in “Cash Flows from Operating Activities”. The Corporation’s commodity derivatives are not accounted for under hedge accounting. At times, the Corporation also enters into currency and interest rate derivatives, none of which are material to the Corporation’s financial position as of March 31, 2025 and December 31, 2024, or results of operations for the periods ended March 31, 2025 and 2024.

The Corporation operates a program to hedge certain of its fixed-rate debt instruments against changes in fair value due to changes in the designated benchmark interest rate. This program utilizes fair value hedge accounting. The derivative (hedging) instruments are fixed-for-floating interest rate swaps, with settlement dates that correspond to the interest payments associated with the fixed-rate debt (hedged item). Changes in the fair values of the hedging instruments are perfectly offset by changes in the fair values of the hedged items; the effects of these changes in fair values are recorded in "Interest expense" in the Consolidated Statement of Income. This program was not material to the Consolidated Financial Statements as of the end of first quarter 2025.

Credit risk associated with the Corporation’s derivative position is mitigated by several factors, including the use of derivative clearing exchanges and the quality of and financial limits placed on derivative counterparties. The Corporation maintains a system of controls that includes the authorization, reporting, and monitoring of derivative activity.

The net notional long/(short) position of derivative instruments at March 31, 2025 and December 31, 2024, was as follows:

| | | | | | | | |

| (millions) | March 31, 2025 | December 31, 2024 |

| Crude oil (barrels) | 35 | | 13 | |

| Petroleum products (barrels) | (28) | | (32) | |

| Natural gas (MMBTUs) | (702) | | (675) | |

| | |

Realized and unrealized gains/(losses) on derivative instruments that were recognized in the Condensed Consolidated Statement of Income are included in the following lines on a before-tax basis:

| | | | | | | | | | |

| (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| Sales and other operating revenue | 19 | | (792) | | | |

| Crude oil and product purchases | 2 | | 3 | | | |

| | | | |

| Total | 21 | | (789) | | | |

Note 8. Disclosures about Segments and Related Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | Upstream | Energy Products | Chemical Products | Specialty Products | Segment Total |

| U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| | | | | | | | | | |

| Three Months Ended March 31, 2025 | | | | | | | | | |

| Revenues and other income | | | | | | | | | |

| Sales and other operating revenue | 7,318 | | 3,960 | | 23,885 | | 36,077 | | 2,022 | | 3,385 | | 1,367 | | 3,025 | | 81,039 | |

| Income from equity affiliates | 4 | | 1,247 | | 36 | | 1 | | 23 | | 140 | | — | | (22) | | 1,429 | |

| Intersegment revenue | 6,556 | | 9,850 | | 4,624 | | 6,672 | | 1,675 | | 739 | | 549 | | 114 | | 30,779 | |

| Other income | (135) | | 374 | | 56 | | 24 | | 1 | | (1) | | — | | 27 | | 346 | |

| Segment revenues and other income | 13,743 | | 15,431 | | 28,601 | | 42,774 | | 3,721 | | 4,263 | | 1,916 | | 3,144 | | 113,593 | |

| | | | | | | | | |

| Costs and other items | | | | | | | | | |

| Crude oil and product purchases | 5,429 | | 3,261 | | 25,106 | | 35,046 | | 2,154 | | 3,015 | | 997 | | 2,079 | | 77,087 | |

Operating expenses, excl. depreciation and depletion (1) | 2,763 | | 2,281 | | 2,082 | | 2,159 | | 1,063 | | 1,084 | | 472 | | 570 | | 12,474 | |

| Depreciation and depletion (includes impairments) | 3,038 | | 1,689 | | 195 | | 173 | | 145 | | 122 | | 27 | | 38 | | 5,427 | |

| Interest expense | 37 | | 6 | | — | | 1 | | — | | — | | — | | — | | 44 | |

| Other taxes and duties | 64 | | 539 | | 787 | | 4,562 | | 16 | | 22 | | 2 | | 44 | | 6,036 | |

| Total costs and other deductions | 11,331 | | 7,776 | | 28,170 | | 41,941 | | 3,378 | | 4,243 | | 1,498 | | 2,731 | | 101,068 | |

Segment income (loss) before income taxes | 2,412 | | 7,655 | | 431 | | 833 | | 343 | | 20 | | 418 | | 413 | | 12,525 | |

| Income tax expense (benefit) | 542 | | 2,598 | | 94 | | 187 | | 88 | | (6) | | 96 | | 77 | | 3,676 | |

| Segment net income (loss) incl. noncontrolling interests | 1,870 | | 5,057 | | 337 | | 646 | | 255 | | 26 | | 322 | | 336 | | 8,849 | |

| Net income (loss) attributable to noncontrolling interests | — | | 171 | | 40 | | 116 | | — | | 8 | | — | | 3 | | 338 | |

| Segment income (loss) | 1,870 | | 4,886 | | 297 | | 530 | | 255 | | 18 | | 322 | | 333 | | 8,511 | |

| | | | | | | | | |

Reconciliation of consolidated revenues | | | | | | | |

| Segment revenues and other income | 113,593 | | | | | | | |

Other revenues (2) | 316 | | | | | | | |

| Elimination of intersegment revenues | (30,779) | | | | | | | |

| Total consolidated revenues and other income | 83,130 | | | | | | | |

| | | | | | | | | |

| Reconciliation of income (loss) attributable to ExxonMobil | | | | | | | |

| Total segment income (loss) | 8,511 | | | | | | | |

| Corporate and Financing income (loss) | (798) | | | | | | | |

| Net income (loss) attributable to ExxonMobil | 7,713 | | | | | | | |

| | | | | | | | | |

| (millions of dollars) | Upstream | Energy Products | Chemical Products | Specialty Products | Segment Total |

| U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Three Months Ended March 31, 2025 | | | | | | | | | |

Additions to property, plant and equipment (3) | 2,780 | | 2,022 | | 116 | | 228 | | 145 | | 117 | | 49 | | 53 | | 5,510 | |

| | | | | | | | | |

| As of March 31, 2025 | | | | | | | | | |

| Investments in equity companies | 4,933 | | 21,359 | | 454 | | 923 | | 2,998 | | 2,663 | | — | | 805 | | 34,135 | |

| Total assets | 153,432 | | 136,606 | | 33,105 | | 46,181 | | 17,400 | | 18,023 | | 2,837 | | 8,334 | | 415,918 | |

|

| Reconciliation to Corporate Total | Segment Total | Corporate and Financing | Corporate Total | | | |

| Three Months Ended March 31, 2025 | | | | | | | | | |

Additions to property, plant and equipment (3) | 5,510 | | 519 | | 6,029 | | | | |

| | | | | | | | | |

| As of March 31, 2025 | | | | | | | | | |

| Investments in equity companies | 34,135 | | (132) | | 34,003 | | | | |

| Total assets | 415,918 | | 35,990 | | 451,908 | | | | |

|

(1) Operating expenses, excl. depreciation and depletion includes the following GAAP line items, as reflected on the Income Statement: Production and manufacturing expenses; Selling, general and administrative expenses; Exploration expenses, including dry holes; and Non-service pension and postretirement benefit expense. |

(2) Primarily Corporate and Financing Interest revenue of $363 million. |

(3) Includes non-cash additions. |

| Due to rounding, numbers presented may not add up precisely to the totals indicated. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | Upstream | Energy Products | Chemical Products | Specialty Products | Segment Total |

| U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| | | | | | | | | |

| Three Months Ended March 31, 2024 | | | | | | | | | |

| Revenues and other income | | | | | | | | | |

| Sales and other operating revenue | 2,190 | | 3,526 | | 24,803 | | 39,409 | | 2,194 | | 3,646 | | 1,469 | | 3,150 | | 80,387 | |

| Income from equity affiliates | (105) | | 1,708 | | 33 | | 25 | | 57 | | 205 | | — | | (9) | | 1,914 | |

| Intersegment revenue | 5,988 | | 9,980 | | 6,558 | | 6,752 | | 1,865 | | 1,025 | | 655 | | 164 | | 32,987 | |

| Other income | (39) | | 137 | | 43 | | 19 | | 1 | | 5 | | 3 | | 32 | | 201 | |

| Segment revenues and other income | 8,034 | | 15,351 | | 31,437 | | 46,205 | | 4,117 | | 4,881 | | 2,127 | | 3,337 | | 115,489 | |

| | | | | | | | | |

| Costs and other items | | | | | | | | | |

| Crude oil and product purchases | 2,993 | | 2,483 | | 27,276 | | 38,351 | | 2,291 | | 3,351 | | 1,146 | | 2,285 | | 80,176 | |

Operating expenses, excl. depreciation and depletion (1) | 1,727 | | 2,630 | | 2,014 | | 2,138 | | 991 | | 1,060 | | 428 | | 535 | | 11,523 | |

| Depreciation and depletion expense | 1,842 | | 2,035 | | 196 | | 189 | | 159 | | 109 | | 22 | | 39 | | 4,591 | |

| Interest expense | 28 | | 15 | | 1 | | 2 | | — | | — | | — | | 1 | | 47 | |

| Other taxes and duties | 98 | | 613 | | 820 | | 4,703 | | 17 | | 19 | | 2 | | 52 | | 6,324 | |

| Total costs and other deductions | 6,688 | | 7,776 | | 30,307 | | 45,383 | | 3,458 | | 4,539 | | 1,598 | | 2,912 | | 102,661 | |

| Segment income (loss) before income taxes | 1,346 | | 7,575 | | 1,130 | | 822 | | 659 | | 342 | | 529 | | 425 | | 12,828 | |

| Income tax expense (benefit) | 292 | | 2,825 | | 236 | | 138 | | 155 | | 50 | | 125 | | 63 | | 3,884 | |

| Segment net income (loss) incl. noncontrolling interests | 1,054 | | 4,750 | | 894 | | 684 | | 504 | | 292 | | 404 | | 362 | | 8,944 | |

| Net income (loss) attributable to noncontrolling interests | — | | 144 | | 58 | | 144 | | — | | 11 | | — | | 5 | | 362 | |

| Segment income (loss) | 1,054 | | 4,606 | | 836 | | 540 | | 504 | | 281 | | 404 | | 357 | | 8,582 | |

| | | | | | | | | |

Reconciliation of consolidated revenues | | | | | | | |

| Segment revenues and other income | 115,489 | | | | | | | |

Other revenues (2) | 581 | | | | | | | |

| Elimination of intersegment revenues | (32,987) | | | | | | | |

| Total consolidated revenues and other income | 83,083 | | | | | | | |

| | | | | | | | | |

| Reconciliation of income (loss) attributable to ExxonMobil | | | | | | | |

| Total segment income (loss) | 8,582 | | | | | | | |

| Corporate and Financing income (loss) | (362) | | | | | | | |

| Net income (loss) attributable to ExxonMobil | 8,220 | | | | | | | |

| | | | | | | | | |

| (millions of dollars) | Upstream | Energy Products | Chemical Products | Specialty Products | Segment Total |

| U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Three Months Ended March 31, 2024 | | | | | | | | | |

Additions to property, plant and equipment (3) | 2,028 | | 1,664 | | 142 | | 321 | | 100 | | 235 | | 14 | | 58 | | 4,562 | |

| | | | | | | | | |

| As of December 31, 2024 | | | | | | | | | |

| Investments in equity companies | 4,884 | | 21,396 | | 444 | | 915 | | 3,016 | | 2,649 | | — | | 814 | | 34,118 | |

| Total assets | 154,914 | | 134,609 | | 32,143 | | 43,399 | | 17,445 | | 17,692 | | 2,882 | | 8,040 | | 411,124 | |

|

| Reconciliation to Corporate Total | Segment Total | Corporate and Financing | Corporate Total | | | |

| Three Months Ended March 31, 2024 | | | | | | | | | |

Additions to property, plant and equipment (3) | 4,562 | | 512 | | 5,074 | | | | |

| | | | | | | | | |

| As of December 31, 2024 | | | | | | | | | |

| Investments in equity companies | 34,118 | | (108) | | 34,010 | | | | |

| Total assets | 411,124 | | 42,351 | | 453,475 | | | | |

|

(1) Operating expenses, excl. depreciation and depletion includes the following GAAP line items, as reflected on the Income Statement: Production and manufacturing expenses; Selling, general and administrative expenses; Exploration expenses, including dry holes; and Non-service pension and postretirement benefit expense. |

(2) Primarily Corporate and Financing Interest revenue of $474 million. |

(3) Includes non-cash additions. |

| Due to rounding, numbers presented may not add up precisely to the totals indicated. |

Revenue from Contracts with Customers

Sales and other operating revenue include both revenue within the scope of ASC 606 and outside the scope of ASC 606. Trade receivables in Notes and accounts receivable – net reported on the Balance Sheet also includes both receivables within the scope of ASC 606 and those outside the scope of ASC 606. Revenue and receivables outside the scope of ASC 606 primarily relate to physically settled commodity contracts accounted for as derivatives. Contractual terms, credit quality, and type of customer are generally similar between those revenues and receivables within the scope of ASC 606 and those outside it.

| | | | | | | | | | |

Sales and other operating revenue (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| Revenue from contracts with customers | 56,931 | | 58,419 | | | |

| Revenue outside the scope of ASC 606 | 24,127 | | 21,992 | | | |

| Total | 81,058 | | 80,411 | | | |

| | | | | | | | | | |

| Geographic Sales and Other Operating Revenue | | | | |

| (millions of dollars) | Three Months Ended

March 31, | |

| 2025 | 2024 | | |

| United States | 34,607 | | 30,656 | | | |

| Non-U.S. | 46,451 | | 49,755 | | | |

| Total | 81,058 | | 80,411 | | | |

| | | | |

Significant Non-U.S. revenue sources include: (1) | | | | |

| Canada | 6,990 | | 7,055 | | | |

| United Kingdom | 5,840 | | 5,160 | | | |

| Singapore | 3,833 | | 4,018 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

(1) Revenue is determined by primary country of operations. Excludes certain sales and other operating revenues in non-U.S. operations where attribution to a specific country is not practicable. |

Note 9. Divestment Activities

Through March 31, 2025, the Corporation realized proceeds of approximately $1.8 billion and net after-tax earnings of approximately $0.2 billion from its divestment activities. This included the sale of select conventional assets in Texas and New Mexico, Mobil Argentina S.A., as well as other smaller divestments.

In 2024, the Corporation realized proceeds of approximately $5.0 billion and recognized net after-tax earnings of approximately $1.0 billion from its divestment activities. This included the sale of the Santa Ynez Unit and associated facilities in California, Mobil Producing Nigeria Unlimited, ExxonMobil Exploration Argentina, the Fos-sur-Mer Refinery (France), the Adriatic LNG terminal (Italy), and certain conventional and unconventional assets in the United States, as well as other smaller divestments.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

During the first quarter of 2025, the price of crude oil remained roughly flat relative to fourth quarter 2024 and near the middle of the 10-year historical range (2010-2019). Natural gas prices improved during the quarter and moved above the 10-year range on stronger global demand, driven by colder weather in the U.S. and Europe. Global industry refining margins declined and moved below the low end of the 10-year range, driven by weakness in Asia Pacific from capacity additions and higher regional feed costs. The Corporation benefited from its relatively large refining footprint in North America where industry margins improved as a result of turnarounds and industry outages. Chemical margins remained at bottom of cycle conditions, and well below the 10-year range, as growing demand was met by continued capacity additions.

During 2025, the U.S. announced a variety of trade-related actions, including the imposition of tariffs on imports from several countries. In response, many countries announced their own retaliatory tariffs. Certain tariffs were paused for a period of time but have not been withdrawn. The global trade environment continues to be volatile. The likelihood of the U.S. or its trading partners resuming tariffs, imposing new or reciprocal tariffs, export restrictions, or other forms of trade-related sanctions is highly uncertain. Additionally, significant uncertainty exists as to what effects these actions will ultimately have on the Corporation, our suppliers and our customers, as well as on the overall macroeconomic environment. We continually monitor the global trade environment and work to mitigate potential impacts.

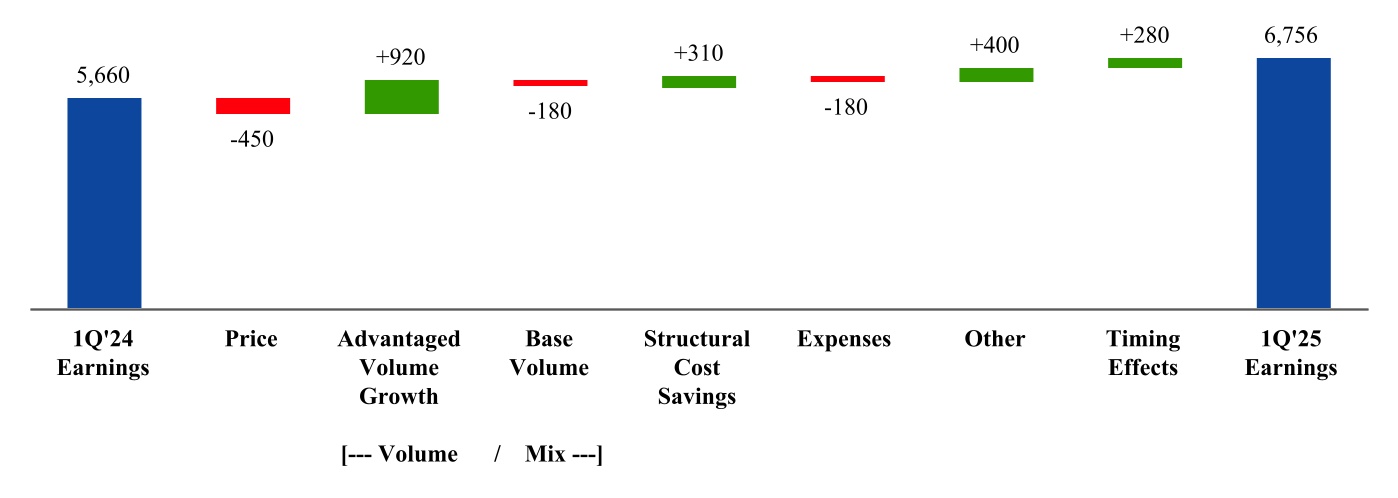

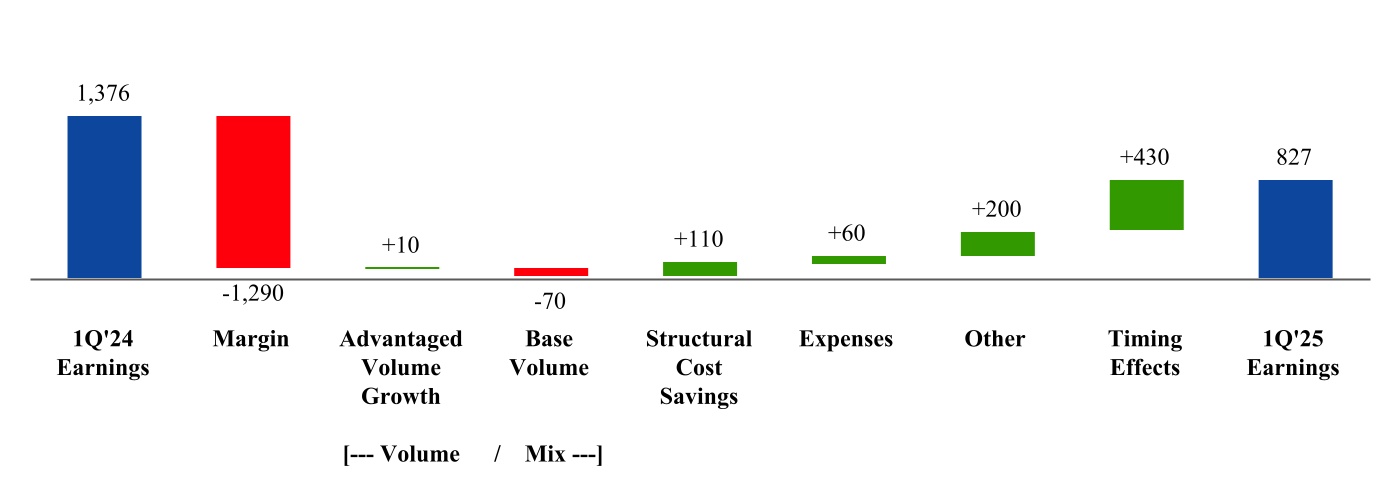

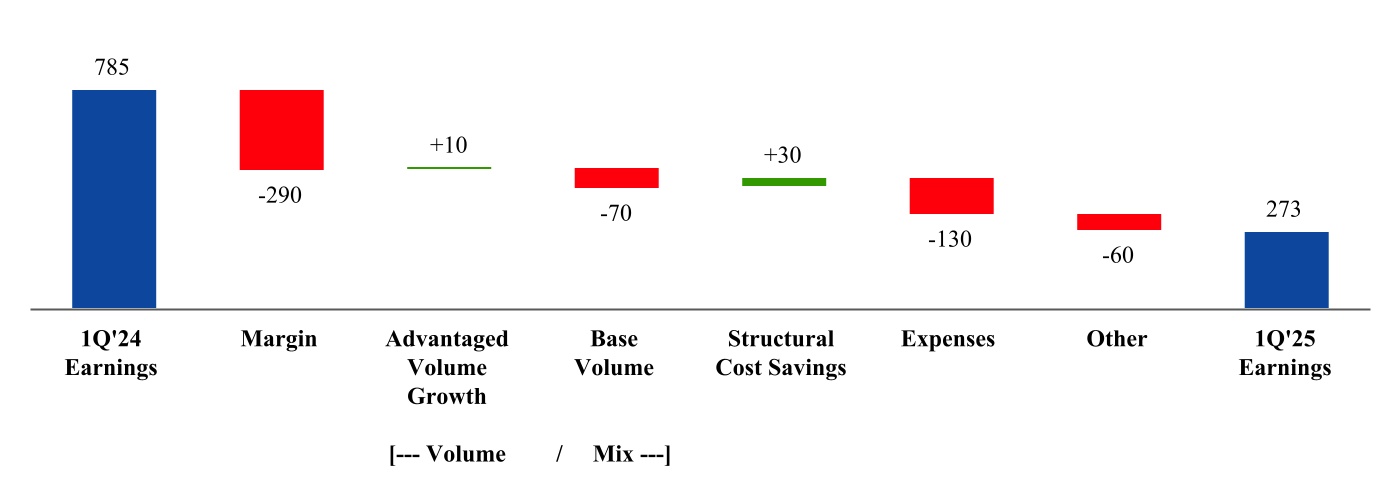

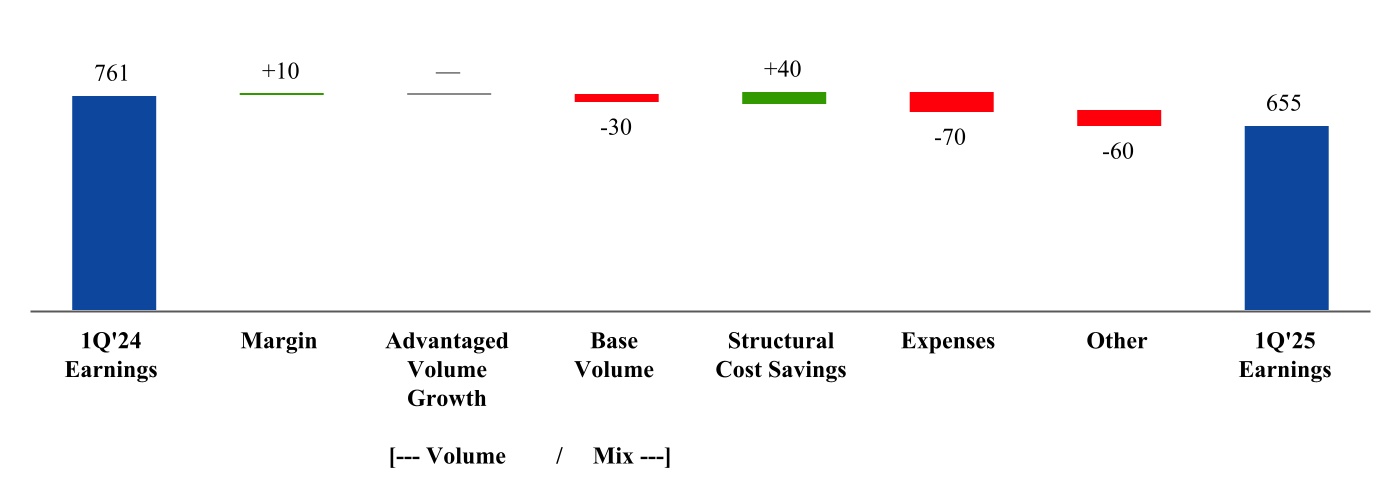

Selected Earnings Driver Definitions

The earnings drivers provide additional visibility into our business results. The Company evaluates these drivers periodically to determine if any enhancements may provide helpful insights to the market. Listed below are descriptions of the earnings drivers:

Advantaged Volume Growth. Represents earnings impacts from change in volume/mix from advantaged assets, advantaged projects, and high-value products.

•Advantaged Assets (Advantaged growth projects). Includes Permian, Guyana, and LNG.

•Advantaged Projects. Includes capital projects and programs of work that contribute to Energy, Chemical, and/or Specialty Products segments that drive integration of segments/businesses, increase yield of higher value products, or deliver higher than average returns.

•High-Value Products. Includes performance products and lower-emission fuels. Performance products (performance chemicals, performance lubricants) refers to products that provide differentiated performance for multiple applications through enhanced properties versus commodity alternatives and bring significant additional value to customers and end-users. Lower-emission fuels refers to fuels with lower life cycle emissions than conventional transportation fuels for gasoline, diesel and jet transport.

Base Volume. Represents all volume/mix drivers not included in Advantaged Volume Growth defined above.

Structural Cost Savings. Represents after-tax earnings effects of Structural Cost Savings as defined on page 19, including cash operating expenses related to divestments. Expenses. Represents all expenses otherwise not included in other earnings drivers.

Timing Effects. Represents timing effects that are primarily related to unsettled derivatives (mark-to-market) and other earnings impacts driven by timing differences between the settlement of derivatives and their offsetting physical commodity realizations (due to LIFO inventory accounting).

Earnings (loss) excluding Identified Items (Non-GAAP)

Earnings (loss) excluding Identified Items are earnings (loss) excluding individually significant non-operational events with, typically, an absolute corporate total earnings impact of at least $250 million in a given quarter. The earnings (loss) impact of an Identified Item for an individual segment may be less than $250 million when the item impacts several segments or several periods. Earnings (loss) excluding Identified Items does include non-operational earnings events or impacts that are generally below the $250 million threshold utilized for Identified Items. Management uses these figures to improve comparability of the underlying business across multiple periods by isolating and removing significant non-operational events from business results. The Corporation believes this view provides investors increased transparency into business results and trends, and provides investors with a view of the business as seen through the eyes of management. Earnings (loss) excluding Identified Items is not meant to be viewed in isolation or as a substitute for net income (loss) attributable to ExxonMobil as prepared in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Three Months Ended March 31, 2025 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate and Financing | Total |

| (millions of dollars) | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings (loss) (U.S. GAAP) | 1,870 | | 4,886 | | 297 | | 530 | | 255 | | 18 | | 322 | | 333 | | (798) | | 7,713 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Identified Items | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | |

Earnings (loss) excluding Identified Items (Non-GAAP) | 1,870 | | 4,886 | | 297 | | 530 | | 255 | | 18 | | 322 | | 333 | | (798) | | 7,713 | |

| | | | | | | | | | |

Three Months Ended March 31, 2024 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate and Financing | Total |

| (millions of dollars) | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings (loss) (U.S. GAAP) | 1,054 | | 4,606 | | 836 | | 540 | | 504 | | 281 | | 404 | | 357 | | (362) | | 8,220 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Identified Items | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | |

Earnings (loss) excluding Identified Items (Non-GAAP) | 1,054 | | 4,606 | | 836 | | 540 | | 504 | | 281 | | 404 | | 357 | | (362) | | 8,220 | |

References in this discussion to Corporate earnings (loss) mean net income (loss) attributable to ExxonMobil (U.S. GAAP) from the Condensed Consolidated Statement of Income. Unless otherwise indicated, references to earnings (loss); Upstream, Energy Products, Chemical Products, Specialty Products, and Corporate and Financing earnings (loss); and earnings (loss) per share are ExxonMobil's share after excluding amounts attributable to noncontrolling interests.

Due to rounding, numbers presented may not add up precisely to the totals indicated.

Structural Cost Savings (Non-GAAP)

Structural Cost Savings describes decreases in cash opex excluding energy and production taxes as a result of operational efficiencies, workforce reductions, divestment-related reductions, and other cost-savings measures that are expected to be sustainable compared to 2019 levels. Relative to 2019, estimated cumulative Structural Cost Savings totaled $12.7 billion, which included an additional $0.6 billion in the first three months of 2025. The total change between periods in expenses below will reflect both Structural Cost Savings and other changes in spend, including market factors, such as inflation and foreign exchange impacts, as well as changes in activity levels and costs associated with new operations, mergers and acquisitions, new business venture development, and early-stage projects. Structural Cost Savings from new operations, mergers and acquisitions, and new business venture developments are included in the cumulative Structural Cost Savings. Estimates of cumulative annual structural savings may be revised depending on whether cost reductions realized in prior periods are determined to be sustainable compared to 2019 levels. Structural Cost Savings are stewarded internally to support management's oversight of spending over time. This measure is useful for investors to understand the Corporation's efforts to optimize spending through disciplined expense management.

| | | | | | | | | | | | | | | | | |

Dollars in billions (unless otherwise noted) | Twelve Months

Ended December 31, | Three Months Ended

March 31, | |

| 2019 | 2024 | 2024 | 2025 | |

| Components of Operating Costs | | | | | |

From ExxonMobil’s Consolidated Statement of Income

(U.S. GAAP) | | | | | |

| Production and manufacturing expenses | 36.8 | | 39.6 | | 9.1 | | 10.1 | | |

| Selling, general and administrative expenses | 11.4 | | 10.0 | | 2.5 | | 2.5 | | |

| Depreciation and depletion (includes impairments) | 19.0 | | 23.4 | | 4.8 | | 5.7 | | |

| Exploration expenses, including dry holes | 1.3 | | 0.8 | | 0.1 | | 0.1 | | |

| Non-service pension and postretirement benefit expense | 1.2 | | 0.1 | | — | | 0.1 | | |