FALSE00000340882022Q3--12-3100000340882022-01-012022-09-300000034088us-gaap:CommonStockMember2022-01-012022-09-300000034088xom:ZeroPointOneFourTwoPercentNotesDue2024Member2022-01-012022-09-300000034088xom:ZeroPointFiveTwoFourPercentNotesDue2028Member2022-01-012022-09-300000034088xom:ZeroPointEightThreeFivePercentNotesDue2032Member2022-01-012022-09-300000034088xom:OnePointFourZeroEightPercentNotesDue2039Member2022-01-012022-09-3000000340882022-09-30xbrli:shares00000340882022-07-012022-09-30iso4217:USD00000340882021-07-012021-09-3000000340882021-01-012021-09-30iso4217:USDxbrli:shares00000340882021-12-3100000340882020-12-3100000340882021-09-300000034088us-gaap:CommonStockMember2021-06-300000034088us-gaap:RetainedEarningsMember2021-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300000034088us-gaap:TreasuryStockMember2021-06-300000034088us-gaap:ParentMember2021-06-300000034088us-gaap:NoncontrollingInterestMember2021-06-3000000340882021-06-300000034088us-gaap:CommonStockMember2021-07-012021-09-300000034088us-gaap:ParentMember2021-07-012021-09-300000034088us-gaap:NoncontrollingInterestMember2021-07-012021-09-300000034088us-gaap:RetainedEarningsMember2021-07-012021-09-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300000034088us-gaap:TreasuryStockMember2021-07-012021-09-300000034088us-gaap:CommonStockMember2021-09-300000034088us-gaap:RetainedEarningsMember2021-09-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300000034088us-gaap:TreasuryStockMember2021-09-300000034088us-gaap:ParentMember2021-09-300000034088us-gaap:NoncontrollingInterestMember2021-09-300000034088us-gaap:CommonStockMember2022-06-300000034088us-gaap:RetainedEarningsMember2022-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000034088us-gaap:TreasuryStockMember2022-06-300000034088us-gaap:ParentMember2022-06-300000034088us-gaap:NoncontrollingInterestMember2022-06-3000000340882022-06-300000034088us-gaap:CommonStockMember2022-07-012022-09-300000034088us-gaap:ParentMember2022-07-012022-09-300000034088us-gaap:NoncontrollingInterestMember2022-07-012022-09-300000034088us-gaap:RetainedEarningsMember2022-07-012022-09-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000034088us-gaap:TreasuryStockMember2022-07-012022-09-300000034088us-gaap:CommonStockMember2022-09-300000034088us-gaap:RetainedEarningsMember2022-09-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000034088us-gaap:TreasuryStockMember2022-09-300000034088us-gaap:ParentMember2022-09-300000034088us-gaap:NoncontrollingInterestMember2022-09-300000034088us-gaap:CommonStockMember2020-12-310000034088us-gaap:RetainedEarningsMember2020-12-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000034088us-gaap:TreasuryStockMember2020-12-310000034088us-gaap:ParentMember2020-12-310000034088us-gaap:NoncontrollingInterestMember2020-12-310000034088us-gaap:CommonStockMember2021-01-012021-09-300000034088us-gaap:ParentMember2021-01-012021-09-300000034088us-gaap:NoncontrollingInterestMember2021-01-012021-09-300000034088us-gaap:RetainedEarningsMember2021-01-012021-09-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300000034088us-gaap:TreasuryStockMember2021-01-012021-09-300000034088us-gaap:CommonStockMember2021-12-310000034088us-gaap:RetainedEarningsMember2021-12-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000034088us-gaap:TreasuryStockMember2021-12-310000034088us-gaap:ParentMember2021-12-310000034088us-gaap:NoncontrollingInterestMember2021-12-310000034088us-gaap:CommonStockMember2022-01-012022-09-300000034088us-gaap:ParentMember2022-01-012022-09-300000034088us-gaap:NoncontrollingInterestMember2022-01-012022-09-300000034088us-gaap:RetainedEarningsMember2022-01-012022-09-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300000034088us-gaap:TreasuryStockMember2022-01-012022-09-300000034088xom:Sakhalin1Member2022-01-012022-09-30utr:Boexbrli:pure0000034088xom:ExxonMobilCorporationMember2021-12-310000034088xom:DebtRelatedGuaranteesMemberxom:EquityCompanyObligationsMember2022-09-300000034088xom:OtherThirdPartyObligationsMemberxom:DebtRelatedGuaranteesMember2022-09-300000034088xom:DebtRelatedGuaranteesMember2022-09-300000034088xom:OtherGuaranteesMemberxom:EquityCompanyObligationsMember2022-09-300000034088xom:OtherThirdPartyObligationsMemberxom:OtherGuaranteesMember2022-09-300000034088xom:OtherGuaranteesMember2022-09-300000034088xom:EquityCompanyObligationsMember2022-09-300000034088xom:OtherThirdPartyObligationsMember2022-09-300000034088xom:OperatingLeaseMember2022-09-300000034088xom:FinanceLeaseMember2022-09-300000034088srt:ParentCompanyMember2020-12-310000034088srt:ParentCompanyMember2021-01-012021-09-300000034088srt:ParentCompanyMember2021-09-300000034088srt:ParentCompanyMember2021-12-310000034088srt:ParentCompanyMember2022-01-012022-09-300000034088srt:ParentCompanyMember2022-09-300000034088country:USus-gaap:PensionPlansDefinedBenefitMember2022-07-012022-09-300000034088country:USus-gaap:PensionPlansDefinedBenefitMember2021-07-012021-09-300000034088country:USus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-09-300000034088country:USus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-09-300000034088us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-07-012022-09-300000034088us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-07-012021-09-300000034088us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-09-300000034088us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-09-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-07-012022-09-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-07-012021-09-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-09-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-09-300000034088us-gaap:FairValueInputsLevel1Member2022-09-300000034088us-gaap:FairValueInputsLevel2Member2022-09-300000034088us-gaap:FairValueDisclosureItemAmountsDomain2022-09-300000034088xom:EffectOfCounterpartyNettingMember2022-09-300000034088xom:EffectOfCollateralNettingMember2022-09-300000034088us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300000034088us-gaap:FairValueInputsLevel3Member2022-09-300000034088xom:DifferenceInCarryingValueAndFairValueMember2022-09-300000034088us-gaap:FairValueInputsLevel1Member2021-12-310000034088us-gaap:FairValueInputsLevel2Member2021-12-310000034088us-gaap:FairValueDisclosureItemAmountsDomain2021-12-310000034088xom:EffectOfCounterpartyNettingMember2021-12-310000034088xom:EffectOfCollateralNettingMember2021-12-310000034088us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000034088us-gaap:FairValueInputsLevel3Member2021-12-310000034088xom:DifferenceInCarryingValueAndFairValueMember2021-12-310000034088xom:LineOfCreditShortTermMember2022-09-300000034088xom:LineOfCreditLongTermMember2022-09-300000034088xom:LineOfCreditShortTermMember2022-07-012022-09-300000034088us-gaap:ShortMembersrt:CrudeOilMember2022-01-012022-09-30utr:bbl0000034088us-gaap:LongMembersrt:CrudeOilMember2021-01-012021-12-310000034088us-gaap:ShortMemberxom:ProductsMember2022-01-012022-09-300000034088us-gaap:ShortMemberxom:ProductsMember2021-01-012021-12-310000034088us-gaap:ShortMemberxom:NaturalGasMember2022-01-012022-09-30utr:MMBTU0000034088us-gaap:ShortMemberxom:NaturalGasMember2021-01-012021-12-310000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2022-07-012022-09-300000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2021-07-012021-09-300000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2022-01-012022-09-300000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2021-01-012021-09-30xom:segment0000034088xom:UpstreamUnitedStatesMember2022-07-012022-09-300000034088xom:UpstreamUnitedStatesMember2021-07-012021-09-300000034088xom:UpstreamUnitedStatesMember2022-01-012022-09-300000034088xom:UpstreamUnitedStatesMember2021-01-012021-09-300000034088xom:UpstreamNonUsMember2022-07-012022-09-300000034088xom:UpstreamNonUsMember2021-07-012021-09-300000034088xom:UpstreamNonUsMember2022-01-012022-09-300000034088xom:UpstreamNonUsMember2021-01-012021-09-300000034088xom:EnergyProductsUnitedStatesMember2022-07-012022-09-300000034088xom:EnergyProductsUnitedStatesMember2021-07-012021-09-300000034088xom:EnergyProductsUnitedStatesMember2022-01-012022-09-300000034088xom:EnergyProductsUnitedStatesMember2021-01-012021-09-300000034088xom:EnergyProductsNonUSMember2022-07-012022-09-300000034088xom:EnergyProductsNonUSMember2021-07-012021-09-300000034088xom:EnergyProductsNonUSMember2022-01-012022-09-300000034088xom:EnergyProductsNonUSMember2021-01-012021-09-300000034088xom:ChemicalProductsUnitedStatesMember2022-07-012022-09-300000034088xom:ChemicalProductsUnitedStatesMember2021-07-012021-09-300000034088xom:ChemicalProductsUnitedStatesMember2022-01-012022-09-300000034088xom:ChemicalProductsUnitedStatesMember2021-01-012021-09-300000034088xom:ChemicalProductsNonUSMember2022-07-012022-09-300000034088xom:ChemicalProductsNonUSMember2021-07-012021-09-300000034088xom:ChemicalProductsNonUSMember2022-01-012022-09-300000034088xom:ChemicalProductsNonUSMember2021-01-012021-09-300000034088xom:SpecialtyProductsUnitedStatesMember2022-07-012022-09-300000034088xom:SpecialtyProductsUnitedStatesMember2021-07-012021-09-300000034088xom:SpecialtyProductsUnitedStatesMember2022-01-012022-09-300000034088xom:SpecialtyProductsUnitedStatesMember2021-01-012021-09-300000034088xom:SpecialtyProductsNonUSMember2022-07-012022-09-300000034088xom:SpecialtyProductsNonUSMember2021-07-012021-09-300000034088xom:SpecialtyProductsNonUSMember2022-01-012022-09-300000034088xom:SpecialtyProductsNonUSMember2021-01-012021-09-300000034088xom:CorporateAndFinancingMember2022-07-012022-09-300000034088xom:CorporateAndFinancingMember2021-07-012021-09-300000034088xom:CorporateAndFinancingMember2022-01-012022-09-300000034088xom:CorporateAndFinancingMember2021-01-012021-09-300000034088country:US2022-07-012022-09-300000034088country:US2021-07-012021-09-300000034088country:US2022-01-012022-09-300000034088country:US2021-01-012021-09-300000034088us-gaap:NonUsMember2022-07-012022-09-300000034088us-gaap:NonUsMember2021-07-012021-09-300000034088us-gaap:NonUsMember2022-01-012022-09-300000034088us-gaap:NonUsMember2021-01-012021-09-300000034088country:CA2022-07-012022-09-300000034088country:CA2021-07-012021-09-300000034088country:CA2022-01-012022-09-300000034088country:CA2021-01-012021-09-300000034088country:GB2022-07-012022-09-300000034088country:GB2021-07-012021-09-300000034088country:GB2022-01-012022-09-300000034088country:GB2021-01-012021-09-300000034088country:SG2022-07-012022-09-300000034088country:SG2021-07-012021-09-300000034088country:SG2022-01-012022-09-300000034088country:SG2021-01-012021-09-300000034088country:FR2022-07-012022-09-300000034088country:FR2021-07-012021-09-300000034088country:FR2022-01-012022-09-300000034088country:FR2021-01-012021-09-300000034088country:IT2022-07-012022-09-300000034088country:IT2021-07-012021-09-300000034088country:IT2022-01-012022-09-300000034088country:IT2021-01-012021-09-300000034088country:BE2022-07-012022-09-300000034088country:BE2021-07-012021-09-300000034088country:BE2022-01-012022-09-300000034088country:BE2021-01-012021-09-300000034088country:AU2022-07-012022-09-300000034088country:AU2021-07-012021-09-300000034088country:AU2022-01-012022-09-300000034088country:AU2021-01-012021-09-300000034088xom:UpstreamAssetsInRomaniaAndCanadaMemberus-gaap:ScenarioPlanMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-09-300000034088us-gaap:ScenarioPlanMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxom:SantaYnezUnitMemberus-gaap:SubsequentEventMember2022-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to__________

Commission File Number 1-2256

Exxon Mobil Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New Jersey | | 13-5409005 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

5959 Las Colinas Boulevard, Irving, Texas 75039-2298

(Address of principal executive offices) (Zip Code)

(972) 940-6000

(Registrant's telephone number, including area code)

_______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, without par value | | XOM | | New York Stock Exchange |

| 0.142% Notes due 2024 | | XOM24B | | New York Stock Exchange |

| 0.524% Notes due 2028 | | XOM28 | | New York Stock Exchange |

| 0.835% Notes due 2032 | | XOM32 | | New York Stock Exchange |

| 1.408% Notes due 2039 | | XOM39A | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

|

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding as of September 30, 2022 |

| Common stock, without par value | | 4,118,293,421 |

EXXON MOBIL CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2022

TABLE OF CONTENTS

| | | | | |

| PART I. FINANCIAL INFORMATION |

| | |

| Item 1. Financial Statements | |

| | |

Condensed Consolidated Statement of Income - Three and nine months ended September 30, 2022 and 2021 | 3 | |

| | |

Condensed Consolidated Statement of Comprehensive Income - Three and nine months ended September 30, 2022 and 2021 | 4 | |

| | |

Condensed Consolidated Balance Sheet - As of September 30, 2022 and December 31, 2021 | 5 | |

| | |

Condensed Consolidated Statement of Cash Flows - Nine months ended September 30, 2022 and 2021 | 6 | |

| | |

Condensed Consolidated Statement of Changes in Equity - Three months ended September 30, 2022 and 2021 | 7 | |

| |

Condensed Consolidated Statement of Changes in Equity - Nine months ended September 30, 2022 and 2021 | 8 | |

| |

| |

| | |

| Notes to Condensed Consolidated Financial Statements | 9 | |

| | |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | 18 | |

| | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | 34 | |

| | |

| Item 4. Controls and Procedures | 34 | |

| | |

| | |

| PART II. OTHER INFORMATION |

| |

| Item 1. Legal Proceedings | 35 | |

| |

| |

| | |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 36 | |

| | |

Item 6. Exhibits | 36 | |

| | |

| Index to Exhibits | 37 | |

| | |

| Signature | 38 | |

| | |

PART I. FINANCIAL INFORMATION

| | | | | | | | | | | | | | |

| ITEM 1. FINANCIAL STATEMENTS | | |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| | | | | | | | | | | | | | | | | | | | | |

(millions of dollars, unless noted) | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, |

| 2022 | 2021 | | | 2022 | 2021 |

| Revenues and other income | | | | | | | |

| Sales and other operating revenue | | 106,512 | | 71,892 | | | | 305,511 | | 195,387 | |

| Income from equity affiliates | | 4,632 | | 1,670 | | | | 10,858 | | 4,579 | |

| Other income | | 926 | | 224 | | | | 1,882 | | 709 | |

| Total revenues and other income | | 112,070 | | 73,786 | | | | 318,251 | | 200,675 | |

| Costs and other deductions | | | | | | | |

| Crude oil and product purchases | | 60,197 | | 39,745 | | | | 178,198 | | 109,675 | |

| Production and manufacturing expenses | | 11,317 | | 8,719 | | | | 32,244 | | 25,252 | |

| Selling, general and administrative expenses | | 2,324 | | 2,287 | | | | 7,263 | | 7,060 | |

| Depreciation and depletion (including impairments) | | 5,642 | | 4,990 | | | | 18,976 | | 14,946 | |

Exploration expenses, including dry holes (1) | | 218 | | 190 | | | | 677 | | 530 | |

| Non-service pension and postretirement benefit expense | | 154 | | 146 | | | | 382 | | 686 | |

| Interest expense | | 209 | | 214 | | | | 591 | | 726 | |

| Other taxes and duties | | 6,587 | | 7,889 | | | | 21,009 | | 22,295 | |

| Total costs and other deductions | | 86,648 | | 64,180 | | | | 259,340 | | 181,170 | |

| Income (loss) before income taxes | | 25,422 | | 9,606 | | | | 58,911 | | 19,505 | |

| Income taxes | | 5,224 | | 2,664 | | | | 14,389 | | 4,986 | |

| Net income (loss) including noncontrolling interests | | 20,198 | | 6,942 | | | | 44,522 | | 14,519 | |

| Net income (loss) attributable to noncontrolling interests | | 538 | | 192 | | | | 1,532 | | 349 | |

| Net income (loss) attributable to ExxonMobil | | 19,660 | | 6,750 | | | | 42,990 | | 14,170 | |

| | | | | | | |

Earnings (loss) per common share (dollars) | | 4.68 | | 1.57 | | | | 10.17 | | 3.31 | |

| | | | | | | |

Earnings (loss) per common share - assuming dilution (dollars) | | 4.68 | | 1.57 | | | | 10.17 | | 3.31 | |

| | | | | | | |

| | | | | | | | | | | | | | |

| (1) | Includes $74 million related to the write-off of exploratory well costs in 2022 that were previously capitalized for greater than one year at December 31, 2021. |

| | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME |

| | | | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Net income (loss) including noncontrolling interests | | 20,198 | | | 6,942 | | | 44,522 | | | 14,519 | |

| | | | | | | | |

| Other comprehensive income (loss) (net of income taxes) | | | | | | | | |

| Foreign exchange translation adjustment | | (3,361) | | | (1,625) | | | (5,157) | | | (1,053) | |

| | | | | | | | |

| Postretirement benefits reserves adjustment (excluding amortization) | | 108 | | | 184 | | | 368 | | | 305 | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | 128 | | | 196 | | | 323 | | | 789 | |

| Total other comprehensive income (loss) | | (3,125) | | | (1,245) | | | (4,466) | | | 41 | |

| Comprehensive income (loss) including noncontrolling interests | | 17,073 | | | 5,697 | | | 40,056 | | | 14,560 | |

| Comprehensive income (loss) attributable to noncontrolling interests | | 199 | | | 57 | | | 1,105 | | | 381 | |

| Comprehensive income (loss) attributable to ExxonMobil | | 16,874 | | | 5,640 | | | 38,951 | | | 14,179 | |

| | | | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| | | | | | | | | | | | | | |

(millions of dollars, unless noted) | | September 30, 2022 | December 31, 2021 | | | |

| | | | | | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | 30,407 | | 6,802 | | | | |

| Cash and cash equivalents – restricted | | 57 | | — | | | | |

| Notes and accounts receivable – net | | 42,411 | | 32,383 | | | | |

| Inventories | | | | | | |

| Crude oil, products and merchandise | | 20,078 | | 14,519 | | | | |

| Materials and supplies | | 4,018 | | 4,261 | | | | |

| Other current assets | | 2,318 | | 1,189 | | | | |

| Total current assets | | 99,289 | | 59,154 | | | | |

| Investments, advances and long-term receivables | | 50,235 | | 45,195 | | | | |

| Property, plant and equipment – net | | 203,102 | | 216,552 | | | | |

| Other assets, including intangibles – net | | 17,526 | | 18,022 | | | | |

| Total Assets | | 370,152 | | 338,923 | | | | |

| | | | | | |

| LIABILITIES | | | | | | |

| Current liabilities | | | | | | |

| Notes and loans payable | | 6,182 | | 4,276 | | | | |

| Accounts payable and accrued liabilities | | 62,550 | | 50,766 | | | | |

| Income taxes payable | | 5,325 | | 1,601 | | | | |

| Total current liabilities | | 74,057 | | 56,643 | | | | |

| Long-term debt | | 39,246 | | 43,428 | | | | |

| Postretirement benefits reserves | | 16,799 | | 18,430 | | | | |

| Deferred income tax liabilities | | 21,274 | | 20,165 | | | | |

| Long-term obligations to equity companies | | 2,647 | | 2,857 | | | | |

| Other long-term obligations | | 23,086 | | 21,717 | | | | |

| Total Liabilities | | 177,109 | | 163,240 | | | | |

| | | | | | |

| Commitments and contingencies (Note 3) | | | | | | |

| | | | | | |

| EQUITY | | | | | | |

| Common stock without par value | | | | | | |

(9,000 million shares authorized, 8,019 million shares issued) | | 16,106 | | 15,746 | | | | |

| Earnings reinvested | | 423,877 | | 392,059 | | | | |

| Accumulated other comprehensive income | | (17,803) | | (13,764) | | | | |

| Common stock held in treasury | | | | | | |

(3,901 million shares at September 30, 2022 and 3,780 million shares at December 31, 2021) | | (236,080) | | (225,464) | | | | |

| ExxonMobil share of equity | | 186,100 | | 168,577 | | | | |

| Noncontrolling interests | | 6,943 | | 7,106 | | | | |

| Total Equity | | 193,043 | | 175,683 | | | | |

| Total Liabilities and Equity | | 370,152 | | 338,923 | | | | |

| | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. | | | |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW |

| | | | | | | | | | | |

| (millions of dollars) | | Nine Months Ended September 30, |

| 2022 | 2021 |

| | | |

| CASH FLOW FROM OPERATING ACTIVITIES | | | |

| Net income (loss) including noncontrolling interests | | 44,522 | | 14,519 | |

| Depreciation and depletion (including impairments) | | 18,976 | | 14,946 | |

| | | |

| Changes in operational working capital, excluding cash and debt | | 6 | | 2,232 | |

| All other items – net | | (4,328) | | (692) | |

| Net cash provided by operating activities | | 59,176 | | 31,005 | |

| | | |

| CASH FLOW FROM INVESTING ACTIVITIES | | | |

| Additions to property, plant and equipment | | (12,624) | | (7,987) | |

| Proceeds from asset sales and returns of investments | | 3,914 | | 575 | |

| Additional investments and advances | | (915) | | (1,055) | |

| Other investing activities including collection of advances | | 238 | | 342 | |

| Net cash used in investing activities | | (9,387) | | (8,125) | |

| | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | |

| Additions to long-term debt | | 55 | | 46 | |

| Reductions in long-term debt | | — | | (4) | |

Additions to short-term debt | | — | | 12,197 | |

Reductions in short-term debt | | (3,895) | | (24,066) | |

| Additions/(reductions) in debt with three months or less maturity | | 1,638 | | 997 | |

| Contingent consideration payments | | (58) | | (28) | |

| Cash dividends to ExxonMobil shareholders | | (11,172) | | (11,161) | |

| Cash dividends to noncontrolling interests | | (191) | | (166) | |

| Changes in noncontrolling interests | | (1,074) | | (278) | |

| Common stock acquired | | (10,480) | | (1) | |

| Net cash used in financing activities | | (25,177) | | (22,464) | |

| | | |

| Effects of exchange rate changes on cash | | (950) | | (12) | |

| Increase/(decrease) in cash and cash equivalents | | 23,662 | | 404 | |

| Cash and cash equivalents at beginning of period | | 6,802 | | 4,364 | |

| Cash and cash equivalents at end of period | | 30,464 | | 4,768 | |

| | | |

| SUPPLEMENTAL DISCLOSURES | | | |

| Income taxes paid | | 10,172 | | 3,516 | |

| Cash interest paid | | | |

| Included in cash flows from operating activities | | 660 | | 818 | |

| Capitalized, included in cash flows from investing activities | | 605 | | 478 | |

| Total cash interest paid | | 1,265 | | 1,296 | |

| | | |

| | | |

| Noncash right of use assets recorded in exchange for lease liabilities | | | |

| Operating leases | | 1,648 | | 804 | |

| Finance leases | | 730 | | 168 | |

| | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CHANGE IN EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | ExxonMobil Share of Equity | | |

| | | | | | | | |

(millions of dollars, unless noted) | | Common Stock | Earnings Reinvested | Accumulated Other Comprehensive Income | Common Stock Held in Treasury | ExxonMobil Share of Equity | Non-controlling Interests | Total Equity |

| | | | | | | | |

| Balance as of June 30, 2021 | | 16,006 | | 383,922 | | (15,586) | | (225,771) | | 158,571 | | 6,985 | | 165,556 | |

| Amortization of stock-based awards | | 99 | | — | | — | | — | | 99 | | — | | 99 | |

| Other | | (1) | | — | | — | | — | | (1) | | 4 | | 3 | |

| Net income (loss) for the period | | — | | 6,750 | | — | | — | | 6,750 | | 192 | | 6,942 | |

| Dividends - common shares | | — | | (3,720) | | — | | — | | (3,720) | | (54) | | (3,774) | |

| Other comprehensive income (loss) | | — | | — | | (1,110) | | — | | (1,110) | | (135) | | (1,245) | |

| Acquisitions, at cost | | — | | — | | — | | — | | — | | (75) | | (75) | |

| Dispositions | | — | | — | | — | | — | | — | | — | | — | |

| Balance as of September 30, 2021 | | 16,104 | | 386,952 | | (16,696) | | (225,771) | | 160,589 | | 6,917 | | 167,506 | |

| | | | | | | | |

| Balance as of June 30, 2022 | | 16,018 | | 407,902 | | (15,017) | | (231,587) | | 177,316 | | 7,192 | | 184,508 | |

| Amortization of stock-based awards | | 91 | | — | | — | | — | | 91 | | — | | 91 | |

| Other | | (3) | | — | | — | | — | | (3) | | (29) | | (32) | |

| Net income (loss) for the period | | — | | 19,660 | | — | | — | | 19,660 | | 538 | | 20,198 | |

| Dividends - common shares | | — | | (3,685) | | — | | — | | (3,685) | | (68) | | (3,753) | |

| Other comprehensive income (loss) | | — | | — | | (2,786) | | — | | (2,786) | | (339) | | (3,125) | |

| Acquisitions, at cost | | — | | — | | — | | (4,494) | | (4,494) | | (351) | | (4,845) | |

| Dispositions | | — | | — | | — | | 1 | | 1 | | — | | 1 | |

| Balance as of September 30, 2022 | | 16,106 | | 423,877 | | (17,803) | | (236,080) | | 186,100 | | 6,943 | | 193,043 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, 2022 | | Three Months Ended September 30, 2021 |

| | | | | | | | |

Common Stock Share Activity (millions of shares) | | Issued | Held in Treasury | Outstanding | | Issued | Held in Treasury | Outstanding |

| Balance as of June 30 | | 8,019 | | (3,851) | | 4,168 | | | 8,019 | | (3,785) | | 4,234 | |

| Acquisitions | | — | | (50) | | (50) | | | — | | — | | — | |

| Dispositions | | — | | — | | — | | | — | | — | | — | |

| Balance as of September 30 | | 8,019 | | (3,901) | | 4,118 | | | 8,019 | | (3,785) | | 4,234 | |

| | | | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CHANGE IN EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | ExxonMobil Share of Equity | | |

| | | | | | | | |

(millions of dollars, unless noted) | | Common Stock | Earnings Reinvested | Accumulated Other Comprehensive Income | Common Stock Held in Treasury | ExxonMobil Share of Equity | Non-controlling Interests | Total Equity |

| | | | | | | | |

| Balance as of December 31, 2020 | | 15,688 | | 383,943 | | (16,705) | | (225,776) | | 157,150 | | 6,980 | | 164,130 | |

| Amortization of stock-based awards | | 427 | | — | | — | | — | | 427 | | — | | 427 | |

| Other | | (11) | | — | | — | | — | | (11) | | 90 | | 79 | |

| Net income (loss) for the period | | — | | 14,170 | | — | | — | | 14,170 | | 349 | | 14,519 | |

| Dividends - common shares | | — | | (11,161) | | — | | — | | (11,161) | | (166) | | (11,327) | |

| | | | | | | | |

| Other comprehensive income (loss) | | — | | — | | 9 | | — | | 9 | | 32 | | 41 | |

| Acquisitions, at cost | | — | | — | | — | | (1) | | (1) | | (368) | | (369) | |

| Dispositions | | — | | — | | — | | 6 | | 6 | | — | | 6 | |

| Balance as of September 30, 2021 | | 16,104 | | 386,952 | | (16,696) | | (225,771) | | 160,589 | | 6,917 | | 167,506 | |

| | | | | | | | |

| Balance as of December 31, 2021 | | 15,746 | | 392,059 | | (13,764) | | (225,464) | | 168,577 | | 7,106 | | 175,683 | |

| Amortization of stock-based awards | | 372 | | — | | — | | — | | 372 | | — | | 372 | |

| Other | | (12) | | — | | — | | — | | (12) | | (30) | | (42) | |

| Net income (loss) for the period | | — | | 42,990 | | — | | — | | 42,990 | | 1,532 | | 44,522 | |

| Dividends - common shares | | — | | (11,172) | | — | | — | | (11,172) | | (191) | | (11,363) | |

| | | | | | | | |

| Other comprehensive income (loss) | | — | | — | | (4,039) | | — | | (4,039) | | (427) | | (4,466) | |

| Acquisitions, at cost | | — | | — | | — | | (10,620) | | (10,620) | | (1,047) | | (11,667) | |

| Dispositions | | — | | — | | — | | 4 | | 4 | | — | | 4 | |

| Balance as of September 30, 2022 | | 16,106 | | 423,877 | | (17,803) | | (236,080) | | 186,100 | | 6,943 | | 193,043 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2022 | | Nine Months Ended September 30, 2021 |

| | | | | | | | |

Common Stock Share Activity (millions of shares) | | Issued | Held in Treasury | Outstanding | | Issued | Held in Treasury | Outstanding |

| Balance as of December 31 | | 8,019 | | (3,780) | | 4,239 | | | 8,019 | | (3,786) | | 4,233 | |

| Acquisitions | | — | | (121) | | (121) | | | — | | — | | — | |

| Dispositions | | — | | — | | — | | | — | | 1 | | 1 | |

| Balance as of September 30 | | 8,019 | | (3,901) | | 4,118 | | | 8,019 | | (3,785) | | 4,234 | |

| | | | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

Note 1. Basis of Financial Statement Preparation

These unaudited condensed consolidated financial statements should be read in the context of the consolidated financial statements and notes thereto filed with the Securities and Exchange Commission in the Corporation's 2021 Annual Report on Form 10-K. In the opinion of the Corporation, the information furnished herein reflects all known accruals and adjustments necessary for a fair statement of the results for the periods reported herein. All such adjustments are of a normal recurring nature. Prior data has been reclassified in certain cases to conform to the current presentation basis.

The Corporation's exploration and production activities are accounted for under the "successful efforts" method.

Note 2. Russia

In response to Russia’s military action in Ukraine, the Corporation announced in early 2022 that it planned to discontinue operations on the Sakhalin-1 project (“Sakhalin”) and develop steps to exit the venture. In light of this, an impairment assessment was conducted, and management determined that the carrying value of the asset group was not recoverable. As a result, the Corporation’s first quarter earnings included after-tax charges of $3.4 billion largely representing the full impairment of its operations related to Sakhalin. On a before-tax basis, the charges amounted to $4.6 billion, substantially all of which is reflected in the line captioned “Depreciation and depletion (including impairments)” on the Condensed Consolidated Statement of Income. Effective October 14, the Russian government unilaterally terminated the Corporation’s interests in Sakhalin-1, and the project has been transferred to a Russian operator. The Corporation's exit from the project results in quantities estimated at 150 million oil-equivalent barrels no longer qualifying as proved reserves, which represents less than one percent of the Corporation's 18.5 billion oil-equivalent barrels of proved reserves at year-end 2021.

Note 3. Litigation and Other Contingencies

Litigation

A variety of claims have been made against ExxonMobil and certain of its consolidated subsidiaries in a number of pending lawsuits. Management has regular litigation reviews, including updates from corporate and outside counsel, to assess the need for accounting recognition or disclosure of these contingencies. The Corporation accrues an undiscounted liability for those contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated. If a range of amounts can be reasonably estimated and no amount within the range is a better estimate than any other amount, then the minimum of the range is accrued. The Corporation does not record liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be reasonably estimated or when the liability is believed to be only reasonably possible or remote. For contingencies where an unfavorable outcome is reasonably possible and which are significant, the Corporation discloses the nature of the contingency and, where feasible, an estimate of the possible loss. For purposes of our contingency disclosures, “significant” includes material matters, as well as other matters which management believes should be disclosed. ExxonMobil will continue to defend itself vigorously in these matters. Based on a consideration of all relevant facts and circumstances, the Corporation does not believe the ultimate outcome of any currently pending lawsuit against ExxonMobil will have a material adverse effect upon the Corporation's operations, financial condition, or financial statements taken as a whole.

Other Contingencies

The Corporation and certain of its consolidated subsidiaries were contingently liable at September 30, 2022, for guarantees relating to notes, loans and performance under contracts. Where guarantees for environmental remediation and other similar matters do not include a stated cap, the amounts reflect management’s estimate of the maximum potential exposure. These guarantees are not reasonably likely to have a material effect on the Corporation’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

| | | | | | | | | | | |

| | September 30, 2022 |

| | | |

| (millions of dollars) | Equity Company Obligations (1) | Other Third-Party Obligations | Total |

| Guarantees | | | |

| Debt-related | 1,239 | | 154 | | 1,393 | |

| Other | 727 | | 5,032 | | 5,759 | |

| Total | 1,966 | | 5,186 | | 7,152 | |

| | | |

| (1) ExxonMobil share | | | |

Additionally, the Corporation and its affiliates have numerous long-term sales and purchase commitments in their various business activities, all of which are expected to be fulfilled with no adverse consequences material to the Corporation’s operations or financial condition. In the third quarter, the Corporation entered into a long-term purchase agreement with minimum annual payments of approximately $0.4 billion from 2025 through 2045. As of September 30, undiscounted commitments for leases not yet commenced totaled $2.5 billion for operating leases and $4.3 billion for finance leases.

The operations and earnings of the Corporation and its affiliates throughout the world have been, and may in the future be, affected from time to time in varying degree by political developments and laws and regulations, such as forced divestiture of assets; restrictions on production, imports and exports; price controls; tax increases and retroactive tax claims; expropriation of property; cancellation of contract rights; sanctions and environmental regulations. Both the likelihood of such occurrences and their overall effect upon the Corporation vary greatly from country to country and are not predictable.

Note 4. Other Comprehensive Income Information

| | | | | | | | | | | |

ExxonMobil Share of Accumulated Other Comprehensive Income (millions of dollars) | Cumulative Foreign Exchange Translation Adjustment | Postretirement Benefits

Reserves Adjustment | Total |

| Balance as of December 31, 2020 | (10,614) | | (6,091) | | (16,705) | |

Current period change excluding amounts reclassified from accumulated other comprehensive income (1) | (1,041) | | 289 | | (752) | |

| Amounts reclassified from accumulated other comprehensive income | — | | 761 | | 761 | |

| Total change in accumulated other comprehensive income | (1,041) | | 1,050 | | 9 | |

| Balance as of September 30, 2021 | (11,655) | | (5,041) | | (16,696) | |

| | | |

| Balance as of December 31, 2021 | (11,499) | | (2,265) | | (13,764) | |

Current period change excluding amounts reclassified from accumulated other comprehensive income (1) | (4,680) | | 335 | | (4,345) | |

| Amounts reclassified from accumulated other comprehensive income | — | | 306 | | 306 | |

| Total change in accumulated other comprehensive income | (4,680) | | 641 | | (4,039) | |

| Balance as of September 30, 2022 | (16,179) | | (1,624) | | (17,803) | |

| | | |

(1) Cumulative Foreign Exchange Translation Adjustment includes net investment hedge gain/(loss) net of taxes of $551 million and $240 million in 2022 and 2021, respectively. |

| | | | | | | | | | | | | | | | | | | | | |

Amounts Reclassified Out of Accumulated Other Comprehensive Income - Before-tax Income/(Expense) (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | | 2021 |

| | | | | | | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | | | | | | |

| (Statement of Income line: Non-service pension and postretirement benefit expense) | | (163) | | (256) | | | (415) | | | (1,020) | |

| | | | | | | | | | | | | | | | | | | | | |

Income Tax (Expense)/Credit For Components of Other Comprehensive Income (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | | 2021 |

| | | | |

Foreign exchange translation adjustment | | (61) | | (26) | | | (151) | | | (60) | |

| Postretirement benefits reserves adjustment (excluding amortization) | | (82) | | (76) | | | (205) | | | (109) | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | (35) | | (60) | | | (92) | | | (231) | |

| Total | | (178) | | (162) | | | (448) | | | (400) | |

Note 5. Earnings Per Share

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | | 2021 |

| Earnings per common share | | | | | | | |

Net income (loss) attributable to ExxonMobil (millions of dollars) | | 19,660 | | 6,750 | | | 42,990 | | | 14,170 | |

Weighted average number of common shares outstanding (millions of shares) | | 4,185 | | 4,276 | | | 4,227 | | | 4,275 | |

Earnings (loss) per common share (dollars) (1) | | 4.68 | | 1.57 | | | 10.17 | | | 3.31 | |

Dividends paid per common share (dollars) | | 0.88 | | 0.87 | | | 2.64 | | | 2.61 | |

| | | | | | | |

| (1) The calculation of earnings (loss) per common share and earnings (loss) per common share – assuming dilution are the same in each period shown. |

Note 6. Pension and Other Postretirement Benefits

| | | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | | 2021 |

| Components of net benefit cost | | | | | | | |

| Pension Benefits - U.S. | | | | | | | |

| Service cost | | 173 | | 228 | | | 529 | | | 661 | |

| Interest cost | | 130 | | 139 | | | 388 | | | 418 | |

| Expected return on plan assets | | (140) | | (181) | | | (420) | | | (542) | |

| Amortization of actuarial loss/(gain) | | 39 | | 62 | | | 117 | | | 184 | |

| Amortization of prior service cost | | (8) | | (5) | | | (22) | | | (17) | |

| Net pension enhancement and curtailment/settlement cost | | 87 | | 75 | | | 177 | | | 468 | |

| Net benefit cost | | 281 | | 318 | | | 769 | | | 1,172 | |

| | | | | | | |

| Pension Benefits - Non-U.S. | | | | | | | |

| Service cost | | 138 | | 194 | | | 433 | | | 587 | |

| Interest cost | | 149 | | 131 | | | 466 | | | 396 | |

| Expected return on plan assets | | (198) | | (256) | | | (618) | | | (777) | |

| Amortization of actuarial loss/(gain) | | 44 | | 104 | | | 138 | | | 319 | |

| Amortization of prior service cost | | 10 | | 14 | | | 33 | | | 43 | |

| Net pension enhancement and curtailment/settlement cost | | — | | 4 | | | (1) | | | 16 | |

| Net benefit cost | | 143 | | 191 | | | 451 | | | 584 | |

| | | | | | | |

| Other Postretirement Benefits | | | | | | | |

| Service cost | | 30 | | 44 | | | 108 | | | 139 | |

| Interest cost | | 54 | | 55 | | | 162 | | | 166 | |

| Expected return on plan assets | | (4) | | (5) | | | (11) | | | (14) | |

| Amortization of actuarial loss/(gain) | | 1 | | 19 | | | 4 | | | 57 | |

| Amortization of prior service cost | | (10) | | (10) | | | (31) | | | (31) | |

| Net benefit cost | | 71 | | 103 | | | 232 | | | 317 | |

Note 7. Financial Instruments and Derivatives

The estimated fair value of financial instruments and derivatives at September 30, 2022 and December 31, 2021, and the related hierarchy level for the fair value measurement was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2022 |

| | | | | | | | |

| | | | | | | | |

| | Fair Value | | | | |

| (millions of dollars) | Level 1 | Level 2 | Level 3 | Total Gross Assets

& Liabilities | Effect of

Counterparty Netting | Effect of

Collateral

Netting | Difference in Carrying Value and Fair Value | Net

Carrying

Value |

| Assets | | | | | | | | |

Derivative assets (1) | 5,972 | | 4,379 | | — | | 10,351 | | (8,398) | | (519) | | — | | 1,434 | |

| | | | | | | | |

Advances to/receivables from equity companies (2)(6) | — | | 2,374 | | 5,325 | | 7,699 | | — | | — | | 734 | | 8,433 | |

| | | | | | | | |

Other long-term financial assets (3) | 1,185 | | — | | 1,329 | | 2,514 | | — | | — | | 313 | | 2,827 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

Derivative liabilities (4) | 5,638 | | 5,112 | | — | | 10,750 | | (8,398) | | (185) | | — | | 2,167 | |

Long-term debt (5) | 32,236 | | 90 | | 6 | | 32,332 | | — | | — | | 4,638 | | 36,970 | |

| | | | | | | | |

Long-term obligations to equity companies (6) | — | | — | | 2,711 | | 2,711 | | — | | — | | (64) | | 2,647 | |

| | | | | | | | |

Other long-term financial liabilities (7) | — | | — | | 773 | | 773 | | — | | — | | 56 | | 829 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2021 |

| | | | | | | | | |

| | | | | | | | | |

| | | Fair Value | | | | |

| (millions of dollars) | | Level 1 | Level 2 | Level 3 | Total Gross Assets

& Liabilities | Effect of

Counterparty Netting | Effect of

Collateral

Netting | Difference in Carrying Value and Fair Value | Net

Carrying

Value |

| Assets | | | | | | | | | |

Derivative assets (1) | | 1,422 | | 1,523 | | — | | 2,945 | | (1,930) | | (28) | | — | | 987 | |

| | | | | | | | | |

Advances to/receivables from equity companies (2)(6) | | — | | 3,076 | | 5,373 | | 8,449 | | — | | — | | (123) | | 8,326 | |

| | | | | | | | | |

Other long-term financial assets (3) | | 1,134 | | — | | 1,058 | | 2,192 | | — | | — | | 181 | | 2,373 | |

| | | | | | | | | |

| Liabilities | | | | | | | | | |

Derivative liabilities (4) | | 1,701 | | 2,594 | | — | | 4,295 | | (1,930) | | (306) | | — | | 2,059 | |

Long-term debt (5) | | 44,454 | | 88 | | 3 | | 44,545 | | — | | — | | (2,878) | | 41,667 | |

| | | | | | | | | |

Long-term obligations to equity companies (6) | | — | | — | | 3,084 | | 3,084 | | — | | — | | (227) | | 2,857 | |

| | | | | | | | | |

Other long-term financial liabilities (7) | | — | | — | | 902 | | 902 | | — | | — | | 58 | | 960 | |

| | | | | |

| (1) | Included in the Balance Sheet lines: Notes and accounts receivable - net and Other assets, including intangibles - net |

| (2) | Included in the Balance Sheet line: Investments, advances and long-term receivables |

| (3) | Included in the Balance Sheet lines: Investments, advances and long-term receivables and Other assets, including intangibles - net |

| (4) | Included in the Balance Sheet lines: Accounts payable and accrued liabilities and Other long-term obligations |

| (5) | Excluding finance lease obligations |

| (6) | Advances to/receivables from equity companies and long-term obligations to equity companies are mainly designated as hierarchy level 3 inputs. The fair value is calculated by discounting the remaining obligations by a rate consistent with the credit quality and industry of the company. |

| (7) | Included in the Balance Sheet line: Other long-term obligations. Includes contingent consideration related to a prior year acquisition where fair value is based on expected drilling activities and discount rates. |

At September 30, 2022 and December 31, 2021, respectively, the Corporation had $1,826 million and $641 million of collateral under master netting arrangements not offset against the derivatives on the Consolidated Balance Sheet, primarily related to initial margin requirements.

The Corporation may use non-derivative financial instruments, such as its foreign currency-denominated debt, as hedges of its net investments in certain foreign subsidiaries. Under this method, the change in the carrying value of the financial instruments due to foreign exchange fluctuations is reported in accumulated other comprehensive income. As of September 30, 2022, the Corporation has designated $4.4 billion of its Euro-denominated long-term debt and related accrued interest as a net investment hedge of its European business. The net investment hedge is deemed to be perfectly effective.

The Corporation had undrawn short-term committed lines of credit of $549 million and undrawn long-term committed lines of credit of $351 million as of third quarter 2022. Undrawn short-term committed lines of credit amounting to $10 billion expired in the third quarter of 2022.

Derivative Instruments

The Corporation’s size, strong capital structure, geographic diversity and the complementary nature of its business segments reduce the Corporation’s enterprise-wide risk from changes in commodity prices, currency rates and interest rates. In addition, the Corporation uses commodity-based contracts, including derivatives, to manage commodity price risk and to generate returns from trading. Commodity contracts held for trading purposes are presented in the Condensed Consolidated Statement of Income on a net basis in the line “Sales and other operating revenue". The Corporation’s commodity derivatives are not accounted for under hedge accounting. At times, the Corporation also enters into currency and interest rate derivatives, none of which are material to the Corporation’s financial position as of September 30, 2022 and December 31, 2021, or results of operations for the periods ended September 30, 2022 and 2021.

Credit risk associated with the Corporation’s derivative position is mitigated by several factors, including the use of derivative clearing exchanges and the quality of and financial limits placed on derivative counterparties. The Corporation maintains a system of controls that includes the authorization, reporting and monitoring of derivative activity.

The net notional long/(short) position of derivative instruments at September 30, 2022 and December 31, 2021, was as follows:

| | | | | | | | |

|

| | |

| (millions) | September 30, 2022 | December 31, 2021 |

| Crude oil (barrels) | (15) | | 82 | |

| Petroleum products (barrels) | (22) | | (48) | |

| Natural gas (MMBTUs) | (120) | | (115) | |

| | |

Realized and unrealized gains/(losses) on derivative instruments that were recognized in the Condensed Consolidated Statement of Income are included in the following lines on a before-tax basis:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

|

| | | | | | |

| (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | 2021 |

| Sales and other operating revenue | | 945 | | (1,596) | | | (3,003) | | (3,196) | |

| Crude oil and product purchases | | (56) | | (34) | | | (82) | | (53) | |

| Total | | 889 | | (1,630) | | | (3,085) | | (3,249) | |

Note 8. Disclosures about Segments and Related Information

Effective April 1, 2022, the Corporation streamlined its business structure by combining the Chemical and Downstream businesses into a single business, Product Solutions. Product Solutions consists of three operating segments:

•Energy Products: Fuels, aromatics, and catalysts and licensing

•Chemical Products: Olefins, polyethylene, polypropylene, and intermediates

•Specialty Products: Finished lubricants, basestocks and waxes, synthetics, and elastomers and resins

Information disclosed in this note has been recast for the new segmentation.

| | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | 2021 |

| Earnings (Loss) After Income Tax | | | | | | |

| Upstream | | | | | | |

| United States | | 3,110 | | 869 | | | 9,235 | | 1,895 | |

| Non-U.S. | | 9,309 | | 3,082 | | | 19,043 | | 7,795 | |

| Energy Products | | | | | | |

| United States | | 3,008 | | 479 | | | 6,152 | | (31) | |

| Non-U.S. | | 2,811 | | 50 | | | 4,744 | | (1,217) | |

| Chemical Products | | | | | | |

| United States | | 635 | | 1,121 | | | 2,030 | | 2,923 | |

| Non-U.S. | | 177 | | 907 | | | 1,263 | | 2,695 | |

| Specialty Products | | | | | | |

| United States | | 306 | | 247 | | | 784 | | 689 | |

| Non-U.S. | | 456 | | 592 | | | 871 | | 1,454 | |

| Corporate and Financing | | (152) | | (596) | | | (1,132) | | (2,033) | |

| Corporate total | | 19,660 | | 6,750 | | | 42,990 | | 14,170 | |

| | | | | | |

| Sales and Other Operating Revenue | | | | | | |

| Upstream | | | | | | |

| United States | | 4,163 | | 2,072 | | | 10,777 | | 5,683 | |

| Non-U.S. | | 8,770 | | 2,295 | | | 22,214 | | 9,181 | |

| Energy Products | | | | | | |

| United States | | 31,324 | | 20,988 | | | 90,650 | | 55,292 | |

| Non-U.S. | | 50,215 | | 34,305 | | | 144,734 | | 91,120 | |

| Chemical Products | | | | | | |

| United States | | 2,499 | | 3,474 | | | 8,773 | | 9,007 | |

| Non-U.S. | | 4,213 | | 4,215 | | | 13,207 | | 12,200 | |

| Specialty Products | | | | | | |

| United States | | 1,615 | | 1,227 | | | 4,659 | | 3,606 | |

| Non-U.S. | | 3,709 | | 3,309 | | | 10,478 | | 9,382 | |

| Corporate and Financing | | 4 | | 7 | | | 19 | | (84) | |

Corporate total (1) | | 106,512 | | 71,892 | | | 305,511 | | 195,387 | |

| | | | | | |

| Intersegment Revenue | | | | | | |

| Upstream | | | | | | |

| United States | | 6,536 | | 4,374 | | | 19,907 | | 11,524 | |

| Non-U.S. | | 11,723 | | 9,371 | | | 36,091 | | 23,935 | |

| Energy Products | | | | | | |

| United States | | 7,580 | | 4,132 | | | 22,777 | | 11,395 | |

| Non-U.S. | | 9,551 | | 6,787 | | | 29,161 | | 16,872 | |

| Chemical Products | | | | | | |

| United States | | 2,579 | | 1,479 | | | 6,904 | | 4,285 | |

| Non-U.S. | | 1,252 | | 1,098 | | | 4,359 | | 2,849 | |

| Specialty Products | | | | | | |

| United States | | 662 | | 578 | | | 1,934 | | 1,658 | |

| Non-U.S. | | 246 | | 212 | | | 665 | | 532 | |

| Corporate and Financing | | 59 | | 57 | | | 175 | | 166 | |

| | | | | | |

(1) See footnote on the next page. |

| | | | | | | | | | | | | | | | | | | | |

| Geographic Sales and Other Operating Revenue | | | | | | |

| (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | 2021 |

| United States | | 39,601 | | 27,761 | | | 114,859 | | 73,588 | |

| Non-U.S. | | 66,911 | | 44,131 | | | 190,652 | | 121,799 | |

Total (1) | | 106,512 | | 71,892 | | | 305,511 | | 195,387 | |

| | | | | | |

Significant Non-U.S. revenue sources include: (2) | | | | | | |

| Canada | | 8,468 | | 5,837 | | | 25,105 | | 15,378 | |

| United Kingdom | | 8,845 | | 3,379 | | | 24,699 | | 10,137 | |

| Singapore | | 5,262 | | 3,678 | | | 14,358 | | 10,628 | |

| France | | 4,449 | | 3,513 | | | 14,071 | | 9,541 | |

| Italy | | 2,990 | | 2,808 | | | 8,888 | | 7,139 | |

| Belgium | | 2,755 | | 2,409 | | | 8,632 | | 6,590 | |

| Australia | | 2,936 | | 1,751 | | | 8,597 | | 5,499 | |

| | | | | | |

(1) Includes approximately 25% and 16% related to revenue outside the scope of ASC 606 "Revenue from Contracts with Customers" for the three months ended September 30, 2022 and September 30, 2021, respectively, and 23% and 16% for the nine months ended September 30, 2022 and September 30, 2021, respectively. Trade receivables in Notes and accounts receivable – net reported on the Balance Sheet include both receivables within the scope of ASC 606 and those outside the scope of ASC 606. Revenue and receivables outside the scope of ASC 606 primarily relate to physically settled commodity contracts accounted for as derivatives. Credit quality and type of customer are generally similar between those revenues and receivables within the scope of ASC 606 and those outside it. |

(2) Revenue is determined by primary country of operations. Excludes certain sales and other operating revenues in Non-U.S. operations where attribution to a specific country is not practicable. |

Note 9. Divestment Activities

In the third quarter, the Corporation sold certain Upstream unproved assets in Romania and Upstream unconventional assets in Alberta, Canada, which resulted in total gains on sales of approximately $600 million which are largely included in "Other income" in the Condensed Consolidated Statement of Income.

In August 2022, the Corporation executed an agreement for the sale of Upstream unconventional shale interests in the Arkoma basin (United States) to Flywheel, LLC. The transaction is anticipated to close in the fourth quarter.

In August 2022, the Corporation executed an agreement for the sale of Mobil California Exploration and Producing Asset Company (United States), consisting of ExxonMobil's interest in the Aera Energy Joint Venture, to Green Gate Resources E, LLC. The transaction is anticipated to close in the fourth quarter.

In February 2022, the Corporation signed an agreement with Seplat Energy Offshore Limited for the sale of Mobil Producing Nigeria Unlimited. The agreement is subject to certain conditions precedent and government approvals. In early July, a Nigerian court issued an order to halt transition activities and enter into arbitration with the Nigerian National Petroleum Company. The closing date and any loss on sale will depend on resolution of these matters.

After the end of the third quarter, the Corporation signed an agreement for the sale of the Santa Ynez Unit and associated assets in California. The agreement is subject to certain conditions precedent and government approvals and does not yet meet held-for-sale criteria under ASC 360. The transaction would be expected to close in 2023. The Corporation expects to recognize a loss of up to $2 billion on the potential transaction.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

During the COVID-19 pandemic, industry investment to maintain and increase production capacity was restrained to preserve capital, resulting in underinvestment and supply tightness as demand for petroleum and petrochemical products recovered. In addition, industry rationalization of refining assets resulted in more than 3 million barrels per day of capacity being taken offline. Across late 2021 and the first half of 2022, this dynamic, along with supply chain constraints, and a continuation of demand recovery led to a steady increase in oil and natural gas prices and refining margins. In the first half of 2022, tightness in the oil and natural gas markets was further exacerbated by Russia’s invasion of Ukraine and subsequent sanctions imposed upon business and other activities in Russia. The price of Brent crude oil and certain regional natural gas indicators increased to levels not seen for several years, and both natural gas realizations and industry refining margins improved to levels well above the 10-year range. In the third quarter, crude prices moved back within the upper-end of the 10-year range as higher supply slightly exceeded demand. Natural gas prices rose to record levels in the third quarter, reflecting concerns in Europe about the withdrawal of Russian supply as well as efforts to build inventory ahead of winter. While natural gas prices recently moderated, they remain well above the 10-year historical range. In the U.S., prices increased by about 15% driven by higher summer cooling demand and inventory concerns. Refining margins remained well above the 10-year range due to inflated diesel crack spreads resulting from expensive natural gas and high demand for diesel. Higher refinery runs and flat demand for gasoline in the U.S. resulted in refining margins declining from the second quarter. In contrast, global chemical margins fell below the bottom of the 10-year range reflecting weakening global demand. Margins in North America and Europe have softened with regional pricing moving closer to global parity as demand and logistics constraints relaxed. Asia Pacific remained in bottom-of-cycle conditions as COVID-19 restrictions continue to suppress demand in China. Commodity and product prices are expected to remain volatile given the current global economic uncertainty and geopolitical events affecting supply and demand.

Russia-Ukraine Conflict

In response to Russia’s military action in Ukraine, the Corporation announced in early 2022 that it planned to discontinue operations on the Sakhalin-1 project (“Sakhalin”) and develop steps to exit the venture. The Corporation’s first quarter results included after-tax charges of $3.4 billion largely representing the impairment of its operations related to Sakhalin (see Note 2 to Condensed Consolidated Financial Statements). While the Corporation’s affiliate was in force majeure due to the unprecedented impact of global sanctions, it continued to make concerted attempts to engage in good-faith discussions with the Russian government and all Sakhalin-1 partners. The Corporation remained focused on safety of people, protection of the environment, and integrity of operations. Effective October 14, with two decrees the Russian government unilaterally terminated the Corporation’s interests in Sakhalin-1, and the project has been transferred to a Russian operator. While the recent decrees violate the Corporation’s rights in Russia established by the production sharing agreement, and interrupted the exit process the Corporation was working, it did not prevent the safe winding down of operations.

The Corporation’s exit from the venture is expected to result in no future hydrocarbon sales and minimal cash flow impacts for the Corporation’s account in the fourth quarter. For reference, excluding the impact of impairments and other charges, year-to-date after-tax earnings related to the Corporation’s interest in Sakhalin through the end of the third quarter of 2022 were approximately $0.2 billion, and combined oil and gas production was approximately 34 thousand oil-equivalent barrels per day. The Corporation's exit from the project results in quantities estimated at 150 million oil-equivalent barrels no longer qualifying as proved reserves, which represents less than one percent of the Corporation's 18.5 billion oil-equivalent barrels of proved reserves at year-end 2021. The Corporation is complying with all applicable laws and sanctions.

The Corporation holds a 25% interest in Tengizchevroil, LLP (TCO), which operates the Tengiz and Korolev oil fields in Kazakhstan, and holds a 16.8% working interest in the Kashagan field in Kazakhstan. Oil production from those operations is exported through the Caspian Pipeline Consortium (CPC), in which the Corporation holds a 7.5% interest. CPC traverses parts of Kazakhstan and Russia to tanker-loading facilities on the Russian coast of the Black Sea. In the event that Russia takes countermeasures in response to existing sanctions related to its military actions in Ukraine, it is possible that the transportation of Kazakhstan oil through the CPC pipeline could be disrupted, curtailed, temporarily suspended, or otherwise restricted. In such a case, the Corporation could experience a loss of cash flows of uncertain duration. For reference, year-to-date after-tax earnings related to the Corporation’s interests in Kazakhstan through the end of the third quarter 2022 were approximately $2.0 billion, and its share of combined oil and gas production was approximately 240 thousand oil-equivalent barrels per day.

European Union Solidarity Contribution

On October 6, European Union (“EU”) Member States formally adopted a European Union Council Regulation for a new tax described as an emergency intervention to address high energy prices. This regulation imposes a mandatory tax on certain companies active in the crude petroleum, coal, natural gas and refinery sectors. The regulation requires Member States to levy a minimum 33% tax on in-scope companies’ 2022 and/or 2023 “surplus profits”, defined in the regulation as taxable profits exceeding 120% of the annual average during the 2018-2021 period. EU Member States are required to implement the tax, or an equivalent national measure, by December 31, 2022. Depending on the national measures to be adopted by the EU Member States, and the financial years for which these measures would be applicable, the Corporation’s liability, based on currently available public information, could be in excess of $2 billion through the end of 2023. The actual impact and timing of recognition in the financial statements will depend on the specific provisions of the EU Member States’ measures.

ExxonMobil Product Solutions Reorganization

Effective April 1, 2022, the Corporation streamlined its business structure by combining the Chemical and Downstream businesses into a single business, Product Solutions. The new business is focused on growing high-value products, improving competitiveness and leading in sustainability. Product Solutions consists of three operating segments:

•Energy Products: Fuels, aromatics, and catalysts and licensing

•Chemical Products: Olefins, polyethylene, polypropylene, and intermediates

•Specialty Products: Finished lubricants, basestocks and waxes, synthetics, and elastomers and resins

Further information on financial performance related to the new segments is disclosed in Management's Discussion and Analysis and Note 8 to the Condensed Consolidated Financial Statements.

FUNCTIONAL EARNINGS SUMMARY

Earnings (loss) excluding Identified Items, are earnings (loss) excluding individually significant non-operational events with an absolute corporate total earnings impact of at least $250 million in a given quarter. The earnings (loss) impact of an Identified Item for an individual segment in a given quarter may be less than $250 million when the item impacts several segments or several periods. Management uses these figures to improve comparability of the underlying business across multiple periods by isolating and removing significant non-operational events from business results. The Corporation believes this view provides investors increased transparency into business results and trends and provides investors with a view of the business as seen through the eyes of management. Earnings (loss) excluding Identified Items is not meant to be viewed in isolation or as a substitute for net income (loss) attributable to ExxonMobil as prepared in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended

September 30, 2022 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

| Earnings (loss) (U.S. GAAP) | 3,110 | | 9,309 | | | 3,008 | | 2,811 | | | 635 | | 177 | | 306 | | 456 | | | | (152) | | | 19,660 | |

| Identified Items | | | | | | | | | | | | | | | |

| Impairments | — | | (697) | | | — | | — | | | — | | — | | — | | — | | | | — | | | (697) | |

| Gain/(loss) on sale of assets | — | | 587 | | | — | | — | | | — | | — | | — | | — | | | | — | | | 587 | |

| | | | | | | | | | | | | | | |

| Tax-related items | — | | — | | | — | | — | | | — | | — | | — | | — | | | | 324 | | | 324 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other | — | | 688 | | | — | | — | | | — | | — | | — | | — | | | | 76 | | | 764 | |

| | | | | | | | | | | | | | | |

| Earnings (loss) excluding Identified Items | 3,110 | | 8,731 | | | 3,008 | | 2,811 | | | 635 | | 177 | | 306 | | 456 | | | | (552) | | | 18,682 | |

| | | | | | | | | | | | | | | |

Three Months Ended

September 30, 2021 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

| Earnings (loss) (U.S. GAAP) | 869 | | 3,082 | | | 479 | | 50 | | | 1,121 | | 907 | | 247 | | 592 | | | | (596) | | | 6,750 | |

| Identified Items | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Severance charges | — | | — | | | — | | — | | | — | | — | | — | | — | | | | (5) | | | (5) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Earnings (loss) excluding Identified Items | 869 | | 3,082 | | | 479 | | 50 | | | 1,121 | | 907 | | 247 | | 592 | | | | (591) | | | 6,755 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nine Months Ended

September 30, 2022 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

| Earnings (loss) (U.S. GAAP) | 9,235 | | 19,043 | | | 6,152 | | 4,744 | | | 2,030 | | 1,263 | | 784 | | 871 | | | | (1,132) | | | 42,990 | |

| Identified Items | | | | | | | | | | | | | | | |

| Impairments | — | | (3,574) | | | — | | — | | | — | | — | | — | | — | | | | (98) | | | (3,672) | |

| Gain/(loss) on sale of assets | 299 | | 587 | | | — | | — | | | — | | — | | — | | — | | | | — | | | 886 | |

| | | | | | | | | | | | | | | |

| Tax-related items | — | | — | | | — | | — | | | — | | — | | — | | — | | | | 324 | | | 324 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other | — | | 310 | | | — | | — | | | — | | — | | — | | — | | | | 76 | | | 386 | |

| | | | | | | | | | | | | | | |

| Earnings (loss) excluding Identified Items | 8,936 | | 21,720 | | | 6,152 | | 4,744 | | | 2,030 | | 1,263 | | 784 | | 871 | | | | (1,434) | | | 45,066 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Nine Months Ended

September 30, 2021 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

| Earnings (loss) (U.S. GAAP) | 1,895 | | 7,795 | | | (31) | | (1,217) | | | 2,923 | | 2,695 | | 689 | | 1,454 | | | | (2,033) | | | 14,170 | |

| Identified Items | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Severance charges | — | | — | | | — | | — | | | — | | — | | — | | — | | | | (48) | | | (48) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Earnings (loss) excluding Identified Items | 1,895 | | 7,795 | | | (31) | | (1,217) | | | 2,923 | | 2,695 | | 689 | | 1,454 | | | | (1,985) | | | 14,218 | |

References in this discussion to Corporate earnings (loss) mean net income (loss) attributable to ExxonMobil (U.S. GAAP) from the Condensed Consolidated Statement of Income. Unless otherwise indicated, references to earnings (loss); Upstream, Energy Products, Chemical Products, Specialty Products, and Corporate and Financing segment earnings (loss); and earnings (loss) per share are ExxonMobil's share after excluding amounts attributable to noncontrolling interests.

Due to rounding, numbers presented may not add up precisely to the totals indicated.

REVIEW OF THIRD QUARTER 2022 RESULTS

ExxonMobil’s third quarter 2022 earnings were $19.7 billion, or $4.68 per diluted share, compared with earnings of $6.8 billion a year earlier. The increase in earnings was driven by higher Upstream realizations and Energy Products margins as well as increased volume and improved mix. Capital and exploration expenditures were $5.7 billion, up $1.9 billion from third quarter 2021.

Earnings for the first nine months of 2022 were $43.0 billion, or $10.17 per diluted share, compared with $14.2 billion a year earlier. Capital and exploration expenditures were $15.2 billion, up $4.5 billion from 2021. The Corporation distributed $11.2 billion in dividends to shareholders and repurchased $10.5 billion of common stock.

UPSTREAM

| | | | | | | | | | | | | | | | | | | | |

| Upstream Financial Results | | | | | | |

| | | | | | |

| (millions of dollars) | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2022 | 2021 | | 2022 | 2021 |

| Earnings (loss) (U.S. GAAP) | | | | | | |

| United States | | 3,110 | | 869 | | | 9,235 | | 1,895 | |

| Non-U.S. | | 9,309 | | 3,082 | | | 19,043 | | 7,795 | |

| Total | | 12,419 | | 3,951 | | | 28,278 | | 9,690 | |

| | | | | | |

Identified Items (1) | | | | | | |

| United States | | — | | — | | | 299 | | — | |

| Non-U.S. | | 578 | | — | | | (2,677) | | — | |

| Total | | 578 | | — | | | (2,378) | | — | |

| | | | | | |

Earnings (loss) excluding Identified Items (1) | | | | | | |

| United States | | 3,110 | | 869 | | | 8,936 | | 1,895 | |

| Non-U.S. | | 8,731 | | 3,082 | | | 21,720 | | 7,795 | |

| Total | | 11,841 | | 3,951 | | | 30,656 | | 9,690 | |

| | | | | | | | | | | | | | |

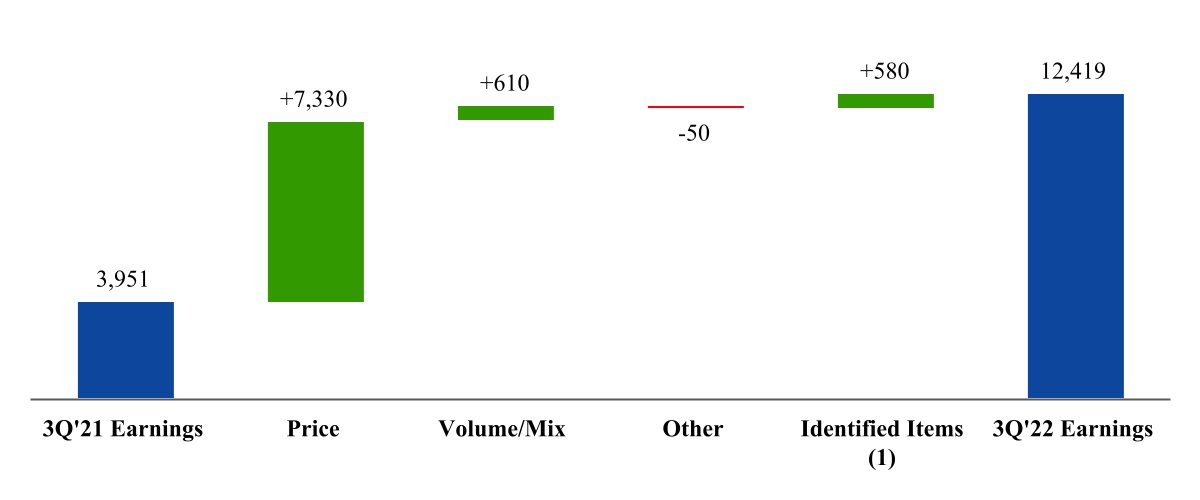

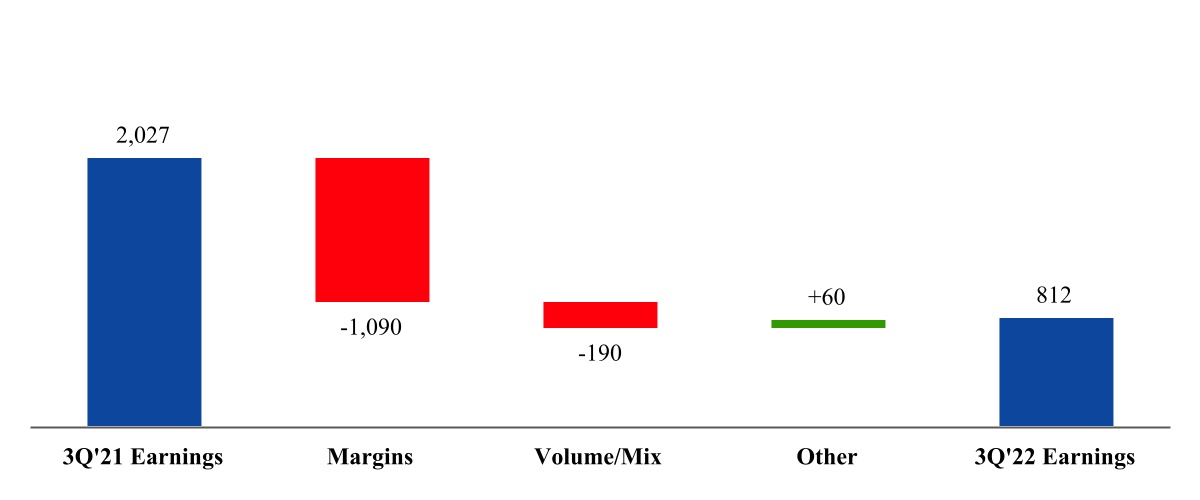

Upstream Third Quarter Earnings Factor Analysis | | |

| (millions of dollars) | | | | |

Price – Higher realizations increased earnings by $7,330 million as average natural gas realizations increased 172%, while realizations for crude oil increased 39%.

Volume/Mix – Higher volumes increased earnings by $610 million, reflecting growth in Guyana and Permian and eased curtailments, partly offset by planned and unplanned downtime and divestments.

Other – All other items decreased earnings by $50 million.

Identified Items (1) – 3Q 2022 $580 million gain on the sale of Romania and XTO Energy Canada assets and one-time benefits from tax and other reserve adjustments, partly offset by impairments.

(1) Refer to Functional Earnings Summary for definition of Identified Items and earnings (loss) excluding Identified Items.

| | | | | | | | | | | | | | |

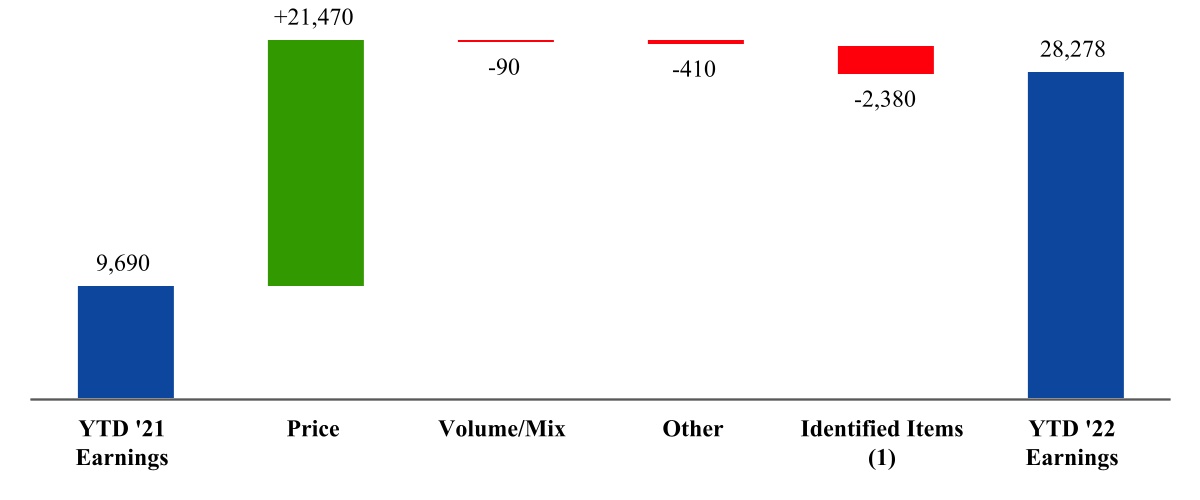

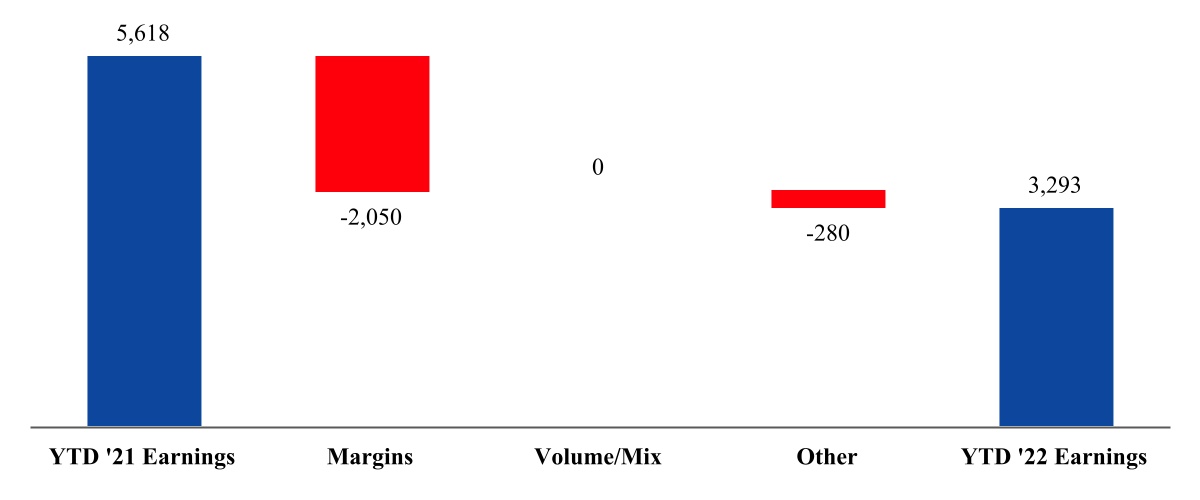

| Upstream Year-to-Date Earnings Factor Analysis | | |

| (millions of dollars) | | | | |

Price – Higher realizations increased earnings by $21,470 million as average realizations for crude oil increased 58% and natural gas realizations increased 167%.

Volume/Mix – Unfavorable volume and mix effects decreased earnings by $90 million, as growth in Guyana and Permian and eased curtailments nearly offset the impacts from the reduced Groningen gas production limit in Netherlands, Russia curtailments, higher downtime including the effects of weather in the first quarter, and lower entitlements due to higher prices.

Other – All other items decreased earnings by $410 million largely due to divestment-related impairments and the absence of prior year one-time tax impacts.

Identified Items (1) – 2022 $(2,380) million loss mainly driven by the first quarter impairment of the Russia Sakhalin-1 project, partly offset by gains on the sale of the U.S. Barnett Shale, Romania, and XTO Energy Canada assets and one-time benefits from tax and other reserve adjustments.

(1) Refer to Functional Earnings Summary for definition of Identified Items and earnings (loss) excluding Identified Items.

| | | | | | | | | | | | | | | | |

| Upstream Operational Results | | | | | | |

| | | | | | |

| (thousands of barrels daily) | | | Three Months Ended

September 30, 2022 | | | Nine Months Ended

September 30, 2022 |

Volumes reconciliation (Oil-equivalent production) (1) | | | | | | |

| 2021 | | | 3,665 | | | 3,677 |

| Entitlements - Net Interest | | | (27) | | | (28) |

| Entitlements - Price / Spend / Other | | | (52) | | | (53) |

| Government Mandates | | | 85 | | | 97 |

| Divestments | | | (75) | | | (58) |

| Growth / Demand / Other | | | 120 | | | 73 |

| 2022 | | | 3,716 | | | 3,708 |

| | | | | | |

(1)Natural gas is converted to an oil-equivalent basis at six million cubic feet per one thousand barrels. |

3Q 2022 versus 3Q 2021 - 3.7 million oil-equivalent barrels per day in 3Q 2022 increased 51 thousand oil-equivalent barrels per day from 3Q 2021 reflecting growth in Guyana and Permian, and easing government-mandated curtailments, partly offset by divestments and lower entitlements due to higher prices.