| | | | | | | | | | | | | | |

| | | | |

| | | | |

3Q 2022 Earnings Release | | | | |

| | | | |

| FOR IMMEDIATE RELEASE | | | | October 28, 2022 |

ExxonMobil Announces Third-Quarter 2022 Results

•Grew earnings and cash flow from operating activities to $19.7 billion and $24.4 billion, respectively, as strong volume performance, including record refining volumes¹, rigorous cost control and higher natural gas realizations more than offset lower crude realizations and weaker industry refining margins

•Achieved best-ever quarterly refining throughput in North America and highest globally since 2008¹

•Delivered strong quarterly oil and gas production, including record Permian production of nearly 560,000 oil-equivalent barrels per day to better serve demand; year-on-year, total production increased 50,000 oil-equivalent barrels per day

•Signed largest-of-its-kind commercial agreement to capture and permanently store up to 2 million metric tons of CO2 emissions per year

•Declared fourth-quarter dividend of $0.91 per share, an increase of $0.03 per share; paying out $15 billion in aggregate for the year

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Results Summary | |

| | | | | | | | |

| 3Q22 | 2Q22 | Change vs 2Q22 | 3Q21 | Change vs 3Q21 | Dollars in millions (except per share data) | YTD 2022 | YTD 2021 | Change vs YTD 2021 |

| 19,660 | | 17,850 | | +1,810 | | 6,750 | | +12,910 | | Earnings (U.S. GAAP) | 42,990 | | 14,170 | | +28,820 | |

| 18,682 | | 17,551 | | +1,131 | | 6,755 | | +11,927 | | Earnings Excluding Identified Items | 45,066 | | 14,218 | | +30,848 | |

| | | | | | | | |

| 4.68 | | 4.21 | | +0.47 | | 1.57 | | +3.11 | | Earnings Per Common Share ² | 10.17 | | 3.31 | | +6.86 | |

| 4.45 | | 4.14 | | +0.31 | | 1.58 | | +2.87 | | Earnings Excl. Identified Items Per Common Share ² | 10.66 | | 3.33 | | +7.33 | |

| | | | | | | | |

| 5,728 | | 4,609 | | +1,119 | | 3,851 | | +1,877 | | Capital and Exploration Expenditures | 15,241 | | 10,787 | | +4,454 | |

| | | | | | | | |

| |

IRVING, Texas – October 28, 2022 – Exxon Mobil Corporation today announced third-quarter 2022 earnings of $19.7 billion, or $4.68 per share assuming dilution. Third-quarter results included net favorable identified items of nearly $1 billion associated with the completion of the XTO Energy Canada and Romania Upstream affiliate divestments and one-time benefits from tax and other reserve adjustments, partly offset by impairments. Capital and exploration expenditures were $5.7 billion in the third quarter, bringing year-to-date 2022 investments to $15.2 billion, on track with full-year guidance of $21 billion to $24 billion.

“Our strong third-quarter results reflect the hard work of our people to invest in and build businesses critical to meeting the demand we see today,” commented Darren Woods, chairman and chief executive officer. "We all understand how important our role is in producing the energy and products the world needs, and third-quarter results reflect our commitment to that objective."

“The investments we've made, even through the pandemic, enabled us to increase production to address the needs of consumers. Rigorous cost control and growth of higher-margin petroleum and chemical products also contributed to earnings and cash flow growth in the quarter. At the same time, we are expanding our Low Carbon Solutions business with the signing of the largest-of-its-kind customer contract to capture and permanently store carbon dioxide, demonstrating our ability to offer competitive emission-reduction services to large industrial customers around the world,” concluded Woods.

¹ Best-ever quarterly refining throughput in North America and highest globally since 2008, both based on current refinery circuit

² Assuming dilution

| | | | | | | | | | | | | | |

2Q22 to 3Q22 Factor Analysis |

Financial Highlights

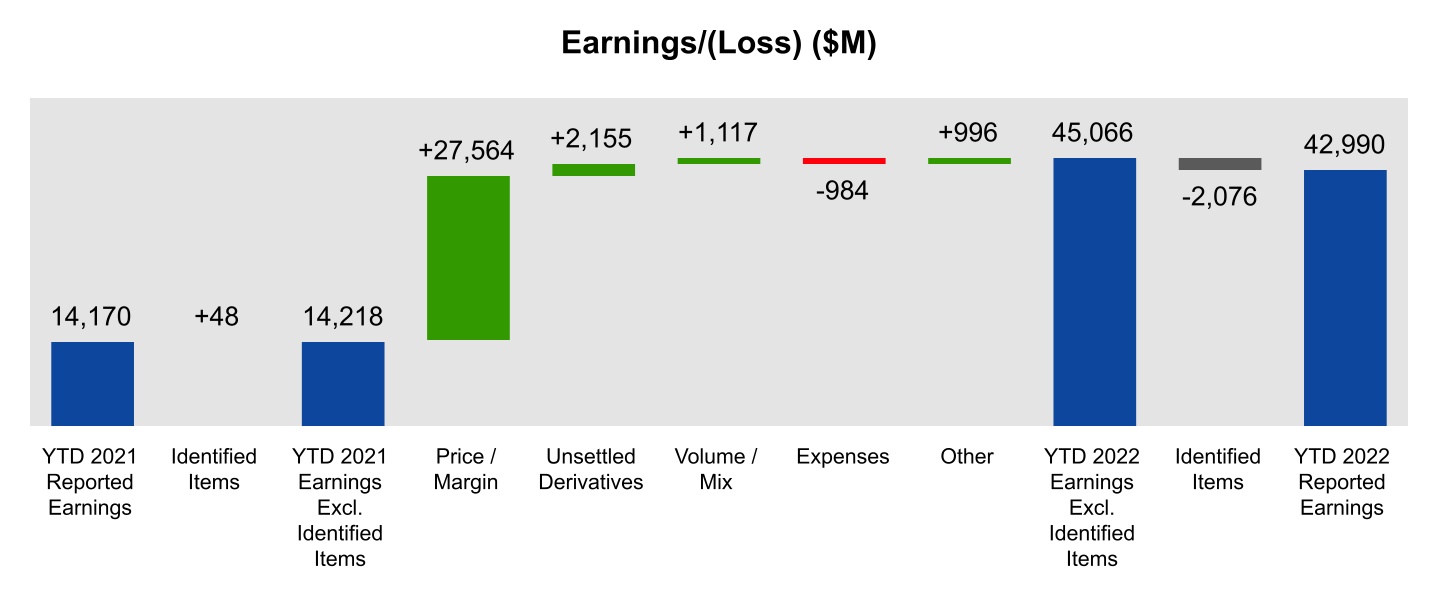

•Third-quarter earnings were $19.7 billion compared with $17.9 billion in the second quarter of 2022. Excluding identified items, earnings of $18.7 billion were up $1.1 billion versus the prior quarter as higher natural gas realizations, record throughput in Energy Products, and continued cost control, were partially offset by lower crude realizations and moderating industry refining margins.

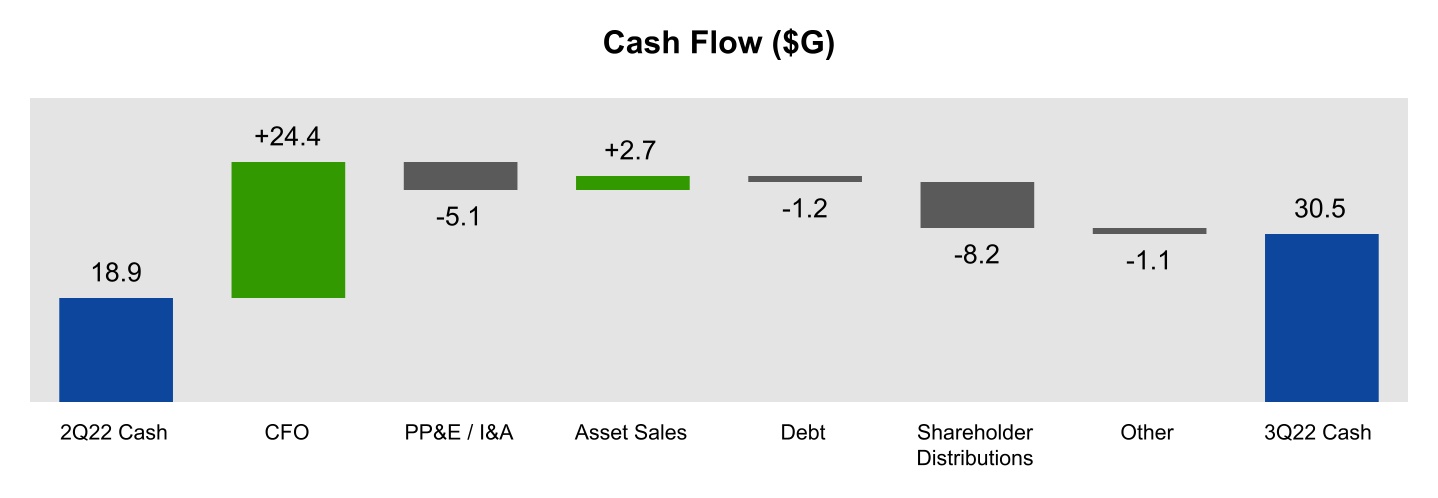

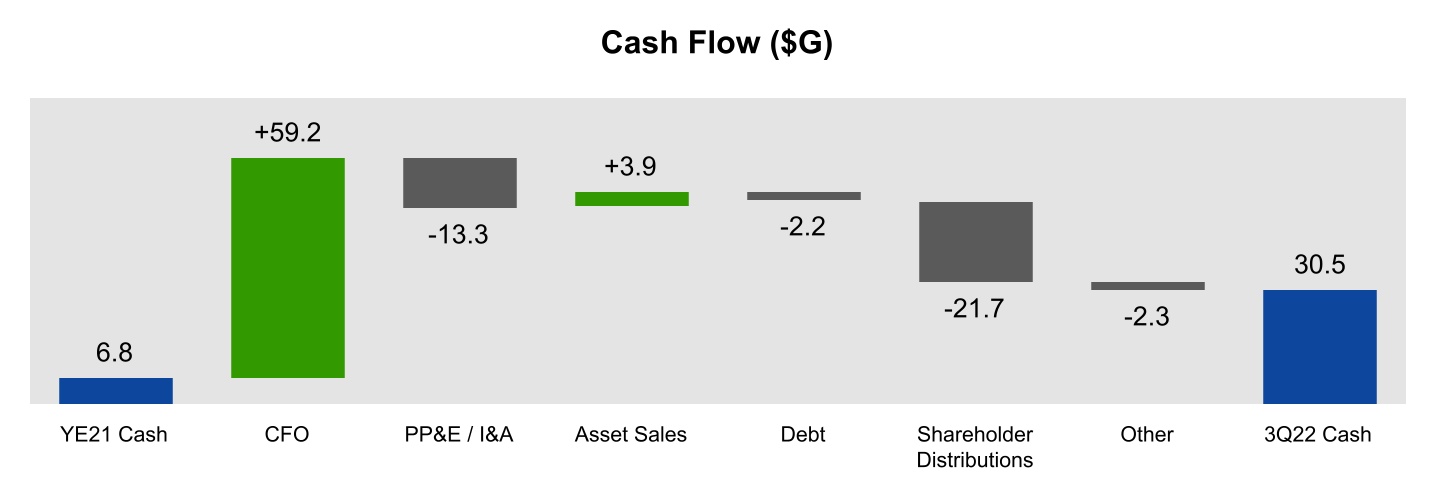

•Cash increased by $11.6 billion in the third quarter with free cash flow of $22 billion. Shareholder distributions were $8.2 billion for the quarter, including $3.7 billion of dividends and $4.5 billion of share repurchases, bringing year-to-date repurchases to $10.5 billion, consistent with the company's plan to repurchase up to $30 billion of shares through 2023.

•The Corporation declared a fourth-quarter dividend of $0.91 per share, payable on December 9th. The increase of $0.03 per share reflects confidence in our strategy, businesses performance, and financial strength, and marks 40 consecutive years of annual dividend growth. A reliable and growing dividend shows the company's commitment to return profits to shareholders, of which approximately 40% are individual investors.

•Net-debt-to-capital ratio improved to about 7%, reflecting a period-end cash balance of $30.5 billion. The debt-to-capital ratio is now 19%, just below the low-end of the company's target range.

•Asset sales and divestments resulted in $2.7 billion of cash proceeds during the quarter, bringing year-to-date proceeds to nearly $4 billion.

Leading the Drive to Net Zero

Carbon Capture and Storage

•ExxonMobil and CF Industries, a leading global manufacturer of hydrogen and nitrogen products, have entered into the largest-of-its-kind commercial agreement to capture and permanently store up to 2 million metric tons of carbon dioxide (CO2) emissions annually from CF Industries' manufacturing complex in Louisiana. The project, which is scheduled to start up in early 2025, supports Louisiana’s objective of net zero CO2 emissions by 2050.

As part of the project, ExxonMobil signed an agreement with EnLink Midstream to use EnLink’s transportation network to deliver CO2 to secure, permanent, underground geologic storage. The 2 million metric tons of captured emissions is the equivalent of replacing approximately 700,000 gasoline-powered cars with electric vehicles.

This landmark project represents large-scale, real-world progress on the journey to decarbonize the global economy. Carbon capture and storage is a safe, proven technology that can enable some of the highest-emitting sectors to meaningfully reduce their emissions, and the company expects this technology to play an important role in the energy transition.

Constructive policy such as the U.S. Inflation Reduction Act will provide support to carbon capture and storage projects like this, promoting the development of low-carbon energy in the United States. Carbon capture and sequestration provisions provide incentives that make CO2 capture more economic, including for less concentrated CO2 streams and for those streams in areas without close proximity to permanent storage.

•The Bureau of Land Management approved a proposal to sequester carbon deep under federal land in Lincoln and Sweetwater counties in Wyoming. This is the first project of its kind to be approved on land managed by the Bureau of Land Management and, once completed, will provide the opportunity for permanent underground storage of CO2 that is generated as a by-product of helium and natural gas production at the ExxonMobil Shute Creek Plant.

Biofuels and Hydrogen

•Imperial Oil Ltd., an ExxonMobil majority-owned affiliate, announced a long-term contract through which Air Products will supply lower-carbon hydrogen by pipeline from its hydrogen plant, currently under construction in Edmonton, to Imperial's Strathcona refinery. The lower-carbon hydrogen will be used in production of renewable diesel that substantially reduces greenhouse gas emissions relative to conventional production. The Strathcona refinery project is expected to produce approximately 20,000 barrels per day of renewable diesel, which could reduce emissions in the Canadian transportation sector by about 3 million metric tons per year, the equivalent to taking approximately 650,000 passenger vehicles off the road1.

1 Estimates based on United States Environmental Protection Agency Greenhouse Gas Equivalencies Calculator

| | | | | | | | | | | | | | |

| . | | | |

EARNINGS AND VOLUME SUMMARY BY SEGMENT |

| | | | | | | | | | | | | | | | | |

Upstream |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions (unless otherwise noted) | YTD 2022 | YTD 2021 |

| | | Earnings/(Loss) (U.S. GAAP) | | |

| 3,110 | 3,749 | 869 | United States | 9,235 | 1,895 |

| 9,309 | 7,622 | 3,082 | Non-U.S. | 19,043 | 7,795 |

| 12,419 | 11,371 | 3,951 | Worldwide | 28,278 | 9,690 |

| | | | | |

| | | Earnings/(Loss) Excluding Identified Items | | |

| 3,110 | 3,450 | 869 | United States | 8,936 | 1,895 |

| 8,731 | 7,622 | 3,082 | Non-U.S. | 21,720 | 7,795 |

| 11,841 | 11,072 | 3,951 | Worldwide | 30,656 | 9,690 |

| | | | | |

| 3,716 | 3,732 | 3,665 | Production (koebd) | 3,708 | 3,677 |

•Upstream third-quarter 2022 earnings were $12.4 billion compared to $11.4 billion in the second quarter. Excluding identified items, earnings were $11.8 billion, an increase of $0.8 billion from the previous quarter. Gas realizations increased 22% on European supply concerns and efforts to build inventory ahead of winter, more than offsetting the impact of decreasing crude realizations, which were down 12% on modest supply increases. Earnings also benefited from higher volumes and improved mix from growth in the company's advantaged assets in Guyana and the Permian.

•Oil-equivalent production in the third quarter was 3.7 million barrels per day. Absent divestments and the Russia exit impact, sequential quarter volume growth was more than 50,000 oil-equivalent barrels per day.

•The Permian delivered record production in the quarter of nearly 560,000 oil-equivalent barrels a day.

•Offshore Guyana quarterly average gross production increased to nearly 360,000 oil-equivalent barrels per day, with Liza Phase 1 and 2 production exceeding design capacity by more than 15,000 barrels per day. In addition, two new discoveries were announced in the Stabroek block, adding to the company's extensive portfolio of development opportunities.

•Earnings excluding identified items increased $7.9 billion relative to the third quarter of 2021. This improvement was driven by a 172% increase in natural gas realizations and an increase of nearly 40% in crude realizations. Oil-equivalent production grew approximately 50,000 barrels per day despite a reduction of 75,000 barrels per day from divestments.

•Year-to-date earnings excluding identified items were $30.7 billion, an increase of $21 billion versus the first nine months of 2021 on higher crude and natural gas realizations. Excluding impacts from divestments, oil-equivalent production grew nearly 90,000 barrels per day.

•Earlier this month, first LNG production was achieved from Mozambique’s Coral South Floating LNG, contributing new supply amid growing global demand.

•The company completed the sales of XTO Energy Canada and the Romania Upstream affiliate, resulting in earnings of $0.6 billion and more than $2 billion in cash proceeds during the quarter. In addition, an agreement was announced with Green Gate Resources E, LLC, for the sale of ExxonMobil's interest in the Aera oil-production operation in California, which is expected to close in the fourth quarter.

| | | | | | | | | | | | | | | | | |

Energy Products |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions (unless otherwise noted) | YTD 2022 | YTD 2021 |

| | | Earnings/(Loss) (U.S. GAAP) | | |

| 3,008 | 2,655 | 479 | United States | 6,152 | (31) |

| 2,811 | 2,617 | 50 | Non-U.S. | 4,744 | (1,217) |

| 5,819 | 5,273 | 529 | Worldwide | 10,896 | (1,248) |

| | | | | |

| | | Earnings/(Loss) Excluding Identified Items | | |

| 3,008 | 2,655 | 479 | United States | 6,152 | (31) |

| 2,811 | 2,617 | 50 | Non-U.S. | 4,744 | (1,217) |

| 5,819 | 5,273 | 529 | Worldwide | 10,896 | (1,248) |

| | | | | |

| 5,537 | 5,310 | 5,302 | Energy Products Sales (kbd) | 5,321 | 5,049 |

•Energy Products third-quarter 2022 earnings totaled $5.8 billion compared to $5.3 billion in the second quarter. Industry refining margins remained strong on high global diesel demand, yet declined 30% from second quarter levels due to higher refinery runs and flat U.S. gasoline demand. The impact of lower industry refining margins was partially offset by higher aromatics, marketing and trading margins. In addition, record throughput1 on strong reliability, improved product yields, and lower turnaround activity also contributed to the earnings improvement.

•Earnings increased $5.3 billion compared to the third quarter of 2021 due to stronger industry refining margins, positive derivative mark-to-market effects and higher volumes.

•Year-to-date earnings of $10.9 billion compared to a loss of $1.2 billion in the same period last year, driven by stronger industry refining margins and increased volumes on strong reliability and lower scheduled maintenance.

•Third-quarter refining throughput was 4.2 million barrels per day, up 177,000 barrels from the second quarter. This reflects best ever quarterly refining throughput in North America and the highest globally since 20081.

1 Best-ever quarterly refining throughput in North America and highest globally since 2008, both based on current refinery circuit

| | | | | | | | | | | | | | | | | |

Chemical Products |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions (unless otherwise noted) | YTD 2022 | YTD 2021 |

| | | Earnings/(Loss) (U.S. GAAP) | | |

| 635 | 625 | 1,121 | United States | 2,030 | 2,923 |

| 177 | 450 | 907 | Non-U.S. | 1,263 | 2,695 |

| 812 | 1,076 | 2,027 | Worldwide | 3,293 | 5,618 |

| | | | | |

| | | Earnings/(Loss) Excluding Identified Items | | |

| 635 | 625 | 1,121 | United States | 2,030 | 2,923 |

| 177 | 450 | 907 | Non-U.S. | 1,263 | 2,695 |

| 812 | 1,076 | 2,027 | Worldwide | 3,293 | 5,618 |

| | | | | |

| 4,680 | 4,811 | 4,814 | Chemical Products Sales (kt) | 14,509 | 14,309 |

•Chemical Products third-quarter 2022 earnings were $0.8 billion compared to $1.1 billion in the second quarter. Solid earnings reflected reliable operations and cost discipline, partially offsetting the negative impact on volumes and margins from bottom-of-cycle conditions in Asia Pacific and softening demand in Europe and North America, with regional pricing moving closer to global parity. Record quarterly sales volume for performance polyethylene helped upgrade product mix, which served as a partial offset to lower volumes.

•Earnings were $1.2 billion lower compared to third-quarter 2021 on weaker industry margins and lower sales, reflecting softening market conditions.

•Year-to-date earnings totaled $3.3 billion compared to $5.6 billion in the first nine months of 2021, driven by lower margins on rising feed and energy costs, higher project and planned maintenance expenses, and unfavorable foreign exchange effects.

| | | | | | | | | | | | | | | | | |

Specialty Products |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions (unless otherwise noted) | YTD 2022 | YTD 2021 |

| | | Earnings/(Loss) (U.S. GAAP) | | |

| 306 | 232 | 247 | United States | 784 | 689 |

| 456 | 185 | 592 | Non-U.S. | 871 | 1,454 |

| 762 | 417 | 839 | Worldwide | 1,655 | 2,143 |

| | | | | |

| | | Earnings/(Loss) Excluding Identified Items | | |

| 306 | 232 | 247 | United States | 784 | 689 |

| 456 | 185 | 592 | Non-U.S. | 871 | 1,454 |

| 762 | 417 | 839 | Worldwide | 1,655 | 2,143 |

| | | | | |

| 1,917 | 2,100 | 1,896 | Specialty Products Sales (kt) | 6,024 | 5,832 |

•Specialty Products third-quarter 2022 earnings were $0.8 billion compared with $0.4 billion in the second quarter. The strong quarterly performance was driven by improved margins reflecting tight market conditions, partly offset by lower sales from a reliability event resolved within the quarter.

•Compared to the same quarter last year, earnings declined $0.1 billion. Margins were robust, but down year-on-year reflecting a higher feed cost environment.

•Year-to-date earnings of $1.7 billion decreased from $2.1 billion in the same period last year, primarily due to lower margins on higher feed costs and energy prices, partly offset by higher sales.

| | | | | | | | | | | | | | | | | |

Corporate and Financing |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions (unless otherwise noted) | YTD 2022 | YTD 2021 |

| (152) | (286) | (596) | Earnings/(Loss) (U.S. GAAP) | (1,132) | (2,033) |

| (552) | (286) | (591) | Earnings/(Loss) Excluding Identified Items | (1,434) | (1,985) |

•Corporate and Financing reported net charges of $0.2 billion in the third quarter of 2022 compared to $0.3 billion in the second quarter. Excluding favorable identified items of $0.4 billion related to tax and other reserve adjustments, net charges were up $0.3 billion, reflecting the absence of the prior quarter's favorable one-time tax impacts.

•Net charges excluding identified items of $0.6 billion in the third quarter of 2022 were in line with the same quarter of 2021.

•Year-to-date net charges excluding identified items of $1.4 billion were down $0.6 billion from last year, mainly due to decreased pension-related expenses and lower financing costs.

| | | | | | | | | | | | | | |

| . | | | |

CASH FLOW FROM OPERATIONS AND ASSET SALES EXCLUDING WORKING CAPITAL |

| | | | | | | | | | | | | | | | | |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions | YTD 2022 | YTD 2021 |

| 20,198 | 18,574 | 6,942 | Net income/(loss) including noncontrolling interests | 44,522 | 14,519 |

| 5,642 | 4,451 | 4,990 | Depreciation and depletion (includes impairments) | 18,976 | 14,946 |

| 1,667 | (2,747) | 659 | Changes in operational working capital | 6 | 2,232 |

| (3,082) | (315) | (500) | Other | (4,328) | (692) |

| 24,425 | 19,963 | 12,091 | Cash Flow from Operating Activities (U.S. GAAP) | 59,176 | 31,005 |

| | | | | |

| 2,682 | 939 | 18 | Proceeds associated with asset sales | 3,914 | 575 |

| 27,107 | 20,902 | 12,109 | Cash Flow from Operations and Asset Sales | 63,090 | 31,580 |

| | | | | |

| (1,667) | 2,747 | (659) | Changes in operational working capital | (6) | (2,232) |

| 25,440 | 23,649 | 11,450 | Cash Flow from Operations and Asset Sales excluding Working Capital | 63,084 | 29,348 |

| | | | | |

| | |

| | | | | | | | | | | | | | | | | |

FREE CASH FLOW | | |

| | | | | |

3Q22 | 2Q22 | 3Q21 | Dollars in millions | YTD 2022 | YTD 2021 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| 24,425 | 19,963 | 12,091 | Cash Flow from Operating Activities (U.S. GAAP) | 59,176 | 31,005 |

| | | | | |

| (4,876) | (3,837) | (2,840) | Additions to property, plant and equipment | (12,624) | (7,987) |

| (272) | (226) | (442) | Additional investments and advances | (915) | (1,055) |

| 88 | 60 | 210 | Other investing activities including collection of advances | 238 | 342 |

| 2,682 | 939 | 18 | Proceeds from asset sales and returns of investments | 3,914 | 575 |

| 22,047 | 16,899 | 9,037 | Free Cash Flow | 49,789 | 22,880 |

ExxonMobil will discuss financial and operating results and other matters during a webcast at 7:30 a.m. Central Time on October 28, 2022. To listen to the event or access an archived replay, please visit www.exxonmobil.com.

Cautionary Statement

Outlooks; projections; descriptions of strategic, operating, and financial plans and objectives; statements of future ambitions and plans; and other statements of future events or conditions in this release, are forward-looking statements. Similarly, discussion of future carbon capture, biofuel and hydrogen plans to drive towards net zero emissions are dependent on future market factors, such as continued technological progress and policy support, and represent forward-looking statements. Actual future results, including financial and operating performance; total capital expenditures and mix, including allocations of capital to low carbon solutions; cost reductions and efficiency gains, including the ability to offset inflationary pressure; plans to reduce future emissions and emissions intensity; timing and outcome of projects to capture and store CO2, and produced biofuels; timing and outcome of hydrogen projects; cash flow, dividends and shareholder returns, including the timing and amounts of share repurchases; future debt levels and credit ratings; business and project plans, timing, costs, capacities and returns; and resource recoveries and production rates could differ materially due to a number of factors. These include global or regional changes in the supply and demand for oil, natural gas, petrochemicals, and feedstocks and other market conditions that impact prices and differentials for our products; government policies supporting lower carbon investment opportunities such as the U.S. Inflation Reduction Act or policies limiting the attractiveness of future investment such as the European Solidarity Tax; variable impacts of trading activities on our margins and results each quarter; actions of competitors and commercial counterparties; the outcome of commercial negotiations, including final agreed terms and conditions; the ability to access debt markets; the ultimate impacts of COVID-19, including the effects of government responses on people and economies; reservoir performance, including variability and timing factors applicable to unconventional resources; the outcome of exploration projects and decisions to invest in future reserves; timely completion of development and other construction projects; final management approval of future projects and any changes in the scope, terms, or costs of such projects as approved; changes in law, taxes, or regulation including environmental regulations, trade sanctions, and timely granting of governmental permits and certifications; government policies and support and market demand for low carbon technologies; war, and other political or security disturbances; expropriations, seizure, or capacity, insurance or shipping limitations by foreign governments or laws; opportunities for potential investments or divestments and satisfaction of applicable conditions to closing, including regulatory approvals; the capture of efficiencies within and between business lines and the ability to maintain near-term cost reductions as ongoing efficiencies; unforeseen technical or operating difficulties and unplanned maintenance; the development and competitiveness of alternative energy and emission reduction technologies; the results of research programs and the ability to bring new technologies to commercial scale on a cost-competitive basis; and other factors discussed under Item 1A. Risk Factors of ExxonMobil’s 2021 Form 10-K.

Forward-looking and other statements regarding our environmental, social and other sustainability efforts and aspirations are not an indication that these statements are necessarily material to investors or requiring disclosure in our filing with the SEC. In addition, historical, current, and forward-looking environmental, social and sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future rule-making.

Frequently Used Terms and Non-GAAP Measures

This press release includes cash flow from operations and asset sales. Because of the regular nature of our asset management and divestment program, the company believes it is useful for investors to consider proceeds associated with the sales of subsidiaries, property, plant and equipment, and sales and returns of investments together with cash provided by operating activities when evaluating cash available for investment in the business and financing activities. A reconciliation to net cash provided by operating activities for 2021 and 2022 periods is shown on page 7.

This press release also includes cash flow from operations and asset sales excluding working capital. The company believes it is useful for investors to consider these numbers in comparing the underlying performance of the company's business across periods when there are significant period-to-period differences in the amount of changes in working capital. A reconciliation to net cash provided by operating activities for 2021 and 2022 periods is shown on page 7.

This press release also includes earnings/(loss) excluding identified items, which are earnings/(loss) excluding individually significant non-operational events with an absolute corporate total earnings impact of at least $250 million in a given quarter. The earnings/(loss) impact of an identified item for an individual segment may be less than $250 million when the item impacts several periods or several segments. Earnings/(loss) excluding identified items does include non-operational earnings events or impacts that are below the $250 million threshold utilized for identified items. When the effect of these events is material in aggregate, it is indicated in analysis of period results as part of quarterly earnings press release and teleconference materials. Management uses these figures to improve comparability of the underlying business across multiple periods by isolating and removing significant non-operational events from business results. The Corporation believes this view provides investors increased transparency into business results and trends and provides investors with a view of the business as seen through the eyes of management. Earnings excluding identified items is not meant to be viewed in isolation or as a substitute for net income/(loss) attributable to ExxonMobil as prepared in accordance with U.S. GAAP. A reconciliation to earnings is shown for 2022 and

2021 periods in Attachments II-a and II-b. Corresponding per share amounts are shown on page 1 and in Attachment II-a, including a reconciliation to earnings/(loss) per common share – assuming dilution (U.S. GAAP).

This press release also includes total taxes including sales-based taxes. This is a broader indicator of the total tax burden on the Corporation’s products and earnings, including certain sales and value-added taxes imposed on and concurrent with revenue-producing transactions with customers and collected on behalf of governmental authorities (“sales-based taxes”). It combines “Income taxes” and “Total other taxes and duties” with sales-based taxes, which are reported net in the income statement. The company believes it is useful for the Corporation and its investors to understand the total tax burden imposed on the Corporation’s products and earnings. A reconciliation to total taxes is shown in Attachment I-a.

This press release also references free cash flow. Free cash flow is the sum of net cash provided by operating activities and net cash flow used in investing activities. This measure is useful when evaluating cash available for financing activities, including shareholder distributions, after investment in the business. Free cash flow is not meant to be viewed in isolation or as a substitute for net cash provided by operating activities. A reconciliation to net cash provided by operating activities for 2021 and 2022 periods is shown on page 7.

References to the resource base and other quantities of oil, natural gas or condensate may include estimated amounts that are not yet classified as “proved reserves” under SEC definitions, but which are expected to be ultimately recoverable. A reconciliation of production excluding divestments, entitlements, and government mandates to actual production is contained in the Supplement to this release included as Exhibit 99.2 to the Form 8-K filed the same day as this news release. The term “project” as used in this release can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Reference to Earnings

References to corporate earnings mean net income attributable to ExxonMobil (U.S. GAAP) from the consolidated income statement. Unless otherwise indicated, references to earnings, Upstream, Energy Products, Chemical Products, Specialty Products and Corporate and Financing segment earnings, and earnings per share are ExxonMobil’s share after excluding amounts attributable to noncontrolling interests.

Exxon Mobil Corporation has numerous affiliates, many with names that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For convenience and simplicity, those terms and terms such as corporation, company, our, we, and its are sometimes used as abbreviated references to specific affiliates or affiliate groups. Similarly, ExxonMobil has business relationships with thousands of customers, suppliers, governments, and others. For convenience and simplicity, words such as venture, joint venture, partnership, co-venturer, and partner are used to indicate business and other relationships involving common activities and interests, and those words may not indicate precise legal relationships. ExxonMobil's ambitions, plans and goals do not guarantee any action or future performance by its affiliates or Exxon Mobil Corporation's responsibility for those affiliates' actions and future performance, each affiliate of which manages its own affairs.

Throughout this press release, both Exhibit 99.1 as well as Exhibit 99.2, due to rounding, numbers presented may not add up precisely to the totals indicated.

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT I-a |

CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| (Preliminary) | | | |

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

Dollars in millions (unless otherwise noted) | 2022 | 2021 | 2022 | 2021 |

| Revenues and other income | | | | |

| Sales and other operating revenue | 106,512 | | 71,892 | | 305,511 | | 195,387 | |

| Income from equity affiliates | 4,632 | | 1,670 | | 10,858 | | 4,579 | |

| Other income | 926 | | 224 | | 1,882 | | 709 | |

| Total revenues and other income | 112,070 | | 73,786 | | 318,251 | | 200,675 | |

| Costs and other deductions | | | | |

| Crude oil and product purchases | 60,197 | | 39,745 | | 178,198 | | 109,675 | |

| Production and manufacturing expenses | 11,317 | | 8,719 | | 32,244 | | 25,252 | |

| Selling, general and administrative expenses | 2,324 | | 2,287 | | 7,263 | | 7,060 | |

| Depreciation and depletion (includes impairments) | 5,642 | | 4,990 | | 18,976 | | 14,946 | |

| Exploration expenses, including dry holes | 218 | | 190 | | 677 | | 530 | |

| Non-service pension and postretirement benefit expense | 154 | | 146 | | 382 | | 686 | |

| Interest expense | 209 | | 214 | | 591 | | 726 | |

| Other taxes and duties | 6,587 | | 7,889 | | 21,009 | | 22,295 | |

| Total costs and other deductions | 86,648 | | 64,180 | | 259,340 | | 181,170 | |

| Income/(Loss) before income taxes | 25,422 | | 9,606 | | 58,911 | | 19,505 | |

| Income tax expense/(benefit) | 5,224 | | 2,664 | | 14,389 | | 4,986 | |

| Net income/(loss) including noncontrolling interests | 20,198 | | 6,942 | | 44,522 | | 14,519 | |

| Net income/(loss) attributable to noncontrolling interests | 538 | | 192 | | 1,532 | | 349 | |

| Net income/(loss) attributable to ExxonMobil | 19,660 | | 6,750 | | 42,990 | | 14,170 | |

| | | | |

| OTHER FINANCIAL DATA | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| 2022 | 2021 | 2022 | 2021 |

Earnings per common share (U.S. dollars) | 4.68 | | 1.57 | | 10.17 | | 3.31 | |

Earnings per common share - assuming dilution (U.S. dollars) | 4.68 | | 1.57 | | 10.17 | | 3.31 | |

| | | | |

| Dividends on common stock | | | | |

| Total | 3,685 | | 3,720 | | 11,172 | | 11,161 | |

Per common share (U.S. dollars) | 0.88 | | 0.87 | | 2.64 | | 2.61 | |

| | | | |

| Millions of common shares outstanding | | | | |

| Average - assuming dilution | 4,185 | | 4,276 | | 4,227 | | 4,275 | |

| | | | |

| Income taxes | 5,224 | | 2,664 | | 14,389 | | 4,986 | |

| Total other taxes and duties | 7,473 | | 8,572 | | 23,701 | | 24,296 | |

| Total taxes | 12,697 | | 11,236 | | 38,090 | | 29,282 | |

| Sales-based taxes | 6,364 | | 5,775 | | 19,321 | | 15,885 | |

| Total taxes including sales-based taxes | 19,061 | | 17,011 | | 57,411 | | 45,167 | |

| | | | |

| ExxonMobil share of income taxes of equity companies | 2,902 | | 713 | | 6,082 | | 1,838 | |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT I-b |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| (Preliminary) | | | |

| | | | | | | | |

| Dollars in millions (unless otherwise noted) | September 30, 2022 | December 31, 2021 |

| ASSETS | | |

| Current assets | | |

| Cash and cash equivalents | 30,407 | | 6,802 | |

| Cash and cash equivalents - restricted | 57 | | — | |

| Notes and accounts receivable – net | 42,411 | | 32,383 | |

| Inventories | | |

| Crude oil, products and merchandise | 20,078 | | 14,519 | |

| Materials and supplies | 4,018 | | 4,261 | |

| Other current assets | 2,318 | | 1,189 | |

| Total current assets | 99,289 | | 59,154 | |

| Investments, advances and long-term receivables | 50,235 | | 45,195 | |

| Property, plant and equipment – net | 203,102 | | 216,552 | |

| Other assets, including intangibles – net | 17,526 | | 18,022 | |

| Total Assets | 370,152 | | 338,923 | |

| | |

| LIABILITIES | | |

| Current liabilities | | |

| Notes and loans payable | 6,182 | | 4,276 | |

| Accounts payable and accrued liabilities | 62,550 | | 50,766 | |

| Income taxes payable | 5,325 | | 1,601 | |

| Total current liabilities | 74,057 | | 56,643 | |

| Long-term debt | 39,246 | | 43,428 | |

| Postretirement benefits reserves | 16,799 | | 18,430 | |

| Deferred income tax liabilities | 21,274 | | 20,165 | |

| Long-term obligations to equity companies | 2,647 | | 2,857 | |

| Other long-term obligations | 23,086 | | 21,717 | |

| Total Liabilities | 177,109 | | 163,240 | |

| | |

| EQUITY | | |

| Common stock without par value | | |

(9,000 million shares authorized, 8,019 million shares issued) | 16,106 | | 15,746 | |

| Earnings reinvested | 423,877 | | 392,059 | |

| Accumulated other comprehensive income | (17,803) | | (13,764) | |

| Common stock held in treasury | | |

(3,901 million shares at September 30, 2022, and 3,780 million shares at December 31, 2021) | (236,080) | | (225,464) | |

| ExxonMobil share of equity | 186,100 | | 168,577 | |

| Noncontrolling interests | 6,943 | | 7,106 | |

| Total Equity | 193,043 | | 175,683 | |

| Total Liabilities and Equity | 370,152 | | 338,923 | |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT I-c |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS |

| (Preliminary) | | | |

| | | | | | | | |

| Nine Months Ended September 30, |

| Dollars in millions (unless otherwise noted) | 2022 | 2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | |

| Net income/(loss) including noncontrolling interests | 44,522 | | 14,519 | |

| Depreciation and depletion (includes impairments) | 18,976 | | 14,946 | |

| | |

| Changes in operational working capital, excluding cash and debt | 6 | | 2,232 | |

| All other items – net | (4,328) | | (692) | |

| Net cash provided by operating activities | 59,176 | | 31,005 | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | |

| Additions to property, plant and equipment | (12,624) | | (7,987) | |

| Proceeds from asset sales and returns of investments | 3,914 | | 575 | |

| Additional investments and advances | (915) | | (1,055) | |

| Other investing activities including collection of advances | 238 | | 342 | |

| Net cash used in investing activities | (9,387) | | (8,125) | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | |

| Additions to long-term debt | 55 | | 46 | |

| Reductions in long-term debt | — | | (4) | |

| Additions to short-term debt | — | | 12,197 | |

| Reductions in short-term debt | (3,895) | | (24,066) | |

| Additions/(Reductions) in debt with three months or less maturity | 1,638 | | 997 | |

| Contingent consideration payments | (58) | | (28) | |

| Cash dividends to ExxonMobil shareholders | (11,172) | | (11,161) | |

| Cash dividends to noncontrolling interests | (191) | | (166) | |

| Changes in noncontrolling interests | (1,074) | | (278) | |

| Common stock acquired | (10,480) | | (1) | |

| Net cash used in financing activities | (25,177) | | (22,464) | |

| Effects of exchange rate changes on cash | (950) | | (12) | |

| Increase/(Decrease) in cash and cash equivalents | 23,662 | | 404 | |

| Cash and cash equivalents at beginning of period | 6,802 | | 4,364 | |

| Cash and cash equivalents at end of period | 30,464 | | 4,768 | |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT II-a |

KEY FIGURES: IDENTIFIED ITEMS |

| | | | | | | | | | | | | | | | | |

| 3Q22 | 2Q22 | 3Q21 | Dollars in Millions | YTD 2022 | YTD 2021 |

| 19,660 | 17,850 | 6,750 | Earnings/(Loss) (U.S. GAAP) | 42,990 | 14,170 |

| | | | | |

| | | Identified Items | | |

| (697) | — | — | Impairments | (3,672) | — |

| 587 | 299 | — | Gain/(Loss) on sale of assets | 886 | — |

| | | | | |

| 324 | — | — | Tax-related items | 324 | — |

| — | — | (5) | Severance | — | (48) |

| 764 | — | — | Other | 386 | — |

| 978 | 299 | (5) | Total Identified Items | (2,076) | (48) |

| | | | | |

| 18,682 | 17,551 | 6,755 | Earnings/(Loss) (U.S. GAAP) Excluding Identified Items | 45,066 | 14,218 |

| | | | | |

| | | | | |

| 3Q22 | 2Q22 | 3Q21 | Dollars Per Common Share | YTD 2022 | YTD 2021 |

| 4.68 | 4.21 | 1.57 | Earnings/(Loss) Per Common Share ¹ | 10.17 | 3.31 |

| | | | | |

| | | Identified Items Per Common Share ¹ | | |

| (0.16) | — | — | Impairments | (0.87) | — |

| 0.14 | 0.07 | — | Gain/(Loss) on sale of assets | 0.21 | — |

| | | | | |

| 0.08 | — | — | Tax-related items | 0.08 | — |

| — | — | (0.01) | Severance | — | (0.02) |

| 0.18 | — | — | Other | 0.09 | — |

| 0.23 | 0.07 | (0.01) | Total Identified Items Per Common Share ¹ | (0.49) | (0.02) |

| | | | | |

| 4.45 | 4.14 | 1.58 | Earnings/(Loss) (U.S. GAAP) Excl. Identified Items Per Common Share ¹ | 10.66 | 3.33 |

¹ Assuming dilution |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT II-b |

KEY FIGURES: IDENTIFIED ITEMS BY SEGMENT |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter 2022 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing | Total |

| Dollars in millions | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings/(Loss) (U.S. GAAP) | 3,110 | 9,309 | 3,008 | 2,811 | 635 | 177 | 306 | 456 | (152) | 19,660 |

| | | | | | | | | | |

| Identified Items | | | | | | | | | | |

| Impairments | — | (697) | — | — | — | — | — | — | — | (697) |

| Gain/(Loss) on sale of assets | — | 587 | — | — | — | — | — | — | — | 587 |

| | | | | | | | | | |

| Tax-related items | — | — | — | — | — | — | — | — | 324 | 324 |

| | | | | | | | | | |

| | | | | | | | | | |

| Other | — | 688 | — | — | — | — | — | — | 76 | 764 |

| Total Identified Items | — | 578 | — | — | — | — | — | — | 400 | 978 |

| | | | | | | | | | |

| Earnings/(Loss) Excl. Identified Items | 3,110 | 8,731 | 3,008 | 2,811 | 635 | 177 | 306 | 456 | (552) | 18,682 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Second Quarter 2022 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing | Total |

| Dollars in millions | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings/(Loss) (U.S. GAAP) | 3,749 | 7,622 | 2,655 | 2,617 | 625 | 450 | 232 | 185 | (286) | 17,850 |

| | | | | | | | | | |

| Identified Items | | | | | | | | | | |

| | | | | | | | | | |

| Gain/(Loss) on sale of assets | 299 | — | — | — | — | — | — | — | — | 299 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Identified Items | 299 | — | — | — | — | — | — | — | — | 299 |

| | | | | | | | | | |

| Earnings/(Loss) Excl. Identified Items | 3,450 | 7,622 | 2,655 | 2,617 | 625 | 450 | 232 | 185 | (286) | 17,551 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter 2021 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing | Total |

| Dollars in millions | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings/(Loss) (U.S. GAAP) | 869 | 3,082 | 479 | 50 | 1,121 | 907 | 247 | 592 | (596) | 6,750 |

| | | | | | | | | | |

| Identified Items | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Severance | — | — | — | — | — | — | — | — | (5) | (5) |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Identified Items | — | — | — | — | — | — | — | — | (5) | (5) |

| | | | | | | | | | |

| Earnings/(Loss) Excl. Identified Items | 869 | 3,082 | 479 | 50 | 1,121 | 907 | 247 | 592 | (591) | 6,755 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| YTD 2022 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing | Total |

| Dollars in millions | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings/(Loss) (U.S. GAAP) | 9,235 | 19,043 | 6,152 | 4,744 | 2,030 | 1,263 | 784 | 871 | (1,132) | 42,990 |

| | | | | | | | | | |

| Identified Items | | | | | | | | | | |

| Impairments | — | (3,574) | — | — | — | — | — | — | (98) | (3,672) |

| Gain/(Loss) on sale of assets | 299 | 587 | — | — | — | — | — | — | — | 886 |

| | | | | | | | | | |

| Tax-related items | — | — | — | — | — | — | — | — | 324 | 324 |

| | | | | | | | | | |

| | | | | | | | | | |

| Other | — | 310 | — | — | — | — | — | — | 76 | 386 |

| Total Identified Items | 299 | (2,677) | — | — | — | — | — | — | 302 | (2,076) |

| | | | | | | | | | |

| Earnings/(Loss) Excl. Identified Items | 8,936 | 21,720 | 6,152 | 4,744 | 2,030 | 1,263 | 784 | 871 | (1,434) | 45,066 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| YTD 2021 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing | Total |

| Dollars in millions | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. |

| Earnings/(Loss) (U.S. GAAP) | 1,895 | 7,795 | (31) | (1,217) | 2,923 | 2,695 | 689 | 1,454 | (2,033) | 14,170 |

| | | | | | | | | | |

| Identified Items | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Severance | — | — | — | — | — | — | — | — | (48) | (48) |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Identified Items | — | — | — | — | — | — | — | — | (48) | (48) |

| | | | | | | | | | |

| Earnings/(Loss) Excl. Identified Items | 1,895 | 7,795 | (31) | (1,217) | 2,923 | 2,695 | 689 | 1,454 | (1,985) | 14,218 |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT III |

KEY FIGURES: UPSTREAM VOLUMES |

| | | | | | | | | | | | | | | | | |

| 3Q22 | 2Q22 | 3Q21 | Net production of crude oil, natural gas liquids, bitumen and synthetic oil, thousand barrels per day (kbd) | YTD 2022 | YTD 2021 |

| 783 | 777 | 758 | United States | 771 | 704 |

| 641 | 556 | 569 | Canada/Other Americas | 558 | 557 |

| 4 | 4 | 21 | Europe | 4 | 24 |

| 249 | 224 | 248 | Africa | 243 | 252 |

| 666 | 691 | 668 | Asia | 698 | 676 |

| 46 | 46 | 49 | Australia/Oceania | 44 | 44 |

| 2,389 | 2,298 | 2,313 | Worldwide | 2,318 | 2,257 |

| | | | | |

| 3Q22 | 2Q22 | 3Q21 | Natural gas production available for sale, million cubic feet per day (mcfd) | YTD 2022 | YTD 2021 |

| 2,351 | 2,699 | 2,701 | United States | 2,607 | 2,757 |

| 158 | 180 | 184 | Canada/Other Americas | 175 | 197 |

| 541 | 825 | 343 | Europe | 711 | 796 |

| 70 | 67 | 53 | Africa | 65 | 41 |

| 3,304 | 3,320 | 3,365 | Asia | 3,321 | 3,465 |

| 1,539 | 1,515 | 1,464 | Australia/Oceania | 1,460 | 1,266 |

| 7,963 | 8,606 | 8,110 | Worldwide | 8,339 | 8,522 |

| | | | | |

| 3,716 | 3,732 | 3,665 | Oil-equivalent production (koebd)¹ | 3,708 | 3,677 |

| | | | | |

1 Natural gas is converted to an oil-equivalent basis at six million cubic feet per one thousand barrels. | |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT IV |

KEY FIGURES: MANUFACTURING THROUGHPUT AND SALES |

| | | | | | | | | | | | | | | | | |

| 3Q22 | 2Q22 | 3Q21 | Refinery throughput, thousand barrels per day (kbd) | YTD 2022 | YTD 2021 |

| 1,742 | 1,686 | 1,684 | United States | 1,705 | 1,583 |

| 426 | 413 | 404 | Canada | 413 | 367 |

| 1,253 | 1,164 | 1,215 | Europe | 1,204 | 1,197 |

| 557 | 532 | 585 | Asia Pacific | 542 | 579 |

| 187 | 193 | 163 | Other | 182 | 162 |

| 4,165 | 3,988 | 4,051 | Worldwide | 4,046 | 3,888 |

| | | | | |

| 3Q22 | 2Q22 | 3Q21 | Energy Products sales, thousand barrels per day (kbd) | YTD 2022 | YTD 2021 |

| 2,479 | 2,452 | 2,361 | United States | 2,399 | 2,223 |

| 3,058 | 2,858 | 2,941 | Non-U.S. | 2,922 | 2,825 |

| 5,537 | 5,310 | 5,302 | Worldwide | 5,321 | 5,049 |

| | | | | |

| 2,335 | 2,208 | 2,191 | Gasolines, naphthas | 2,220 | 2,102 |

| 1,818 | 1,755 | 1,796 | Heating oils, kerosene, diesel | 1,766 | 1,731 |

| 365 | 350 | 228 | Aviation fuels | 335 | 204 |

| 252 | 228 | 276 | Heavy fuels | 243 | 269 |

| 767 | 769 | 811 | Other energy products | 758 | 742 |

| 5,537 | 5,310 | 5,302 | Worldwide | 5,321 | 5,049 |

| | | | | |

| 3Q22 | 2Q22 | 3Q21 | Chemical Products sales, thousand metric tons (kt) | YTD 2022 | YTD 2021 |

| 1,658 | 1,998 | 1,807 | United States | 5,688 | 5,210 |

| 3,023 | 2,812 | 3,007 | Non-U.S. | 8,821 | 9,100 |

| 4,680 | 4,811 | 4,814 | Worldwide | 14,509 | 14,309 |

| | | | | |

| 3Q22 | 2Q22 | 3Q21 | Specialty Products sales, thousand metric tons (kt) | YTD 2022 | YTD 2021 |

| 483 | 590 | 471 | United States | 1,594 | 1,476 |

| 1,434 | 1,511 | 1,424 | Non-U.S. | 4,430 | 4,356 |

| 1,917 | 2,100 | 1,896 | Worldwide | 6,024 | 5,832 |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT V |

KEY FIGURES: CAPITAL AND EXPLORATION EXPENDITURES |

| | | | | | | | | | | | | | | | | |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions | YTD 2022 | YTD 2021 |

| | | Upstream | | |

| 1,837 | 1,644 | 976 | United States | 4,850 | 2,711 |

| 2,244 | 1,983 | 1,863 | Non-U.S. | 6,737 | 5,302 |

| 4,081 | 3,627 | 2,839 | Total | 11,587 | 8,013 |

| | | | | |

| | | Energy Products | | |

| 316 | 300 | 194 | United States | 1,008 | 651 |

| 274 | 206 | 240 | Non-U.S. | 654 | 661 |

| 590 | 506 | 434 | Total | 1,662 | 1,312 |

| | | | | |

| | | Chemical Products | | |

| 310 | 250 | 383 | United States | 791 | 900 |

| 644 | 169 | 151 | Non-U.S. | 1,018 | 445 |

| 954 | 419 | 534 | Total | 1,809 | 1,345 |

| | | | | |

| | | Specialty Products | | |

| 15 | 14 | 7 | United States | 34 | 18 |

| 72 | 42 | 36 | Non-U.S. | 132 | 97 |

| 87 | 56 | 43 | Total | 166 | 115 |

| | | | | |

| | | Other | | |

| 16 | 1 | 1 | Other | 17 | 2 |

| | | | | |

| 5,728 | 4,609 | 3,851 | Worldwide | 15,241 | 10,787 |

| | | | | |

| CASH CAPITAL EXPENDITURES |

| | | | | |

| 3Q22 | 2Q22 | 3Q21 | Dollars in millions | YTD 2022 | YTD 2021 |

| 4,876 | 3,837 | 2,840 | Additions to property, plant and equipment | 12,624 | 7,987 |

| 184 | 166 | 232 | Net investments and advances | 677 | 713 |

| 5,060 | 4,003 | 3,072 | Total Cash Capital Expenditures | 13,301 | 8,700 |

| | | | | |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT VI |

KEY FIGURES: YEAR-TO-DATE EARNINGS/(LOSS) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Results Summary | |

| | | | | | | | |

| 3Q22 | 2Q22 | Change vs 2Q22 | 3Q21 | Change vs 3Q21 | Dollars in millions (except per share data) | YTD 2022 | YTD 2021 | Change vs YTD 2021 |

| 19,660 | | 17,850 | | +1,810 | | 6,750 | | +12,910 | | Earnings/(Loss) (U.S. GAAP) | 42,990 | | 14,170 | | +28,820 | |

| 18,682 | | 17,551 | | +1,131 | | 6,755 | | +11,927 | | Earnings/(Loss) Excluding Identified Items | 45,066 | | 14,218 | | +30,848 | |

| | | | | | | | |

| 4.68 | | 4.21 | | +0.47 | | 1.57 | | +3.11 | | Earnings Per Common Share ¹ | 10.17 | | 3.31 | | +6.86 | |

| 4.45 | | 4.14 | | +0.31 | | 1.58 | | +2.87 | | Earnings/(Loss) Excl. Identified Items Per Common Share ¹ | 10.66 | | 3.33 | | +7.33 | |

| | | | | | | | |

| 5,728 | | 4,609 | | +1,119 | | 3,851 | | +1,877 | | Capital and Exploration Expenditures | 15,241 | | 10,787 | | +4,454 | |

| | | | | | | | |

| ¹ Assuming dilution | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Year-to-date Factor Analysis | |

| | | | | | | | | | | | | | |

| . | | | ATTACHMENT VII |

KEY FIGURES: EARNINGS/(LOSS) BY QUARTER |

| | | | | | | | | | | | | | | | | |

| Dollars in millions | 2022 | 2021 | 2020 | 2019 | 2018 |

| First Quarter | 5,480 | | 2,730 | | (610) | | 2,350 | | 4,650 | |

| Second Quarter | 17,850 | | 4,690 | | (1,080) | | 3,130 | | 3,950 | |

| Third Quarter | 19,660 | | 6,750 | | (680) | | 3,170 | | 6,240 | |

| Fourth Quarter | — | | 8,870 | | (20,070) | | 5,690 | | 6,000 | |

| Full Year | — | | 23,040 | | (22,440) | | 14,340 | | 20,840 | |

| | | | | |

| Dollars per common share ¹ | 2022 | 2021 | 2020 | 2019 | 2018 |

| First Quarter | 1.28 | | 0.64 | | (0.14) | | 0.55 | | 1.09 | |

| Second Quarter | 4.21 | | 1.10 | | (0.26) | | 0.73 | | 0.92 | |

| Third Quarter | 4.68 | | 1.57 | | (0.15) | | 0.75 | | 1.46 | |

| Fourth Quarter | — | | 2.08 | | (4.70) | | 1.33 | | 1.41 | |

| Full Year | — | | 5.39 | | (5.25) | | 3.36 | | 4.88 | |

| | | | | |

1 Computed using the average number of shares outstanding during each period. | |